Professional Documents

Culture Documents

DBS Group Holdings LTD: Allowances Dent Record Operating Result

Uploaded by

CalebOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DBS Group Holdings LTD: Allowances Dent Record Operating Result

Uploaded by

CalebCopyright:

Available Formats

DBS Group Holdings Ltd

Allowances dent record operating result

04 May 2020

SINGAPORE | BANKING | 1Q20 RESULTS

1Q20 earnings of $1.17bn missed original estimates of $1.59bn. However, pre-provision

ACCUMULATE (Maintained)

LAST TRADED PRICE SGD 19.96

operating profit (PPOP) of $2.47bn was 15% higher than previous estimates.

FORECAST DIV SGD 1.32

$1.09bn of allowances was undertaken to build-up capital buffer from the impact of

TARGET PRICE SGD 20.59

COVID-19. Two-thirds were booked as GP while the remainder was from SP. TOTAL RETURN 9.8%

The bank expects credit costs to increase by $3bn-5bn (80-130 bps) cumulatively over

the next two years as a result of the COVID-19 pandemic. COMPANY DATA

1Q20 interim dividend at S$0.33 per share was maintained from the previous quarter. BLOOMBERG TICKER DBS SP

O/S SHARES (MN) : 2,539

We expect annual dividends of S$1.32, a yield of 6.4% for DBS based on our TP.

Maintain ACCUMULATE with a downward revision in TP to S$20.60. Our FY20e MARKET CAP (USD mn / SGD mn) : 35786 / 50680

52 - WK HI/LO (SGD) : 27.89 / 16.65

earnings estimate was revised downwards by 33% after raising provision by $700mn per 3M Average Daily T/O (mn) : 8.90

quarter over the next 5 quarters and compressing NIM by 10 bps.

MAJOR SHAREHOLDERS (%)

Temasek Holdings Pte Ltd 30.2%

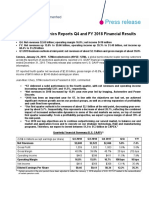

Results at a glance

(SGD mn) 1Q20 1Q19 YoY Comments Capital Group Cos Inc 5.0%

Vanguard Group Inc 2.5%

NIM was resilient at 1.86% for the quarter (vs. 1Q19: 1.88%)

NII 2,482 2,310 7.4%

with LIBOR under stressed funding market conditions.

PRICE PERFORMANCE (%)

Fee income continue to reach record levels on better WM fee 1MTH 3MTH 1YR

Net Fees & Comm 832 730 14.0% (+28% YoY), loan-related fees (+17% YoY) and investment

COMPANY 7.5 (21.3) (25.3)

banking fees (+64% YoY).

STI RETURN 5.80 (16.40) (19.67)

Other non-interest income grew 39% as gains were realised on

Other Non-II 712 511 39.3% investment holdings over the quarter on fixed income

PRICE VS. STI

holdings.

Total Income 4,026 3,551 13.4%

28.0

Positive JAW of 9% lowered CIR to 39% compared to 42% a

Expenses 1,556 1,498 3.9% 26.0

year ago.

24.0

Stellar operating performance provides headstart to

PPOP 2,470 2,053 20.3% 22.0

brace against upcoming periods of stress.

20.0

$1.09bn of total allowances taken pre-emptively to accelerate 18.0

Allowance 1,086 76 n.m.

build-up of reserves to combat impact of COVID-19. 16.0

May-19 Aug-19 Nov-19 Feb-20

PATMI 1,165 1,651 -29.4%

DBS SP Equity FSSTITR index

Source: Company, PSR

Source: Bloomberg, PSR

The Positives KEY FINANCIALS

+ Record PPOP of $2.48bn provides buffer amidst trying operating environment. Total Y/E Dec FY18 FY19 FY20e FY21e

income crossed record $4bn mark (+13.4% YoY) as cost discipline was maintained (+3.9% Total Inc (SGD mn) 13,183 14,544 14,744 15,496

YoY) to provide a positive JAW of 9%. CIR improved to 38.6% in 1Q20 (1Q20: 42.2%). Op Profit (SGD mn) 6,659 7,583 4,935 7,575

NPAT (SGD mn) 5,653 6,429 4,152 6,398

EPS (SGD) 2.17 2.51 1.99 2.49

Income was buoyed by robust growth across all segments. In particular non-interest income

PER, (X) 9.2 7.9 10.0 8.0

benefitted the most (+39.3% YoY) as investment gains were realised on fixed income assets

P/BV, (X) 1.1 1.0 1.1 1.1

during the quarter.

