Professional Documents

Culture Documents

Absorption (Total) Costing: A2 Level Accounting - Resources, Past Papers, Notes, Exercises & Quizes

Uploaded by

Aung Zaw HtweOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Absorption (Total) Costing: A2 Level Accounting - Resources, Past Papers, Notes, Exercises & Quizes

Uploaded by

Aung Zaw HtweCopyright:

Available Formats

Absorption (Total) Costing

DEFINITION

In this method of costing, all overheads (indirect costs) must be absorbed (recovered) by

the products produced. This method of costing on the full production cost (direct plus

indirect costs) of manufactured products.

NEW TERMS

1. Direct Costs – are those costs directly linked to a product being manufactured. Eg

labour and materials needed to make the product.

2. Indirect Costs – those costs not directly linked to a product being manufactured

(also known as overheads). Eg administrative and selling expenses.

3. Fixed Costs – those costs that do not change as the amount of products

manufactured changes (in the short term). Fixed costs per product decrease as the

level of production increases (and vice versa). Eg Rent expense.

4. Variable Costs – are those costs which change as the amount of products being

manufactured changes. Variable costs per product do not change as the level of

production changes. Eg Raw Materials.

5. Total Costs = Fixed Costs + Variable Costs

6. Cost Centre – any department or process in a business to which costs may be

attributed

APPORTIONING COSTS TO PRODUCTION COST CENTRES

Direct costs and some indirect costs (overheads) can be identified and allocated to

specific cost centres.

Other indirect costs (overheads) incurred are apportioned between cost centres on one

of the following bases:

a) Floor area

b) Cost or Book Value of the assets in each centre

c) Number or value of requisitions (orders)

d) Number of personnel

In this way the Total Cost per cost centre can be calculated.

A2 Level Accounting - Resources, Past Papers, Notes, Exercises & Quizes

APPORTIONING SERVICE COST CENTRE OVERHEADS TO PRODUCTION

COST CENTRES

Service cost centres provide services to the production centres. Eg Stores, Canteens

Maintenance etc.

The overheads of service departments must be shared / apportioned between the

Production Cost Centres in order to calculate the Total Cost of goods produced..

Methods of apportioning:

a) The Elimination Method

The costs of the service departments are apportioned between the

Production centres and other service centres. Once the costs of one service

centre have been apportioned it is eliminated from the next apportionment.

The basis of apportionment of the service centres could be:

a) Floor area

b) Cost or Book Value of the assets in each centre

c) Number or value of requisitions (orders)

d) Number of personnel

Example:

Stores must be apportioned on the basis of personnel

Canteen must be apportioned on the basis of number of requisitions

Cutting Sanding Assembly Stores Canteen

No of personnel 20 10 30 5 5

No of Requisitions 15 5 10 2 7

Apportionment:

Cutting Sanding Assembly Stores Canteen

Overheads 10 000 12 000 24 000 3000 6000

First Apportionment (based on 65 staff) 923 462 1385 (3000) 230

Second App (based on 30 requisitions) 3000 1000 2000 (6000)

TOTAL COSTS 13923 13462 23385 - -

A2 Level Accounting - Resources, Past Papers, Notes, Exercises & Quizes

CALCULATING OVERHEAD ABSORPTION RATES (OAR)

Once overheads have been apportioned to production cost centres, the next step is to

calculate the Overhead Absorption Rates.

NOTE: Overhead Absorption Rates are calculated on future planned volumes of

production and overhead expenditure because the cost of production must be known in

advance in order to set the selling prices for the products.

Methods of calculating Overhead Absorption Rates:

a) On the basis of Direct Labour Hours (if production is labour intensive)

Total budgeted expenditure x No of labour hours taken to produce one product

Total budgeted labour hours

Example:

A company plans to produce 10 000 units of P and 8 000 units of Q

Each unit of P requires 1 ½ hours to make and each unit of Q Takes ¾ of an hour

The total budgeted overheads for the company are $131 250

Answer

Total labour hours = (10 000 x 1 ½) + (8 000 x ¾)

= 21 000 hours

OAR for P = 131 220

21000

= $6.25 per direct labour hour

The overhead absorbed by one unit of P = $6.25 x 1 ½ = $9.37

The overhead absorbed by one unit of Q = $6.25 x ¾ = $4.69

Total overhead will be absorbed as follows:

P = 10 000 x $9.37 = 93 700

Q = 8 000 x $4.69 = 37 520

131220

A2 Level Accounting - Resources, Past Papers, Notes, Exercises & Quizes

b) On the basis of Machine Hours (if production is capital intensive)

Total budgeted expenditure x No of machine hours taken to produce one product

Total budgeted machine hours

c) On any other basis that management decide upon

Eg direct material costs; prime cost; direct wages

OVER – ABSORPTION AND UNDER- ABSORPTION OF OVERHEADS

Remember that Overhead Absorption Rates are calculated on future planned volumes of

production and budgeted expenditure. It is most likely that the actual volume of goods

produced and expenditure will be different from these forecasts.

