Professional Documents

Culture Documents

Fourth Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A.LL.B. / B.B.A. LL.B. Examination, December 2015 Opt - Ii: Banking Law

Uploaded by

NnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fourth Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A.LL.B. / B.B.A. LL.B. Examination, December 2015 Opt - Ii: Banking Law

Uploaded by

NnCopyright:

Available Formats

*0404-0805* 0404 / 0805

Fourth Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A.LL.B. / B.B.A. LL.B.

Examination, December 2015

Opt – II : BANKING LAW

Duration : 3 Hours Max. Marks : 100

Instructions : 1. Answer Q. No. 9 and any five of the remaining questions.

2. Q. No. 9 carries 20 marks and the remaining questions

carry 16 marks each.

3. Answers should be written either in English or Kannada

completely.

Q. No. 1. Discuss briefly the functions of Reserve Bank of India along

with its promotional role. Marks : 16

»ÝÃÜ£à¿á ÄgÊ ì ¸ÝÂíP ®Ü PÝ¿áìWÜÙ®Ü áÜ ° A¨ÜÃÜ ±æäÅàñÝÕÖPÜ Ü ±ÝñÜŨã

æ í©Wæ

aÜbìÔÄ.

Q. No. 2. What are the activities (businesses) permitted by Banking

Regulation Act, 1949 to be taken by the Banker ? Marks : 16

¸ÝÂíQíW ¯¿áíñÜÅ| A¯¿áÊÜá 1949ÃÜ A®ÜÌ¿á ¸ÝÂíPÜà ¿ÞÊÜ

ÊÜÂÊÜÖÝÃÜWÜÙÜ®Üá° ®ÜvæÓÜÆá A®ÜáÊÜᣠ¯àvÜÇÝX¨æ ?

Q. No. 3. Explain the general principles relating to secured loan. Marks : 16

»Ü¨ÜÅñæ¿á ÓÝÆPæR ÓÜííÔ¨Üíñæ ÓÝÊÜޮܠñÜñÜÌWÜÙÜ®Üá° ËÊÜÄÔ.

Q. No. 4. What is indorsement ? Explain the different types of

Indorsement. Marks : 16

×íÃÜÖÜ Gí¨ÜÃæà®Üá ? ËË«Ü Äࣿá ×íÃÜÖÜWÜÙÜ®Üá° ËÊÜÄÔ.

Q. No. 5. Who is a Banker ? Explain general relationship of Banker with

his customer. Marks : 16

¸ÝÂíPÜà Gí¨ÜÃæ ¿ÞÃÜá ? WÝÅÖÜPÜ®Ü hæãñæX®Ü ¸ÝÂíPÜà ®Ü ÓÝÊÜÞ®ÜÂ

ÓÜíí«ÜÊÜ®Üá° ËÊÜÄÔ.

P.T.O.

0404 / 0805 -2- *0404-0805*

Q. No. 6. What precautions should a Banker take in opening a new

account in the name of a partnership and trust ? Marks : 16

±ÝÆá¨ÝÄPæ ÊÜáñÜᤠ®ÝÂÓÜWÜÙÜá ¸ÝÂíQ®ÜÈÉ ÖæãÓÜTÝñæ ñæÃæ¿ááÊÜ ÓÜÊÜá¿á¨ÜÈÉ

¸ÝÂíPÜÃÜ®Üá ñæWæ¨ÜáPæãÙÜÛ¸æàPÝXÃÜáÊÜ ÊÜááíhÝWÜÅñÝ PÜÅÊÜáWÜÙÝÊÜâÊÜâ ?

Q. No. 7. Briefly explain the customer's duties towards his Banker. Marks : 16

ñܮܰ ¸ÝÂíPÜÃ

®Ü PÜáÄñÜá WÝÅÖÜPܯXÃÜáÊÜ PÜñÜìÊÜÂWÜÙÜ®Üá° ÓÜíQұܤÊÝX ËÊÜÄÔ.

