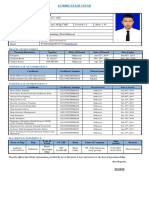

Professional Documents

Culture Documents

Sunway Reit: Company Report

Uploaded by

Brian StanleyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sunway Reit: Company Report

Uploaded by

Brian StanleyCopyright:

Available Formats

REITS

SUNWAY REIT

(SREIT MK EQUITY, SUNW.KL) 10 Feb 2021

MCO2.0 derails recovery; long term outlook still positive

Company report BUY

AmInvestment Bank (Maintained)

www.amequities.com.my

03-2036 2240 Rationale for report: Company results

Investment Highlights

Price RM1.41

Fair Value RM1.64

52-week High/Low RM1.92/RM1.34 We maintain our BUY recommendation on Sunway REIT,

with a lower fair value of RM1.64 (from RM1.94) based on

Key Changes

an unchanged target yield of 5.5% over our revised FY22F

Fair value

EPS distributable income.

YE to Dec

*FY20 #FY21F FY22F FY23F

We cut our FY21F–23F distributable income by 41%, 16%

and 13% to RM257.7mil, RM308.4mil and RM347.2mil

Revenue (RM mil) 556.9 675.3 632.6 707.6 respectively (from RM437mil, RM365.9mil and

Distributable Income (RM mil) 248.4 257.7 308.4 347.2 RM399.0mil) to largely reflect the lower-than-expected

Distributable Income PU (sen) 7.3 7.5 9.0 10.1 rental reversion, as well as the impact of the extended

Distributable Income PU growth (%) -13.3 3.7 19.7 12.6 MCO 2.0 in 1QFY20F, which is likely lead to more rental

Consensus Net Profit (RM mil) - 306.8 298.5 322.8 rebates, followed by a slower recovery. Meanwhile, the

DPS (sen) 6.2 7.0 9.0 10.1 hotel segment continued to experience pressure on the

PE (x) 19.4 18.7 15.7 13.9 occupancy rate.

EV/EBITDA (x) 21.7 20.9 19.6 18.4

Div yield (%) 4.4 5.3 6.4 7.2

Sunway REIT reported its 6MFY21 revenue and

ROE (%) distributable income of RM203.2mil (-35% YoY) and

5.2 5.4 6.4 7.2

Net debt to total assets (%) RM57.8mil (-61% YoY) respectively, which came in below

39.5 40.1 40.7 41.0

our forecasts and the consensus estimates, at 13% of our

*FYE Jun; #18 months

full-year 18-month forecasts (due to the change of its

Stock and Financial Data

financial year-end) and 19% of the consensus full-year 12-

month estimates (which have yet to be adjusted to the

Shares Outstanding (million) 3,424.8 new financial year-end).

Market Cap (RM mil) 4,829.0

Book Value (RM/share) 1.40 The weaker revenue was mainly due to lower rental

P/BV (x) 1.0 income from the retail and hotel segments with the

ROE (%) 5.4

reinstated CMCO during the quarter, and no income from

Net Gearing (%) 39.5

Sunway Resort Hotel as the hotel was closed for phased

Major Shareholders Sunway Bhd (40.9%) refurbishment works since July 2020. Meanwhile, Sunway

EPF (15.2%) REIT’s 6MFY21 NPI and distributable income dropped by

KWAP (6.2%)

Free Float 37.7

43% and 61% to RM134.1mil and RM57.8mil respectively,

Avg Daily Value (RM mil) 3.2 in line with the lower revenue as mentioned above.

Price performance 3mth 6mth 12mth The retail segment’s 6MFY21 revenue declined by 37%

YoY to RM134.5mil (from RM212.3mil), while NPI

Absolute (%) 3.7 (8.4) (21.7)

contracted by 48% YoY to RM78.1mil (from RM149.3mil)

Relative (%) (0.4) (8.9) (23.2)

mainly due to rental support for affected tenants and

2.5 2,000

lower carpark income amidst the ongoing nationwide

1,800

RMCO and CMCO in KL and Selangor since 14 October

2.0 1,600

2020.

