Professional Documents

Culture Documents

Al SYMLIFE #9 - Part5

Uploaded by

Cf DoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Al SYMLIFE #9 - Part5

Uploaded by

Cf DoyCopyright:

Available Formats

SYMPHONY LIFE (SYMLIFE-KU)

Real Estate / Real Estate Operations / Real Estate Rental & Dev. DETAILED STOCK REPORT

Report Date: 17 May 2020

FUNDAMENTAL

NEGATIVE OUTLOOK: Weak fundamentals Fundamental Score Averages

such as low profit margins, high debt levels, or Real Estate Operations Group: 5.0 Small Market Cap: 5.2

falling dividends. Real Estate Sector: 5.1 FBM KLCI Index: 6.0

Q2 Q3 Q4 Q1

Fundamental Score Trend Peers 2019 2019 2019 2020 Current 3Y Trend

BREM 7 7 7 NR 10

Positive

OIB 7 7 8 NR 7

Neutral TAMBUN 8 8 8 NR 5

Negative GLOMAC 2 2 2 NR 2

Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 SYMLIFE 2 6 5 NR 2

2017 2018 2019

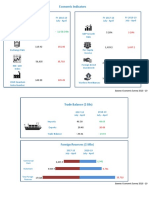

FUNDAMENTAL INDICATORS

Profitability Debt Earnings Quality Dividend

(25% weight) (25% weight) (25% weight) (25% weight)

BREM

SYMLIF… BREM

BREM

OIB OIB

TAMBU…

TAMBU…

GLOMA… TAMBU… GLOMA…

GLOMA…

BREM

OIB

OIB

GLOMA… SYMLIF…

SYMLIF…

SYMLIF…

TAMBU…

Revenue Growth 57.4% Current Ratio 2.4 Oper. Cash Yield -63.6% Dividend Growth -100.0%

For year over year For interim period For latest 12 months For year over year

ending 12-2019 ending 12-2019 ending 12-2019 ending 12-2018

Gross Margin 16.8% Debt-to-Capital 29.8% Accruals 13.9% Dividend Payout 5.8%

For latest 12 months For annual period For latest 12 months For latest 12 months

ending 12-2019 ending 03-2019 ending 03-2019 ending 12-2019

Return On Equity 12.7% Interest Funding 83.3% Days Sales In Inv. 1080.7 Dividend Coverage -3.6

For interim period For interim period For annual period For annual period

ending 12-2019 ending 06-2019 ending 03-2019 ending 03-2018

Net Margin 41.7% Interest Coverage 1.5 Days Sales In Rec. 346.2 Current Div. Yield 2.6%

For latest 12 months For interim period For annual period For latest 12 months

ending 12-2019 ending 12-2019 ending 03-2019 ending 05-2020

HIGHLIGHTS

- The Fundamental Rating for Symphony Life declined significantly over - The company's days sales in inventory has been higher than its

the last quarter from 6 to 2. The current rating is considerably more industry group average for each of the past five years.

bearish than the Real Estate Operations industry group average of - Of the 86 firms within the Real Estate Operations industry group,

5.0. Symphony Life is among 40 companies that pay a dividend. The

- SYMLIFE's gross margin of 16.8% is substantially below the Real stock's dividend yield is currently 2.6%.

Estate Operations industry group average of 29.4%.

- The company's debt-to-capital has been higher than its industry group

average for each of the past five years.

Page 5 of 11

© 2020 Refinitiv. All rights reserved.

You might also like

- Al SYMLIFE #9 - Part8Document1 pageAl SYMLIFE #9 - Part8Cf DoyNo ratings yet

- Cosmic Subsidiary Presentation (Case Study Solution)Document3 pagesCosmic Subsidiary Presentation (Case Study Solution)Fakz OlaNo ratings yet

- AI YLI #1 - Part5Document1 pageAI YLI #1 - Part5Cf DoyNo ratings yet

- Coca-Cola HBC 2019 IAR Performance 19mar2020Document4 pagesCoca-Cola HBC 2019 IAR Performance 19mar2020neferty valderrama sandovalNo ratings yet