Q. No. 8. Write short note on any two of the following : Marks : (2×8=16)

¿ÞÊÜâ¨Ý¨ÜÃÜã GÃÜvÜPæR q±Ü³~ ÃæÀáÄ :

(a) Cyber evidence

˨Üá®ݾ®Ü ÓÝPÜÒ$Â

(b) Paying Banker

±ÝÊÜ£ÓÜáÊÜ ¸ÝÂíPÜÃ

(c) Banking Ombudsman

¸ÝÂíQíW

KíávÜÕÊÜá®

.

Q. No. 9 . Solve any two problems of the following : Marks : (2×10=20)

¿ÞÊÜâ¨Ý¨ÜÃÜã GÃÜvÜá ÓÜÊÜáÓæÂWÜÙÜ®Üá° ±ÜÄÖÜÄÔ :

(a) ‘H’ signs an instrument in the following form :

“I promise to pay ‘S’ or order Rs. 1,00,000 on the marriage

day of ‘S’

Is it a valid Promissory Note ? Give reasons.

"Ga ' GíáÊÜ®Üá D PæÙÜX®Üíñæ ÈUñܱÜñÜÅPæR ÓÜ× ÖÝQ¨Ýª®æ.

""®Ý®Üá "GÓ ' ¯Wæ A¥ÜÊÝ B¨æàÍÜ¨Ü ÊæáàÃæWæ ÃÜã. 1,00,000 ®Üá° "GÓ '®Ü

ÊÜá¨ÜáÊæ ©®Ü ÓÜí¨Ý¿á ÊÜÞvÜÆá ÊÝWݪ®Ü ÊÜÞvÜáñæ¤à®æ ''.

D ÊÝWݪ®Ü±ÜñÜÅ Ôí«ÜáÊæà ? PÝÃÜ| PæãwÄ.

*0404-0805* -3- 0404 / 0805

(b) ‘C’ instructs his Banker to buy certain debentures for him

and asks the Banker to keep them for him and collect the

interest on them. Subsequently ‘C’s current account is

overdrawn.

Can Banker exercise the lien over debentures ?

"PÜ' ñܮܰ ¸ÝÂíPÜÃ

¯Wæ ñܮܰ ±ÜÃÜÊÝX PæÆÊÜâ ÓÝƱÜñÜÅ SÄà©ÓÜÆá

ÓÜãbÓÜáñݤ®æ. ÊÜáñÜᤠAÊܯWÝX AÊÜâWÜÙÜ®Üá° ¸ÝÂíPÜÃ

®Üá CoárPæãívÜá

A¨ÜÄí¨Ü ÃÜáÊÜ wx ÓÜíWÜÅ×ÓÜÆá PæàÚPæãíwÃÜáñݤ®æ. ®ÜíñÜÃÜ "PÜ'®Üá

aÝȤ TÝñæ¿áÈÉ Öæbc®Ü ÖÜ| ±Üvæ©ÃÜáñݤ®æ.

B ÓÝƱÜñÜÅWÜÙÜ ÊæáàÇæ ¸ÝÂíPÜÃ

®Üá «ÝÃÜOÝPÝÃÜ aÜÇÝÀáÓÜÖÜá¨æà ?

(c) ‘A’ maintains an account in his sole name and enjoys an

overdraft which he does not repay despite demands. The

Banker adjusts the overdraft from the credit balance held

in the account in the joint names of ‘A’ and ‘B’.

‘B’ challenges it and demands for restoration of amount

from the Banker. Decide.

"A' ®Üá ñÜ®æã°º®Ü ÖæÓÜÄ®ÜÈÉ TÝñæ ñæWæ¨Üá , Öæbc®Ü ÖÜ|ÊÜ®Üá° ¸ÝÂíQ¯í¨Ü

±Üvæ¨ÜáPæãívÜá ¸ÝÂíPÜà ×í©ÃÜáXÓÜÆá ¸æàwPæÀápÝrWÜÆã

ÊÜáÃÜÚPæãvÜÆá £ÃÜÓÜRÄԨݪ®æ. BWÜ ¸ÝÂíPÜà "A' ÊÜáñÜᤠ"' CÊÜĺÃÜ

gíqà TÝñæÀáí¨Ü D ÖæaÜácÊÜÄ¿ÞX Pæãor ÖÜ|ÊÜ®Üá° Öæãí¨Ý~Pæ

ÊÜÞwPæãÙÜáÛñݤ®æ.