1,400

1.5 1,200

Meanwhile, the hotel segment’s 6MFY21 revenue dived by

77% YoY to RM10.7mil (from RM46.2mil), and NPI shrank

1,000

by 82% YoY to RM7.8mil (from RM43.1mil) amidst a surge

1.0 800

in Covid-19 cases nationwide and further restrictions on

600

interstate, district and inbound travel, group and

0.5 400

200

corporate events with the CMCO in KL and Selangor, as

0.0 0

well as the closure of Sunway Resort Hotel for phased

Feb-16 Feb-17 Feb-18 Feb-19 Feb-20 refurbishment of 12–24 months from July 2020.

SREIT MK FBMKLCI Index

Sunway REIT 10 Feb 2021

Sunway REIT proposed a distribution of 0.77 sen per unit for 2QFY21 compared with 2.45 sen per unit YoY. We lower

our FY21F–23F distribution projection to 7.5 sen (18 months), 9.0 sen and 10.1 sen respectively, from 12.8 sen (18

months), 10.7 sen and 11.7 sen projected previously.

Sunway REIT’s debt-to-asset ratio has eased slightly to 33% (vs. 38% previously) following its recent private

placement exercise. We take comfort that it remains well below the regulatory threshold of 60% (temporarily raised

from 50% up to 31 December 2022 by the Securities Commission, being a Covid-19 relief measure). As such, Sunway

REIT does have some headroom to gear up for new acquisitions.

We believe Sunway REIT’s long-term outlook remains positive given its diversified strategic asset portfolio (which

includes retail malls, hotels, offices, university, hospital, etc.) backed by defensive tenants, and the large pipeline of

potential assets for future injection. It is poised to benefit from the growth in Malaysia’s economy post-pandemic.

We like Sunway REIT as a recovery play as well as a yield play, with attractive dividend yields of 5.3% for FY21 and

more than 6% for FY22 and beyond amidst a low interest rate environment that is likely to be prolonged

EXHIBIT 1: EARNINGS SUMMARY

FY 30 Jun (RMmil) 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21 QoQ % YoY % 1HFY20 1HFY21 YTD %

Gross rental income 155.8 140.8 104.9 107.4 95.8 -10.9% -38.5% 311.2 203.2 -34.7%

Property operating cost (39.2) (37.3) (86.3) (39.4) (29.8) -24.4% -24.0% (75.5) (69.1) -8.4%

Net property income 116.6 103.5 18.6 68.1 66.0 -3.1% -43.4% 235.7 134.1 -43.1%

Other income 1.8 1.1 1.7 0.0 0.0 -10.0% -98.5% 2.9 0.1 -98.0%

Fair value adjustments 0.0 0.0 0.0 0.0 0.0 n.a. n.a. 0.0 0.0 n.a.

Net interest (30.5) (29.0) (26.6) (24.3) (22.0) -9.1% -27.7% (60.8) (46.3) -23.9%

Other expenses (10.7) (9.9) (8.1) (9.5) (10.5) 11.0% -1.9% (21.7) (20.0) -8.2%

Fair value adjustments 0.0 0.0 0.0 0.0 0.0 n.a. n.a. 0.0 0.0 n.a.

Income before tax 77.2 65.7 (14.4) 34.4 33.5 -2.6% -56.6% 156.0 67.9 -56.5%

Taxation 0.0 0.0 0.9 0.0 0.0 n.a. n.a. 0.0 0.0 n.a.

Income after tax 77.2 65.7 (13.5) 34.4 33.5 -2.6% -56.6% 156.0 67.9 -56.5%

Distribution perpetual holders & adjustments (5.1) (5.0) 35.4 (5.0) (5.0) 0.0% -0.3% (9.7) (10.1) 4.0%

