Professional Documents

Culture Documents

AI YLI #1 - Part3

Uploaded by

Cf DoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AI YLI #1 - Part3

Uploaded by

Cf DoyCopyright:

Available Formats

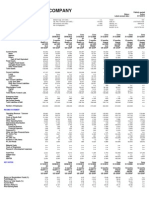

YLI HOLDINGS (YLI-KU)

Mineral Resources / Metals & Mining / Iron & Steel DETAILED STOCK REPORT

Report Date: 17 May 2020

EARNINGS Currency in MYR

This company does not currently meet the data Earnings Score Averages

requirements to calculate a score for this Metals & Mining Group: 5.6 Small Market Cap: 5.1

component. Mineral Resources Sector: 6.0 FBM KLCI Index: 6.4

Earnings Score Trend (4-Week Moving Avg) Peers -6M -3M -1M -1W Current 1Y Trend

Positive AISB NR NR NR NR NR

DYNACIA NR NR NR NR NR

Neutral LSTEEL NR NR NR NR NR

YLI NR NR NR NR NR

Negative

YUNKONG NR NR NR NR NR

MAY-2017 MAY-2018 MAY-2019 MAY-2020

EARNINGS INDICATORS

Earnings Surprises Estimate Revisions Recommendation Changes

(33.3% weight) (33.3% weight) (33.3% weight)

AISB AISB AISB

DYNACIA DYNACIA DYNACIA

LSTEEL LSTEEL LSTEEL

YLI YLI YLI

YUNKONG YUNKONG YUNKONG

Last 4 Quarters Last 4 Weeks Last 120 Days

# Positive Surprises (> 2%) 0 # Up Revisions -- # Broker Upgrades 0

# Negative Surprises (< -2%) 0 # Down Revisions -- # Broker Downgrades 0

# In-Line Surprises (within 2%) 0 Avg Up Revisions --

Avg Surprise -- Avg Down Revisions --

HIGHLIGHTS PRICE TARGET

- Due to a lack of recent analyst activity, no Earnings Rating can be The chart indicates where analysts predict the stock price will be within

calculated for YLI Holdings. The average Earnings Rating for its Iron & the next 12 months, as compared to the current price.

Steel industry is 5.3 and the FTSE BURSA MALAYSIA COMPOSITE

index average is 6.3. 12-Month Price Target

Mean (MYR) --

- There have been no upward or downward broker recommendation

High --

changes for YLI Holdings over the past 120 days.

Data is not available Low --

Target vs. Current --

# of Analysts --

Current Price Price Target

(MYR)

Page 3 of 11

© 2020 Refinitiv. All rights reserved.

You might also like

- Secretary's Certificare - BIR eCAR ApplicationDocument1 pageSecretary's Certificare - BIR eCAR ApplicationAngieLlantoCurioso100% (2)

- Dalal Street Investment Journal November 01 2017Document68 pagesDalal Street Investment Journal November 01 2017Sunil NmNo ratings yet

- Balanced Scorecards For Law FirmsDocument14 pagesBalanced Scorecards For Law FirmsArk Group33% (18)

- Gundlach Nov 2018Document54 pagesGundlach Nov 2018Zerohedge100% (5)

- BSBFIM601 Manage Finances: ASSESSMENT 1 - Written QuestionsDocument41 pagesBSBFIM601 Manage Finances: ASSESSMENT 1 - Written QuestionsPriyanka Aggarwal75% (4)

- Business Analytics 705 v1 468Document468 pagesBusiness Analytics 705 v1 468Harty Robert100% (1)

- Mergent Online As Reported - Tesla IncDocument2 pagesMergent Online As Reported - Tesla IncLyca MaeNo ratings yet

- Atrium Management Corp vs. CAvvvvvvvvDocument2 pagesAtrium Management Corp vs. CAvvvvvvvvMonikkaNo ratings yet

- Review of Internal Audit in RBS Exam: Business Continuity Planning (BCP)Document26 pagesReview of Internal Audit in RBS Exam: Business Continuity Planning (BCP)Jt AnifowoseNo ratings yet

- Implications of PropTechDocument107 pagesImplications of PropTechAnsar FarooqiNo ratings yet

