Professional Documents

Culture Documents

Al SYMLIFE #9 - Part8

Uploaded by

Cf DoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Al SYMLIFE #9 - Part8

Uploaded by

Cf DoyCopyright:

Available Formats

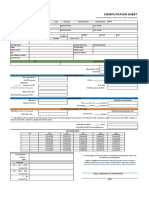

SYMPHONY LIFE (SYMLIFE-KU)

Real Estate / Real Estate Operations / Real Estate Rental & Dev. DETAILED STOCK REPORT

Report Date: 17 May 2020

RISK

POSITIVE OUTLOOK: Consistent return Risk Score Averages

patterns (low volatility). Real Estate Operations Group: 6.4 Small Market Cap: 4.9

Real Estate Sector: 6.8 FBM KLCI Index: 8.9

Risk Score Trend (4-Week Moving Avg) Peers -6M -3M -1M -1W Current 1Y Trend

Positive TAMBUN 10 10 10 10 10

BREM 9 9 8 9 9

Neutral SYMLIFE 8 8 9 9 9

GLOMAC 9 10 8 8 8

Negative

OIB NR NR 7 7 7

MAY-2017 MAY-2018 MAY-2019 MAY-2020

RISK INDICATORS

Magnitude of Returns Volatility Beta (1-year) Correlation

(25% weight) (25% weight) (25% weight) (25% weight)

BREM

OIB

GLOMA…

BREM BREM

OIB TAMBU…

GLOMA… SYMLIF…

SYMLIF…

TAMBU…

TAMBU…

TAMBU…

SYMLIF…

SYMLIF… GLOMA…

GLOMA…

OIB

BREM

OIB

Daily Returns (Last 90 Days) Standard Deviation Beta vs. FBM KLCI 0.84 Correlation vs. FBM KLCI

Best 15.0% Last 90 Days 4.40 Positive Days Only 0.40 Last 90 Days 38%

Worst -8.6% Last 60 Months 7.71 Negative Days Only 1.08 Last 60 Months 53%

Monthly Returns (Last 60 Months) Intra-Day Swing (Last 90 Days) Beta vs. Group 0.82 Correlation vs. Group

Best 14.6% Average 5.9% Positive Days Only 0.82 Last 90 Days 49%

Worst -27.2% Largest 16.1% Negative Days Only 0.87 Last 60 Months 72%

HIGHLIGHTS RISK ANALYSIS

- Symphony Life currently has a Risk Rating of 9 while the FTSE Last 90 Days Last 60 Months

BURSA MALAYSIA COMPOSITE index has an average rating Best Worst # # Largest Best Worst

of 9.2. Daily Daily Days Days Intra-Day Monthly Monthly

- On days when the market is up, SYMLIFE tends to lag the Peers Return Return Up Down Swing Return Return

FTSE BURSA MALAYSIA COMPOSITE index. On days when SYMLIFE 15.0% -8.6% 25 29 16.1% 14.6% -27.2%

the market is down, the stock generally performs in-line with the

index. BREM 6.3% -10.8% 19 23 10.4% 20.7% -27.0%

- In the short term, SYMLIFE has shown average correlation (>= GLOMAC 11.5% -13.3% 20 25 12.1% 14.3% -14.8%

0.2 and < 0.4) with the FTSE BURSA MALAYSIA COMPOSITE

index. The stock has, however, shown high correlation (>= 0.4) OIB 7.3% -10.1% 12 20 10.0% 24.1% -19.4%

with the market in the long term.

TAMBUN 7.6% -14.4% 24 29 15.7% 22.7% -28.2%

- Over the last 90 days, SYMLIFE shares have been more

volatile than the overall market, as the stock's daily price FBM KLCI 6.9% -5.3% 31 31 6.4% 5.5% -8.9%

fluctuations have exceeded that of 97% of FTSE BURSA

MALAYSIA COMPOSITE index firms.

Page 8 of 11

© 2020 Refinitiv. All rights reserved.

