Professional Documents

Culture Documents

Circular-No-22-2020 For The Marketing Companies

Uploaded by

Ankit SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Circular-No-22-2020 For The Marketing Companies

Uploaded by

Ankit SharmaCopyright:

Available Formats

Circular No.

22/2020-Customs

F. No.450/119/2017-Cus IV

Government of India

Ministry of Finance

Department of Revenue

(Central Board of Indirect Taxes & Customs)

*****

Room No.229A, North Block, New Delhi.

New Delhi, dated the 21st of April, 2020

To,

All Principal Chief Commissioners/ Chief Commissioners of Customs/ Customs (Preventive),

All Principal Chief Commissioners/ Chief Commissioners of Customs & Central tax,

All Principal Commissioners/ Commissioners of Customs/ Customs (Preventive),

All Principal Commissioners/ Commissioners of Customs & Central tax,

Madam/Sir,

Subject: IGST refunds on exports-extension in SB005 alternate mechanism- reg.

Kind reference is invited to Board`s Circulars 08/2018- Cus dt 23.03.2018, 15/2018- Cus dt

06.06.2018, 22/2018-Cus dt 18.07.2018, 40/2018-Cus dt 24.10.2018 and 26/2019-Cus dt

27.08.2019 on the above subject of SB005 error resolution.

2. The above Board circulars have been issued in the spirit of trade facilitation and as interim

measures to help trade adapt and acclimatize to changing requirements in the GST era. However,

representations have been received till today on the same subject issue. There are still numerous

Shipping Bills having invoice mismatches between the GST returns data and the customs data

presented along with the Shipping Bills resulting in SB005 error. This results in blocking of the

IGST refund disbursal, which is otherwise fully automated, except for the refund scroll generation.

3. The matter has been re-examined. Considering that the entire country is facing

unprecedented challenges due to the COVID 19 pandemic , and that the exporters are facing

genuine hard-ships due to the SB005 errors, it has now been decided to extend the facility of SB005

error correction in the Customs EDI system for Shipping Bills with date upto 31.12.2019.

4. All members of the trade, exporters, shipping lines, customs brokers are duly advised

again to make efforts to understand the problems due to mismatch of invoices resulting in SB005

error, and to invest time and due precautions for preventing such error in the future.

5. Suitable Trade Notice/ Standing order may please be issued to guide the trade and

industry. Difficulty, if any, faced in implementation may be brought to the notice of Board

immediately.

Yours faithfully,

(Eric C Lallawmpuia)

OSD Cus IV

You might also like

- HDFC Home Loan It CertDocument1 pageHDFC Home Loan It Certjonnalagadda surya0% (1)

- MBA FinanceDocument11 pagesMBA Financeranjithc240% (1)

- Circular No.32/2020-Customs: Initiatives For Contactless CustomsDocument3 pagesCircular No.32/2020-Customs: Initiatives For Contactless CustomsPrashant BharthiNo ratings yet

- Circular No 28 of Customs DT 5th June 2020Document3 pagesCircular No 28 of Customs DT 5th June 2020emailgmailNo ratings yet

- Cs Ins 05 2021Document2 pagesCs Ins 05 2021Sri CharanNo ratings yet

- Subject: Reducing/eliminating Printouts in Customs Clearance - RegardingDocument2 pagesSubject: Reducing/eliminating Printouts in Customs Clearance - RegardingMohamed GaniNo ratings yet

- Circulars 2011 Circ01 2k11 CusDocument2 pagesCirculars 2011 Circ01 2k11 Cusksvv prasadNo ratings yet

- CB LICENCE IS LIFE TIME Circular-No-17-2021-rDocument2 pagesCB LICENCE IS LIFE TIME Circular-No-17-2021-rganeshNo ratings yet

- Subject: Sanction of Pending IGST Refund Claims Where The Records Have Not Been Transmitted From The GSTN To DG Systems - RegDocument4 pagesSubject: Sanction of Pending IGST Refund Claims Where The Records Have Not Been Transmitted From The GSTN To DG Systems - RegSanjay ChandelNo ratings yet