- Tracking Our Progress: Leverage Our Win in The UNIQUE 24/7 Marketplace PortfolioDocument8 pagesTracking Our Progress: Leverage Our Win in The UNIQUE 24/7 Marketplace PortfolioMihaiNo ratings yet

- Average Score: Symphony Life (Symlife-Ku)Document1 pageAverage Score: Symphony Life (Symlife-Ku)Cf DoyNo ratings yet

- SBI Annual-Report 19-20 10727Document396 pagesSBI Annual-Report 19-20 10727gauravkrastogiNo ratings yet

- Tugas Kelompok - MKUG - TBIGDocument12 pagesTugas Kelompok - MKUG - TBIGSedih BerasaNo ratings yet

- No Financial Indicators Formula Weight Score Year Final Score ScoreDocument2 pagesNo Financial Indicators Formula Weight Score Year Final Score ScoreAndi WibowoNo ratings yet

- Results-Presentation 2019Document32 pagesResults-Presentation 2019Shahin AlamNo ratings yet

- Gabriel IndiaDocument137 pagesGabriel IndiaIshaan MakkerNo ratings yet

- HDFC Life Presentation - Q1 FY21 FinalDocument59 pagesHDFC Life Presentation - Q1 FY21 FinaljhopadlpNo ratings yet

- VLL RENTAL ESTIMATE RAISED, SALES FORECAST CUTDocument4 pagesVLL RENTAL ESTIMATE RAISED, SALES FORECAST CUTJajahinaNo ratings yet

- Investment Research: Fundamental Coverage-Gm Breweries LTDDocument7 pagesInvestment Research: Fundamental Coverage-Gm Breweries LTDkishore13No ratings yet

- Kantar_Worldpanel_-_FMCG_Monitor_August_2017_-_ENDocument9 pagesKantar_Worldpanel_-_FMCG_Monitor_August_2017_-_ENtinadang12796No ratings yet

- Viacom Reports Second Quarter Results: Statement From Bob Bakish, President & CeoDocument14 pagesViacom Reports Second Quarter Results: Statement From Bob Bakish, President & CeoNickALiveNo ratings yet

- PMS Guide August 2019Document88 pagesPMS Guide August 2019HetanshNo ratings yet

- 2017 Profits of Most Companies Missed Expectations: Slow and Below Expected Earnings GrowthDocument9 pages2017 Profits of Most Companies Missed Expectations: Slow and Below Expected Earnings GrowthJM CrNo ratings yet

- Reducing FV Estimate On A More Conservative Outlook: Bloomberry Resorts CorporationDocument10 pagesReducing FV Estimate On A More Conservative Outlook: Bloomberry Resorts CorporationJajahinaNo ratings yet

- Vietnam FMCG Market Update Shows Slight Slowdown in Urban Areas But Growth in RuralDocument9 pagesVietnam FMCG Market Update Shows Slight Slowdown in Urban Areas But Growth in RuralCuong Chi HuyenNo ratings yet

- Alibaba Sept Q2017Document18 pagesAlibaba Sept Q2017free meNo ratings yet

- Financial Analysis of Asian PaintsDocument7 pagesFinancial Analysis of Asian PaintsMONIKA YADAVNo ratings yet

- Financial Analysis Reveals Asian Paints' Strong GrowthDocument7 pagesFinancial Analysis Reveals Asian Paints' Strong GrowthRohit SinghNo ratings yet

- Highlights of Annual Report and Comparative AnalysisDocument13 pagesHighlights of Annual Report and Comparative AnalysisAlina KujurNo ratings yet

- IRM Approaches of Operational Risk Capital Charge EstimationDocument50 pagesIRM Approaches of Operational Risk Capital Charge EstimationPrabhat SinghNo ratings yet

- Radico Khaitan Ltd. Earnings Presentation: Q4 and Full Year FY2020Document23 pagesRadico Khaitan Ltd. Earnings Presentation: Q4 and Full Year FY2020UmangNo ratings yet

- IP June 17Document31 pagesIP June 17tarun lahotiNo ratings yet

- 2016 SMIC Annual ReportDocument120 pages2016 SMIC Annual ReportPatricia ReyesNo ratings yet

- IGB REIT Case Study AnalysisDocument7 pagesIGB REIT Case Study AnalysisPau Choon HockNo ratings yet

