Professional Documents

Culture Documents

Demands and Appeals: Answer

Uploaded by

timirkantaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Demands and Appeals: Answer

Uploaded by

timirkantaCopyright:

Available Formats

CHAPTER 9

Demands and Appeals

Question 1

Explain the provisions of recovery of duties not levied or short levied or erroneously refunded.

Answer

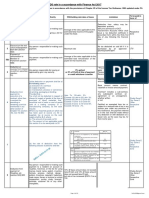

Section 28 deals with the recovery of duties not levied or short levied or erroneously refunded.

It is worth highlighting that provisions of section 28 have been substituted with effect from

08.04.2011 with a view to make these provisions more coherent and clear. The provisions of

substituted section 28 are given below in the form of a table for easy understanding:

Relevant section and sub- Brief Heading Relevant provisions

section

28(1)(a) Issue of Show Cause Notice Where any duty has not been

within one year from the levied or has been short-

relevant date levied or erroneously

refunded, or any interest

payable has not been paid,

part-paid or erroneously

refunded, for any reason

other than the reasons of

collusion or any wilful mis-

statement or suppression

of facts,-

(a) the proper officer shall,

within one year from the

relevant date, serve notice on

the person chargeable with

the duty or interest which has

not been so levied or which

has been short-levied or

short-paid or to whom the

refund has erroneously been

made, requiring him to show

cause why he should not

pay the amount specified in

the notice;

28(1)(b) Payment of duty or interest the person chargeable with

before issue of SCN the duty or interest may pay,

© The Institute of Chartered Accountants of India

Demands & Appeals 9.2

before service of notice

under clause (a), on the

basis of-

(i) his own ascertainment of

such duty; or

(ii) the duty ascertained by

the proper officer,

the amount of duty along with

the interest payable thereon

under section 28AA or the

amount of interest which has

not been so paid or part-paid.

28(2) Written intimation to Proper The person who has paid the

Officer regarding payment of duty along with interest or

duty and/ interest and amount of interest under

consequent no issue of SCN clause (b) of sub-section (1)

shall inform the proper

officer of such payment in

writing, who, on receipt of

such information, shall not

serve any notice under

clause (a) of that sub-section

in respect of the duty or

interest so paid or any

penalty leviable under the

provisions of this Act or the

rules made thereunder in

respect of such duty or

interest.

28(3) Issue of SCN for the deficient Where the proper officer is of

amount within one year from the opinion that the amount

the date of receipt of paid under clause (b) of sub-

information u/s 28(2) section (1) falls short of the

amount actually payable,

then, he shall proceed to

issue the notice as provided

for in clause (a) of that sub-

section in respect of such

amount which falls short of

the amount actually payable

in the manner specified under

that sub section and the

© The Institute of Chartered Accountants of India

9.3 Indirect Tax Laws

period of one year shall be

computed from the date of

receipt of information under

sub-section (2).

28(4) Issue of SCN within five Where any duty has not been

years in case of collusion, levied or has been short-

willful mis-statement etc. levied or erroneously

refunded, or interest payable

has not been paid, part-paid

or erroneously refunded, by

reason of—

(a) collusion; or

(b) any wilful mis-statement;

or

(c) suppression of facts,

by the importer or the

exporter or the agent or

employee of the importer or

exporter, the proper officer

shall, within five years from

the relevant date, serve

notice on the person

chargeable with duty or

interest which has not been

so levied or which has been

so short levied or short-paid

or to whom the refund has

erroneously been made,

requiring him to show cause

why he should not pay the

amount specified in the

notice.

28(5) Payment of accepted duty Where any duty has not been

along with interest on such levied or has been short-

accepted duty as well as levied or the interest has not

penalty of 25% of accepted been charged or has been

duty and submission of part-paid or the duty or

relevant intimation in writing interest has been erroneously

to proper officer refunded by reason of

collusion or any wilful mis-

statement or suppression of

facts by the importer or the

© The Institute of Chartered Accountants of India

Demands & Appeals 9.4

exporter or the agent or the

employee of the importer or

the exporter, to whom a

notice has been served under

sub-section (4) by the proper

officer, such person may

pay the duty in full or in

part, as may be accepted by

him, and the interest

payable thereon under

section 28AA and the

penalty equal to twenty-five

per cent, of the duty

specified in the notice or

the duty so accepted by

that person, within thirty

days of the receipt of the

notice and inform the proper

officer of such payment in

writing.

28(6) Deemed conclusion of Where the importer or the

proceedings if in the opinion exporter or the agent or the

of proper officer duty, interest employee of the importer or

and penalty has been paid the exporter, as the case may

in full u/s 28(5). be, has paid the duty with

Issue of SCN under section interest and penalty under

28(1)(a) for recovery of subsection (5), the proper

deficient amount within one officer shall determine the

year from date of receipt of amount of duty or interest and

intimation u/s 28(5), if in the on determination, if the

opinion of proper officer duty, proper officer is of the

interest and penalty has not opinion-

paid in full u/s 28(5) (i) that the duty with interest

and penalty has been paid

in full, then, the

proceedings in respect of

such person or other persons

to whom the notice is served

under sub-section (1) or sub-

section (4), shall, without

prejudice to the provisions of

sections 135,135A and 140

be deemed to be conclusive

© The Institute of Chartered Accountants of India

9.5 Indirect Tax Laws

as to the matters stated

therein; or

(ii) that the duty with

interest and penalty that

has been paid falls short of

the amount actually

payable, then, the proper

officer shall proceed to issue

the notice as provided for in

clause (a) of sub-section (1)

in respect of such amount

which falls short of the

amount actually payable in

the manner specified under

that sub-section and the

period of one year shall be

computed from the date of

receipt of information under

sub-section (5).

