Professional Documents

Culture Documents

Legal Basics PDF

Legal Basics PDF

Uploaded by

MikeDouglas0 ratings0% found this document useful (0 votes)

21 views2 pagesOriginal Title

legal_basics.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views2 pagesLegal Basics PDF

Legal Basics PDF

Uploaded by

MikeDouglasCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

SPECIAL SECTION: SURETY BONDING

Q&ATHE LEGAL BASICS

OF SURETY BONDS

B Y LY N N S C H U B E R T

What Is a Surety Bond and How Are the the bond and any agreement of indem- What Happens with a Claim

Parties Involved Defined? nity. The principal must cooperate with on a Surety Bond?

A: A surety bond is a three-party

agreement assuring the project

owner (obligee) that the contractor (prin-

any investigation of an allegation of

default and reimburse the surety for any

losses incurred due to the default of the

A: When a claim is made on a

bond, the surety must investigate

the allegation of contractor default. The

cipal) will perform a contract in accor- principal on its promise. principal must cooperate with the surety

dance with the contract documents. and provide the information necessary for

When a contractor requires its subcon- Which Laws Require Bonding? the surety to make a decision of whether

tractors to obtain bonds, the contractor is

the obligee and the subcontractor is the

principal.

A: The Miller Act of 1935 (origi-

nally enacted in 1893 as the

Heard Act) mandates performance and

it must perform under the bond. For

example, the surety will examine the

validity of the bond, whether notice of

Most surety companies are subsidiaries payment bonds for all federal public works default was proper, whether there were

or divisions of insurance companies, and contracts in excess of $100,000 and pay- material alterations or changes in the

both surety bonds and traditional insur- ment protection, with payment bonds the scope of the contract or gross overpay-

ance policies are risk-transfer mechanisms preferred method for contracts in excess ments, among other information.

regulated by state insurance departments. of $25,000. Also, almost all 50 states, the If the surety determines that its obli-

Surety is designed to prevent a loss. District of Columbia, Puerto Rico and gations have not become void, the surety

The surety prequalifies the contractor most local jurisdictions have enacted sim- will identify its course of action, which

based on financial strength and construc- ilar legislation requiring surety bonds on may include:

tion expertise. Because the bond is under- public works over certain dollar amounts. • providing financial or technical assis-

written with little expectation of loss, the These generally are referred to as “Little tance to the contractor;

premium is primarily a fee for prequalifi- Miller Acts.” • arranging for a replacement contractor;

cation services. Many general contractors then require • re-bidding the project for completion;

their subcontractors to obtain similar or

What Are the Obligations of bonds to protect them from contractor • paying the penal sum of the bond.

Each Party To the Bond? default. While most states do not require

A: Each of the parties has responsi-

bilities related to each other party.

• The principal has the duty to the obligee

bonds on private construction projects,

many owners do require them to protect

their project and assets.

What Are Rights of Subrogation?

A: Subrogation is the surety’s right

to enforce a third-party’s rights

to perform its contract. The obligee like- against the principal. The surety must

wise owes a duty to the principal to uphold What Are Attorney-in-Fact and have made a payment to the third party

its end of the contract, including payment Power of Attorney? in order to exercise subrogation rights. If

in accordance with the contract terms.

• The surety has a duty to the obligee to

take action under the terms of the bond

A: Most surety companies distrib-

ute surety bonds through the

independent agency system. When a con-

the owner declares the contractor in

default and the surety completes the con-

tract, the surety has rights to undispersed

if the principal defaults under the con- tractor or subcontractor needs a bond, the contract funds. The principal must reim-

tract. But the obligee has a duty to ful- first step is to contact a surety bond pro- burse the surety for any losses incurred

fill its bargain under the contract, again, ducer, also known as an agent or broker. due to the principal’s default.

including payment of any sums due The producer generally receives power of If the surety determines that the alle-

under the contract, but this time to the attorney, i.e. the producer can sign bonds gation of default is wrong, the surety and

surety that performs. on behalf of the surety company for proj- principal stand together to oppose the

• The surety and the principal also have ects that fall within acceptable ranges obligee’s claims. In addition to its subro-

duties to each other. The surety has the established by the surety company. The gation rights, the surety also acquires pro-

duty to determine whether the principal attorney-in-fact is the holder of the power tection against loss through the general

is in default, and abide by the terms of of attorney. indemnity agreement.