- Relative Valuation: Yli Holdings (Yli-Ku)Document1 pageRelative Valuation: Yli Holdings (Yli-Ku)Cf DoyNo ratings yet

- AI YLI #1 - Part1Document1 pageAI YLI #1 - Part1Cf DoyNo ratings yet

- AI YLI #1 - Part8Document1 pageAI YLI #1 - Part8Cf DoyNo ratings yet

- AI YLI #1 - Part5Document1 pageAI YLI #1 - Part5Cf DoyNo ratings yet

- Price Momentum: Yli Holdings (Yli-Ku)Document1 pagePrice Momentum: Yli Holdings (Yli-Ku)Cf DoyNo ratings yet

- Datarails Financial Ratios TemplateDocument8 pagesDatarails Financial Ratios Templateobengmensahbridget9No ratings yet

- Yli Holdings (Yli-Ku) : Earnings Per ShareDocument1 pageYli Holdings (Yli-Ku) : Earnings Per ShareCf DoyNo ratings yet

- Symphony Life (Symlife-Ku) : Earnings Per ShareDocument1 pageSymphony Life (Symlife-Ku) : Earnings Per ShareCf DoyNo ratings yet

- Apollo Hospitals Enterprise Limited: Strong BUYDocument9 pagesApollo Hospitals Enterprise Limited: Strong BUYakumar4uNo ratings yet

- R611 Iifi Urja-InDocument11 pagesR611 Iifi Urja-InShailesh ChhajedNo ratings yet

- Inance Nequality and The OOR: T B A D - K R LDocument20 pagesInance Nequality and The OOR: T B A D - K R Lhuat huatNo ratings yet

- Kelompok 2 ADDB - Assigment Week 1Document7 pagesKelompok 2 ADDB - Assigment Week 1Putri Ayuningtyas KusumawatiNo ratings yet

- Quantitative Method For Multidimensional Management and Group Decision-Making 206Document16 pagesQuantitative Method For Multidimensional Management and Group Decision-Making 206jbrunomaciel1957No ratings yet

- Mission Viejo - CondoDocument17 pagesMission Viejo - CondoDeborah Lynn ThomasNo ratings yet

- Mission Viejo - CondoDocument17 pagesMission Viejo - CondoDeborah Lynn ThomasNo ratings yet

- Mission Viejo - CondoDocument17 pagesMission Viejo - CondoDeborah Lynn ThomasNo ratings yet

- The Nielsen Company (Malaysia) SDN BHD Pib 20211026153914Document13 pagesThe Nielsen Company (Malaysia) SDN BHD Pib 20211026153914ANURADHA JAYAWARDANANo ratings yet

- Mission Viejo - CondoDocument7 pagesMission Viejo - CondoDeborah Lynn ThomasNo ratings yet

- QuantDocument31 pagesQuantSMNo ratings yet

- Market Update: Jennifer PritchettDocument36 pagesMarket Update: Jennifer PritchettJennifer PritchettNo ratings yet

- Whitehat JR Intro Deck: Update: Apr 18Document27 pagesWhitehat JR Intro Deck: Update: Apr 18Harsh DabasNo ratings yet

- OKE - ArgusDocument5 pagesOKE - ArgusJeff SturgeonNo ratings yet

- Mission Viejo - SFDocument17 pagesMission Viejo - SFDeborah Lynn ThomasNo ratings yet

- Mission Viejo - SFDocument17 pagesMission Viejo - SFDeborah Lynn ThomasNo ratings yet

- Lake Forest - CondoDocument7 pagesLake Forest - CondoDeborah Lynn ThomasNo ratings yet

- StockReportsPlus NKLA ODocument12 pagesStockReportsPlus NKLA OMatusa MtsNo ratings yet

- Lake Forest - CondoDocument7 pagesLake Forest - CondoDeborah Lynn ThomasNo ratings yet

- Mission Viejo - CondoDocument17 pagesMission Viejo - CondoDeborah Lynn ThomasNo ratings yet

- Aray FordDocument3 pagesAray Fordphysicallen1791No ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q22018Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q22018Anonymous Feglbx5No ratings yet

- Aug 2022 New Business League PhilippinesDocument2 pagesAug 2022 New Business League PhilippinesJR dela CernaNo ratings yet

