Professional Documents

Culture Documents

California - Manufacturing - Co. - Inc. - V.20170723-911-Ub410s

Uploaded by

mimimilkteaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

California - Manufacturing - Co. - Inc. - V.20170723-911-Ub410s

Uploaded by

mimimilkteaCopyright:

Available Formats

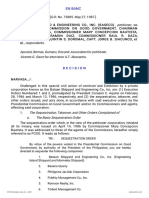

FIRST DIVISION

[G.R. No. 202454. April 25, 2017.]

CALIFORNIA MANUFACTURING COMPANY, INC. , petitioner, vs.

INC. respondent.

ADVANCED TECHNOLOGY SYSTEM, INC.,

DECISION

SERENO , C.J : p

Before us is a Petition for Review on Certiorari assailing the Decision 1 of the

Court of Appeals (CA) in CA-G.R. CV No. 94409, which denied the appeal led by

California Manufacturing Company, Inc. (CMCI) from the Decision 2 of Regional Trial

Court (RTC) of Pasig City, Branch 268, in the Complaint for Sum of Money 3 led by

Advanced Technology Systems, Inc. (ATSI) against the former.

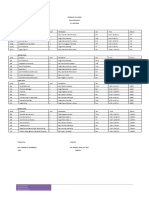

The RTC ordered CMCI to pay ATSI the amount of P443,729.39 for the unpaid

rentals for a Prodopak machine, plus legal interest from the date of extra-judicial

demand until full payment; 30% of the judgment award as attorney's fees; and the costs

of litigation. The CA a rmed the trial court's decision, but it deleted the award of

attorney's fees for lack of factual and legal basis and ordered CMCI to pay the costs of

litigation.

THE ANTECEDENT FACTS

Petitioner CMCI is a domestic corporation engaged in the food and beverage

manufacturing business. Respondent ATSI is also a domestic corporation that

fabricates and distributes food processing machinery and equipment, spare parts, and

its allied products. 4

In August 2001, CMCI leased from ATSI a Prodopak machine which was used to

pack products in 20-ml. pouches. 5 The parties agreed to a monthly rental of P98,000

exclusive of tax. Upon receipt of an open purchase order on 6 August 2001, ATSI

delivered the machine to CMCI's plant at Gateway Industrial Park, General Trias, Cavite

on 8 August 2001.

In November 2003, ATSI led a Complaint for Sum of Money 6 against CMCI to

collect unpaid rentals for the months of June, July, August, and September 2003. ATSI

alleged that CMCI was consistently paying the rents until June 2003 when the latter

defaulted on its obligation without just cause. ATSI also claimed that CMCI ignored all

the billing statements and its demand letter. Hence, in addition to the unpaid rents ATSI

sought payment for the contingent attorney's fee equivalent to 30% of the judgment

award.

CMCI moved for the dismissal of the complaint on the ground of extinguishment

of obligation through legal compensation. The RTC, however, ruled that the con icting

claims of the parties required trial on the merits. It therefore dismissed the motion to

dismiss and directed CMCI to file an Answer. 7

In its Answer, 8 CMCI averred that ATSI was one and the same with Processing

Partners and Packaging Corporation (PPPC), which was a toll packer of CMCI

CD Technologies Asia, Inc. © 2017 cdasiaonline.com

products. To support its allegation, CMCI submitted copies of the Articles of

Incorporation and General Information Sheets (GIS) 9 of the two corporations. CMCI

pointed out that ATSI was even a stockholder of PPPC as shown in the latter's GIS. 1 0

CMCI alleged that in 2000, PPPC agreed to transfer the processing of CMCI's

product line from its factory in Meycauayan to Malolos, Bulacan. Upon the request of

PPPC, through its Executive Vice President Felicisima Celones, CMCI advanced P4

million as mobilization fund. PPPC President and Chief Executive O cer Francis

Celones allegedly committed to pay the amount in 12 equal instalments deductible

from PPPC's monthly invoice to CMCI beginning in October 2000. 1 1 CMCI likewise

claims that in a letter dated 30 July 2001, 1 2 Felicisima proposed to set off PPPC's

obligation to pay the mobilization fund with the rentals for the Prodopak machine.

CMCI argued that the proposal was binding on both PPPC and ATSI because

Felicisima was an officer and a majority stockholder of the two corporations. Moreover,

in a letter dated 16 September 2003, 1 3 she allegedly represented to the new

management of CMCI that she was authorized to request the offsetting of PPPC's

obligation with ATSI's receivable from CMCI. When ATSI led suit in November 2003,

PPPC's debt arising from the mobilization fund allegedly amounted to P10,766,272.24.

Based on the above, CMCI argued that legal compensation had set in and that

ATSI was even liable for the balance of PPPC's unpaid obligation after deducting the

rentals for the Prodopak machine.

