Professional Documents

Culture Documents

Fourth Semester 3 Year LL.B./VIII Semester 5 Year B.A. LL.B./ B.B.A. LL.B. (Old) Examination, June/July 2016 BANKING LAW (Optional - II)

Uploaded by

18651 SYEDA AFSHAN0 ratings0% found this document useful (0 votes)

17 views2 pagesOriginal Title

BL - June 2016

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesFourth Semester 3 Year LL.B./VIII Semester 5 Year B.A. LL.B./ B.B.A. LL.B. (Old) Examination, June/July 2016 BANKING LAW (Optional - II)

Uploaded by

18651 SYEDA AFSHANCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

*04040805* 0404/0805

Fourth Semester 3 Year LL.B./VIII Semester 5 Year B.A. LL.B./

B.B.A. LL.B. (Old) Examination, June/July 2016

BANKING LAW (Optional – II)

Duration : 3 Hours Max. Marks : 100

Instructions : 1. Answer Question No. 9 and any five of the remaining

questions.

2. Q. No. 9 carries 20 marks and remaining questions carry

16 marks each.

3. Answers should be written either in English or Kannada

completely.

Q. No. 1. Discuss the functions of commercial banks in India. Marks : 16

»ÝÃÜñܨÜÈÉ®Ü ÊÝ~g ¸ÝÂíPÜáWÜÙÜ PÝÃÜÂWÜÙÜ®Üá° aÜbìÔÄ.

Q. No. 2. Discuss the Banker’s obligation to maintain the secrecy of the

customers account. Marks : 16

WÝÅÖÜPÜ®Ü TÝñæ¿á Wè±ÜÂñæ¿á®Üá° PݱÝvÜáÊÜÈÉ ¸ÝÂíPÜÃÜ®Ü ÖæãOæWÝÄPæ¿á®Üá°

aÜbìÔÄ.

Q. No. 3. What is endorsement ? Explain different types of endorsement. Marks : 16

×íÃÜÖÜ Gí¨ÜÃæà®Üá ? ËË«Ü Äࣿá ×íÃÜÖÜWÜÙÜ®Üá° ËÊÜÄÔ.

Q. No. 4. Explain the precautions to be taken by a banker while lending

against goods. Marks : 16

¸ÝÂíQ®ÜÊÜÃÜá ÓÜÃÜPÜáWÜÙÜ B«ÝÃÜ¨Ü ÊæáàÇæ ÓÝÆ PæãvÜáÊÝWÜ ¿ÞÊÜ Äࣿá

GaÜcÄPÝ PÜÅÊÜáWÜÙÜ®Üá° ñæWæ¨ÜáPæãÙÜÛ¸æàPÜæíá¨Ü®Üá° ËÊÜÄÔ.

Q. No. 5. Examine the grounds under which banking ombudsman may

reject the complaint. Marks : 16

¨ÜãÃÜáWÜÙÜ®Üá° ¸ÝÂíQíW Kív ÕÊÜá® ¿ÞÊÜ B«ÝÃÜWÜÙÜ ÊæáàÇæ

£ÃÜÓÜRÄÓÜÖÜá¨æí WæY ±ÜÄàQÒÔÄ.

Q. No. 6. Define cheque. Distinguish cheque from bill of exchange. Marks : 16

""aæP '' C¨ÜÃÜ ÊÝÂTæ Pæãw. aæP ®Üᰠ˯ÊÜá¿á ±ÜñÜÅ©í¨Ü ÊÜÂñÜÂÔÔÄ.

Q. No. 7. Who is paying banker ? State the statutory protections

available to paying banker. Marks : 16

±ÝÊÜ£ ¸ÝÂíPÜÃÜ Gí¨ÜÃæ ¿ÞÃÜá ? ±ÝÊÜ£ ¸ÝÂíPÜÃÜÄWæ CÃÜáÊÜ ÍÝÓܮܨÜ

ÃÜPæÒWÜÙÜ®Üá° £ÚÔ.

P.T.O.

