Professional Documents

Culture Documents

Part Two: Matching

Uploaded by

Bereket MamoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Part Two: Matching

Uploaded by

Bereket MamoCopyright:

Available Formats

Mid Exam for Prepare Financial Report and Merchandising Business

Name: __________________________________________

Part I : Choose the best answer from the given alternatives

1. ___________ is the process of allocating to expense the cost of a plant asset over its

useful (service) life in a rational and systematic manner.

A. Depreciation B. Depletion C. Amortization D. All

2. Net Solutions sold merchandise on account for $18,000 terms of 2/10, n/30. What is the

discount?

A. 36 B. 30. C. 10 D. 360

3. If beginning inventory is $60,000, cost of goods purchased is $380,000, and ending

inventory is $50,000, cost of goods sold is:

A. $390,000 B. $330,000 C. $370,000 D. $420,000

4. Assume that equipment was purchased on January 1, 2011 as follows: initial cost $24,000

expected useful life 5 years estimated residual value $2,000. Compute the Accumulated

depreciation of equipment in December 31, 2011 by using DOUBLE DECLINE

BALANCE Method.

A. $ 4,400 B. $8,800 C. $9,600 D. $17,200

5. A company purchased a new truck at a cost of $42,000 on January 1, 2004. The truck is

estimated to have a useful life of 6 years and a salvage value of $3,000. Which of the

following will be included in the journal entry recorded on December 31, 2004?

A. Credit Depreciation Expense $6,500. B. Credit Accumulated Depreciation $3,250.

C. Debit Depreciation Expense $4,000. D. Credit Accumulated Depreciation $6,500.

Part Two: Matching

A B

1. Straight line A. Most accelerated depreciation

2. Units of productivity B. Measured solely by the passage of time

3. Double Declining Balance C. Depreciation cost per unit

4. Sum of The years digit D. Common denominator

5. Sales minus cost of goods sold E. Accumulated Depreciation

F. Annual depreciation expense

G. Net income

H. Gross Profit

Part Three: Work out

1. The following transactions were completed by Montrose Company during May of the

current year. Montrose Company uses a perpetual inventory system.

May 3. Purchased merchandise on account from Floyd Co.,$4,000,terms FOB

shipping point,2/10, n/30,with prepaid freight of $120added to the invoice.

May 5. Purchased merchandise on account from Kramer Co., $8,500, terms FOB

destination, 1/10, n/30.

6. Sold merchandise on account to C.F. Howell Co. with price of $4,000 terms 2/10,n/30.The

cost of the merchandise sold was $1,125.

8. Purchased office supplies for cash, $150.

10. Returned merchandise purchased on May 5 from Kramer Co., $1,300.

13. Paid Floyd Co. on account for purchase of May 3, less discount.

14. Purchased merchandise for cash, $10,500.

15. Paid Kramer Co. on account for purchase of May 5, less return of May 10 and discount.

16. Received cash on account from sale of May 6 to C. F. Howell Co., less discount.

19. Sold merchandise on MasterCard credit cards, $2,450. The cost of the merchandise sold was

$980.

22. Sold merchandise on account to Comer Co., $3,480, terms 2/10, n/30. The cost of the

merchandise sold was $1,400.

24. Sold merchandise for cash, $4,350. The cost of the merchandise sold was $1,750.

25. Received merchandise returned by Comer Co. from sale on May 22, $1,480. The cost of the

returned merchandise was $600.

31. Paid a service processing fee of $140 for MasterCard sales.

Instructions

1. Journalize each transaction in a two-column journal.

2. Based on the following data, determine the cost of merchandise sold for May.

Merchandise inventory, May 1 . . . . . . . . . . . . . . . . $121,200

Merchandise inventory, May 31 . . . . . . . . . . . . . . . 142,000

Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 985,000

Purchases returns and allowances . . . . . . . . . . . . . 23,500

Purchases discounts . . . . . . . . . . . . . . . . . . . . . . . . 21,000

Freight in….. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,300

You might also like

- Datril Case StudyDocument10 pagesDatril Case Studyrahul_pathak2393100% (1)

- Assignment 001: Fundamentals of Accounting/Answer KeyDocument65 pagesAssignment 001: Fundamentals of Accounting/Answer Keymoncarla lagon83% (6)

- Kimmel Weygandt Kieso Financial Accounting Chapter 9Document6 pagesKimmel Weygandt Kieso Financial Accounting Chapter 9Zenni T XinNo ratings yet