After trial, the RTC rendered a Decision in favor of ATSI with the following

dispositive portion:

WHEREFORE, foregoing premises considered, judgment is hereby

rendered in favor of plaintiff and against the defendant, ordering the latter to

pay the former, the following sums:

1. Php443,729.39 representing the unpaid rental for the prodopak

machine plus legal interest from the date of extra judicial demand (October

13, 2003 — Exh. "E") until satisfaction of this judgment;

2. 30% of the judgment award as and by way of attorney's fees; and

3. costs of litigation. 1 4

The trial court ruled that legal compensation did not apply because PPPC had a

separate legal personality from its individual stockholders, the Spouses Celones, and

ATSI. Moreover, there was no board resolution or any other proof showing that

Felicisima's proposal to set-off the unpaid mobilization fund with CMCI's rentals to

ATSI for the Prodopak Machine had been authorized by the two corporations.

Consequently, the RTC ruled that CMCI's nancial obligation to pay the rentals for the

Prodopak machine stood and that its claim against PPPC could be properly ventilated

in the proper proceeding upon payment of the required docket fees. 1 5

On appeal by CMCI, the CA a rmed the trial court's ruling that legal

compensation had not set in because the element of mutuality of parties was lacking.

Likewise, the appellate court sustained the trial court's refusal to pierce the corporate

veil. It ruled that there must be clear and convincing proof that the Spouses Celones

had used the separate personalities of ATSI or PPPC as a shield to commit fraud or any

wrong against CMCI, which was not existing in this case. 1 6

Aside from the absence of a board resolution issued by ATSI, the CA observed

that the letter dated 30 July 2001 clearly showed that Felicisima's proposal to effect

the offsetting of debts was limited to the obligation of PPPC. 1 7 The appellate court

CD Technologies Asia, Inc. © 2017 cdasiaonline.com

thus sustained the trial court's finding that ATSI was not bound by Felicisima's conduct.

Moreover, the CA rejected CMCI's argument that ATSI is barred by estoppel as it

found no indication that ATSI had created any appearance of false fact. 1 8 CA also held

that estoppel did not apply to PPPC because the latter was not even a party to this

case.

The CA, however, deleted the trial court's award of attorney's fees and costs of

litigation in favor of ATSI as it found no discussion in the body of the decision of the

factual and legal justification for the award.

CMCI led a Motion for Reconsideration of the CA Decision, but the appellate

court denied the motion for lack of merit. 1 9 Hence, this petition. 2 0

THE ISSUE

The assignment of errors raised by CMCI all boil down to the question of whether

the CA erred in a rming the ruling of the RTC that legal compensation between ATSI's

claim against CMCI on the one hand, and the latter's claim against PPPC on the other

hand, has not set in.

OUR RULING

We affirm the CA Decision in toto.

CMCI argues that both the RTC and the CA overlooked the circumstances that it

has proven to justify the piercing of corporate veil in this case, i.e., (1) the interlocking

board of directors, incorporators, and majority stockholder of PPPC and ATSI; (2)

control of the two corporations by the Spouses Celones; and (3) the two corporations

were mere alter egos or business conduits of each other. CMCI now asks us to

disregard the separate corporate personalities of ATSI and PPPC based on those

circumstances and to enter judgment in favor of the application of legal compensation.

Whether one corporation is merely an alter ego of another, a sham or subterfuge,

and whether the requisite quantum of evidence has been adduced to warrant the

puncturing of the corporate veil are questions of fact. 2 1 Relevant to this point is the

settled rule that in a petition for review on certiorari like this case, this Court's

jurisdiction is limited to reviewing errors of law in the absence of any showing that the

factual ndings complained of are devoid of support in the records or are glaringly

erroneous. 2 2 This rule alone warrants the denial of the petition, which essentially asks

us to reevaluate the evidence adduced by the parties and the credibility of the

witnesses presented.

We have reviewed the evidence on record and have found no cogent reason to

disturb the ndings of the courts a quo that ATSI is distinct and separate from PPPC,

or from the Spouses Celones.

Any piercing of the corporate veil must be done with caution. 2 3 As the CA had

correctly observed, it must be certain that the corporate fiction was misused to such an

extent that injustice, fraud, or crime was committed against another, in disregard of

rights. Moreover, the wrongdoing must be clearly and convincingly established. Sarona

v. NLRC 2 4 instructs, thus:

Whether the separate personality of the corporation should be pierced

hinges on obtaining facts appropriately pleaded or proved. However, any

piercing of the corporate veil has to be done with caution, albeit the Court will

not hesitate to disregard the corporate veil when it is misused or when

necessary in the interest of justice. After all, the concept of corporate entity was

CD Technologies Asia, Inc. © 2017 cdasiaonline.com

not meant to promote unfair objectives.