DPS (SGD) 1.20 1.23 1.32 1.32

ROE 12.3% 13.3% 8.3% 11.6%

Fee income enjoyed strong growth (+14% YoY) from WM fees (+28% YoY), loan-related fees Source: Bloomberg, Company, PSR

(+17% YoY) as well as investment banking fees (+64% YoY). Valuation Method:

Gordon Growth Model (COE: 8.4%, g: 2.0%)

NII grew 7.4% YoY on relatively stable NIM (1Q20: 1.86% vs. 1Q19: 1.88%) and loans growth

of 4% YoY as translation effect of interest rate cuts on NIM was muted in the first quarter. Tay Wee Kuang (+65 6212 1853)

Research Analyst

Strong operating results in 1Q20 is expected to hold up FY20 income levels similar to FY19 taywk@phillip.com.sg

levels as business slows in subsequent quarters. This means the bank expects income gain of

$500mn in 1Q20 YoY to be offset by lower income across the subsequent three quarters of

FY20.

Page | 1 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

MCI (P) 006/10/2019

Ref. No.: SG2020_0053

DBS GROUP HOLDINGS RESULTS

+ Interim quarterly dividends maintained at of 33 cents, providing an annualised yield of List of Abbreviations

WM – Wealth Management

6.6%. The bank expects current levels of dividend to be sustainable unless CET-1 levels fall

IB – Investment Banking

drastically below the targeted operating range of 12.5 – 13.5%. Current CET-1 level maintains IBG – Institutional Banking Group

at 13.9%, little changed from a year ago (1Q19: 14.1%). DBS added that dividend is guided CBG – Consumer Banking Group

by stability rather than a targeted payout ratio. NII – Net Interest Income

Non-II – Non-Interest Income

NIM – Net Interest Margin

The Negatives LDR – Loan to Deposit Ratio

- Allowances put a huge dent on earnings. In anticipation of the impact from the pandemic, NPL – Non-performing Loans

DBS has set aside $1.09bn in 1Q20 as allowances. Of which, $706mn was booked as GP as CASA – Current Account, Savings Account

O&G – Oil and Gas

economic conditions continue deteriorating. This was a stark contrast from a year ago, when

SP – specific provisions

DBS wrote-back $100mn in GP on upgrades and recoveries. The remaining amount was GP – general provisions

charged to SP, largely attributed to new account in the O&G sector identified in the quarter. AUM – Asset Under Management

We believe around S$200mn (or “more than half”) of specific allowances were made on a CIR - Cost-to-income ratio

notable oil trader.

Exposure to the O&G sector maintained at $23bn, roughly 6% of loan book. However,

exposure to traders within the sector, who are at risk from the oil price crisis stands at $5bn,

lower than 2% of overall loan exposure.

Outlook

Downward NIM pressure to kick in in subsequent quarters. Resilience in NIM in 1Q20 was

not reflective of NIM pressure ahead as LIBOR held up due to stressed funding conditions.

We have reduced FY20 NIM forecast by 10 bps to incorporate the lower interest rate cuts

environment. Conversely, DBS mentioned there is pricing power by increasing spreads

especially when competing banks start to withdraw their loans.

Credit costs to increase by 80-130 bps cumulatively over the next 2 years, amounting to

$3bn-5bn in additional allowances to be booked. We have included an additional $3bn on

top of the $1.09 booked in 1Q20 in our estimates, putting allowance at around $700mn per

quarter for the next 4 quarters.

Sufficient capital to ride through this downturn. CET1 is 13.9% Currently, cumulative GP

stands at $3.2bn, including management overlays of around $1bn. The bank’s various capital

and liquidity positions also maintain well above regulatory requirements. For more

information, please refer to Annex A.

Investment Actions

We maintain our ACCUMULATE recommendation with a lowered TP of S$20.60 (previously

$27.30). We have revised the model by considering the expected allowances of $700mn per

quarter to be booked over the next four quarters and further reducing NIM by 10 bps as

translation effect from the interest rate cuts in March.

