Professional Documents

Culture Documents

12 Month Cash Flow Statement1

12 Month Cash Flow Statement1

Uploaded by

nag00na0 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

12 month cash flow statement1.xls

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 page12 Month Cash Flow Statement1

12 Month Cash Flow Statement1

Uploaded by

nag00naCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

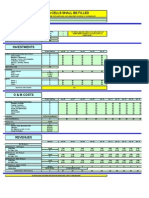

Twelve-month cash flow Enter Company Name Here Fiscal Year Begins: Jan-05

Pre-Startup Total Item

Jan-05 Feb-05 Mar-05 Apr-05 May-05 Jun-05 Jul-05 Aug-05 Sep-05 Oct-05 Nov-05 Dec-05

EST EST

Cash on Hand (beginning of

0 0 0 0 0 0 0 0 0 0 0 0 0

month) Notes on Preparation

CASH RECEIPTS Note: You may want to print this information to use as reference later. To

delete these instructions, click the border of this text box and then press the

Cash Sales DELETE key.

Collections fm CR accounts Refer back to your Profit & Loss Projection. Line-by-line ask yourself when

you should expect cash to come and go. You have already done a sales

Loan/ other cash inj.

projection, now you must predict when you will actually collect from

TOTAL CASH RECEIPTS 0 0 0 0 customers.

0 0 On the expense

0 side,

0 you have 0 previously

0 projected0 expenses;

0 0 0

now predict when you will actually have to write the check to pay those bills.

Total Cash Available (before

0 0 0 0

Most

0

items0 will be the

0

same as0on the Profit

0

& Loss0Projection.

0

Rent and0 0 0

cash out) utility bills, for instance, are usually paid in the month they are incurred. Other

items will differ from the Profit & Loss view. Insurance and some types of

CASH PAID OUT taxes, for example, may actually be payable quarterly or semiannually, even

though you recognize them as monthly expenses. Just try to make the Cash

Purchases (merchandise) Flow as realistic as you can line by line. The payoff for you will be an ability to

manage and forecast working capital needs. Change the category labels in

Purchases (specify) the left column as needed to fit your accounting system.

Purchases (specify) Note that lines for 'Loan principal payment' through 'Owners' Withdrawal' are

Gross wages (exact withdrawal)

for items that always are different on the Cash Flow than on the Profit & Loss.

Loan Principal Payment, Capital Purchases, and Owner's Draw simply do

Payroll expenses (taxes, etc.) not, by the rules of accounting, show up on the Profit & Loss Projection. They

do, however, definitely take cash out of the business, and so need to be

Outside services included in your Cash plan. On the other hand, you will not find Depreciation

on the Cash Flow because you never write a check for Depreciation. Cash

Supplies (office & oper.) from Loans Received and Owners' Injections go in the "Loan/ other cash inj."

row. The "Pre-Startup" column is for cash outlays prior to the time covered by

Repairs & maintenance

the Cash Flow. It is intended primarily for new business startups or major

Advertising expansion projects where a great deal of cash must go out before operations

commence. The bottom section, "ESSENTIAL OPERATING DATA", is not

Car, delivery & travel actually part of the Cash model, but it allows you to track items which have a

heavy impact on cash. The Cash Flow Projection is the best way to forecast

Accounting & legal working capital needs. Begin with the amount of Cash on Hand you expect to

have. Project all the Receipts and Paid Outs for the year. If CASH POSITION

Rent gets dangerously low or negative, you will need to pump in more cash to keep

the operation afloat. Many profitable businesses have gone under because

Telephone

they could not pay the bills while waiting for money to flow in. Your creditors

Utilities do not care about profit; they want to be paid with cash. Cash is the financial

lifeblood of your business.

Insurance

Taxes (real estate, etc.)

