Professional Documents

Culture Documents

Insurance Industry Value Chain Analysis

Insurance Industry Value Chain Analysis

Uploaded by

ish juneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Industry Value Chain Analysis

Insurance Industry Value Chain Analysis

Uploaded by

ish juneCopyright:

Available Formats

Company Infrastructure (Finance, IT and Risk Management)

Human Resource Management

Risk Management

Corporate Governance

Product Development,

Policy Administration Claims/Benefits Asset

Underwriting and Marketing and Sales

and Servicing Management Management

Pricing

Step 1: Primary Activities

Product Development, Underwriting

Policy Administration Claims/Benefits Asset

and Marketing and Sales

and Servicing Management Management

Pricing

Step 2: Cost and Importance

Product Development,

Policy Administration Claims/Benefits

Underwriting and Marketing and Sales Asset Management

and Servicing Management

Pricing

cost to develop a product; transaction processing cost; Adjudicate claims; claims Transaction costs; portfolio

Market research costs, Advertising fees, commissions customer service cost (i.e. review costs (ie salaries of manager/ analysts fee (i.e.

underwritng & actuarial fees salaries or outsourcing fees ) claims analysts, clerk etc) salaries or professional fee)

Mid Importance Mid Importance High Importance High Importance High Importance

Step 3: Cost Drivers

Product Development,

Policy Administration Claims/Benefits

Underwriting and Marketing and Sales Asset Management

and Servicing Management

Pricing

No. and complexity of product no. of sales agents, no. of New policy volume; no. of

no. of investment

proposals; no. of actuarial campaigns (print, broadcast, new applications; no. of

no. of claims transactions; no. of reports

engagements; project/ outdoor , digital); no. of policies issued; no. of phone

and analysis

research hours prospective clients calls;

Step 4: Link Between Activities

Product Development,

Policy Administration Claims/Benefits

Underwriting and Marketing and Sales Asset Management

and Servicing Management

Pricing

With the increase in the no. of

With increasing no. of

claims, the company should

The higher the viability of a application and new policies,

With extensive marketing and make sure that funds are

new product developed, the the more administrative

sales effort, the more new placed in a profitable

more marketing effort to be transactions requiring

applications and new polocies investment. Hence, this

exerted and the more customer service and also the

to be issued requires, proper asset

knowledgeable agents needed no. of claims may also

management, risk

increase

management and reinsurance.

Step 5: Opportunities for Reducing Costs

Product Development,

Policy Administration Claims/Benefits

Underwriting and Marketing and Sales Asset Management

and Servicing Management

Pricing

Design apps or models help to

predict the effectiveness

Business intelligence for CRM affecting product of the portfolio in different

Leverage RPA to assign a ‘robot’ to do repetitive task while

development and Marketing and sales (this includes customer established economical

process owners can focus on their responsibilities and analyze

profitability analysis, customer life time value, customer scenarios

special process cases

segmentation, and campaign and cross-selling analysis etc.) as well as the future need of

the insurer for

working capital.

Digital insurance

Multidimensional OLAP

simplifying collective and analysis for

other report elaboration with the claims data analysis

detailed and aggregated data, according to customer

to shorten the response time segments or geographical

for client inquiry factors in order to estimate

future claims more accurately

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- PeachTree Securities (B-2) FINALDocument45 pagesPeachTree Securities (B-2) FINALish june100% (1)

- Robert Montoya Case LearningsDocument4 pagesRobert Montoya Case Learningsish juneNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Case-Astra ZenecaDocument20 pagesCase-Astra Zenecaish june100% (1)

- Result Gazette HSSC II A 2018Document861 pagesResult Gazette HSSC II A 2018Muhammad MumtazNo ratings yet

- Insurance Industry Balance ScorecardDocument6 pagesInsurance Industry Balance Scorecardish june100% (1)

- Volunteer Exercise Chapter 12 Harry's Car WashDocument1 pageVolunteer Exercise Chapter 12 Harry's Car Washish juneNo ratings yet

- Peachtree Securities Inc. (A) Answers - Irish JuneDocument8 pagesPeachtree Securities Inc. (A) Answers - Irish Juneish juneNo ratings yet

- Mole Concept Lesson PlanDocument4 pagesMole Concept Lesson PlanJhezreel John100% (3)

- Week 5 EntrepreneurshipDocument10 pagesWeek 5 EntrepreneurshipSuperHero ForFun100% (6)

- Strategic PlanningDocument47 pagesStrategic Planningish june100% (6)

- People As Priority. The Government's Function Is To Promote The General WelfareDocument2 pagesPeople As Priority. The Government's Function Is To Promote The General Welfareish juneNo ratings yet

- CSR Proposal v1Document14 pagesCSR Proposal v1ish june100% (1)

