Professional Documents

Culture Documents

Fiat's Strategic Alliance With Tata: Centre

Uploaded by

The Panda EntertainerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fiat's Strategic Alliance With Tata: Centre

Uploaded by

The Panda EntertainerCopyright:

Available Formats

SM-1528-E

0-308-023

Fiat's Strategic Alliance with Tata

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

“I like the Tatas. I like the organization and the way they operate.1

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Sergio Marchionne, CEO of Fiat Group

Introduction

Educational material supplied by The Case Centre

On Oct., 11, 2007, firm handshakes between top executives of Italy’s Fiat

Copyright encoded A76HM-JUJ9K-PJMN9I

Group and India’s Tata Motors were exchanged at the official ceremony to

Order reference F271545

mark the signing of a joint venture (JV) to manufacture passenger cars,

engines and transmissions for the Indian and overseas markets. Several

executives from both sides had worked tirelessly on securing the agreement

since the initial idea to collaborate had emerged in early 2005. From the

first memorandum of understanding (MoU) signed in September 2005, the

relationship had expanded substantially; in addition to the recently signed

JV, the alliance encompassed an agreement to jointly manufacture pick-up

trucks in Fiat’s Argentinean facility as well as a distribution arrangement

between Fiat’s commercial vehicle subsidiary, Iveco, and Tata’s commercial

division.

1 “Fiat offers technical tie up with Tatas in CV venture,” The Press Trust of India Limited, May., 3, 2007.

This case was prepared by Jordan Mitchell, Research Assistant and Brian Hohl, MBA 2008, under

the supervision of Professors Africa Ariño and Pinar Ozcan, within the joint project between the

Center for Globalization and Strategy of IESE and KPMG on "Strategic Alliances and Joint

Ventures", as a basis for classroom discussion and not an illustration of good or bad management

in a specific situation. March 2008.

The authors would like to thank KPMG for the funding provided.

This case was written with the support of the Center for Globalization and Strategy, IESE.

Copyright © 2008, IESE. To order copies or request permission to reproduce materials, contact IESE

PUBLISHING via the website, www.iesep.com. Alternatively, call +34 932 534 200, send a fax to

+34 932 534 343, or write IESEP, C/ Juan de Alós, 43 - 08034 Barcelona, Spain, or iesep@iesep.com.

No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or

transmitted in any form or by any means – electronic, mechanical, photocopying, recording, or otherwise –

without the permission of IESE.

Last updated: 6/6/08

1

Distributed by The Case Centre North America Rest of the world

www.thecasecentre.org t +1 781 239 5884 t +44 (0)1234 750903

case centre All rights reserved f +1 781 239 5885

e info.usa@thecasecentre.org

f +44 (0)1234 751125

e info@thecasecentre.org

SM-1528-E Fiat's Strategic Alliance with Tata

Observers lauded the tie-in stating that Fiat had the potential for more sales in the

burgeoning Indian market while Tata stood to gain technology and new export

markets. While there was a lot to celebrate, Fiat and Tata executives had been given a

clear directive that all contracts detailing different aspects of the companies’

collaboration such as engineering support were to be wrapped up by the end of the

year. Fiat executives thought about the immediate road ahead of getting the final

agreements in fewer than three months.

As the ceremony was coming to a close, one observer quipped: “You know, in India,

the average joint venture with a foreign firm lasts three and half years.” The

bittersweet remark gave Fiat executives pause to ponder: How could the Fiat team

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

guarantee long-term success?

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Section I: Background

Global Automotive Industry

Valued at US$1.2 trillion (€956bn2) in 2006, the global automobile market encompassed

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

retail sales of new cars, light commercial vehicles3 and motorcycles.4 Including suppliers,

spare parts and other strata of the auto industry, the entire sector was estimated to be

Order reference F271545

worth over $2 trillion (€1.6 trillion), which was equivalent to the gross domestic product

(GDP) of the United Kingdom, the world’s sixth largest economy.5 The market had grown

by 5.2% over the previous year and since 2002, the value of the automobiles market

advanced at a compound annual growth rate (CAGR) of 4.7%.

In 2006, 65.7 million automobiles and commercial vehicles (excluding motorcycles)

were sold, representing an increase of 4% over the previous year.6 It was estimated that

there were 900 million cars and light vehicles on the road in 2006; or, one automobile

per seven people on a global basis. 7 Exhibit 1 shows volume and revenue growth

between 2002 and 2006.

The leading revenue-generating region in the auto industry was the U.S. market, with

38.1% of the global value, followed by Europe with 29.3%, Asia-Pacific with 23.3%

and the rest of the world with 9.1%. Much of the growth in recent years had occurred

in the Asia-Oceania region, where production had surged forward by 9%. Other

growing production regions included South America and Central/Eastern Europe.

Exhibit 2 provides a breakdown of automobile production by region and company.

2 Different US Dollar to Euro exchange rates were applied depending on the time period.

3 ‘Light commercial vehicles’ are defined as light goods vehicles and small buses that do not exceed 3.5 tonnes and have capacity for up

to 15 passengers. Source: www.OneMotoring.com, ‘Revised Speed Limit for Light Commercial Vehicles’, 2005.

4 Datamonitor, Automobiles Industry Profile Global Mar2007, March 2007, Reference code 0199-2011, p. 7

5 International Organization of Motor Vehicle Manufacturers, “The Auto Industry – A Key Player in the World”, 2006 Edition of the

World’s Auto Industry Key Figures, p. 5

6 Source: Datamonitor, Automobiles Industry Profile Global March 2007, March 2007, Reference code 0199-2011, p. 3, 7

7 The Automotive Industry in the 21st Century, Toby Procter and John Constable, reference # 307-180-5, p. 5

2 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

There were 18 manufacturers that produced more than one million vehicles per year.

The top five companies were responsible for almost half of the industry’s output, and

the top 10 represented more than 68%.8 In terms of revenue, General Motors (GM) was

the leader with a 17.3% market share. In volume, Toyota was about to overtake GM as

the largest global player, even outselling GM in the U.S. 9 See Exhibit 3 for global

market shares. Most of the major automakers had been established in the late 1800s

and early 1900s. Of the newer entrants (manufacturers that entered after World War II),

only a handful had subsequently become high-volume producers – the most prominent

were Korean brands: Hyundai and Kia.

In recent years, automotive manufacturers had been plagued by overcapacity. One

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

estimate suggested that if combined, car makers had the capacity to produce 24 million

more cars than could be sold each year.10 The oversupply caused car makers to engage

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

in price wars, thus destroying margins and reducing profits.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

In an attempt to lower costs, most major automotive makers had set up factories in

emerging markets such as China, India, South America and Eastern Europe. While lower

production costs were one incentive, experts also suggested that car makers could gain

access to growing and fertile marketplaces. 11 For example, retail sales in Asia-Pacific

Educational material supplied by The Case Centre

(excluding the mature Japanese market) increased 11.1%,12 while retail sales in China

Copyright encoded A76HM-JUJ9K-PJMN9I

heaved forward with 26% growth in 2006.13 According to a 2007 study of the industry,

Order reference F271545

78% of auto manufacturer executives indicated that they would likely locate or expand

operations in China in the next five years compared with 61% who indicated opening or

expanding in Eastern Europe, 54% in India, and 52% in Latin America.14

All manufacturers with production greater than one million vehicles were involved in

one or more alliances with other producers. Automobile manufacturers formed

alliances for a variety of factors with the primary rationale being an attempt to reduce

labor, energy, and raw material costs. Experts pointed to increased globalization,

industry overcapacity and the rationalization of globally-marketed products as

additional motivations for the formation of alliances.15

Significant capital outlay was required to enter into the automotive industry, such as

the installation of complex and costly manufacturing systems and engineering know-

8 International Organization of Motor Vehicle Manufacturers, “World Ranking of Manufacturers”, OICA Correspondents Survey, 2007

9 Peter Day, “'Mr Toyota' is shy about being No 1,” BBC, June 25, 2007, http://news.bbc.co.uk/2/hi/business/6237110.stm, Accessed Aug., 12, 2007.

