Professional Documents

Culture Documents

Interest On Drawings

Uploaded by

Welcome 1995Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interest On Drawings

Uploaded by

Welcome 1995Copyright:

Available Formats

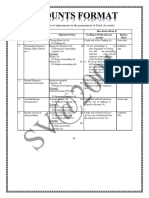

a) Interest on drawings

When the proprietor withdraws money from the business for personal use, it almost

amounts to temporary loan by the business to the proprietor. The adjustment entry is

Capital A/c Dr. xxx

To Interest on drawings A/c Xxx

b) Bad debts

When a claim against a debtor becomes irrecoverable, it is called bad debt.

The entry in the books of the creditor is:

Bad debts A/c Dr. xxx

To Debtor’s A/c Xxx

Bad debts is shown on the debit side of P & L A/c and also deducted from debtors in the

balance sheet.

c) Provision for discount on debtors

The provision for discount on debtors is calculated at a certain percentage on good

debtors. The adjustment entry is:

Profit & Loss A/c Dr. xxx

To Provision for discount on debtors A/c Xxx

The provision for discount on debtors is shown as a deduction from good debtors on the

asset side of balance sheet and is debited to profit &loss account.

d) Provision for discount on creditors

The creditors may offer some discount for prompt payment by the firm. This is calculated

at a certain percentage on sundry creditors. The adjustment entry is:

Provision for discount on creditors A/c Dr. xxx

To Profit & Loss A/c Xxx

The provision for discount on creditors is shown as a deduction from sundry creditors on

the liabilities side of balance sheet and is credited to P & L A/c.

e) Loss of stock by accident, fire etc.

Stock of goods destroyed due to abnormal causes must be treated as abnormal loss. If

there is no insurance the entire stock lost should be treated as abnormal loss. The entry is:

Abnormal loss A/c Dr. xxx

To Trading A/c Xxx

Since there will be no recovery, the abnormal loss has to be closed.

Profit & Loss A/c Dr. xxx

To Abnormal loss A/c Xxx

If there is insurance, amount recoverable from insurance co., has to be debited to

insurance company and the balance of abnormal loss is written off to P & L A/c

Profit & loss A/c Dr. Xxx

Insurance company A/c Dr.

To Abnormal loss A/c Xxx

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Chapter 17 Capital Structure-TestbankDocument12 pagesChapter 17 Capital Structure-TestbankLâm Thanh Huyền NguyễnNo ratings yet

- Brain Breaks: Animal WalksDocument6 pagesBrain Breaks: Animal WalksMárcia DiasNo ratings yet

- INS21MOCQDocument37 pagesINS21MOCQcriespin0% (1)

- Nutrition Through-Out Lifespan (Infancy)Document37 pagesNutrition Through-Out Lifespan (Infancy)Vincent Maralit MaterialNo ratings yet

- SYNERGY Fake Job Offer LetterDocument5 pagesSYNERGY Fake Job Offer LetterSyed's Way PoolNo ratings yet

- Manufacturing Process of Plastic BottlesDocument19 pagesManufacturing Process of Plastic BottlesAparna Samuel87% (23)

- ISO 27001 Controls - Audit ChecklistDocument9 pagesISO 27001 Controls - Audit ChecklistpauloNo ratings yet

- AccountingDocument26 pagesAccountingMuhammad Jaafar AbinalNo ratings yet

- Nursing Care Plan: Chronic Pain and COPDDocument11 pagesNursing Care Plan: Chronic Pain and COPDneuronurse100% (1)

- Module Tests: Expert PTEA Testmaster B2 Answer KeyDocument5 pagesModule Tests: Expert PTEA Testmaster B2 Answer KeyRyan MathProNo ratings yet

- Depreciation of AssetDocument2 pagesDepreciation of AssetWelcome 1995No ratings yet

- Cost Accounting Unit 3 BBA (B&I) GGSIPUDocument10 pagesCost Accounting Unit 3 BBA (B&I) GGSIPUAkshansh Singh ChaudharyNo ratings yet

- Retirement or Death of Partner NewDocument5 pagesRetirement or Death of Partner NewAnkit Roy100% (1)

- CH 01 Accounting For Partnership - Basic ConceptsDocument11 pagesCH 01 Accounting For Partnership - Basic ConceptsMahathi AmudhanNo ratings yet