' C¨Ü®Üá° ±ÜÅΰÔ, ¸ÝÂíPÜà ñܮܰ gíqà TÝñæ¿á ÖÜ|ÊÜ®Üá°

ÊÜáÃÜÚÓܸàæ Pæí¨Üá ¸æàwPæ ÓÜÈÉԨݪ®æ. £àÊÜÞì¯Ô.

________________

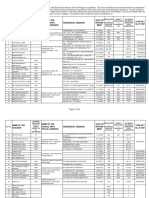

You might also like

- 18 Stages of Civil Suit As Per Civil Procedure CodeDocument13 pages18 Stages of Civil Suit As Per Civil Procedure CodeAdv Kirti Dubey100% (2)

- 18 Stages of Civil Suit As Per Civil Procedure CodeDocument13 pages18 Stages of Civil Suit As Per Civil Procedure CodeAdv Kirti Dubey100% (2)

- Indian Contract Act, 1872Document302 pagesIndian Contract Act, 1872Neha Kalra100% (3)

- Proceedings - of - The - Grand - Lodge - of - NY 1905 History of Lodges Including Hiram 105 PDFDocument573 pagesProceedings - of - The - Grand - Lodge - of - NY 1905 History of Lodges Including Hiram 105 PDFMark RobsonNo ratings yet

- KSLU Previous Question PapersDocument228 pagesKSLU Previous Question PapersSandeep Shekar50% (2)

- Itm Memorial Petitioner PDFDocument34 pagesItm Memorial Petitioner PDFNnNo ratings yet

- Copyright Ipr 2Document8 pagesCopyright Ipr 2NnNo ratings yet

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- Barangay Budget ExecutionDocument6 pagesBarangay Budget Executionlinden_07100% (1)

- Bar Exam Suggested Answers - 2017 Labor Law Bar Q&A AUGUST 31, 2018 2017 Labor Law Bar Questions and AnswersDocument17 pagesBar Exam Suggested Answers - 2017 Labor Law Bar Q&A AUGUST 31, 2018 2017 Labor Law Bar Questions and AnswersImma FoosaNo ratings yet

- KSLU Previous Question Papers FewDocument3 pagesKSLU Previous Question Papers FewSandeep Shekar100% (1)

- Resource Ordering Management API REST SpecificationDocument34 pagesResource Ordering Management API REST SpecificationalexfarcasNo ratings yet

- IV Semester 3 Yrs. LL.B./VIII Semester 5 Yrs. B.A.LL.B./B.B.A.LL.B. Examination, December 2017 Opt. Ii: Banking LawDocument2 pagesIV Semester 3 Yrs. LL.B./VIII Semester 5 Yrs. B.A.LL.B./B.B.A.LL.B. Examination, December 2017 Opt. Ii: Banking LawNnNo ratings yet

- IV Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A. LL.B./B.B.A.LL.B. Examination, June/July 2015 Opt. - Ii: Banking LawDocument2 pagesIV Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A. LL.B./B.B.A.LL.B. Examination, June/July 2015 Opt. - Ii: Banking LawNnNo ratings yet

- Fourth Semester 3 Year LL.B./VIII Semester 5 Year B.A. LL.B./ B.B.A. LL.B. (Old) Examination, June/July 2016 BANKING LAW (Optional - II)Document2 pagesFourth Semester 3 Year LL.B./VIII Semester 5 Year B.A. LL.B./ B.B.A. LL.B. (Old) Examination, June/July 2016 BANKING LAW (Optional - II)18651 SYEDA AFSHANNo ratings yet