The doctrine of piercing the corporate veil applies only in three (3) basic

areas, namely: 1) defeat of public convenience as when the corporate ction is

used as a vehicle for the evasion of an existing obligation; 2) fraud cases or

when the corporate entity is used to justify a wrong, protect fraud, or defend a

crime; or 3) alter ego cases, where a corporation is merely a farce since it is a

mere alter ego or business conduit of a person, or where the corporation is so

organized and controlled and its affairs are so conducted as to make it merely

an instrumentality, agency, conduit or adjunct of another corporation. 2 5

CMCI's alter ego theory rests on the alleged interlocking boards of directors and

stock ownership of the two corporations. The CA, however, rejected this theory based

on the settled rule that mere ownership by a single stockholder of even all or nearly all

of the capital stocks of a corporation, by itself, is not su cient ground to disregard the

corporate veil. We can only sustain the CA's ruling. The instrumentality or control test of

the alter ego doctrine requires not mere majority or complete stock control, but

complete domination of nances, policy and business practice with respect to the

transaction in question. The corporate entity must be shown to have no separate mind,

will, or existence of its own at the time of the transaction. 2 6

Without question, the Spouses Celones are incorporators, directors, and majority

stockholders of the ATSI and PPPC. But that is all that CMCI has proven. There is no

proof that PPPC controlled the nancial policies and business practices of ATSI either

in July 2001 when Felicisima proposed to set off the unpaid P3.2 million mobilization

fund with CMCI's rental of Prodopak machines; or in August 2001 when the lease

agreement between CMCI and ATSI commenced. Assuming arguendo that Felicisima

was su ciently clothed with authority to propose the offsetting of obligations, her

proposal cannot bind ATSI because at that time the latter had no transaction yet with

CMCI. Besides, CMCI had leased only one Prodopak machine. Felicisima's reference to

the Prodopak machines in its letter in July 2001 could only mean that those were

different from the Prodopak machine that CMCI had leased from ATSI.

Contrary to the claim of CMCI, none of the letters from the Spouses Celones tend

to show that ATSI was even remotely involved in the proposed offsetting of the

outstanding debts of CMCI and PPPC. Even Felicisima's letter to the new management

of CMCI in 2003 contains nothing to support CMCI's argument that Felicisima

represented herself to be clothed with authority to propose the offsetting. For clarity,

we quote below the relevant portions of her letter:

Gentlemen:

I apologize for writing this letter. But kindly spare me your time and allow

to ventilate my grievances against California Manufacturing Corporation x x x. I

had formally lodged my grievances with the management of CMC, but until

now, no action has been done yet. It is on this spirit and time tested principle of

diplomacy that I write this letter.

I am the Executive Vice President of Processing Partners &

Packaging Corporation (PPPC), a duly organized domestic

corporation, engaged in the toll packing business.

Sometime in November of 1996, CMC availed of the toll packing

services of PPPC. At the outset, business relationship between the two was

going smoothly. In due time, PPPC proved its name to CMC in delivering quality

toll packing services. As a matter of fact, after the expiration of the toll packing

contract, CMC still retained the services of PPPC. Thus, sometime in the year

CD Technologies Asia, Inc. © 2017 cdasiaonline.com

2000, CMC executed another toll packing contract with PPC.

However, the business relationship unexpectedly turned sour when CMC

changed its Management in the latter part of 2002. Since then CMC's new

management has been committing unsound business practices prejudicial to

the interests of PPPC.

xxx xxx xxx

Failure of CMC to honor its

agreement with PPC anent

the pickling machinery

xxx xxx xxx

Leapfrog Plant/Jasmine and

Rose Plant

xxx xxx xxx

Pre-termination of toll

[p]acking [a]greement for

KLS Spaghetti Sauce without

just cause

xxx xxx xxx

Unpaid rentals for the lease

of machinery from Advanced

Technology Systems, Inc.

CMC has been leasing a machinery of Advanced Technology Systems,

Inc. (Advanced Tech), a domestic corporation of which I am also the majority

stockholder. CMC owes Advanced Tech. unpaid rentals in the amount of

P443,729.37, but despite various demands, CMC refused to pay

Advanced Tech.

We have already formally lodged our grievances concerning the

foregoing with the management of CMC. However, until now, no action has

been done. We believe that before we take coercive actions available under the

law, it is wise to bring said grievances rst to your attention to exhaust available

venues for amicable settlement.

Though PPPC's grievances are ripe for judicial action, we still hope

that we can settle [the] same amicably. However, if we run out of choices, we

will [be] constrained to invoke the aid of the appropriate court. (Emphases

supplied) 2 7

Nothing in the narration above supports CMCI's claim that it had been led to

believe that ATSI and PPPC were one and the same; or, that ATSI's collectible was

intertwined with the business transaction of PPPC with CMCI.

In all its pleadings, CMCI averred that the P4 million mobilization fund was in

furtherance of its agreement with PPPC in 2000. Prior thereto, PPPC had been a toll

packer of its products as early as 1996. Clearly, CMCI had been dealing with PPPC as a

distinct juridical person acting through its own corporate o cers from 1996 to 2003.

CMCI's dealing with ATSI began only in August 2001. It appears, however, that CMCI

now wants the Court to gloss over the separate corporate existence ATSI and PPPC

notwithstanding the dearth of evidence showing that either PPPC or ATSI had used

their corporate cover to commit fraud or evade their respective obligations to CMCI. It

even appears that CMCI faithfully discharged its obligation to ATSI for a good two

CD Technologies Asia, Inc. © 2017 cdasiaonline.com

years without raising any concern about its relationship to PPPC.

