Professional Documents

Culture Documents

Schedule of Charges - Retail (India)

Uploaded by

John PeterOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schedule of Charges - Retail (India)

Uploaded by

John PeterCopyright:

Available Formats

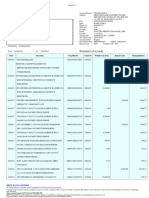

Schedule of Charges – Retail (India)

Particulars Charges

Non Maintenance of Minimum Average Balance & Others

Average Quarterly Balance (AQB) Rs. 10,000/-

Rs. 300/- plus 3% of the shortfall in the required

Savings Bank A/c

Average minimum quarterly balance

Current A/c Currently no charges

Issue of Pass Book/ Statement of Account/Balance Free

Certificate

Rs.100/- per Pass book/statement physical (email is

Issue of Duplicate Pass Book/Statement

free)

No dues certificate Rs.100/- per certificate

Balance Certificate Current year - Free; previous year - Rs. 100/-

Photo attestation Rs 100 per application/letter

Signature attestation Rs 100 per application/letter

Address confirmation Rs.100 per request

Cheque book facility

First Cheque book free, thereafter Rs.100/- per

Savings Bank

cheque book (25 leaves)

First Cheque book free, thereafter Rs.125/- per

Current / OD / CC

cheque book (50 leaves)

Stop Payment Charges

Stop Payment Charges Rs. 100 per cheque, Max. 250

Account Closures less than 1 year Rs. 500

Rs.500/- for one cheque return per month and

thereafter, Rs.750 per return in the same month for

Cheque Return Charges outward/inward financial reasons and Rs.100 for non-financial reasons

except for signature verification & technical returns

due to bank's fault.

Demand Draft & Pay Order Charges

Up to Rs.25,000 - Minimum Rs.100, Rs.25,000 -

Rs.100,000 Rs.3 per thousand - Min Rs.200, Above

Demand Draft Issuance

Rs.100,000 - Rs.2 per thousand - Min Rs.400 and

Max.Rs.5,000/-

Draft/Pay Order Cancellation Rs. 100

Draft/Pay Order Revalidation Rs. 100

Draft/Pay Order Duplicate Issuance Rs. 100

Rs. 2/- per thousand with a minimum of Rs.100/- and

Pay Order

maximum Rs.5000/-

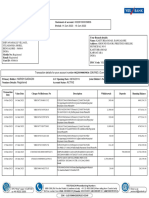

NEFT & RTGS Charges / Outstation Cheque Collection charges

NEFT through Internet/Mobile Banking : Free

NEFT through branches:

NEFT - Rs. Up to 10,000 - Rs. 2, Up to Rs.

a) NEFT Transfers

100,000 - Rs. 4.50, Rs. 100,000 to Rs. 200,000 - Rs.

14.50, Above Rs. 200,000 - 24.50

NEFT Inward : Free

RTGS through Internet/Mobile Banking: Free

RTGS through branches:

b) RTGS Transfers RTGS - Rs. 200,000 - Rs. 500,000 - Rs. 15, Rs.

500,000 and above - Rs. 40

RTGS Inward : Free

Up to Rs.10,000 Rs. 2.50 per Rs.1,000 Minimum

Rs.50 Plus postage/courier

Rs. 10,001 to Rs. 100,000 Rs.2.50 per

Rs.1,000Minimum Rs. 100Plus postage/courier

Outstation Cheque Collection per instrument

> Rs. 100,001 to Rs.1,000,000 - Rs.2.50 per Rs.1,000

Minimum Rs. 150 Plus postage/courier

> Rs. 1,000,001 - Rs.2.50 per Rs.1,000 Minimum

Rs.500 Plus postage/courier

Payment by Electronic Clearing Services(ECS) / No Charges

NACH

Locker Charges

Small Size Rs.1,000 p.a. plus advance rent for one year

Medium Size Rs.1,800 p.a. plus advance rent for one year

Large Size Rs. 3,500 p.a. plus advance rent for one year

Giant Size Rs. 6,000 p.a. plus advance rent for one year

ATM cum Debit Card

ATM - Cash withdrawal charges (within India) Currently No charges

Rs. 25 per balance enquiry & Rs. 125 per cash

withdrawal (plus taxes as applicable).

