Professional Documents

Culture Documents

Circular No.28/2020-Customs outlines 1st phase of Faceless Assessment

Uploaded by

emailgmailOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Circular No.28/2020-Customs outlines 1st phase of Faceless Assessment

Uploaded by

emailgmailCopyright:

Available Formats

Circular No.

28/2020-Customs

F. No.450/26/2019-Cus IV(Pt)

Government of India

Ministry of Finance

Department of Revenue

(Central Board of Indirect Taxes & Customs)

*****

Room No.229A, North Block, New Delhi.

New Delhi, dated the 5th of June, 2020

To,

All Principal Chief Commissioners/ Chief Commissioners of Customs/ Customs (Preventive),

All Principal Chief Commissioners/ Chief Commissioners of Customs & Central tax,

All Principal Commissioners/ Commissioners of Customs/ Customs (Preventive),

All Principal Commissioners/ Commissioners of Customs & Central tax,

Madam/Sir,

Subject: 1st phase of All India roll-out of Faceless Assessment - reg.

Kind reference is invited to Circular No.09/2019-Customs, dated 28th February 2019,

which communicated Board’s decision to implement the next generation reforms in the Customs

clearance process under the umbrella of Turant Customs with the objectives of speedy

clearance, transparency in decision making, and ease of doing business. Subsequently, Board

rolled out numerous changes to the Customs clearance process, which combine together support

Turant Customs. These initiatives include the self-registration of goods by importers, automated

clearances of bills of entry, digitisation of customs documents, paperless clearance, etc. The stage

is now set for the roll out of the most critical reform under the Turant Customs viz., Faceless

Assessment.

2. The first pilot programme of Faceless Assessment (at times also referred commonly to as

anonymised assessment or virtual assessment) covering articles primarily falling under Chapter

84 of the Customs Tariff Act, 1975 was begun in Chennai on 14th August, 2019. Similar pilot

programmes were subsequently begun in Customs formations in Delhi, Bengaluru, Gujarat and

Visakhapatnam for articles primarily falling under other varied chapters such as chapters 85, 86

to 92, 39, 50 to 71 and 72 to 83 of the Customs Tariff Act, 1975. Taking into account the lessons

learned from these pilots, a consultation paper was placed in the public domain on 18th February

2020 for further comments and feedback. A large number of useful inputs were received in

response and these have been taken on board for revising the process flow and modalities for

implementing Faceless Assessment. Thus, Board is now ready to launch Faceless Assessment pan

India. At the same time, noting that Faceless Assessment is a complete departure from the

existing manner of Customs assessment, there is a need to introduce the changes in phases which

would give the trade and other stakeholders (including the Customs officers) time to adapt to the

changed scenario without any disruption of work. Thus, Board has decided to begin Faceless

Assessment in phases beginning with Customs stations which already have the experience of the

pilot programmes. Therefore, the first phase would begin from 8th June 2020 at Bengaluru and

Chennai for items of imports primarily covered by Chapters 84 and 85 of the Customs Tariff Act,

1975. The phased rollout plan envisages that Faceless Assessment shall be the norm pan India by

31st December 2020.

3. In order to introduce Phase 1 of Faceless Assessment at Bengaluru and Chennai from 8th

June 2020 for imports primarily made under Chapters 84 and 85 of the Customs Tariff Act, 1975

at these Customs stations, Board has issued two notifications, as follows:

I. Notification No.50/2020-Customs (N.T.) dated 05.06.2020 implements Faceless

Assessment across different Principal Chief Commissioner/Chief Commissioner Zones. This

notification enables an assessing officer (proper officer under Sections 17 and 18 of the Customs

Act, 1962), who is physically located in a particular jurisdiction to assess a Bill of Entry

pertaining to imports made at a different Customs station, whenever such a Bill of Entry has been

assigned to him in the Customs Automated system. However, it is clarified that in the first phase

of the roll-out, this notification will be applied only for inter-linking of Bengaluru and Chennai

Customs zones for the purpose of Faceless Assessment. Thus, w.e.f. 8th June, 2020 the Customs

Automated System will assign the non-facilitated Bills of Entry filed for imports of articles

primarily falling under Chapters 84 and 85 of the Customs Tariff Act, 1975, at any of the

Customs stations at Bengaluru and Chennai to the officers of the concerned Faceless Assessment

group on a first-cum-first basis for assessment. In other words, irrespective of whether the goods

are imported at any Customs station falling under the jurisdiction of Bengaluru or Chennai

Customs Zone, the Bills of Entry pertaining primarily to the said two chapters will be marked by

the Customs Automated System to the nominated Faceless Assessment group for assessment.