Interest

Other expenses (specify)

Other (specify)

Other (specify)

Miscellaneous

SUBTOTAL 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Loan principal payment

Capital purchase (specify)

Other startup costs

Reserve and/or Escrow

Owners' Withdrawal

TOTAL CASH PAID OUT 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Cash Position (end of month) 0 0 0 0 0 0 0 0 0 0 0 0 0 0

ESSENTIAL OPERATING DATA (non cash flow information)

Sales Volume (dollars)

Accounts Receivable

Bad Debt (end of month)

Inventory on hand (eom)

Accounts Payable (eom)

Depreciation

You might also like

- Cashflow Forecasting TemplateDocument53 pagesCashflow Forecasting Templatemaahi7No ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- 73 Designed Quality Excel Chart TemplatesDocument63 pages73 Designed Quality Excel Chart TemplatesiPakistan100% (9)

- TEMPLATE Financial Projections WorkbookDocument22 pagesTEMPLATE Financial Projections WorkbookFrancois ChampenoisNo ratings yet

- Financial Projection Template: Strictly ConfidentialDocument62 pagesFinancial Projection Template: Strictly ConfidentialKnightspageNo ratings yet

- Personal Financial StatementDocument9 pagesPersonal Financial Statementlikae trNo ratings yet

- Template Financial Forecast ModelDocument46 pagesTemplate Financial Forecast ModelMLastTry100% (2)

- Current I-9 FormDocument4 pagesCurrent I-9 Formlegiziano100% (4)

- Templates For Cost Pricing Labor Burden Overhead CalculationDocument13 pagesTemplates For Cost Pricing Labor Burden Overhead CalculationameerNo ratings yet

- Project Cost Break Up2Document1 pageProject Cost Break Up2DrJennifer LoboNo ratings yet

- Micro Eportfolio Competition Spreadsheet Data-Fall 18Document4 pagesMicro Eportfolio Competition Spreadsheet Data-Fall 18api-334921583No ratings yet

- Chapter 02 - Construction Accounting SystemsDocument29 pagesChapter 02 - Construction Accounting SystemsPat Ricia100% (1)

- Property Info: Operation CostsDocument2 pagesProperty Info: Operation CostsKilogram LossNo ratings yet

- Cash Flow TemplateDocument13 pagesCash Flow TemplateJohn ArikoNo ratings yet

- Free Business TemplatesDocument3 pagesFree Business Templateshowieg43100% (9)

- 5 Year Financial PlanDocument20 pages5 Year Financial PlanNKITDOSHI100% (1)

- Cost Center and GL CodeDocument51 pagesCost Center and GL CodeHarshanand KalgeNo ratings yet

- Contractor'S Estimate Worksheet Bituminous and Polymer Material (Design Build and Lump Sum Projects)Document3 pagesContractor'S Estimate Worksheet Bituminous and Polymer Material (Design Build and Lump Sum Projects)Qi ZengNo ratings yet

- Excel Template, Equipment Inventory ListDocument2 pagesExcel Template, Equipment Inventory ListiPakistan100% (1)

- Investment TrackerDocument9 pagesInvestment TrackerRick MischkaNo ratings yet

- Construction Cost EstimateDocument1 pageConstruction Cost Estimateapi-3764623No ratings yet

- Format of Financial Statements Under The Revised Schedule VIDocument97 pagesFormat of Financial Statements Under The Revised Schedule VIDebadarshi RoyNo ratings yet

- TEM Reporting DashboardDocument21 pagesTEM Reporting DashboardLawrence BrownNo ratings yet

- Construction Cost Estimate 2011Document1 pageConstruction Cost Estimate 2011Adil KhanNo ratings yet

- Constrcution Project Cash Flow FormatDocument5 pagesConstrcution Project Cash Flow FormatAnoop NimkandeNo ratings yet

- Cash Flow ProjectionsDocument33 pagesCash Flow ProjectionsShah JeeNo ratings yet

- Cash Flow Small BusinessDocument39 pagesCash Flow Small Businessmariusdr84No ratings yet

- Financial Model Flow ChartDocument1 pageFinancial Model Flow ChartTallal Mughal100% (1)

