Professional Documents

Culture Documents

Life Insurance Institution-Level Statistics Glossaryv1

Life Insurance Institution-Level Statistics Glossaryv1

Uploaded by

mcaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- The Big Book of Blob TreesDocument167 pagesThe Big Book of Blob TreesVera Toth100% (5)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ensayos Sobre Derecho y Sociedad en La Era TecnológicaDocument175 pagesEnsayos Sobre Derecho y Sociedad en La Era TecnológicaMartha Ochoa LeónNo ratings yet

- Self Care Deficit Theory of NursingDocument4 pagesSelf Care Deficit Theory of NursingMark Elben100% (1)

- ANNEX A-F Bank AccountsDocument47 pagesANNEX A-F Bank AccountsRG CruzNo ratings yet

- Important Notice: Source of DataDocument3 pagesImportant Notice: Source of DatamcaNo ratings yet

- Definitions and Abbreviations: Adequacy, A Private Health Insurer Must Have, and Comply With, A Written, BoardDocument2 pagesDefinitions and Abbreviations: Adequacy, A Private Health Insurer Must Have, and Comply With, A Written, BoardmcaNo ratings yet

- Glossary: AASB 9 Financial Instruments) - These Are Generally Securities Purchased With The IntentDocument3 pagesGlossary: AASB 9 Financial Instruments) - These Are Generally Securities Purchased With The IntentmcaNo ratings yet

- Quarterly Life Insurance Performance Statistics Explanatory NotesDocument1 pageQuarterly Life Insurance Performance Statistics Explanatory NotesmcaNo ratings yet

- Quarterly Life Insurance Performance Statistics Glossary: DefinitionsDocument3 pagesQuarterly Life Insurance Performance Statistics Glossary: DefinitionsmcaNo ratings yet

- Glossary IGISDocument1 pageGlossary IGISmcaNo ratings yet

- IGIS Explanatory NotesDocument1 pageIGIS Explanatory NotesmcaNo ratings yet

- Elton Tiny Dancer Sheet Music PDFDocument5 pagesElton Tiny Dancer Sheet Music PDFMike ScottNo ratings yet

- Electronic Waste: A Major Challenge To Sustainable Development in AfricaDocument8 pagesElectronic Waste: A Major Challenge To Sustainable Development in AfricaJohnbosco UgochukwuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument115 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Airports Authority of India Final ReportDocument50 pagesAirports Authority of India Final ReportAshwini Kumar100% (1)

- Official CVDocument4 pagesOfficial CVapi-665345625No ratings yet

- IOSA Manual 14Document709 pagesIOSA Manual 14AlexNo ratings yet

- KB4 PortfolioDocument16 pagesKB4 Portfoliosandra_cristacheNo ratings yet

- NEA Hold DownDocument1 pageNEA Hold DownKLNo ratings yet

- Oracle Advanced CollectionsDocument3 pagesOracle Advanced CollectionsVinita BhatiaNo ratings yet

- TRANSPO Law Reviewer Nicky Ty1Document109 pagesTRANSPO Law Reviewer Nicky Ty1Melrich SanchezNo ratings yet

- Super Speciality Hospital in KanpurDocument178 pagesSuper Speciality Hospital in KanpurgauravsriNo ratings yet

- Advanced Technologies For Industry: Final ReportDocument82 pagesAdvanced Technologies For Industry: Final ReportIsmail DRIOUCHNo ratings yet

- Metraux 1942 NativeDocument218 pagesMetraux 1942 NativeTúlio ArrudaNo ratings yet

- II (A) PROCEDURAL MANUAL - MU Rev.01Document2 pagesII (A) PROCEDURAL MANUAL - MU Rev.01Marj ApolinarNo ratings yet

- CivPro Digest CasesDocument25 pagesCivPro Digest CasesLex DagdagNo ratings yet

- MCQ - MarketingDocument8 pagesMCQ - MarketingMuna ShawlNo ratings yet

- Practice 2: Introduction To Oracle9i: SQL 2Document10 pagesPractice 2: Introduction To Oracle9i: SQL 2John Paul Duque GutierrezNo ratings yet

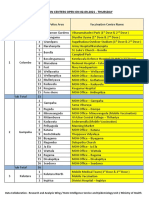

- Vaccination Centers On 02.09.2021Document12 pagesVaccination Centers On 02.09.2021Chanu On CT100% (1)

- People v. PunzalanDocument17 pagesPeople v. PunzalanJSJNo ratings yet

- Comparing-Contrasting Similaritiies and DifferencesDocument11 pagesComparing-Contrasting Similaritiies and DifferencesMuhammad Farid100% (1)