Valuation: Gordon Growth Model

Item Description Value

Rf Risk-free rate 2.6%

E Equity-risk premium 5.5%

B Beta 1.2

COE Cost of Equity 9.3%

ROE Return on Equity 10.0%

g Terminal growth rate 2.0%

(ROE-g)/ Target Price to Book 1.09

(COE-g)

BVPS, S$ 18.9

Valuation, S$ 20.6

Page | 2 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

DBS GROUP HOLDINGS RESULTS

Annex A: DBS has sufficient buffer vs. Regulatory Capital Requirements

Source: DBS, MAS, PSR

Page | 3 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

DBS GROUP HOLDINGS RESULTS

Financials

Income Statement Balance Sheet

Y/E Dec, SGD mn FY17 FY18 FY19 FY20e FY21e Y/E Dec, SGD mn FY17 FY18 FY19 FY20e FY21e

Net Int Income 7,791 8,955 9,625 9,342 9,308 Cash and bal w central banks 26,463 22,185 26,362 56,258 58,631

Fees and Commission 2,622 2,780 3,052 3,389 3,808 Due from banks 35,975 40,178 39,336 40,933 42,595

Other Non int income 1,511 1,448 1,867 2,014 2,380 Govt, Bank & Corp Sec & T Bills 95,342 105,475 113,475 114,760 116,070

Total income 11,924 13,183 14,544 14,744 15,496 Derivatives 17,585 17,029 17,235 17,611 17,697

Operating expenses 5,205 5,814 6,258 6,536 6,874 Goodwill and intangibles 5,165 5,175 5,170 5,170 5,170

Provisions 1,544 710 703 3,274 1,048 Property and other fixed assets 1,233 1,450 3,225 6,371 13,295

Operating profit 5,175 6,659 7,583 4,935 7,575 Loans to non-bank customers 323,099 345,003 357,884 369,414 369,414

Associates & JVs 0 0 0 0 0 JV and Associates 783 838 835 842 849

Profit Before Tax 5,175 6,659 7,583 4,935 7,575 Other assets 12,066 13,418 15,424 14,901 14,369

Taxation 671 1,006 1,154 783 1,176 Total Assets 517,711 550,751 578,946 626,260 638,089

Profit After Tax 4,504 5,653 6,429 4,152 6,398 17,803 22,648 23,773 26,757 26,757

Non-controlling Interest 133 76 38 38 38 Deposits from customers 373,634 393,785 404,289 445,279 445,279

Net Income, reported 4,371 5,577 6,391 4,114 6,360 Derivatives 18,003 16,692 17,512 17,611 17,697

Net Income, adj. 4,371 5,577 6,391 4,114 6,360 Other liabilities 16,615 18,440 20,907 22,596 23,438

Other debt securities 40,716 45,712 57,128 57,854 58,651

Per share data (SGD) Subordinated term debts 1,138 3,599 3,538 3,538 3,538

Y/E Dec FY17 FY18 FY19 FY20e FY21e Total liabilities 467,909 500,876 527,147 573,635 575,360

EPS, reported 1.69 2.17 2.51 1.99 2.49 Shareholder's equity 47,458 49,045 50,981 51,834 61,967

DPS 1.43 1.20 1.23 1.32 1.32 Non-controlling interest 2,344 830 818 792 762

BVPS 17.85 18.12 19.17 18.54 18.38 Total Equity 49,802 49,875 51,799 52,626 62,729