- Banking Law Old Question Paper 2016Document3 pagesBanking Law Old Question Paper 2016ashokromansNo ratings yet

- Üå. Óüí. Êüáñüá Eú Ü ¿Þêüâ Æà I Üpær Eñü Äôä. Üå. Óüí. Pær Aípüwüùüá Êüáñüá Eú Üêüâwüúwæ Ñüçý Aípüwüùüá. Eñü Ãüêü®Üá° Bíwüé A Üêý Pü®Ü°Vü Üèé Óüí Üä - Ìêýx Ÿãæ¿Á ÆàpüáDocument3 pagesÜå. Óüí. Êüáñüá Eú Ü ¿Þêüâ Æà I Üpær Eñü Äôä. Üå. Óüí. Pær Aípüwüùüá Êüáñüá Eú Üêüâwüúwæ Ñüçý Aípüwüùüá. Eñü Ãüêü®Üá° Bíwüé A Üêý Pü®Ü°Vü Üèé Óüí Üä - Ìêýx Ÿãæ¿Á ÆàpüáNagalikar LawNo ratings yet

- 0404/0805 IV Semester 3 Year LL.B./ VIII Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. Ii: Banking LawDocument3 pages0404/0805 IV Semester 3 Year LL.B./ VIII Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. Ii: Banking LawNnNo ratings yet

- Question Paper.2011Document3 pagesQuestion Paper.2011Ranjan BaradurNo ratings yet

- KSLU Previous Question Papers Semester 1Document228 pagesKSLU Previous Question Papers Semester 1Sandeep ShekarNo ratings yet

- June2017maj MinDocument3 pagesJune2017maj Minmonish bNo ratings yet

- 0201 0521Document3 pages0201 0521Whimsical WillowNo ratings yet

- Fourth Semester 3 Yrs. LL.B./Eight Semester 5 Yrs. B.A. LL.B./ B.B.A. LL.B. Examination, December 2014 BANKING LAW (Optional - II)Document3 pagesFourth Semester 3 Yrs. LL.B./Eight Semester 5 Yrs. B.A. LL.B./ B.B.A. LL.B. Examination, December 2014 BANKING LAW (Optional - II)Nagalikar LawNo ratings yet

- Taxation Laws - 2017Document2 pagesTaxation Laws - 201718651 SYEDA AFSHANNo ratings yet

- 0202/0621 II Semester 3 Years LL.B./VI Semester 5 Years B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Company Law (Old Batch)Document3 pages0202/0621 II Semester 3 Years LL.B./VI Semester 5 Years B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Company Law (Old Batch)18651 SYEDA AFSHANNo ratings yet

- II Semester 3 Years LL.B. / VI Semester 5 Years B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Property Law (Old Batch)Document3 pagesII Semester 3 Years LL.B. / VI Semester 5 Years B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Property Law (Old Batch)RichardNo ratings yet

- Taxation Law - Question PapersDocument2 pagesTaxation Law - Question Papers18651 SYEDA AFSHANNo ratings yet

- Company Law 2017Document3 pagesCompany Law 2017Kishor SinghNo ratings yet

- II Semester 3 Year LL.B./VI Semester 5 Years B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Company LawDocument3 pagesII Semester 3 Year LL.B./VI Semester 5 Years B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Company Law18651 SYEDA AFSHANNo ratings yet

- I Semester 3 Years LL.B./IV Semester 5 Years B.A. LL.B./B.B.A. LL.B. (5 Years Course) Examination, December 2014 Contract - I - General Principles of ContractsDocument6 pagesI Semester 3 Years LL.B./IV Semester 5 Years B.A. LL.B./B.B.A. LL.B. (5 Years Course) Examination, December 2014 Contract - I - General Principles of ContractssimranNo ratings yet

- 2048 0203 0622 PDFDocument3 pages2048 0203 0622 PDFPARAMESHA ANo ratings yet

- June 2015 Admin Law KSLU QPDocument4 pagesJune 2015 Admin Law KSLU QPAarthi SnehaNo ratings yet

