Professional Documents

Culture Documents

August Property Update

August Property Update

Uploaded by

preeve0 ratings0% found this document useful (0 votes)

35 views1 pageAugust Wellington Property Update Philip Reeve & Aaron Burke

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAugust Wellington Property Update Philip Reeve & Aaron Burke

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views1 pageAugust Property Update

August Property Update

Uploaded by

preeveAugust Wellington Property Update Philip Reeve & Aaron Burke

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Aaron Burke & Philip Reeve’s

WELLINGTON REGION

All the best moves happen with great teamwork.

Together we’ll make your next move your best move. AUGUST 2008

Cautious optimism on interest rates

Six months of interest rate cuts predicted

In its final weekly report of July, Westpac Bank predicted that the Reserve Bank

will continue to cut interest rates at every review from now until January. At that Avoiding DIY disasters

point, assuming 25 basis point (0.25%) reductions at each review, the official The Department of Building and Housing have some helpful advice for DIYers.

cash rate will be 7%. “At some point in the future, activity will start to show Here is an excerpt from their website consumerbuild.org where they highlight

some important aspects of DIY.

some improvement, and the RBNZ will have to turn its attention back to the

increasingly ugly outlook for inflation. But it’s hard to predict exactly when the There are a number of informed decisions that need to be made before

starting a project. For example, if you decide to paint the bathroom, think

penny will drop. Our best guess is that the last cut will come in January, leaving

about these issues:

the OCR at 7.00%. While this seems like a high ‘trough’ compared to history, the

Do you have the patience and equipment to peel off the old wallpaper,

prospect of higher average inflation in coming years suggests that a 7% cash plaster and sand the wallboard to a smooth enough finish for painting and

rate will be close to neutral”. apply a professional-looking coat of paint?

Do you fix or float? Do you know enough about the products, such as how to seal the walls

Westpac further commented that “last week’s OCR cut has already fed through before painting, and how to choose paint that is water-resistant?

to lower fixed rates in the 2-year term, and floating and 6-month fixed home When you take off the wallpaper, will you be able to replace any wallboard

loan rates may also eventually fall. However, we caution that further falls in fixed that is rotten or damaged and, more importantly, can you find the source

of any dampness and deal with it?

rates are not guaranteed. The global credit crunch continues to raise the cost of

If you only have weekends to work, are you prepared to have a half-

borrowing offshore for New Zealand banks, which could limit passing on OCR

finished bathroom for a number of weeks? (Drying times can stretch the

reductions. In this environment, waiting to fix may be a risky option.” BNZ Chief process out.)

Economist, Tony Alexander, in a recent release said “If I were borrowing at the

moment I would fix for a one-year period anticipating a much lower cost in a

years time and 12 months from now I would judge whether to go floating and ride Win Dinner for 2 at

further declines or perhaps fix for another six months or one-year period.” Logan Brown Restaurant

Set in the beautifully restored 1920s banking chamber and renovated with

Wellington Regional Update comfort, style and ambient lighting, Logan Brown Restaurant and Bar sets the

According to the latest REINZ statistics, nationally the lower end of the scene for an enjoyable dining experience. Featuring classical and contemporary

property market was relatively liquid. This contributed to the national food cooked perfectly.

median price falling slightly from $345,000 in May to $340,000 in June. Cnr Cuba and Vivian Streets Tel: 801 5114

Sales of properties under $400,000 were up slightly from 2,680 in May

Courtesy of Logan Brown Restaurant you are offered the

opportunity to win dinner for two to the value of $250.00

to 2,708 in June, but sales of properties valued at between $400,000 and

To go into the draw fill in your name address and telephone number and mail

$599,999 were down from 1,041 in May to 1,039 and properties between your Newsletter by the end of the month to: “RE/MAX Leaders Logan Brown

$600,000 and $999,999 were down from 508 to 427. Sales of properties contest” PO Box 11 509 Wellington

worth $1 million and over were down from 143 to 131. Newsletter sent to me by of RE/MAX Leaders

Name

Wellington’s median price for June was $366,500 compared with

Address

$389,500 in May (June 2007: $375,000). In total, 458 houses sold Telephone Email

throughout the region in June compared with 534 sold in May (June I am happy to receive information from Logan Brown Restaurant yes/no

2007: 788). Last month’s winner was: David McKenzie of Wellington

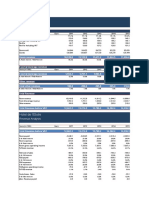

WELLINGTON REGIONAL COMPARISON

SALES MEDIAN DAYS TO SELL MEDIAN SALE PRICE Wellington Region Median Sales Price

AREA JUN 07 JUN 08 JUN 07 JUN 08 JUN 07 JUN 08

$000s $000s

MEDIAN SELL PRICE

Wellington Central 95 40 24 50 $390 $387

Wellington West 44 37 22 46 $543 $440

Wellington East 42 29 26 50 $490 $427

Wellington South 40 22 21 44 $532 $426

Wellington North 89 54 24 49 $420 $420

Pukerua Bay/Tawa 56 43 31 67 $385 $367

Hutt Valley 140 91 31 44 $340 $305

Otaki/Paekakariki 103 60 35 58 $360 $332

Comparative sales figures compiled from the Real Estate Institute of NZ statistics