- Accounting UC3M Midterm Mock ExamDocument5 pagesAccounting UC3M Midterm Mock ExamInterecoNo ratings yet

- Quiz B Inventory Valuation Marks 05: Q: Choose The Best Answer For Each of The Following QuestionsDocument2 pagesQuiz B Inventory Valuation Marks 05: Q: Choose The Best Answer For Each of The Following QuestionsArjun LalwaniNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- DSF Ohada English VersionDocument44 pagesDSF Ohada English VersionNana Abdoulbagui100% (1)

- Harley-Davidson Case Study Explores Strategy and Global ReachDocument11 pagesHarley-Davidson Case Study Explores Strategy and Global ReachBao Ngoc NguyenNo ratings yet

- Forum ACC WM - Sesi 3 (REV)Document9 pagesForum ACC WM - Sesi 3 (REV)Windy Martaputri100% (2)

- Achievement Test 3.chapters 5&6Document9 pagesAchievement Test 3.chapters 5&6Quỳnh Vũ100% (1)

- Intermediate Accounting Practice HandoutsDocument8 pagesIntermediate Accounting Practice HandoutspolxrixNo ratings yet

- Fundamentals of AcctDocument5 pagesFundamentals of AcctAshenafiNo ratings yet

- FDNACCT LE2 ReviewerDocument5 pagesFDNACCT LE2 Reviewerclassic swagNo ratings yet

- True or False inventory accounting quizDocument5 pagesTrue or False inventory accounting quizYonas80% (5)

- Confram QuizDocument8 pagesConfram QuizCelestine MariNo ratings yet

- Tài chính Doanh Nghiệp / Corporate Finance Test 2Document9 pagesTài chính Doanh Nghiệp / Corporate Finance Test 2Tan NguyenNo ratings yet

- Chapter 4 5 6Document4 pagesChapter 4 5 6nguyen2190No ratings yet

- QuizDocument13 pagesQuizErlyNo ratings yet

- Accouting ExamDocument7 pagesAccouting ExamThien PhuNo ratings yet

- Assignment For Financial Accounting II Submit Before or On 10/10/2012 E.CDocument5 pagesAssignment For Financial Accounting II Submit Before or On 10/10/2012 E.CYewulsewYitbarekNo ratings yet

- luyện tập IFRSDocument6 pagesluyện tập IFRSÁnh Nguyễn Thị NgọcNo ratings yet

- SssssDocument7 pagesSssssMark Domingo MendozaNo ratings yet

- 1E Financial (Sat - 16-3-2024) - Final Ch.1Document11 pages1E Financial (Sat - 16-3-2024) - Final Ch.1ahmedNo ratings yet

- Activity 2: COST ACCOUNTING AND COST CONTROL (Select The Letter of The Best Answer)Document8 pagesActivity 2: COST ACCOUNTING AND COST CONTROL (Select The Letter of The Best Answer)kakimog738No ratings yet

- Final Principle of Accounting 1Document4 pagesFinal Principle of Accounting 1DeviSelenaNo ratings yet

- Acct CH.6Document12 pagesAcct CH.6j8noelNo ratings yet

- 33-Principles of Accounting I I - WorksheetDocument4 pages33-Principles of Accounting I I - WorksheetnatiNo ratings yet

- ACCT 210 - Introductory Financial Accounting I Assignment #3Document17 pagesACCT 210 - Introductory Financial Accounting I Assignment #3dleverNo ratings yet

- FoA II-Individual AssignmentDocument6 pagesFoA II-Individual Assignmentmedhane negaNo ratings yet

- Intermediate Assignment 1Document3 pagesIntermediate Assignment 1tilahuntsigewoldeNo ratings yet

- Intacc Q2Document4 pagesIntacc Q2Juliana Reign RuedaNo ratings yet

- Test Chapter 04-05Document3 pagesTest Chapter 04-05goharmahmood203No ratings yet

- Acca F2 MCQ Dec 2015 ExamsDocument12 pagesAcca F2 MCQ Dec 2015 ExamsAli Rizwan50% (2)

- REVIEWER - Basic MERCHANDISING Accounting2023Document9 pagesREVIEWER - Basic MERCHANDISING Accounting2023hello hayaNo ratings yet

- Act 310 Mid-2 MCQDocument67 pagesAct 310 Mid-2 MCQMd Al Alif Hossain 2121155630No ratings yet