- IV Semester of 3 Year LL.B./VIII Semester of 5 Year B.A.,LL.B./ B.B.A.,LL.B. Examination, December 2013 Optional - II: BANKING LAWDocument4 pagesIV Semester of 3 Year LL.B./VIII Semester of 5 Year B.A.,LL.B./ B.B.A.,LL.B. Examination, December 2013 Optional - II: BANKING LAWGanesh MaligoudarNo ratings yet

- First Semester 3 Year LL.B./ IV Semester 5 Year B.A. LL.B. / B.B.A. LL.B. Examination, December 2015 Contract - IDocument4 pagesFirst Semester 3 Year LL.B./ IV Semester 5 Year B.A. LL.B. / B.B.A. LL.B. Examination, December 2015 Contract - ISavioPereira1234No ratings yet

- E-July-2020 - Contract Law-I KSLUDocument3 pagesE-July-2020 - Contract Law-I KSLUBalachandra P RNo ratings yet

- Special Contract Question PapersDocument10 pagesSpecial Contract Question PapersVeeresh AngadiNo ratings yet

- Itl June 2017Document2 pagesItl June 2017MITHUN UNo ratings yet

- Second Semester 3 Year LL.B./Sixth Semester 5 Year B.A.LL.B./ B.B.A.LL.B. Examination, December 2016 Property LawDocument3 pagesSecond Semester 3 Year LL.B./Sixth Semester 5 Year B.A.LL.B./ B.B.A.LL.B. Examination, December 2016 Property LawRichardNo ratings yet

- V Semester 3 Year LL.B./IX Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. - Iv: Competition LawDocument3 pagesV Semester 3 Year LL.B./IX Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. - Iv: Competition LawSandesh S BhasriNo ratings yet

- Civil Procedure Code PDFDocument3 pagesCivil Procedure Code PDFAnonymous VXnKfXZ2PNo ratings yet

- V Semester 3 Yr. LL.B./IX Semester 5 Yr. B.A.LL.B./B.B.A.LL.B. Examination, Dec. 2017 Optional Iv: Competition LawDocument3 pagesV Semester 3 Yr. LL.B./IX Semester 5 Yr. B.A.LL.B./B.B.A.LL.B. Examination, Dec. 2017 Optional Iv: Competition LawSandesh S BhasriNo ratings yet

- First Semester 3 Year LL.B./IV Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2016 Contract I General Principles of ContractDocument3 pagesFirst Semester 3 Year LL.B./IV Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2016 Contract I General Principles of ContractAbhiNo ratings yet

- Emailing Labour Law - II QN PapersDocument67 pagesEmailing Labour Law - II QN PapersHavnur SLSRFNo ratings yet

- Economics Question Paper 3rd SemDocument8 pagesEconomics Question Paper 3rd SemChandra MouliNo ratings yet

- Economics Major Pap-2Document2 pagesEconomics Major Pap-2Nandan GowdaNo ratings yet

- Dec 2018 Old & NewDocument2 pagesDec 2018 Old & NewRama sekarNo ratings yet

- BCMCMC 155Document3 pagesBCMCMC 155PRAJNEESH SHETTYNo ratings yet

- II Semester of Three Year LL.B. / V Semester of Five Year B.A. LL.B./ B.B.A. LL.B. Examination, June/July 2014 CONTRACT - II (Course - II)Document4 pagesII Semester of Three Year LL.B. / V Semester of Five Year B.A. LL.B./ B.B.A. LL.B. Examination, June/July 2014 CONTRACT - II (Course - II)RichardNo ratings yet

- III Semester of 3 Yr. LL.B./VII Semester of 5 Yr. B.A./ B.B.A. LL.B Examination, December 2016 JurisprudenceDocument2 pagesIII Semester of 3 Yr. LL.B./VII Semester of 5 Yr. B.A./ B.B.A. LL.B Examination, December 2016 JurisprudenceRichardNo ratings yet