28(7) Exclusion of Period of Stay in In computing the period of

computing the period of one one year referred to in clause

year/five years (a) of sub-section (1) or five

years referred to in sub-

section (4), the period during

which there was any stay by

an order of a court or tribunal

in respect of payment of such

duty or interest shall be

excluded.

28(8) Determination of due amount The proper officer shall, after

of duty or interest allowing the concerned

person an opportunity of

being heard and after

considering the

representation, if any, made

by such person, determine

the amount of duty or

interest due from such

person not being in excess of

the amount specified in the

notice.

28(9) Time-limit for determination The proper officer shall

of duty or interest due by determine the amount of duty

© The Institute of Chartered Accountants of India

Demands & Appeals 9.6

proper officer or interest under sub-section

(8),-

(a) within six months from the

date of notice, where it is

possible to do so, in respect

of cases falling under clause

(a) of sub-section (7);

(b) within one year from the

date of notice, where it is

possible to do so, in respect

of cases falling under sub-

section (4).

28(10) Compulsory payment of Where an order determining

interest the duty is passed by the

proper officer under this

section, the person liable to

pay the said duty shall pay

the amount so determined

along with the interest due

on such amount whether or

not the amount of interest

is specified separately.

Explanation 1 to Section Meaning of Expression For the purposes of this

28(1) ‘Relevant Date’ section, "relevant date"

means,

- (a) in a case where duty is

not levied, or interest is not

charged, the date on which

the proper officer makes an

order for the clearance of

goods;

(b) in a case where duty is

provisionally assessed

under section 18, the date of

adjustment of duty after the

final assessment thereof or

re-assessment, as the case

may be;

(c) in a case where duty or

interest has been

erroneously refunded, the

date of refund;

© The Institute of Chartered Accountants of India

9.7 Indirect Tax Laws

(d) in any other case, the

date of payment of duty or

interest.

Explanation 2 to section Non-levy, short levy or For the removal of doubts, it

28(1) erroneous refund before is hereby declared that any

08.04.2011 to be governed non-levy, short levy or

by erstwhile provisions erroneous refund before the

date on which the Finance

Bill, 2011 receives the assent

of the President i.e.

08.04.2011 shall continue to

be governed by the

provisions of section 28 as

it stood immediately before

the date on which such

assent is received.

Question 2

Explain briefly the provisions of section 28(5) of the Customs Act, 1962 in respect of a person

who voluntarily deposits full duty demanded along with interest and applicable penalty.

Answer

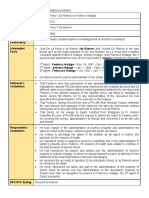

Section 28(5) provides an option to the importer or the exporter or the agent or employee of

the importer or exporter to whom a notice has been served by the proper officer for short/non

levy or non or short payment of interest or erroneous refund of duty and interest by reason of

collusion or any willful mis-statement or suppression of facts.

Such a person may pay the duty in full or in part as may be accepted by him including the

interest payable thereon under section 28AA and penalty equal to 25% of the duty specified

within 30 days of the receipt of the notice. In addition, such a person should inform the

proper officer about such payment in writing.

According to provisions of section 28(6) where in the opinion of the proper officer duty is paid

in full together with the interest and penalty under sub-section (5), the proceedings in respect

of such persons to whom notice is served shall be deemed to have been concluded in

respect of the matters stated therein. On the other hand, where in the opinion of the proper

officer the duty with interest and penalty that has been paid falls short of the amount actually

payable, then, the proper officer shall proceed to issue the notice as provided in section

28(1)(a) in respect of the such amount which falls short of the amount actually payable within

one year from the date of receipt of information under section 28(5).

Question 3

Write a note on the provisions of section 28AA of the Customs Act, 1962 regarding interest on

delayed payment of duty.

© The Institute of Chartered Accountants of India

Demands & Appeals 9.8

Answer

W.E.F. 08.04.2011 the provisions of section 28AA regarding interest on delayed payment of

duty are as under:

Relevant Section Brief Heading Details

& Sub-section

28AA(1) Compulsory payment of Notwithstanding anything contained in any

interest judgment, decree, order/direction of any court,

Appellate Tribunal or any authority or any

other provision of Customs Act or the rules

made thereunder, the person, who is liable to

duty in accordance with the provisions of

section 28, shall be liable to pay interest, if

any, fixed under section 28AA(2) in addition to

making payment of such duty. Further, it is

immaterial whether aforementioned interest

payment is made voluntarily or after

determination of the duty.

28AA(2) Rate of Interest and Interest is to be paid at such rate not below

Period of Interest 10% per cent and not exceeding 36% p.a., as

the Central Govt. may fix by way of

notification in the Official Gazette.

The above interest is to be paid for the period

beginning from the first day of the month

succeeding the month in which the duty ought

to have been paid or from the date of such

erroneous refund up to the date of payment of

such duty.

28AA(3) Situation when no Notwithstanding anything contained in Section

interest is required to 28AA(1), no interest shall be payable in the

be paid following situation-

(a)The duty becomes payable consequent to

the issue of an order/ instruction/direction by

the Board under section 151A; and

(b)Such amount of duty is voluntarily paid in

full, within 45 days from the date of issue of

such order, instruction/direction, without

reserving any right to appeal against the

said payment at any subsequent stage of

such payment.