Aaron Burke & Philip Reeve - Service to the Power of 2

Call us anytime on 0800 REMAX1 (0800 736 291) or email ajburke@leaders.co.nz or preeve@remax.net

Disclaimer: All the information published in Property Update is true and accurate to the best of the publisher’s knowledge.

No liability is assumed by RE/MAX Leaders, nor the publisher, for any losses suffered by any person or organisation relying directly or indirectly on this newsletter.

Leaders Real Estate Group represented by: Leaders Real Estate (1987) Ltd, Northside Realty Ltd, Villa Real Estate Ltd. MREINZ © YORK MANAGEMENT Ph: (04) 478 5777, E-mail: graham@homenet.co.nz

You might also like

- Lake Superior Lodge Case StudyDocument7 pagesLake Superior Lodge Case StudyRudresh JagadishNo ratings yet

- Amortization: ObjectivesDocument9 pagesAmortization: ObjectivesRya Cindy Marie AlcidNo ratings yet

- Obligations With A PeriodDocument27 pagesObligations With A PeriodMajorie Arimado100% (1)

- Inflation & Your LoanDocument11 pagesInflation & Your LoanmalvikasinghalNo ratings yet

- WR May News 2010Document2 pagesWR May News 2010Wakefield Reutlinger RealtorsNo ratings yet

- Inflation & Your Loan - 2023Document12 pagesInflation & Your Loan - 2023AR HemantNo ratings yet

- ANZ Property Focus - JanuaryDocument16 pagesANZ Property Focus - JanuaryTim MooreNo ratings yet

- Wakefield Reutlinger Realtors September 2010 NewsletterDocument2 pagesWakefield Reutlinger Realtors September 2010 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- San Diego County: A Normal Market Begins With Great InvestmentsDocument4 pagesSan Diego County: A Normal Market Begins With Great Investmentsjefflang3607No ratings yet

- 7.17 Invista PresentationDocument25 pages7.17 Invista PresentationDavid Ruiz PayaresNo ratings yet

- Weekly Commentary: The Shine Is Coming OffDocument8 pagesWeekly Commentary: The Shine Is Coming OffOktaNo ratings yet

- New Zealand Economics: Anz ResearchDocument16 pagesNew Zealand Economics: Anz ResearchshreyakarNo ratings yet

- Housing EncoreDocument3 pagesHousing EncorebernardchickeyNo ratings yet

- Christophers Housing Boom and Bust Report 2016 2017Document66 pagesChristophers Housing Boom and Bust Report 2016 2017rramirov001No ratings yet

- Wakefield Reutlinger Realtors Sept 09 NewsletterDocument2 pagesWakefield Reutlinger Realtors Sept 09 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- Case Analysis 1 Write Up RevisedDocument8 pagesCase Analysis 1 Write Up RevisedAbda Alif PrasidyaNo ratings yet

- Property UpdateDocument1 pageProperty UpdatepreeveNo ratings yet

- EY Could Uncertainty Be Your Best Opportunity For GrowthDocument6 pagesEY Could Uncertainty Be Your Best Opportunity For GrowthShreyas RajanNo ratings yet

- Tonys View 15 December 2022 PDFDocument5 pagesTonys View 15 December 2022 PDFAndreas KleberNo ratings yet

- CMBS Special Topic: Outlook For The CMBS Market in 2011Document26 pagesCMBS Special Topic: Outlook For The CMBS Market in 2011Yihai YuNo ratings yet

- PropertyDocument8 pagesPropertyRameeshaAmanNo ratings yet

- Pinnacle Team July-August 2010 NewsletterDocument7 pagesPinnacle Team July-August 2010 NewsletterThe Pinnacle TeamNo ratings yet

- Screenshot 2023-03-12 at 10.59.00 AMDocument1 pageScreenshot 2023-03-12 at 10.59.00 AMpaendabakhtNo ratings yet

- Vetiva Research - FY'10 Earnings Season - Are Banks Still In-The-MoneyDocument4 pagesVetiva Research - FY'10 Earnings Season - Are Banks Still In-The-MoneyRasaq Muhammed AbiolaNo ratings yet

- Breakfast With Dave 100110Document5 pagesBreakfast With Dave 100110Alvin JeeawockNo ratings yet