II. Notification No.51/2020-Customs (N.T.) dated 05.06.2020 is issued for the purpose of

empowering the jurisdictional Commissioners of Customs (Appeals) at Bengaluru and Chennai to

take up appeals filed in respect of Faceless Assessments pertaining to imports made in their

jurisdictions even though the assessing officer may be located at the other Customs station. To

illustrate, Commissioners of Customs (Appeals) at Bengaluru would decide appeals filed for

imports at Bengaluru though the assessing officer is located at Chennai. This has been done to

ensure the trade is not put to any hardship and can get their appeals heard locally, as at present.

4. Further, as one of the main objectives of Faceless Assessment is speedy and uniform

assessment practices, in Phase 1 of Faceless Assessment, Board hereby nominates Principal

Commissioner/Commissioner of Customs, Bengaluru City, Bengaluru, Principal

Commissioner/Commissioner of Customs,Airport and Air Cargo Complex, Bengaluru, Principal

Commissioner/Commissioner of Customs (II), Chennai and Principal

Commissioner/Commissioner of Customs (VII), Air Cargo Complex Chennai to act as nodal

Commissioners for the purpose of administratively monitoring the assessment practice in respect

of imported goods which are assigned in the Customs Automated System to the officers of the

Faceless Assessment Groups in Bengaluru and Chennai, for articles primarily falling under

Chapters 84 and 85, of the Customs Tariff Act, 1975. The said nodal Commissioners would work

in a coordinated manner. This arrangement would pave the path to establish National Assessment

Commissionerates (NACs) with the mandate to examine the assessment practices of imported

articles across Customs stations and suggest measures to bring about uniformity and enhanced

quality of assessments. The NACs would be put in place as and when Faceless Assessment is

rolled out in phases across the country.

5. The Principal Chief Commissioners/ Chief Commissioners concerned shall set up

dedicated cells called Turant Suvidha Kendras, in every Customs station manned by custom

officers to cater to varied functions and roles which are clarified in Instruction No.09/2020 dated

05.06.2020. The Turant Suvidha Kendra is for facilitation of the trade in completing various

formalities relating to the Customs procedures in the new regime of Faceless Assessment. The

details of functions, roles, location and timing of the Turant Suvidha Kendras shall be intimated

by the local Customs administration to all stakeholders.

5.1. Turant Suvidha Kendra would be a dedicated cell in every Customs port of import and

will be manned by Custom officers to cater to functions and roles such as :

I. Accept Bond or Bank Guarantee;

II. Carry out any other verifications that may be referred by Faceless Assessment Groups;

III. Defacing of documents/ permits licences, wherever required;

IV. Debit of documents/ permits/ licences, wherever required; and

V. Other functions determined by Commissioner to facilitate trade.

6. Principal Chief Commissioner of Customs, Chennai and Chief Commissioner of Customs,

Bengaluru are requested to issue Public Notices and guide the trade suitably to ensure the smooth

roll out of Phase 1 of Faceless Assessment. In this regard reference may also be made to the

detailed instructions issued vide Board`s Instruction No.09/2020 Customs dated 05.06.2020.