Distributable income 72.1 60.7 21.9 29.4 28.5 -3.1% -60.6% 146.3 57.8 -60.5%

EPU (sen) 2.11 1.77 0.64 0.86 0.83 -3.1% -60.6% 4.27 1.69 -60.5%

DPU (sen) 2.45 0.00 2.38 0.90 0.77 -14.4% -68.6% 4.95 1.67 -66.3%

NAV/unit (RM) 1.49 1.49 1.48 1.48 1.48 0.0% -0.6% 1.49 1.48 -0.6%

NPI margin (% ) 74.9% 73.5% 17.7% 63.4% 68.9% 75.7% 66.0%

Net margin (% ) 46.3% 43.1% 20.9% 27.3% 29.7% 47.0% 28.4%

Source: Company, AmInvestment Bank Bhd

EXHIBIT 2: PB BAND CHART EXHIBIT 3: PE BAND CHART

1.60 30.00

1.40 +1δ

25.00

Avg +1δ

1.20 -1δ Avg

20.00 -1δ

1.00

0.80 15.00

0.60

10.00

0.40

5.00

0.20

0.00 0.00

Jul-16

Jan-17

Jan-20

Oct-16

Apr-17

Jul-17

Jan-18

Oct-17

Apr-18

Jul-18

Jan-19

Oct-18

Apr-19

Jul-19

Oct-19

Apr-20

Jul-20

Jan-21

Oct-20

Jul-16

Oct-16

Apr-17

Jan-17

Jul-17

Oct-17

Apr-18

Jul-18

Oct-18

Apr-19

Jul-19

Oct-19

Apr-20

Jan-18

Jan-19

Jan-20

Jul-20

Oct-20

Jan-21

AmInvestment Bank Bhd 2

Sunway REIT 10 Feb 2021

EXHIBIT 4: FINANCIAL DATA

Income Statement (RMmil, YE 31 FY19 FY20 FY21F FY22F FY23F

Rev enue 580.3 556.9 675.3 632.6 707.6

Net property income (NPI) 439.7 416.8 443.6 473.9 508.8

Operating income (EBIT) 399.0 376.3 397.9 428.7 459.3

Other income & associates 0.0 0.0 0.0 0.0 0.0

Net interest (117.7) (116.4) (120.3) (100.2) (112.1)

Ex ceptional items 0.0 0.0 0.0 0.0 0.0

Pretax profit 281.3 259.9 277.7 328.4 347.2

Tax ation (7.9) 0.9 0.0 0.0 0.0

Minorities/pref div idends 0.0 0.0 0.0 0.0 0.0

Net income 273.3 260.8 277.7 328.4 347.2

Distributable Income 286.5 248.4 257.7 308.4 347.2

Balance Sheet (RMmil, YE 30 Jun) FY19 FY20 FY21F FY22F FY23F

PPE 12.5 12.0 14.6 13.6 15.3

Intangible assets 0.0 0.0 0.0 0.0 0.0

Other long-term assets 8,047.4 8,347.4 8,547.4 8,647.4 8,747.4

Total non-current assets 8,059.9 8,359.4 8,562.0 8,661.1 8,762.7

Cash & equiv alent 67.3 71.9 72.2 72.5 72.5

Inv entories 0.0 0.0 0.0 0.0 0.0

Trade receiv ables 19.4 19.3 23.9 21.8 24.6

Other current assets 11.5 11.5 11.5 11.5 11.5

Total current assets 98.1 102.6 107.6 105.7 108.6

Trade pay ables 3.1 2.9 4.4 3.2 4.0

Short-term borrow ings 3,090.8 2,966.0 3,596.8 3,369.3 3,768.9

Other current liabilities 175.8 168.7 204.4 191.5 214.1

Total current liabilities 3,269.6 3,137.6 3,805.6 3,564.1 3,987.0

Long-term borrow ings 0.0 444.5 (51.7) 272.8 (55.7)

Other long-term liabilities 91.9 88.8 104.5 98.8 108.8

Total long-term liabilities 91.9 533.2 52.8 371.6 53.1

Shareholders’ funds 4,796.6 4,791.2 4,811.2 4,831.1 4,831.1

Minority interests 0.0 0.0 0.0 0.0 0.0

BV/share (RM) 1.40 1.40 1.40 1.41 1.41

Cash Flow (RMmil, YE 30 Jun) FY19 FY20 FY21F FY22F FY23F

Pretax profit 281.3 259.9 277.7 328.4 347.2

Depreciation/Amortisation 0.0 0.0 0.0 0.0 0.0

Net change in w orking capital (167.6) (7.1) 32.5 (11.9) 20.5

Others 268.5 0.0 0.0 0.0 0.0

Cash flow from operations 382.2 252.8 310.2 316.5 367.7

Capital ex penditure (3.1) (3.0) (3.6) (3.4) (3.8)

Net inv estments & sale of fix ed (550.0) (300.0) (200.0) (100.0) (100.0)

Others (3.1) 0.0 0.0 0.0 0.0

Cash Flow (used in) / from (556.2) (303.0) (203.6) (103.4) (103.8)