- Dec 2017 - Admin LawDocument3 pagesDec 2017 - Admin Law18651 SYEDA AFSHANNo ratings yet

- July 2019 Old & NewDocument3 pagesJuly 2019 Old & NewRama sekarNo ratings yet

- Fourth Semester of Three Year LL.B. Examination, January 2012 Optional - II: BANKING LAW (Course - III)Document4 pagesFourth Semester of Three Year LL.B. Examination, January 2012 Optional - II: BANKING LAW (Course - III)Nagalikar LawNo ratings yet

- IV Semester 3 Year LL.B./VIII Semester 5 Year B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Opt. - I: Insurance LawDocument2 pagesIV Semester 3 Year LL.B./VIII Semester 5 Year B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Opt. - I: Insurance LawRichardNo ratings yet

- 0405 0804Document4 pages0405 0804RichardNo ratings yet

- III/IV Semester 5 Year B.A., LL.B. (Major - Minor) Examination, June/July 2016 Major III / Minor II: Paper - 3: ECONOMICS Economic Theory and Public FinanceDocument2 pagesIII/IV Semester 5 Year B.A., LL.B. (Major - Minor) Examination, June/July 2016 Major III / Minor II: Paper - 3: ECONOMICS Economic Theory and Public FinanceRichardNo ratings yet

- II/III Semester 5 Year B.A. LL.B. (Maj-Min) Examination, June/July 2016 ECONOMICS - II (Major-Minor - II) (Money, Banking and International Trade)Document2 pagesII/III Semester 5 Year B.A. LL.B. (Maj-Min) Examination, June/July 2016 ECONOMICS - II (Major-Minor - II) (Money, Banking and International Trade)Raksha RNo ratings yet

- KSLU Question PaerDocument4 pagesKSLU Question Paerinpbm0No ratings yet

- Itl Dec 2015Document2 pagesItl Dec 2015MITHUN UNo ratings yet

- Ix Semester 5yr. B.A./B.B.A., Ll.B. (Hon'S) Examination, March/April 2021 Civil Procedure Code and Limitation ActDocument3 pagesIx Semester 5yr. B.A./B.B.A., Ll.B. (Hon'S) Examination, March/April 2021 Civil Procedure Code and Limitation ActSoundary DesaiNo ratings yet

- Banking Theory & Pactice May 2012Document2 pagesBanking Theory & Pactice May 2012Prasad C MNo ratings yet

- Dec 2017 Old & NewDocument3 pagesDec 2017 Old & NewRama sekarNo ratings yet

- IX Semester 5 Year B.A. LL.B./B.B.A., LL.B. (Hons.) Examination, December 2016 Civil Procedure Code and Limitation ActDocument3 pagesIX Semester 5 Year B.A. LL.B./B.B.A., LL.B. (Hons.) Examination, December 2016 Civil Procedure Code and Limitation ActSoundary DesaiNo ratings yet

- Torts - 2015 - 12Document2 pagesTorts - 2015 - 12Aarthi SnehaNo ratings yet

- Second Semester of Three Year LL.B. Examination, June 2011 CONTRACT - II (Course - I)Document4 pagesSecond Semester of Three Year LL.B. Examination, June 2011 CONTRACT - II (Course - I)RichardNo ratings yet

- V Semester 3 Year LL.B./IX Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, December 2016 Opt. Iii: Intellectual Property Rights IDocument2 pagesV Semester 3 Year LL.B./IX Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, December 2016 Opt. Iii: Intellectual Property Rights ISandesh S BhasriNo ratings yet

- 2043 I Semester 3 Years LL.B./V Semester 5 Year B.A.LL.B. (Maj.-Min.-System) / V Semester 5 Year B.B.A.LL.B. (New) Examination, June/July 2017 Law of TortsDocument3 pages2043 I Semester 3 Years LL.B./V Semester 5 Year B.A.LL.B. (Maj.-Min.-System) / V Semester 5 Year B.B.A.LL.B. (New) Examination, June/July 2017 Law of TortsSuraj Srivatsav.SNo ratings yet