7. Any difficulties, in this regard, may please be brought to notice of Board.

Yours faithfully,

(Eric C Lallawmpuia)

OSD Cus IV

You might also like

- Compendium On Office Procedure PrefaceDocument42 pagesCompendium On Office Procedure PrefaceemailgmailNo ratings yet

- Business LettersDocument15 pagesBusiness Lettersgzel07No ratings yet

- Tax Return Engagement LetterDocument2 pagesTax Return Engagement LetterAshru AshrafNo ratings yet

- Internal Control Affecting Liabilities and EquityDocument21 pagesInternal Control Affecting Liabilities and EquityClark Regin SimbulanNo ratings yet

- GST Procedural UpdatesDocument15 pagesGST Procedural UpdatesSP CONTRACTORNo ratings yet

- Urdaneta City University College of Criminal Justice Education Outcomes-Based Teaching Learning PlanDocument9 pagesUrdaneta City University College of Criminal Justice Education Outcomes-Based Teaching Learning PlanSheane Mincy M. SiyangbigayNo ratings yet

- Derrida Kafka EssayDocument18 pagesDerrida Kafka EssayKushal HaranNo ratings yet

- Aberca vs. Fabian Ver - Case DigestDocument1 pageAberca vs. Fabian Ver - Case DigestOM Molins0% (1)

- Instruction No 9 Customs DT 5th June 2020Document11 pagesInstruction No 9 Customs DT 5th June 2020emailgmailNo ratings yet

- Circular No.32/2020-Customs: Initiatives For Contactless CustomsDocument3 pagesCircular No.32/2020-Customs: Initiatives For Contactless CustomsPrashant BharthiNo ratings yet

- Circular-No-22-2020 For The Marketing CompaniesDocument1 pageCircular-No-22-2020 For The Marketing CompaniesAnkit SharmaNo ratings yet

- CBIC removes renewal of customs licensesDocument2 pagesCBIC removes renewal of customs licensesganeshNo ratings yet

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNo ratings yet

- Circular No 55 2020Document13 pagesCircular No 55 2020Sarika JainNo ratings yet

- 9 of 2023 Customs Circular InstructionsDocument4 pages9 of 2023 Customs Circular InstructionsUniversal CargoNo ratings yet

- Customs Faceless Assessment - Key Benefits of AnonymityDocument17 pagesCustoms Faceless Assessment - Key Benefits of AnonymitySowmiyaNo ratings yet

- Advance filing of Bills of Entry under amended Section 46 of Customs ActDocument2 pagesAdvance filing of Bills of Entry under amended Section 46 of Customs ActSri CharanNo ratings yet

- Amendment CustomsDocument50 pagesAmendment Customsamithamp20No ratings yet

- Circular No 70 - NewDocument3 pagesCircular No 70 - NewHr legaladviserNo ratings yet

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNo ratings yet

- Government Regulates Tax Incentives To Boost Ease of ExportDocument2 pagesGovernment Regulates Tax Incentives To Boost Ease of ExportDaisy Anita SusiloNo ratings yet

- 100% Eou PDFDocument6 pages100% Eou PDFశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- PN No 78Document7 pagesPN No 78saurabhNo ratings yet

- CENVAT Credit PDFDocument177 pagesCENVAT Credit PDFkgsanghaviNo ratings yet

- Subject: Reducing/eliminating Printouts in Customs Clearance - RegardingDocument2 pagesSubject: Reducing/eliminating Printouts in Customs Clearance - RegardingMohamed GaniNo ratings yet

- Circular No. 36 /2020-CustomsDocument16 pagesCircular No. 36 /2020-CustomsAshok KumarNo ratings yet

- Annexure 2Document3 pagesAnnexure 2Suryakanta PaniNo ratings yet

- NotificationFNo153 191 2002TPLDocument2 pagesNotificationFNo153 191 2002TPLadarshkjainNo ratings yet

- Public Notice No 2Document98 pagesPublic Notice No 2Rajat MehtaNo ratings yet

- MOT For CustomsDocument5 pagesMOT For Customsbiswajit85No ratings yet

- Subject: Sanction of Pending IGST Refund Claims Where The Records Have Not Been Transmitted From The GSTN To DG Systems - RegDocument4 pagesSubject: Sanction of Pending IGST Refund Claims Where The Records Have Not Been Transmitted From The GSTN To DG Systems - RegSanjay ChandelNo ratings yet

- Chapter 2 - Tax On Sales Trade EtcDocument42 pagesChapter 2 - Tax On Sales Trade EtcS Dharam SinghNo ratings yet

- Clarification on tax payment for warehoused goodsDocument2 pagesClarification on tax payment for warehoused goodssridharanNo ratings yet