10 Gabriel Kahn, Stephen Power, Alessandra Galloni, “Separation Anxiety: Once a Dream Couple, GM, Fiat May Face Messy Breakup…,”

The Wall Street Journal, Jan., 24, 2005, p. A1.

11 Labor costs represent about 9% of wholesale price of the average car in Europe. In Central Europe, for example, the costs are lower,

and labor’s proportion of the wholesale price is trimmed by as much as 40%. [Source: “Global Automotive Review”, Deutsche Bank,

Gaetan Tolemonde and Jochen Gehrke, Dec., 2006, p. 5]

12 International Organization of Motor Vehicle Manufacturers, ”World Motor Vehicle Production by Country”, OICA Correspondents

Survey, 2007

13 Hoovers Online, GM Corporation overview, 2007

14 "Innovation in emerging markets: 2007 annual study", Deloitte Global Manufacturing Industry Group, 2007.

15 Datamonitor, Automobiles Industry Profile Global Mar2007, March 2007, Reference code 0199-2011, p. 8

IESE Business School-University of Navarra 3

SM-1528-E Fiat's Strategic Alliance with Tata

how. The cost of the development of new car models was estimated at approximately

$1-2bn. taking between three and five years. Each year thereafter, investments were

required for engineering changes to annual models. Nearly all manufacturers operated

with profit margins of under 3%.16

A vehicle consisted of up to 15,000 separate parts, and the material costs could reach

about 70% (including both suppliers and assemblers) of the automobile’s wholesale

value. The sourcing of parts usually involved 30 direct suppliers as well as 70 or more

indirect suppliers (who served the direct suppliers). Automobile manufacturers usually

established long-term relationships with their suppliers and involved suppliers in the

development of new models. As part of their own initiatives, suppliers sought

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

opportunities to increase margins by developing proprietary technologies that would

add value to the manufacturer and the automobile. See Exhibit 4 for an approximate

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

breakdown of the automotive value system.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Automobiles in India

The automobile industry in India was valued at over $23bn (€18bn) in 2006. Unit sales

in the same year exceeded 1.5 million passenger cars (commercial vehicles accounted

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

for an additional 547,000 vehicles). 17 It was estimated that seven in 1,000 Indians

owned a car; by 2010, this statistic was expected to climb to 11 in 1,000.18 India’s total

Order reference F271545

population was 1.1 billion people. By means of comparison, the U.S. had the highest

penetration of automotive owners in the world with one out of two people owning a

car. The majority of Indians used motorcycles and three-wheel diesel-powered

rickshaws or non-motorized means such as walking, bicycles and cycle rickshaws.

Public transport such as trams, trains and buses were also commonly used.

The first imported car arrived on Indian soil in the 1920s, and by the 1940s, cars were

being manufactured in the country.19 During the 1950s, the Indian government permitted

only those companies who were manufacturing to operate in the automotive sector

(opposed to those that were solely importing); seven Indian firms were given licenses to

continue (foreign companies were not given licenses), among them, Tata Motors (then

called Telco), Hindustan Motors, Premier Automobiles and Mahindra & Mahindra (M&M).

One of the most symbolic cars of this period became Hindustan Motors’ Ambassador, a

model that had been based on the UK’s Morris Oxford. As of 2007, it was still being built

and was one of the country’s hallmark automobiles, reinforced by the fact that it was the

country’s most common taxi.

The Indian government launched its own company, Maruti Limited, in an effort to

develop and manufacture the “People’s Car.” To bring the “People’s Car” to market, the

government of India entered into a 50:50 JV with Japan’s Suzuki Motors in 1982. The

16 Procter Toby and Constable John, The Automotive Industry in the 21st Century, Reference # 307-180-5, p. 9

17 “New Cars in India,” Datamonitor, October 2006 and “Trucks in India,” Datamonitor, Nov., 2006.

18 Jorn Madslien, “India prepares for automotive boom,” BBC, April, 3, 2007, http://news.bbc.co.uk/2/hi/business/6521909.stm,

Accessed Aug., 11, 2007.

19 Auto India Mart Website, Events and Milestones, Indian car history, http://auto.indiamart.com/cars/events.html, Accessed Aug., 11, 2007.

4 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

venture produced the Maruti 800, outselling all other passenger cars. In commercial

vehicles, Tata began producing light commercial vehicles in the 1980s, quickly

becoming the largest commercial vehicle manufacturer in the country (and the fifth

largest in the world). The liberalization policies in 1991 opened up India to new import

and export possibilities.

As of 2007, the top players in the domestic passenger car market were Maruti Udyog

with 48.8% market share, Tata with 20% and Hyundai with 19.0%.20 The market was

divided into four primary segments: compact cars (A), midsize cars (B), premium cars

(C), and sports-utility vehicles (SUVs) (D).

The market for commercial vehicles was dominated by Tata Motors with 65%, followed

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

by Ashok Leyland with 15.1%, Isuzu with 3.3%, and M&M with 2.2%. See Exhibit 5

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

for more information on the Indian automotive market.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

India’s automotive sector had attracted international attention for both its

manufacturing capabilities and blooming market potential. Nearly all international

automotive players had ownership stakes in a manufacturing facility in India. Over the

past five years, the number of new car sales had grown at a CAGR of 19.2% while the

Educational material supplied by The Case Centre

number of trucks had posted a CAGR of 24.3%.21 Over the next decade, future growth

Copyright encoded A76HM-JUJ9K-PJMN9I

was expected to exceed 10% year on year. One industry analyst projected that India’s

Order reference F271545

annual volume would reach 3.5 million cars by 2015.22

To add to the excitement of an explosive marketplace, Tata was in the process of

developing the 1-lakh rupee (US$2,500, €1,750, 1 lakh=100,000 rupees) car for 2008.

Many predicted that the car would dramatically change the Indian automotive

landscape considering that it would cost half as much as the least expensive car

currently available.23 Renault had announced that it too would pursue the development

of an ultra-low cost vehicle to be ready in as little as three years. Renault was planning

a plant to produce 400,000 units in its JV between M&M and Renault’s division,

Nissan.24

Background on the Fiat Group

Established in 1899 by Giovanni Agnelli and a group of investors in Turin, Italy, Fiat

Group was Italy’s largest car maker and one of the country’s dominant industrial

groups. The Fiat Group posted net revenues of €51.8 billion and net profits of €1.1

billion in 2006. The group comprised five business areas:

20 “New Cars in India,” Datamonitor, Oct., 2006.

21 “New Cars in India,” Datamonitor, Oct., 2006 and “Trucks in India,” Datamonitor, Nov., 2006.

22 Source: ‘Tata and Fiat: Small is Big in India’, BusinessWeek Online, Jan., 2007.

23 Thomas Ryard, “Renault Plans New US$3,000 Car,” Global Insight Daily Analysis, June, 14, 2007.

24 Ibid.

IESE Business School-University of Navarra 5

SM-1528-E Fiat's Strategic Alliance with Tata

• Automobiles (49.3% of net revenues); including Fiat, Lancia, Alfa Romeo,

Maserati and an 85% ownership stake in Ferrari

• Agricultural and Construction Equipment (20.3% of net revenues) under the

company CNH;

• Trucks and Commercial Vehicles (17.6% of net revenues) under the Iveco

brand;

• Components and Production Systems (23.9% of net revenues) under Fiat Power

Train, Magneti Marelli, Teksid and Comau; and,

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

• Other businesses (3.1% of net revenues) 25 including services, publishing and

communications such as the ownership of Italy’s La Stampa daily newspaper

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

and holding companies.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Refer to Exhibit 6 for Fiat Group’s financial statements and divisional performance.