The fraud test, which is the second of the three-prong test to determine the

application of the alter ego doctrine, requires that the parent corporation's conduct in

using the subsidiary corporation be unjust, fraudulent or wrongful. Under the third

prong, or the harm test, a causal connection between the fraudulent conduct

committed through the instrumentality of the subsidiary and the injury suffered or the

damage incurred by the plaintiff has to be established. 2 8 None of these elements have

been demonstrated in this case. Hence, we can only agree with the CA and RTC in ruling

out mutuality of parties to justify the application of legal compensation in this case.

Article 1279 of the Civil Code provides:

ARTICLE 1279. In order that compensation may be proper, it is necessary:

(1) That each one of the obligors be bound principally, and that he be

at the same time a principal creditor of the other;

(2) That both debts consist in a sum of money, or if the things due

are consumable, they be of the same kind, and also of the same quality if the

latter has been stated;

(3) That the two debts be due;

(4) That they be liquidated and demandable;

(5) That over neither of them there be any retention or controversy,

commenced by third persons and communicated in due time to the debtor.

The law, therefore, requires that the debts be liquidated and demandable.

Liquidated debts are those whose exact amounts have already been determined. 2 9

CMCI has not presented any credible proof, or even just an exact computation, of

the supposed debt of PPPC. It claims that the mobilization fund that it had advanced to

PPPC was in the amount of P4 million. Yet, Felicisima's proposal to conduct offsetting

in her letter dated 30 July 2001 pertained to a P3.2 million debt of PPPC to CMCI.

Meanwhile, in its Answer to ATSI's complaint, CMCI sought to set off its unpaid rentals

against the alleged P10 million debt of PPPC. The uncertainty in the supposed debt of

PPPC to CMCI negates the latter's invocation of legal compensation as justi cation for

its non-payment of the rentals for the subject Prodopak machine.

WHEREFORE, the Decision dated 25 August 2011 and Resolution dated 21 June

2012 issued by the Court of Appeals in CA-G.R. CV No. 94409 are AFFIRMED.

AFFIRMED The

instant Petition is DENIED for lack of merit.

SO ORDERED.

Leonardo-de Castro, Del Castillo, Perlas-Bernabe and Caguioa, JJ., concur.

Footnotes

1. Rollo, pp. 57-78. The Decision is dated 25 August 2011 and it was penned by Associate

Justice Celia C. Librea-Leagogo, with Associate Justices Remedios Salazar-Fernando

and Michael P. Elbinias concurring.

2. Id. at 84-88. The Decision is dated 13 April 2009 and was penned by Judge Amelia C.

Manalastas.

3. The case was docketed as Civil Case No. 69735.

4. RTC Records, p. 41.

CD Technologies Asia, Inc. © 2017 cdasiaonline.com

5. Id. at 6.

6. Id. at 1-11.

7. Id. at 125 (Order dated 2 August 2004).

8. Id. at 131-142. The title of the pleading is Answer Ad Cautelam as CMCI reserved the filing of

a Petition for Certiorari within the period allowed by the Rules.

9. Id. at 149-204, 564-638.

10. Id. at 203.

11. Id. at 144, 612.

12. Id. at 145, 560.

13. Id. at 146-148, 561-563.

14. Id. at 88.

15. Id. at 87-88.

16. Id. at 68-70.

17. Id. at 71.

18. Id. at 71-72.

19. Id. at 80-82. The Order denying the Motion for Reconsideration is dated 21 June 2012, and it

was penned by Associate Justice Celia C. Librea-Leagogo, with Associate Justices

Remedios Salazar-Fernando and Michael P. Elbinias concurring.

20. Respondent did not le a Comment on the Petition despite several notices from the Court.

The rst Resolution requiring respondent to le a Comment was dated 21 January 2013

(Rollo, p. 102), which was received by Eric Sorodia, authorized agent of ATSI, on 5 April

2013 (Id. at 103). The subsequent Resolution dated 11 December 2013 containing a

show cause and comply order intended was likewise received by respondent on 7 March

2014 through its authorized agent, Albert Prado (Id. at 107). The two resolutions were

resent and duly received by respondent on 30 October 2014 as shown in the return card

attached to the rollo. The last Resolution directing respondent to le a Comment was

dated 5 August 2015 (Id. at 135). In the Resolution dated 27 July 2016 (Id. at 141-142),

we noted that the show cause and comply order with copies of the Resolutions dated 21

January 2013 and 11 December 2013 were returned to the Court undelivered with the

postal notation "RTS-moved out left no address." Accordingly, we ruled that respondent's

right to le Comment was deemed waived and we directed the Clerk of Court, Court of

Appeals, to elevate the complete records of the case.

21. Philippine National Bank v. Hydro Resources Contractors Corporation, 706 Phil. 297 (2013).

22. Bank of Philippine Islands v. Bank of Philippine Islands Employees Union-Metro Manila, 693

Phil. 82 (2012) citing Retuya v. Dumarpa, 455 Phil. 734 (2003).

23. Vda. de Roxas v. Our Lady's Foundation, Inc., 705 Phil. 505 (2013).

24. 679 Phil. 394 (2012).