0404/0805 *04040805*

Q. No. 8. Write short note any two of the following : Marks : 2×8=16

¿ÞÊÜâ¨Ý¨ÜÃÜã GÃÜvÜPæR q±Ü³~ ÃæÀáÄ :

a) Internet banking

Cíoà ®æp ¸ÝÂíQíW

b) Promissory note

ÊÝWݪ®Ü ±ÜñÜÅ

c) Agency services.

PÝÃÜ»ÝÄ ÓæàÊæWÜÙÜá.

Q. No. 9. Solve any two of the following problems : Marks : 10×2=20

PæÙÜX®Ü ¿ÞÊÜâ¨Ý¨ÜÃÜã GÃÜvÜá ÓÜÊÜáÓæÂWÜÙÜ®Üá° £àÊÜÞì¯ÔÄ :

a) A, B, C and D are partners in the Y firm. They informed the

banker that A and B will operate the firm's current account. Can

banker honour the cheques of the firm signed by A and C ?

G, ¹, Ô ÊÜáñÜᤠw CÊÜÃáÜ Êæç ±ÝÆá¨ÝÄPÝ ÓÜíÓæ¿ § áÈÉ ±ÝÆá¨ÝÃÜÃÝX¨ÝªÃ.æ

AÊÜÃáÜ ¸ÝÂíQ®ÜÈÉ ñæè

æ Ü aÝȤ TÝñæ¿á®Üá° G ÊÜáñÜᤠ¹ ¯ÊÜì×ÓÜáñݤÃíæ ¨Üá

¸ÝÂíPÜÃ¯Ü Wæ £ÚÔÃÜáñݤÃ.æ ¸ÝÂíPÜÃ®Ü áÜ A¨Ü®áÜ ° J²³Pã

æ ívÜá G ÊÜáñÜá¤ Ô ÓÜ×

ÊÜÞw¨Ü aæPÜR®Üá° ±ÝÊÜ£ÓÜÖÜá¨æà ?

b) Rajesh could not present the cheque received from his

friend due to the busy schedule. Period of limitation is

about to expire on a day which happens to be a public

holiday. Advice Rajesh.

ÃÝhæàÍ ñܮܰ Óæ°à×ñܯí¨Ü ±Üvæ¨Ü aæPÜ®Üá° PæÆÓÜ ¯Ëáñܤ PÝÃÜ| ¸ÝÂíQWæ

ÓÜÈÉÓÜÇÝWÜÈÆÉ. ÓÝÊÜìg¯PÜ ÃÜhÝ ©®Ü¨Üí¨Üá PÝÆ ±ÜÄËᣠAÊÜ

ÊÜááPݤ¿áÊÝWÜáÊÜâ¨ÜÃÜÈɨæ. ÃÝhæàÍ Wæ ÓÜÆÖæ ¯àw.

c) A customer of a Canara Bank approaches another branch of

the same bank for loan facility against F.D. receipt of

Rs. 2,00,000.00 issued in his favour. Whether his request

for loan can be considered ? Decide.

Pæ®ÜÃÝ ¸ÝÂíQ®Ü Jí¨Üá ÍÝTæ¿á WÝÅÖÜPÜ®Üá A¨æà ¸ÝÂíQ®Ü C®æã°í¨Üá

ÍÝTæWæ ÖæãàX ¯ÃÜSá sæàÊÜ~ ±ÜñÜÅ¨Ü B«ÝÃÜ¨Ü ÊæáàÇæ ÃÜã±ÝÀá

2,00,000.00 ÓÝÆ PæãvÜáÊÜíñæ ±ÜÅÓݤÊÜ®æ ÊÜáãÆPÜ Ë®Üí£ÓÜáÊÜ®Üá.

¸ÝÂíPÜÃÜ®Üá D ±ÜÅÓݤÊÜ®æ¿á®Üá° ÖæàWæ ±ÜÄWÜ~ÓܸæàPÜá ? ¯«ÜìÄÔ.