- UntitledDocument9 pagesUntitledĐăng Nguyễn HảiNo ratings yet

- Trắc nghiệmDocument8 pagesTrắc nghiệmHồ Đan Thục0% (1)

- Financial Accounting Chapter 5 QuizDocument6 pagesFinancial Accounting Chapter 5 QuizZenni T XinNo ratings yet

- Workshop F3 May 2011 UpdatedDocument16 pagesWorkshop F3 May 2011 Updatedroukaiya_peerkhanNo ratings yet

- Problems Inter Acc1Document10 pagesProblems Inter Acc1Chau NguyenNo ratings yet

- Cost Accounting QuestionsDocument47 pagesCost Accounting QuestionsBea GarciaNo ratings yet

- Midterm Exam (No Answers) Accounting IDocument4 pagesMidterm Exam (No Answers) Accounting IJuan Carlos ManriqueNo ratings yet

- ACC112 Midterm RevisionDocument17 pagesACC112 Midterm Revisionhabdulla_2No ratings yet

- AIS 301 701 Practice Exam 3 Final VersionDocument16 pagesAIS 301 701 Practice Exam 3 Final VersionRafaelAlexandrianNo ratings yet

- Test SamplesDocument18 pagesTest SamplesDen NgNo ratings yet

- 會計學 (二) 第一次會考 1、 Multiple Choice:40%Document5 pages會計學 (二) 第一次會考 1、 Multiple Choice:40%ramNo ratings yet

- Financial Accounting Midterm ExamDocument4 pagesFinancial Accounting Midterm ExamMary Joy SumapidNo ratings yet

- Mac 101 1Document13 pagesMac 101 1RuvarasheNo ratings yet

- Revision For Midterm ExamDocument24 pagesRevision For Midterm ExamMinh Nguyen Thi HongNo ratings yet

- BSAMERCHANDISING2021Document5 pagesBSAMERCHANDISING2021Jean MaeNo ratings yet

- NtantDocument6 pagesNtantmahedreNo ratings yet

- CN09Document4 pagesCN09Phan Lê Anh ĐàoNo ratings yet

- Exercise 5Document7 pagesExercise 5Thai Anh HoNo ratings yet

- Finance Quiz 3Document3 pagesFinance Quiz 3jovanaNo ratings yet

- SF Comprehensive Quiz 1Document10 pagesSF Comprehensive Quiz 1Francis Raagas40% (5)

- ACCT_322_absorp_var_and_bgt (1)Document3 pagesACCT_322_absorp_var_and_bgt (1)gurnoorkaurgilllNo ratings yet

- Basic Accounting QuestionnaireDocument7 pagesBasic Accounting QuestionnaireSVTKhsiaNo ratings yet

- Multiple choice and accounting problemsDocument3 pagesMultiple choice and accounting problemssamuel debebeNo ratings yet

- Confram Q AnswerkeyDocument13 pagesConfram Q AnswerkeyCelestine MariNo ratings yet

- POA1-Assignment - Chapter 5 - QDocument5 pagesPOA1-Assignment - Chapter 5 - QAuora Bianca100% (1)

- (123doc) - Tai-Lieu-Accounting-Principles-Mid-Semester-Test PDFDocument4 pages(123doc) - Tai-Lieu-Accounting-Principles-Mid-Semester-Test PDFTrung HậuNo ratings yet

- ACCT 2251 Practice FinalDocument20 pagesACCT 2251 Practice FinalHạnhNekoNo ratings yet

- MBA Review Questions CH 8 & CH 10 Princ. Acc. IIDocument5 pagesMBA Review Questions CH 8 & CH 10 Princ. Acc. IIMirna Kassar100% (1)

- Itss 1Document1 pageItss 1Bereket MamoNo ratings yet

- Create Directory StructureDocument5 pagesCreate Directory StructureBereket MamoNo ratings yet

- Project:: InstructionDocument1 pageProject:: InstructionBereket MamoNo ratings yet

- Project:: InstructionDocument1 pageProject:: InstructionBereket MamoNo ratings yet

- Name - Id - No. - Sign. - : Project OneDocument2 pagesName - Id - No. - Sign. - : Project OneBereket MamoNo ratings yet

- Internal Exam Mettu: Questions ListDocument11 pagesInternal Exam Mettu: Questions ListBereket MamoNo ratings yet