Dividend Pay-out Ratio 84.4% 55.4% 49.0% 66.2% 53.0%

Supplementary items Valuation Ratios

Y/E Dec FY17 FY18 FY19 FY20e FY21e Y/E Dec FY17 FY18 FY19 FY20e FY21e

CET1 CAR 14.3% 13.9% 0.1% 9.7% 16.5% P/E (X), avg 11.8 9.2 7.9 10.0 8.0

Tier 1 CAR 15.1% 15.1% 0.1% 10.3% 17.2% P/B (X), avg 1.1 1.1 1.0 1.1 1.1

Total CAR 15.9% 16.9% 0.2% 11.5% 18.8% Dividend Yield 7.2% 6.0% 6.2% 6.6% 6.6%

Growth & Margins

Growth

Net interest income 6.7% 14.9% 7.5% -2.9% -0.4%

Net Fee and Comm Inc 12.5% 6.0% 9.8% 11.0% 12.4%

Total income 3.8% 10.6% 10.3% 1.4% 5.1%

Profit before tax 1.8% 28.7% 13.9% -34.9% 53.5%

Net income, reported 3.1% 27.6% 14.6% -35.6% 54.6%

Net income, adj. 3.1% 27.6% 14.6% -35.6% 54.6%

Margins

Net interest margin 1.75% 1.85% 1.89% 1.77% 1.72%

Key Ratios

ROE 9.9% 12.3% 13.3% 8.3% 11.6%

ROA 0.9% 1.0% 1.1% 0.7% 1.0%

RORWA 1.5% 1.9% 2.2% 1.3% 1.9%

Non-interest/total income ratio 34.7% 32.1% 33.8% 36.6% 39.9%

Cost/income ratio 43.7% 44.1% 43.0% 44.3% 44.4%

Loan/deposit ratio 86.5% 87.6% 88.5% 83.0% 83.0%

NPL ratio 1.7% 1.5% 1.5% 1.7% 1.8%

Source: Company, Phillip Securities Research (Singapore) Estimates

Page | 4 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

DBS GROUP HOLDINGS RESULTS

Ratings History

35.00

Market Price Target Price

30.00

25.00

20.00

Source: Bl oomberg, PSR

15.00

May-18

Aug-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

Nov-20

1

2

3

4

5

PSR Rating System

Total Returns Recommendation Rating

> +20% Buy 1

+5% to +20% Accumul a te 2

-5% to +5% Neutra l 3

-5% to -20% Reduce 4

<-20% Sel l 5

Remarks

We do not ba s e our recommenda ti ons enti rel y on the a bove qua nti ta ti ve

return ba nds . We cons i der qua l i ta ti ve fa ctors l i ke (but not l i mi ted to) a s tock's

ri s k rewa rd profi l e, ma rket s enti ment, recent ra te of s ha re pri ce a ppreci a ti on,

pres ence or a bs ence of s tock pri ce ca ta l ys ts , a nd s pecul a ti ve undertones

s urroundi ng the s tock, before ma ki ng our fi na l recommenda ti on.

Page | 5 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

DBS GROUP HOLDINGS RESULTS

Contact Information (Singapore Research Team)

Head of Research Research Admin

Paul Chew – paulchewkl@phillip.com.sg Siti Nursyazwina - syazwina@phillip.com.sg

Property | REITs Property | REITs Banking & Financials | Healthcare

Natalie Ong - natalieongpf@phillip.com.sg Tan Jie Hui - tanjh@phillip.com.sg Tay Wee Kuang - taywk@phillip.com.sg

Technical Analyst China/HK Equity Credit Analyst (Bonds)

Chua Wei Ren – chuawr@phillip.com.sg Zheng Jieyuan – zhengjy@phillip.com.sg Timothy Ang – timothyang@phillip.com.sg

Contact Information (Regional Member Companies)

SINGAPORE MALAYSIA HONG KONG

Phillip Securities Pte Ltd Phillip Capital Management Sdn Bhd Phillip Securities (HK) Ltd

Raffles City Tower B-3-6 Block B Level 3 Megan Avenue II, 11/F United Centre 95 Queensway

250, North Bridge Road #06-00 No. 12, Jalan Yap Kwan Seng, 50450 Hong Kong

Singapore 179101 Kuala Lumpur Tel +852 2277 6600

Tel +65 6533 6001 Tel +603 2162 8841 Fax +852 2868 5307

Fax +65 6535 6631 Fax +603 2166 5099 Websites: www.phillip.com.hk

Website: www.poems.com.sg Website: www.poems.com.my

JAPAN INDONESIA CHINA

Phillip Securities Japan, Ltd. PT Phillip Securities Indonesia Phillip Financial Advisory (Shanghai) Co Ltd

4-2 Nihonbashi Kabuto-cho Chuo-ku, ANZ Tower Level 23B, No 550 Yan An East Road,

Tokyo 103-0026 Jl Jend Sudirman Kav 33A Ocean Tower Unit 2318,

Tel +81-3 3666 2101 Jakarta 10220 – Indonesia Postal code 200001

Fax +81-3 3666 6090 Tel +62-21 5790 0800 Tel +86-21 5169 9200

Website: www.phillip.co.jp Fax +62-21 5790 0809 Fax +86-21 6351 2940

Website: www.phillip.co.id Website: www.phillip.com.cn

THAILAND FRANCE UNITED KINGDOM

Phillip Securities (Thailand) Public Co. Ltd King & Shaxson Capital Limited King & Shaxson Capital Limited

15th Floor, Vorawat Building, 3rd Floor, 35 Rue de la Bienfaisance 75008 6th Floor, Candlewick House,