- Flow ChartDocument1 pageFlow ChartJp GallardoNo ratings yet

- Cashflow Option1Document78 pagesCashflow Option1api-3814033No ratings yet

- Analyze The Potential Profit or Loss of Your Real Estate InvestmentDocument3 pagesAnalyze The Potential Profit or Loss of Your Real Estate InvestmentiskandarmalaysiaNo ratings yet

- Chapter 7 InventoriesDocument5 pagesChapter 7 InventoriesJoyce Mae D. FloresNo ratings yet

- Resumes Cover Letters From YaleDocument24 pagesResumes Cover Letters From YaleiPakistan88% (8)

- Chartofaccounts ExampleDocument3 pagesChartofaccounts ExampleherawandonoNo ratings yet

- Profit and Loss Projection, 1yrDocument1 pageProfit and Loss Projection, 1yrhowieg43100% (2)

- Profit & Loss StatementDocument1 pageProfit & Loss StatementNabila Ayuningtias100% (1)

- Generally Accepted Scheduling Principles Gasp CompiledDocument1,821 pagesGenerally Accepted Scheduling Principles Gasp CompiledIgnacio Manzanera0% (1)

- Cash Breakeven Analysis: Awus $10,000 100%Document13 pagesCash Breakeven Analysis: Awus $10,000 100%iPakistanNo ratings yet

- Merger ModelDocument3 pagesMerger Modelcyberdevil321No ratings yet

- Budget Vs Actual Dashboard - BAANS ConsultingDocument3 pagesBudget Vs Actual Dashboard - BAANS ConsultingayvadavidNo ratings yet

- Total Project Cost Analysis Excel TemplateDocument16 pagesTotal Project Cost Analysis Excel TemplateMayank BlueRoseNo ratings yet

- Pre Bid Queries and Clarification 23 FebDocument27 pagesPre Bid Queries and Clarification 23 Febkiran3882No ratings yet

- Project Monthly Report - February 2014 R2 1Document19 pagesProject Monthly Report - February 2014 R2 1sampath_priyashanthaNo ratings yet

- Cashflow ProjectionsDocument1 pageCashflow ProjectionsJoe MageroNo ratings yet

- DPR Financial Model Final 30.07.10Document194 pagesDPR Financial Model Final 30.07.10deshmukhvaibhav2009No ratings yet

- Estimate Summary: Change Order Cont. Sales TaxDocument2 pagesEstimate Summary: Change Order Cont. Sales TaxM.N Huda Construction LtdNo ratings yet

- UNFCCC Revised Budget (With TS&GM Comments)Document7 pagesUNFCCC Revised Budget (With TS&GM Comments)Amalia Prameswari JoedawinataNo ratings yet

- Audit of InventoriesDocument57 pagesAudit of Inventoriessethdrea officialNo ratings yet

- Financial ModelDocument8 pagesFinancial Modelapi-382249450% (4)

- Template of Financial Plan - 22.03.2017Document27 pagesTemplate of Financial Plan - 22.03.2017jpsmu09No ratings yet

- Profit Plan and Cash Flow ProjectionDocument5 pagesProfit Plan and Cash Flow ProjectionfondershellNo ratings yet

- Project 4 - Forecasting Financial StatementsDocument56 pagesProject 4 - Forecasting Financial StatementsTulasi ReddyNo ratings yet

- Cash Flow Forecast TemplateDocument1 pageCash Flow Forecast TemplateMohamed Ahmed100% (1)

- 2008 Purchase Request FormDocument1 page2008 Purchase Request Formcolorado576No ratings yet

- Event Planning Budget Template (Excel)Document3 pagesEvent Planning Budget Template (Excel)MicrosoftTemplates100% (7)

- P&L StatementDocument2 pagesP&L StatementiPakistan100% (8)

- Expense Report: From: To: Purpose: Statement #: Name: Employee ID: Department: ManagerDocument4 pagesExpense Report: From: To: Purpose: Statement #: Name: Employee ID: Department: Managerprajapatiprashant40No ratings yet

- Hindustan Unilever Development Centre: BasementDocument20 pagesHindustan Unilever Development Centre: BasementAssem ElhajjNo ratings yet