- CH - 04 Dissolution of Partnership FirmDocument10 pagesCH - 04 Dissolution of Partnership FirmMahathi AmudhanNo ratings yet

- AdjustmentsDocument3 pagesAdjustmentsapi-417927166No ratings yet

- Unit 1 Amalgamation of Companies-Accounting TreatmentDocument7 pagesUnit 1 Amalgamation of Companies-Accounting Treatmentmadhushree madhushreeNo ratings yet

- Entries and Adjustments in Different Books of AccountsDocument34 pagesEntries and Adjustments in Different Books of AccountsSHEKHAR SUMITNo ratings yet

- Ins NewDocument59 pagesIns NewcoolashhNo ratings yet

- Final-Accounts-Q - A P&L ACCDocument31 pagesFinal-Accounts-Q - A P&L ACCNikhil PrasannaNo ratings yet

- FORMATDocument10 pagesFORMATShreeram vikiNo ratings yet

- Abhinav Adjustment HardDocument5 pagesAbhinav Adjustment HardakashNo ratings yet

- 20 Admission of PartnerDocument12 pages20 Admission of PartnerNadeem Manzoor100% (1)

- Dissolution of Partnership FirmDocument28 pagesDissolution of Partnership FirmMohammad Tariq AnsariNo ratings yet

- Final Account Adjusment EntryDocument1 pageFinal Account Adjusment Entrykhanpur88822No ratings yet

- AdjustmentDocument8 pagesAdjustmentBibin SavioNo ratings yet

- 2 Final Accounts - Sole Proprietor - Format - AdjustmentsDocument14 pages2 Final Accounts - Sole Proprietor - Format - AdjustmentsSudha Agarwal100% (1)

- Non Proportional TreatiesDocument23 pagesNon Proportional TreatiesKhushboo Balani100% (1)

- Underwriting of Shares and DebenturesDocument5 pagesUnderwriting of Shares and Debenturesharsh singhNo ratings yet

- Corrected File Unit 2 Final AccountDocument19 pagesCorrected File Unit 2 Final AccountUtkarsh SharmaNo ratings yet

- Final AccountsDocument61 pagesFinal AccountsvimalaNo ratings yet

- ALL JOURNAL ENTRIES - CMA-Executive-RevisionDocument13 pagesALL JOURNAL ENTRIES - CMA-Executive-RevisionRevanthi DNo ratings yet

- CHAPTER 4casecDocument3 pagesCHAPTER 4casecArgen GrzesiekNo ratings yet

- Advanced Accounting Intellect - I UNIT-1Document12 pagesAdvanced Accounting Intellect - I UNIT-1DeepeshNo ratings yet

- Submitted By: Varuchi Malhotra, Kartik, Anup Submitted To: Mrs Pooja PurohitDocument23 pagesSubmitted By: Varuchi Malhotra, Kartik, Anup Submitted To: Mrs Pooja Purohit22rikearthNo ratings yet

- Redemption of Debentures: Debenture Redemption Reserve (D.R.R)Document4 pagesRedemption of Debentures: Debenture Redemption Reserve (D.R.R)binuNo ratings yet

- Irrecoverable Debts and Allowances For ReceivablesDocument20 pagesIrrecoverable Debts and Allowances For ReceivablesShayan KhanNo ratings yet

- Underwriting of Shares and Debentures: As Per Sebi Guidelines 14 (4) (B)Document9 pagesUnderwriting of Shares and Debentures: As Per Sebi Guidelines 14 (4) (B)harsh singhNo ratings yet

- Acquisition of BusinessDocument14 pagesAcquisition of BusinessTholai Nokku [ தொலை நோக்கு ]No ratings yet

- Final AccountsDocument9 pagesFinal AccountsRositaNo ratings yet

- Unit 3 Insurance Theory FinalDocument6 pagesUnit 3 Insurance Theory Finalthella deva prasadNo ratings yet

- Final AccountsDocument13 pagesFinal AccountsRahul NegiNo ratings yet

- Company Accounts - Issue of DebenturesDocument11 pagesCompany Accounts - Issue of DebenturesHarsh MishraNo ratings yet