- Second Semester of Three Year LL.B./Sixth Semester of Five Year B.A. LL.B./B.B.A. LL.B. Examination, December 2013 Property Law (Course - Iii)Document4 pagesSecond Semester of Three Year LL.B./Sixth Semester of Five Year B.A. LL.B./B.B.A. LL.B. Examination, December 2013 Property Law (Course - Iii)RichardNo ratings yet

- Second Semester of Three Year LL.B./Sixth Semester of Five Year B.A. LL.B./B.B.A. LL.B. Examination, December 2013 Property Law (Course - Iii)Document4 pagesSecond Semester of Three Year LL.B./Sixth Semester of Five Year B.A. LL.B./B.B.A. LL.B. Examination, December 2013 Property Law (Course - Iii)saditha manjulahariNo ratings yet

- V Semester 3 Year LL.B./IX Semester 5 Year B.A.LL.B./B.B.A.LL.B. Examination, December 2017 Opt. Iii: Intellectual Property Rights IDocument2 pagesV Semester 3 Year LL.B./IX Semester 5 Year B.A.LL.B./B.B.A.LL.B. Examination, December 2017 Opt. Iii: Intellectual Property Rights ISandesh S BhasriNo ratings yet

- WTODocument5 pagesWTONnNo ratings yet

- 0404/0805 IV Semester 3 Year LL.B./ VIII Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. Ii: Banking LawDocument3 pages0404/0805 IV Semester 3 Year LL.B./ VIII Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. Ii: Banking LawNnNo ratings yet

- Sai Abhipsa Gochhayat: Understanding of Right To Abortion Under Indian ConstitutionDocument10 pagesSai Abhipsa Gochhayat: Understanding of Right To Abortion Under Indian ConstitutionMalaisamy ANo ratings yet

- WTODocument5 pagesWTONnNo ratings yet

- 1 Itm Moot FinalDocument31 pages1 Itm Moot FinalNnNo ratings yet

- The Honourable Supreme Court of Neverland: BeforeDocument31 pagesThe Honourable Supreme Court of Neverland: BeforeNnNo ratings yet

- In The Hon'Ble Trial Court Ordinary Original Jurisdiction Civil Suit No. - of 2015Document13 pagesIn The Hon'Ble Trial Court Ordinary Original Jurisdiction Civil Suit No. - of 2015NnNo ratings yet

- Main PetitionDocument46 pagesMain PetitionNnNo ratings yet

- Reservations Are Restrictions of Present India: Naveed NaseemDocument3 pagesReservations Are Restrictions of Present India: Naveed NaseemNnNo ratings yet

- The Honourable Supreme Court of Neverland: BeforeDocument33 pagesThe Honourable Supreme Court of Neverland: BeforeNnNo ratings yet

- Indian Constitution and Self Inflicted Wounds ARVIND P DATAR PDFDocument21 pagesIndian Constitution and Self Inflicted Wounds ARVIND P DATAR PDFSHIVENDRA SHIVAM SINGH RATHORENo ratings yet

- Problem No. 5 PDFDocument2 pagesProblem No. 5 PDFNnNo ratings yet

- Problem No.4Document2 pagesProblem No.4NnNo ratings yet

- Literary ManualDocument24 pagesLiterary ManualFaheem QaziNo ratings yet

- Campus Law Centre Freshers Induction Moot 2015Document13 pagesCampus Law Centre Freshers Induction Moot 2015Shubham Nath33% (3)

- 186th ReportDocument169 pages186th ReportMeera KackerNo ratings yet

- Problem No. 5 PDFDocument2 pagesProblem No. 5 PDFNnNo ratings yet

- Free Online Courses For (Aspiring) LawyersDocument5 pagesFree Online Courses For (Aspiring) LawyersNnNo ratings yet