- D.R. Horton, Inc. Presents at UBS Global Industrials and Transportation Conference 2022, Jun-07-2022 09 - 40 AMDocument20 pagesD.R. Horton, Inc. Presents at UBS Global Industrials and Transportation Conference 2022, Jun-07-2022 09 - 40 AMEdward LaiNo ratings yet

- End Your Year With A Bang: Residential Sales by PriceDocument1 pageEnd Your Year With A Bang: Residential Sales by PriceIvonne WojdanskiNo ratings yet

- San Diego County: A Normal Market Begins With Great InvestmentsDocument4 pagesSan Diego County: A Normal Market Begins With Great InvestmentsmiguelnunezNo ratings yet

- Pinnacle Team July NewsletterDocument5 pagesPinnacle Team July NewsletterThe Pinnacle Team100% (2)

- Greenpath's Weekly Mortgage Newsletter - 2/6/2011Document1 pageGreenpath's Weekly Mortgage Newsletter - 2/6/2011CENTURY 21 AwardNo ratings yet

- BUSI 331 - Jatinderpal Gill - #3005301 - Project 2Document12 pagesBUSI 331 - Jatinderpal Gill - #3005301 - Project 2sunnygilliganNo ratings yet

- Pinnacle Team May NewsletterDocument5 pagesPinnacle Team May NewsletterThe Pinnacle TeamNo ratings yet

- 11 16 2022 Lacrwed A1Document1 page11 16 2022 Lacrwed A1Beth DurremanNo ratings yet

- Crews Near Construction Kickoff at Allen Building: LC RecordDocument16 pagesCrews Near Construction Kickoff at Allen Building: LC RecordBeth DurremanNo ratings yet

- 5 Ways To Inflation Proof Your MortgageDocument35 pages5 Ways To Inflation Proof Your Mortgagerayan quresheyNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 10/31/2010Document1 pageGreenpath's Weekly Mortgage Newsletter - 10/31/2010CENTURY 21 AwardNo ratings yet

- Supplies ProposalDocument2 pagesSupplies ProposalJhopReyLynNo ratings yet

- 7456 - Learner Workbook (Basic Numeracy)Document23 pages7456 - Learner Workbook (Basic Numeracy)LeratoNo ratings yet

- Market Overview September 2010Document5 pagesMarket Overview September 2010miguelnunezNo ratings yet

- Many Colors: A House ofDocument76 pagesMany Colors: A House ofDragoi MihaiNo ratings yet

- Buying A Foreclosed HomeDocument2 pagesBuying A Foreclosed Homeapi-3708315No ratings yet

- Analysts' Meet On The Financial Results For The Q3 FY 17 (Company Update)Document53 pagesAnalysts' Meet On The Financial Results For The Q3 FY 17 (Company Update)Shyam SunderNo ratings yet

- Butler Lumber Company: Case AnalysisDocument13 pagesButler Lumber Company: Case AnalysisFreshela AtasNo ratings yet

- Butler Lumber Company PDFDocument13 pagesButler Lumber Company PDFFreshela AtasNo ratings yet

- Bits & Pieces (We Sold The House - Now What - ..... Part 2) 20210903Document37 pagesBits & Pieces (We Sold The House - Now What - ..... Part 2) 20210903VSNNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 12/6/2010Document1 pageGreenpath's Weekly Mortgage Newsletter - 12/6/2010CENTURY 21 AwardNo ratings yet

- JanuaryDocument8 pagesJanuaryJan GarmanNo ratings yet

- Abuja Office Weekly Report March 8 15Document7 pagesAbuja Office Weekly Report March 8 15denokgroupNo ratings yet

- Home Prices 7 Things To Know Oi 9 2024Document2 pagesHome Prices 7 Things To Know Oi 9 2024akaminki4456No ratings yet

- Apartment Market Research Seattle 2010 3qDocument4 pagesApartment Market Research Seattle 2010 3qDave EicherNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 12/20/2010Document1 pageGreenpath's Weekly Mortgage Newsletter - 12/20/2010CENTURY 21 AwardNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 11/7/2010Document1 pageGreenpath's Weekly Mortgage Newsletter - 11/7/2010CENTURY 21 AwardNo ratings yet

- RBA Rate Rise: Why Lowe Delivered The Christmas Present No One WantedDocument4 pagesRBA Rate Rise: Why Lowe Delivered The Christmas Present No One WantedShtutsa.lisaNo ratings yet

- Dear Neighbor,: Inside This IssueDocument4 pagesDear Neighbor,: Inside This IssuejcarrierNo ratings yet

- Inside This Issue: Dear NeighborDocument4 pagesInside This Issue: Dear Neighboradebok100% (1)

- Insights Dim Light at The End of TunnelDocument37 pagesInsights Dim Light at The End of TunnelKelvin Narada GunawanNo ratings yet