Although Fiat had been credited as the first successful automaker to build a “global

car” with the Palio model in the mid-1990s26, most commentators agreed that the past

Educational material supplied by The Case Centre

10 years had been rough for Fiat, especially in its ailing auto division. Market share in

Copyright encoded A76HM-JUJ9K-PJMN9I

Italy fell from 60% in the mid-1980s to 30% by 2006.27 Within Europe, Fiat’s share

Order reference F271545

dropped from 13.8% in 1990 to 6.5% in 2005.28 Between 2001 and 2004, the company

overall lost nearly $12 billion (€10 billion).29 Several reasons were seen to contribute to

Fiat’s difficulties including its low-margin mix of smaller cars, languid new product

introductions and the onslaught of more Japanese cars in Italy due to the abolition of

quotas on foreign imports.30

In 2003, the company’s management began taking steps to reduce costs and sell non-

core divisions. The period was also marked by a series of changes in top management.

Long-time chairman, and grandson of Fiat’s founder, Gianni Agnelli died in 2003;

Umberto Agnelli assumed the role of chairman until his death in 2004. Ferrari’s CEO and

long-time Agnelli acquaintance, Luca Cordero di Montezemolo was appointed as the

chairman, John Elkann (Gianni Agnelli’s grandson) as vice-chairman and Sergio

Marchionne as CEO. Marchionne, an Italian-Canadian, had been recruited from the top

post of SGS (Société Générale de Surveillance; a Swiss certification company partially

owned by the Agnelli family). Marchionne set out to perform “radical surgery” by

reducing Fiat’s management, firing underperformers and refinancing the bank debt. He

25 Fiat Annual Report 2006, Dec., 31, 2006, p. 26. Note that eliminations account for the other -14.2%.

26 Lakshman Nandini, “Fiat Makes a New Friend in India,” Dec., 15, 2006.

27 “Working with Fiat: Rising Star ties up with old world Titan,” The Economic Times, Sept., 7, 2006.

28 Edmondson Gail, “Fiat's Comeback—Is It for Real?” Business Week, July, 25, 2006,

http://www.businessweek.com/globalbiz/content/jul2006/gb20060726_749437.htm?chan=search, Accessed Aug., 8, 2007.

29 Edmondson Gail, “Fiat's Turnaround Takes Root,” Nov., 10, 2006,

http://www.businessweek.com/globalbiz/content/nov2006/gb20061110_334864.htm, Accessed Aug., 12, 2007.

30 Edmondson Gail et. al, “Fiat: Running on Empty,” Business Week, May, 13, 2002,

http://www.businessweek.com/magazine/content/02_19/b3782014.htm?chan=search, Accessed Aug., 8, 2007.

6 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

continued with the former management’s plan to sell off non-core assets and breathe

new life into the frail auto division through new product introductions.31 The company

recruited a number of high profile auto executives, including top design talent from

Rolls-Royce and BMW to infuse a nimble culture of design and innovation into the

company. 12,000 jobs were shed across the entire group, including a large proportion

outside of Italy; the company chose not to close its national plants to avoid a clash with

Italy’s powerful unions.32 To spur on a change of mindset, Fiat’s management set targets

of growing volume from 1.3 million units in 2006 to 1.9 million units by 2010.33

Alliances at Fiat

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

The GM-Fiat Alliance

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

In 2000, GM and Fiat signed an agreement to exchange 20% of Fiat Automobiles

shares with 5.1% of GM shares, both valued at $2.4bn (€2.6bn). The companies formed

two JVs: Fiat-GM Powertrain and GM-Fiat Worldwide Purchasing. The JVs were aimed

at developing engines and transmissions and creating a common purchasing

organization. 34 The intention of the agreement was for GM to gain supply chain

Educational material supplied by The Case Centre

savings with its European operations and Fiat hoped to strengthen its overall position

Copyright encoded A76HM-JUJ9K-PJMN9I

in light of recent automotive consolidation while not compromising its position within

Order reference F271545

Italy and Europe. Many observers believed that if Fiat Automobiles were sold to a

European carmaker (in early 2000, DaimlerChrysler had reportedly offered about €12bn

in cash for Fiat Auto), Fiat would be merged into the European operations of the buyer.

The Fiat-GM arrangement included a put option 35 whereby GM could purchase the

other 80% of Fiat at fair market value beginning in 2004.36 To service its high debt

level, Fiat sold a number of assets including its stake in GM. Fiat asked GM for more

cash in a round of financing. When GM refused, Fiat sought additional financing from

other sources (including a capital injection from the Agnelli family).37 GM’s share in

Fiat was subsequently diluted to 10%. With continuing financial troubles at Fiat, GM

wrote down their investment in Fiat to zero.38

31 Kahn Gabriel, “Fiat CEO says major surgery drives revival,” The Wall Street Journal Europe, Nov., 4, 2005.

32 Mackintosh James, “Interview: Sergio Marchionne, Chief Executive of Fiat. The impetus behind a move into higher gear,” Financial

Times, May, 22, 2006.

33 Ciferri Luca, “Marchionne: Fiat will push its rivals,” Auto News Europe, Dec., 11, 2006, p. 17.

34 “GM and Fiat sign separation agreement,” Press Release, Fiat Group, Amsterdam, Detroit, Turin, May, 13, 2005.

35 A put option gives one party the right to sell its shares (or other securities) to another party usually at an agreed-upon price by a

specific date.

36 Edmondson Gail et. al, “Fiat: Running on Empty,” Business Week, May, 13, 2002,

http://www.businessweek.com/magazine/content/02_19/b3782014.htm?chan=search, Accessed Aug., 8, 2007.

37 Kahn Gabriel, Power Stephen, Galloni Alessandra, “Separation Anxiety: Once a Dream Couple, GM, Fiat May Face Messy Breakup…,”

The Wall Street Journal, Jan., 24, 2005, p. A1.

38 Ibid.

IESE Business School-University of Navarra 7

SM-1528-E Fiat's Strategic Alliance with Tata

Fiat then began negotiating with GM to exercise the put option (something which was

previously seen to be included in the original contract as a type of “insurance”). In early

2005, the two sides negotiated a break-up fee of $2bn (€1.55bn) paid to Fiat by GM.

Both joint ventures were subsequently dissolved. Fiat Powertrain was then formed to

design and produce transmissions and engines for passenger and commercial vehicles.

A Fiat executive gave one viewpoint on the GM-Fiat relationship: “One of the

complications with GM was with mutual ownership participation. We needed to go to

them and ask them when we wanted to do something and vice-versa.” Another Fiat

executive stated: “[GM] did a classic financial due diligence, when in reality, the

situation was much more complicated, and required understanding the strategic,

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

political and social situation of the company.”39

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

Other Alliances

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Despite the break-up with GM, Fiat sought a number of partnerships in an effort to

increase efficiencies and reduce costs. In 2005, Fiat signed a deal with Ford to

collaborate on the development and manufacturing of a common platform for Fiat’s

retro Cinquecento and the next generation of Ford’s Ka. The building of both cars was

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

to take place at Fiat’s plant in Poland.40 Later in the year, Fiat reached an agreement to

license its JTDi 1.3 litre diesel engine to Suzuki for production at its Maruti plant in

Order reference F271545

India.41 It also renewed a contract for a 10-year period to license transmissions from

PSA Peugeot-Citroën to be manufactured in Fiat’s factory in Córdoba, Argentina.42 In

the summer of 2006, Fiat signed three agreements for joint projects: the production of

heavy trucks in China with Chinese firms Saic Motor Corporation and the Chongging

Heavy Vehicle Group; the production of Fiat’s Ducato van line with Russia’s Severstal

Auto; and, the creation of Fiat Auto Financial Services with French bank Credit

Agricole to assume the role of Fiat’s financing arm previously managed by Fiat’s

wholly-owned company, Fidis.43 In the summer of 2007, Fiat agreed to supply 80,000

light-duty diesel engines to Japan’s second largest truck maker, Mitsubishi Fuso

(majority owned by DaimlerChrysler).44 See Exhibit 7 for a list of Fiat’s major joint

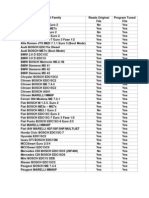

ventures as of the end of 2006.