Debt raised/(repaid) (1,000.0) 315.1 134.3 96.7 71.2

Equity raised/(repaid) 0.0 0.0 0.0 0.0 0.0

Div idends paid (278.6) (213.6) (257.7) (308.4) (347.2)

Others 1,425.1 (34.2) 17.1 (1.0) 12.2

Cash flow (used in) / from 146.5 67.3 (106.2) (212.8) (263.8)

Net cash flow (27.6) 17.1 0.3 0.3 0.0

Net cash/(debt) b/f 57.6 47.3 71.9 72.2 72.5

Net cash/(debt) c/f 30.0 64.3 72.2 72.5 72.5

Key Ratios (YE30 Jun) FY19 FY20 FY21F FY22F FY23F

Rev enue grow th (%) 3.5 (4.0) 21.3 (6.3) 11.9

NPI margin (%) 75.8 74.8 65.7 74.9 71.9

Pretax margin (%) 48.5 46.7 41.1 51.9 49.1

Net profit margin (%) 47.1 46.8 41.1 51.9 49.1

Interest cov er (x ) 4.0 3.6 3.4 3.2 3.3

Effectiv e tax rate (%) 2.8 0.3 0.0 0.0 0.0

Div idend pay out (%) 103.3 81.9 92.8 93.9 100.0

Receiv able turnov er (day s) 12.2 12.6 12.9 12.6 12.7

Inv entory turnov er (day s) 0.0 0.0 0.0 0.0 0.0

Pay able turnov er (day s) 1.6 1.9 2.0 2.2 1.9

Source: Company, AmInvestment Bank Bhd

AmInvestment Bank Bhd 3

Sunway REIT 10 Feb 2021

Source: Company, AmInvestment Bank Bhd estimates

DISCLOSURE AND DISCLAIMER

This report is prepared for information purposes only and it is issued by AmInvestment Bank Berhad (“AmInvestment”) without

regard to your individual financial circumstances and objectives. Nothing in this report shall constitute an offer to sell, warranty,

representation, recommendation, legal, accounting or tax advice, solicitation or expression of views to influence any one to buy

or sell any real estate, securities, stocks, foreign exchange, futures or investment products. AmInvestment recommends that

you evaluate a particular investment or strategy based on your individual circumstances and objectives and/or seek financial,

legal or other advice on the appropriateness of the particular investment or strategy.

The information in this report was obtained or derived from sources that AmInvestment believes are reliable and correct at the

time of issue. While all reasonable care has been taken to ensure that the stated facts are accurate and views are fair and

reasonable, AmInvestment has not independently verified the information and does not warrant or represent that they are

accurate, adequate, complete or up-to-date and they should not be relied upon as such. All information included in this report

constitute AmInvestment’s views as of this date and are subject to change without notice. Notwithstanding that, AmInvestment

has no obligation to update its opinion or information in this report. Facts and views presented in this report may not reflect the

views of or information known to other business units of AmInvestment’s affiliates and/or related corporations (collectively,

“AmBank Group”).

This report is prepared for the clients of AmBank Group and it cannot be altered, copied, reproduced, distributed or republished

for any purpose without AmInvestment’s prior written consent. AmInvestment, AmBank Group and its respective directors,

officers, employees and agents (“Relevant Person”) accept no liability whatsoever for any direct, indirect or consequential

losses, loss of profits and/or damages arising from the use or reliance of this report and/or further communications given in

relation to this report. Any such responsibility is hereby expressly disclaimed.

AmInvestment is not acting as your advisor and does not owe you any fiduciary duties in connection with this report. The

Relevant Person may provide services to any company and affiliates of such companies in or related to the securities or

products and/or may trade or otherwise effect transactions for their own account or the accounts of their customers which may

give rise to real or potential conflicts of interest.

This report is not directed to or intended for distribution or publication outside Malaysia. If you are outside Malaysia, you should

have regard to the laws of the jurisdiction in which you are located.

If any provision of this disclosure and disclaimer is held to be invalid in whole or in part, such provision will be deemed not to

form part of this disclosure and disclaimer. The validity and enforceability of the remainder of this disclosure and disclaimer will

not be affected.