- QB Certification Section 1Document3 pagesQB Certification Section 1Jimmy JamesNo ratings yet

- Case 2: Ikea Design & Pricing: I. Problem StatementDocument3 pagesCase 2: Ikea Design & Pricing: I. Problem StatementZed Ladja0% (1)

- Income StatementDocument19 pagesIncome StatementiPakistan67% (3)

- Treasury Analysis WorksheetDocument5 pagesTreasury Analysis WorksheetiPakistan100% (3)

- Candy Activity Supply and DemandDocument3 pagesCandy Activity Supply and Demandbonnavie.buenoNo ratings yet

- BudgetDocument5 pagesBudgetMayamba Ivan100% (1)

- Cma of HostelDocument128 pagesCma of HostelkolnureNo ratings yet

- Corporate Budget Memo No. 39Document95 pagesCorporate Budget Memo No. 39mcla28No ratings yet

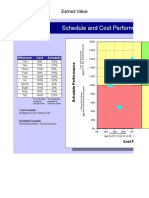

- Earned Value Quadrant ChartDocument2 pagesEarned Value Quadrant ChartAbhishek Pandey100% (1)

- Just Some BlingDocument5 pagesJust Some BlingRamesh RadhakrishnarajaNo ratings yet

- Asyad Financial AnalysisDocument9 pagesAsyad Financial AnalysisshawktNo ratings yet

- Cash Expense Report or Company Credit Card RPTDocument4 pagesCash Expense Report or Company Credit Card RPTTyler Beth VandeWaterNo ratings yet

- 12 Month Cash Flow Statement1Document1 page12 Month Cash Flow Statement1Vorn Ra VuthNo ratings yet

- 12 Month Cash FlowDocument3 pages12 Month Cash FlowDarkchild HeavensNo ratings yet

- Cash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-17Document3 pagesCash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-17Adam PerezNo ratings yet

- 12 Month Cash Flow StatementDocument1 page12 Month Cash Flow StatementSmita KumarNo ratings yet

- Letter of InterestDocument1 pageLetter of InterestiPakistan100% (3)

- To Do ListDocument1 pageTo Do ListiPakistan100% (3)

- Market Analysis Worksheet: (Company Name) (Date)Document6 pagesMarket Analysis Worksheet: (Company Name) (Date)iPakistanNo ratings yet

- Interview, Sample Post-Interview Thank You LetterDocument1 pageInterview, Sample Post-Interview Thank You LetteriPakistan50% (2)

- Interview, Thank You Letter That Mentions Interview AfterthoughtsDocument1 pageInterview, Thank You Letter That Mentions Interview AfterthoughtsiPakistanNo ratings yet

- Interview, A Thank You Letter That Stresses FitDocument1 pageInterview, A Thank You Letter That Stresses FitiPakistanNo ratings yet

- A Free General Thank You Letter SampleDocument1 pageA Free General Thank You Letter SampleiPakistan100% (1)

- Simple Payroll CalculatorDocument4 pagesSimple Payroll CalculatormaginguaNo ratings yet

- Excel Monthly Payment CalendarDocument1 pageExcel Monthly Payment CalendariPakistan67% (6)

- Perpetual Event CalendarDocument1 pagePerpetual Event CalendarMusadya100% (1)

- Excel FunctionsDocument33 pagesExcel FunctionsiPakistan100% (1)

- JavascriptDocument1 pageJavascriptiPakistanNo ratings yet

- Cover Letter 2Document1 pageCover Letter 2iPakistan100% (3)

- Pearbudget: (Easy Budgeting For Everyone)Document62 pagesPearbudget: (Easy Budgeting For Everyone)iPakistan100% (3)

- Car Maintenance ScheduleDocument6 pagesCar Maintenance ScheduleiPakistan100% (4)

- Chronological Resume FormatDocument1 pageChronological Resume FormatiPakistanNo ratings yet