________________

You might also like

- Master Franchise AgreementDocument21 pagesMaster Franchise AgreementJyoti Singh100% (3)

- KSLU Previous Question PapersDocument228 pagesKSLU Previous Question PapersSandeep Shekar50% (2)

- KSLU Previous Question Papers FewDocument3 pagesKSLU Previous Question Papers FewSandeep Shekar100% (1)

- UG JForce Agreement - Terms and ConditionsDocument8 pagesUG JForce Agreement - Terms and ConditionsALELE VINCENTNo ratings yet

- Azure Data Platform Overview PDFDocument30 pagesAzure Data Platform Overview PDFpraveenindayNo ratings yet

- IV Semester 3 Yrs. LL.B./VIII Semester 5 Yrs. B.A.LL.B./B.B.A.LL.B. Examination, December 2017 Opt. Ii: Banking LawDocument2 pagesIV Semester 3 Yrs. LL.B./VIII Semester 5 Yrs. B.A.LL.B./B.B.A.LL.B. Examination, December 2017 Opt. Ii: Banking LawNnNo ratings yet

- IV Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A. LL.B./B.B.A.LL.B. Examination, June/July 2015 Opt. - Ii: Banking LawDocument2 pagesIV Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A. LL.B./B.B.A.LL.B. Examination, June/July 2015 Opt. - Ii: Banking LawNnNo ratings yet

- Fourth Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A.LL.B. / B.B.A. LL.B. Examination, December 2015 Opt - Ii: Banking LawDocument3 pagesFourth Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A.LL.B. / B.B.A. LL.B. Examination, December 2015 Opt - Ii: Banking LawNnNo ratings yet

- Banking Law Old Question Paper 2016Document3 pagesBanking Law Old Question Paper 2016ashokromansNo ratings yet

- 0404/0805 IV Semester 3 Year LL.B./ VIII Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. Ii: Banking LawDocument3 pages0404/0805 IV Semester 3 Year LL.B./ VIII Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. Ii: Banking LawNnNo ratings yet

- Üå. Óüí. Êüáñüá Eú Ü ¿Þêüâ Æà I Üpær Eñü Äôä. Üå. Óüí. Pær Aípüwüùüá Êüáñüá Eú Üêüâwüúwæ Ñüçý Aípüwüùüá. Eñü Ãüêü®Üá° Bíwüé A Üêý Pü®Ü°Vü Üèé Óüí Üä - Ìêýx Ÿãæ¿Á ÆàpüáDocument3 pagesÜå. Óüí. Êüáñüá Eú Ü ¿Þêüâ Æà I Üpær Eñü Äôä. Üå. Óüí. Pær Aípüwüùüá Êüáñüá Eú Üêüâwüúwæ Ñüçý Aípüwüùüá. Eñü Ãüêü®Üá° Bíwüé A Üêý Pü®Ü°Vü Üèé Óüí Üä - Ìêýx Ÿãæ¿Á ÆàpüáNagalikar LawNo ratings yet

- 0201 0521Document3 pages0201 0521Whimsical WillowNo ratings yet

- Fourth Semester 3 Yrs. LL.B./Eight Semester 5 Yrs. B.A. LL.B./ B.B.A. LL.B. Examination, December 2014 BANKING LAW (Optional - II)Document3 pagesFourth Semester 3 Yrs. LL.B./Eight Semester 5 Yrs. B.A. LL.B./ B.B.A. LL.B. Examination, December 2014 BANKING LAW (Optional - II)Nagalikar LawNo ratings yet

- KSLU Previous Question Papers Semester 1Document228 pagesKSLU Previous Question Papers Semester 1Sandeep ShekarNo ratings yet

- II Semester 3 Years LL.B. / VI Semester 5 Years B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Property Law (Old Batch)Document3 pagesII Semester 3 Years LL.B. / VI Semester 5 Years B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Property Law (Old Batch)RichardNo ratings yet

- II Semester 3 Year LL.B./VI Semester 5 Years B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Company LawDocument3 pagesII Semester 3 Year LL.B./VI Semester 5 Years B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Company Law18651 SYEDA AFSHANNo ratings yet

- 0202/0621 II Semester 3 Years LL.B./VI Semester 5 Years B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Company Law (Old Batch)Document3 pages0202/0621 II Semester 3 Years LL.B./VI Semester 5 Years B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Company Law (Old Batch)18651 SYEDA AFSHANNo ratings yet