This will result in overhead expenditure being either under or over absorbed.

Under-absorption – occurs actual expenditure is more than the budgeted figure and/or

actual production is less than the planned level.

Over-absorption – occurs when actual expenditure is less than the budgeted figure

and/or actual production is more than the planned level.

Example:

2005 2006

Budgeted expenditure $200 000 $240 000

Planned volume of production(units) 80 000 100 000

OAR = 200 000 = $2.50 240 000 = $2.40

80 000 100 000

Actual expenditure $215 000 $230 000

Actual volume of production (units) 76 000 106 000

Overhead Recovered 76 000 x $2.50 106 000 x $2.40

= $190 000 = $254 400

Therefore in 2005, there was an under-absorption of:

$215 000 - $190 000

= $25 000

And in 2006 there was an over-absorption of :

$230 000 – 254 400

= $24 400

A2 Level Accounting - Resources, Past Papers, Notes, Exercises & Quizes

You might also like

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Absorption CostingDocument4 pagesAbsorption CostingHamiz AizuddinNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- F2 Management Accounting Overheads & Absorption CostingDocument10 pagesF2 Management Accounting Overheads & Absorption CostingCourage KanyonganiseNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Handout Activity Based Costing 2020Document2 pagesHandout Activity Based Costing 2020Nicah AcojonNo ratings yet

- F5 Asignment 1Document5 pagesF5 Asignment 1Minhaj AlbeezNo ratings yet

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- Assgnment 2 (f5) 10341Document11 pagesAssgnment 2 (f5) 10341Minhaj AlbeezNo ratings yet

- 602 Assignment 1Document8 pages602 Assignment 1Irina ShamaievaNo ratings yet

- BBA211 Vol6 ABC SystemDocument11 pagesBBA211 Vol6 ABC SystemAnisha SarahNo ratings yet

- B01 AbcDocument21 pagesB01 AbcAcca BooksNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- ABC Costing Autumn 19Document15 pagesABC Costing Autumn 19Tory IslamNo ratings yet

- 7e Extra QDocument72 pages7e Extra QNur AimyNo ratings yet

- Quiz ABCDocument2 pagesQuiz ABCZoey Alvin EstarejaNo ratings yet

- Activity Based CostingDocument50 pagesActivity Based CostingParamjit Sharma97% (65)

- Chapter 5 ABC System For StudentsDocument14 pagesChapter 5 ABC System For StudentsNour Al Kaddah100% (1)

- ACCT3500 (Fall 20) Answers To Tutorial 3Document7 pagesACCT3500 (Fall 20) Answers To Tutorial 3Mohammad ShabirNo ratings yet

- Accounting Assignment CardiffDocument12 pagesAccounting Assignment CardiffpavanihirushaNo ratings yet

- ABC Sample Problems 1Document13 pagesABC Sample Problems 1Mary Grace PagalanNo ratings yet

- Class Exercise CH 10Document5 pagesClass Exercise CH 10Iftekhar AhmedNo ratings yet

- Activity Based Costing Review QuestionsDocument3 pagesActivity Based Costing Review Questionshome labNo ratings yet

- BusinessManagement_Midterm (1)Document6 pagesBusinessManagement_Midterm (1)Hoàng Thị Phương TrinhNo ratings yet

- S Iv CC 402 ScmaDocument60 pagesS Iv CC 402 ScmaRajnish DubeyNo ratings yet

- Ch.2 - Job CostingDocument26 pagesCh.2 - Job Costingahmedgalalabdalbaath2003No ratings yet

- Measuring and Managing Process Performance: QuestionsDocument4 pagesMeasuring and Managing Process Performance: QuestionsAshik Uz ZamanNo ratings yet

- Measuring and Managing Process Performance: QuestionsDocument4 pagesMeasuring and Managing Process Performance: QuestionsAshik Uz ZamanNo ratings yet

- COSTING METHODS TITLEDocument6 pagesCOSTING METHODS TITLEAravind P RNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- Questions and Answers For MGT 3 000 Level 23Document15 pagesQuestions and Answers For MGT 3 000 Level 23Monsonedu IkechukwuNo ratings yet