You might also like

- Al SYMLIFE #9 - Part5Document1 pageAl SYMLIFE #9 - Part5Cf DoyNo ratings yet

- Average Score: Symphony Life (Symlife-Ku)Document1 pageAverage Score: Symphony Life (Symlife-Ku)Cf DoyNo ratings yet

- Ram 2011 Ecu 2 PDFDocument1 pageRam 2011 Ecu 2 PDFMartin ReyesNo ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- 2017 Profits of Most Companies Missed Expectations: Slow and Below Expected Earnings GrowthDocument9 pages2017 Profits of Most Companies Missed Expectations: Slow and Below Expected Earnings GrowthJM CrNo ratings yet

- AI YLI #1 - Part5Document1 pageAI YLI #1 - Part5Cf DoyNo ratings yet

- Screenshot 2023-07-20 at 10.41.27Document12 pagesScreenshot 2023-07-20 at 10.41.27Izzatt TazaliNo ratings yet

- ANTREPAGRIBSNSSDocument2 pagesANTREPAGRIBSNSSMary Joy FanikerNo ratings yet

- Factsheet LU1931956442 ENG GRC 2023-07-31Document5 pagesFactsheet LU1931956442 ENG GRC 2023-07-31ATNo ratings yet

- Cosmic Subsidiary Presentation (Case Study Solution)Document3 pagesCosmic Subsidiary Presentation (Case Study Solution)Fakz OlaNo ratings yet

- (Head Office Group/ Division) : Summary of Risk AssessmentDocument7 pages(Head Office Group/ Division) : Summary of Risk AssessmentHAMMADHRNo ratings yet

- Lecture SlidesDocument51 pagesLecture SlidesAshish MalhotraNo ratings yet

- Zambian Breweries Research Report - Avior Capital MarketsDocument24 pagesZambian Breweries Research Report - Avior Capital MarketsCHRISTIANNo ratings yet

- Computation SheetDocument1 pageComputation SheetVista VerdeNo ratings yet

- SegrigationDocument13 pagesSegrigationSHRIKANT SAHUNo ratings yet

- Capm Premio Por Riesgo: Annual Returns On Investments inDocument1 pageCapm Premio Por Riesgo: Annual Returns On Investments inLuis CortesNo ratings yet

- Symphony LTD: It's Going To Be A HOT' SummerDocument29 pagesSymphony LTD: It's Going To Be A HOT' SummerDinil KothariNo ratings yet

- RamSync BriefDocument5 pagesRamSync Briefjoshua arnettNo ratings yet

- Simbhaoli Sugars LTD.: Stakeholders Empowerment ServicesDocument9 pagesSimbhaoli Sugars LTD.: Stakeholders Empowerment ServicesvishalNo ratings yet

- Simbhaoli Sugars LTD.: Stakeholders Empowerment ServicesDocument9 pagesSimbhaoli Sugars LTD.: Stakeholders Empowerment ServicesvishalNo ratings yet

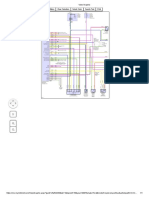

- Wiring Diagram Ford 1Document1 pageWiring Diagram Ford 1Harlinton descalziNo ratings yet

- Bal Krishna SoniDocument6 pagesBal Krishna SoniPreetam JainNo ratings yet

- Portfolios Factsheet: Fund Objective Fund DetailsDocument1 pagePortfolios Factsheet: Fund Objective Fund DetailsJ. BangjakNo ratings yet

- Microsoft MSFT Stock Valuation Calculator SpreadsheetDocument15 pagesMicrosoft MSFT Stock Valuation Calculator SpreadsheetOld School Value100% (1)

- Cambridge Associates LLC U.S. Venture Capital Index and Selected Benchmark Statistics March 31, 2009Document11 pagesCambridge Associates LLC U.S. Venture Capital Index and Selected Benchmark Statistics March 31, 2009Dan Primack100% (1)

- Shriram Multi Asset Allocation Fund - Regular GDocument4 pagesShriram Multi Asset Allocation Fund - Regular GMarotrao BhiseNo ratings yet