- June2017maj MinDocument3 pagesJune2017maj Minmonish bNo ratings yet

- Taxation Law - Question PapersDocument2 pagesTaxation Law - Question Papers18651 SYEDA AFSHANNo ratings yet

- Taxation Laws - 2017Document2 pagesTaxation Laws - 201718651 SYEDA AFSHANNo ratings yet

- 2048 0203 0622 PDFDocument3 pages2048 0203 0622 PDFPARAMESHA ANo ratings yet

- I Semester 3 Years LL.B./IV Semester 5 Years B.A. LL.B./B.B.A. LL.B. (5 Years Course) Examination, December 2014 Contract - I - General Principles of ContractsDocument6 pagesI Semester 3 Years LL.B./IV Semester 5 Years B.A. LL.B./B.B.A. LL.B. (5 Years Course) Examination, December 2014 Contract - I - General Principles of ContractssimranNo ratings yet

- June 2015 Admin Law KSLU QPDocument4 pagesJune 2015 Admin Law KSLU QPAarthi SnehaNo ratings yet

- Second Semester 3 Year LL.B./Sixth Semester 5 Year B.A.LL.B./ B.B.A.LL.B. Examination, December 2016 Property LawDocument3 pagesSecond Semester 3 Year LL.B./Sixth Semester 5 Year B.A.LL.B./ B.B.A.LL.B. Examination, December 2016 Property LawRichardNo ratings yet

- Civil Procedure Code PDFDocument3 pagesCivil Procedure Code PDFAnonymous VXnKfXZ2PNo ratings yet

- III Semester of 3 Yr. LL.B./VII Semester of 5 Yr. B.A./ B.B.A. LL.B Examination, December 2016 JurisprudenceDocument2 pagesIII Semester of 3 Yr. LL.B./VII Semester of 5 Yr. B.A./ B.B.A. LL.B Examination, December 2016 JurisprudenceRichardNo ratings yet

- Torts - 2015 - 12Document2 pagesTorts - 2015 - 12Aarthi SnehaNo ratings yet

- Company Law 2017Document3 pagesCompany Law 2017Kishor SinghNo ratings yet

- Dec 2017 - Admin LawDocument3 pagesDec 2017 - Admin Law18651 SYEDA AFSHANNo ratings yet

- Economics Question Paper 3rd SemDocument8 pagesEconomics Question Paper 3rd SemChandra MouliNo ratings yet

- E-July-2020 - Contract Law-I KSLUDocument3 pagesE-July-2020 - Contract Law-I KSLUBalachandra P RNo ratings yet

- IV Semester 3 Years LL.B./VIII Semester 5 Years B.A.LL.B. / B.B.A.LL.B. Examination, December 2015 Public International LawDocument3 pagesIV Semester 3 Years LL.B./VIII Semester 5 Years B.A.LL.B. / B.B.A.LL.B. Examination, December 2015 Public International LawRichardNo ratings yet

- Question Paper.2011Document3 pagesQuestion Paper.2011Ranjan BaradurNo ratings yet

- Itl June 2017Document2 pagesItl June 2017MITHUN UNo ratings yet

- Special Contract Question PapersDocument10 pagesSpecial Contract Question PapersVeeresh AngadiNo ratings yet

- V Semester 3 Yr. LL.B./IX Semester 5 Yr. B.A.LL.B./B.B.A.LL.B. Examination, Dec. 2017 Optional Iv: Competition LawDocument3 pagesV Semester 3 Yr. LL.B./IX Semester 5 Yr. B.A.LL.B./B.B.A.LL.B. Examination, Dec. 2017 Optional Iv: Competition LawSandesh S BhasriNo ratings yet

- Dec 2017 Old & NewDocument3 pagesDec 2017 Old & NewRama sekarNo ratings yet

- Economics Major Pap-2Document2 pagesEconomics Major Pap-2Nandan GowdaNo ratings yet

- First Semester 3 Year LL.B./IV Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2016 Contract I General Principles of ContractDocument3 pagesFirst Semester 3 Year LL.B./IV Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2016 Contract I General Principles of ContractAbhiNo ratings yet