- MGT Accounting, Intermideiate-SolutionsDocument31 pagesMGT Accounting, Intermideiate-SolutionsRONALD SSEKYANZINo ratings yet

- Lecture 6 - ABC Costing RevisedDocument22 pagesLecture 6 - ABC Costing RevisedMJ jNo ratings yet

- Question - Parallel Quiz - Final Term - Cost Accounting 22 - 23Document6 pagesQuestion - Parallel Quiz - Final Term - Cost Accounting 22 - 23Gistima Putra JavandaNo ratings yet

- Intervention ManDocument47 pagesIntervention ManFrederick GbliNo ratings yet

- Analyze manufacturing costs and variances for Marston, IncDocument11 pagesAnalyze manufacturing costs and variances for Marston, IncCharles GohNo ratings yet

- Analyze Cost Allocation Methods and Overhead VariancesDocument73 pagesAnalyze Cost Allocation Methods and Overhead VariancesPiyal Hossain100% (1)

- CMA CU - Chap5Document29 pagesCMA CU - Chap5TAMANNANo ratings yet

- Managerial Accounting Final Exam SolutionsDocument10 pagesManagerial Accounting Final Exam SolutionsRanim HfaidhiaNo ratings yet

- Week 9 - 10 - OverheadDocument44 pagesWeek 9 - 10 - OverheadMohammad EhsanNo ratings yet

- PA1 Group1 P10Document8 pagesPA1 Group1 P10Phuong Nguyen MinhNo ratings yet

- Garrison 8 Ex 5-20, PR 5-25Document17 pagesGarrison 8 Ex 5-20, PR 5-25Shalini VeluNo ratings yet

- PA1 Group1 Week8Document8 pagesPA1 Group1 Week8Phuong Nguyen MinhNo ratings yet

- Assignment FinanceDocument8 pagesAssignment FinanceAkshat BansalNo ratings yet

- ABC-sample ProblemDocument5 pagesABC-sample ProblemLee Jap OyNo ratings yet

- Tutorial 2 - SolutionsDocument15 pagesTutorial 2 - SolutionsLijing CheNo ratings yet

- 05 Handout 1Document6 pages05 Handout 1Reanne Mae BilogNo ratings yet

- Week 5 Tutorial SolutionDocument6 pagesWeek 5 Tutorial SolutionRosemarie Mae DezaNo ratings yet

- Waterway Continuous Problem WCPDocument17 pagesWaterway Continuous Problem WCPAboi Boboi50% (4)

- MODULE 6 Mid-Term Exam Review Exercises - F23Document6 pagesMODULE 6 Mid-Term Exam Review Exercises - F23pratibhaNo ratings yet

- Cost Accounting Progress AssignmentsDocument6 pagesCost Accounting Progress AssignmentsWesleyNo ratings yet

- 13 Factory Overhead - DepartmentaliationDocument25 pages13 Factory Overhead - DepartmentaliationGab Gab Malgapo100% (1)

- Activity Based Costing ER - NewDocument14 pagesActivity Based Costing ER - NewFadillah LubisNo ratings yet

- COST MANAGEMENT AND FINANCIAL INFORMATIONDocument7 pagesCOST MANAGEMENT AND FINANCIAL INFORMATIONSamuel DwumfourNo ratings yet

- QA Activity Based Costing1Document12 pagesQA Activity Based Costing1umar441100% (1)

- Lecture 5-6 Unit Cost CalculationDocument32 pagesLecture 5-6 Unit Cost CalculationAfzal AhmedNo ratings yet

- ABC System Eliminates Product Cost DistortionDocument16 pagesABC System Eliminates Product Cost DistortionPoint BlankNo ratings yet

- 1.3 Activity Based Costing 1.3 Activity Based CostingDocument10 pages1.3 Activity Based Costing 1.3 Activity Based CostingSUHRIT BISWASNo ratings yet

- BACT 302 Activity Based CostingDocument25 pagesBACT 302 Activity Based CostingLetsah BrightNo ratings yet

- ASE20102 - Examiner Report - November 2018Document13 pagesASE20102 - Examiner Report - November 2018Aung Zaw HtweNo ratings yet

- Sample Audit ProgramDocument119 pagesSample Audit ProgramEcyojEiramMarapaoNo ratings yet

- J-AP-1 - Long-Term Loans and AdvancesDocument13 pagesJ-AP-1 - Long-Term Loans and AdvancesAung Zaw HtweNo ratings yet