- FireWire SurfboardsDocument10 pagesFireWire Surfboardsish juneNo ratings yet

- Case 1. Kelso Toy ManufacturingDocument3 pagesCase 1. Kelso Toy Manufacturingish juneNo ratings yet

- HUMRES - Job Posting AnalysisDocument2 pagesHUMRES - Job Posting Analysisish juneNo ratings yet

- Hydro Skimming Margins Vs Cracking MarginsDocument78 pagesHydro Skimming Margins Vs Cracking MarginsWon Jang100% (1)

- PT 6.3 Business StrategiesDocument6 pagesPT 6.3 Business StrategiesPaula de TorresNo ratings yet

- Ns Unit 3Document36 pagesNs Unit 3sharath_rakkiNo ratings yet

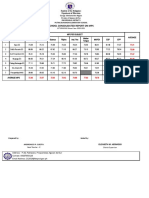

- School Consolidated Report On MPS: Puting Buhangin Elementary SchoolDocument14 pagesSchool Consolidated Report On MPS: Puting Buhangin Elementary SchoolVince Michael YtangNo ratings yet

- TestDocument13 pagesTestmani kandanNo ratings yet

- CLE-ESP-CM GR, 7 EditDocument17 pagesCLE-ESP-CM GR, 7 Editjonalyn obinaNo ratings yet

- DBMS Unit-8 9Document67 pagesDBMS Unit-8 9hetmovaliya0010No ratings yet

- In Uence of Type of Loading (Tension or Bending) On Cracking Behaviour of Reinforced Concrete Elements. Experimental StudyDocument26 pagesIn Uence of Type of Loading (Tension or Bending) On Cracking Behaviour of Reinforced Concrete Elements. Experimental Studydmt7nzztcmNo ratings yet

- Aa Educ 55 Chapter 7-8Document2 pagesAa Educ 55 Chapter 7-8Noel OrsalNo ratings yet

- BSC6900 GSM Initial Integration Procedure (V900R013C00 - 04)Document172 pagesBSC6900 GSM Initial Integration Procedure (V900R013C00 - 04)touaiti2009100% (1)

- HabibDocument92 pagesHabibalsanendiaye257No ratings yet

- The Good EggDocument6 pagesThe Good EggMichael BataanNo ratings yet

- Using The Netkey Utility For Managing Csi Network LicensesDocument7 pagesUsing The Netkey Utility For Managing Csi Network Licensesthanzawtun1981No ratings yet

- MOdule 4 Unders CulDocument2 pagesMOdule 4 Unders CulQuinto Grace IreneNo ratings yet

- Certificate Program in Lean Six Sigma: by - Paresh Kariya B.E. (Mech), MBA. Ph.D. Six Sigma, FIVDocument75 pagesCertificate Program in Lean Six Sigma: by - Paresh Kariya B.E. (Mech), MBA. Ph.D. Six Sigma, FIVBhargav Ka.PatelNo ratings yet

- AC410Document1 pageAC410P Singh KarkiNo ratings yet

- IGCSE - 2nd - Sample EssayDocument4 pagesIGCSE - 2nd - Sample EssayJake ParkNo ratings yet

- Manual Viscosimetro OfiteDocument24 pagesManual Viscosimetro OfitejulioNo ratings yet

- Detroit Diesel Catalog 2009Document72 pagesDetroit Diesel Catalog 2009rcervantes1883100% (2)

- Assessment 2Document14 pagesAssessment 2api-297389221No ratings yet

- Project Camelot Barcelona Exopolitics Speakers Panel On Disclosure - Part 1 of 2Document30 pagesProject Camelot Barcelona Exopolitics Speakers Panel On Disclosure - Part 1 of 2Christian UFO Illuminati100% (1)

- 318-Article Text-588-1-10-20210322Document9 pages318-Article Text-588-1-10-20210322aliya kinantiNo ratings yet

- ATTACKING DEFENDING 1v1Document1 pageATTACKING DEFENDING 1v1Martin WeiNo ratings yet

- Building Tech Current TrendsDocument30 pagesBuilding Tech Current TrendsMariane CadizNo ratings yet

- PRESS RELEASE Babylon Whore Mother of ProstitutesDocument6 pagesPRESS RELEASE Babylon Whore Mother of ProstitutesMichael MeadeNo ratings yet

- Avataras or Incarnations of Lord Visnhu: MatsyavataraDocument6 pagesAvataras or Incarnations of Lord Visnhu: MatsyavataraMeda ParmikoNo ratings yet

- Lesson Plan Formats For The Multi-Grade Classroom SettingDocument6 pagesLesson Plan Formats For The Multi-Grade Classroom SettingKenisha CalNo ratings yet