- CBDT It Cir 04 29 06 09Document2 pagesCBDT It Cir 04 29 06 09Narayan ShankarNo ratings yet

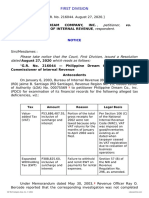

- 02 Philippine Dream Company Inc. vs. CIRDocument13 pages02 Philippine Dream Company Inc. vs. CIREnma KozatoNo ratings yet

- Incometax 29 09 2022Document3 pagesIncometax 29 09 2022nitishbhaskaran4No ratings yet

- WWF Taxation Order FOrmatDocument6 pagesWWF Taxation Order FOrmatSohaib ZafarNo ratings yet

- Instruction No 9 Customs DT 5th June 2020Document11 pagesInstruction No 9 Customs DT 5th June 2020emailgmailNo ratings yet

- Circular No.: Government India Department Revenue Board Direct Division)Document2 pagesCircular No.: Government India Department Revenue Board Direct Division)ashim1No ratings yet

- NotificationFNo153 191 2002TPLDocument2 pagesNotificationFNo153 191 2002TPLadarshkjainNo ratings yet

- Customclearance 27march2017Document2 pagesCustomclearance 27march2017rajen sahaNo ratings yet

- Circular No 55 2020Document13 pagesCircular No 55 2020Sarika JainNo ratings yet

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDocument11 pages35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNo ratings yet

- GST Summary NotesDocument93 pagesGST Summary NotesMohit KhandelwalNo ratings yet

- Mo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven StoresDocument4 pagesMo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven Storesbuwa moNo ratings yet

- Office of Commissioner of Customs Ns-Iv Jawahar Lal Nehru Custom House, Nhava Sheva Tal: Uran, Dist. Raigad, Maharashtra-400707Document4 pagesOffice of Commissioner of Customs Ns-Iv Jawahar Lal Nehru Custom House, Nhava Sheva Tal: Uran, Dist. Raigad, Maharashtra-400707Huzaifa JariwalaNo ratings yet

- REFUNDDocument52 pagesREFUNDarpit85No ratings yet

- Tax Updates BGC Jekell Dec13, 2019Document115 pagesTax Updates BGC Jekell Dec13, 2019Darlene GanubNo ratings yet

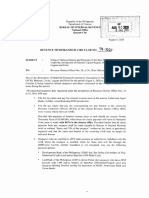

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- Ceibcbic GST Investigation Instruction 2 2021 22Document5 pagesCeibcbic GST Investigation Instruction 2 2021 22KANCHIVIVEKGUPTANo ratings yet

- Circular 1 2020Document2 pagesCircular 1 2020inti binduNo ratings yet

- RMC No. 3-2022Document2 pagesRMC No. 3-2022Shiela Marie MaraonNo ratings yet

- Bureau of Internal RevenueDocument3 pagesBureau of Internal RevenueReymund S BumanglagNo ratings yet

- 17-Article Text-186-3-10-20220308Document7 pages17-Article Text-186-3-10-20220308Decky SulistyoNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- GST Charts by CA Deep Jain SirDocument41 pagesGST Charts by CA Deep Jain SirVINAY SHARMANo ratings yet

- PHD Research Bureau PHD Chamber of Commerce and IndustryDocument33 pagesPHD Research Bureau PHD Chamber of Commerce and IndustrySUNIL PUJARINo ratings yet

- Israel Giya ProposalDocument19 pagesIsrael Giya ProposalBarnababas BeyeneNo ratings yet

- Inter GST Chart Book Nov2022Document41 pagesInter GST Chart Book Nov2022Aastha ChauhanNo ratings yet

- Notice 138Document13 pagesNotice 138Farhan AliNo ratings yet

- Internal Revenue: Republic of Pfiilippines DepartmentDocument1 pageInternal Revenue: Republic of Pfiilippines DepartmentJohn RoeNo ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Tax On MIEsDocument18 pagesTax On MIEsEuniceBrillanteNo ratings yet

- Aino Communique PDFDocument14 pagesAino Communique PDFSwathi JainNo ratings yet

