Professional Documents

Culture Documents

SHE Aulia

Uploaded by

Jesselin VemberainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SHE Aulia

Uploaded by

Jesselin VemberainCopyright:

Available Formats

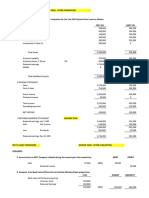

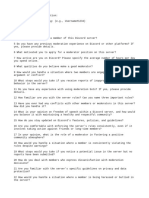

AULIA, INC

SHAREHOLDER'S EQUITY

31-Dec-15

1 2 3 4

BAL / BOOK PAJE BAL / AUDIT

DESCRIPTION 31-Dec-15 DR CR 31-Dec-15

1 Share Capital Preferred 1,500,000 1,500,000

2 Share Capital Ordinary 1,540,000 A 200,000 M 20,000 1,054,000

D 180,000

I 120,000

Q 6,000

OS SUBSCRIBED 0 L 20,000 J 40,000 20,000

OSDD 0 N 216,000 S 216,000 0

3 Share Premium Preferred 750,000 750,000

Share Premium Ordinary 610,000 R 210,000 E 180,000 859,500

K 80,000

P 199,500

Share Premium Treasury 0 C 20,000 20,000

4 RETAINED EARNINGS (RE) 2,670,000 G 550,000 O 16,500 2,138,000

T 105,000 U 106,500

RE APPROPRIATED (REA) 0 H 550,000 550,000

5 DONATED CAPITAL 0 F 2,000,000 2,000,000

6 TREASURY SHARE - Ordinary (540,000) B 180,000 (360,000)

7

BALANCE PER AUDIT 6,530,000 1,607,000 3,608,500 8,531,500

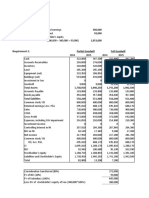

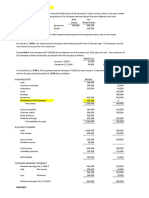

NO TGL CLIENT DR CR SHOULD BE DR CR PAJE DR CR

1 1/2/05 Cash 200,000 Cash 200,000 Share capital-ordinary 200,000 A

Share capital-ordinary 200,000 Treasury share 180,000 Treasury share 180,000 B

Share premium - treasury 20,000 Share premium - treasury 20,000 C

TS 20,000

2 1/4/05 Cash 300,000 Cash 300,000 Share capital-ordinary 180,000 D

Share capital-ordinary 300,000 Share capital-ordinary 120,000

Share premium - ordinary 180,000 Share premium - ordinary 180,000 E

SC-ordinary 30,000

3 1/5/05 PPE 5,000,000 PPE 2,000,000 Payable to Govt 5,000,000

Payable to Govt 5,000,000 Donated Capital 2,000,000 Donated Capital 2,000,000 F

Fixed Asset 3,000,000

4 1/7/05 No entry Retained Earnings 550,000 Retained Earnings 550,000 G

RE-Appropriated 550,000 RE-Appropriated 550,000 H

5 1/8/05 Acc Rec 120,000 OSSR 120,000 Share capital-ordinary 120,000 I

Share capital-ordinary 120,000 OS Subscribed 40,000 OSSR 120,000

Share premium-ordinary 80,000 Acc rec 120,000

OS Subscribed 40,000 J

Share premium-ordinary 80,000 K

OSSR = Ordinary share subscription receivable

6 15/8/05 Cash 60,000 Cash 60,000 Acc Rec 60,000

Acc Rec 60,000 OSSR 60,000 OSSR 60,000

No entry OS Subscribed 20,000 "-->5000x$4 OS Subscribed 20,000 L

Share capital-ordinary 20,000 CS 20,000 M

OS 5,000

7 1/9/05 Retained Earnings 330,000 Retained Earnings 313,500 "->28500x$11 OSDD 216,000 N

OSDD 330,000 OSDD --> 28500 x $4 114,000 Retained Earnings 16,500 O

Share premium-ordinary 199,500 Share premium-ordinary 199,500 P

OSDD = Ordinary share dividend distributable

8 1/10/05 OSDD 330,000 OSDD 114,000 Share capital-ordinary 6,000 Q 1-Jan 200,000

Share capital-ordinary 120,000 Share capital-ordinary 114,000 Share premium-ord 210,000 R TS (60,000)

Share premium-ordinary 210,000 OSDD 216,000 S TS 20,000

1-Apr 30,000

9 1/11/05 No entry Retained earnings 105,000 "-->700x150 Retained Earnings 105,000 T Total 190,000