- Chapter 21Document10 pagesChapter 21soniadhingra1805No ratings yet

- Notes For Students Amalgamation 1Document3 pagesNotes For Students Amalgamation 1vanvunNo ratings yet

- Balance Sheet AdjustmentsDocument2 pagesBalance Sheet AdjustmentsVijay DangwaniNo ratings yet

- Re InsuranceDocument61 pagesRe InsurancebsrinivasllbNo ratings yet

- Accounts For Insurance Company Chapter 2Document3 pagesAccounts For Insurance Company Chapter 2Anmol poudelNo ratings yet

- Microsoft PowerPoint - PL & BS (Compatibility Mode)Document30 pagesMicrosoft PowerPoint - PL & BS (Compatibility Mode)Riyasat khanNo ratings yet

- Final RMDocument7 pagesFinal RMKim LiênNo ratings yet

- Amalgamation, Conversion & Sale of Partnership FirmDocument141 pagesAmalgamation, Conversion & Sale of Partnership FirmdhruvrohatgiNo ratings yet

- CMA Part 1 Unit 2 (2021)Document116 pagesCMA Part 1 Unit 2 (2021)athul16203682No ratings yet

- C5 Estimation of Doubtful AcccountsDocument17 pagesC5 Estimation of Doubtful AcccountsKenzel lawasNo ratings yet

- Dipendra Giri B2 (Smile Please) : Cash A/c....... Dr. To Bad Debts Recovered A/cDocument1 pageDipendra Giri B2 (Smile Please) : Cash A/c....... Dr. To Bad Debts Recovered A/cDipendra GiriNo ratings yet

- Dear Students, Good MorningDocument11 pagesDear Students, Good Morningtara nath acharyaNo ratings yet

- Test Bank 4Document5 pagesTest Bank 4Jinx Cyrus RodilloNo ratings yet

- Amalgamation & AbsorptionDocument11 pagesAmalgamation & AbsorptionSubhra DasNo ratings yet

- PL and BSDocument30 pagesPL and BSAdefolajuwon ShoberuNo ratings yet

- Dissolution of Partnership FirmDocument17 pagesDissolution of Partnership FirmRenu Bala JainNo ratings yet

- Unit 5Document37 pagesUnit 5Rej HaanNo ratings yet

- CMAINTER SelfBalLedgDocument13 pagesCMAINTER SelfBalLedgnobi85804No ratings yet

- Ajustment For Final AccountsDocument9 pagesAjustment For Final AccountsTimi DeleNo ratings yet

- 37 19 Branch Accounts Theory ProblemsDocument19 pages37 19 Branch Accounts Theory Problemsemmanuel Johny100% (2)

- Accounts Full ConceptsDocument91 pagesAccounts Full ConceptsAnmol BehalNo ratings yet

- Debentures Bonds and TFCsDocument15 pagesDebentures Bonds and TFCsRaheel FareedNo ratings yet

- Transaction Value of Identical GoodsDocument1 pageTransaction Value of Identical GoodsWelcome 1995No ratings yet

- Prohibition and Regulation of Drawback in Certain CasesDocument1 pageProhibition and Regulation of Drawback in Certain CasesWelcome 1995No ratings yet

- Powers of Customs OfficernDocument1 pagePowers of Customs OfficernWelcome 1995No ratings yet

- Transaction Value of Identical GoodsDocument1 pageTransaction Value of Identical GoodsWelcome 1995No ratings yet

- Drawback Allowable On ReDocument1 pageDrawback Allowable On ReWelcome 1995No ratings yet

- Permission For Deposit of Goods in A Warehouse UnderDocument1 pagePermission For Deposit of Goods in A Warehouse UnderWelcome 1995No ratings yet

- Clearance of Goods For Home ConsumptionDocument1 pageClearance of Goods For Home ConsumptionWelcome 1995No ratings yet

- Rate of Duty and Tariff ValuationDocument1 pageRate of Duty and Tariff ValuationWelcome 1995No ratings yet

- Transaction Value of Identical GoodsDocument1 pageTransaction Value of Identical GoodsWelcome 1995No ratings yet

- Exemption by Special OrderDocument1 pageExemption by Special OrderWelcome 1995No ratings yet

- Transaction Value of Identical GoodsDocument1 pageTransaction Value of Identical GoodsWelcome 1995No ratings yet