AmInvestment Bank Bhd 4

You might also like

- Aclu List Research Export 20160810050210Document2 pagesAclu List Research Export 20160810050210api-285701682100% (1)

- Enclosure No. 6: Election Application PacketDocument8 pagesEnclosure No. 6: Election Application PacketLen LegaspiNo ratings yet

- Oil & Gas Firm Earnings Rise Despite CovidDocument5 pagesOil & Gas Firm Earnings Rise Despite CovidBrian StanleyNo ratings yet

- MANUFACTURING EARNINGS RECOVERDocument5 pagesMANUFACTURING EARNINGS RECOVERspam adsNo ratings yet

- Berjaya Food: Company ReportDocument5 pagesBerjaya Food: Company ReportBrian StanleyNo ratings yet

- IJM Corporation Berhad - A Challenging Year For FY21 - 200629Document3 pagesIJM Corporation Berhad - A Challenging Year For FY21 - 200629YI HEN ONGNo ratings yet

- Oil & Gas Report Flags Weaker Serba Dinamik EarningsDocument6 pagesOil & Gas Report Flags Weaker Serba Dinamik EarningsRichbull TraderNo ratings yet

- Lpi Capital: Company ReportDocument5 pagesLpi Capital: Company ReportBrian StanleyNo ratings yet

- V.I.P. Industries (VIP IN) : Q1FY21 Result UpdateDocument6 pagesV.I.P. Industries (VIP IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Ultratech Cement Limited: Outlook Remains ChallengingDocument5 pagesUltratech Cement Limited: Outlook Remains ChallengingamitNo ratings yet

- IDBI Capital Century Plyboards Q1FY23 Result ReviewDocument10 pagesIDBI Capital Century Plyboards Q1FY23 Result ReviewTai TranNo ratings yet

- Nippon Life India Asset Management: Market Share Remains Elusive ReduceDocument10 pagesNippon Life India Asset Management: Market Share Remains Elusive ReduceSriHariKalyanBNo ratings yet

- Nippon Life India Asset Management 1QFY21 results show decline in revenue and profitsDocument10 pagesNippon Life India Asset Management 1QFY21 results show decline in revenue and profitsSriHariKalyanBNo ratings yet

- UEM Sunrise company report provides earnings forecast and maintains HOLD ratingDocument4 pagesUEM Sunrise company report provides earnings forecast and maintains HOLD ratingBrian StanleyNo ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- Bursa Malaysia: Company ReportDocument9 pagesBursa Malaysia: Company ReportBrian StanleyNo ratings yet

- Kian Joo Can Factory: Good Things Come in A Long-Term PackageDocument13 pagesKian Joo Can Factory: Good Things Come in A Long-Term PackageEcho WackoNo ratings yet

- InfosysDocument13 pagesInfosysreena21a9No ratings yet

- FINANCIAL SERVICES TITLEDocument9 pagesFINANCIAL SERVICES TITLEBrian StanleyNo ratings yet

- Sadbhav Engineering (SADE IN) : Q4FY20 Result UpdateDocument8 pagesSadbhav Engineering (SADE IN) : Q4FY20 Result UpdatewhitenagarNo ratings yet

- Deleum 2Q10Results UpdateDocument3 pagesDeleum 2Q10Results Updatelimml63No ratings yet

- H.G. Infra quarterly results beat estimates; maintain 'BuyDocument9 pagesH.G. Infra quarterly results beat estimates; maintain 'BuyDhavalNo ratings yet

- DBS 1Q20 Earnings Miss Estimates Due to Higher AllowancesDocument7 pagesDBS 1Q20 Earnings Miss Estimates Due to Higher AllowancesCalebNo ratings yet

- Iifl - M-Reit - Kyc - 20200915Document37 pagesIifl - M-Reit - Kyc - 20200915Saatvik ShettyNo ratings yet

- AnandRathi On Affle India Pain in Developed Markets Continues MaintainingDocument6 pagesAnandRathi On Affle India Pain in Developed Markets Continues MaintainingamsukdNo ratings yet

- Indian Hotel - Q4FY22 Results - DAMDocument8 pagesIndian Hotel - Q4FY22 Results - DAMRajiv BharatiNo ratings yet

- Anand Rural Electrification Corp Buy 25oct10Document2 pagesAnand Rural Electrification Corp Buy 25oct10bhunkus1327No ratings yet

- MSIL Earnings UpdateDocument6 pagesMSIL Earnings UpdateHitesh JainNo ratings yet

