Professional Documents

Culture Documents

Income Tax: Cabria Cpa Review Center

Uploaded by

MaeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax: Cabria Cpa Review Center

Uploaded by

MaeCopyright:

Available Formats

CABRIA CPA REVIEW CENTER

INCOME TAX Tel. Nos. (043) 980-6659

ERNIE M. LAT II

LECTURE

Corporation – an artificial being created by operation of Current Tax

Definition of terms Current tax for the current and prior periods should be

Accounting profit is profit or loss for a period before recognized as a liability to the extent that it has not yet been

deducting tax expense. settled, and as an asset to the extent that the amounts

already paid exceed the amount due. The benefit of a tax

Taxable profit (tax loss) is the profit (loss) for a period, loss which can be carried back to recover current tax of a

determined in accordance with the rules established by the prior period should be recognized as an asset. Current tax

taxation authorities, upon which income taxes are payable assets and liabilities should be measured at the amount

(recoverable).

expected to be paid to (recovered from) taxation authorities,

Tax expense (tax income) is the aggregate amount included using the rates/laws that have been enacted or substantively

in the determination of profit or loss for the period in respect enacted by the end of the reporting period.

of current tax and deferred tax.

Recognition of Deferred Tax Liabilities

Current tax is the amount of income taxes payable The general principle in PAS 12 is that deferred tax liabilities

(recoverable) in respect of the taxable profit (tax loss) for a should be recognized for all taxable temporary differences.

period. There are 3 exceptions to the requirement to recognize a

deferred tax liability, as follows:

Deferred tax liabilities are the amounts of income taxes liabilities arising from goodwill for which

payable in future periods in respect of taxable temporary amortization is not deductible for tax purposes;

differences. liabilities arising from the initial recognition of an

asset/liability other than in a business combination

Deferred tax assets are the amounts of income taxes which, at the time of the transaction, does not affect

recoverable in future periods in respect of: either the accounting or the taxable profit; and

(a) deductible temporary differences; liabilities arising from undistributed profits from

(b) the carryforward of unused tax losses; and investments where the enterprise is able to control

(c) the carryforward of unused tax credits. the timing of the reversal of the difference and it is

probable that the reversal will not occur in the

Temporary differences are differences between the carrying foreseeable future.

amount of an asset or liability in the statement of financial

position and its tax base. Temporary differences may be Recognition of Deferred Tax Assets

either: A deferred tax asset should be recognized for deductible

(a) taxable temporary differences, which are temporary temporary differences, unused tax losses and unused tax

differences that will result in taxable amounts in determining credits to the extent that it is probable that taxable profit will

taxable profit (tax loss) of future periods when the carrying be available against which the deductible temporary

amount of the asset or liability is recovered or settled; or differences can be utilized, unless the deferred tax asset

(b) deductible temporary differences, which are temporary arises from the initial recognition of an asset/liability other

differences that will result in amounts that are deductible in than in a business combination which, at the time of the

determining taxable profit (tax loss) of future periods when transaction, does not affect the accounting or the taxable

the carrying amount of the asset or liability is recovered or profit.

settled. Deferred tax assets for deductible temporary differences

arising from investments in subsidiaries, associates,

The tax base of an asset or liability is the amount attributed branches and joint ventures should be recognized to the

to that asset or liability for tax purposes. extent that it is probable that the temporary difference will

reverse in the foreseeable future and that taxable profit will

Tax expense (tax income) comprises current tax expense be available against which the temporary difference will be

(current tax income) and deferred tax expense (deferred tax utilized.

income).

Page 1 of 4 cabria.batangas@gmail.com FAR.119

CABRIA CPA REVIEW CENTER

The carrying amount of deferred tax assets should be REVIEW QUESTIONS

reviewed at the end of each reporting period and reduced to 1. What is the basic principle for accounting for income

the extent that it is no longer probable that sufficient taxable taxes under IAS 12?

profit will be available to allow the benefit of part or all of a. There must be no large fluctuation in an

that deferred tax asset to be utilized. Any such reduction enterprise’s income tax expense from period to

should be subsequently reversed to the extent that it period.

becomes probable that sufficient taxable profit will be b. The income tax expense must be related to the

available. income or expense item that results in income

tax.