39 Kahn Gabriel, Power Stephen, Galloni Alessandra, “Separation Anxiety: Once a Dream Couple, GM, Fiat May Face Messy Breakup…,”

The Wall Street Journal, Jan., 24, 2005, p. A1.

40 Edmondson Gail, “Fiat's Comeback—Is It for Real?” Business Week, July, 25, 2006,

http://www.businessweek.com/globalbiz/content/jul2006/gb20060726_749437.htm?chan=search, Accessed Aug., 8, 2007.

41 Nandini Sen Gupta, “GM may drive in its small car with Fiat diesel engine,” The Economic Times, Aug., 10, 2006.

42 Newton Paul, “Fiat-Tata Alliance Considers Investing US$100 mil. in Argentine Plant,” Global Insight Daily Analysis, Aug., 7, 2006.

43 VB, “Fiat cements alliance with India’s Tata,” ANSA - English Media Service, July, 25, 2006.

44 Reed John and Michaels Adrian, “FT.com site: Fiat agrees DaimlerChrysler engine deal,” Financial Times (http://ft.com), June, 19, 2007.

8 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

Fiat’s Operations in India

Credited as helping to “motorize Mumbai,” Fiat appointed Bombay 45 Motor Cars

Company as its national sales representative in 1905, long before the first car arrived

in the country. By the 1920s, Fiat cars were being imported from Italy. In 1951, Fiat

licensed its passenger car, the Fiat 1100, to the Indian firm Premier Automobiles.

Renamed as the Premier Padmini, the model quickly became a product hit as it was

associated with sturdiness and value for money.46 Premier Automobiles later released a

car with the body of the Fiat 124 and an engine and transmission from Nissan. 47

Premier Automobiles marketed versions of the Padmini until 2000. See Exhibit 8 for a

photo history of Fiat’s major models in India.

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

The Indian government’s liberalization plan in 1991 paved the way for Fiat to establish

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

a wholly-owned subsidiary, Fiat India, in 1995. Fiat India and Premier Automobiles

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

formed a joint venture (51:49 in Fiat India’s favor) to produce Fiat’s compact car, the

Uno, in Premier’s plant in Kurla, Mumbai. At the time, Premier Automobiles also had a

joint project with Peugeot. Demand for the Uno initially grew, but after minimal

promotional efforts and inconsistent dealer service, the model did not reach its

expected level of sales. 48 Fiat India upped its participation in the joint venture,

Educational material supplied by The Case Centre

eventually assuming control of the Kurla factory. Throughout the tie-in with Premier,

Copyright encoded A76HM-JUJ9K-PJMN9I

the plant endured troubles with the labor force including a long-strike in 2001.

Order reference F271545

(Peugeot’s joint venture also suffered from labor setbacks, causing it to leave the

country). To boost sales, Fiat India tried its hand at releasing other models including

the Siena and the globally-formatted Palio, and signed an agreement between Fiat’s

Fidis and Sundaram Finance to offer consumer auto financing. Palio sales were given a

boost and in preparation for future predictions, Fiat started the construction of a

second production facility at Ranjangaon, Maharashtra. However, sales slowed after

consumers complained about fuel efficiency and poor dealer service. Fiat’s other

products failed to provide sufficient volumes to justify the completion of the

construction of the second plant.

In the early years after 2000, Fiat India was loss-making and its Kurla plant was

operating under capacity. In an attempt to turn Fiat India into a profitable division,

Paolo Castagna was named as the head of the affiliate in March 2005. Castagna had

worked within Fiat Group since 1988 and had extensive international experience

previously as the managing director of a Fiat Group company in Austria and

Germany.49

45 Mumbai was officially called Bombay until 1995.

46 Lakshman Nandini, “Fiat Makes a New Friend in India,” Dec., 15, 2006.

47 Ibid.

48 Ibid.

49 “Castagna to head Fiat India,” S Corporate Bureau in Mumbai, May 31, 2005, http://www.rediff.com/money/2005/may/31fiat.htm,

Accessed Feb., 18, 2008.

IESE Business School-University of Navarra 9

SM-1528-E Fiat's Strategic Alliance with Tata

Plans for a turnaround were set back when Fiat India’s Kurla plant suffered a work

stoppage for six months due to severe damage caused by flooding.50 Throughout 2006,

Fiat India instigated a voluntary retirement scheme and a relocation program to reduce

its workforce at the 53-acre Kurla plant as the company planned to eventually close it

and consolidate all production activities at the newer 200-acre Ranjangaon facility.51

In addition to realizing savings through the consolidation, the Kurla plant was deemed

unsuitable for large-scale production after the damage from the floods in 2005.52

The company was faced with a decision of whether to close down the Indian operation

or look for an alternative such as finding a local partner. Michele Lombardi, a Fiat

Group manager today responsible for strategic alliances in Fiat Powertrain

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

Technologies, explained the impetus for a local partner:

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

You can’t just go it alone – well, some companies like Toyota do. However, we are

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

not large enough to do it alone. When the GM joint ventures ended, we identified

three specific areas for focused alliances: product technology, industrial know-how

and scale and geographical markets. Alliances are definitely the right way for Fiat

as they can provide incredible efficiencies and knowledge.

Educational material supplied by The Case Centre

Even with our direct market presence, our market share was quite low. So in India,

Copyright encoded A76HM-JUJ9K-PJMN9I

we began looking for a partner. We wanted that partner to be local since they

Order reference F271545

needed to understand the market, the customer and the complicated value chain.

Fiat Group executives initially short-listed two potential partners. While both

candidates had several years in the automotive sector, neither party seemed to possess

the competencies or the commitment Fiat Group was after. Lombardi commented:

One of the partners was willing to put down a financial commitment but we were

uncertain whether they would be able to support us in identifying the right product,

determining the appropriate pricing, marketing to the right customer and building

the right distribution. With the other partner, we did not get the sense that

management was in it for the long-term. We decided that we needed to have a

much more committed player who would really provide a benefit from an entire

market level. We had had a relationship with Tata from a group level perspective

and that enabled us to initiate a conversation about a potential partnership.

During early 2005, Marchionne and other Fiat Group senior executives first

approached Tata Group’s chairman Ratan Tata and his senior managers about potential

collaboration.

50 “Fiat’s golden handshake for Kurla unit employees,” The Economic Times, 22 Aug., 2006,

http://economictimes.indiatimes.com/News/News_By_Company/Companies_A-

Z/F_Companies_/Fiats_golden_handshake_for_Kurla_unit_employees/rssarticleshow/1914113.cms, Accessed Nov., 15, 2007.

51 Ibid.

52 “Kurla fetches Fiat Rs 608 cr.,” The Telegraph, Nov., 3, 2007,

http://www.telegraphindia.com/1071103/asp/business/story_8506341.asp, Accessed Nov., 16, 2007.

10 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

Brief on Tata Group

Tata Group was one of India’s foremost industrial conglomerates with ownership

interests in automotive, engineering, steel, energy, chemicals, information technology,

consulting, food and beverages, consumer products, hotels, publishing, financial

services and several other lines of business. See Exhibit 9 for more detailed

information on the Tata Group.

Tata Motors

Tata Group’s automotive division, Tata Motors, was India’s largest automotive producer

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

(when taking into account all types of vehicles) with sales of €4.5bn. The division was

the world’s fifth largest commercial vehicle manufacturer. It had acquired Korea’s

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

second largest truck maker from Daewoo in 2004, purchased a 21% stake in the

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Spanish bus manufacturer, Hispano Carrocera, in 2005 and signed a joint venture

(51:49 in Tata Motors’ favor) with Brazilian bus maker Marcopolo to open a bus

factory in India.