- Public Investment Bank: Dayang Enterprise HoldingsDocument4 pagesPublic Investment Bank: Dayang Enterprise Holdingsumyatika92No ratings yet

- S Chand and Company (SCHAND IN) : Q3FY20 Result UpdateDocument6 pagesS Chand and Company (SCHAND IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- AirAsia Report Raises Earnings ForecastDocument5 pagesAirAsia Report Raises Earnings ForecastJing GokNo ratings yet

- Finance ProjectDocument5 pagesFinance ProjectSanjana Premkumar1998No ratings yet

- Bharti Airtel Company Update - 270810Document6 pagesBharti Airtel Company Update - 270810Robin BhimaiahNo ratings yet

- IDirect MarutiSuzuki Q2FY19Document12 pagesIDirect MarutiSuzuki Q2FY19Rajani KantNo ratings yet

- Serba Dinamik Holdings Under Review: Another Results DisappointmentDocument4 pagesSerba Dinamik Holdings Under Review: Another Results DisappointmentZhi_Ming_Cheah_8136No ratings yet

- AmInv 95622347Document5 pagesAmInv 95622347Lim Chau LongNo ratings yet

- ITC AnalysisDocument7 pagesITC AnalysisPRASHANT ARORANo ratings yet

- Consolidated Construction Consortium LTD.: Dismal Quarter Expect Pick Up AheadDocument6 pagesConsolidated Construction Consortium LTD.: Dismal Quarter Expect Pick Up AheadVivek AgarwalNo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- PGOLD Sees A Slower Performance in 2H20: Puregold Price Club, IncDocument7 pagesPGOLD Sees A Slower Performance in 2H20: Puregold Price Club, IncJNo ratings yet

- DMART - RR - 17102022 - Retail 17 October 2022 104478400Document13 pagesDMART - RR - 17102022 - Retail 17 October 2022 104478400Dhruval KabariyaNo ratings yet

- MMC Corp maintains BUY call amid 8% stake disposal in Saudi portDocument4 pagesMMC Corp maintains BUY call amid 8% stake disposal in Saudi portBrian StanleyNo ratings yet

- ZEE Q4FY20 RESULT UPDATEDocument5 pagesZEE Q4FY20 RESULT UPDATEArpit JhanwarNo ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- Cyient: Poor Quarter Recovery Likely in The Current QuarterDocument9 pagesCyient: Poor Quarter Recovery Likely in The Current QuarterADNo ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- Blue Star (BLSTR In) 2QFY20 Result Update - RsecDocument9 pagesBlue Star (BLSTR In) 2QFY20 Result Update - RsecHardik ShahNo ratings yet

- Eicher Motors Q2FY20 result update sees muted volume growthDocument10 pagesEicher Motors Q2FY20 result update sees muted volume growthDushyant ChaturvediNo ratings yet

- DMART Continues Strong Growth Despite COVID ImpactDocument9 pagesDMART Continues Strong Growth Despite COVID ImpactBhav Bhagwan HaiNo ratings yet

- CEAT Annual Report 2019Document5 pagesCEAT Annual Report 2019Roberto GrilliNo ratings yet

- Nickel StudyDocument7 pagesNickel StudyILSEN N. DAETNo ratings yet

- Oil & Gas Ops Continue for Sapura Despite Partner's WoesDocument4 pagesOil & Gas Ops Continue for Sapura Despite Partner's WoesBrian StanleyNo ratings yet

- Notion Vtec Berhad: Worse Than Feared - 06/08/2010Document3 pagesNotion Vtec Berhad: Worse Than Feared - 06/08/2010Rhb InvestNo ratings yet

- Results Update Jadi 2QFY10Document4 pagesResults Update Jadi 2QFY10limml63No ratings yet

- 1Q21 Profit in Line With Estimates: SM Investments CorporationDocument8 pages1Q21 Profit in Line With Estimates: SM Investments CorporationJajahinaNo ratings yet

- KEC InternationalDocument2 pagesKEC InternationalSnow SnowNo ratings yet

- Astra Agro Lestari Earnings ReviewDocument7 pagesAstra Agro Lestari Earnings ReviewPutri CandraNo ratings yet

- CDSL TP: 750: in Its Own LeagueDocument10 pagesCDSL TP: 750: in Its Own LeagueSumangalNo ratings yet