Property Div Payable 105,000 Property Div Payable 105,000 Share div 28,500

10 1/12/05 Acc depr 87,000 Acc depr 88,500 * 590

Loss on MV App 93,000 Prop Div Payable 105,000 Prop Div Payable 105,000 105000

Vehicle 180,000 Gain on MV App 13,500 Acc depr 1,500

Vehicle 180,000 Gain on MV App 106,500 U

*180000 x 10% x 4th11bln

11 31/12/05 Income summary 450,000 Income summary 450,000 No entry

Retained Earnings 450,000 Retained Earnings 450,000

NUMBER SHARES STOCK

NO TGL share capital preferred share capital ordinary treasury share (cost)

PAR AUTHORIZED ISSUED OUTSTANDINGPAR AUTHORIZED ISSUED OUTSTANDING COST PURCH SALE BAL

31/12/04 10 200,000 150,000 150,000 4 300,000 200,000 140,000 9 60,000 0 60,000

1/2/05 160,000 20,000 40,000

1/4/05 30,000 190,000

1/5/05

1/7/05 -> up to 1/7/05190000

1/8/05

15/8/05 5,000 195,000

1/9/05

1/10/05 28,500 223,500

1/11/05

31/12/05

Shares outstanding 31 Dec 2005 223,500

Perhitungan Outstanding 190,000

share dividend For 20

Block 9,500

SD 3

Total sharesSD 28,500

Par 4

CSD/CS 114,000

You might also like

- Consolidated Net Income P 370,000 P 460,000: Illustrative ProblemsDocument11 pagesConsolidated Net Income P 370,000 P 460,000: Illustrative ProblemsKeir GaspanNo ratings yet

- How Much Is The Legal Capital? (2,300,000 + 5.250,000) 7550000Document5 pagesHow Much Is The Legal Capital? (2,300,000 + 5.250,000) 7550000jelai anselmoNo ratings yet

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Journal entries for PT AndrifaDocument5 pagesJournal entries for PT AndrifaALICE NADINE KURNIA SURYANo ratings yet

- Audit Journal Entries GuideDocument7 pagesAudit Journal Entries Guidereina maica terradoNo ratings yet

- Chapter 6Document7 pagesChapter 6Its meh SushiNo ratings yet

- Seminar 09 Calculating NCInt Simple Example ColourDocument2 pagesSeminar 09 Calculating NCInt Simple Example Colour金鑫No ratings yet

- Consolidated financial statements of PT P and subsidiaryDocument24 pagesConsolidated financial statements of PT P and subsidiaryzahra calista armansyahNo ratings yet

- Sogradiel - Final ExamDocument17 pagesSogradiel - Final ExamRIZLE SOGRADIELNo ratings yet

- Chapter 6 Jan 2022Document7 pagesChapter 6 Jan 2022zjen3owrene3rongavilNo ratings yet

- Balances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareDocument4 pagesBalances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareJhazreel BiasuraNo ratings yet

- Journal Entries For 2005: ' (P720,000/1,800 Shares)Document6 pagesJournal Entries For 2005: ' (P720,000/1,800 Shares)Dreiu EsmeleNo ratings yet

- Pembahasan Kuiz Indirect HoldingsDocument3 pagesPembahasan Kuiz Indirect HoldingsAdara KiranaNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- P9-2 Consolidation Workpaper EntriesDocument13 pagesP9-2 Consolidation Workpaper EntriesAlfatih 1453No ratings yet

- Implied Value Implied Value BV Equity BV EquityDocument12 pagesImplied Value Implied Value BV Equity BV Equitysean franciscusNo ratings yet

- Cristobal Store Problem 8-4 Accounts Adjusted Trial BalanceDocument3 pagesCristobal Store Problem 8-4 Accounts Adjusted Trial BalanceFakerPlaymakerNo ratings yet

- CH 4 Comprehensive ProblemDocument5 pagesCH 4 Comprehensive ProblemLNo ratings yet

- Jawaban Soal Latihan LKK1-BondsDocument21 pagesJawaban Soal Latihan LKK1-Bondszahra calista armansyahNo ratings yet

- A. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CDocument23 pagesA. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CHilario, Jana Rizzette C.No ratings yet

- 5-1 and 5-4Document2 pages5-1 and 5-4Rundhille AndalloNo ratings yet

- Diandra Murti Liza Aulia 2022210006 Tugas P-12 Pengantar Akuntansi 2Document3 pagesDiandra Murti Liza Aulia 2022210006 Tugas P-12 Pengantar Akuntansi 2Diandra MurtiNo ratings yet