© The Institute of Chartered Accountants of India

9.9 Indirect Tax Laws

Question 4

Write a brief note on the provisions of section 28BA of the Customs Act, 1962 regarding

property that may be attached provisionally to protect the interest of revenue in certain cases.

Answer

Section 28BA provides that during the pendency of any proceeding under section 28 or

section 28B, the proper officer may provisionally attach any property belonging to the person

on whom notice has been served under section 28(1) or section 28B(2), in accordance with

section 142 of the Customs Act and the Rules made thereunder. This action requires prior

approval of the Commissioner of Customs and must be necessary for protecting the interest of

Revenue.

Such an attachment could be effected for a period of 6 months which shall commence from

the date of the order of the Commissioner permitting such provisional attachment. This period

may be extended by the Chief Commissioner of Customs by such further period or periods as

may be determined by him. The reasons for such extension should be recorded in writing and

the total period should not exceed 2 years.

If an application for the settlement of the case is made under section 127B, the period

commencing from the date on which such an application is made and ending with the date on

which order under section 127C(1) is made shall be excluded from the period of 2 years

mentioned above.

Question 5

State the situations in which the proper officer is authorized to issue show-cause notice under

section 28 of the Customs Act, 1962 and also the time limit.

Answer

As per section 28(1) of the Customs Act, 1962, the proper officer is authorized to issue show

cause notice in the following situations:

(i) when duty has not been levied

(ii) when duty has been short-levied

(iii) when duty has been erroneously refunded

(iv) when interest payable has not been paid

(v) when interest payable has been part paid

(vi) when interest has been erroneously refunded

W.E.F. 08.04.2011 Time Limit for issue of show-cause notice

(a) For any reason other than the reasons of collusion or any willful mis-statement or

suppression of facts– within one year from the relevant date

© The Institute of Chartered Accountants of India

Demands & Appeals 9.10

(b) In the case of collusion or any willful mis-statement or suppression of facts by the

importer or the exporter or the agent or employee of the importer or exporter-within five

years from the relevant date.

Question 6

Examine briefly the powers of the department, if it is not satisfied with an order made under

section 47 of the Customs Act, 1962 pursuant to which goods have been cleared.

Answer

Goods are cleared from customs after proper officer makes an order permitting clearance of

the same for home consumption under section 47 of the Customs Act. Once goods are

cleared after issue of such order but the department is not satisfied with the order, following

action can be taken:

(i) Department can file a review application under section 129D(2) of the Customs Act

against the order of the proper officer with the Commissioner (Appeals); or

(ii) Action can be taken under section 28 of the Customs Act, by issuing a show cause notice.

It has also been held by the Supreme Court in UOI v. Jain Shudh Vanaspati Ltd. (1996) 86

ELT 460 (SC) that action can be taken under section 28 of the Customs Act, even after goods

are released from Customs by issuing a show cause notice etc.

Question 7

A show cause notice demanding customs duty was issued in case of clearances made by

100% Export Oriented Undertaking (EOU) to Domestic Tariff Area (DTA). Is the show-cause

notice defective in law?

Answer

Yes, the show cause notice issued is defective in law as in respect of clearances made by a

100% export oriented undertaking (EOU) to domestic tariff area, the duty to be paid by the

100% EOU is the duty of excise and not customs duty. Therefore, show cause notice

using the word customs duty instead of central excise duty is not maintainable. Similar view

was expressed in the case of CCE v. Suresh Synthetics (2007) 216 ELT 662 (SC).

Question 8

State the circumstances under which a revision petition can be filed before the Central

Government under the Customs Act.

Answer

The first proviso to section 129A of the Customs Act, 1962 provides that the Appellate

Tribunal shall not have jurisdiction to decide any appeal in respect of any order passed by

Commissioner (Appeals) if such order relates to, -

(a) any goods imported or exported as baggage;

© The Institute of Chartered Accountants of India

9.11 Indirect Tax Laws

(b) any goods loaded in a conveyance for importation into India, but which are not unloaded

at their place of destination in India, or which are short landed at that destination;

(c) payment of drawback as provided in Chapter X, and the rules made thereunder.

In such cases, redressal lies with the Central Government. Section 129DD(1) enables the

appellant to get the orders of Appellate Commissioner (on these three aspects) annulled or

modified by the Central Government.

Sub-section 1A of section 129DD enables the Commissioner of Customs to direct the

proper officer to make an application on his behalf to the Central Government for

revision of an order. However, such application can be made only if the Commissioner is of

the opinion that the order passed by the Commissioner (Appeals) under section 128A is not

legal or proper.

Question 9

The Committee of Commissioners of Customs is empowered under the Customs Act, 1962 to

direct the filing of an appeal before the Appellate Tribunal in certain cases while in certain

others, it may direct an application to be filed before the Appellate Tribunal for determination

of such points arising out of the decision or order as may be specified by the said committee.

Write a brief note on the powers of the Committee of Commissioners of Customs bringing out

the difference in the exercise of such powers.

*Note: The power to direct an application to be filed before the Appellate Tribunal for

determination of such points arising out of the decision or order as may be specified by the

Committee vests with the Committee of Chief Commissioner.

Answer

Under section 129A(2) of the Customs Act, 1962, the Committee of Commissioners of

Customs may direct the proper officer to file appeal on its behalf to the Appellate Tribunal

against the order of Commissioner (Appeals), if it is of the opinion that the order is not legal or

proper.