- Introduction To Network Security (Chapman & Hall - CRC Computer and Information Science Series) - Douglas JacobsonDocument502 pagesIntroduction To Network Security (Chapman & Hall - CRC Computer and Information Science Series) - Douglas Jacobson7tr5wgnddzNo ratings yet

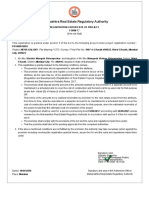

- Rera Registration NehaDocument1 pageRera Registration NehaAKSHAY GUTKANo ratings yet

- Bickle MiklDocument12 pagesBickle MiklLevi Van CleefNo ratings yet

- Bibliografia - Società Giapponese Contemporanea - 2019 - 20 - PDFDocument323 pagesBibliografia - Società Giapponese Contemporanea - 2019 - 20 - PDFMJ RecordNo ratings yet

- July Cecil V Hall Kirk (Holiday With Pay Case)Document10 pagesJuly Cecil V Hall Kirk (Holiday With Pay Case)Carla-anne Harris RoperNo ratings yet

- Side by Side A Comparison of Fortune Hi Tech Marketing and Herbalife 3.14.13Document19 pagesSide by Side A Comparison of Fortune Hi Tech Marketing and Herbalife 3.14.13lon1747No ratings yet

- Best Practices For SaaS SecurityDocument5 pagesBest Practices For SaaS SecuritySilvia GutierrezNo ratings yet

Life Insurance Institution-Level Statistics Glossaryv1

Life Insurance Institution-Level Statistics Glossaryv1

Uploaded by

mcaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Life Insurance Institution-Level Statistics Glossaryv1

Life Insurance Institution-Level Statistics Glossaryv1

Uploaded by

mcaCopyright:

Available Formats

Glossary

Definitions

Additional Tier 1 Capital (table 3) is as defined in Prudential Standard LPS 112 Capital Adequacy: Measurement of

Capital (LPS 112).

Capital adequacy statistics in Table 3 is as per LPS 110 Capital adequacy under the revised capital framework

effective from 1 January 2013.

Capital base is comprised of Tier 1 Capital and Tier 2 Capital as defined in LPS 112.

Capital base (net of Tier 2 Capital) ratio is Capital base net of Tier 2 Capital divided by Prescribed Capital Amount.

Capital in excess of prescribed capital amount is the surplus or deficit of a fund's capital base over its prescribed

capital amount.

Common Equity Tier 1 Capital comprises the highest quality components of capital and consists of the sum of paid-up

ordinary shares issued by a life company, retained earnings, undistributed current year earnings, accumulated other

comprehensive income and other disclosed reserves, and regulatory adjustments as defined in LPS 112.

Common Equity Tier 1 Capital ratio is Common Equity Tier 1 Capital divided by prescribed capital amount.

Effective movement in net policy liabilities is calculated as movement in net policy liabilities less deposits received,

plus withdrawals of deposits, plus non-premium related fees for management services, plus movements in the liability

for deferred fee revenue, less movements in the liability for deferred acquisition costs.

General fund means the shareholders' fund for a life company other than a friendly society as per LPS 001 Definitions.

Net policy expenses is policy expenses net of outward reinsurance claims.

Net policy revenue is policy revenue net of outward reinsurance premiums.

Other (table 2) comprises reserves, shareholder retained profits and foreign currency translations.

Prescribed capital amount is as defined in LPS 110.

Prescribed capital amount coverage is capital base divided by prescribed capital amount.

Tax comprises taxes that a life insurance company is liable to pay on behalf of its policy owners and taxes it is liable

to pay on behalf of its shareholders.

Tier 1 Capital ratio is Tier 1 Capital divided by prescribed capital amount.

Tier 2 Capital includes other components of capital that, to varying degrees, fall short of the quality of Tier 1 Capital

but nonetheless contribute to the overall strength of a life company and its capacity to absorb losses. It is net of

regulatory adjustments as defined in LPS 112.

Australian Prudential Regulation Authority 1

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- The Big Book of Blob TreesDocument167 pagesThe Big Book of Blob TreesVera Toth100% (5)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ensayos Sobre Derecho y Sociedad en La Era TecnológicaDocument175 pagesEnsayos Sobre Derecho y Sociedad en La Era TecnológicaMartha Ochoa LeónNo ratings yet

- Self Care Deficit Theory of NursingDocument4 pagesSelf Care Deficit Theory of NursingMark Elben100% (1)

- ANNEX A-F Bank AccountsDocument47 pagesANNEX A-F Bank AccountsRG CruzNo ratings yet

- Important Notice: Source of DataDocument3 pagesImportant Notice: Source of DatamcaNo ratings yet

- Definitions and Abbreviations: Adequacy, A Private Health Insurer Must Have, and Comply With, A Written, BoardDocument2 pagesDefinitions and Abbreviations: Adequacy, A Private Health Insurer Must Have, and Comply With, A Written, BoardmcaNo ratings yet