- Average Score: Mega Sun City Holdings (Megasun-Ku)Document11 pagesAverage Score: Mega Sun City Holdings (Megasun-Ku)Zhi_Ming_Cheah_8136No ratings yet

- Reports CRMDocument11 pagesReports CRMderek_2010No ratings yet

- Rancho Santa Margarita - CondoDocument7 pagesRancho Santa Margarita - CondoDeborah Lynn ThomasNo ratings yet

- GM Financial ReportDocument2 pagesGM Financial ReportLiliana VarricchioNo ratings yet

- Mission Viejo - SFDocument17 pagesMission Viejo - SFDeborah Lynn ThomasNo ratings yet

- Personalis Inc. $1.47 Rating: PositiveDocument3 pagesPersonalis Inc. $1.47 Rating: PositiveS MNo ratings yet

- Osun 2022Document9 pagesOsun 2022Ady IbikunleNo ratings yet

- CFRAEquityResearch DaeyangPaperMfgCoLtd Aug 31 2021Document9 pagesCFRAEquityResearch DaeyangPaperMfgCoLtd Aug 31 2021Camila CalderonNo ratings yet

- Svi Biz Plan DraftDocument14 pagesSvi Biz Plan Draftqocok347666No ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Market Update: Jennifer PritchettDocument31 pagesMarket Update: Jennifer PritchettJennifer PritchettNo ratings yet

- Rancho Santa Margarita - CondoDocument7 pagesRancho Santa Margarita - CondoDeborah Lynn ThomasNo ratings yet

- This Week: PASADENA, CA 91105Document1 pageThis Week: PASADENA, CA 91105api-26327314No ratings yet

- Average Score: Xidelang Holdings (Xdl-Ku)Document11 pagesAverage Score: Xidelang Holdings (Xdl-Ku)Zhi_Ming_Cheah_8136No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26216409No ratings yet

- Rancho Santa Margarita - CondoDocument7 pagesRancho Santa Margarita - CondoDeborah Lynn ThomasNo ratings yet

- Antero Resources Corp $36.74 Rating: Positive Positive Very PositiveDocument3 pagesAntero Resources Corp $36.74 Rating: Positive Positive Very Positivephysicallen1791No ratings yet

- Paytm Masterclass DSP AMCDocument17 pagesPaytm Masterclass DSP AMCDaniel JamesNo ratings yet

- Adobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Document9 pagesAdobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Santi11052009No ratings yet

- Ramnord Research Laboratories Pvt. LTDDocument6 pagesRamnord Research Laboratories Pvt. LTDraghavNo ratings yet

- Adobe Scan 02-Dec-2022Document1 pageAdobe Scan 02-Dec-2022Aditya SharmaNo ratings yet

- CFRAEquityResearch PSPSwissPropertyAG Feb 05 2023Document9 pagesCFRAEquityResearch PSPSwissPropertyAG Feb 05 2023Christian?97No ratings yet

- Bonds - March 2 2021Document3 pagesBonds - March 2 2021Lisle Daverin BlythNo ratings yet

- 2021-11-09-SWIR - OQ-RBC Capital Markets-Normalizing Following Manufacturing Disruptions-94496714Document14 pages2021-11-09-SWIR - OQ-RBC Capital Markets-Normalizing Following Manufacturing Disruptions-94496714andrewNo ratings yet

- ExpeditorsDocument11 pagesExpeditorsderek_2010100% (1)

- Al SYMLIFE #9 - Part8Document1 pageAl SYMLIFE #9 - Part8Cf DoyNo ratings yet

- Symphony Life (Symlife-Ku) : Earnings Per ShareDocument1 pageSymphony Life (Symlife-Ku) : Earnings Per ShareCf DoyNo ratings yet

- Symphony Life (Symlife-Ku) : Price To Sales Trailing PeDocument1 pageSymphony Life (Symlife-Ku) : Price To Sales Trailing PeCf DoyNo ratings yet

- Al SYMLIFE #9 - Part5Document1 pageAl SYMLIFE #9 - Part5Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Detailed Stock Report TipsDocument1 pageYli Holdings (Yli-Ku) : Detailed Stock Report TipsCf DoyNo ratings yet