Under section 129D(1) of the Customs Act, 1962, the Committee of Chief Commissioners

of Customs may, of its own motion, call for and examine the record of any proceedings in

which a Commissioner of Customs has passed any decision or order under this Act for the

purpose of satisfying itself as to the legality or propriety of any such decision or order and

may, by order, direct such Commissioner or any other Commissioner to apply to the Appellate

Tribunal for the determination of such points arising out of the decision or order as may be

specified by the Committee of Chief Commissioners of Customs in its order.

Therefore, difference in two cases mentioned above is that in the former case the Department

has to file a regular appeal with the Tribunal while in the latter case a review application is

filed with the Tribunal. It may also be noted here that the review application is treated as

appeal filed against the decision or order of the adjudicating authority vide section 129D(4) of

the Customs Act, 1962.

© The Institute of Chartered Accountants of India

Demands & Appeals 9.12

Further, in the former case an appeal has to be filed within three months as specified in

section 129A(3) of the Customs Act, 1962 while in the latter case application for review can be

filed within four months; three months for the Committee of Chief Commissioner of Customs

to issue order for review and further one month to the Commissioner to file an application .

Question 10

K imported some old machinery from London claiming that the machinery was fully exempted

from customs duty under a notification. Assistant Commissioner of Customs, the authority in

original, differed and held that the machinery so imported was covered under a different

heading and attracted customs duty. Therefore, K had to furnish bank guarantee for duty

payable for release of machine.

Subsequently, the Assistant Commissioner of Customs ordered to encash the bank guarantee

to realize the duty. This order was issued to K and immediately thereafter, the Customs

Department invoked bank guarantee by sending request to bank for making payment to them.

K contended that order of the Assistant Commissioner was appealable and the period of filing

appeal was yet to expire. Hence the action of the Department was not correct. You are

required to comment whether the action of customs Department is correct in law based on

decided case law, if any.

Answer

Similar situation was faced by Bombay High Court, in the case of Ocean Driving Centre Ltd.

v. Union of India 2005 (180) E.L.T 313,. In that case, the petitioner contended that he had a

statutory right of appeal before the Appellate Authority and also he had a right to move an

application to get the pre-deposit waived in terms of section 129E of the Customs Act, 1962.

He further submitted that he had an arguable case on classification. The debatable question

had resulted in release of goods subject to furnishing bank guarantee at the stage of

provisional assessment. Had it not been a debatable issue, he would not have been

allowed to claim release of goods on furnishing the bank guarantee, which was furnished to

secure the dues of Department. The same was valid and should have been kept alive till the

dispute was finally resolved. According to them, the order of assessment was not final and

conclusive.

The High Court observed that it was not in dispute that the appeal period was yet to expire

and that the order was an appealable order as per the Departmental circular no. 396/29/98-

C.E dated 2nd June, 1998, the Department was expected not to resort to coercive action so

long as the appeal period was not over. Hence, the Departmental action was contrary to their

own policy. According to the High Court, it was not proper on the part of Department to

encash the bank guarantee before the expiry of statutory period provided for filing appeal.

Thus, the stand taken by the Department was not tenable in law.

Question 11

What are the orders of Commissioner (Appeals) not appealable to Appellate Tribunal as per

section 129A of the Customs Act, 1962?

© The Institute of Chartered Accountants of India

9.13 Indirect Tax Laws

Answer

No appeal shall lie to the Appellate Tribunal and the Appellate Tribunal shall have no

jurisdiction to decide any appeal in respect of any order passed by the Commissioner of

Appeals under section 129A, if such order relates to:

(i) any goods imported or exported as baggage;

(ii) any goods loaded in conveyance for importation into India, but which are not unloaded

at their place of destination in India, or so much of the quantity of such goods as has not

been unloaded at any such destination, if goods unloaded at such destination are short

of the quantity required to be unloaded at that destination.

(iii) payment of drawback as provided in Chapter X and the rules made there under.

Question 12

What are the orders that are appealable to the High Court under the Customs Act, 1962? Can

the delay in filing an appeal be condoned by the High Court?

Answer

As per section 130(1) of the Customs Act, 1962, an appeal can be made to the High Court

against the order of the Tribunal if the case involves substantial question of law, except in

cases relating to rate of duty and valuation.

Sub-section (2) of section 130 inter alia lays down that an appeal can be made to the High

Court within 180 days from the date on which the order appealed against is received by the

Commissioner of Customs or the other party.

The High Court has power to condone the delay and admit an appeal after the expiry of the

period of 180 days referred to in sub-section (2), if it is satisfied that there was sufficient cause

for not filing the same within that period [sub-section (2A)].

Question 13

Mention the orders against which appeal lies to the Supreme Court under Section 130E of the

Customs Act.

Answer

As per section 130E of the Customs Act, an appeal shall lie to the Supreme Court from-

(a) any judgment of High Court delivered

(i) in an appeal made under section 130, or

(ii) on a reference made under section 130 by the Appellate Tribunal before

01.07.2003, or

(iii) on a reference made u/s 130 A,

© The Institute of Chartered Accountants of India

Demands & Appeals 9.14

if the High Court certifies the case to be fit for appeal to the Supreme Court. Such

certification can be done by the High Court on its own motion or on an oral application

made by or on behalf of the aggrieved party, immediately after passing of the judgement.

(b) any order of the Appellate Tribunal having relation to the determination of rate of

customs duty or value of goods, among other things.

Question 14

Briefly explain the time limit for issuing show cause notice for demanding customs duty short

paid.