- Intangibles Assignment - Valix 2017Document3 pagesIntangibles Assignment - Valix 2017Shinny Jewel VingnoNo ratings yet

- Finman 2A Midterm Quiz 1 October 2021 34 Points Test 1 Prepare Journal Entries in The Books of COVID Partnership To Record The FollowingDocument22 pagesFinman 2A Midterm Quiz 1 October 2021 34 Points Test 1 Prepare Journal Entries in The Books of COVID Partnership To Record The Followingella alfonsoNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Investment Portfolio Performance ReportDocument7 pagesInvestment Portfolio Performance ReportTirza LangkayNo ratings yet

- Revaluation, Retirement and Partnership ChangesDocument11 pagesRevaluation, Retirement and Partnership ChangesDheerNo ratings yet

- Analysis of Consolidated Financial Statements for Parent and SubsidiaryDocument22 pagesAnalysis of Consolidated Financial Statements for Parent and Subsidiaryzahra calista armansyahNo ratings yet

- Vdocuments - MX - Answers Chapter 3 Vol 2 RvsedDocument13 pagesVdocuments - MX - Answers Chapter 3 Vol 2 RvsedmirayNo ratings yet

- Book 11Document4 pagesBook 11Actg SolmanNo ratings yet

- 5 - Assign - Pad & Sad Co.Document2 pages5 - Assign - Pad & Sad Co.Pinky DaisiesNo ratings yet

- Tugas Akm Ii Pertemuan 10Document5 pagesTugas Akm Ii Pertemuan 10Alisya UmariNo ratings yet

- Consolidated Financial Statements Worked ExampleDocument5 pagesConsolidated Financial Statements Worked ExampleEnalem OtsuepmeNo ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

- PTC2000CashCollectionDocument7 pagesPTC2000CashCollectionMae MaupoNo ratings yet

- Enriquez, Michaella Activity1 Bsa3203Document13 pagesEnriquez, Michaella Activity1 Bsa3203Miks EnriquezNo ratings yet

- Aminah Quiz Answer Done by Abdullah Narejo-The Great.Document10 pagesAminah Quiz Answer Done by Abdullah Narejo-The Great.Abdullah NarejoNo ratings yet

- AFAR1 Partnership Formation SolutionDocument3 pagesAFAR1 Partnership Formation SolutionVenti AlexisNo ratings yet

- Paw & Saw Downstream ConsolidationDocument3 pagesPaw & Saw Downstream ConsolidationLorie Roncal JimenezNo ratings yet

- Marking Scheme: PRE - BOARD-2 (2023 - 2024)Document11 pagesMarking Scheme: PRE - BOARD-2 (2023 - 2024)Kaustav DasNo ratings yet

- Answers To AssessmentDocument5 pagesAnswers To AssessmentMyco PaqueNo ratings yet

- Corporate Share Transactions Journal EntriesDocument9 pagesCorporate Share Transactions Journal EntriesJasmine ActaNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Acccob1 Online Quiz 3 - Solution Guide (Part Iii)Document3 pagesAcccob1 Online Quiz 3 - Solution Guide (Part Iii)Abe Miguel BullecerNo ratings yet

- Analyzing Consolidated Financial StatementsDocument3 pagesAnalyzing Consolidated Financial StatementsBryle Jay LapeNo ratings yet

- FAR 1 Chapter - 10Document12 pagesFAR 1 Chapter - 10Klaus DoNo ratings yet

- FAR 1 Chapter - 10Document12 pagesFAR 1 Chapter - 10Klaus DoNo ratings yet

- 4BSA2 GROUP2 GroupActivityNo.1Document4 pages4BSA2 GROUP2 GroupActivityNo.1Lizerie Joy Kristine CristobalNo ratings yet

- Module 3 - Handout 1 80% Acquisition: Price FMV: ExampleDocument3 pagesModule 3 - Handout 1 80% Acquisition: Price FMV: ExampleChinee CastilloNo ratings yet

- Module 3 Handout 1 Business ComDocument3 pagesModule 3 Handout 1 Business ComChinee CastilloNo ratings yet

- Bahas Latihan TM11-1 2Document7 pagesBahas Latihan TM11-1 2Shely NaNo ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Jawaban Latihan Kasus KelasDocument5 pagesJawaban Latihan Kasus KelasSHYAILA ANISHA DE LAVANDANo ratings yet

- Pert 9 - Equity InvestmentDocument12 pagesPert 9 - Equity InvestmentVidya IntaniNo ratings yet