- Average Score: Symphony Life (Symlife-Ku)Document1 pageAverage Score: Symphony Life (Symlife-Ku)Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Detailed Stock ReportDocument1 pageYli Holdings (Yli-Ku) : Detailed Stock ReportCf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Indicator ComponentsDocument1 pageYli Holdings (Yli-Ku) : Indicator ComponentsCf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Earnings Per ShareDocument1 pageYli Holdings (Yli-Ku) : Earnings Per ShareCf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Price To Sales Trailing PeDocument1 pageYli Holdings (Yli-Ku) : Price To Sales Trailing PeCf DoyNo ratings yet

- Datasonic FS - Part10Document1 pageDatasonic FS - Part10Cf DoyNo ratings yet

- Etsu Board of Trustees Agenda 11-19-21Document116 pagesEtsu Board of Trustees Agenda 11-19-21Van JonesNo ratings yet

- Ce SPD PDFDocument1 pageCe SPD PDFCamilo Andres Bayona AguileraNo ratings yet

- Mamta MeenaDocument58 pagesMamta MeenaTarun Bhati0% (1)

- GST Project Report SummaryDocument14 pagesGST Project Report SummaryWwe MomentsNo ratings yet

- 14-09-20 - Introduction To Business ProcessesDocument21 pages14-09-20 - Introduction To Business ProcessescitraNo ratings yet

- Benefit Illustration: UIN: 104N116V02 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V02 Page 1 of 3Ravindar aNo ratings yet

- P60 End of Year Certificate 2021 P60 End of Year CertificateDocument1 pageP60 End of Year Certificate 2021 P60 End of Year CertificateIsmael GomesNo ratings yet

- Indian Equities:: Digital Transformation As Private Goes PublicDocument25 pagesIndian Equities:: Digital Transformation As Private Goes PublicDilip KumarNo ratings yet

- What Can I Do With My Degree in (2837)Document18 pagesWhat Can I Do With My Degree in (2837)Trần Phương QuyênNo ratings yet

- Shuchana Development Human Resource PlanningDocument4 pagesShuchana Development Human Resource PlanningNaveed AdnanNo ratings yet

- Economic Analysis of Cryptocurrency Backed Money LaunderingDocument19 pagesEconomic Analysis of Cryptocurrency Backed Money Launderingজুবায়ের আহমেদNo ratings yet

- Apostila Preparatória - Workshop de Psicologia Perinatal - 14wppDocument25 pagesApostila Preparatória - Workshop de Psicologia Perinatal - 14wppRose FalcãoNo ratings yet

- Haigh's Final Report Haigh's Final ReportDocument10 pagesHaigh's Final Report Haigh's Final ReportMelvina GodivaNo ratings yet

- Annex A - GBA Interview ToolDocument4 pagesAnnex A - GBA Interview ToolYumul JacyNo ratings yet

- Sunley CaseDocument5 pagesSunley CasePeterNo ratings yet

- Profil: Rata - ID (PT. Rupa Aestetika Teknologi Aktual) 2020-Present Head of Marketing & StrategyDocument2 pagesProfil: Rata - ID (PT. Rupa Aestetika Teknologi Aktual) 2020-Present Head of Marketing & Strategyokky dewantoNo ratings yet

- NTN - Catálogo de MancaisDocument16 pagesNTN - Catálogo de MancaisGooyNo ratings yet

- Governor Stitt Veto MessageDocument1 pageGovernor Stitt Veto MessageDavid MarkNo ratings yet

- Anisul Hoq Shovon 1710503: Identify How Job Analysis Assist in Other Human Resource FunctionsDocument6 pagesAnisul Hoq Shovon 1710503: Identify How Job Analysis Assist in Other Human Resource Functionsnabila haroonNo ratings yet

- Business English Placement TestDocument3 pagesBusiness English Placement TestIrenaNikolovskaNo ratings yet

- 3rd GovAcc 1SAY2324Document9 pages3rd GovAcc 1SAY2324Grand DuelistNo ratings yet

- Course Outline - BUS301 - BRAC UniversityDocument6 pagesCourse Outline - BUS301 - BRAC UniversitySaiyan IslamNo ratings yet

- Chapter 7Document16 pagesChapter 7arfankafNo ratings yet