- Economic Indicators of PakistanDocument4 pagesEconomic Indicators of PakistanhellosaadyNo ratings yet

- Investment Objective Historical Performance: Philam Fund, IncDocument1 pageInvestment Objective Historical Performance: Philam Fund, IncWeas ChuckNo ratings yet

- 2019 Q1 CushWake Jakarta IndustrialDocument2 pages2019 Q1 CushWake Jakarta IndustrialCookiesNo ratings yet

- Realigning Estimate On Stronger Than Expected Mass Market: Bloomberry Resorts CorporationDocument8 pagesRealigning Estimate On Stronger Than Expected Mass Market: Bloomberry Resorts CorporationJajahinaNo ratings yet

- Study Id117047 Nbfcs in IndiaDocument14 pagesStudy Id117047 Nbfcs in IndiaankitNo ratings yet

- Zambian Breweries Research Report - Avior Capital MarketsDocument24 pagesZambian Breweries Research Report - Avior Capital MarketsCHRISTIANNo ratings yet

- HTHB KLDocument7 pagesHTHB KLypNo ratings yet

- Simbhaoli Sugars LTD.: Stakeholders Empowerment ServicesDocument9 pagesSimbhaoli Sugars LTD.: Stakeholders Empowerment ServicesvishalNo ratings yet

- Simbhaoli Sugars LTD.: Stakeholders Empowerment ServicesDocument9 pagesSimbhaoli Sugars LTD.: Stakeholders Empowerment ServicesvishalNo ratings yet

- Fibank Albania Annual Report 2019 083685f7fdDocument141 pagesFibank Albania Annual Report 2019 083685f7fdKarolina MusagalliuNo ratings yet

- Alibaba Dec Q2020Document15 pagesAlibaba Dec Q2020free meNo ratings yet

- Financial Management (1) (8818)Document22 pagesFinancial Management (1) (8818)georgeNo ratings yet

- Earnings and GDP Drive PCOMP Higher: Week in ReviewDocument2 pagesEarnings and GDP Drive PCOMP Higher: Week in ReviewAhwen 'ahwenism'No ratings yet

- March Quarter 2019 LIC Market UpdateDocument88 pagesMarch Quarter 2019 LIC Market Updateleh.mo9315No ratings yet

- Company: Apple, Inc. Ticker: Aapl Date: 7/31/2018Document14 pagesCompany: Apple, Inc. Ticker: Aapl Date: 7/31/2018januarNo ratings yet

- Group Assignment FIN 410 - Group #3Document22 pagesGroup Assignment FIN 410 - Group #3ShahikNo ratings yet

- Financial Statement AnalysisDocument23 pagesFinancial Statement AnalysisFeMakes MusicNo ratings yet

- Investor Digest: Equity Research - 28 March 2019Document9 pagesInvestor Digest: Equity Research - 28 March 2019Rising PKN STANNo ratings yet

- HCL Tech q1 2019 Investor Release PDFDocument23 pagesHCL Tech q1 2019 Investor Release PDFmanishaNo ratings yet

- Sanulac Nutricion Colombia S.A.S. (Colombia) : SourceDocument2 pagesSanulac Nutricion Colombia S.A.S. (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Eicher Motors LTD: DCF Analysis Valuation Date: 13 March, 2019Document60 pagesEicher Motors LTD: DCF Analysis Valuation Date: 13 March, 2019CharanjitNo ratings yet

- 4QFY16 Income Declines 21.1%: Share DataDocument5 pages4QFY16 Income Declines 21.1%: Share DataJajahinaNo ratings yet

- SegrigationDocument13 pagesSegrigationSHRIKANT SAHUNo ratings yet

- FCFF Valuation of Coal Mining Company PTBADocument16 pagesFCFF Valuation of Coal Mining Company PTBACOKDEHNo ratings yet

- Financial Performance Analysis - Marico LTDDocument18 pagesFinancial Performance Analysis - Marico LTDpankaj baviskar0% (1)

- 1Q18 Earnings Drop 49.9% Y/y On Lower Revenues, Below COL ForecastDocument6 pages1Q18 Earnings Drop 49.9% Y/y On Lower Revenues, Below COL ForecastMark Angelo BustosNo ratings yet