Answer

Section 28 of the Customs Act, 1962 provides that where the customs duty has been short

paid, a show cause notice shall be issued-

(i) within one year from the relevant date in the case of any import made by any

individual for his personal use or by Government or by any educational, research or

charitable institution or hospital;

(ii) within six months from the relevant date in any other case.

However, if the customs duty has been short paid by reason of collusion or any willful mis-

statement or suppression of facts by the importer or the exporter or their agent or employee,

the show cause notice can be issued within five years from the relevant date.

Relevant date means –

(i) in a case where duty is not levied, the date on which the proper officer makes an order

for the clearance of goods;

(ii) in the case of provisional assessment, the date of adjustment of duty after the final

assessment;

(iii) in any other case, the date of payment of duty.

Question 15

M/s. XYZ, a 100% export oriented undertaking (100% E.O.U. in short) imported DG sets and

furnace oil duty free for setting up captive power plant for its power requirements for export

production. They used the power so generated for export production but sold surplus power in

domestic tariff area. Is customs department justified in demanding duty on DG sets and

furnace oil as surplus power has been sold in domestic tariff area?

Answer

D.G. Sets, spare parts of D.G. Sets and consumables, such as furnace oil/lubricating oil/HSD

are exempt from duty if used in connection with the production of goods meant for export by a

100% EOU vide Notification Nos. 13/81-Cus., 53/91-Cus. and 1/95-Cus. In Commissioner v.

Hanil Era Textile Ltd. - 2005 (180) E.L.T. A044 (S.C.) the Supreme Court agreed to the view

taken by the Tribunal that in the absence of a restrictive clause in the notifications that

© The Institute of Chartered Accountants of India

9.15 Indirect Tax Laws

imported goods are to be solely or exclusively used for manufacture of goods for export, there

is no violation of any condition of notification if surplus power generated due to unforeseen

exigencies is sold in domestic tariff area.

Therefore, no duty can be demanded from M/s XYZ for selling the surplus power in domestic

tariff area for the following reasons:

(i) They have used the DG sets and furnace oil imported duty free for generation of power,

and

(ii) such power generated has been used for manufacturing goods for export, and

(iii) only the surplus power has been sold, as power cannot be stored.

Self-examination questions

Question 1

Briefly state the law relating to demand for payment of duty under section 28 of the Customs

Act, 1962.

Question 2

What are the ‘relevant dates’ for the purpose of issuing the show cause notice for demanding

customs duty not levied?

Question 3

Write a brief note on power not to recover duties not levied or short-levied as a result of

general practice under section 28A of the Customs Act, 1962.

Question 4

Mention briefly the orders that are not appealable to the Appellate Tribunal.

Question 5

Discuss the provisions in respect of making an appeal to the High Court.

Question 6

Explain briefly the powers of revision of Board or Commissioner of Customs in certain cases.

Question 7

Discuss the revisionary powers of the Central Government.

Question 8

Write a note on the Committee of Commissioners.

Question 9

‘M’ imported second-hand machinery from Singapore and filed the classification list. ‘M’

claimed that the machinery was fully exempt from payment of customs duty under a

Notification. However, the Assistant Commissioner of Customs, the authority in original,

© The Institute of Chartered Accountants of India

Demands & Appeals 9.16

passed an order-in-original holding that the machinery imported by ‘M’ was classifiable under

a different heading and chargeable to customs duty. Consequently, ‘M’ had to furnish the

bank guarantee for the duty payable under that heading in order to release the machinery.

Subsequently, the Assistant Commissioner of Customs ordered to encash the bank guarantee

executed by ‘M’ to realise the customs duty. No sooner the aforesaid order-in-original was

issued to ‘M’, the Customs Department invoked the bank guarantee by sending an intimation-

cum-request to the Bank to pay to them the amount of bank guarantee. ‘M’ contended that the

order of the Assistant Commissioner was an appelable order and since the statutory period of

filing an appeal was yet to expire, the Department’s action was not correct.

Do you think the stand taken by the Customs Department is tenable in law? Discuss.

Answer

Similar situation was addressed to by the High Court in the case of the Ocean Driving Centre

Ltd. v. Union of India 2005 (180) E.L.T. 313 (Bom.). In this case, the petitioner contended

that he had a statutory right of appeal before the Appellate Authority and at the same time, he

also had a right to move an application to get the pre-deposit waived in terms of section 129E

of the Customs Act, 1962. He further submitted that he had an arguable case on classification.

The debatable question had resulted in the release of goods subject to the furnishing of the

bank guarantee at the stage of the provisional assessment. Had it not been a debatable issue,

he would not have been allowed to claim release of the goods on furnishing the bank

guarantee. The bank guarantee was furnished to secure dues of Department. The same was

valid and should have been kept alive till the dispute was finally resolved. According to him,

order of assessment as on date was not final and conclusive.

The High Court observed that it was not in dispute that the appeal period was yet to expire

and that the order was an appealable order. Further, as per the policy engrafted in the

Circular No. 396/29/98-CX., dated 2nd June 1998 the Department was expected not to

resort to coercive action so long as the appeal period was not over. Hence, the action of

Department was contrary to their own policy. The High Court held that it was not proper on the

part of the Department to encash the bank guarantee before the expiry of the statutory period

provided for filing appeal.

In the given case also ‘M’ had a statutory right to file an appeal and get the pre-deposit

waived. Thus, extending the ratio of the above decision, it can be inferred that the stand taken

by the Department is not tenable in law.