849 Silom Road, Silom, Bangrak, Paris France 120 Cannon Street,

Bangkok 10500 Thailand Tel +33-1 45633100 London, EC4N 6AS

Tel +66-2 6351700 / 22680999 Fax +33-1 45636017 Tel +44-20 7426 5950

Fax +66-2 22680921 Website: www.kingandshaxson.com Fax +44-20 7626 1757

Website www.phillip.co.th Website: www.kingandshaxson.com

UNITED STATES AUSTRALIA SRI LANKA

Phillip Capital Inc Phillip Capital Limited Asha Phillip Securities Limited

141 W Jackson Blvd Ste 3050 Level 10, 330 Collins Street No. 60, 5th Lane,

The Chicago Board of Trade Building Melbourne, Victoria 3000, Australia Colombo 3, Sri Lanka

Chicago, IL 60604 USA Tel +61-03 8633 9803 Tel: (94) 11 2429 100

Tel +1-312 356 9000 Fax +61-03 8633 9899 Fax: (94) 11 2429 199

Fax +1-312 356 9005 Website: www.phillipcapital.com.au Website: www.ashaphillip.net

Website: www.phillipusa.com

INDIA TURKEY DUBAI

PhillipCapital (India) Private Limited PhillipCapital Menkul Degerler Phillip Futures DMCC

No.1, 18th Floor, Urmi Estate Dr. Cemil Bengü Cad. Hak Is Merkezi Member of the Dubai Gold and

95, Ganpatrao Kadam Marg No. 2 Kat. 6A Caglayan Commodities Exchange (DGCX)

Lower Parel West, Mumbai 400-013 34403 Istanbul, Turkey Unit No 601, Plot No 58, White Crown Bldg,

Maharashtra, India Tel: 0212 296 84 84 Sheikh Zayed Road, P.O.Box 212291

Tel: +91-22-2300 2999 / Fax: +91-22-2300 2969 Fax: 0212 233 69 29 Dubai-UAE

Website: www.phillipcapital.in Website: www.phillipcapital.com.tr Tel: +971-4-3325052 / Fax: + 971-4-3328895

CAMBODIA

Phillip Bank Plc

Ground Floor of B-Office Centre, #61-64,

Norodom Blvd Corner Street 306,Sangkat

Boeung Keng Kang 1, Khan Chamkamorn,

Phnom Penh, Cambodia

Tel: 855 (0) 7796 6151/855 (0) 1620 0769

Website: www.phillipbank.com.kh

Page | 6 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

DBS GROUP HOLDINGS RESULTS

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s license under the

Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may

constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part,

for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public

sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied

that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is

subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any

corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without

prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as

authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available

constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for

the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all

investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent

determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be

considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this

report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons

involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited

to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip

Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons

involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have

performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities

Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services

to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons

involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase

or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments

will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or

foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers,

directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an

interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may

be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors,

employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected

to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted

by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to

Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material

that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where

such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration

or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any

particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a

professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific

investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities

Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSES

Where the report contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact Phillip Securities Research (and not the relevant foreign research house) in Singapore at 250 North Bridge

Road, #06-00 Raffles City Tower, Singapore 179101, telephone number +65 6533 6001, in respect of any matters arising from, or in connection with, the

analyses or reports; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore who is not an accredited investor, expert

investor or institutional investor, Phillip Securities Research accepts legal responsibility for the contents of the analyses or reports.

Page | 7 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

You might also like

- FINANCE For PrintDocument10 pagesFINANCE For PrintKrn FernNo ratings yet

- 20 Year Intrinsic ValueDocument27 pages20 Year Intrinsic ValueCaleb100% (2)

- GTD Trello Sample LTRDocument12 pagesGTD Trello Sample LTRCaleb100% (2)

- Chapter 14 Test Bank Test BankDocument45 pagesChapter 14 Test Bank Test Bankngan phanNo ratings yet

- Ultimate Guide To Timeboxing: The Best Time-Saving Technique!Document21 pagesUltimate Guide To Timeboxing: The Best Time-Saving Technique!Caleb100% (4)

- TESCO 2020.2 报告 PDFDocument176 pagesTESCO 2020.2 报告 PDFHongxian JiNo ratings yet

- Project of Mutual FundsDocument41 pagesProject of Mutual FundsNeha ShahNo ratings yet