- Glossary: AASB 9 Financial Instruments) - These Are Generally Securities Purchased With The IntentDocument3 pagesGlossary: AASB 9 Financial Instruments) - These Are Generally Securities Purchased With The IntentmcaNo ratings yet

- Quarterly Life Insurance Performance Statistics Explanatory NotesDocument1 pageQuarterly Life Insurance Performance Statistics Explanatory NotesmcaNo ratings yet

- Quarterly Life Insurance Performance Statistics Glossary: DefinitionsDocument3 pagesQuarterly Life Insurance Performance Statistics Glossary: DefinitionsmcaNo ratings yet

- Glossary IGISDocument1 pageGlossary IGISmcaNo ratings yet

- IGIS Explanatory NotesDocument1 pageIGIS Explanatory NotesmcaNo ratings yet

- Elton Tiny Dancer Sheet Music PDFDocument5 pagesElton Tiny Dancer Sheet Music PDFMike ScottNo ratings yet

- Electronic Waste: A Major Challenge To Sustainable Development in AfricaDocument8 pagesElectronic Waste: A Major Challenge To Sustainable Development in AfricaJohnbosco UgochukwuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument115 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Airports Authority of India Final ReportDocument50 pagesAirports Authority of India Final ReportAshwini Kumar100% (1)

- Official CVDocument4 pagesOfficial CVapi-665345625No ratings yet

- IOSA Manual 14Document709 pagesIOSA Manual 14AlexNo ratings yet

- KB4 PortfolioDocument16 pagesKB4 Portfoliosandra_cristacheNo ratings yet

- NEA Hold DownDocument1 pageNEA Hold DownKLNo ratings yet

- Oracle Advanced CollectionsDocument3 pagesOracle Advanced CollectionsVinita BhatiaNo ratings yet

- TRANSPO Law Reviewer Nicky Ty1Document109 pagesTRANSPO Law Reviewer Nicky Ty1Melrich SanchezNo ratings yet

- Super Speciality Hospital in KanpurDocument178 pagesSuper Speciality Hospital in KanpurgauravsriNo ratings yet

- Advanced Technologies For Industry: Final ReportDocument82 pagesAdvanced Technologies For Industry: Final ReportIsmail DRIOUCHNo ratings yet

- Metraux 1942 NativeDocument218 pagesMetraux 1942 NativeTúlio ArrudaNo ratings yet

- II (A) PROCEDURAL MANUAL - MU Rev.01Document2 pagesII (A) PROCEDURAL MANUAL - MU Rev.01Marj ApolinarNo ratings yet

- CivPro Digest CasesDocument25 pagesCivPro Digest CasesLex DagdagNo ratings yet

- MCQ - MarketingDocument8 pagesMCQ - MarketingMuna ShawlNo ratings yet

- Practice 2: Introduction To Oracle9i: SQL 2Document10 pagesPractice 2: Introduction To Oracle9i: SQL 2John Paul Duque GutierrezNo ratings yet

- Vaccination Centers On 02.09.2021Document12 pagesVaccination Centers On 02.09.2021Chanu On CT100% (1)

- People v. PunzalanDocument17 pagesPeople v. PunzalanJSJNo ratings yet

- Comparing-Contrasting Similaritiies and DifferencesDocument11 pagesComparing-Contrasting Similaritiies and DifferencesMuhammad Farid100% (1)

- Introduction To Network Security (Chapman & Hall - CRC Computer and Information Science Series) - Douglas JacobsonDocument502 pagesIntroduction To Network Security (Chapman & Hall - CRC Computer and Information Science Series) - Douglas Jacobson7tr5wgnddzNo ratings yet

- Rera Registration NehaDocument1 pageRera Registration NehaAKSHAY GUTKANo ratings yet

- Bickle MiklDocument12 pagesBickle MiklLevi Van CleefNo ratings yet

- Bibliografia - Società Giapponese Contemporanea - 2019 - 20 - PDFDocument323 pagesBibliografia - Società Giapponese Contemporanea - 2019 - 20 - PDFMJ RecordNo ratings yet

- July Cecil V Hall Kirk (Holiday With Pay Case)Document10 pagesJuly Cecil V Hall Kirk (Holiday With Pay Case)Carla-anne Harris RoperNo ratings yet

- Side by Side A Comparison of Fortune Hi Tech Marketing and Herbalife 3.14.13Document19 pagesSide by Side A Comparison of Fortune Hi Tech Marketing and Herbalife 3.14.13lon1747No ratings yet

- Best Practices For SaaS SecurityDocument5 pagesBest Practices For SaaS SecuritySilvia GutierrezNo ratings yet