A deferred tax asset should be recognized for an unused tax c. An entity is required to recognize deferred tax

loss carryforward or unused tax credit if, and only if, it is liability or asset when the book basis for the

considered probable that there will be sufficient future asset or liability is not equal to its tax bases and

taxable profit against which the loss or credit carryforwards the difference is due to temporary difference.

can be utilized. d. An entity is required to recognize deferred tax

liability or asset when the book basis for the

Measurement of Deferred Tax Assets and Liabilities asset or liability is not equal to its tax base and

Deferred tax assets and liabilities should be measured at the the difference is due to permanent difference.

tax rates that are expected to apply to the period when the

asset is realized or the liability is settled (liability method), 2. The differences between accounting profit and

based on tax rates/laws that have been enacted or taxable income that do not have tax consequences

substantively enacted by the end of the reporting period. are called

The measurement should reflect the entity's expectations, at a. Permanent differences

the end of the reporting period, as to the manner in which b. Non-temporary differences

the carrying amount of its assets and liabilities will be c. Temporary differences

recovered or settled. d. Timing differences

Deferred tax assets and liabilities should not be discounted. 3. If during the current year, taxable profit is greater

than accounting profit and the difference is a

Recognition of Tax Expense or Income temporary difference

Current and deferred tax should be recognized as income or a. A deferred tax asset is recognized at the end of

expense and included in net profit or loss for the period, the current year.

except to the extent that the tax arises from: b. A deferred tax asset will be recognized in future

a transaction or event that is recognized directly in years.

equity; or c. A deferred tax liability is recognized at the end

a business combination accounted for as an of the current year.

acquisition. d. A deferred tax liability will be recognized in

future years.

If the tax relates to items that are credited or charged

directly to equity, the tax should also be charged or credited 4. Profit or income determined after applying the

directly to equity. financial reporting framework at a particular time is

called

If the tax arises from a business combination that is an a. Accounting profit

acquisition, it should be recognized as an identifiable asset b. Gross income

or liability at the date of acquisition in accordance with PFRS c. Taxable income

3 Business Combinations (thus affecting goodwill or negative d. Taxable revenues

goodwill).

5. Profit or income determined after applying the

Presentation provisions of the NIRC is called

Current tax assets and current tax liabilities should be offset a. Accounting income

on the statement of financial position only if the enterprise b. Gross income

has the legal right and the intention to settle on a net basis. c. Taxable income

d. Taxable revenues

Deferred tax assets and deferred tax liabilities should be

offset on the statement of financial position only if the 6. A major difference between permanent differences

enterprise has the legal right to settle on a net basis and and temporary differences is

they are levied by the same taxing authority on the same a. Permanent differences do not represent

entity or different entities that intend to realize the asset and generally accepted accounting practices.

settle the liability at the same time. b. Temporary differences occur less frequently

than permanent differences.

Page 2 of 4 cabria.batangas@gmail.com FAR.119

CABRIA CPA REVIEW CENTER

c. Temporary differences may become permanent 12. Carpet Company has three financial statement

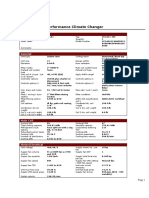

differences with the passage of time, but elements for which the December 31, 2016 book

permanent differences can never become basis is different form the December 31, 2016 tax

temporary differences basis:

d. Temporary differences reverse themselves Book Tax basis Difference

in subsequent reporting period, whereas basis

permanent differences do not reverse Equipment P2,000,000 P1,200,000 P800,000

Prepaid officer’s 750,000 0 750,000

7. Which of the following shall be classified as insurance policy

permanent differences between pretax Warranty liability 500,000 0 500,000

financial income and taxable income?

a. Payment of premiums for life insurance

b. Depreciation expense As a result of these differences, future taxable

c. Fines for violations of law amounts are

d. Product warranty costs a. P500,000

b. P800,000

8. Which of the following would create a permanent c. P1,550,000

difference between pretax financial income and d. P2,050,000

taxable income?

a. Using accelerated depreciation for tax purposes 13. L Corp.’s worksheet for calculating current and

and straight-line depreciation for accounting deferred income taxes for 2016 (000 omitted):

purposes.

b. Purchasing equipment previously leased with an 2016 2017 2018

operating lease in prior years. Pretax accounting P14,000

c. Using the percentage of completion method on profit

long term construction contracts Temporary

d. Recoding interest revenue on government- differences:

issued securities Depreciation (8,000) (P12,000) P20,000

Warranty costs 4,000 (1,000) (3,000)

9. Which of the following would create a deferred tax Taxable income P10,000

liability?

a. Interest revenue on municipal bonds Enacted rate 30% 30% 35%

b. Accrual of warranty expense.

c. Excess of tax depreciation over financial

accounting depreciation L had no prior deferred tax balances. In its 2016

d. Subscriptions received in advance income statement, what amount report as current

income tax expense?