- Circular 52 2018 Customs NewDocument2 pagesCircular 52 2018 Customs NewSteve MclarenNo ratings yet

- Issuance of Look Out Circulars (LOC) For Indirect Tax DefaultsDocument2 pagesIssuance of Look Out Circulars (LOC) For Indirect Tax DefaultsLuv Sanjay ShahNo ratings yet

- India Revenue: ST STDocument1 pageIndia Revenue: ST STShantanu MetayNo ratings yet

- Toshiba V CirDocument15 pagesToshiba V CirSallen DaisonNo ratings yet

- Circular 98 17 2019 GSTDocument4 pagesCircular 98 17 2019 GSTBS Nanjunda SwamyNo ratings yet

- Rmo No.47-2019Document2 pagesRmo No.47-2019Sid CandelariaNo ratings yet

- Sec 183Document1 pageSec 183goelshubham92No ratings yet

- Settlement CommissionDocument24 pagesSettlement CommissionVaishnavi CNo ratings yet

- E Invoice Under GST - NovDocument2 pagesE Invoice Under GST - NovVishwanath HollaNo ratings yet

- GST 7th Edition PDFDocument366 pagesGST 7th Edition PDFUtkarshNo ratings yet

- Government Regulates Tax Incentives To Boost Ease of ExportDocument2 pagesGovernment Regulates Tax Incentives To Boost Ease of ExportDaisy Anita SusiloNo ratings yet

- Taxblitz - 2020 - 2 - Respons Corona, Paket Stimulus Pajak Resmi Berlaku 6 BulanDocument4 pagesTaxblitz - 2020 - 2 - Respons Corona, Paket Stimulus Pajak Resmi Berlaku 6 BulanAguss SupriyantoNo ratings yet

- RMC No. 77-2022 (Stoppage of LOA Issuance 2022)Document1 pageRMC No. 77-2022 (Stoppage of LOA Issuance 2022)yuhabayNo ratings yet

- Revenue Memorandum Order No. 19-2006 Subject:: Bureau of Internal RevenueDocument2 pagesRevenue Memorandum Order No. 19-2006 Subject:: Bureau of Internal RevenueSittyNo ratings yet

- Tax Memo For Tax Year 2022 (FY 2021-22) Applicable From 1st July 2021Document68 pagesTax Memo For Tax Year 2022 (FY 2021-22) Applicable From 1st July 2021internal auditNo ratings yet

- GST TheoryDocument147 pagesGST TheoryNeha SharmaNo ratings yet

- 61397cajournal Oct2020 28Document4 pages61397cajournal Oct2020 28Anupam BaliNo ratings yet

- Indian Customs Duty - Import Duty India of HS Code 4707Document4 pagesIndian Customs Duty - Import Duty India of HS Code 4707Tuna ManNo ratings yet

- Master Circular 19.01.2022-Recovery of ArrearsDocument16 pagesMaster Circular 19.01.2022-Recovery of ArrearsShiv Swarup PandeyNo ratings yet

- FIRS Handbook on Reforms in the Tax System 2004-2011From EverandFIRS Handbook on Reforms in the Tax System 2004-2011No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Introduction To Networking: Charles SeveranceDocument119 pagesIntroduction To Networking: Charles SeveranceShailendra ShaelNo ratings yet

- 3rdNovember-Active Directory Fundamentals AdministrationDocument41 pages3rdNovember-Active Directory Fundamentals AdministrationgraxiaxNo ratings yet

- External DOS CommandsDocument1 pageExternal DOS CommandsLawrence RolluquiNo ratings yet

- Certificate of Continuing Education Completion: Ankit SharmaDocument1 pageCertificate of Continuing Education Completion: Ankit SharmaAnkit SharmaNo ratings yet

- Sgvu Project Work For Mba PDFDocument5 pagesSgvu Project Work For Mba PDFParbat DahalNo ratings yet

- 3rdNovember-Active Directory Fundamentals AdministrationDocument41 pages3rdNovember-Active Directory Fundamentals AdministrationgraxiaxNo ratings yet

- Human Resource Management Project ReportDocument63 pagesHuman Resource Management Project ReportAnkit SharmaNo ratings yet