- Different Types of Customs Dutie1Document1 pageDifferent Types of Customs Dutie1Welcome 1995No ratings yet

- Valuation of Goods Under Customs ActDocument1 pageValuation of Goods Under Customs ActWelcome 1995No ratings yet

- Transaction Value of Similar GoodsDocument1 pageTransaction Value of Similar GoodsWelcome 1995No ratings yet

- Deductive Value MethodDocument1 pageDeductive Value MethodWelcome 1995No ratings yet

- Residual MethodDocument1 pageResidual MethodWelcome 1995No ratings yet

- Product Not Covered SR - No Classification Description of GoodsDocument2 pagesProduct Not Covered SR - No Classification Description of GoodsWelcome 1995No ratings yet

- Simply Put - ENT NOSE LECTURESDocument38 pagesSimply Put - ENT NOSE LECTURESCedric KyekyeNo ratings yet

- History of Co-Operative Credit Society in IndiaDocument14 pagesHistory of Co-Operative Credit Society in IndiaTerry YanamNo ratings yet

- Grade 5 Health Most Essential Learning Competencies MELCsDocument6 pagesGrade 5 Health Most Essential Learning Competencies MELCsSaldi VitorilloNo ratings yet

- Vendor PerformanceDocument38 pagesVendor PerformanceManojNo ratings yet

- Food WebDocument12 pagesFood WebShaurya ChauhanNo ratings yet

- Journal of Drug Delivery Science and TechnologyDocument11 pagesJournal of Drug Delivery Science and TechnologyNguyen PhuongNo ratings yet

- ScoliosisDocument3 pagesScoliosisTracy100% (1)

- 3rd - Sem-Ct-23-Chemical EngineeringDocument3 pages3rd - Sem-Ct-23-Chemical EngineeringJay RanjanNo ratings yet

- Nadca 13 Acrbooklet Revised - 5 8 2013Document36 pagesNadca 13 Acrbooklet Revised - 5 8 2013EMP KFMNo ratings yet

- Bipolar Disorder - Case studyTSAD2015Document37 pagesBipolar Disorder - Case studyTSAD2015Eldruga PabloNo ratings yet

- Pregnancy in Dental TreatmentDocument62 pagesPregnancy in Dental TreatmentChinar HawramyNo ratings yet

- Review On Metallization Approaches For High-Efficiency Silicon Heterojunction Solar CellsDocument16 pagesReview On Metallization Approaches For High-Efficiency Silicon Heterojunction Solar Cells蕭佩杰No ratings yet

- 20mpe18 Aeor Assignment 3Document9 pages20mpe18 Aeor Assignment 3Shrinath JaniNo ratings yet

- DRR Accomplishment ReportDocument12 pagesDRR Accomplishment ReportSandra EsparteroNo ratings yet

- DP27, DP27E, DP27R and DP27Y Pilot Operated Pressure Reducing ValvesDocument36 pagesDP27, DP27E, DP27R and DP27Y Pilot Operated Pressure Reducing ValvesAntonio FedatoNo ratings yet

- Kottak14e PPT ch03Document37 pagesKottak14e PPT ch03MMC BSEDNo ratings yet

- Sa Bref 0505Document469 pagesSa Bref 0505tc5440No ratings yet

- Selecting Employees: Publishing As Prentice Hall 1Document55 pagesSelecting Employees: Publishing As Prentice Hall 1Waisuddin KarimiNo ratings yet

- Neki-Dent KATALOGU FINAL - CompressedDocument73 pagesNeki-Dent KATALOGU FINAL - CompressedStefan PutnikNo ratings yet

- Hildegard PeplauDocument7 pagesHildegard PeplauCarmenchuParraNo ratings yet

- Waxman Et Al., 2004: AnalysisDocument2 pagesWaxman Et Al., 2004: AnalysisAmanodin E. TambakNo ratings yet

- System 4 Med G 7831 - PG 85362Document76 pagesSystem 4 Med G 7831 - PG 85362jerimiah_manzonNo ratings yet

- in This Photograph, The Issue or Problem Depicted Is That We Became The Slaves of Science andDocument1 pagein This Photograph, The Issue or Problem Depicted Is That We Became The Slaves of Science andClarisse Angela Postre50% (2)