- Emailing Labour Law - II QN PapersDocument67 pagesEmailing Labour Law - II QN PapersHavnur SLSRFNo ratings yet

- July 2019 Old & NewDocument3 pagesJuly 2019 Old & NewRama sekarNo ratings yet

- First Semester 3 Year LL.B./ IV Semester 5 Year B.A. LL.B. / B.B.A. LL.B. Examination, December 2015 Contract - IDocument4 pagesFirst Semester 3 Year LL.B./ IV Semester 5 Year B.A. LL.B. / B.B.A. LL.B. Examination, December 2015 Contract - ISavioPereira1234No ratings yet

- II/III Semester 5 Year B.A. LL.B. (Maj-Min) Examination, June/July 2016 ECONOMICS - II (Major-Minor - II) (Money, Banking and International Trade)Document2 pagesII/III Semester 5 Year B.A. LL.B. (Maj-Min) Examination, June/July 2016 ECONOMICS - II (Major-Minor - II) (Money, Banking and International Trade)Raksha RNo ratings yet

- Dec 2016Document3 pagesDec 201618651 SYEDA AFSHANNo ratings yet

- Ios 2016Document2 pagesIos 2016Soundary DesaiNo ratings yet

- V Semester 3 Year LL.B./IX Semester 5 Year B.A.LL.B./B.B.A.LL.B. Examination, December 2017 Opt. Iii: Intellectual Property Rights IDocument2 pagesV Semester 3 Year LL.B./IX Semester 5 Year B.A.LL.B./B.B.A.LL.B. Examination, December 2017 Opt. Iii: Intellectual Property Rights ISandesh S BhasriNo ratings yet

- Banking Theory & Pactice May 2012Document2 pagesBanking Theory & Pactice May 2012Prasad C MNo ratings yet

- 2043 I Semester 3 Years LL.B./V Semester 5 Year B.A.LL.B. (Maj.-Min.-System) / V Semester 5 Year B.B.A.LL.B. (New) Examination, June/July 2017 Law of TortsDocument3 pages2043 I Semester 3 Years LL.B./V Semester 5 Year B.A.LL.B. (Maj.-Min.-System) / V Semester 5 Year B.B.A.LL.B. (New) Examination, June/July 2017 Law of TortsSuraj Srivatsav.SNo ratings yet

- Ix Semester 5yr. B.A./B.B.A., Ll.B. (Hon'S) Examination, March/April 2021 Civil Procedure Code and Limitation ActDocument3 pagesIx Semester 5yr. B.A./B.B.A., Ll.B. (Hon'S) Examination, March/April 2021 Civil Procedure Code and Limitation ActSoundary DesaiNo ratings yet

- V Semester 3 Year LL.B./IX Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. - Iv: Competition LawDocument3 pagesV Semester 3 Year LL.B./IX Semester 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2017 Opt. - Iv: Competition LawSandesh S BhasriNo ratings yet

- June 2016 LLB Question Paper Property LawDocument3 pagesJune 2016 LLB Question Paper Property LawSameer G100% (1)

- IV Semester of 3 Year LL.B./VIII Semester of 5 Year B.A. LL.B./B.B.A. LL.B. Examination, December 2015 Opt. - I: Insurance LawDocument4 pagesIV Semester of 3 Year LL.B./VIII Semester of 5 Year B.A. LL.B./B.B.A. LL.B. Examination, December 2015 Opt. - I: Insurance LawRichardNo ratings yet

- Question Paper Human Rights2021Document3 pagesQuestion Paper Human Rights2021anand baliNo ratings yet

- 2018 Batch 2018d Constitutional 2Document3 pages2018 Batch 2018d Constitutional 2Rama sekarNo ratings yet

- IV Semester of 3 Year LL.B./VIII Semester of 5 Year B.A.,LL.B./ B.B.A.,LL.B. Examination, December 2013 Optional - II: BANKING LAWDocument4 pagesIV Semester of 3 Year LL.B./VIII Semester of 5 Year B.A.,LL.B./ B.B.A.,LL.B. Examination, December 2013 Optional - II: BANKING LAWGanesh MaligoudarNo ratings yet