Tata Motors had initiated the production of passenger vehicles in 1991 with the hybrid

Educational material supplied by The Case Centre

car-truck, the Sierra. Tata Motors followed with several models such as the Estate in

Copyright encoded A76HM-JUJ9K-PJMN9I

1992, a sports utility vehicle (SUV), the Safari, and a compact economy car, the Indica

Order reference F271545

in 1998. The Indica was seen as a technological breakthrough for Indian industry as it

included an in-house developed diesel engine and several features such as air

conditioning and power steering, which were only available in up-scale models.

Development costs were estimated to be €400m, far below the average €1 billion-plus

development cost of a new car. The Indica captured 22% market share in the compact

segment within five years and was one of the top three selling cars in the country.53

See Exhibit 10 for more information about Tata Motors and Exhibit 11 for selected

photos of Tata Motors’ models.

Section II: The Fiat-Tata Relationship

Fiat and Tata’s Initial Meetings and Agreements

After conversations between top level Fiat and Tata executives, negotiating teams from

both sides were put in place. At Fiat, a team of four members was constructed:

Alessandro Nasi and Michele Lombardi represented Fiat Group at corporate level, Ezio

Barra from Fiat Automobiles and Giovanni De Filippis from Fiat India. Later, other

managers such as Roberto Grazioli from Fiat Powertrain were brought on to the team.

All team members had previous experience with alliances. Additionally, De Filippis had

worked on projects at Fiat India since 2003. Tata Motors’ negotiating team included

the following executives: the CFO, the head of exports, head of domestic sales, head of

business development and strategy and other experts.

53 Tata Motors Annual Report 2003-2004, March, 31, 2004, pg. xxix.

IESE Business School-University of Navarra 11

SM-1528-E Fiat's Strategic Alliance with Tata

In the first meeting, the two sides signed a non-disclosure agreement and briefly

outlined their strategic priorities and interests in working together. As further initial

meetings unfolded, the two sides found common ground in the distribution and

manufacturing of cars. De Filippis described the process:

We started with a blank white board and talked about where we saw potential

opportunities. As more meetings took place, we saw that we shared a common set

of values. Even if two companies have common values, they may not cooperate.

However, we were very fast in finding common ground.

We were very confident in Tata since they are a large company that can deliver. In

the past, we haven’t had good experiences with small partners. You feel like you

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

can’t control it and many times, they cannot invest. We’ve been in situations where

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

we had no car delivery and no spare parts. We were sure that this would not happen

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

with Tata.

Lombardi commented on his initial impressions:

Going in, we knew that Tata had great products, a respected history, and an

excellent domestic and international reputation. From the meetings, we saw that

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

they really had a great commitment for the long term. We concluded that their

management has a similar spirit to ours.

Order reference F271545

Memorandum of Understanding (MoU)

The teams came together throughout the spring and summer of 2005 in India at Tata’s

head office and began drafting up a memorandum of understanding (MoU) to

document the relationship. On Sept., 22, 2005, both companies announced that the

MoU had been signed with the following purpose: “to analyze the feasibility of

cooperation, across markets, in the area of passenger cars that would encompass

development, manufacturing, sourcing and distribution of products, aggregates and

components.”54 In the press release, Marchionne stated:

The possible strategic cooperative agreement with Tata Group represents another

step in our clearly defined strategy that calls for targeted alliances across the

automobile value chain. It is consistent with successful ventures established with

premier partners including PSA Peugeot Citroen and Suzuki, and the recently

announced signing of a MoU with Ford Motor Co. I want to thank the Tata team,

especially its chairman, Mr. Ratan Tata, for the outstanding work shared with us.55

Ratan Tata commented:

We are delighted to be in dialogue with the Fiat Group on the range of possibilities

between the two corporations. Fiat is a globally respected corporation, with a long-

54 “Fiat and Tata Groups explore strategic alliance opportunities,” Fiat-Tata Press Release, Sept., 22, 2005.

55 Ibid.

12 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

standing presence in automobiles. Both companies will benefit from this alliance in

terms of possible joint product development, shared platforms and aggregates.56

After the signing of the MoU in September 2005, Giovanni De Filippis, who had been

involved in the negotiations and the drafting of the MoU, took over as the head of Fiat

India from Paolo Castagna. As De Filippis explained: “I was sent to manage the Indian

affiliate for two purposes: to restructure Fiat India and get the joint venture signed

with Tata.”

The Agreement for Tata to Distribute Fiat cars in India

In January 2006, the two sides signed an agreement for dealer network sharing in

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

India. The agreement called for Tata Motors to manage the marketing and distribution

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

of Fiat’s Palio and Palio Adventure via existing dealers in 11 cities throughout the

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

country from March 2006 onwards. Two Fiat models would be displayed alongside

Tata’s five main passenger cars and the Fiat logo would be showcased beside Tata’s on

the dealers’ exteriors. As part of the agreement, the dealers would offer service, spare

parts for Fiat cars and consumer financing through Tata Motors Finance. The dealer

network included a total of 28 dealers; 25 were Tata Motors dealers and three were Fiat

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

India’s. At the time of the announcement, Marchionne said: “This agreement is a

milestone in our presence in India. It enables us to increase our customer base in the

Order reference F271545

country and to provide superior quality service and facilities to our existing customers.

The joint team is doing an excellent job and I am confident that our cooperation with

Tata will further expand in the areas of product development, manufacturing and

sourcing.”57

The Road to the Joint Venture

During the summer of 2006, several key actions signaled the strengthening of the

relationship between the two entities. In May 2006, Ratan Tata was appointed to Fiat

Group’s board of directors. As one observer noted: “The appointment of Ratan Tata to

Fiat’s board is telling the world that Tata is truly a partner.” A month later, Fiat India

began using excess capacity at its Kurla plant by painting 3,000 to 4,000 Tata Motors

pickup truck bodies. At the time, Fiat was producing between 250 and 300 of its own cars.

On July 25, 2006, both groups announced two additional cooperation agreements. The

first involved the signing of another MoU to establish an industrial joint-venture to

manufacture passenger cars, engines and transmissions for both the Indian market and

overseas. The second agreement was a 60-day study to explore the possibility to use

Fiat’s facility in Córdoba, Argentina, to produce both Fiat and Tata utility vehicles and

pickups for sale within Latin America and export markets. See Exhibit 12 for a

description of the companies’ other agreements. Lombardi talked about how the scope

of the relationship broadened:

56 “Fiat and Tata Groups explore strategic alliance opportunities,” Fiat-Tata Press Release, Sept., 22, 2005.

57 “Fiat cars to be available in India through Tata dealers from March 2006,” Fiat-Tata Press Release, Jan., 13, 2006.

IESE Business School-University of Navarra 13

SM-1528-E Fiat's Strategic Alliance with Tata

At the beginning, it was only cars. Then, as the conversations continued, the idea

for producing engines and transmissions came up. Tata was particularly interested

in the joint engine production because they have expressed interest in a “new

generation” engine for their vehicles. The way that we discussed further

collaboration is very much in line with the spirit of the relationship to look for new

opportunities.

After identifying that the two sides were interested in manufacturing powertrains, they

thought that a possible structure could involve the formation of two separate companies:

one focused on powertrains and the other for the manufacturing of cars or two

companies with different shareholding patterns between Fiat and Tata. However, after

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

additional discussions, the teams decided that they would view all projects as an equal

split as it was felt that both sides were contributing equal knowledge and resources.

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

During the second half of 2006, the two sides jointly developed a business plan with

targets for the demand of cars and powertrains. The directive was to achieve a project

payback of eight years and at least €30m in net present value. 58 Roberto Grazioli

explained the process:

Educational material supplied by The Case Centre

When developing the business case for a joint venture, we start by defining the key

Copyright encoded A76HM-JUJ9K-PJMN9I

strategic terms. In this first phase the basic principles are determined such as the

Order reference F271545

location, the types of products, the range of volumes and the approximate price

points. Then, different scenarios are constructed to explore alternatives such as

building the plant from scratch or only assembling instead of manufacturing the

powertrain and the car together.