- Heidelberg Cement India (HEIM IN) : Q3FY20 Result UpdateDocument6 pagesHeidelberg Cement India (HEIM IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- CIFC - Q1FY22 Result Update - 03082021 - 03-08-2021 - 14Document7 pagesCIFC - Q1FY22 Result Update - 03082021 - 03-08-2021 - 14Rojalin SwainNo ratings yet

- MRCB-Quill REIT Neutral: MalaysiaDocument5 pagesMRCB-Quill REIT Neutral: MalaysiaAhmad ShukriNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Oil & Gas Ops Continue for Sapura Despite Partner's WoesDocument4 pagesOil & Gas Ops Continue for Sapura Despite Partner's WoesBrian StanleyNo ratings yet

- Construction Sector 210209Document3 pagesConstruction Sector 210209Brian StanleyNo ratings yet

- Axiata Group: Company ReportDocument5 pagesAxiata Group: Company ReportBrian StanleyNo ratings yet

- Bursa Malaysia: Company ReportDocument9 pagesBursa Malaysia: Company ReportBrian StanleyNo ratings yet

- Stocks on Radar for D&O Green Technologies and Pos MalaysiaDocument2 pagesStocks on Radar for D&O Green Technologies and Pos MalaysiaBrian StanleyNo ratings yet

- Lpi Capital: Company ReportDocument5 pagesLpi Capital: Company ReportBrian StanleyNo ratings yet

- UEM Sunrise company report provides earnings forecast and maintains HOLD ratingDocument4 pagesUEM Sunrise company report provides earnings forecast and maintains HOLD ratingBrian StanleyNo ratings yet

- Telecommunication Sector 210319Document6 pagesTelecommunication Sector 210319Brian StanleyNo ratings yet

- MMC Corp maintains BUY call amid 8% stake disposal in Saudi portDocument4 pagesMMC Corp maintains BUY call amid 8% stake disposal in Saudi portBrian StanleyNo ratings yet

- Apex Healthcare: Company ReportDocument10 pagesApex Healthcare: Company ReportBrian StanleyNo ratings yet

- PPB Group: Company ReportDocument3 pagesPPB Group: Company ReportBrian StanleyNo ratings yet

- Banking Sector 210202Document15 pagesBanking Sector 210202Brian StanleyNo ratings yet

- Sunway Construction: UnderweightDocument5 pagesSunway Construction: UnderweightBrian StanleyNo ratings yet

- Top Glove Corp: Company ReportDocument3 pagesTop Glove Corp: Company ReportBrian StanleyNo ratings yet

- Westports Holdings: Company ReportDocument3 pagesWestports Holdings: Company ReportBrian StanleyNo ratings yet

- Apex Healthcare: Company ReportDocument10 pagesApex Healthcare: Company ReportBrian StanleyNo ratings yet

- Westports Holdings: Company ReportDocument5 pagesWestports Holdings: Company ReportBrian StanleyNo ratings yet

- Bursa Malaysia: Company ReportDocument9 pagesBursa Malaysia: Company ReportBrian StanleyNo ratings yet

- Stocks on Radar for D&O Green Technologies and Pos MalaysiaDocument2 pagesStocks on Radar for D&O Green Technologies and Pos MalaysiaBrian StanleyNo ratings yet

- Plantation News Flow 210202Document3 pagesPlantation News Flow 210202Brian StanleyNo ratings yet

- Lpi Capital: Company ReportDocument5 pagesLpi Capital: Company ReportBrian StanleyNo ratings yet

- Stocks On Radar: Retail ResearchDocument2 pagesStocks On Radar: Retail ResearchBrian StanleyNo ratings yet

- MMC Corp maintains BUY call amid 8% stake disposal in Saudi portDocument4 pagesMMC Corp maintains BUY call amid 8% stake disposal in Saudi portBrian StanleyNo ratings yet

- Banking Sector 210202Document15 pagesBanking Sector 210202Brian StanleyNo ratings yet

- Property & REIT sector rebounds expected in 2H20Document3 pagesProperty & REIT sector rebounds expected in 2H20Brian StanleyNo ratings yet

- Sunway: Company ReportDocument4 pagesSunway: Company ReportBrian StanleyNo ratings yet