- 9c - Insurance LawDocument3 pages9c - Insurance LawRichardNo ratings yet

- 0405 0804Document4 pages0405 0804RichardNo ratings yet

- July 2016Document3 pagesJuly 201618651 SYEDA AFSHANNo ratings yet

- (OLD) I Semester 3 Year LL.B./III Semester 5 Year B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Constitutional LawDocument4 pages(OLD) I Semester 3 Year LL.B./III Semester 5 Year B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Constitutional LawnavyaNo ratings yet

- Itl Dec 2015Document2 pagesItl Dec 2015MITHUN UNo ratings yet

- Ix Semester 5 Year B.A./B.B.A. Ll.B. (Hons.) Examination, December 2019 Civil Procedure Code and Limitation ActDocument3 pagesIx Semester 5 Year B.A./B.B.A. Ll.B. (Hons.) Examination, December 2019 Civil Procedure Code and Limitation ActSoundary DesaiNo ratings yet

- Shake Them Haters off -Volume 3- Your Money: $ Be Allergic to Broke $From EverandShake Them Haters off -Volume 3- Your Money: $ Be Allergic to Broke $No ratings yet

- Third Semester of Three Year LL.B. Examination, January 2011 CLINICAL COURSE - I: Professional Ethics and Professional Accounting System (Course - V)Document48 pagesThird Semester of Three Year LL.B. Examination, January 2011 CLINICAL COURSE - I: Professional Ethics and Professional Accounting System (Course - V)18651 SYEDA AFSHANNo ratings yet

- 0445 IV Semester 5 Year B.B.A. LL.B. (Hons.) Examination, Dec. 2012 International BusinessDocument11 pages0445 IV Semester 5 Year B.B.A. LL.B. (Hons.) Examination, Dec. 2012 International Business18651 SYEDA AFSHANNo ratings yet

- 0445 IV Semester 5 Year B.B.A. LL.B. (Hons.) Examination, Dec. 2012 International BusinessDocument11 pages0445 IV Semester 5 Year B.B.A. LL.B. (Hons.) Examination, Dec. 2012 International Business18651 SYEDA AFSHANNo ratings yet

- 0224 II Semester Five Years B.A.LL.B. Examination, December 2012 Economics IDocument44 pages0224 II Semester Five Years B.A.LL.B. Examination, December 2012 Economics I18651 SYEDA AFSHANNo ratings yet

- Fourth Semester of Three Year LL.B. Examination, June 2011 Public International Law (Course - I)Document42 pagesFourth Semester of Three Year LL.B. Examination, June 2011 Public International Law (Course - I)18651 SYEDA AFSHANNo ratings yet

- Fourth Semester of Three Year LL.B. Examination, January 2012 Clinical Course - II (Course - IV) Alternative Disputes Resolution SystemsDocument29 pagesFourth Semester of Three Year LL.B. Examination, January 2012 Clinical Course - II (Course - IV) Alternative Disputes Resolution Systems18651 SYEDA AFSHANNo ratings yet

- Third Semester of Five Year B.A.LL.B. Examination, June 2011 Political Science - Iii (Course - Ii) International RelationsDocument30 pagesThird Semester of Five Year B.A.LL.B. Examination, June 2011 Political Science - Iii (Course - Ii) International Relations18651 SYEDA AFSHANNo ratings yet

- 0442 Fourth Semester 5 Year B.B.A.,LL.B. (Hons.) Examination, December 2012 Financial ManagementDocument60 pages0442 Fourth Semester 5 Year B.B.A.,LL.B. (Hons.) Examination, December 2012 Financial Management18651 SYEDA AFSHANNo ratings yet

- II Semester 3 Year LL.B./VI Semester 5 Years B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Company LawDocument31 pagesII Semester 3 Year LL.B./VI Semester 5 Years B.A.LL.B./B.B.A.LL.B. Examination, December 2016 Company Law18651 SYEDA AFSHANNo ratings yet