25. Supra.

26. Supra note 21.

CD Technologies Asia, Inc. © 2017 cdasiaonline.com

27. Records, pp. 146-148.

28. Supra note 20.

29. Asia Trust Development Bank v. Tuble, 691 Phil. 732 (2012).

CD Technologies Asia, Inc. © 2017 cdasiaonline.com

You might also like

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- California Manufacturing Company vs Advanced Technology SystemsDocument9 pagesCalifornia Manufacturing Company vs Advanced Technology SystemsAmmie AsturiasNo ratings yet

- California Manufacturing Company, Inc. vs. Advanced Technology System, Inc.Document7 pagesCalifornia Manufacturing Company, Inc. vs. Advanced Technology System, Inc.louryNo ratings yet

- California Manufacturing Company, Inc. vs. Advanced Technology System, Inc.Document7 pagesCalifornia Manufacturing Company, Inc. vs. Advanced Technology System, Inc.louryNo ratings yet

- California Vs AdvancedDocument7 pagesCalifornia Vs AdvancedMazaya VillameNo ratings yet

- CMCI Ordered to Pay Rental Arrears for Prodopak MachineDocument4 pagesCMCI Ordered to Pay Rental Arrears for Prodopak MachineCherry ChaoNo ratings yet

- California Manufacturing Company Inc. v. Advanced TechnologyDocument2 pagesCalifornia Manufacturing Company Inc. v. Advanced TechnologyGR100% (4)

- California Manufacturing Company Inc vs. Advanced System Technology IncDocument3 pagesCalifornia Manufacturing Company Inc vs. Advanced System Technology IncCarlota Nicolas VillaromanNo ratings yet

- California Manufacturing Company Inc vs. Advanced System Technology Inc PDFDocument3 pagesCalifornia Manufacturing Company Inc vs. Advanced System Technology Inc PDFCarlota Nicolas Villaroman100% (1)

- CA Affirms No Legal Compensation Between Manufacturing Company and Technology Firm Rent DisputeDocument2 pagesCA Affirms No Legal Compensation Between Manufacturing Company and Technology Firm Rent DisputeMac SorianoNo ratings yet

- G.R. No. 202454 Alter Ego CaseDocument14 pagesG.R. No. 202454 Alter Ego CaseChatNo ratings yet

- Adr Set PNCC Vs CA G.R. No. 165433 February 6, 2007Document12 pagesAdr Set PNCC Vs CA G.R. No. 165433 February 6, 2007RL N DeiparineNo ratings yet

- Sun Insurance Office, Ltd. V. Hon. Maximiano Asuncion: RuledDocument15 pagesSun Insurance Office, Ltd. V. Hon. Maximiano Asuncion: RuledEzra Joy Angagan CanosaNo ratings yet

- 147 Republic Vs Mega Pacific ESolutionsDocument2 pages147 Republic Vs Mega Pacific ESolutionsJulius Geoffrey Tangonan67% (3)

- C-1 Communication and Information Systems Corp V Mark Sensing AustraliaDocument8 pagesC-1 Communication and Information Systems Corp V Mark Sensing AustraliaKim MontanoNo ratings yet

- Communication System Corporation vs. Mark Sensing Australia, G.R. No. 192159, 2016Document6 pagesCommunication System Corporation vs. Mark Sensing Australia, G.R. No. 192159, 2016Nikko AlelojoNo ratings yet

- Insular Savings Bank V. Febtc FactsDocument9 pagesInsular Savings Bank V. Febtc FactsLincy Jane AgustinNo ratings yet

- DPWH V. CMC (G.R. NO. 1797323, September 13, 2017)Document2 pagesDPWH V. CMC (G.R. NO. 1797323, September 13, 2017)Digna LausNo ratings yet

- Cases On Docket FeesDocument7 pagesCases On Docket FeesKrystal HolmesNo ratings yet

- PNCC vs. CA (514 SCRA 569)Document12 pagesPNCC vs. CA (514 SCRA 569)Emmanuel S. CaliwanNo ratings yet

- PNCC Vs CaDocument19 pagesPNCC Vs CaJacquelyn AlegriaNo ratings yet

- Public Estates AuthorityDocument6 pagesPublic Estates AuthorityZydalgLadyz NeadNo ratings yet

- Korea Tech V Lerma DigestDocument7 pagesKorea Tech V Lerma Digestdivine_carlosNo ratings yet

- Judicial Review of CIAC Findings in Construction DisputesDocument2 pagesJudicial Review of CIAC Findings in Construction DisputesCareyssa Mae50% (2)

- Corporation Law Assignment CasesDocument14 pagesCorporation Law Assignment CasesRidmd TresNo ratings yet

- Rule 65Document9 pagesRule 65Rochelle GablinesNo ratings yet

- Adr Digest August 5 Case 6-110Document7 pagesAdr Digest August 5 Case 6-110JohnPaulRomero0% (1)

- Magellan Corporation Vs Phil - Air ForceDocument10 pagesMagellan Corporation Vs Phil - Air ForceRald RamirezNo ratings yet

- DPWH V CMCDocument4 pagesDPWH V CMCAnonymous yEnT80100% (2)