10. Which of the following creates a deferred tax asset? a. P4,900,000

a. Tax depreciation exceeding book depreciation b. P4,200,000

b. Using installment sales method for tax purposes c. P3,500,000

and accrual basis for accounting purposes d. P3,000,000

c. Recognition of prepaid expenses

d. Recognition of unearned revenues 14. Use same info from 13. What amount should L

report as income tax expense – deferred in its 2016

11. Q Co. leased a building and received the P3,600,000 statement of comprehensive income?

annual rental payment on June 15, 2015. The lease a. P2,050,000

starts on July 1, 2015. Rental income is taxable b. P1,400,000

when received. Q’s tax rates are 30% for 2015 and c. P1,200,000

35% thereafter. Q has no other permanent or d. P550,000

temporary differences. Q determined that any

deferred tax asset is fully realizable. 15. At the end of 2016, its first year of operations, G Co

prepared a reconciliation between pretax financial

What amount of deferred tax asset should Q report income and taxable income as follows:

in its December 31, 2015 SFP?

a. P540,000 Pretax financial income P4,500,000

b. P630,000 Estimated litigation expenses 6,000,000

c. P1,080,000 Excess depreciation for taxes (9,000,000)

d. P1,260,000 Taxable income P1,500,000

Page 3 of 4 cabria.batangas@gmail.com FAR.119

CABRIA CPA REVIEW CENTER

The estimated litigation expense of P6,000,000 will

be deductible in 2017 when it is expected to be paid.

Use of the depreciable assets will result in taxable

amounts of P3,000,000 in each of the next three

years. The income tax rate is 30% for all years.

Assuming no payment yet has been paid for income

taxes, what is the income tax payable at the end of

2016?

a. P0

b. P450,000

c. P900,000

d. P1,350,000

16. Use same info from 15. What is the amount of

deferred tax asset recorded at December 31, 2016?

a. P450,000

b. P900,000

c. P1,350,000

d. P1,800,000

End

Page 4 of 4 cabria.batangas@gmail.com FAR.119

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Far.119 Income TaxDocument4 pagesFar.119 Income Taxjhon tupagNo ratings yet

- Income Taxes Lang HehezDocument8 pagesIncome Taxes Lang HehezDiana Rose BassigNo ratings yet

- Income Taxes (IAS 12)Document15 pagesIncome Taxes (IAS 12)Mahir RahmanNo ratings yet

- Factsheet IAS12 Income TaxesDocument14 pagesFactsheet IAS12 Income TaxesMira EbreoNo ratings yet

- Ias 12Document2 pagesIas 12Philemon FatunbiNo ratings yet

- Classroom Notes 6382Document2 pagesClassroom Notes 6382THRISHIA ANN SOLIVANo ratings yet

- This Study Resource Was: Cebu Cpar Center Inc. Unit 103, MGA Arcade, A.C. Cortes Ave., Mandaue CityDocument3 pagesThis Study Resource Was: Cebu Cpar Center Inc. Unit 103, MGA Arcade, A.C. Cortes Ave., Mandaue CityNhel AlvaroNo ratings yet

- Accounting For Income TaxDocument12 pagesAccounting For Income Taxglrosaaa cNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxGirl Lang AkoNo ratings yet

- Pas 12 Income TaxesDocument3 pagesPas 12 Income TaxesR.A.No ratings yet

- Module 10 - Income TaxDocument6 pagesModule 10 - Income TaxLuiNo ratings yet

- IAS 12 TaxationDocument7 pagesIAS 12 Taxationv0524 vNo ratings yet

- Chapter 4 - Accounting For Other LiabilitiesDocument21 pagesChapter 4 - Accounting For Other Liabilitiesjeanette lampitoc0% (1)