- Eicher Motors LTD: DCF Analysis Valuation Date: 13 March, 2019Document60 pagesEicher Motors LTD: DCF Analysis Valuation Date: 13 March, 2019CharanjitNo ratings yet

- Inv 22-23-12 Aza Fashion 122340Document1 pageInv 22-23-12 Aza Fashion 122340Amita Chauhan YadavNo ratings yet

- Del Monte Pacific 4Q Fy2021 Results: 23 June 2021Document39 pagesDel Monte Pacific 4Q Fy2021 Results: 23 June 2021handsomefaceNo ratings yet

- AI YLI #1 - Part8Document1 pageAI YLI #1 - Part8Cf DoyNo ratings yet

- Bag FilterDocument1 pageBag FilterJay MarkNo ratings yet

- SBI Annual-Report 19-20 10727Document396 pagesSBI Annual-Report 19-20 10727gauravkrastogiNo ratings yet

- Coca-Cola HBC 2019 IAR Performance 19mar2020Document4 pagesCoca-Cola HBC 2019 IAR Performance 19mar2020neferty valderrama sandovalNo ratings yet

- Average Score: Ajinomoto (Malaysia) (Aji-Ku)Document11 pagesAverage Score: Ajinomoto (Malaysia) (Aji-Ku)Zhi_Ming_Cheah_8136No ratings yet

- Organizational Chart August 2019Document1 pageOrganizational Chart August 2019Deon marianoNo ratings yet

- StockReportsPlus BMW XEDocument11 pagesStockReportsPlus BMW XEMadalin DavidNo ratings yet

- Fs SP 500Document7 pagesFs SP 500sohbifayrouzNo ratings yet

- Coca Cola (KO) Financial RatiosDocument4 pagesCoca Cola (KO) Financial RatiosKhmao SrosNo ratings yet

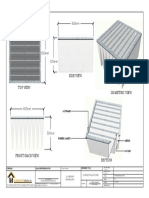

- FT Mini SE5: Designed By: Josh Bixler Drawing By: Dan SponholzDocument4 pagesFT Mini SE5: Designed By: Josh Bixler Drawing By: Dan SponholzBen SuttonNo ratings yet

- EFI - FS Moderate Portolio ETP - 2023.Q3.EN - EUDocument1 pageEFI - FS Moderate Portolio ETP - 2023.Q3.EN - EUpderby1No ratings yet

- Empirical Asset Pricing: Classes 5 & 6: The Cross-Section of Expected Stock ReturnsDocument24 pagesEmpirical Asset Pricing: Classes 5 & 6: The Cross-Section of Expected Stock ReturnsJoe23232232No ratings yet

- Diagram 2Document1 pageDiagram 2Omar ZepedaNo ratings yet

- HTHB KLDocument7 pagesHTHB KLypNo ratings yet

- Effect of Net Profit Margin, Debt To Equity Ratio, Current Ratio and Inflation On Dividend Payout RatioDocument10 pagesEffect of Net Profit Margin, Debt To Equity Ratio, Current Ratio and Inflation On Dividend Payout RatioThe IjbmtNo ratings yet

- Sime Darby Berhad: Confidence Still Shaky - 31/5/2010Document5 pagesSime Darby Berhad: Confidence Still Shaky - 31/5/2010Rhb InvestNo ratings yet

- For Local Sales Only: The Peak Antipolo City, Rizal February 04, 2022 12:38 AMDocument1 pageFor Local Sales Only: The Peak Antipolo City, Rizal February 04, 2022 12:38 AMGEN888 IGNo ratings yet

- JPM ASEAN Equity Fund Factsheet - C Acc USD - 1120 - SEASGIIDocument4 pagesJPM ASEAN Equity Fund Factsheet - C Acc USD - 1120 - SEASGIIsidharth guptaNo ratings yet

- ALL - Initiation of Coverage - 29abr09 BanifDocument8 pagesALL - Initiation of Coverage - 29abr09 Banifbenjah2No ratings yet

- Diagrama 2018Document1 pageDiagrama 2018Javier InzaurgaratNo ratings yet

- 2003 Ranger 2.3 at WiringDocument3 pages2003 Ranger 2.3 at WiringReese BlalockNo ratings yet