- Petitioners Vs Vs Respondent: Second DivisionDocument10 pagesPetitioners Vs Vs Respondent: Second DivisionPaulo PeñaNo ratings yet

- 2022bcctc7Document11 pages2022bcctc7Alex PereiraNo ratings yet

- CDCP Vs CuencaDocument4 pagesCDCP Vs CuencaRhoddickMagrataNo ratings yet

- SEC jurisdiction over proxy validation disputesDocument8 pagesSEC jurisdiction over proxy validation disputesAnonymous vTBEE2No ratings yet

- State Immunity and AttachmentDocument5 pagesState Immunity and AttachmentReina Anne JaymeNo ratings yet

- 166783-2011-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Pz9mxuDocument11 pages166783-2011-Keppel Cebu Shipyard Inc. v. Pioneer20210424-14-Pz9mxuHADTUGINo ratings yet

- 10 Philrock Vs CIAC Case Digest OkDocument8 pages10 Philrock Vs CIAC Case Digest OkIvan Montealegre ConchasNo ratings yet

- MITSUBISHI MOTORS v. BOCDocument2 pagesMITSUBISHI MOTORS v. BOCRuby ReyesNo ratings yet

- Comelec's Flawed AES Bidding Process Ruled UnconstitutionalDocument11 pagesComelec's Flawed AES Bidding Process Ruled UnconstitutionalJunalyn BuesaNo ratings yet

- ABS-CBN Broadcasting Corporation Vs World Interactive Network Systems (WINS) Japan Co., LTD., 544 SCRA 308 / G.R. No. 169332, February 11, 2008 FactsDocument7 pagesABS-CBN Broadcasting Corporation Vs World Interactive Network Systems (WINS) Japan Co., LTD., 544 SCRA 308 / G.R. No. 169332, February 11, 2008 FactsYen pptoNo ratings yet

- PAF Dispute Over Aircraft Engine Repair PaymentDocument29 pagesPAF Dispute Over Aircraft Engine Repair PaymentChris.No ratings yet

- Supreme Court Rules Against Rescission of HMO ContractDocument4 pagesSupreme Court Rules Against Rescission of HMO ContractRobert Jayson UyNo ratings yet

- 17 PCIC Vs Philippine National ConstructionDocument6 pages17 PCIC Vs Philippine National ConstructionVina CagampangNo ratings yet

- HCI vs EMI dispute over HMO contract terminationDocument8 pagesHCI vs EMI dispute over HMO contract terminationRobyn BangsilNo ratings yet

- El Dorado Consulting Realty and Development20210505-12-7ret26Document9 pagesEl Dorado Consulting Realty and Development20210505-12-7ret26Li-an RodrigazoNo ratings yet

- Bautista Casedigest4Document6 pagesBautista Casedigest4Cecille BautistaNo ratings yet

- National Transmission Corp vs. Alphaomega PDFDocument14 pagesNational Transmission Corp vs. Alphaomega PDFAira Mae P. LayloNo ratings yet

- GMCC vs. Gotesco: GMCC Can Withdraw The Petition After The Satisfaction of The Judgment AwardDocument18 pagesGMCC vs. Gotesco: GMCC Can Withdraw The Petition After The Satisfaction of The Judgment AwardyanaNo ratings yet

- FRIA Case Digests 2020Document21 pagesFRIA Case Digests 2020Mae100% (1)

- Civil Law Review 2 Oblicon CasesDocument22 pagesCivil Law Review 2 Oblicon CasesPaulitoPunongbayanNo ratings yet

- Court limits judicial review of CIAC arbitral awardsDocument4 pagesCourt limits judicial review of CIAC arbitral awardsRhoanne Shyry OregilaNo ratings yet

- CIVCRED 2015 (GR No 172301, Philippine National Construction Corp. v. Asiavest Merchant Bankers (M) Berhad)Document2 pagesCIVCRED 2015 (GR No 172301, Philippine National Construction Corp. v. Asiavest Merchant Bankers (M) Berhad)Michael Parreño VillagraciaNo ratings yet

- JUDICIAL PROCEDURES ON TAX ASSESSMENTSDocument4 pagesJUDICIAL PROCEDURES ON TAX ASSESSMENTSVikki AmorioNo ratings yet

- Quality Check On DigestsDocument3 pagesQuality Check On DigestsStephen MagallonNo ratings yet

- Supreme Court upholds ruling requiring Seaoil to pay Autocorp for excavatorDocument7 pagesSupreme Court upholds ruling requiring Seaoil to pay Autocorp for excavatoremslansanganNo ratings yet

- KOREA TECHNOLOGIES CO., LTD., V Judge LermaDocument5 pagesKOREA TECHNOLOGIES CO., LTD., V Judge LermaKastin SantosNo ratings yet

- Adr CasesDocument5 pagesAdr CasesJerraemie Nikka Cipres PatulotNo ratings yet

- Philrock Vs CIACDocument2 pagesPhilrock Vs CIACmamacheNo ratings yet

- Korea Tech v. Lerma #4 (2nd Batch)Document4 pagesKorea Tech v. Lerma #4 (2nd Batch)Michelle Dulce Mariano CandelariaNo ratings yet