- Accounting For Income Tax: Technical KnowledgeDocument45 pagesAccounting For Income Tax: Technical KnowledgeCharlene de LaraNo ratings yet

- Accounting For Income Tax: Technical KnowledgeDocument42 pagesAccounting For Income Tax: Technical KnowledgeAngela Miles DizonNo ratings yet

- 34 Accounting For Income Tax Intermediate Accounting 2 - CompressDocument4 pages34 Accounting For Income Tax Intermediate Accounting 2 - CompressKIMBERLY BEZARNo ratings yet

- Income TaxDocument15 pagesIncome Taxkimuli FreddieNo ratings yet

- ToA 10 Income Tax StudentDocument4 pagesToA 10 Income Tax Studentlana del reyNo ratings yet

- 11 Income-Tax Lecture-NotesDocument6 pages11 Income-Tax Lecture-NotesandreamrieNo ratings yet

- Pas 12Document5 pagesPas 12yeldez arra100% (1)

- Chapter 13 - IAS 12Document54 pagesChapter 13 - IAS 12Bahader AliNo ratings yet

- Pas 12 Income TaxesDocument4 pagesPas 12 Income TaxesFabrienne Kate Eugenio Liberato100% (1)

- PAS 12 INCOME TAXES Cont With ProbsDocument8 pagesPAS 12 INCOME TAXES Cont With ProbsFabrienne Kate Eugenio Liberato100% (1)

- Events After The Reporting Period: Pas 10, Pas 12, and Pas 16 ObjectiveDocument5 pagesEvents After The Reporting Period: Pas 10, Pas 12, and Pas 16 ObjectiveMica DelaCruzNo ratings yet

- Ifrs at A Glance: IAS 12 Income TaxesDocument4 pagesIfrs at A Glance: IAS 12 Income Taxeslina_siscanu6356No ratings yet

- Income TaxesDocument11 pagesIncome TaxesamNo ratings yet

- Pas 12Document2 pagesPas 12Sacedon, Trishia Mae C.No ratings yet

- Accounting For Income TaxDocument31 pagesAccounting For Income TaxJames Ryan AlzonaNo ratings yet

- Income Taxes (Ias - 12) : Page 1 of 25Document25 pagesIncome Taxes (Ias - 12) : Page 1 of 25ErslanNo ratings yet

- Ind AS 12Document37 pagesInd AS 12Amal P TomyNo ratings yet

- Reviewer in InternediateDocument2 pagesReviewer in InternediateMeigs PastorNo ratings yet

- IAS 12 - Income TaxesDocument1 pageIAS 12 - Income TaxesFeras ShreimNo ratings yet

- Topic 4Document20 pagesTopic 4Ollid Kline Jayson JNo ratings yet

- Deferred TaxDocument16 pagesDeferred TaxErick NuescaNo ratings yet

- Pas 12Document5 pagesPas 12elle friasNo ratings yet

- Ias 12Document21 pagesIas 12david_thapaNo ratings yet

- Ind As 12: Income Taxes: Current Tax Temporary Difference: TaxableDocument2 pagesInd As 12: Income Taxes: Current Tax Temporary Difference: Taxablechandrakumar k pNo ratings yet

- IAS 12 Income Taxes: DefinitionsDocument50 pagesIAS 12 Income Taxes: DefinitionsAANo ratings yet

- Accounting For Income TaxesDocument4 pagesAccounting For Income TaxesDivine CuasayNo ratings yet

- PAS12 mcq4Document17 pagesPAS12 mcq4Margaux CornetaNo ratings yet

- Document From Adhu-6 PDFDocument19 pagesDocument From Adhu-6 PDFBasavaraj S PNo ratings yet

- FAR.2835 Income Taxes PDFDocument7 pagesFAR.2835 Income Taxes PDFNah HamzaNo ratings yet

- Learning Resource 11 Jerald Jay CatacutanDocument8 pagesLearning Resource 11 Jerald Jay CatacutanRemedios Capistrano CatacutanNo ratings yet

- Ias 12Document27 pagesIas 12Kuti KuriNo ratings yet

- FAR 4116 CleanDocument7 pagesFAR 4116 Cleanruel c armillaNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxMjhayeNo ratings yet

- Module 4 Accounting For TaxesDocument14 pagesModule 4 Accounting For TaxesFujoshi BeeNo ratings yet