The Bank will charge cross-currency mark-up of 3.5%

ATM - Cash withdrawal charges (outside India) on foreign currency transactions carried out on Debit

Cards. The exchange rate used will be the

VISA/Master Card wholesale exchange rate prevailing

at the time of transaction

ATM Card Issue Charges First Card Free

Duplicate/Replacement Card issuance Rs.250/-

First Card Free, thereafter chargeable for

Add on Card, if any

duplicate/replacement issuance

Debit Card Annual Fees Rs.150/- per card

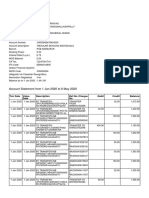

Inward Remittance

Commission for our own customers Free

Commission for non-customers Rs.300/- plus applicable NEFT/RTGS charges

E-Remittance DB-DB Free

E-Remittance DB-Non DB Rs.50/-

Outward Remittance

Commission Rs.1,000/-

Swift Charges Rs.1,000/-

Portfolio Investment Scheme (PIS)

PIS approval fee (One time) NIL

Annual account maintenance fee Rs.1,000/-

PIS Reporting charges

Purchase Rs.50/- (per Scrip)

Sale Rs.50/- (per Scrip)

Scrip Transfer Out Charges Rs.50/- (per Scrip)

Forward Contracts

For booking of sale/purchase contracts Rs.750/-

Extension/cancellation/early delivery Rs.500/-

Miscellaneous Charges

For application to RBI for extension of time for Rs.1,000/-

realisation of export proceeds beyond prescribed

period

For processing other application to RBI Rs.1,000/-

Stamp duty As per government regulations from time to time

Approval for export bill write off Rs.1,000/-

Bank Certificate for application of Importer Exporter Rs.500/-

Code (IEC)

Foreign bank charges for LC advising where charges USD 25 or its equivalent

are to recovered from foreign bank

Courier Local Rs.50/-

Courier Domestic Outstation Rs.200/-

Courier International Rs.750/-

Disclosures –

Applicable taxes will be levied extra over & above the charges mentioned in the schedule.

If there is no sufficient balance in customer's savings account to recover the applicable non-

maintenance charges then the deficit recoverable/due amount will marked as hold in the savings

account, which shall be recovered first immediately on receipt of any credit in your account.

Proceeding towards FCNR deposit maturity/prematurity will not considered as outward remittance,

hence such transaction will not attract any charges.

Details of the latest applicable fees and charges as stipulated by Bank will be displayed on the

website (www.dohabank.co.in) and/or at the branches and are subject to change from time to time at

the sole discretion of Bank.

You might also like

- FAKE Atm RECEIPT TEMPLATEDocument2 pagesFAKE Atm RECEIPT TEMPLATEDrop That Beat50% (2)

- PDFDocument5 pagesPDFManuel AlejandroNo ratings yet

- Personal Account Statement: Claudio Cardoso Da Silva Junior .53Document40 pagesPersonal Account Statement: Claudio Cardoso Da Silva Junior .53C CardosoNo ratings yet

- PayPass MChip Requirements 2013 PDFDocument75 pagesPayPass MChip Requirements 2013 PDFrodonetNo ratings yet

- Service Charges As Per Rbi GuidelinesDocument10 pagesService Charges As Per Rbi Guidelineskrunal3726No ratings yet

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocument2 pagesSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaNo ratings yet

- Nri Schedule of ChargesDocument4 pagesNri Schedule of ChargesRishiNo ratings yet

- Common Service ChargesDocument3 pagesCommon Service ChargesatharvxunoNo ratings yet

- Service Charges Annexure-A Revised 18-7-11Document28 pagesService Charges Annexure-A Revised 18-7-11Dhaliwal JassieNo ratings yet

- Pca 14 6Document2 pagesPca 14 6Arora MathewNo ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Schedule of Charges For Nri Accounts PrimeDocument4 pagesSchedule of Charges For Nri Accounts PrimeSonam SharmaNo ratings yet

- RBI SBI Demand Draft Exchange RatesDocument11 pagesRBI SBI Demand Draft Exchange RatesJithin VijayanNo ratings yet

- Schedule of Charges Edge Business 1st Feb 20 PDFDocument2 pagesSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaNo ratings yet

- NeekiDocument2 pagesNeekiRamNo ratings yet

- Description of Charge/Feature: Param VisheshDocument4 pagesDescription of Charge/Feature: Param Visheshgaurav_p_9No ratings yet

- Rationalization ServiceDocument5 pagesRationalization Servicesachin9984No ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- "Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Document2 pages"Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Sweta MistryNo ratings yet

- SBI Site Upload-Service Charges-2017 June 2017 (REVISED)Document1 pageSBI Site Upload-Service Charges-2017 June 2017 (REVISED)NDTVNo ratings yet

- 2014 06 16 Cir 336 2014 NOTICE - OnlyDocument2 pages2014 06 16 Cir 336 2014 NOTICE - OnlyVirat GoyalNo ratings yet