- Snapshots: Egp 7.6 BN Egp 5.7 BN Egp 239 MN Egp 239 MN Egp 1.4 BN Egp 1.4 BNDocument2 pagesSnapshots: Egp 7.6 BN Egp 5.7 BN Egp 239 MN Egp 239 MN Egp 1.4 BN Egp 1.4 BNAmr AbdelMoneimNo ratings yet

- The Markets on Friday: Sensex up 135.8 points, Nifty gains 28.4 pointsDocument1 pageThe Markets on Friday: Sensex up 135.8 points, Nifty gains 28.4 pointsSiddharth PujariNo ratings yet

- Corporate Finance - 1: Group Assignment Report OnDocument15 pagesCorporate Finance - 1: Group Assignment Report Onvaibhav naharNo ratings yet

- On RIL AND RPLDocument27 pagesOn RIL AND RPLpramod_2300No ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Relative Valuation: Symphony Life (Symlife-Ku)Document1 pageRelative Valuation: Symphony Life (Symlife-Ku)Cf DoyNo ratings yet

- Average Score: Symphony Life (Symlife-Ku)Document1 pageAverage Score: Symphony Life (Symlife-Ku)Cf DoyNo ratings yet

- Price Momentum: Yli Holdings (Yli-Ku)Document1 pagePrice Momentum: Yli Holdings (Yli-Ku)Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Detailed Stock ReportDocument1 pageYli Holdings (Yli-Ku) : Detailed Stock ReportCf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Detailed Stock Report TipsDocument1 pageYli Holdings (Yli-Ku) : Detailed Stock Report TipsCf DoyNo ratings yet

- Symphony Life (Symlife-Ku) : Earnings Per ShareDocument1 pageSymphony Life (Symlife-Ku) : Earnings Per ShareCf DoyNo ratings yet

- Symphony Life (Symlife-Ku) : Price To Sales Trailing PeDocument1 pageSymphony Life (Symlife-Ku) : Price To Sales Trailing PeCf DoyNo ratings yet

- Relative Valuation: Yli Holdings (Yli-Ku)Document1 pageRelative Valuation: Yli Holdings (Yli-Ku)Cf DoyNo ratings yet

- AI YLI #1 - Part8Document1 pageAI YLI #1 - Part8Cf DoyNo ratings yet

- AI YLI #1 - Part3Document1 pageAI YLI #1 - Part3Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Earnings Per ShareDocument1 pageYli Holdings (Yli-Ku) : Earnings Per ShareCf DoyNo ratings yet

- AI YLI #1 - Part1Document1 pageAI YLI #1 - Part1Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Indicator ComponentsDocument1 pageYli Holdings (Yli-Ku) : Indicator ComponentsCf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Indicator ComponentsDocument1 pageYli Holdings (Yli-Ku) : Indicator ComponentsCf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Earnings Per ShareDocument1 pageYli Holdings (Yli-Ku) : Earnings Per ShareCf DoyNo ratings yet

- Datasonic FS - Part10Document1 pageDatasonic FS - Part10Cf DoyNo ratings yet

- Relative Valuation: Yli Holdings (Yli-Ku)Document1 pageRelative Valuation: Yli Holdings (Yli-Ku)Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Price To Sales Trailing PeDocument1 pageYli Holdings (Yli-Ku) : Price To Sales Trailing PeCf DoyNo ratings yet

- AI YLI #1 - Part3Document1 pageAI YLI #1 - Part3Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Price To Sales Trailing PeDocument1 pageYli Holdings (Yli-Ku) : Price To Sales Trailing PeCf DoyNo ratings yet

- Datasonic FS - Part11Document1 pageDatasonic FS - Part11Cf DoyNo ratings yet

- Datasonic FS - Part6Document1 pageDatasonic FS - Part6Cf DoyNo ratings yet

- Datasonic FS - Part8Document1 pageDatasonic FS - Part8Cf DoyNo ratings yet

- Datasonic FS Part19Document1 pageDatasonic FS Part19Cf DoyNo ratings yet

- AI YLI #1 - Part1Document1 pageAI YLI #1 - Part1Cf DoyNo ratings yet

- Datasonic FS - Part9Document1 pageDatasonic FS - Part9Cf DoyNo ratings yet

- Financial Accounting - M1 NotesDocument15 pagesFinancial Accounting - M1 NotesSana BajpaiNo ratings yet