- DOMS ReportDocument6 pagesDOMS ReportTanumay NaskarNo ratings yet

- Problems and Issues in Mandatory Overtime - ppt-2Document27 pagesProblems and Issues in Mandatory Overtime - ppt-2Ann Grethel Tan100% (1)

- The 10-Step of Knowledge Management.Document4 pagesThe 10-Step of Knowledge Management.raja farhanNo ratings yet

- Triple Top Chart Pattern: Rajesh Chauhan Ravindra JainDocument10 pagesTriple Top Chart Pattern: Rajesh Chauhan Ravindra JainRohan SwamyNo ratings yet

- The Tall Pines Hotel - Group ProjectDocument3 pagesThe Tall Pines Hotel - Group ProjectAmrit Shakya100% (1)

- New Comparative Analysis of Companies Act 2013 With 1956Document185 pagesNew Comparative Analysis of Companies Act 2013 With 1956city cyberNo ratings yet

- Quiz Financial Reporting - Docx 17181554-012Document7 pagesQuiz Financial Reporting - Docx 17181554-012Ali Asad BaigNo ratings yet

- Risk and Rates of Return: Multiple Choice: ConceptualDocument2 pagesRisk and Rates of Return: Multiple Choice: ConceptualKristel SumabatNo ratings yet

- Deborina Bhattacharyya University of Kalyani 4 Semester Assignment On Strategic Management CP-401Document4 pagesDeborina Bhattacharyya University of Kalyani 4 Semester Assignment On Strategic Management CP-401Deborina BhattacharyyaNo ratings yet

- Riph - Unit 5 - The 1987 Constitution - Synthesis - Domingo, Ma. Eau Claire A.Document2 pagesRiph - Unit 5 - The 1987 Constitution - Synthesis - Domingo, Ma. Eau Claire A.Eau Claire DomingoNo ratings yet

- Tourism Multiplier Effects On PeruDocument13 pagesTourism Multiplier Effects On PeruVanessa PortocarreroNo ratings yet

- 10-18th Century Economy and SocietyDocument26 pages10-18th Century Economy and SocietyThatKidNo ratings yet

- Describing Graphs and Charts Handout2Document10 pagesDescribing Graphs and Charts Handout2MoaazDardeerNo ratings yet

- Pagawa Balance SheetDocument37 pagesPagawa Balance Sheetjoffer idagoNo ratings yet

- Organization and Amanagement Quarter 1 Week 4 Module 4: Learning CompetencyDocument13 pagesOrganization and Amanagement Quarter 1 Week 4 Module 4: Learning CompetencySir Jeh TungolNo ratings yet

- BP803ET LECTURE 5 Marketing Environment Part 1Document31 pagesBP803ET LECTURE 5 Marketing Environment Part 1Danish KhanNo ratings yet

- Oas Community College: Republic of The Philippines Commission On Higher Education Oas, AlbayDocument12 pagesOas Community College: Republic of The Philippines Commission On Higher Education Oas, AlbayYram GambzNo ratings yet

- AFA - Earnings Drivers EtcDocument24 pagesAFA - Earnings Drivers EtcHYUN JUNG KIMNo ratings yet

- Historical Bidding Information - 202010Document139 pagesHistorical Bidding Information - 202010btharun2008No ratings yet

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Document8 pagesCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Ch. 10 UrbanizationDocument3 pagesCh. 10 UrbanizationAli sibtain0% (1)

- Profit & Loss: Prof.b.p.mshra XimbDocument28 pagesProfit & Loss: Prof.b.p.mshra XimbSudhansuSekharNo ratings yet

- Module 6 - Income Tax On Corporations - Part 2Document5 pagesModule 6 - Income Tax On Corporations - Part 2Never Letting GoNo ratings yet

- Human Resouce Management BY Muhammad Akif RabbaniDocument73 pagesHuman Resouce Management BY Muhammad Akif RabbaniAkif RabbaniNo ratings yet

- Chapter 1 Illustrative Case 1 - AuditDocument7 pagesChapter 1 Illustrative Case 1 - AuditanonymousNo ratings yet