- AnnexA-SoC Comfort01062014Document4 pagesAnnexA-SoC Comfort01062014satyabrataNo ratings yet

- Soc Ca 01.01.22Document4 pagesSoc Ca 01.01.22Abhishek ShivappaNo ratings yet

- Account Tariff Structure Basic Savings AccountDocument1 pageAccount Tariff Structure Basic Savings Accountgaddipati_ramuNo ratings yet

- NRENROBeingMeaccountApril 012019Document2 pagesNRENROBeingMeaccountApril 012019KxhsujsnsNo ratings yet

- Services ProvidedDocument15 pagesServices ProvidedParul AroraNo ratings yet

- ICICI Bank Service ChargesDocument7 pagesICICI Bank Service ChargesRanjith MeelaNo ratings yet

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNo ratings yet

- Branch)Document3 pagesBranch)Jeyavel NagarajanNo ratings yet

- Description of Charges AU Bank Credit Cards - Altura, Altura Plus, Vetta, ZenithDocument2 pagesDescription of Charges AU Bank Credit Cards - Altura, Altura Plus, Vetta, ZenithMohitNo ratings yet

- Preferred AccountDocument2 pagesPreferred AccountaurummaangxinchenNo ratings yet

- Table I - Service Charges For Current Accounts and Other Running AccountsDocument8 pagesTable I - Service Charges For Current Accounts and Other Running AccountsAthish KumarNo ratings yet

- Basic Saving Account With Complete KYCDocument2 pagesBasic Saving Account With Complete KYCVarsha100% (1)

- Particulars Revised SBTRS Charges W.E.F. July 1, 2020Document2 pagesParticulars Revised SBTRS Charges W.E.F. July 1, 2020Parikshit ShomeNo ratings yet

- PNB Suvidha Scheme (Deposits) : Categorization of Retail Lending SchemesDocument3 pagesPNB Suvidha Scheme (Deposits) : Categorization of Retail Lending Schemesnishi namitaNo ratings yet

- UCO Service ChargesDocument34 pagesUCO Service Chargeshimz101No ratings yet

- Schedule of Charges Unity Classic Saving AcDocument4 pagesSchedule of Charges Unity Classic Saving Acpunitrai28111No ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Theory MojskshajajahbilityDocument2 pagesTheory Mojskshajajahbilityßtylish Murthuja ValiNo ratings yet

- IDBI Royale Plus Account Sep 01 2018Document2 pagesIDBI Royale Plus Account Sep 01 2018Sumit KumarNo ratings yet

- HDFC Vs IciciDocument10 pagesHDFC Vs IciciRahulNo ratings yet

- Being MeDocument2 pagesBeing MeVarshaNo ratings yet

- Being MeDocument2 pagesBeing Metharun venkatNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- SOC June 2022 FinalDocument16 pagesSOC June 2022 Finaladilurrahmanadil5656No ratings yet

- Service ChargesDocument64 pagesService ChargesAmrutaNo ratings yet

- Super Savings Account: Common Service ChargesDocument2 pagesSuper Savings Account: Common Service ChargesSantosh ThakurNo ratings yet

- Annexure2 PDFDocument2 pagesAnnexure2 PDFMukeshNo ratings yet

- SBI Commission Structure W.E.F 01102015Document4 pagesSBI Commission Structure W.E.F 01102015Mahesh V KalbhairavNo ratings yet

- Key Fact DocumentDocument2 pagesKey Fact DocumentJagiNo ratings yet

- Jubilee Plus Savings Account: (January 01,2020)Document2 pagesJubilee Plus Savings Account: (January 01,2020)Ruthvik TMNo ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- RBL Mitc FinalDocument16 pagesRBL Mitc FinalVivekNo ratings yet

- Effective From 1st April, 2020Document2 pagesEffective From 1st April, 2020SundarNo ratings yet

- DownloadDocument2 pagesDownloadGazzu GazaliNo ratings yet

- Basic Savings Bank Deposit Account SocsDocument6 pagesBasic Savings Bank Deposit Account Socstrue chartNo ratings yet

- Revision of Service Charges - DepositDocument10 pagesRevision of Service Charges - DepositThe QuintNo ratings yet

- Service Charges, Fees and Commissions Domestic OperationsDocument5 pagesService Charges, Fees and Commissions Domestic OperationsJahankeer MzmNo ratings yet

- Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesGrace Period Granted - 1 Month As Per RBI Guidelines To Restore MABprasanNo ratings yet

- Commission Structure: S.No. Particulars CSP ShareDocument4 pagesCommission Structure: S.No. Particulars CSP ShareKunal ShivhareNo ratings yet