- 27Document54 pages2718651 SYEDA AFSHANNo ratings yet

- II/III Semester 5 Year B.A.LL.B. (Maj.-Min.) (Old) Examination, December 2016 Major (Paper - 2) : Minor - I (Paper - 2) : SOCIOLOGY (Indian Society: Continuity and Change)Document39 pagesII/III Semester 5 Year B.A.LL.B. (Maj.-Min.) (Old) Examination, December 2016 Major (Paper - 2) : Minor - I (Paper - 2) : SOCIOLOGY (Indian Society: Continuity and Change)18651 SYEDA AFSHANNo ratings yet

- Salient Features of The Probation of Offenders ActDocument3 pagesSalient Features of The Probation of Offenders Act18651 SYEDA AFSHAN100% (4)

- Second Semester 3 Year LL.B. Examination, January 2011 FAMILY LAW - II (Mohammedan Law and Indian Succession Act) (Course - V)Document44 pagesSecond Semester 3 Year LL.B. Examination, January 2011 FAMILY LAW - II (Mohammedan Law and Indian Succession Act) (Course - V)18651 SYEDA AFSHANNo ratings yet

- First Semester of 3 Year LL.B. Examination, January 2011 CRIMINAL LAW - I: Indian Penal Code (Course - V)Document47 pagesFirst Semester of 3 Year LL.B. Examination, January 2011 CRIMINAL LAW - I: Indian Penal Code (Course - V)18651 SYEDA AFSHANNo ratings yet

- First Semester of LL.B. (3 Years) Examination, January 2011 Law of Torts (Course - III)Document52 pagesFirst Semester of LL.B. (3 Years) Examination, January 2011 Law of Torts (Course - III)18651 SYEDA AFSHANNo ratings yet

- First Semester Three Year LL.B. Examination, January 2011 CONTRACT - I (Course - I) (General Principles of Contracts)Document54 pagesFirst Semester Three Year LL.B. Examination, January 2011 CONTRACT - I (Course - I) (General Principles of Contracts)18651 SYEDA AFSHANNo ratings yet

- Dec 2018Document3 pagesDec 201818651 SYEDA AFSHANNo ratings yet

- Adminstrative Law - Smart Notes PDFDocument92 pagesAdminstrative Law - Smart Notes PDFNaksh SansonNo ratings yet

- II Semester 3 Year LL.B./VI Semester 5 Yrs. B.A. LL.B./B.B.A.LL.B. Examination, December 2015 Administrative LawDocument3 pagesII Semester 3 Year LL.B./VI Semester 5 Yrs. B.A. LL.B./B.B.A.LL.B. Examination, December 2015 Administrative LawAarthi SnehaNo ratings yet

- Industrial Disputes Act, 1947Document83 pagesIndustrial Disputes Act, 1947Arjoo BakliwalNo ratings yet

- Second Semester of Three Year LL.B. Examination, January 2011 CONTRACT - II (Course - I)Document59 pagesSecond Semester of Three Year LL.B. Examination, January 2011 CONTRACT - II (Course - I)18651 SYEDA AFSHANNo ratings yet

- Compiled by K.L.E.Society's Law College BangaloreDocument23 pagesCompiled by K.L.E.Society's Law College Bangalore18651 SYEDA AFSHANNo ratings yet

- Second Semester 3 Years LL.B./ VI Semester 5 Years B.A.LL.B./B.B.A. LL.B. Examination, December 2016 Administrative LawDocument4 pagesSecond Semester 3 Years LL.B./ VI Semester 5 Years B.A.LL.B./B.B.A. LL.B. Examination, December 2016 Administrative Law18651 SYEDA AFSHANNo ratings yet

- II Semester 3 Year LL.B./ VI Sem. 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2016 Administrative LawDocument4 pagesII Semester 3 Year LL.B./ VI Sem. 5 Year B.A. LL.B./B.B.A. LL.B. Examination, June/July 2016 Administrative LawAarthi SnehaNo ratings yet

- Dec 2017 - Admin LawDocument3 pagesDec 2017 - Admin Law18651 SYEDA AFSHANNo ratings yet

- KSLU LLB 3 Yr Admin Law June 2017 QPDocument3 pagesKSLU LLB 3 Yr Admin Law June 2017 QPAarthi SnehaNo ratings yet