48 | Construction EXECUTIVE November 2003

SPECIAL SECTION: SURETY BONDING

What Is a General Indemnity Agreement? other companies that sign are liable to subcontractor wants to be sure that the

A: While a surety guarantees the

performance of the principal to

the obligee, the principal remains liable

repay the surety for amounts it pays on

the company’s behalf.

contractor will enter into the contract if

awarded. The bid bond encourages con-

tractors to do just that in order to avoid

for its original obligation. If the surety What Legal Benefits Does a Bond having to repay losses to the surety from

must perform its duty to the obligee Provide Subcontractors? their failure to do so. The performance

regarding the principal’s contract, the

principal is liable to reimburse the surety

for that performance.

A: Sureties provide three basic bonds

on a construction project: the bid

bond, the performance bond and the pay-

bond ensures that if the contractor

defaults on the project someone else will

be there with sufficient funds to see that

Because many contracting firms do not ment bond. The bid bond ensures that the the contractor’s obligation to perform is

have the capital to assure this repayment, contractor will enter into the contract for completed. Subcontractors value having

most surety companies require a general the terms of its bid and supply the required the performance continue with someone

agreement of indemnity (GAI) to be additional bonds. The performance bond able to reaffirm the subcontracts without

signed not only by the firm, but by indi- ensures the contractor will perform the having to rebid the work under public bid-

viduals willing to support the firm. This contract, including paying its subcontrac- ding laws.

might be the owner(s) of the firm, the tors and suppliers, and the payment bond The payment bond has the most obvi-

spouse of the owner, a parent corporation provides a direct claim for subcontractors ous legal value to subcontractors. If a con-

or merely other individuals willing to put for unpaid invoices to the contractor. Each tractor fails to pay for work properly per-

themselves on the line due to their belief of these bonds has legal benefits to sub- formed by subcontractors, those subs have

in the firm. Under the GAI (sometimes contractors. a direct claim against the surety for sums

called simply an indemnity agreement), If a subcontractor submits a proposal justly due. The sub does not have to obtain

the principal company and all people or to a contractor to be included in a bid, the its money from the general, but can work

directly with the surety. This direct right

of claim is especially valuable on a public

project where a sub cannot file a lien

against the work.

How Do I Find an Attorney

Specializing in Bonding?

A: If there is any question or doubt

of a contractor’s or the surety’s

rights or obligations, it may be advisable

to consult an attorney knowledgeable of

construction and surety. The American

Bar Association (ABA) Trial Tort and

Insurance Practice Section’s Fidelity and

Surety Law Committee includes lawyers

who specialize in surety law. Many state

bar associations also have surety commit-

tees or construction law committees.

For names of lawyers who have

knowledge in your area, call the ABA,

(312) 988-5607 and request the FLSC

membership directory or the pages for a

particular state, or call the state bar asso-

ciation for a reference.

Schubert is president of The Surety Association

of America (SAA). For more information,

contact SAA, information@surety.org, (202)

463-0600 or www.surety.org.

50 | Construction EXECUTIVE November 2003

You might also like

- Make Your CPN InstrctionsDocument21 pagesMake Your CPN InstrctionsMikeDouglas95% (175)

- TDA Birth Certificate Bond InstructionsDocument4 pagesTDA Birth Certificate Bond InstructionsMikeDouglas98% (201)

- A4V Procedure - Accept For Value, Return For ValueDocument6 pagesA4V Procedure - Accept For Value, Return For ValueBob Hurt97% (94)

- Diplomatic Immunity State Citizen PassportDocument20 pagesDiplomatic Immunity State Citizen PassportMikeDouglas98% (48)

- Financial Institution - Borrower: One Thousand One Hundred-Ten Dollars and 10/100Document1 pageFinancial Institution - Borrower: One Thousand One Hundred-Ten Dollars and 10/100MikeDouglas100% (11)

- Sample BondDocument3 pagesSample BondJoshua Sygnal Gutierrez100% (1)

- GP 220 PDFDocument1 pageGP 220 PDFMikeDouglasNo ratings yet

- Illinois State Police - FOID ApplicationDocument2 pagesIllinois State Police - FOID ApplicationrhippleNo ratings yet