- 201.04 Accounting For Income Taxes (IAS-12)Document16 pages201.04 Accounting For Income Taxes (IAS-12)Biplob K. SannyasiNo ratings yet

- 0 - Accounting For Income Tax SummaryDocument7 pages0 - Accounting For Income Tax SummaryJaneNo ratings yet

- Chapter FiveDocument15 pagesChapter FiveTesfaye Megiso BegajoNo ratings yet

- Income Tax: Full PFRS, Prfs For Smes & Pfrs For SesDocument15 pagesIncome Tax: Full PFRS, Prfs For Smes & Pfrs For SesChara etangNo ratings yet

- Pas 12Document2 pagesPas 12JennicaBailonNo ratings yet

- Income Taxes Far Reviwer NotesDocument15 pagesIncome Taxes Far Reviwer Notesabb.reviewersNo ratings yet

- HO1 - Accounting For Income TaxDocument5 pagesHO1 - Accounting For Income TaxCharlesNo ratings yet

- Csfas Pas12Document31 pagesCsfas Pas12Jack GriffoNo ratings yet

- SelectionDocument27 pagesSelectionMohammad BaratNo ratings yet

- Income Taxes: Indian Accounting Standard (Ind AS) 12Document36 pagesIncome Taxes: Indian Accounting Standard (Ind AS) 12PRATHAMESH_GORENo ratings yet

- IAS 12 Income TaxesDocument42 pagesIAS 12 Income TaxesziyuNo ratings yet

- AS22Document7 pagesAS22Selvi balanNo ratings yet

- Learning Delivery Modality Decision Tree: YES Limited NODocument2 pagesLearning Delivery Modality Decision Tree: YES Limited NOMae98% (52)

- Topic Do Not Forget To Use Atleast 3-5 Citations Maximum of 3 Pages OnlyDocument21 pagesTopic Do Not Forget To Use Atleast 3-5 Citations Maximum of 3 Pages OnlyMaeNo ratings yet

- Taxation Under The Train Law: 1 - PageDocument30 pagesTaxation Under The Train Law: 1 - PageMae50% (2)

- FEASIBILITY - STUDY v1Document24 pagesFEASIBILITY - STUDY v1MaeNo ratings yet

- The Legislative DepartmentDocument20 pagesThe Legislative DepartmentMaeNo ratings yet

- Nike Case StudyDocument8 pagesNike Case StudyMaeNo ratings yet

- Computer TechnologyDocument3 pagesComputer TechnologyMaeNo ratings yet

- BORROWING COSTS With AnswerDocument3 pagesBORROWING COSTS With AnswerMaeNo ratings yet

- Corporation GPP Income Taxation PDFDocument22 pagesCorporation GPP Income Taxation PDFMaeNo ratings yet

- FAR.113 - INVESTMENT PROPERTY With Answer PDFDocument5 pagesFAR.113 - INVESTMENT PROPERTY With Answer PDFMaeNo ratings yet

- FAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerDocument6 pagesFAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerMaeNo ratings yet

- FAR.110 - Property Plant Equipment With AnswerDocument9 pagesFAR.110 - Property Plant Equipment With AnswerMaeNo ratings yet

- FAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerDocument12 pagesFAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerMae100% (2)

- FAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerDocument12 pagesFAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerMae100% (2)

- FAR.113 - INVESTMENT PROPERTY With Answer PDFDocument5 pagesFAR.113 - INVESTMENT PROPERTY With Answer PDFMaeNo ratings yet

- BORROWING COSTS With AnswerDocument3 pagesBORROWING COSTS With AnswerMaeNo ratings yet

- Lecture Notes: Auditing Theory AT.0102-Code of Ethics - Part I MAY 2020Document8 pagesLecture Notes: Auditing Theory AT.0102-Code of Ethics - Part I MAY 2020MaeNo ratings yet

- AT.0105 - Fraud Error and Non ComplianceDocument9 pagesAT.0105 - Fraud Error and Non ComplianceMaeNo ratings yet

- Accounting SystemDocument36 pagesAccounting SystemMaeNo ratings yet

- PolicySchedule PDFDocument1 pagePolicySchedule PDFSandeep Borse100% (1)

- Answers 1Document68 pagesAnswers 1Miguel Angel HernandezNo ratings yet

- Acr Oss The Line ContactorsDocument2 pagesAcr Oss The Line ContactorshmavisNo ratings yet