© The Institute of Chartered Accountants of India

You might also like

- Suspension of Running of Statute of Limitations. Sec. 223, NIRCDocument2 pagesSuspension of Running of Statute of Limitations. Sec. 223, NIRCshiejingNo ratings yet

- Penalties: After Studying This Chapter, You Would Be Able ToDocument47 pagesPenalties: After Studying This Chapter, You Would Be Able ToDeepesh HingoraniNo ratings yet

- PenaltiesDocument44 pagesPenaltiesabcNo ratings yet

- Title ViiiDocument8 pagesTitle ViiiErica Mae GuzmanNo ratings yet

- Remedies Under NIRCDocument14 pagesRemedies Under NIRCcmv mendoza100% (3)

- Base Amonut Does Not Exceed-Tk. 50 Lakh/ - 3%. Exceeds 50 Lakh To 2 Crore - 5% Exceeds 2 Crore - 7%Document8 pagesBase Amonut Does Not Exceed-Tk. 50 Lakh/ - 3%. Exceeds 50 Lakh To 2 Crore - 5% Exceeds 2 Crore - 7%Mohammad BaratNo ratings yet

- Bullet QQR Taxation Law FinalDocument46 pagesBullet QQR Taxation Law FinalPrincess Janine Sy100% (2)

- Title Viii - RemediesDocument7 pagesTitle Viii - RemedieshrvyvyyyNo ratings yet

- Refund of Taxes: in GeneralDocument3 pagesRefund of Taxes: in GeneralAileen Love ReyesNo ratings yet

- Power of Commissioner Penalties PDFDocument14 pagesPower of Commissioner Penalties PDFKomal JaiswalNo ratings yet

- Penalities and ProsecutionDocument37 pagesPenalities and ProsecutionDharshini AravamudhanNo ratings yet

- Assignment CTP Tecnia Institute of Advanced Studies Penalties and ProsecutionsDocument7 pagesAssignment CTP Tecnia Institute of Advanced Studies Penalties and ProsecutionssyedarsalNo ratings yet

- Title X Statutory Offenses and Penalties Additions To The Tax SEC. 247. General Provisions.Document10 pagesTitle X Statutory Offenses and Penalties Additions To The Tax SEC. 247. General Provisions.Jenny Marie B. AlapanNo ratings yet

- Pdfdownloader - Lain.in 150469451 2012 Ateneo LawTaxation Law Summer Reviewer 2 PDFDocument13 pagesPdfdownloader - Lain.in 150469451 2012 Ateneo LawTaxation Law Summer Reviewer 2 PDFJericho PedragosaNo ratings yet

- ObliCon ReviewerDocument1 pageObliCon Reviewerriverakathleen72No ratings yet

- TDS VDS Rate Thorugh FA 2017.pdf 1348997815Document10 pagesTDS VDS Rate Thorugh FA 2017.pdf 1348997815Abu KawcherNo ratings yet

- Estates and TrustsDocument2 pagesEstates and TrustsMCNo ratings yet

- Module 40 Taxes: Gift and EstateDocument2 pagesModule 40 Taxes: Gift and EstateZeyad El-sayedNo ratings yet

- CODAL - TAXATION - TITLE VIII RemediesDocument10 pagesCODAL - TAXATION - TITLE VIII RemediesTea AnnNo ratings yet

- Petitioner Respondent: Second DivisionDocument19 pagesPetitioner Respondent: Second DivisionJeffrey JosolNo ratings yet

- The Negotiable Instruments LawDocument3 pagesThe Negotiable Instruments LawAinah BaratamanNo ratings yet

- Penalties Under The Income Tax Act 1961Document10 pagesPenalties Under The Income Tax Act 1961Ram IyerNo ratings yet

- This Study Resource Was Shared ViaDocument8 pagesThis Study Resource Was Shared ViaDominic BulaclacNo ratings yet

- NIL CodalDocument17 pagesNIL Codalblue_blue_blue_blue_blueNo ratings yet

- Tax Sheth MergedDocument79 pagesTax Sheth MergedUtsav MehtaNo ratings yet

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNo ratings yet

- Obli ART 1232Document44 pagesObli ART 1232Pearl Angeli Quisido CanadaNo ratings yet

- Cabria Cpa Review Center: Tel. Nos. (043) 980-6659Document12 pagesCabria Cpa Review Center: Tel. Nos. (043) 980-6659MaeNo ratings yet

- The Negotiable Instrument Law (Codal)Document12 pagesThe Negotiable Instrument Law (Codal)Junior DaveNo ratings yet

- Cir v. GoodrichDocument7 pagesCir v. GoodrichClaudine Ann ManaloNo ratings yet

- Negotiable Instruments LawDocument17 pagesNegotiable Instruments LawPaper BucksNo ratings yet

- Order by The Commissioner of State Tax, Gujarat State, AhmedabadDocument10 pagesOrder by The Commissioner of State Tax, Gujarat State, Ahmedabadarpit85No ratings yet

- Act No 2031Document15 pagesAct No 2031GrayNo ratings yet

- Negotiable Instruments Enotes1Document31 pagesNegotiable Instruments Enotes1Celina GonzalesNo ratings yet

- Second Half Lecture NotesDocument27 pagesSecond Half Lecture NotesShingo TakasugiNo ratings yet

- Nego Codal Provisions PrintDocument16 pagesNego Codal Provisions PrintJoanna Paula P. SollanoNo ratings yet

- Act No 2031Document18 pagesAct No 2031Denise CruzNo ratings yet

- University of Perpetual Help System DaltaDocument11 pagesUniversity of Perpetual Help System DaltaDerick Ocampo Fulgencio100% (2)