- TSR highlightsKeyPoints1Document29 pagesTSR highlightsKeyPoints1billybyrd_99100% (2)

- Assignment 29: Indemnity BondDocument8 pagesAssignment 29: Indemnity Bondfaareha100% (1)

- Reed Smith A Construction Bonds OverviewDocument15 pagesReed Smith A Construction Bonds OverviewMikeDouglasNo ratings yet

- The Importance of Surety BondsDocument2 pagesThe Importance of Surety BondsMikeDouglasNo ratings yet

- Exhaustion of Administrative RemediesDocument1 pageExhaustion of Administrative RemediesMikeDouglasNo ratings yet

- Name ChangeDocument2 pagesName ChangeAleria ButlerNo ratings yet

- Dictionary Thesaurus Medical Financial Acronyms Idioms Encyclopedia WikipediaDocument1 pageDictionary Thesaurus Medical Financial Acronyms Idioms Encyclopedia WikipediaMikeDouglasNo ratings yet

- TAX2 3rd PartDocument8 pagesTAX2 3rd Partmitsudayo_No ratings yet

- Fidelityvs Surety BondsDocument4 pagesFidelityvs Surety BondsBelteshazzarL.CabacangNo ratings yet

- Contract To SellDocument3 pagesContract To SellIan GermanNo ratings yet

- See, E.G. Winnett v. Roberts, Supra, 179 Cal App.3d 909, 902 Lichtv v. Whitney, Supra, 80 Cal. App.2d 696, 701 See Also Code Civ. Proc. SS 2074.Document1 pageSee, E.G. Winnett v. Roberts, Supra, 179 Cal App.3d 909, 902 Lichtv v. Whitney, Supra, 80 Cal. App.2d 696, 701 See Also Code Civ. Proc. SS 2074.MikeDouglasNo ratings yet

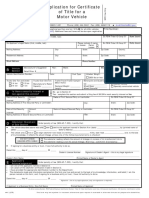

- Application For Certificate of Title For Motor VehicleDocument1 pageApplication For Certificate of Title For Motor VehicleAnonymous L3hKyrVEpNo ratings yet

- Positive Law Book Rev3a 3172011Document172 pagesPositive Law Book Rev3a 3172011Theplaymaker508100% (1)

- Suspicious Activity Information Explanation/Description # KSV2109-189020253Document1 pageSuspicious Activity Information Explanation/Description # KSV2109-189020253MikeDouglasNo ratings yet

- Break Down ContractsDocument41 pagesBreak Down ContractsGreta CarterNo ratings yet

- United States Court of Appeals, Eighth CircuitDocument23 pagesUnited States Court of Appeals, Eighth CircuitScribd Government DocsNo ratings yet

- For The Client: A Basic Guide To Surety BondsDocument2 pagesFor The Client: A Basic Guide To Surety Bondsaychiluhimhailu100% (1)

- Deeds Registries Act (Chapter 20-05) As Amended 2005Document41 pagesDeeds Registries Act (Chapter 20-05) As Amended 2005walceeNo ratings yet

- PSA Certificate of Live Birth FormDocument1 pagePSA Certificate of Live Birth FormJane Avila100% (1)

- EFT Response Flow Chart PDFDocument1 pageEFT Response Flow Chart PDFMikeDouglasNo ratings yet

- 1031 Drawdown Settlement OptionDocument1 page1031 Drawdown Settlement OptionMikeDouglas0% (1)

- 8 Get Your Finances & Credit in OrderDocument15 pages8 Get Your Finances & Credit in OrdercropdownunderNo ratings yet

- Moore Vs East Cleveland Case Where They Cant Just Evict You They Have To Follow LawDocument35 pagesMoore Vs East Cleveland Case Where They Cant Just Evict You They Have To Follow LawMikeDouglasNo ratings yet

- US Internal Revenue Service: Irb01-11Document112 pagesUS Internal Revenue Service: Irb01-11IRSNo ratings yet

- Revisiting The Legal Tender CasesDocument52 pagesRevisiting The Legal Tender CasesA1 Hair BeautyNo ratings yet