- Copy (2) of - Qbnew1 - Pid37504 PbadDocument3 pagesCopy (2) of - Qbnew1 - Pid37504 PbadMichael MartinezNo ratings yet

- Serial Key 1 - 1u3y8-Pt5pd-R1s3x-Zd4tgDocument1 pageSerial Key 1 - 1u3y8-Pt5pd-R1s3x-Zd4tgAnkit SharmaNo ratings yet

- Customer Service Call Center Dashboard Template: Total Calls Call Abandon Rate Calls Per Rep Average Answer Time in SecDocument2 pagesCustomer Service Call Center Dashboard Template: Total Calls Call Abandon Rate Calls Per Rep Average Answer Time in SecAnkit SharmaNo ratings yet

- North Price List Hindware 2021Document6 pagesNorth Price List Hindware 2021Ankit SharmaNo ratings yet

- Human Resource Management System: A.S.Syed Navaz A.S.Syed Fiaz, C.Prabhadevi, V.Sangeetha, S.GopalakrishnanDocument10 pagesHuman Resource Management System: A.S.Syed Navaz A.S.Syed Fiaz, C.Prabhadevi, V.Sangeetha, S.GopalakrishnanshishaysgkNo ratings yet

- More DownloadsDocument1 pageMore DownloadsAditya ChourasiyaNo ratings yet

- 7320 2in1 Through AmazonDocument2 pages7320 2in1 Through AmazonAnkit SharmaNo ratings yet

- IeltsDocument181 pagesIeltsMahmodNo ratings yet

- Dell XPS 9305Document2 pagesDell XPS 9305Ankit SharmaNo ratings yet

- COVID-19 SOP For HomeDocument2 pagesCOVID-19 SOP For HomeAnkit SharmaNo ratings yet

- Atmanirbhar Presentation Part-1 Business Including MSMEs 13-5-2020Document27 pagesAtmanirbhar Presentation Part-1 Business Including MSMEs 13-5-2020Ankit SharmaNo ratings yet

- Build Your Own Windows Server IT Lab Ebook PDFDocument15 pagesBuild Your Own Windows Server IT Lab Ebook PDFJeff ScottNo ratings yet

- Handy So As Not To Get Confused Once You Resume Work in The OfficeDocument4 pagesHandy So As Not To Get Confused Once You Resume Work in The OfficeAnkit SharmaNo ratings yet

- Impact of COVID-19 On Sectors in India: AssumptionsDocument2 pagesImpact of COVID-19 On Sectors in India: AssumptionsadhavanannathuraiNo ratings yet

- Details About 32 Bit and 64 Bit SystemsDocument3 pagesDetails About 32 Bit and 64 Bit SystemsAnkit SharmaNo ratings yet

- Computer Basics Workshop: Linux Command Prompt: By: Amit Goyal (MLC)Document7 pagesComputer Basics Workshop: Linux Command Prompt: By: Amit Goyal (MLC)Barada PriyadarshineeNo ratings yet

- GFWLIVESetup LogDocument1 pageGFWLIVESetup LogMorten MidtkandalNo ratings yet

- 8 Queen AlgoDocument1 page8 Queen AlgoAnkit SharmaNo ratings yet

- Nodal Officers of States & UTs For Stranded PersonsDocument7 pagesNodal Officers of States & UTs For Stranded PersonsAnkit SharmaNo ratings yet

- AffidavitDocument4 pagesAffidavitAnkit SharmaNo ratings yet

- 8 Queen AlgoDocument1 page8 Queen AlgoAnkit SharmaNo ratings yet

- Denr Administrative Order No. 2007 - 12Document9 pagesDenr Administrative Order No. 2007 - 12cookiemonster1996No ratings yet

- Estate and Donors Tax in Re TRAIN LAWDocument8 pagesEstate and Donors Tax in Re TRAIN LAWRona RososNo ratings yet

- Income Tax Semifinals ExamDocument5 pagesIncome Tax Semifinals ExamFeelingerang MAYoraNo ratings yet