- Act No 2031Document20 pagesAct No 2031Andrea RioNo ratings yet

- Guidelines BIR Form No. 2000-OTDocument1 pageGuidelines BIR Form No. 2000-OTAnneNo ratings yet

- Tax 2 Final NotesDocument117 pagesTax 2 Final Notesmelaniem_1No ratings yet

- TAX CODAL As Per SyllabusDocument5 pagesTAX CODAL As Per SyllabusCarmela WenceslaoNo ratings yet

- NEGOTIABLE INSTRUMENTS Enotes1Document35 pagesNEGOTIABLE INSTRUMENTS Enotes1Celina GonzalesNo ratings yet

- Miscellaneous Provisions: After Studying This Chapter, You Would Be Able ToDocument40 pagesMiscellaneous Provisions: After Studying This Chapter, You Would Be Able ToYASH PATILNo ratings yet

- Negotiable Instruments LawDocument18 pagesNegotiable Instruments LawJemNo ratings yet

- Relevant Provisions Assessment & CollectionDocument6 pagesRelevant Provisions Assessment & CollectionBryan Yabo RubioNo ratings yet

- Regulatory Framework AND Legal Issues IN Business: Cristine G. Policarpio Bsais 3-BDocument33 pagesRegulatory Framework AND Legal Issues IN Business: Cristine G. Policarpio Bsais 3-BApril Joy SevillaNo ratings yet

- Enforcement ProcedureDocument15 pagesEnforcement ProcedureShweta TomarNo ratings yet

- NIL (Sections 1 - 9)Document2 pagesNIL (Sections 1 - 9)Jeremiah LacapNo ratings yet

- Law and Negotiable 1-29Document5 pagesLaw and Negotiable 1-29James Cedrick NuasNo ratings yet

- 1704 MqyDocument1 page1704 MqyRizza Mae RodriguezNo ratings yet

- Negotiable Instruments ActDocument8 pagesNegotiable Instruments ActKarthik ImperiousNo ratings yet

- The Negotiable Instruments LawDocument15 pagesThe Negotiable Instruments LawHello KittyNo ratings yet

- ObliCon Reviewer 1231-1304Document18 pagesObliCon Reviewer 1231-1304Gilbert John LacorteNo ratings yet

- Negotiable Instruments LawDocument19 pagesNegotiable Instruments LawFelise MarieNo ratings yet

- Period of Limitation NIRC Vs Customs vs. LGC - TAXDocument2 pagesPeriod of Limitation NIRC Vs Customs vs. LGC - TAXTenshi OideNo ratings yet

- 21833vol3cstms cp11Document6 pages21833vol3cstms cp11timirkantaNo ratings yet

- Levy of Exemptions From Customs Duty: HapterDocument8 pagesLevy of Exemptions From Customs Duty: HaptertimirkantaNo ratings yet

- Oracle Infrastructure Architect Associate All One PDFDocument663 pagesOracle Infrastructure Architect Associate All One PDFtimirkantaNo ratings yet

- Rep198 PDFDocument507 pagesRep198 PDFtimirkantaNo ratings yet

- Vol 3 Secaidtccp 9Document7 pagesVol 3 Secaidtccp 9timirkantaNo ratings yet

- 19351sm SFM Finalnew cp8 PDFDocument40 pages19351sm SFM Finalnew cp8 PDFtimirkantaNo ratings yet

- Arbitration, Compromises, Arrangements and Reconstructions (Sections 389 - 396 A)Document17 pagesArbitration, Compromises, Arrangements and Reconstructions (Sections 389 - 396 A)timirkantaNo ratings yet

- Service Tax Procedures: HapterDocument25 pagesService Tax Procedures: HaptertimirkantaNo ratings yet

- Advance Ruling: 14.1 Definitions (Section 28E)Document5 pagesAdvance Ruling: 14.1 Definitions (Section 28E)timirkantaNo ratings yet

- Clubpatterns PDFDocument169 pagesClubpatterns PDFtimirkantaNo ratings yet

- Board's Powers and Restrictions Thereon (Sections 291 - 293)Document20 pagesBoard's Powers and Restrictions Thereon (Sections 291 - 293)timirkantaNo ratings yet

- (Amendments For Nov 2010 / May 2011 Students) : Compiled by CA Sarthak Jain 9229223040Document17 pages(Amendments For Nov 2010 / May 2011 Students) : Compiled by CA Sarthak Jain 9229223040timirkantaNo ratings yet

- Foreign Exchange Management Act-1999 PDFDocument18 pagesForeign Exchange Management Act-1999 PDFtimirkantaNo ratings yet

- 8019supp Adv AuditingDocument119 pages8019supp Adv AuditingtimirkantaNo ratings yet

- Vol 3 Secaidtccp 4Document35 pagesVol 3 Secaidtccp 4timirkantaNo ratings yet

- Anand Desai: ProfileDocument1 pageAnand Desai: ProfiletimirkantaNo ratings yet

- Notifications, Departmental Clarifications and Trade NoticesDocument4 pagesNotifications, Departmental Clarifications and Trade NoticestimirkantaNo ratings yet

- 21797vol3secaidtccp1 PDFDocument14 pages21797vol3secaidtccp1 PDFtimirkantaNo ratings yet

- Work Energy: Unit ANDDocument16 pagesWork Energy: Unit ANDtimirkantaNo ratings yet

- Administrative Aspects of Customs Act 1962: Self-Examination QuestionsDocument1 pageAdministrative Aspects of Customs Act 1962: Self-Examination QuestionstimirkantaNo ratings yet