- Ultratech Cement Limited: Outlook Remains ChallengingDocument5 pagesUltratech Cement Limited: Outlook Remains ChallengingamitNo ratings yet

- PT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsDocument9 pagesPT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsSugeng YuliantoNo ratings yet

- BUY TP: IDR1,700: Bank Tabungan NegaraDocument6 pagesBUY TP: IDR1,700: Bank Tabungan NegaraAl VengerNo ratings yet

- IJM Corporation Berhad - A Challenging Year For FY21 - 200629Document3 pagesIJM Corporation Berhad - A Challenging Year For FY21 - 200629YI HEN ONGNo ratings yet

- Snapshots: Egp 7.6 BN Egp 5.7 BN Egp 239 MN Egp 239 MN Egp 1.4 BN Egp 1.4 BNDocument2 pagesSnapshots: Egp 7.6 BN Egp 5.7 BN Egp 239 MN Egp 239 MN Egp 1.4 BN Egp 1.4 BNAmr AbdelMoneimNo ratings yet

- Uol Group Fy2020 Results 26 FEBRUARY 2021Document33 pagesUol Group Fy2020 Results 26 FEBRUARY 2021Pat KwekNo ratings yet

- Anand Rural Electrification Corp Buy 25oct10Document2 pagesAnand Rural Electrification Corp Buy 25oct10bhunkus1327No ratings yet

- Dialog Group: Company ReportDocument5 pagesDialog Group: Company ReportBrian StanleyNo ratings yet

- Investor Digest: Equity Research - 28 March 2019Document9 pagesInvestor Digest: Equity Research - 28 March 2019Rising PKN STANNo ratings yet

- Finance ProjectDocument5 pagesFinance ProjectSanjana Premkumar1998No ratings yet

- Bank Rakyat Indonesia: 4Q20 Review: Better-Than-Expected EarningsDocument7 pagesBank Rakyat Indonesia: 4Q20 Review: Better-Than-Expected EarningsPutri CandraNo ratings yet

- SAWAD230228RDocument8 pagesSAWAD230228RsozodaaaNo ratings yet

- 1Q21 Core Earnings Up 19% Y/y Meet Estimates: GT Capital Holdings, IncDocument8 pages1Q21 Core Earnings Up 19% Y/y Meet Estimates: GT Capital Holdings, IncJajahinaNo ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- Sunway Reit: Company ReportDocument4 pagesSunway Reit: Company ReportBrian StanleyNo ratings yet

- 2020 08 06 PH e Mpi PDFDocument8 pages2020 08 06 PH e Mpi PDFJNo ratings yet

- ResearchDocument4 pagesResearchIv YuhanNo ratings yet

- ملخص 2020 PDFDocument14 pagesملخص 2020 PDFمحمد فوزيNo ratings yet

- Kossan Rubber (KRI MK) : Regional Morning NotesDocument5 pagesKossan Rubber (KRI MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Wipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityDocument14 pagesWipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityPramod KulkarniNo ratings yet

- S Chand and Company (SCHAND IN) : Q3FY20 Result UpdateDocument6 pagesS Chand and Company (SCHAND IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- KPJ Healthcare Neutral: MalaysiaDocument5 pagesKPJ Healthcare Neutral: MalaysiaArdoni SaharilNo ratings yet

- S Chand and Company (SCHAND IN) : Q4FY20 Result UpdateDocument6 pagesS Chand and Company (SCHAND IN) : Q4FY20 Result UpdateRaj PrakashNo ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- TCS - 1QFY20 - HDFC Sec-201907100816499656445Document15 pagesTCS - 1QFY20 - HDFC Sec-201907100816499656445Sandip HaseNo ratings yet

- CYIENT Kotak 22102018Document6 pagesCYIENT Kotak 22102018ADNo ratings yet

- Ii. Financial Performance: Assets and Liabilities Net Interest IncomeDocument2 pagesIi. Financial Performance: Assets and Liabilities Net Interest IncomeAnuska MohantyNo ratings yet

- Research Report - Vipshop Holdings LimitedDocument5 pagesResearch Report - Vipshop Holdings LimitedGlen BorgNo ratings yet

- Datasonic 3QFY21 Result Update PDFDocument4 pagesDatasonic 3QFY21 Result Update PDFGiddy YupNo ratings yet

- Wells Fargo - First-Quarter-2020-EarningsDocument40 pagesWells Fargo - First-Quarter-2020-EarningsAlexNo ratings yet