- AUG 20 SO Review Format FinalDocument80 pagesAUG 20 SO Review Format FinalPinku JaiswalNo ratings yet

- Relative Valuation: Yli Holdings (Yli-Ku)Document1 pageRelative Valuation: Yli Holdings (Yli-Ku)Cf DoyNo ratings yet

- Residual Income Model (Max) : Input Data + Hitung Book ValueDocument29 pagesResidual Income Model (Max) : Input Data + Hitung Book ValueFadel Khalif MuhammadNo ratings yet

- Ecm Nissan Versa 2014 5Document1 pageEcm Nissan Versa 2014 5Ghianny AndresNo ratings yet

- AMMB Holdings Berhad: Off To A Strong Start - 18/08/2010Document5 pagesAMMB Holdings Berhad: Off To A Strong Start - 18/08/2010Rhb InvestNo ratings yet

- Description: S&P/BMV Mexico-Brazil IndexDocument6 pagesDescription: S&P/BMV Mexico-Brazil Indextmayur21No ratings yet

- Rnav (GNSS) Z Rwy 34 Slag/Mhw Monteagudo, BoliviaDocument67 pagesRnav (GNSS) Z Rwy 34 Slag/Mhw Monteagudo, BoliviaPatriciaTapiaNo ratings yet

- DA Report 22110120Document8 pagesDA Report 22110120Mohammed GhaziNo ratings yet

- Screenshot 2023-11-07 at 15.39.23Document46 pagesScreenshot 2023-11-07 at 15.39.23mgangajacob2No ratings yet

- Symphony Life (Symlife-Ku) : Earnings Per ShareDocument1 pageSymphony Life (Symlife-Ku) : Earnings Per ShareCf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Detailed Stock ReportDocument1 pageYli Holdings (Yli-Ku) : Detailed Stock ReportCf DoyNo ratings yet

- Symphony Life (Symlife-Ku) : Price To Sales Trailing PeDocument1 pageSymphony Life (Symlife-Ku) : Price To Sales Trailing PeCf DoyNo ratings yet

- AI YLI #1 - Part5Document1 pageAI YLI #1 - Part5Cf DoyNo ratings yet

- AI YLI #1 - Part8Document1 pageAI YLI #1 - Part8Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Detailed Stock Report TipsDocument1 pageYli Holdings (Yli-Ku) : Detailed Stock Report TipsCf DoyNo ratings yet

- Price Momentum: Yli Holdings (Yli-Ku)Document1 pagePrice Momentum: Yli Holdings (Yli-Ku)Cf DoyNo ratings yet

- Relative Valuation: Yli Holdings (Yli-Ku)Document1 pageRelative Valuation: Yli Holdings (Yli-Ku)Cf DoyNo ratings yet

- AI YLI #1 - Part1Document1 pageAI YLI #1 - Part1Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Indicator ComponentsDocument1 pageYli Holdings (Yli-Ku) : Indicator ComponentsCf DoyNo ratings yet

- AI YLI #1 - Part3Document1 pageAI YLI #1 - Part3Cf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Earnings Per ShareDocument1 pageYli Holdings (Yli-Ku) : Earnings Per ShareCf DoyNo ratings yet

- Yli Holdings (Yli-Ku) : Price To Sales Trailing PeDocument1 pageYli Holdings (Yli-Ku) : Price To Sales Trailing PeCf DoyNo ratings yet

- Datasonic FS - Part10Document1 pageDatasonic FS - Part10Cf DoyNo ratings yet

- طبى 145Document2 pagesطبى 145Yazan AbuFarhaNo ratings yet

- Cataloge ICARDocument66 pagesCataloge ICARAgoess Oetomo100% (1)

- BlahDocument8 pagesBlahkwood84100% (1)

- R. Nishanth K. VigneswaranDocument20 pagesR. Nishanth K. VigneswaranAbishaTeslinNo ratings yet

- Class 7 Work Book Answers Acid Bases and SaltsDocument2 pagesClass 7 Work Book Answers Acid Bases and SaltsGaurav SethiNo ratings yet