- Fdcpa HandoutsDocument7 pagesFdcpa HandoutsStephen MonaghanNo ratings yet

- Contract Law. Offer and AcceptanceDocument16 pagesContract Law. Offer and Acceptanceandreapap99No ratings yet

- What Is A Title?Document9 pagesWhat Is A Title?Amisha MistryNo ratings yet

- US Department of Education LetterDocument2 pagesUS Department of Education LetterTasha CainNo ratings yet

- Basic Tax OutlineDocument29 pagesBasic Tax OutlinestaceyNo ratings yet

- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsDocument1 pageAnnual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign GiftsCarolina AldanaNo ratings yet

- LeverageDocument38 pagesLeverageAnant MauryaNo ratings yet

- Federal Habeas Corpus Petition 28 U S C 2254Document19 pagesFederal Habeas Corpus Petition 28 U S C 2254Janeth Mejia Bautista AlvarezNo ratings yet

- Clarkson14e - PPT - ch29 U6 CREDITORS RIGHTS BK. Creditors' Rights and RemediesDocument47 pagesClarkson14e - PPT - ch29 U6 CREDITORS RIGHTS BK. Creditors' Rights and RemediesBao PhamNo ratings yet

- Strawman Lien 09+03+2023 Updated Regina Tyshonda Willis-1Document5 pagesStrawman Lien 09+03+2023 Updated Regina Tyshonda Willis-1dawud beyNo ratings yet

- All The Things The IRS Can Take Even Retirement Accounts!Document5 pagesAll The Things The IRS Can Take Even Retirement Accounts!NoelNo ratings yet

- Negotiable Instruments Act, 1881 PDFDocument67 pagesNegotiable Instruments Act, 1881 PDFKomal BasantaniNo ratings yet

- (Insert "Maker" If Maker and Borrower Are The Same EntityDocument5 pages(Insert "Maker" If Maker and Borrower Are The Same EntityJames neteruNo ratings yet

- United States Court of Appeals Tenth CircuitDocument15 pagesUnited States Court of Appeals Tenth CircuitScribd Government DocsNo ratings yet

- LLC Operating Agreement FormDocument17 pagesLLC Operating Agreement FormIva alanovicNo ratings yet

- Sample Letter of DefaultDocument1 pageSample Letter of DefaultWinnie WenNo ratings yet

- Legality of MinorDocument50 pagesLegality of Minorkareem hassanNo ratings yet

- Commercial Liens: A Most Potent Weapon: Home Search Guest Book Contact What'S New Disclaimer Source AreaDocument74 pagesCommercial Liens: A Most Potent Weapon: Home Search Guest Book Contact What'S New Disclaimer Source AreaMicheal Lee100% (1)

- BKL Holdings v. Globe Life Inc - Case 4-22-Cv-00170-ALM (Doc 1-3)Document33 pagesBKL Holdings v. Globe Life Inc - Case 4-22-Cv-00170-ALM (Doc 1-3)Fuzzy PandaNo ratings yet

- From England Where All This Crappola Began - The Word Goes ForthDocument2 pagesFrom England Where All This Crappola Began - The Word Goes ForthAlex BrownNo ratings yet

- Security DepositDocument10 pagesSecurity DepositshirishNo ratings yet

- Title 8 USC 1452b1 Federal Procedure To Become A National But NotDocument2 pagesTitle 8 USC 1452b1 Federal Procedure To Become A National But Nototis tolbertNo ratings yet

- Trusts Arent Just For Taxes and They Never Were - NJLJ - EW&MV - 02.08.10Document2 pagesTrusts Arent Just For Taxes and They Never Were - NJLJ - EW&MV - 02.08.10lbaker2009No ratings yet

- 1041Document3 pages1041Taha Al-abedNo ratings yet

- Cash Assignment Form 2013Document3 pagesCash Assignment Form 2013ARTHUR MILLERNo ratings yet

- Real Estate Power of Attorney TemplateDocument5 pagesReal Estate Power of Attorney TemplateRandolph AlvarezNo ratings yet

- Bizfile Online Account SetupDocument9 pagesBizfile Online Account SetupBaby BoppNo ratings yet

- Do-Did Mortgage Backed SecuritiesDocument1 pageDo-Did Mortgage Backed SecuritiesA. CampbellNo ratings yet