- Scheme 1Document19 pagesScheme 1Jayesh ValwarNo ratings yet

- 2021326153532729circular13 2021Document4 pages2021326153532729circular13 2021Ahmad SafiNo ratings yet

- GN 44AB DTC 19 8 22 fINALDocument446 pagesGN 44AB DTC 19 8 22 fINALj s chauhanNo ratings yet

- CBDTDocument2 pagesCBDTShyam KumarNo ratings yet

- Customs Procedure Regarding Filing of Ex-Bond Bill of Entry - Taxguru - inDocument3 pagesCustoms Procedure Regarding Filing of Ex-Bond Bill of Entry - Taxguru - inharshavardhan reddy PalugullaNo ratings yet

- Government determines customs values for mobile phone LCD screensDocument4 pagesGovernment determines customs values for mobile phone LCD screensMeeNo ratings yet

- Country Presentation Customs KenyaDocument5 pagesCountry Presentation Customs KenyavictormathaiyaNo ratings yet

- Accounting of Income Tax Collection PerspectiveDocument12 pagesAccounting of Income Tax Collection PerspectiveadilshahkazmiNo ratings yet

- CX Prosection Circular No 1009 - 16 - 2015Document5 pagesCX Prosection Circular No 1009 - 16 - 2015yogeshshukla.ys14No ratings yet

- Rajasthan VAT Technical GuideDocument170 pagesRajasthan VAT Technical GuideSuraj Shenoy NagarNo ratings yet

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNo ratings yet

- Large Taxpayer Unit (Ltu) : Concept ofDocument3 pagesLarge Taxpayer Unit (Ltu) : Concept ofswami_ratanNo ratings yet

- Public Notice 59Document16 pagesPublic Notice 59Shreyansh ShreyNo ratings yet

- Annual Report 2018-19 Traffic SignalsDocument1 pageAnnual Report 2018-19 Traffic SignalsQ C ShamlajiNo ratings yet

- 20962tg Cenvat CreditDocument181 pages20962tg Cenvat Creditcex0105fzdNo ratings yet

- GST Update129 PDFDocument2 pagesGST Update129 PDFTharun RajNo ratings yet

- Instruction No: CustomsDocument2 pagesInstruction No: CustomsSEAPATH DOCSNo ratings yet

- Applied Indirect TaxationDocument349 pagesApplied Indirect TaxationVijetha K Murthy100% (1)

- SAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.Document56 pagesSAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.imran mughalNo ratings yet

- Circular No 38 2020Document6 pagesCircular No 38 2020Ruchir KumarNo ratings yet

- Direct TaxDocument13 pagesDirect TaxRajveer Singh SekhonNo ratings yet

- GST Refund ReportDocument52 pagesGST Refund Reportarpit85No ratings yet

- Import Clearance GuideDocument15 pagesImport Clearance GuideWYNBADNo ratings yet

- Indirect Tax AmendmentsDocument46 pagesIndirect Tax AmendmentsCeciro LodhamNo ratings yet

- AEO Fact Sheet 2.pdf - 30374Document4 pagesAEO Fact Sheet 2.pdf - 30374V R Logistics LimitedNo ratings yet

- MOOWR 36 OF 2019Document8 pagesMOOWR 36 OF 2019itelsindiaNo ratings yet

- RMO No. 59-2016Document6 pagesRMO No. 59-2016theo toaNo ratings yet

- Karnataka Vat AuditDocument199 pagesKarnataka Vat Auditgvramon100% (1)

- Customs Circular-No-18-2023Document1 pageCustoms Circular-No-18-2023Raja SinghNo ratings yet

- Trade and Transport Facilitation Monitoring Mechanism in Bhutan: Baseline StudyFrom EverandTrade and Transport Facilitation Monitoring Mechanism in Bhutan: Baseline StudyNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Regulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshFrom EverandRegulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

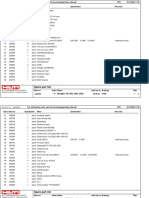

- Boe No Boe DT Igm Inward Date Consignee CHA SL No Fine AmountDocument1 pageBoe No Boe DT Igm Inward Date Consignee CHA SL No Fine AmountemailgmailNo ratings yet