- WhatsNew - Service Charge (GST) - E143467a15Document11 pagesWhatsNew - Service Charge (GST) - E143467a15MD ShakeelNo ratings yet

- Schedule of Charges Deutsche Bank 4Document3 pagesSchedule of Charges Deutsche Bank 4Sayantika MondalNo ratings yet

- CRYPTOCURRENCYDocument5 pagesCRYPTOCURRENCYCLINT SHEEN CABIASNo ratings yet

- Current Acct Statement - XX0388 - 12092023Document10 pagesCurrent Acct Statement - XX0388 - 12092023Ashwani KumarNo ratings yet

- Andhra Pragathi Grameena Bank (APGB) DEBIT CARDDocument2 pagesAndhra Pragathi Grameena Bank (APGB) DEBIT CARDHari Sandeep ReddyNo ratings yet

- PT Hensel Davest Indonesia, TBK: The (Hidden) Ecommerce & Fintech Gem From East IndonesiaDocument10 pagesPT Hensel Davest Indonesia, TBK: The (Hidden) Ecommerce & Fintech Gem From East Indonesiazainuddin spiritusNo ratings yet

- AP-Trial Balance ReportDocument328 pagesAP-Trial Balance ReportArun EverthunderNo ratings yet

- Product Variants - SB-Elite / SB-Premium / SB-Advantage / SB-Standard/ SB-Sanchay/SB Digi/SB Digi RegularDocument4 pagesProduct Variants - SB-Elite / SB-Premium / SB-Advantage / SB-Standard/ SB-Sanchay/SB Digi/SB Digi RegularVikram JhaNo ratings yet

- Hasiyaa InnovationDocument11 pagesHasiyaa InnovationSudhar SanNo ratings yet

- NTRP - Track Transaction HistoryDocument2 pagesNTRP - Track Transaction HistorySathish KumarNo ratings yet

- E - Business Unit-III, 2020Document15 pagesE - Business Unit-III, 2020Sourabh SoniNo ratings yet

- p7 PDFDocument9 pagesp7 PDFazmanNo ratings yet

- DetailsDocument1 pageDetailssyed abbassNo ratings yet

- Electronic Bill PaymentDocument2 pagesElectronic Bill PaymentHeikkiNo ratings yet

- Efficiency of Electronic Payment System To Student Entrepreneur of Mariners' NagaDocument17 pagesEfficiency of Electronic Payment System To Student Entrepreneur of Mariners' NagaAngelo MelgarNo ratings yet

- StarlingStatement - 01 10 2023 - 19 01 2024Document4 pagesStarlingStatement - 01 10 2023 - 19 01 2024amjadbonusNo ratings yet

- Gmail - Booking Confirmation On IRCTC, Train - 14005, 22-Sep-2022, SL, CPR - ANVTDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 14005, 22-Sep-2022, SL, CPR - ANVT01. ABHINAV KANTINo ratings yet

- Phonepe and Its FunctionalitiesDocument7 pagesPhonepe and Its FunctionalitiesSreeram BaddilaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancevinuthaNo ratings yet

- Tax Invoice: Description Quantity Unit Price Discount TotalDocument1 pageTax Invoice: Description Quantity Unit Price Discount TotalSoon JieNo ratings yet

- Account Statement 14 Jun 2023-19 Jun 2023Document4 pagesAccount Statement 14 Jun 2023-19 Jun 2023propvisor real estateNo ratings yet

- Rapportering Allvarliga Incidenter Psd2 EngDocument20 pagesRapportering Allvarliga Incidenter Psd2 EngAli HassamNo ratings yet

- Interim Report On Study of Equity With The Respect of Banking SectorDocument19 pagesInterim Report On Study of Equity With The Respect of Banking SectorPRASENJIT KUMAR SAHNINo ratings yet

- Account Statement From 1 Dec 2015 To 31 May 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 1 Dec 2015 To 31 May 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancevineethNo ratings yet

- 1588923678515NuoAnGN09hUCMx5q PDFDocument15 pages1588923678515NuoAnGN09hUCMx5q PDFSrínívas SrínuNo ratings yet

- Group 2A: Catanduanes State University Calatagan Virac, CatanduanesDocument9 pagesGroup 2A: Catanduanes State University Calatagan Virac, CatanduanesLaila Mae PiloneoNo ratings yet

- M/Chip Functional Architecture For Debit and Credit: Applies To: SummaryDocument12 pagesM/Chip Functional Architecture For Debit and Credit: Applies To: SummaryAbiy MulugetaNo ratings yet

- IDoc Mapping To X12 and EDIFADocument2 pagesIDoc Mapping To X12 and EDIFASOUMEN DASNo ratings yet