- Metro Construction vs. Chatham PropertiesDocument3 pagesMetro Construction vs. Chatham PropertiesannmirandaNo ratings yet

- MaglalangDocument4 pagesMaglalangmonchievalera100% (1)

- 396014538-2018-Suggested-Tax-Bar-Answer (7) .PDF: Danilo M.sampaga Full DescriptionDocument7 pages396014538-2018-Suggested-Tax-Bar-Answer (7) .PDF: Danilo M.sampaga Full DescriptionmimimilkteaNo ratings yet

- Bataan - Shipyard - and - Engineering - Co. - Inc. - V.20200216-9933-1c7rzuoDocument42 pagesBataan - Shipyard - and - Engineering - Co. - Inc. - V.20200216-9933-1c7rzuomimimilkteaNo ratings yet

- 24 Crisostomo v. Court of AppealsDocument2 pages24 Crisostomo v. Court of AppealsmimimilkteaNo ratings yet

- 396014538-2018-Suggested-Tax-Bar-Answer (7) .PDF: Danilo M.sampaga Full DescriptionDocument7 pages396014538-2018-Suggested-Tax-Bar-Answer (7) .PDF: Danilo M.sampaga Full DescriptionmimimilkteaNo ratings yet

- Gold - Line - Tours - Inc. - v. - Heirs - of - LacsaDocument9 pagesGold - Line - Tours - Inc. - v. - Heirs - of - LacsamimimilkteaNo ratings yet

- Filipinas - Broadcasting - Network - Inc. - v. - Ago20180411-1159-Yqyyb2Document14 pagesFilipinas - Broadcasting - Network - Inc. - v. - Ago20180411-1159-Yqyyb2mimimilkteaNo ratings yet

- CA upholds donation but nullifies deed due to lack of juridical personalityDocument11 pagesCA upholds donation but nullifies deed due to lack of juridical personalitymimimilkteaNo ratings yet

- 21 Manay JR v. Cebu Air Inc.Document2 pages21 Manay JR v. Cebu Air Inc.mimimilkteaNo ratings yet

- Birkenstock - Orthopaedie - GMBH - and - Co. - KG - v.Document9 pagesBirkenstock - Orthopaedie - GMBH - and - Co. - KG - v.mimimilkteaNo ratings yet

- Pearl - Dean - Phil. - v. - Shoemart PDFDocument16 pagesPearl - Dean - Phil. - v. - Shoemart PDFmimimilkteaNo ratings yet

- Supreme Court Rules on Patent Infringement CaseDocument9 pagesSupreme Court Rules on Patent Infringement CasemimimilkteaNo ratings yet

- Ecole - de - Cuisine - Manille - Inc. - v. - RenaudDocument7 pagesEcole - de - Cuisine - Manille - Inc. - v. - RenaudmimimilkteaNo ratings yet

- 23 A.F. Sanchez Brokerage v. Court of AppealsDocument2 pages23 A.F. Sanchez Brokerage v. Court of Appealsmimimilktea100% (2)

- 22 Spouses Fernando v. Northwest Airlines Inc.Document2 pages22 Spouses Fernando v. Northwest Airlines Inc.mimimilkteaNo ratings yet

- Taneo v. CADocument2 pagesTaneo v. CAmimimilkteaNo ratings yet

- 21-E.I. Dupont de Nemours and Co. v. Francisco20161120-672-129pz5yDocument32 pages21-E.I. Dupont de Nemours and Co. v. Francisco20161120-672-129pz5yLyssa TabbuNo ratings yet

- 21 Manay JR v. Cebu Air Inc.Document2 pages21 Manay JR v. Cebu Air Inc.mimimilkteaNo ratings yet

- 1st Set of CasesDocument62 pages1st Set of CasesmimimilkteaNo ratings yet

- Transportation Law CasesDocument159 pagesTransportation Law CasesmimimilkteaNo ratings yet

- 22 Spouses Fernando v. Northwest Airlines Inc.Document2 pages22 Spouses Fernando v. Northwest Airlines Inc.mimimilkteaNo ratings yet

- Transportation Law CasesDocument159 pagesTransportation Law CasesmimimilkteaNo ratings yet

- Transportation Law CasesDocument159 pagesTransportation Law CasesmimimilkteaNo ratings yet

- 1st Set of CasesDocument62 pages1st Set of CasesmimimilkteaNo ratings yet

- Review Labor Atty. Manuel Glen Tuazon NotesDocument70 pagesReview Labor Atty. Manuel Glen Tuazon NotesmimimilkteaNo ratings yet

- Poli - Art 3 Sec 1 Due ProcessDocument119 pagesPoli - Art 3 Sec 1 Due ProcessmimimilkteaNo ratings yet

- Poli - Art 3 Sec 1 Equal ProtectionDocument138 pagesPoli - Art 3 Sec 1 Equal ProtectionmimimilkteaNo ratings yet