- Is Housing A Good InvestmentDocument7 pagesIs Housing A Good InvestmentgoranpassNo ratings yet

- Wakefield Reutlinger Realtors Nov 2009 NewsletterDocument2 pagesWakefield Reutlinger Realtors Nov 2009 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- Prairie Ridge King & Queen: Published by BS CentralDocument8 pagesPrairie Ridge King & Queen: Published by BS CentralBS Central, Inc. "The Buzz"No ratings yet

- 2021 Q3 Market Update WEBDocument24 pages2021 Q3 Market Update WEBDavid RanckNo ratings yet

- 4 Predictions For Mortgage Industry in 2011: Pam Wilhelm, RealtorDocument4 pages4 Predictions For Mortgage Industry in 2011: Pam Wilhelm, RealtorPam Clark-WilhelmNo ratings yet

- Cash Flow From Short Term Rentals: Maximise Vacation and Holiday RentalsFrom EverandCash Flow From Short Term Rentals: Maximise Vacation and Holiday RentalsAnthony PangalloNo ratings yet

- SETP - Error Recognition - 87-89Document3 pagesSETP - Error Recognition - 87-89Nurulnisa Ayu AlfaniNo ratings yet

- Group 1 Team 03 RohitDocument3 pagesGroup 1 Team 03 RohitAntara RabhaNo ratings yet

- Sachin Account: Shree DurgeshDocument55 pagesSachin Account: Shree DurgeshNeha VyasNo ratings yet

- In The Loop Jan Apr 2023Document28 pagesIn The Loop Jan Apr 2023kit katNo ratings yet

- Chapter 6 Ethical Issues and Problems in Business and The Corporate WorldDocument37 pagesChapter 6 Ethical Issues and Problems in Business and The Corporate Worlddhanacruz2009100% (1)

- Consumerism: Dr. E. JalajaDocument19 pagesConsumerism: Dr. E. JalajapraveenaNo ratings yet

- Computationofincome2023 1Document2 pagesComputationofincome2023 1rtaxhelp helpNo ratings yet

- Isha Garg Test 01Document60 pagesIsha Garg Test 01AVINASHNo ratings yet

- Hotel de L - Etoile Income StatementDocument2 pagesHotel de L - Etoile Income StatementasadNo ratings yet

- School Lunch EssayDocument5 pagesSchool Lunch Essayapgsrfnbf100% (2)

- ICGA16 UiTM SinatriatDocument10 pagesICGA16 UiTM SinatriatNanda MartaNo ratings yet

- Dividir Las Siguientes Oraciones en Frases y TraducirlasDocument3 pagesDividir Las Siguientes Oraciones en Frases y TraducirlasHoken ProduccionNo ratings yet

- Vishesh KumarDocument1 pageVishesh Kumardhawan71860No ratings yet

- Diluted Earnings Per ShareDocument14 pagesDiluted Earnings Per Share2022920039No ratings yet

- Trade Unions - The History of Labour UnionsDocument28 pagesTrade Unions - The History of Labour UnionsShrikrishna BhaveNo ratings yet

- PFMS Generated Print Payment Advice: To, The Branch HeadDocument2 pagesPFMS Generated Print Payment Advice: To, The Branch HeadPrakash panjiyarNo ratings yet

- Company Law - Case Study PDFDocument10 pagesCompany Law - Case Study PDFLegal ckongNo ratings yet

- Chapter 5Document53 pagesChapter 5임재영No ratings yet

- Specifications: PartsDocument1 pageSpecifications: PartsSergio TecnicoNo ratings yet

- Online-Offline Competitive Pricing With Reference Price EffectDocument13 pagesOnline-Offline Competitive Pricing With Reference Price Effectamb zarNo ratings yet

- Balance IncomeDocument71 pagesBalance IncomepengeavNo ratings yet

- Dep 30.10.60.32 - Welding of Metals, Based On Iso StandardsDocument76 pagesDep 30.10.60.32 - Welding of Metals, Based On Iso StandardsPablo PazNo ratings yet

- OneSumXY Risk - General Risk PresentationDocument61 pagesOneSumXY Risk - General Risk PresentationjonyNo ratings yet

- U.S. Hydropower Market Report 2023 EditionDocument138 pagesU.S. Hydropower Market Report 2023 EditionvasantchemNo ratings yet

- Business Strategy: Nov - Dec 2011Document20 pagesBusiness Strategy: Nov - Dec 2011Towhidul IslamNo ratings yet

- CompanyDocument49 pagesCompanybabi 2No ratings yet

- Philippine Tax System: I. Introduction To Tax System in The PhilippinesDocument3 pagesPhilippine Tax System: I. Introduction To Tax System in The Philippinescluadine dinerosNo ratings yet

- Chapter 7Document18 pagesChapter 7Kajal YadavNo ratings yet