- MSU Cash and Cash Equivalents Pre-review ProgramDocument3 pagesMSU Cash and Cash Equivalents Pre-review ProgramAsterism LoneNo ratings yet

- Cases Agency PartnershipDocument6 pagesCases Agency PartnershipLourdes Erika CruzNo ratings yet

- Close and Special CorporationsDocument145 pagesClose and Special Corporationsjed_nurNo ratings yet

- Pengukuran Dan Ketidakpastian: Fisika DasarDocument19 pagesPengukuran Dan Ketidakpastian: Fisika DasarDeanNo ratings yet

- Financial Ratio Questions 1Document7 pagesFinancial Ratio Questions 1Afnan QusyairiNo ratings yet

- Marvin Barro - Week 1Document24 pagesMarvin Barro - Week 1jakNo ratings yet

- SRD 1813576Document7 pagesSRD 1813576Sazzad Reza Durlov 1813576630No ratings yet

- Futures Test 03 AnswersDocument22 pagesFutures Test 03 AnswersPrachet KulkarniNo ratings yet

- Chapter 9 - The Organizational PlanDocument14 pagesChapter 9 - The Organizational PlanFatima ChowdhuryNo ratings yet

- Rolta Annual Report 2020 FINAL 07.12.2020Document120 pagesRolta Annual Report 2020 FINAL 07.12.2020Bhavin KariaNo ratings yet

- Ais (FINALS) Pascual (3) YODocument69 pagesAis (FINALS) Pascual (3) YOMarinel FelipeNo ratings yet

- Main Ledger, General Ledger, Nominal LedgerDocument33 pagesMain Ledger, General Ledger, Nominal LedgerpolymeianNo ratings yet

- The Satyam Fiasco: Sinking Ship or Tip of the IcebergDocument30 pagesThe Satyam Fiasco: Sinking Ship or Tip of the IcebergAshwin Hemant LawanghareNo ratings yet

- Afar.3202 Corporate LiquidationDocument6 pagesAfar.3202 Corporate Liquidationruel c armillaNo ratings yet

- Bài tập FRA - FRCDocument12 pagesBài tập FRA - FRCThủy VũNo ratings yet

- Audit of Item of FS Notes by CA Kapil GoyalDocument9 pagesAudit of Item of FS Notes by CA Kapil GoyalAbhimanyu Kumar ranaNo ratings yet

- Treasury and Cash Management: Bill Dorotinsky, PRMPSDocument9 pagesTreasury and Cash Management: Bill Dorotinsky, PRMPSShuh FangNo ratings yet

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Annual Report 2021Document462 pagesAnnual Report 2021Faizan haiderNo ratings yet

- Entrep - Summative TestDocument3 pagesEntrep - Summative TestKira OrsNo ratings yet

- AmalgamationDocument23 pagesAmalgamationGiridhar SinghNo ratings yet

- Assignment#09Document3 pagesAssignment#09Asim QureshiNo ratings yet

- RESOLUTIONS AND AGREEMENTSDocument3 pagesRESOLUTIONS AND AGREEMENTStiger SNo ratings yet

- Master Limited Partnerships: Primer 2nd Edition: A Framework For InvestmentDocument44 pagesMaster Limited Partnerships: Primer 2nd Edition: A Framework For InvestmentGopi BalaNo ratings yet

- AGI Accounting FraudDocument9 pagesAGI Accounting Fraudayushaslaliya110No ratings yet

- 118.2 - Illustrative Example - Hedge Accounting: FV HedgeDocument2 pages118.2 - Illustrative Example - Hedge Accounting: FV HedgeStephen GarciaNo ratings yet

- Financial Reporting: TestbankDocument9 pagesFinancial Reporting: TestbankAustinNo ratings yet

- Temu 4Document8 pagesTemu 4leddy teresaNo ratings yet

- Q PP 4 BondsDocument1 pageQ PP 4 BondsJoebel CristalesNo ratings yet