- Elizabeth OPRA Request FormDocument3 pagesElizabeth OPRA Request FormThe Citizens CampaignNo ratings yet

- The Lobby Network - Big Tech's Web of Influence in The EUDocument48 pagesThe Lobby Network - Big Tech's Web of Influence in The EUJack PurcherNo ratings yet

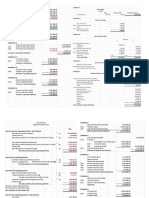

- FI - BBP ReferenceDocument19 pagesFI - BBP ReferenceAshwini KanranjawanePasalkarNo ratings yet

- L7 Does Shopping Behavior Impact SustainabilityDocument7 pagesL7 Does Shopping Behavior Impact SustainabilityYi ZhangNo ratings yet

- Mathematics For Economics and Business 8th Edition Jacques Solutions ManualDocument36 pagesMathematics For Economics and Business 8th Edition Jacques Solutions Manualduckingsiddow9rmb1100% (21)

- This Study Resource Was: I. Title of The Case: Royal Printing and Packaging Company II. Problems EncounteredDocument3 pagesThis Study Resource Was: I. Title of The Case: Royal Printing and Packaging Company II. Problems EncounteredKuya ZoroNo ratings yet

- Statechart Diagram: Aka: State Diagram, State Transition DiagramDocument21 pagesStatechart Diagram: Aka: State Diagram, State Transition DiagramAmit AkterNo ratings yet

- Law On Private Corporation (Title 13)Document6 pagesLaw On Private Corporation (Title 13)Dahyun DahyunNo ratings yet

- Hazard Analysis Critical Control Point (HACCP)Document3 pagesHazard Analysis Critical Control Point (HACCP)Waqar IbrahimNo ratings yet

- IRIS Guideline 6 2014 SPECIAL PROCESSESDocument12 pagesIRIS Guideline 6 2014 SPECIAL PROCESSESmnmlNo ratings yet

- Cash BudgetDocument8 pagesCash BudgetKei CambaNo ratings yet

- 01 Cash & CE CompositionDocument3 pages01 Cash & CE Compositionsharielles /No ratings yet

- Flinn (ISA 315 + ISA 240 + ISA 570)Document2 pagesFlinn (ISA 315 + ISA 240 + ISA 570)Zareen AbbasNo ratings yet

- Open AccessDocument36 pagesOpen AccessOlgalycos100% (1)

- BTS Strategy Execution Lenovo Case Study - 1Document2 pagesBTS Strategy Execution Lenovo Case Study - 1Selvi MoorthyNo ratings yet

- Influence of Social Sciences On Buyer BehaviorDocument5 pagesInfluence of Social Sciences On Buyer BehaviorRavindra Reddy ThotaNo ratings yet

- MTN FinancialsDocument200 pagesMTN FinancialsIshaan SharmaNo ratings yet

- Modern Office & Its FunctionsDocument14 pagesModern Office & Its FunctionsYash SharmaNo ratings yet

- Akzonobel Report15 Entire, 146Document266 pagesAkzonobel Report15 Entire, 146jasper laarmansNo ratings yet

- Chapter 3 Industry and Competitive AnalysisDocument44 pagesChapter 3 Industry and Competitive AnalysisNesley Vie LamoNo ratings yet

- Customer AnalysisDocument15 pagesCustomer AnalysisAigerimNo ratings yet

- Final Chapter 6 Financial PlanDocument26 pagesFinal Chapter 6 Financial Planangelo felizardoNo ratings yet

- Aggregate Planning PDFDocument13 pagesAggregate Planning PDFShimanta EasinNo ratings yet

- Estimate Boq MPMDocument6 pagesEstimate Boq MPMhj203800No ratings yet

- CrisisDocument6 pagesCrisishabibi 101No ratings yet

- No 5Document5 pagesNo 5dragoocepekNo ratings yet

- Chapter Five: The Corporation and External StakeholdersDocument20 pagesChapter Five: The Corporation and External Stakeholdersumar afzalNo ratings yet