- FINA 4360 International Financial Management lecture notesDocument256 pagesFINA 4360 International Financial Management lecture notesGAJALNo ratings yet

- Work 3000Document105 pagesWork 3000Aung Zaw HtweNo ratings yet

- J-AP-2 - Long-Term Deposits and PrepaymentsDocument3 pagesJ-AP-2 - Long-Term Deposits and PrepaymentsAung Zaw HtweNo ratings yet

- F-Ap-3 - Inventory Held For Capital ExpenditureDocument5 pagesF-Ap-3 - Inventory Held For Capital ExpenditureAung Zaw HtweNo ratings yet

- D AP InvestmentDocument8 pagesD AP InvestmentAung Zaw HtweNo ratings yet

- N-AP-1 - Accrued MarkupDocument2 pagesN-AP-1 - Accrued MarkupAung Zaw HtweNo ratings yet

- C-AP - Cash and Bank BalancesDocument7 pagesC-AP - Cash and Bank BalancesAung Zaw HtweNo ratings yet

- F AP 1 Stock in TradeDocument10 pagesF AP 1 Stock in TradeAung Zaw HtweNo ratings yet

- Bank Confirmation LetterDocument4 pagesBank Confirmation Lettermarmah_hadi100% (2)

- E-AP-2 - Short-Term Loans and AdvanceDocument10 pagesE-AP-2 - Short-Term Loans and AdvanceAung Zaw HtweNo ratings yet

- E-AP-1 - Short Term Deposits Prepayments and Other ReceivablesDocument6 pagesE-AP-1 - Short Term Deposits Prepayments and Other ReceivablesAung Zaw HtweNo ratings yet

- E-AP-2 - Short-Term Loans and AdvanceDocument10 pagesE-AP-2 - Short-Term Loans and AdvanceAung Zaw HtweNo ratings yet

- E-AP-4 - Head Office and BranchDocument3 pagesE-AP-4 - Head Office and BranchAung Zaw HtweNo ratings yet

- F-AP-2 - Stores Spares and Loose ToolsDocument7 pagesF-AP-2 - Stores Spares and Loose ToolsAung Zaw HtweNo ratings yet

- E-AP-6 - Bills Discounted and PurchasedDocument3 pagesE-AP-6 - Bills Discounted and PurchasedAung Zaw HtweNo ratings yet

- E-AP-1 - Short Term Deposits Prepayments and Other ReceivablesDocument6 pagesE-AP-1 - Short Term Deposits Prepayments and Other ReceivablesAung Zaw HtweNo ratings yet

- E-AP-5 - Due To From Central BankDocument3 pagesE-AP-5 - Due To From Central BankAung Zaw HtweNo ratings yet

- E-AP-2 - Short-Term Loans and AdvancesDocument7 pagesE-AP-2 - Short-Term Loans and AdvancesAung Zaw HtweNo ratings yet

- N-AP-1 - Accrued MarkupDocument2 pagesN-AP-1 - Accrued MarkupAung Zaw HtweNo ratings yet

- Tax Advisor Confirmation LetterDocument1 pageTax Advisor Confirmation LetterAung Zaw Htwe100% (1)

- Confirm Balance for AuditDocument1 pageConfirm Balance for AuditZeeshan Ahmad Kahloon100% (1)

- Confirm Balance for AuditDocument1 pageConfirm Balance for AuditZeeshan Ahmad Kahloon100% (1)

- C-AP - Cash and Bank BalancesDocument7 pagesC-AP - Cash and Bank BalancesAung Zaw HtweNo ratings yet

- D AP InvestmentDocument8 pagesD AP InvestmentAung Zaw HtweNo ratings yet

- Last Documents NotingDocument1 pageLast Documents NotingSonieta Deguit LabasanNo ratings yet

- Last Documents NotingDocument1 pageLast Documents NotingSonieta Deguit LabasanNo ratings yet

- Cash and Bank BalancesDocument4 pagesCash and Bank BalancesAung Zaw HtweNo ratings yet

- Manufacture of Construction Materials from Plastic WasteDocument17 pagesManufacture of Construction Materials from Plastic WasteMuniaNo ratings yet

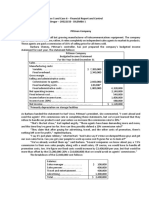

- Individual Assingment Case 5 and Case 6 - FInancial Report and Control - Mohammad Alfian Syah Siregar - DILEMBA 1 - 29322150Document7 pagesIndividual Assingment Case 5 and Case 6 - FInancial Report and Control - Mohammad Alfian Syah Siregar - DILEMBA 1 - 29322150iancroott100% (1)