- Fibre Optic Cable SplicingDocument33 pagesFibre Optic Cable SplicingAmax TeckNo ratings yet

- Student Discussion Board (PHP) PDFDocument54 pagesStudent Discussion Board (PHP) PDFAman Kumar ChoubeyNo ratings yet

- اسئلة الهيئة السعودية- تمريضDocument39 pagesاسئلة الهيئة السعودية- تمريضlolo trabNo ratings yet

- Data Mining ToolsDocument9 pagesData Mining Toolspuneet0303No ratings yet

- GBC Module 1Document69 pagesGBC Module 1MOHAMED82% (129)

- Abu Ibrahim Al-Hashimi Al-Qurashi: Abū Ibrāhīm Al-Hāshimi Al-Qurashi Mawli Al-SalbiDocument12 pagesAbu Ibrahim Al-Hashimi Al-Qurashi: Abū Ibrāhīm Al-Hāshimi Al-Qurashi Mawli Al-SalbiJosué Barrón GonzálezNo ratings yet

- Article Review FormDocument2 pagesArticle Review FormdinarsyifaNo ratings yet

- MITSUBISHI WD738 Service ManualDocument89 pagesMITSUBISHI WD738 Service ManualBryan Kentner100% (1)

- VedicReport2 28 202412 53 08PMDocument55 pagesVedicReport2 28 202412 53 08PM처곧ᄉJimmyNo ratings yet

- G-6 Ing. Luis Rebollar Corona, Member SmicDocument2 pagesG-6 Ing. Luis Rebollar Corona, Member SmicjuncatalanNo ratings yet

- Essay 1 DraftDocument1 pageEssay 1 Draftgdx3100% (3)

- Eia 1163final Commercial and Recreational DVLPMTDocument144 pagesEia 1163final Commercial and Recreational DVLPMTAimanNo ratings yet

- Dividido Trane 30 TonsDocument23 pagesDividido Trane 30 TonsairemexNo ratings yet

- 2011-006 Tangram People (All Ages) PDFDocument28 pages2011-006 Tangram People (All Ages) PDFKhalil BarhoumiNo ratings yet

- List of RAs UpdatedDocument12 pagesList of RAs UpdatedThe SuperstarNo ratings yet

- Banasthali Vidyapith: Bachelor of Arts and Bachelor of LawsDocument172 pagesBanasthali Vidyapith: Bachelor of Arts and Bachelor of Lawssimranrai122002No ratings yet

- C.8 SOLUTIONS (Problems I - IX)Document9 pagesC.8 SOLUTIONS (Problems I - IX)Bianca AcoymoNo ratings yet

- Proposal 4psDocument6 pagesProposal 4psCaridad Avila67% (3)

- 2023 Global State of Digital Trust Infographic FinalDocument1 page2023 Global State of Digital Trust Infographic Finalhakkan meierNo ratings yet

- Quantity Calculation FormatDocument8 pagesQuantity Calculation FormatNabraiz AnsariNo ratings yet

- IndraneelRakshit ResumeDocument7 pagesIndraneelRakshit ResumeIndraneel RakshitNo ratings yet

- Mvo 1965Document113 pagesMvo 1965younisNo ratings yet

- Practical 9: Enthalpy Change of ReactionDocument4 pagesPractical 9: Enthalpy Change of ReactionJulia QistinaNo ratings yet

- Assembly Senate Response.2.10.21. Final PDFDocument16 pagesAssembly Senate Response.2.10.21. Final PDFZacharyEJWilliamsNo ratings yet

- Nike Marketing Plan PDFDocument1 pageNike Marketing Plan PDFSumaira Binte SaleemNo ratings yet

- Dematron 60 70 Parlour Sheet 1.03Document1 pageDematron 60 70 Parlour Sheet 1.03Andrés HurtadoNo ratings yet

- Human Resource ManagementDocument86 pagesHuman Resource ManagementK V S PRASD REDDYNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfFrom EverandTax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.From EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesFrom EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The 6% Life: 7 Legal Tax Loopholes That Any Business Owner Can Use to Design Their Life and Pay the Government 6% or LessFrom EverandThe 6% Life: 7 Legal Tax Loopholes That Any Business Owner Can Use to Design Their Life and Pay the Government 6% or LessNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)