- Very Cheap Car InsuranceDocument1 pageVery Cheap Car Insurancepapi7000No ratings yet

- Public Debt Act of 1941: HearingDocument51 pagesPublic Debt Act of 1941: Hearingguymbula100% (1)

- Surety Bond Claims: A Construction Project Owner's Guide ToDocument9 pagesSurety Bond Claims: A Construction Project Owner's Guide ToMohamed El AbanyNo ratings yet

- AGC Surety Claims GuideDocument8 pagesAGC Surety Claims GuideBleak NarrativesNo ratings yet

- Chapter 14 Performance & Payment BondsDocument50 pagesChapter 14 Performance & Payment Bondsmary100% (1)

- Information For Submission of Form TMSM-01: Remittance/FeesDocument3 pagesInformation For Submission of Form TMSM-01: Remittance/FeesMikeDouglas100% (1)

- Downloaded From Manuals Search EngineDocument16 pagesDownloaded From Manuals Search EngineMikeDouglasNo ratings yet

- 5cb77dd49269b44e227ce65d - NEGOTIABLE DEBT INSTRUMENTS PDFDocument7 pages5cb77dd49269b44e227ce65d - NEGOTIABLE DEBT INSTRUMENTS PDFMikeDouglas100% (4)

- R36 User Manual2 PDFDocument58 pagesR36 User Manual2 PDFMikeDouglasNo ratings yet

- Quick Installation Guide For AWUS036HDocument3 pagesQuick Installation Guide For AWUS036HSejo WalkerNo ratings yet

- SAR Page 3 InstructionsDocument1 pageSAR Page 3 InstructionsMikeDouglasNo ratings yet

- Qig 036NH PDFDocument3 pagesQig 036NH PDFMikeDouglasNo ratings yet

- IRS w4v PDFDocument2 pagesIRS w4v PDFMikeDouglas67% (3)

- IRS Tax Fraud Reporting F3949aDocument2 pagesIRS Tax Fraud Reporting F3949aTim Bryant100% (2)

- SAR InstructionsDocument3 pagesSAR InstructionsMikeDouglas100% (2)

- GP 220 PDFDocument1 pageGP 220 PDFCharles HeavensNo ratings yet

- Moore Vs East Cleveland Case Where They Cant Just Evict You They Have To Follow LawDocument35 pagesMoore Vs East Cleveland Case Where They Cant Just Evict You They Have To Follow LawMikeDouglasNo ratings yet

- SAR Page 3 TextDocument1 pageSAR Page 3 TextMikeDouglasNo ratings yet

- Response To Dishonor of ProcessDocument2 pagesResponse To Dishonor of ProcessMikeDouglas100% (1)

- Response To Dishonor of ProcessDocument2 pagesResponse To Dishonor of ProcessMikeDouglas100% (1)

- Suspicious Activity Report: Reporting Financial Institution InformationDocument6 pagesSuspicious Activity Report: Reporting Financial Institution InformationMikeDouglasNo ratings yet

- Suspicious Activity Information Explanation/Description # KSV2109-189020253Document1 pageSuspicious Activity Information Explanation/Description # KSV2109-189020253MikeDouglasNo ratings yet

- General Instructions For Public Official Bonds: Completed Application - Please Forward The Original (Signed andDocument7 pagesGeneral Instructions For Public Official Bonds: Completed Application - Please Forward The Original (Signed andMikeDouglasNo ratings yet

- Form 1099 Reporting For Federal AgenciesDocument52 pagesForm 1099 Reporting For Federal AgenciesMikeDouglas100% (1)

- Fincen Form 101 Suspicious Activity Report by The Securities and Futures IndustriesDocument7 pagesFincen Form 101 Suspicious Activity Report by The Securities and Futures IndustriesMikeDouglas100% (4)

- Declaration of Independence and Political Status IiDocument2 pagesDeclaration of Independence and Political Status IiMikeDouglas100% (1)

- Sar PDFDocument5 pagesSar PDFMikeDouglasNo ratings yet

- Department of The Treasuryein ConfirmationDocument1 pageDepartment of The Treasuryein ConfirmationMikeDouglasNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherAnithaNo ratings yet