- Stocks On Radar: Retail ResearchDocument2 pagesStocks On Radar: Retail ResearchBrian StanleyNo ratings yet

- The Prosecutor's HandbookDocument162 pagesThe Prosecutor's HandbooksamuelNo ratings yet

- Patient-Centred CareDocument15 pagesPatient-Centred CareMwanja MosesNo ratings yet

- LuisRFlores (lf6225) UTRESUMEDocument3 pagesLuisRFlores (lf6225) UTRESUMELuis Rene FloresNo ratings yet

- Indian Pharmaceutical Industry: The Changing Dynamics: April 2016Document26 pagesIndian Pharmaceutical Industry: The Changing Dynamics: April 2016payal joshiNo ratings yet

- Upliftment of Recto AveDocument6 pagesUpliftment of Recto AveFrance CortezanoNo ratings yet

- Wedding Planning GuideDocument159 pagesWedding Planning GuideRituparna Majumder0% (1)

- TMA2 12 09 2021 UploadDocument3 pagesTMA2 12 09 2021 UploadG.G. PRABHATH CHINTHAKANo ratings yet

- PSC Vacancy Government SpokespersonDocument3 pagesPSC Vacancy Government SpokespersonMoreen WachukaNo ratings yet

- Wa0031 PDFDocument1 pageWa0031 PDFAnaNo ratings yet

- Waterless Dyeing Technique (DYECOO)Document10 pagesWaterless Dyeing Technique (DYECOO)abhishekranjan07100% (2)

- SRX835 Spec Sheet - 11 - 11 - 19Document4 pagesSRX835 Spec Sheet - 11 - 11 - 19Eric PageNo ratings yet

- Vodacom Fibre - Application Form CPD - 23 August 2018Document8 pagesVodacom Fibre - Application Form CPD - 23 August 2018Mla Emmanuel ZondoNo ratings yet

- NY B17 ATF FDR - 7-24-03 ATF Email and 10-25-01 ATF After Action Report 092Document20 pagesNY B17 ATF FDR - 7-24-03 ATF Email and 10-25-01 ATF After Action Report 0929/11 Document Archive100% (2)

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- Preface: What Is Financial Intelligence?Document4 pagesPreface: What Is Financial Intelligence?Iuliana GondosNo ratings yet

- Tle 6 Ict Q4 M9Document16 pagesTle 6 Ict Q4 M9Christ Khayzee R. BacalsoNo ratings yet

- Certified Elder Law Attorney Middletown NyDocument8 pagesCertified Elder Law Attorney Middletown NymidhudsonlawNo ratings yet

- Tribology Aspects in Angular Transmission Systems: Hypoid GearsDocument7 pagesTribology Aspects in Angular Transmission Systems: Hypoid GearspiruumainNo ratings yet

- Instruction Manual For Spider S3 and Spider S4Document6 pagesInstruction Manual For Spider S3 and Spider S4Syah KamalNo ratings yet

- Petitioner Vs Vs Respondents Marcial Esposo Eulogio F. Lerum M. A. FerrerDocument4 pagesPetitioner Vs Vs Respondents Marcial Esposo Eulogio F. Lerum M. A. Ferrerclarisse lyka hattonNo ratings yet

- Global CityDocument3 pagesGlobal Citycr lamigoNo ratings yet

- CV (Muhammad Irfan Khan)Document3 pagesCV (Muhammad Irfan Khan)Niazi_sabNo ratings yet

- Manual Flowpet 5GDocument56 pagesManual Flowpet 5GRahkmat DanizarNo ratings yet

- Shrimp Aquaculture in Sarangani BayDocument5 pagesShrimp Aquaculture in Sarangani BayronanvillagonzaloNo ratings yet

- Systemverilog Interview QuestionsDocument31 pagesSystemverilog Interview QuestionsDivya Dm100% (1)

- Principles of Marketing Handout 4: Marketing Opportunity and Consumer AnalysisDocument19 pagesPrinciples of Marketing Handout 4: Marketing Opportunity and Consumer AnalysisAsset Dy100% (1)

- Accounting for Business CombinationsDocument52 pagesAccounting for Business CombinationsEliza BethNo ratings yet

- Missing Number Series Questions Specially For Sbi Po PrelimsDocument18 pagesMissing Number Series Questions Specially For Sbi Po PrelimsKriti SinghaniaNo ratings yet