- Kinney 8e - IM - CH 06Document19 pagesKinney 8e - IM - CH 06JM TylerNo ratings yet

- Chapter 13 - Relevant Costs For Decision Making PDFDocument34 pagesChapter 13 - Relevant Costs For Decision Making PDFnafin ayub ArilNo ratings yet

- Hygienic Chappathi Business Loan ReportDocument13 pagesHygienic Chappathi Business Loan ReportJose PiusNo ratings yet

- Dokumen PDFDocument21 pagesDokumen PDFMark AlcazarNo ratings yet

- PU-P Advanced Financial Accounting and Reporting Cost ProblemsDocument6 pagesPU-P Advanced Financial Accounting and Reporting Cost ProblemsJO SH UANo ratings yet

- Labor Costs and Accounting Chapter 11Document16 pagesLabor Costs and Accounting Chapter 11Mico Duñas Cruz100% (1)

- Topic 06 - Activity-Based Costing - Cost and Management Accounting Course Notes 2021 PWC Conversion ProgrammeDocument52 pagesTopic 06 - Activity-Based Costing - Cost and Management Accounting Course Notes 2021 PWC Conversion ProgrammejerrymaNo ratings yet

- Solution Guide - Accounting For Labor CostDocument4 pagesSolution Guide - Accounting For Labor CostMirasolNo ratings yet

- BPGroup 2Document38 pagesBPGroup 2JAL KETH ABUEVANo ratings yet

- Cost accounting concepts explainedDocument37 pagesCost accounting concepts explainedEhsan Umer Farooqi100% (1)

- Fim 3A Main June Examination 2014 FinalDocument11 pagesFim 3A Main June Examination 2014 FinalDolly VongweNo ratings yet

- London Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelDocument16 pagesLondon Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced Levelrahat879No ratings yet

- MA 1 Mock Exam QuestionDocument4 pagesMA 1 Mock Exam QuestionAbdul Gaffar100% (1)

- Hassan Swahili Dishes EdittedDocument38 pagesHassan Swahili Dishes EdittedSnev EvansNo ratings yet

- Cost Audit FullDocument33 pagesCost Audit Fullnishaji86% (7)

- AACE Cost EstimationDocument26 pagesAACE Cost Estimationdmscott1093% (14)

- Cost Accounting and Control OutputDocument21 pagesCost Accounting and Control OutputApril Joy Obedoza100% (5)

- Advanced Management AccountingDocument14 pagesAdvanced Management AccountingZain ul AbidinNo ratings yet

- Assigment 5.34Document7 pagesAssigment 5.34Indahna SulfaNo ratings yet

- 2.5 Under - or Over-Applied Overhead - Managerial AccountingDocument5 pages2.5 Under - or Over-Applied Overhead - Managerial AccountingAllur Sai Vijay KumarNo ratings yet

- PMD1D Nov 13 PDFDocument7 pagesPMD1D Nov 13 PDFselva priyadharshiniNo ratings yet

- Advance Cost & Management AccountingDocument3 pagesAdvance Cost & Management AccountingRana Adnan SaifNo ratings yet

- Reviewer: Accounting For Manufacturing OperationsDocument16 pagesReviewer: Accounting For Manufacturing Operationsgab mNo ratings yet

- Decision MakingDocument33 pagesDecision Makingali100% (1)

- Managerial Accounting 16th Edition Garrison Test Bank 1Document25 pagesManagerial Accounting 16th Edition Garrison Test Bank 1margaret100% (49)

- Mgo634 F10 PM1 Q7 AnswersDocument6 pagesMgo634 F10 PM1 Q7 AnswersShang-Jen ChangNo ratings yet

- Cost Accounting RTP CAP-II June 2016Document31 pagesCost Accounting RTP CAP-II June 2016Artha sarokarNo ratings yet

- Danshui Plant No - SolutionDocument30 pagesDanshui Plant No - Solutionmakan94883No ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessFrom EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessRating: 4.5 out of 5 stars4.5/5 (17)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeFrom EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeRating: 3.5 out of 5 stars3.5/5 (3)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersFrom EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Radiographic Testing: Theory, Formulas, Terminology, and Interviews Q&AFrom EverandRadiographic Testing: Theory, Formulas, Terminology, and Interviews Q&ANo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASFrom EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- USMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewFrom EverandUSMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewRating: 4.5 out of 5 stars4.5/5 (7)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)From Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)No ratings yet

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersFrom EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersRating: 4 out of 5 stars4/5 (14)