- Behavior Theory2011Document23 pagesBehavior Theory2011NnNo ratings yet

- Patent Manual RightsDocument0 pagesPatent Manual RightsShubham ShekharNo ratings yet

- Bharat Glass Tube Limited V Gopal Glass Works Limited - NilanjanaDocument2 pagesBharat Glass Tube Limited V Gopal Glass Works Limited - NilanjanaNn100% (1)

- TORTSDocument4 pagesTORTSNnNo ratings yet

- 67Document42 pages67Rick DasNo ratings yet

- Jurisdiction: Raeesa VakilDocument18 pagesJurisdiction: Raeesa VakilAadhitya NarayananNo ratings yet

- Assignment of Mortgage RegularNonMERS-1Document2 pagesAssignment of Mortgage RegularNonMERS-1Helpin HandNo ratings yet

- Prestige Cost CalculatorDocument2 pagesPrestige Cost CalculatornpriyadarshiNo ratings yet

- Tax Planning With Reference To Financial Management: Presented byDocument32 pagesTax Planning With Reference To Financial Management: Presented byamitsingla19No ratings yet

- EUL14137 WomenViolence 101118 WebDocument212 pagesEUL14137 WomenViolence 101118 WebVhenus BeltNo ratings yet

- Acko Group Health Insurance PolicyDocument88 pagesAcko Group Health Insurance Policyhsp0845No ratings yet

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- HistoryDocument2 pagesHistoryJoel Mangallay100% (2)

- Education - Justice and DemocracyDocument37 pagesEducation - Justice and DemocracyRicardo Torres RibeiroNo ratings yet

- S7-1200 TCBDocument60 pagesS7-1200 TCBJack RosalesNo ratings yet

- Geroche Vs People GR No. 179080, November 26, 2014Document6 pagesGeroche Vs People GR No. 179080, November 26, 2014salinpusaNo ratings yet

- Binary Vapor Liquid EquilibriumDocument4 pagesBinary Vapor Liquid EquilibriumFarid DarwishNo ratings yet

- Roundtable On Law School and Bar Admission For People With Criminal Records Stanford Law School April 26-27, 2018 ParticipantsDocument7 pagesRoundtable On Law School and Bar Admission For People With Criminal Records Stanford Law School April 26-27, 2018 ParticipantsJerri Lynn CookNo ratings yet

- Full Text Marine Engineer Officer - Top 10Document3 pagesFull Text Marine Engineer Officer - Top 10TheSummitExpressNo ratings yet

- UntitledDocument4 pagesUntitledPhillips West News OutletNo ratings yet

- 2 0 1 1 C A S E S PropertyDocument36 pages2 0 1 1 C A S E S PropertyIcee GenioNo ratings yet

- F.miklosich - Chronica NestorisDocument258 pagesF.miklosich - Chronica NestorisДжу ХоNo ratings yet

- BD 041222 ICC Update Bank ListDocument18 pagesBD 041222 ICC Update Bank ListArdian MantowNo ratings yet

- NDA - LTA SingaporeDocument5 pagesNDA - LTA Singapore2742481No ratings yet

- Peace Corps Safety Security AssistantDocument2 pagesPeace Corps Safety Security AssistantAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- 2022-1046 N-LIMA BGC PROPERTIES (F)Document1 page2022-1046 N-LIMA BGC PROPERTIES (F)Mary Grace CanjaNo ratings yet

- 2019 Beda Memaid Labor 270Document1 page2019 Beda Memaid Labor 270Marlo Caluya ManuelNo ratings yet

- Gyro Compass Standard 22 NX - Standard 22 NX Replaces Standard 22 - SB - 1 - 2020Document2 pagesGyro Compass Standard 22 NX - Standard 22 NX Replaces Standard 22 - SB - 1 - 2020karthikNo ratings yet

- Dwnload Full Economics 19th Edition Mcconnell Solutions Manual PDFDocument35 pagesDwnload Full Economics 19th Edition Mcconnell Solutions Manual PDFlashingbleeqcf70100% (15)