- rc151 Fill 23eDocument4 pagesrc151 Fill 23eSarena LiNo ratings yet

- Acc 112 MockDocument10 pagesAcc 112 Mockالسيد علي علوي السيد خليل إبراهيمNo ratings yet

- Prism Johnson FY20Document236 pagesPrism Johnson FY20PratikNo ratings yet

- Assignment of Insurance LawDocument11 pagesAssignment of Insurance LawHarish KeluskarNo ratings yet

- 202005-IQVIA DyslipidemiaDocument5 pages202005-IQVIA DyslipidemiaSimon Marco del PontNo ratings yet

- Some of The Major Challenges Facing Today's and Tomorrow's Healthcare Organizations and Healthcare Managers and Why These Challenges Are Present.Document4 pagesSome of The Major Challenges Facing Today's and Tomorrow's Healthcare Organizations and Healthcare Managers and Why These Challenges Are Present.Mercyline MoraaNo ratings yet

- Finman General Assurance Corporation vs. Court of Appeals 213 SCRA 493 September 2, 1992Document4 pagesFinman General Assurance Corporation vs. Court of Appeals 213 SCRA 493 September 2, 1992JayNo ratings yet

- Dee 3 LawDocument9 pagesDee 3 LawSamuelNo ratings yet

- Certificate of Liability Insurance: Insurer (S) Affording Coverage Naic #Document1 pageCertificate of Liability Insurance: Insurer (S) Affording Coverage Naic #bandwagoneerNo ratings yet

- South Sea Surety V CADocument2 pagesSouth Sea Surety V CAAnonymous hS0s2moNo ratings yet

- Intermediate Accounting 1 Sample Problem For Debt Investments - CompressDocument55 pagesIntermediate Accounting 1 Sample Problem For Debt Investments - CompresslerabadolNo ratings yet

- Intel Rewards Experience: Pay and RecognitionDocument6 pagesIntel Rewards Experience: Pay and RecognitionEsha ChaudharyNo ratings yet

- Account Transfer Form: Fax Cover SheetDocument6 pagesAccount Transfer Form: Fax Cover SheetJitendra SharmaNo ratings yet

- Making Automobile and Housing DecisionsDocument70 pagesMaking Automobile and Housing DecisionsAbigail ConstantinoNo ratings yet

- Canara Bank - CrisilDocument7 pagesCanara Bank - Crisilbhavan123No ratings yet

- Synopsis 1Document7 pagesSynopsis 1Girish V ThoratNo ratings yet

- Po17 - Tax Planning and AdviceDocument2 pagesPo17 - Tax Planning and AdvicepassmoreNo ratings yet

- Twitter Thread By: Investment BooksDocument13 pagesTwitter Thread By: Investment Booksfreetrial dontbanNo ratings yet

- Mutual Fund Distributor India 500 Sample QuestionsDocument36 pagesMutual Fund Distributor India 500 Sample QuestionsAhmed AnsariNo ratings yet

- ACN 402 Final AssignmentDocument15 pagesACN 402 Final AssignmentSAIMA SHARMINNo ratings yet

- US Soccer Federation Public 990 - 2018Document65 pagesUS Soccer Federation Public 990 - 2018Beau DureNo ratings yet

- S6 Case Doctor On DemandDocument24 pagesS6 Case Doctor On DemandshaswatNo ratings yet

- 2020 ESC Anexa V Volunteering Agreement IncountryDocument5 pages2020 ESC Anexa V Volunteering Agreement IncountryBogdan ChirisNo ratings yet

- Display - PDF - 2021-05-18T064418.503Document13 pagesDisplay - PDF - 2021-05-18T064418.503SureshNo ratings yet

- Chapter6 Section VDocument114 pagesChapter6 Section VAngeles del CidNo ratings yet

- Chapter 5 CGTMSEDocument17 pagesChapter 5 CGTMSEMikeNo ratings yet

- 2020 Resident - Fellow Salary and BenefitsDocument2 pages2020 Resident - Fellow Salary and Benefitsmld ozilNo ratings yet

- Tax 1st Preboard Questionnaire BDocument6 pagesTax 1st Preboard Questionnaire BAlexis Kaye DayagNo ratings yet

- Section I Instructions To BidderDocument23 pagesSection I Instructions To BidderYass AhmedNo ratings yet