- Primitive Data Types: Trail: Learning The Java Language Lesson: Language Basics Section: VariablesDocument5 pagesPrimitive Data Types: Trail: Learning The Java Language Lesson: Language Basics Section: VariablestimirkantaNo ratings yet

- Unit 16 Further Applications of Integralcalculus: StructureDocument31 pagesUnit 16 Further Applications of Integralcalculus: StructuretimirkantaNo ratings yet

- Machine Learning With PythonDocument137 pagesMachine Learning With Pythontimirkanta100% (1)

- Software Requirements Specification-SETSDocument16 pagesSoftware Requirements Specification-SETStimirkantaNo ratings yet

- 21760sm DTL Pmfinalnew cp18Document10 pages21760sm DTL Pmfinalnew cp18timirkantaNo ratings yet

- Sps. Portic v. Cristobal, G.R. No. 156171, 22 April 2005Document2 pagesSps. Portic v. Cristobal, G.R. No. 156171, 22 April 2005Tryzz dela MercedNo ratings yet

- Dela Cruz v. Dela CruzDocument3 pagesDela Cruz v. Dela CruzSarah Jane UsopNo ratings yet

- Dupasquier v. AscendasDocument21 pagesDupasquier v. AscendasCassie GacottNo ratings yet

- University of The Philippines College of Law: Non Impairment of Contract Clause (Art. 3, Sec.10)Document2 pagesUniversity of The Philippines College of Law: Non Impairment of Contract Clause (Art. 3, Sec.10)Juno GeronimoNo ratings yet

- Contract Labour (Regulation & Abolition) Act, 1970Document61 pagesContract Labour (Regulation & Abolition) Act, 1970Harsh DixitNo ratings yet

- Dwnload Full Understanding Management 10th Edition Daft Test Bank PDFDocument21 pagesDwnload Full Understanding Management 10th Edition Daft Test Bank PDFasales1715uk100% (8)

- J 1998 8 SCC 1 Air 1999 SC 22Document22 pagesJ 1998 8 SCC 1 Air 1999 SC 22siddharthNo ratings yet

- Celebrity Format PDF 2Document1 pageCelebrity Format PDF 2Iyanu Mhi100% (3)

- Jo N Ryan-3516deaf7d6ec81Document7 pagesJo N Ryan-3516deaf7d6ec81Thê Rêâl JôkêrNo ratings yet

- Snakes Saloons Character Sheet v2 Ammo Tracker 5e-FORM FILLABLEDocument5 pagesSnakes Saloons Character Sheet v2 Ammo Tracker 5e-FORM FILLABLEAbílio RossiNo ratings yet

- Estate Tax CasesDocument17 pagesEstate Tax CasesWarly PabloNo ratings yet

- Pbcom vs. CirDocument2 pagesPbcom vs. CirCaroline A. LegaspinoNo ratings yet

- AttributionDocument2 pagesAttributionBalti TorresNo ratings yet

- Utmost Good Faith Principle & Cause ProximaDocument4 pagesUtmost Good Faith Principle & Cause ProximaTONG SHU ZHEN100% (1)

- Sale DeedDocument27 pagesSale DeedMurugeswariNo ratings yet

- Bangladesh Biman Corporation & Others vs. Md. Yousuf Haroon & Others, 2002, 31 CLCDocument8 pagesBangladesh Biman Corporation & Others vs. Md. Yousuf Haroon & Others, 2002, 31 CLCRomana AfrozeNo ratings yet

- Contract Law B NotesDocument7 pagesContract Law B NotesABDOULIENo ratings yet

- IESChoiceof FundDocument3 pagesIESChoiceof FundtedpopperNo ratings yet

- Section 14: An Insurable Interest in Property May Consist inDocument7 pagesSection 14: An Insurable Interest in Property May Consist int7uyuytuNo ratings yet

- Case Citation: Date: Petitioners: Respondents: Subject Matter of Controversy: Antecedent FactsDocument3 pagesCase Citation: Date: Petitioners: Respondents: Subject Matter of Controversy: Antecedent FactsCarie LawyerrNo ratings yet

- Philippine Asset Growth Inc.Document5 pagesPhilippine Asset Growth Inc.Lara Delle0% (1)

- G.R. No. 217781 San Miguel Pure Foods Vs Foodsphere Unfair CompetitionDocument20 pagesG.R. No. 217781 San Miguel Pure Foods Vs Foodsphere Unfair CompetitionChatNo ratings yet

- Iec 859Document76 pagesIec 859vikivarma147No ratings yet

- Look Into Deposits in Cases of General and Special Examination To Further Investigate TheDocument4 pagesLook Into Deposits in Cases of General and Special Examination To Further Investigate TheJoanna MNo ratings yet

- Contract of ServiceDocument2 pagesContract of ServiceFrances vinz C. NapugotNo ratings yet

- Law434 Lecture 2 English Law and Civil Law Act 1956Document30 pagesLaw434 Lecture 2 English Law and Civil Law Act 1956mai diniNo ratings yet

- Dedicated Developer - HumC - Ver1.0Document8 pagesDedicated Developer - HumC - Ver1.0Sanjay KumarNo ratings yet

- Celino-Petition For Letters of AdministrationDocument7 pagesCelino-Petition For Letters of AdministrationChristopher CabigaoNo ratings yet

- Ch03 - Auditor's ResponsibilityDocument15 pagesCh03 - Auditor's ResponsibilityDUNGCA, Regina T.No ratings yet

- 28 JanuaryDocument10 pages28 JanuaryHarneet KaurNo ratings yet