- 1st Set of CasesDocument62 pages1st Set of CasesmimimilkteaNo ratings yet

- 02 Labor Organizations and Registration of UnionsDocument68 pages02 Labor Organizations and Registration of UnionsmimimilkteaNo ratings yet

- 01 Concept and ScopeDocument41 pages01 Concept and ScopemimimilkteaNo ratings yet

- Household Regulations of "The Y" in The HagueDocument2 pagesHousehold Regulations of "The Y" in The HagueBlue CliffNo ratings yet

- SCHEDULE OF CLASSES 2023 2nd SemesterDocument1 pageSCHEDULE OF CLASSES 2023 2nd Semesterarhe gaudelNo ratings yet

- Supreme Court Rules on Interest Payment for Delayed Loan ObligationDocument11 pagesSupreme Court Rules on Interest Payment for Delayed Loan ObligationRozaiineNo ratings yet

- The Revenge of Geography: What The Map Tells Us About Coming Conflicts and The Battle Against Fate - Robert D. KaplanDocument5 pagesThe Revenge of Geography: What The Map Tells Us About Coming Conflicts and The Battle Against Fate - Robert D. Kaplanfazedoto0% (1)

- Enriquez vs. The Mercantile Insurance Co., Inc., GR No. 210950, August 15, 2018Document2 pagesEnriquez vs. The Mercantile Insurance Co., Inc., GR No. 210950, August 15, 2018Judel MatiasNo ratings yet

- Heads of Income TaxDocument6 pagesHeads of Income Taxkanchan100% (1)

- Law2 Quiz 1 2021 Part2Document3 pagesLaw2 Quiz 1 2021 Part2Princess PilNo ratings yet

- Notice MED - Raya V JagaiDocument6 pagesNotice MED - Raya V JagaiDefimediagroup LdmgNo ratings yet

- CPSEETF daily stock price performanceDocument14 pagesCPSEETF daily stock price performanceankit bansalNo ratings yet

- 1.1 The Accountancy ProfessionDocument4 pages1.1 The Accountancy ProfessionBrian VillaluzNo ratings yet

- Permanent Disability RiderDocument10 pagesPermanent Disability RiderVaibhav ShirodkarNo ratings yet

- One Reason I Would Never Again Hire Attorney Wayne P. Giampietro Despite Judge's Offer Permitting Him To Discuss Offer With Me & His Other Clients, He Settled On The SpotDocument9 pagesOne Reason I Would Never Again Hire Attorney Wayne P. Giampietro Despite Judge's Offer Permitting Him To Discuss Offer With Me & His Other Clients, He Settled On The SpotPeter M. HeimlichNo ratings yet

- SAPBMTDocument2 pagesSAPBMTMarieta AlejoNo ratings yet

- Service Bulletin Atr72: Transmittal Sheet Revision No. 08Document13 pagesService Bulletin Atr72: Transmittal Sheet Revision No. 08Pradeep K sNo ratings yet

- Kashmir Files A PropogandaDocument4 pagesKashmir Files A Propogandaashok_pandey_10No ratings yet

- BUCTON vs. GABARDocument2 pagesBUCTON vs. GABARTrisha Paola TanganNo ratings yet

- Baiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklDocument13 pagesBaiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklBaiq Melaty Sepsa WindiNo ratings yet

- Audit Principle Chapter-1Document58 pagesAudit Principle Chapter-1Genanaw SemenehNo ratings yet

- Bridging Borders - A Reflective Journey of Interviewing A Student Studying AbroadDocument3 pagesBridging Borders - A Reflective Journey of Interviewing A Student Studying AbroadGina Sy-lunaNo ratings yet

- AbandonedDocument2 pagesAbandonedRenzo SantosNo ratings yet

- Case Study 3Document2 pagesCase Study 3Krista CandareNo ratings yet

- Extrajudicial Settlement of Estate With SaleDocument1 pageExtrajudicial Settlement of Estate With Saleczabina fatima delicaNo ratings yet

- National Law Institute University, BhopalDocument19 pagesNational Law Institute University, BhopalPrabhav SharmaNo ratings yet

- Letran Dismissal of Student Upheld by CADocument14 pagesLetran Dismissal of Student Upheld by CABrod ChatoNo ratings yet

- (2-1) Bach - v. - Ongkiko - Kalaw - Manhit - Acorda - LawDocument10 pages(2-1) Bach - v. - Ongkiko - Kalaw - Manhit - Acorda - LawJinnelyn LiNo ratings yet

- Case CommentaryDocument20 pagesCase CommentarySiddharth SajwanNo ratings yet

- BEKA Quotation #172-827351-01 - Saurabh Kumar SinghDocument2 pagesBEKA Quotation #172-827351-01 - Saurabh Kumar SinghSaurabh Kumar SinghNo ratings yet

- ARTA Compliance ReportDocument5 pagesARTA Compliance ReportRosa Villaluz BanairaNo ratings yet

- Custody Semi FinalDocument7 pagesCustody Semi FinalAlfonso DosNo ratings yet

- Secretary's Certificate for Bank TransactionsDocument4 pagesSecretary's Certificate for Bank TransactionsRegine TeodoroNo ratings yet