- Advanced Programming Module (CoSc-M2081Document2 pagesAdvanced Programming Module (CoSc-M2081Bereket MamoNo ratings yet

- The Password Is Here: Http://tinybit - Cc/a3cd9fdbDocument1 pageThe Password Is Here: Http://tinybit - Cc/a3cd9fdbBereket MamoNo ratings yet

- Impact of Sales Promotions on Consumer Buying BehaviorDocument42 pagesImpact of Sales Promotions on Consumer Buying BehaviorabeeraNo ratings yet

- Competitive Analysis TableDocument3 pagesCompetitive Analysis Tableapi-301405860No ratings yet

- The Role of Financial System in The EconomyDocument15 pagesThe Role of Financial System in The Economymubarek100% (2)

- Value Chain Analysis and Indian Civil AviationDocument12 pagesValue Chain Analysis and Indian Civil AviationShailesh PatelNo ratings yet

- Salman Bhatti ResumeDocument3 pagesSalman Bhatti ResumeSalman BhattiNo ratings yet

- Nintendo Marketing StrategiesDocument8 pagesNintendo Marketing StrategieshumasNo ratings yet

- Emami ReportDocument43 pagesEmami ReportABHISHEK VERMANo ratings yet

- Rural Women Buying Behavior of Cooking Oil in IndiaDocument14 pagesRural Women Buying Behavior of Cooking Oil in Indiazoye1214No ratings yet

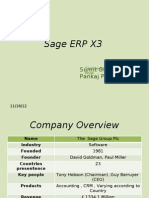

- Sage ERP X3 ModifiedDocument22 pagesSage ERP X3 ModifiedSumit GuptaNo ratings yet

- Laurent Verreault and GLV - Let's Dance!Document145 pagesLaurent Verreault and GLV - Let's Dance!AliNaqviNo ratings yet

- Coca Cola Market Share and Distribution ChannelDocument28 pagesCoca Cola Market Share and Distribution ChannelParminder SinghNo ratings yet

- Drug Reimportation: The Free Market Solution Cato Policy Analysis No. 521Document24 pagesDrug Reimportation: The Free Market Solution Cato Policy Analysis No. 521Cato InstituteNo ratings yet

- Pakistan Accumulators Marketing StrategyDocument6 pagesPakistan Accumulators Marketing StrategyHamza KhanNo ratings yet

- Pre Sales Consultant Australia Epsilon DEP 05022009Document3 pagesPre Sales Consultant Australia Epsilon DEP 05022009samNo ratings yet

- Cabrol Steel Cable DrumDocument44 pagesCabrol Steel Cable DrumHitesh ParmarNo ratings yet

- Appolo Tyre Price List 13 - 07Document9 pagesAppolo Tyre Price List 13 - 07Niamul HasanNo ratings yet

- GG Sportswear V World ClassDocument2 pagesGG Sportswear V World Classmaria_catapang_2No ratings yet

- 7 - Strategic AlliancesDocument4 pages7 - Strategic AlliancesFilipe100% (1)

- Coca Cola OSDocument51 pagesCoca Cola OSJoyal joseNo ratings yet

- VOCABULARY AND LANGUAGEDocument6 pagesVOCABULARY AND LANGUAGEMiran MilosNo ratings yet

- EBS Sales Force MGT Course: April 2007 This Presentation Is Best Viewed in Fullscreen-Press F5 Now..Document45 pagesEBS Sales Force MGT Course: April 2007 This Presentation Is Best Viewed in Fullscreen-Press F5 Now..walidNo ratings yet

- Working Capital ManagementDocument21 pagesWorking Capital ManagementAfzal Kabir Dipu100% (1)

- How Casinos Use CRM Technology to Improve Customer RelationsDocument10 pagesHow Casinos Use CRM Technology to Improve Customer RelationsEsteven D. Fulgar100% (1)

- Isabel Montalban: Work Experience SkillsDocument1 pageIsabel Montalban: Work Experience SkillsIsabel MontalbanNo ratings yet

- Advanced Analysis and Appraisal of PerformanceDocument12 pagesAdvanced Analysis and Appraisal of PerformanceGreghvon MatolNo ratings yet

- IKEA IT System Helps Furniture Retailing Yet Faces ChallengesDocument10 pagesIKEA IT System Helps Furniture Retailing Yet Faces ChallengesOranoot WangsukNo ratings yet

- Just DialDocument39 pagesJust DialJagannath Baranwal0% (1)