- Toxic RelationshipDocument1 pageToxic RelationshipwidyasNo ratings yet

- Little Ann and Other Poems by Ann Taylor and Jane TaylorDocument41 pagesLittle Ann and Other Poems by Ann Taylor and Jane Tayloralexa alexaNo ratings yet

- Plastic As Soil StabilizerDocument28 pagesPlastic As Soil StabilizerKhald Adel KhaldNo ratings yet

- Injection Analyzer Electronic Unit enDocument67 pagesInjection Analyzer Electronic Unit enmayralizbethbustosNo ratings yet

- Low Voltage Fixed and Automatic Power Factor Correction SystemsDocument6 pagesLow Voltage Fixed and Automatic Power Factor Correction Systemszabiruddin786No ratings yet

- Risk Appetite PresentationDocument10 pagesRisk Appetite PresentationAntonyNo ratings yet

- Market Pulse Q4 Report - Nielsen Viet Nam: Prepared by Nielsen Vietnam February 2017Document8 pagesMarket Pulse Q4 Report - Nielsen Viet Nam: Prepared by Nielsen Vietnam February 2017K57.CTTT BUI NGUYEN HUONG LYNo ratings yet

- Transformers: Z Z Z S S Z S SDocument17 pagesTransformers: Z Z Z S S Z S SSreenivasaraoDharmavarapu100% (1)

- Ergo 1 - Workshop 3Document3 pagesErgo 1 - Workshop 3Mugar GeillaNo ratings yet

- IS 4049-Part-IDocument5 pagesIS 4049-Part-ISrinivas KadivetiNo ratings yet

- Fawad Hussain, Feedback On Industrial Visit To Sahiwal Coal Power PlantDocument2 pagesFawad Hussain, Feedback On Industrial Visit To Sahiwal Coal Power PlantSyed Fawad MarwatNo ratings yet

- Governance StructureDocument1 pageGovernance StructureJoydip MukhopadhyayNo ratings yet

- W4. Grade 10 Health - Q1 - M4 - v2Document22 pagesW4. Grade 10 Health - Q1 - M4 - v2Jesmael PantalunanNo ratings yet

- Impact of Job Design On Employee Engagement: A Theoretical and Literature ReviewDocument6 pagesImpact of Job Design On Employee Engagement: A Theoretical and Literature ReviewAnonymous CwJeBCAXpNo ratings yet

- Learning Guide No 5Document19 pagesLearning Guide No 5Menal JemalNo ratings yet

- AACO 7th Aviation Fuel Forum: AttendanceDocument3 pagesAACO 7th Aviation Fuel Forum: AttendanceJigisha Vasa0% (1)

- Carbo Hi DratDocument11 pagesCarbo Hi DratILHAM BAGUS DARMA .NNo ratings yet

- BT HandoutsDocument4 pagesBT HandoutsNerinel CoronadoNo ratings yet

- AUDCISE Unit 1 WorksheetsDocument2 pagesAUDCISE Unit 1 WorksheetsMarjet Cis QuintanaNo ratings yet

- 2008 03 20 BDocument8 pages2008 03 20 BSouthern Maryland OnlineNo ratings yet

- Supercritical Carbon DioxideDocument3 pagesSupercritical Carbon DioxideRawda SeragNo ratings yet

- 03 Secondary School Student's Academic Performance Self Esteem and School Environment An Empirical Assessment From NigeriaDocument10 pages03 Secondary School Student's Academic Performance Self Esteem and School Environment An Empirical Assessment From NigeriaKienstel GigantoNo ratings yet

- Lesson Plan On Tuberculosis (Health Talk)Document8 pagesLesson Plan On Tuberculosis (Health Talk)Priyanka Jangra100% (2)

- Product Term and ConditionsDocument50 pagesProduct Term and Conditionsain2No ratings yet

- 5000mah Mi Power Bank 2 - PDFDocument6 pages5000mah Mi Power Bank 2 - PDFManuel Jesús Fernández lavadoNo ratings yet