In the development of the plan, you then need to translate those strategic and

financial discussions to the technical side. For example, you might have target

prices for engines and you need to work with the technicians to figure out a way to

reduce the cost of the engine.

Typically, there are different plans developed – one internally for each company

and then the joint venture business plan. The reason for the internal plans is not

because the partners want to hide anything, but there may be corporate level plans

such as the introduction of a new model that have not been internally approved yet.

When the time comes, the information is shared with the partner and it is worked

into the plan.

By the end of 2006, the business plan called for the JV to produce both Fiat and Tata

vehicles including the Fiat Palio and Adventure as well as premium cars for the B and

C segments, such as the Fiat Grande Punto and the new Fiat Linea sedan. The first

completed cars were scheduled for early 2007. Other products included the Fiat 1.3 liter

multi-jet diesel, the 1.4 liter diesel engine, a new 1.2 liter gasoline engine and Fiat

transmissions. Initial volumes were planned at 100,000 cars and 200,000 engines and

transmissions. Average prices were estimated at approximately €6,000 for cars and

58 All financial details have been disguised to protect confidentiality.

14 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

€1,400 for powertrains (including both engines and transmissions).59 Typical margins in

the industry ranged from 12 and 16% for cars and 15 to 20% for powertrains.60 Using

the initial volumes, the teams estimated the required investment to reach capacity. It was

determined that the investment would be made in phases and would reach a total of

€665m. 61 As part of the accord, Fiat would contribute its factory at Ranjangaon,

Maharashtra, which would be managed by both parties. Fiat would also license certain

cars and powertrain technology to the joint venture and inject cash in the form of equity

and loans. Tata’s contribution would be in the support provided by its sales distribution

network as well as cash injection in a combination of equity and loans.

On Dec., 14, 2006, the companies announced to the press that they were working towards

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

the signing of a single 50:50 joint venture agreement. Several press reports at the time

pushed the scope beyond what had been declared, speculating that Fiat would contribute

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

its expertise to the 1-lakh automobile project,62 which turned out to be incorrect.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

The Joint Venture Agreement (JVA) Negotiations

With regular meetings occurring once per month (typically for four days in a row) for

over a year (from autumn 2006 to autumn 2007), the two negotiating teams hammered

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

out the details of the JVA.

Order reference F271545

The discussions revolved around several issues such as the value of the Fiat’s assets at

the Ranjangaon plant and the exit clauses for both sides. In negotiating the value of

Fiat’s assets, Fiat’s team first presented a list of assets with market values backed by an

independent assessment. The two sides then negotiated for approximately a six-month

period on the value of those assets. In the situation of the exit clauses, there were two

main aspects: the rights of both companies in the case that one company exited; and,

the continuity of other contracts (such as the distribution deal of Fiat cars in India) if

the JV was terminated. Grazioli talked about overcoming challenges in the

negotiations:

Since I’ve been involved with the negotiations, there has not been a roadblock or

one big issue to face. The overriding issue was getting through the volume of work

in the specified time period.

Obviously, there are difficult moments in any negotiation. During negotiations we

might face particular challenges with a detailed negotiation point. If the negotiating

teams are not capable of resolving the issue, we have put in place structured

escalation procedures, which gradually move the issue up the decision ladder. To

date, this process has worked nicely.

59 All financial details have been disguised to protect confidentiality.

60 Case writer estimates.

61 “Fiat, Tata plan to produce low cost car for Indian market in 2008,” AFX Asia, Jan., 25, 2007.

62 Ullatil Parvathy, “Fiat to power Tata's Rs 1-lakh car,” The Economic Times, Nov., 8, 2006.

IESE Business School-University of Navarra 15

SM-1528-E Fiat's Strategic Alliance with Tata

Fiat’s Team

Fiat’s team comprised the business specialists and legal experts. On the business side,

there was the core negotiation team (Nasi, Lombardi, Barra, Grazioli and De Filippis)

who coordinated other participants for certain issues. In negotiating the JVA, there

were over 50 employees involved from Fiat’s side. Those employees included

representatives from each function such as quality, supply chain, purchasing, diesel

and gasoline engine engineering, transmissions engineering, finance and warranty. On

the legal side, a dedicated legal manager was involved in most of the negotiations.

There were also local Fiat and Tata lawyers dealing exclusively with Indian law and

Fiat’s top legal counsel was involved for key decisions. Grazioli commented on the

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

interplay between the business and legal side in the negotiations:

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

In the course of the negotiation, we also had specific moments when the two teams

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

preferred to have ad-hoc sessions without the legal people involved, in order to be

more focused on the “business issues”. The legal aspects were addressed at a later

stage, when the “open items” were discussed and solved.

Meetings and Cultures

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

Most of the negotiations were held at Tata’s head office in Mumbai. Given that Fiat

Order reference F271545

executives had 10-hour flights from Italy to India, the Fiat team requested alternative

locations such as Fiat’s head office or a relative mid-way point such as Dubai, UAE.

Indian citizens entering Europe required a week-long waiting period, which usually

meant that the meetings were in India. One Fiat executive commented on the timing of

some of the meetings:

It is always difficult going to the other company’s offices as they still have other

work to attend to. So, we might have a meeting scheduled to start at 10am, which

then starts at 11am and might end up being regularly interrupted by other issues.

We also tried phone conversations, but there’s nothing like the face-to-face contact

where you can see body language and reduce the number of distractions.

Another Fiat executive talked about the differences in cultures:

There are two layers of culture. The first is Italian and Indian culture and the second

is the difference in company culture. Even with another Italian company, Fiat can

be very different.

In past experiences such as the GM negotiations, I saw that the Americans were step

by step. They may take 10 days to decide, but when they do, that’s their position

and they don’t budge. I would say that Fiat works on trying to speed up the process.

We might have one position and three days later, the position is different. Also, we

were given a lot of autonomy in our decisions. I got the sense that perhaps at Tata,

the decisions need to be escalated up higher into the organization.

16 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

Making the JV operational

In making the JV operational, due diligence on all financial values was carried out by

KPMG. Fiat and Tata formed a 10-person board of directors for the new company with

five directors from each company. Tata Motors Managing Director, Ravi Kant, was

made chairman and the CEO of Fiat Powertrain Technologies and senior vice-president

business development of Fiat Group Automobiles, Alfredo Altavilla, was made vice-

chairman. The remaining directors were from top-level positions and were matched

equally on both sides; for example, the CEO of Iveco and the CEO of Tata Commercial

Vehicles were included on the board. The board of directors also set up committees

including an Audit Committee and an Organization and Compensation Committee.

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

For the CEO of the newly formed company, the board of directors recruited Rajeev

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

Kapoor from motorcycle manufacturer Hero Honda, where he had held the position of

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

vice-president of manufacturing (Hero Honda manufactured 1.5 million motorcycles

per year).63 The CFO, currently a Fiat representative ad interim, would be nominated by

Tata, while the industrial managers of the cars and powertrain divisions were

nominated by Fiat. Fiat and Tata’s respective human resource departments were

responsible for defining the organization structure together and hiring the other

Educational material supplied by The Case Centre

managers.

Copyright encoded A76HM-JUJ9K-PJMN9I

Order reference F271545

Plant Operations

In late 2006, the companies commissioned the assembly line at the Ranjangaon plant

for the Fiat Palio and Fiat Adventure. An operations manager from Fiat Powertrain

was designated as launch manager and set up the new assembly line by organizing the

configuration of the new machinery, dealing with suppliers and coordinating the labor

flow. Responsibility for plant operations was then passed to the newly installed plant

manager.

In total, the plant was expected to involve 4,000 direct and indirect employees.

Positions at the plant were filled by current workers at the Ranjangaon and relocated

workers from the Kurla plant. De Filippis commented on the work ethic of the

employees:

When I arrived in 2005, the employees were not very clear on the future of the

affiliate. We had 700 employees, and we were in crisis. There was a flood at the

Kurla plant. We were not sufficiently supplying to the market. By restructuring and

seeing the results quickly, we created a good and positive feeling amongst everyone.