- Nippon Life India Asset Management: Market Share Remains Elusive ReduceDocument10 pagesNippon Life India Asset Management: Market Share Remains Elusive ReduceSriHariKalyanBNo ratings yet

- Nippon Life India Asset Management: Market Share Remains Elusive ReduceDocument10 pagesNippon Life India Asset Management: Market Share Remains Elusive ReduceSriHariKalyanBNo ratings yet

- Bajaj Finance Sell: Result UpdateDocument5 pagesBajaj Finance Sell: Result UpdateJeedula ManasaNo ratings yet

- Yongnam Holdings LTD: Good Results As ExpectedDocument5 pagesYongnam Holdings LTD: Good Results As Expectedsagger09No ratings yet

- PPB Group: 2019: Good Results Amid Challenging EnvironmentDocument4 pagesPPB Group: 2019: Good Results Amid Challenging EnvironmentZhi Ming CheahNo ratings yet

- Third Quarter Results: Philippine Stock Exchange Ticker: CHPDocument8 pagesThird Quarter Results: Philippine Stock Exchange Ticker: CHPJep TangNo ratings yet

- 2019 Final Results, Dividend and Closure of Register of MembersDocument55 pages2019 Final Results, Dividend and Closure of Register of MembersGINYNo ratings yet

- ITC AnalysisDocument7 pagesITC AnalysisPRASHANT ARORANo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- Further Resource Sharing: Interim Report 2020Document50 pagesFurther Resource Sharing: Interim Report 2020mailimailiNo ratings yet

- Id 23062020 PDFDocument11 pagesId 23062020 PDFbala gamerNo ratings yet

- BLS International - 2QFY18 - HDFC Sec-201711112030262626379Document11 pagesBLS International - 2QFY18 - HDFC Sec-201711112030262626379Anonymous y3hYf50mTNo ratings yet

- FORTH230228RDocument7 pagesFORTH230228RsozodaaaNo ratings yet

- CFLB Annual Report 31 03 2020Document172 pagesCFLB Annual Report 31 03 2020pasanNo ratings yet

- Accounting - UCO Bank - Assignment2Document1 pageAccounting - UCO Bank - Assignment2KummNo ratings yet

- Stmicro - Q4-Fy2018 PR - FinalDocument12 pagesStmicro - Q4-Fy2018 PR - Finalakshay kumarNo ratings yet

- Motilal Oswal - 2QFY20 - HDFC Sec-201910251913301814908Document15 pagesMotilal Oswal - 2QFY20 - HDFC Sec-201910251913301814908Ajay SinghNo ratings yet

- Blue Star (BLSTR In) 2QFY20 Result Update - RsecDocument9 pagesBlue Star (BLSTR In) 2QFY20 Result Update - RsecHardik ShahNo ratings yet

- Mastek LTD: Index DetailsDocument12 pagesMastek LTD: Index DetailsAshokNo ratings yet

- Ambuja Cement (ACEM IN) : Q3CY20 Result UpdateDocument6 pagesAmbuja Cement (ACEM IN) : Q3CY20 Result Updatenani reddyNo ratings yet

- ZEE Research Report BNP ParibasDocument5 pagesZEE Research Report BNP ParibasArpit JhanwarNo ratings yet

- Fmi Equity ReportDocument1 pageFmi Equity ReportShinThant LinnNo ratings yet

- Larsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYDocument10 pagesLarsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYVikas AggarwalNo ratings yet

- NH Korindo Sekuritas PGAS - Top and Bottom Line Recovers in 3Q20Document6 pagesNH Korindo Sekuritas PGAS - Top and Bottom Line Recovers in 3Q20Hamba AllahNo ratings yet

- Bajaj Finserve Limited: Quarterly Result UpdateDocument2 pagesBajaj Finserve Limited: Quarterly Result UpdateSagar JainNo ratings yet

- Restated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncDocument4 pagesRestated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncJNo ratings yet

- Group 54 Bata India WorldcomDocument15 pagesGroup 54 Bata India WorldcomS BajpaiNo ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- Singapore Exchange Limited: Firing On All CylindersDocument6 pagesSingapore Exchange Limited: Firing On All CylindersCalebNo ratings yet

- Vicom LTD: A Member ofDocument2 pagesVicom LTD: A Member ofCalebNo ratings yet

- Stock Advisor What You Should Know About Facebook's Blockbuster Crypto AnnouncementDocument4 pagesStock Advisor What You Should Know About Facebook's Blockbuster Crypto AnnouncementCalebNo ratings yet