- GL Owners - JTDocument50 pagesGL Owners - JTSuneet GaggarNo ratings yet

- HP MouseDocument1 pageHP MousevishwanathNo ratings yet

- Exports Under GSTDocument5 pagesExports Under GSTphani raja kumarNo ratings yet

- Philex Mining Corporation v. CIR, G.R. No. 125704, August 29, 1998Document8 pagesPhilex Mining Corporation v. CIR, G.R. No. 125704, August 29, 1998samaral bentesinkoNo ratings yet

- Adghal Oilfield Supplies LLC: QuotationDocument1 pageAdghal Oilfield Supplies LLC: QuotationsherinNo ratings yet

- SA108 Notes 2021 - EnglishDocument12 pagesSA108 Notes 2021 - EnglishSameh MohamedNo ratings yet

- Tax Case DigestDocument4 pagesTax Case DigestFelip MatNo ratings yet

- Factors That Influence Taxpayers' Willingness To Pay Taxes With Taxpayers' Awareness As An Intervening VariableDocument13 pagesFactors That Influence Taxpayers' Willingness To Pay Taxes With Taxpayers' Awareness As An Intervening VariableNuyanli PaliNo ratings yet

- Offshore 2.0 - LAVECO Newsletter 2015/2.Document8 pagesOffshore 2.0 - LAVECO Newsletter 2015/2.Offshore Company FormationNo ratings yet

- Chapter10 Internal Trade - 1.3Document156 pagesChapter10 Internal Trade - 1.3Durga Prasad NallaNo ratings yet

- Form No. 34A: Application For A Certificate Under Section 230A (1) of The Income - Tax Act, 1961Document4 pagesForm No. 34A: Application For A Certificate Under Section 230A (1) of The Income - Tax Act, 1961Movie DhamakaNo ratings yet

- Deductions From Gross Income: Basis Ceiling RuleDocument8 pagesDeductions From Gross Income: Basis Ceiling RuleFabiano JoeyNo ratings yet

- PPSC Charter Bill 18th CongressDocument10 pagesPPSC Charter Bill 18th CongressRaki IliganNo ratings yet

- CH 14Document19 pagesCH 14Ahmed Al EkamNo ratings yet

- RF Filing Programme For The Year 2024Document9 pagesRF Filing Programme For The Year 2024Rojen LangatNo ratings yet

- McGraw Hill Connect Question Bank Assignment 1Document2 pagesMcGraw Hill Connect Question Bank Assignment 1Jayann Danielle MadrazoNo ratings yet

- Valutation by Damodaran Chapter 3Document36 pagesValutation by Damodaran Chapter 3akhil maheshwariNo ratings yet

- Mathsgenie - Co.uk Mathsgenie - Co.uk Please Do Not Write On This SheetDocument1 pageMathsgenie - Co.uk Mathsgenie - Co.uk Please Do Not Write On This SheetТатьянаNo ratings yet

- ERCA Background 1Document8 pagesERCA Background 1Abdulhafiz AbakemalNo ratings yet

- Checklist Issuance New License LBDocument3 pagesChecklist Issuance New License LBRodneyAceNo ratings yet

- Fullpaper-Dr Jason NG Wei JianDocument16 pagesFullpaper-Dr Jason NG Wei JianfarishasbiNo ratings yet

- Tattsbet v. MorrowDocument43 pagesTattsbet v. MorrowNarciso Reyes Jr.No ratings yet

- Pest and PestleDocument19 pagesPest and Pestletarungupta1986_66389100% (1)

- MGT45 Fall 2013 HW#2 11AM SectionDocument25 pagesMGT45 Fall 2013 HW#2 11AM SectionTrevor Allen HolleronNo ratings yet

- CHAPTER 6 - Socio-Economic Study - KevinDocument2 pagesCHAPTER 6 - Socio-Economic Study - KevinKevin Baladad75% (4)

- Batangas Power vs. Batangas City and NPC, 152675, April 28, 2004 DigestDocument3 pagesBatangas Power vs. Batangas City and NPC, 152675, April 28, 2004 DigestMa. Melissa Jamella LindoNo ratings yet