The dedication was tremendous since many people worked long hours to turn

around the affiliate. They were motivated to do so because they are very proud of

being part of Fiat.

63 Ciferri Luca, “Rajeev Kapoor to lead Fiat-Tata Indian joint venture,” Automotive News Europe, Oct., 12, 2007,

http://www.autonews.com/apps/pbcs.dll/article?AID=/20071012/ANE01/71012004/1170/rss03&rssfeed=rss03, Accessed Nov., 15, 2007.

IESE Business School-University of Navarra 17

SM-1528-E Fiat's Strategic Alliance with Tata

Conclusion: Looking Toward the Future

The relationship between Tata and Fiat had garnered considerable press and many were

curious if the partnership would be a long-term success. The first agreement for the

distribution of Fiat cars through Tata’s dealerships had already provided quantifiable

benefit – Fiat’s sales in India had spiked by 51% in the first quarter after the accord

had been put in place. 64 Cars, engines and transmissions would soon roll off the

production line at the joint venture plant, according with the target plan, and other

opportunities such as potential collaboration in commercial vehicles would be

imminently pursued.

Now that the manufacturer joint venture had been signed, observers in and outside of

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

the automobile industry asked: What could be learnt about how the two companies

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

had approached the alliance? How could the two teams guarantee future success?.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

Order reference F271545

64 “India: Fiat working on low-cost car with Tata,” Automotive World, Sep., 5, 2006.

18 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

Exhibit 1

Global Automobile Market Size

GLOBAL AUTOMOBILES - VALUE (USD $)

Year $ billion % Growth

2002 980.2

2003 1011.9 3.2%

2004 1061.2 4.9%

2005 1118.8 5.4%

2006 1176.9 5.2%

CAGR: 2002-2006 4.7%

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

GLOBAL AUTOMOBILES - VOLUME (Units)

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Year Unis million % Growth

2002 57.2

2003 58.4 2.1%

2004 60.5 3.6%

2005 63.1 4.3%

Educational material supplied by The Case Centre

2006 65.7 4.1%

Copyright encoded A76HM-JUJ9K-PJMN9I

CAGR: 2002-2006 3.5%

Order reference F271545

Source: Global Automobile Manufacturers, Datamonitor March 2007, pp. 10-11.

IESE Business School-University of Navarra 19

SM-1528-E Fiat's Strategic Alliance with Tata

Exhibit 2

Production by Manufacturer: Vehicle Type and Region

2006 Production by Manufacturer by Type (Vehicle Units)

% to Total Total Cars Light Heavy Heavy Bus

Commercial Commercial

Vehicles Vehicles

Total 100.0% 68,340,304 51,953,234 13,187,688 2,850,233 349,149

1 GM 13.1% 8,926,160 5,708,038 3,156,888 43,838 17,396

2 Toyota 11.8% 8,036,010 6,800,228 1,049,345 122,569 63,868

3 FORD 9.2% 6,268,193 3,800,633 2,386,296 81,264

4 VOLKSWAGEN 8.3% 5,684,603 5,429,896 219,537 29,175 5,995

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

5 Honda 5.4% 3,669,514 3,549,787 119,727

6 PSA 4.9% 3,356,859 2,961,437 395,422

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

7 Nissan 4.7% 3,223,372 2,512,519 570,136 134,874 5,843

8 Chrysler 3.7% 2,544,590 710,291 1,834,299

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

9 RENAULT 3.6% 2,492,470 2,085,837 406,633

10 Hyundai 3.6% 2,462,677 2,231,313 966 145,120 85,278

11 FIAT 3.4% 2,317,652 1,753,673 450,544 89,071 24,364

12 Suzuki 3.4% 2,297,277 2,004,310 292,967

13 DAIMLERCHRYSLER 3.0% 2,044,533 1,275,152 378,278 340,296 50,807

14 Mazda 2.0% 1,396,412 1,169,640 223,995 2,777

15 Kia 2.0% 1,381,123 1,181,877 197,060 2,186

16 B.M.W. 2.0% 1,366,838 1,366,838

Educational material supplied by The Case Centre

17 Mitsubishi 1.9% 1,313,409 1,008,970 296,431 8,008

Copyright encoded A76HM-JUJ9K-PJMN9I

18 Daihatsu 1.6% 1,084,721 905,932 166,667 12,122

19 AVTOVAZ 1.1% 765,627 765,627

Order reference F271545

20 Fuji 0.9% 587,274 507,552 79,722

21 Tata 0.8% 561,081 190,468 196,389 174,224

2006 Production by Manufacturer and Region

Total Vehicle Units (all types)

Company Africa Americas Asia EU Europe Oceania TOTAL

1 GM 5,197,949 1,769,436 1,762,074 68,301 128,400 8,926,160

2 Toyota 142,750 1,777,632 5,285,674 543,259 171,480 115,215 8,036,010

3 Ford 397 3,397,728 256,515 2,203,457 320,896 89,200 6,268,193

4 Volkswagen 128,080 1,026,188 619,782 3,910,553 5,684,603

5 Honda 1,473,780 1,986,086 189,998 19,650 3,669,514

6 PSA 10,176 189,302 452,542 2,695,859 8,980 3,356,859

7 Nissan 44,695 1,150,700 1,520,777 507,200 3,223,372

8 Chrysler 2,454,494 90,096 2,544,590

9 RENAULT 21,444 175,967 162,248 1,853,556 279,255 2,492,470

10 Hyundai 236,773 2,207,359 18,545 2,462,677

11 FIAT 7,130 569,402 53,559 1,517,075 169,324 1,162 2,317,652

12 Suzuki 12,474 2,113,928 170,875 2,297,277

13 DaimlerChrysler 42,975 455,764 178,710 1,352,175 14,909 2,044,533

14 Mazda 20,560 81,520 1,294,332 1,396,412

15 Kia 1,381,123 1,381,123

16 B.M.W. 54,782 105,172 1,206,884 1,366,838

17 Mitsubishi 9,420 115,530 1,099,495 82,544 6,420 1,313,409

18 Daihatsu 1,078,321 6,400 1,084,721

19 AVTOVAZ 765,627 765,627

20 Fuji 104,991 482,283 587,274

21 Tata 561,081 561,081

Source: International Organization of Motor Vehicle Manufacturers, 'World Motor Vehicle Production', OICA Correspondents

Survey, 2006

Note: The above figures refer to production and not sales.

20 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

Exhibit 3

Global Market Share (Based on Revenues)

Global Market Share

General Motors

17.3%

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

Other

35.0%

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Toyota

15.9%

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

DaimlerChrysler

Ford

Order reference F271545

15.9%

15.9%

Source: Global Automobile Manufacturers, Datamonitor, March 2007.

Exhibit 4

Revenue in the Automotive Value System

Revenue Share For Participants in the Automotive Value System

Recommended Retail Price 100%

Dealers 20%

Marketing/Logistics 10%

Assemblers 10%

Suppliers 60%

Source: Toby Procter and John Constable, The Automotive Industry in the 21st Century, Reference # 307-180-5, p. 10

IESE Business School-University of Navarra 21

SM-1528-E Fiat's Strategic Alliance with Tata

Exhibit 5

Indian Automotive Market

NEW CARS IN INDIA - VALUE (USD $) TRUCKS IN INDIA - VALUE (USD $) TOTAL - VALUE (USD $)

Year $ billion % Growth Year $ billion % Growth Year $ billion % Growth

2002 6.3 2002 3.7 2002 10.0

2003 8.6 36.5% 2003 5.2 40.5% 2003 13.8 38.0%

2004 12.7 47.7% 2004 6.7 28.8% 2004 19.4 40.6%

2005 14.7 15.7% 2005 7.4 10.4% 2005 22.1 13.9%

2006 18.1 23.1% 2006 8.2 10.8% 2006 26.3 19.0%

CAGR: 2002-2006 30.2% CAGR: 2002-2006 22.0% CAGR: 2002-2006 27.3%

NEW CARS IN INDIA - VOLUME (Units) TRUCKS IN INDIA - VOLUME (Units) TOTAL - VOLUME (Units)

Year Units 000s % Growth Year Units 000s % Growth Year Units 000s % Growth

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

2002 541.5 2002 191.1 2002 732.6

2003 696.2 28.6% 2003 260.7 36.4% 2003 956.9 30.6%

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

2004 955.2 37.2% 2004 319.2 22.4% 2004 1274.4 33.2%

2005 1028.8 7.7% 2005 351.5 10.1% 2005 1380.3 8.3%

2006 1160.8 12.8% 2006 385.6 9.7% 2006 1546.4 12.0%

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

CAGR: 2002-2006 21.0% CAGR: 2002-2006 19.2% CAGR: 2002-2006 20.5%

Source: New Cars in India and Trucks in India, Datamonitor, October 2006.