- Circular No.28/2020-Customs outlines 1st phase of Faceless AssessmentDocument3 pagesCircular No.28/2020-Customs outlines 1st phase of Faceless AssessmentemailgmailNo ratings yet

- SL DKT# Importer IGM Igm Date Boe # or Job #Document2 pagesSL DKT# Importer IGM Igm Date Boe # or Job #emailgmailNo ratings yet

- SL DKT# Importer IGM Igm Date Boe # or Job #: 1 40213 Invitrogen 1825027 18-May-20 7707424Document2 pagesSL DKT# Importer IGM Igm Date Boe # or Job #: 1 40213 Invitrogen 1825027 18-May-20 7707424emailgmailNo ratings yet

- Questionable Ethics Sherwin Belkin DHCRDocument3 pagesQuestionable Ethics Sherwin Belkin DHCRqwerty99aNo ratings yet

- Pronunciation Extra: Pre-Intermediate Unit 10Document1 pagePronunciation Extra: Pre-Intermediate Unit 10olhaNo ratings yet

- G.pushkala - SC - Sexual HarassmentDocument11 pagesG.pushkala - SC - Sexual HarassmentSCOIBlogNo ratings yet

- Crusader Kings 2 Tutorial Part 1Document62 pagesCrusader Kings 2 Tutorial Part 1Nicolas Nuñez0% (1)

- Fauquier Supervisors May 14, 2020, AgendaDocument3 pagesFauquier Supervisors May 14, 2020, AgendaFauquier NowNo ratings yet

- Daftar Akun For MYOBDocument4 pagesDaftar Akun For MYOBsukainaIlhamNo ratings yet

- Course PlanDocument3 pagesCourse PlannurNo ratings yet

- Advantages and Disadvantages of DemocracyDocument2 pagesAdvantages and Disadvantages of Democracybharath alurNo ratings yet

- RW2011-15 Toc 183749110917062932Document6 pagesRW2011-15 Toc 183749110917062932Dwi AgungNo ratings yet

- BAFE SP101 2017 Scheme Document Draft Consultation Version 1 - January 2017Document24 pagesBAFE SP101 2017 Scheme Document Draft Consultation Version 1 - January 2017orkhan manuchehriNo ratings yet

- AEP Guide to Automated Export ProcessingDocument25 pagesAEP Guide to Automated Export ProcessingNagrani PuttaNo ratings yet

- LAWS1052 Legal Research NotesDocument17 pagesLAWS1052 Legal Research NotesBaar SheepNo ratings yet

- MCB Bank Internship ReportDocument9 pagesMCB Bank Internship ReportZahid ButtNo ratings yet

- People vs. GodinezDocument7 pagesPeople vs. GodinezAustine CamposNo ratings yet

- Giddens PPT Poverty - 2Document23 pagesGiddens PPT Poverty - 2Tufahatti Titikunti MeydinaNo ratings yet

- Revision in Civil and Criminal CasesDocument30 pagesRevision in Civil and Criminal CasesV_malviyaNo ratings yet

- Epson Surecolor S30670: Quick Reference Guide Guía de Referencia Rápida Guia de Referência RápidaDocument111 pagesEpson Surecolor S30670: Quick Reference Guide Guía de Referencia Rápida Guia de Referência RápidaVinicius MeversNo ratings yet

- Pro-choice or pro-life? The case for women's rights and rape victimsDocument2 pagesPro-choice or pro-life? The case for women's rights and rape victimsTreseaNo ratings yet

- Jerom G. Carlos surveillance reportDocument6 pagesJerom G. Carlos surveillance reportAilyn Baltazar BalmesNo ratings yet

- UtopiaDocument2 pagesUtopiaDiana DeedeeNo ratings yet

- Spare Part List: Breaker TE 705 120V USADocument7 pagesSpare Part List: Breaker TE 705 120V USAJoseLuisCarrilloMenaNo ratings yet

- PRAYAS - 2022 Test - 24: EconomyDocument42 pagesPRAYAS - 2022 Test - 24: EconomyShiv Shakti SinghNo ratings yet

- Corpo Cases Finals2Document24 pagesCorpo Cases Finals2Habib SimbanNo ratings yet

- DOCUMENTDocument1 pageDOCUMENTRicky RezaNo ratings yet