- Annual Report 2007Document88 pagesAnnual Report 2007CalebNo ratings yet

- Orchard Parade Annual ReportDocument106 pagesOrchard Parade Annual ReportCalebNo ratings yet

- China Minzhong: Financial AnalysisDocument8 pagesChina Minzhong: Financial AnalysisCalebNo ratings yet

- Raffles Medical Group: Financial AnalysisDocument7 pagesRaffles Medical Group: Financial AnalysisCalebNo ratings yet

- The Hour Glass Limited: Presented by Team MBFC - Aug 2015Document30 pagesThe Hour Glass Limited: Presented by Team MBFC - Aug 2015CalebNo ratings yet

- Edelweiss Twin Win 7.15% - Aug'19Document10 pagesEdelweiss Twin Win 7.15% - Aug'19speedenquiryNo ratings yet

- Exercise InvestmentsDocument14 pagesExercise InvestmentsAlizah Lariosa Bucot43% (7)

- Guidelines by RbiDocument7 pagesGuidelines by RbiSandip BarotNo ratings yet

- Bank Mandiri: 9M21 Review: Strong Earnings Growth ContinuesDocument8 pagesBank Mandiri: 9M21 Review: Strong Earnings Growth ContinuesdkdehackerNo ratings yet

- 2006 Nicolet National Bank Annual ReportDocument35 pages2006 Nicolet National Bank Annual ReportNicolet BankNo ratings yet

- Rakshe VaibhavDocument44 pagesRakshe VaibhavUtkarsh JoshiNo ratings yet

- 20bba098 ReportDocument75 pages20bba098 ReportKARSH PATELNo ratings yet

- Newmont Annual Report 1 100Document100 pagesNewmont Annual Report 1 100David RvNo ratings yet

- Additional Provisions Not Affecting NegotiabilityDocument23 pagesAdditional Provisions Not Affecting NegotiabilityLoNo ratings yet

- Buyback PPTDocument16 pagesBuyback PPTSubham MundhraNo ratings yet

- Quicknet Sure Success Series Ugc Net Solved Paper 2006 2017 For Paper IDocument9 pagesQuicknet Sure Success Series Ugc Net Solved Paper 2006 2017 For Paper IYousaf JamalNo ratings yet

- Chapter 4 Financial Markets ReviewerDocument3 pagesChapter 4 Financial Markets ReviewerJessa BuanNo ratings yet

- Project ReportDocument51 pagesProject Reportvishal141993No ratings yet

- Banking Short NotesDocument15 pagesBanking Short NotesTanjin keyaNo ratings yet

- ADITYA - GHANURE - BBA Pre - Project017009Document21 pagesADITYA - GHANURE - BBA Pre - Project017009Aditya GhanureNo ratings yet

- Summer Internship Project: "Online Trading Mechanism at Sharekhan"Document49 pagesSummer Internship Project: "Online Trading Mechanism at Sharekhan"Manish KumarNo ratings yet

- Straco Corporation: Weak Macro Taking Its Toll On Visitor NumbersDocument10 pagesStraco Corporation: Weak Macro Taking Its Toll On Visitor NumbersKoh YSNo ratings yet

- Last Day Revision Test 2Document54 pagesLast Day Revision Test 2sanjar khokharNo ratings yet

- Chapter 23 - SCF - Aug 2012Document11 pagesChapter 23 - SCF - Aug 2012bebo3usaNo ratings yet

- CustodyDocument8 pagesCustodymohammed aleryaniNo ratings yet

- Amendments To The Anti-Money Laundering ActDocument30 pagesAmendments To The Anti-Money Laundering Actlorkan19No ratings yet

- Customer Relationship and Wealth ManagementDocument65 pagesCustomer Relationship and Wealth ManagementbistamasterNo ratings yet

- Divina Notes On SRCDocument6 pagesDivina Notes On SRCIvan LeeNo ratings yet

- SE Penalities - Jan 22, 2020Document12 pagesSE Penalities - Jan 22, 2020G V KrishnakanthNo ratings yet

- InvestopediaDocument7 pagesInvestopediaakhaveNo ratings yet

- Financial Markets ReviewerDocument8 pagesFinancial Markets ReviewerHalf BloodNo ratings yet

- NASDAQDocument4 pagesNASDAQNeha KrishnaniNo ratings yet