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

Order reference F271545

22 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

Exhibit 6

Fiat Group Financial Statements

millions EUR 2006 2005

Net revenues 51832 46544

Cost of sales 43888 39624

Selling, general and administrative costs 4697 4513

Research and development costs 1401 1364

Other income (expenses) 105 -43

Trading profit 1951 1000

Gains (losses) on the disposal of investments 607 905

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

Restructuring costs 450 502

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

Other unusual income (expenses) -47 812

Operating result 2061 2215

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Financial income (expenses) -576 -843

Unusual financial income 858

Result from investments: 156 34

- Net result of investees accounted for using the equity method 125 115

- Other income (expenses) from investments 31 -81

Result before taxes 1641 2264

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

Income taxes 490 844

Order reference F271545

Result from continuing operations 1151 1420

Result from discontinued operations

Net result 1151 1420

Attributable to:

Equity holders of the parent 1065 1331

Minority interests 86 89

Basic earnings per ordinary and preference share 0.789 1.250

Basic earnings per savings share 1.564 1.250

Diluted earnings per ordinary and preference share 0.788 1.250

Diluted earnings per savings share 1.563 1.250

Source: Fiat Annual Report, December 31, 2006, p. 86.

millions EUR 2006 2005

ASSETS

Total Non-current assets 21,378 22,666

Total Current assets 36,593 39,637

TOTAL ASSETS 58,303 62,454

- Total assets adjusted for asset-backed financing transactions 49,959 51,725

LIABILITIES

Stockholders' equity 10,036 9,413

Provisions: 8,611 8,698

Debt: 20,188 25,761

Other financial liabilities 105 189

Trade payables 12,603 11,777

Other payables: 5,019 4,821

Deferred tax liabilities 263 405

Accrued expenses and deferred income 1,169 1,280

Liabilities held for sale 309 110

TOTAL STOCKHOLDERS' EQUITY AND LIABILITIES 58,303 62,454

- Total stockholders' equity and liabilities adjusted for asset-back financing transactions 49,959 51,725

Source: Fiat Annual Report, December 31, 2006, pp. 87-88

IESE Business School-University of Navarra 23

SM-1528-E Fiat's Strategic Alliance with Tata

Exhibit 6 (continued)

Results by Division, Business Area and Geography

Results by Division

Net Revenues Trading profit Operating result

2006 2005 2006 2005 2006 2005

Fiat Auto 23,702 19,533 291 -281 727 -818

Maserati 519 533 -33 -85 -33 -85

Ferrari 1,447 1,289 183 157 183 157

Agricultural and Construction Equipment (CNH) 10,527 10,212 737 698 592 611

Trucks and Commercial Vehicles (Iveco) 9,136 8,483 546 332 565 212

Fiat Powertrain Technologies 6,145 4,520 168 109 102 81

Components (Magneti Marelli) 4,455 4,033 190 162 175 127

Metallurgical Products (Teksid) 979 1,036 56 45 26 27

Production Systems (Comau) 1,280 1,573 -66 42 -272 -8

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

Services (Business Solutions) 668 752 37 35 28 7

Publishing and Communications (Itedi) 401 397 11 16 12 13

Holding companies, Other Companies and Elminations -7,427 -5,817 -169 -230 -44 1,891

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

Total 51,832 46,544 1,951 1,000 2,061 2,215

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

Revenues by Business Area

2006 2005 % to Total % to Total

2006 2005

Automobiles 25,577 21275 49.3% 45.7%

Agricultural and Construction Equipment 10,527 10212 20.3% 21.9%

Trucks and Commercial Vehicles 9,136 8483 17.6% 18.2%

Components and Production Systems 12,366 10727 23.9% 23.0%

Other Businesses 1,581 1618 3.1% 3.5%

Educational material supplied by The Case Centre

Eliminations -7,355 -5771 -14.2% -12.4%

Copyright encoded A76HM-JUJ9K-PJMN9I

Total 51,832 46544 100.0% 100.0%

Order reference F271545

Source: Fiat Annual Report, December 31, 2006, p. 13, p. 26.

Number of Companies Number of Employees Number of Facilities Number of R&D Centres Revs (millions EUR)

2006 2005 2006 2005 2006 2005 2006 2005 2006 2005

Italy 146 155 75,751 77,070 52 56 50 52 14,851 13,078

Europe excluding Italy 285 280 42,904 43,376 56 58 32 32 20,298 18,518

North America 76 80 11,714 12,575 25 28 15 17 6,315 6,048

Mercosur 31 40 30,877 29,132 20 20 10 10 5,416 4,364

Other regions 99 99 10,766 11,545 27 27 9 9 4,952 4,536

Total 637 654 172,012 173,698 180 189 116 120 51,832 46,544

Source: Fiat Annual Report 2006, p. 11.

24 IESE Business School-University of Navarra

Fiat's Strategic Alliance with Tata SM-1528-E

Exhibit 7

Fiat’s Joint Ventures

At Dec 31, 2006

Name Country Fiat % of Amount

Interest (EUR

millions)

Fiat Auto Financial Services S.p.A. (ex Fidis Retail Italia S.p.A.) Italy 50.0% 528

Tofas-Turk Otomobil Fabrikasi Tofas A.S. Turkey 37.9% 206

Naveco Ltd. China 50.0% 117

Società Europea Veicoli Leggeri-Sevel S.p.A. Italy 50.0% 93

Société Européenne de Véhicules Légers du Nord-Sevelnord Société Anonyme France 50.0% 61

Consolidated Diesel Company USA 50.0% 47

LBX Company LLC USA 50.0% 27

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.

New Holland HFT Japan Inc. Japan 50.0% 27

Turk Traktor Ve Ziraat Makineleri A.S. Turkey 37.5% 23

Please note that you are not permitted to reproduce or redistribute it for any other purpose.

Nan Jing Fiat Auto Co. Ltd. China 50.0% 22

Transolver Finance Establecimiento Financiero de Credito S.A. Spain 50.0% 17

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

New Holland Trakmak Traktor A.S. Turkey 37.5% 14

CNH de Mexico SA de CV Mexico 50.0% 13

Other minor 18

Total investments in jointly controlled entities 1,213

Source: Fiat Annual Report 2006, December 31, 2006, p. 134.

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

Order reference F271545

IESE Business School-University of Navarra 25

Educational material supplied by The Case Centre

Copyright encoded A76HM-JUJ9K-PJMN9I

Order reference F271545

26

SM-1528-E

Exhibit 8

Fiat's Strategic Alliance with Tata

Fiat 1100 (1937-1969)

IESE Business School-University of Navarra

Photo History of Fiat Cars in India

Fiat Palio (1996-present)

Fiat Uno (1983-present)

Premier Padmini (1968-2000)

Purchased for use by Diego Campagnolo on 05-May-2016. Order ref F271545.

You are permitted to view the material on-line and print a copy for your personal use until 5-May-2017.