- Stock Acquisition Consolidated Financial StatementsDocument5 pagesStock Acquisition Consolidated Financial StatementsNicole Anne Santiago SibuloNo ratings yet

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzNo ratings yet

- BuenaventuraEJ Corporation ActivityDocument5 pagesBuenaventuraEJ Corporation ActivityAnonnNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Calpers Public Employees' Retirement FundDocument30 pagesCalpers Public Employees' Retirement FundEpicDoctor0% (1)

- wcl-20-24 11 2023Document15 pageswcl-20-24 11 2023Codarren VelvindronNo ratings yet

- Module 6 - Fabm2-MergedDocument37 pagesModule 6 - Fabm2-MergedJaazaniah S. PavilionNo ratings yet

- Constitutional Law 1 Syllabus SY 2023Document7 pagesConstitutional Law 1 Syllabus SY 2023Nash PungsNo ratings yet

- InDefend Data SheetDocument3 pagesInDefend Data Sheetabhijit379No ratings yet

- Life and General InsuranceDocument28 pagesLife and General InsuranceAravinda ShettyNo ratings yet

- Aerographer's Mate Second Class, Volume 2Document444 pagesAerographer's Mate Second Class, Volume 2Bob Kowalski100% (2)

- Jasa Vol. 3 (1) Jul-Sep 2013Document4 pagesJasa Vol. 3 (1) Jul-Sep 2013AdityaKumarNo ratings yet

- Briefing The Yemen Conflict and CrisisDocument36 pagesBriefing The Yemen Conflict and CrisisFinlay AsherNo ratings yet

- Cost Management For Just-in-Time Environments: Financial and Managerial Accounting 8th Edition Warren Reeve FessDocument57 pagesCost Management For Just-in-Time Environments: Financial and Managerial Accounting 8th Edition Warren Reeve FessRETNO KURNIAWANNo ratings yet

- WebpdfDocument343 pagesWebpdfRahma AbdullahiNo ratings yet

- Erp Cloud Global CatalogDocument124 pagesErp Cloud Global Catalogmaha AhmedNo ratings yet

- Hospicio CaseDocument19 pagesHospicio CaseCserah Marl EnanoNo ratings yet

- Sarah BaartmanDocument6 pagesSarah Baartmanwebe789No ratings yet

- اسئلة استرشادية صوتيات قسم الترجمةDocument6 pagesاسئلة استرشادية صوتيات قسم الترجمةMasarra GhaithNo ratings yet

- All Hands Naval Bulletin - Nov 1942Document56 pagesAll Hands Naval Bulletin - Nov 1942CAP History Library0% (1)

- Labor dispute and illegal dismissal caseDocument5 pagesLabor dispute and illegal dismissal caseRene ValentosNo ratings yet

- Art of War-Chapter 5 (Analysis)Document3 pagesArt of War-Chapter 5 (Analysis)Kaye Sellyn Manabat GonzalesNo ratings yet

- Water Resources in TamilnaduDocument4 pagesWater Resources in TamilnaduVignesh AngelNo ratings yet

- Chhattisgarh Technical University Remuneration BillDocument10 pagesChhattisgarh Technical University Remuneration Billprincipal surajpurNo ratings yet

- SnowflakeDocument6 pagesSnowflakeDivya SrijuNo ratings yet

- PV Technologies Fights to Win Back Biggest ClientDocument33 pagesPV Technologies Fights to Win Back Biggest ClientFloyd Fernz100% (1)

- Asian Age Delhi 2023-11-27Document8 pagesAsian Age Delhi 2023-11-27Govind Mani BhattNo ratings yet

- CSS Fee Structure Table Must Set in System Based On CSS's Prakas - Current Year PDFDocument1 pageCSS Fee Structure Table Must Set in System Based On CSS's Prakas - Current Year PDFsimchandoeunNo ratings yet

- Malawi Economic Recovery PlanDocument21 pagesMalawi Economic Recovery PlanMalawi2014No ratings yet

- Shakespearean LanguageDocument52 pagesShakespearean LanguageBailey HarrisonNo ratings yet

- Sahara and Satyam ScamDocument13 pagesSahara and Satyam ScamJannavi SinghaNo ratings yet

- Labor Law Module 5Document11 pagesLabor Law Module 5dennis delrosarioNo ratings yet

- Mod Questions DiscordDocument2 pagesMod Questions Discordd00151852No ratings yet

- The Day Lodi Si Awọn Night View-yoruba-Gustav Theodor FechnerDocument182 pagesThe Day Lodi Si Awọn Night View-yoruba-Gustav Theodor Fechnergabriel brias buendiaNo ratings yet