Professional Documents

Culture Documents

Examination,: Degree MAY

Uploaded by

Siva Chandran SOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Examination,: Degree MAY

Uploaded by

Siva Chandran SCopyright:

Available Formats

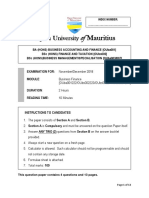

Reg. No.

B.Tech. DEGREE EXAMINATION, MAY 2016

Sixth Semester

MB 1208 - FINANCE FOR NON FINANCE DGCUTIVES

(For the candidates admitted during the academic year 201i - 2014 and 20 )4 -2015)

Note:

(i) Part - A should be answered in OMR sheet within frst 45 minutes and OMR sheet should be handed

over to hall invigilator at the end of 456 minute.

(ir) Part - B and Part - C should be answered in answer booklet.

Time: Three Hours Max. Marks: 100

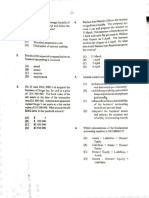

PART - A (20 x 1 = 20 Marlis)

Answer ALL Questions

l. The money lent in money market for a period of 2 days to 15 days is referred to as

(A) Call money (B) Demand money

(C) Tenn load (D) Notice money

2. is not a fxed asset

(A) Livestock @) Loose tools

(C) Equipments @) Goodwill

3. Which one of the following is not a function of financial system?

(A) Risk tunction (B) Social function

(C) Liquidif tunction @) Reformatory function

4. The financial market includes the following except _

(A) Commodity market @) Money market

(C) New issue market @) Stock market

5. Capital budgeting is apart of

(A) Financing decision @) Capitat structure

(C) Investmentdecision @) Dividend decision

6. Minimum rate of return that a firm must eam in order to satisfy its investors, is also known

as:

(A) Average return on inveshrent @) Weighted average cost of capital

(C) Internal rate ofretum @) Benefit cost ratio

7. does not consider the time value of money

(A) Benefit cost ratio (B) Paybackperiod

(C) Intemal rate of retum @) Discounted payback period

8. Risk which can be reduced throrrsh diversification is _

(A) Systematic risk @) Unsystematic risk

(C) Poffolio risk @) Total risk

Page 1 of3 31I\4A6148 1208

9. Which of the following factors does not affect the capital stucture of a company PART-B(5x4=20Marks)

(A) Cost of capital @) Size of the company AnswerANY FfV Questions

(C) Dilution of control @) Composition of current assets

21. Briefly explain the role of secondary market in Indian financial system?

10. is a method of offering securities to the public through a sponsor

(A) Bought out deal (B) Private placement Enumerate the importance of cost of capital?

(C) Public issue @) Underwriting

)? What is preference share capital? List out its pros and cons?

11. Gilt edged securities are the bonds issued by

(A) Financial institutions (B) Big corporates )A Write short notes on performance budgeting?

(C) Central govemment @) Mutual fimds

25. How risk can be evaluated using sensitivity analysis?

12. approach states that changing leverage ratio does not influence the value ofa frm

because of "Arbitrage process". What are the key decision areas in finance?

(A) Net income approach @) Net operating income approach

(C) Traditionalapproach @) Modigliani miller approach 11 Explain the Modigliani and miller hypothesis of irrelevance of capital structure?

13. A cumulative preference share Isone PART-C(5x 12=60Marks)

(A) h which all the unpaid dividends are @) Which can be converted into equity Answer ALL Questions

carried forward and payable

(C) Which can be redeemed (D) Which entitle the preference shareholders 28. a- Briefly explain the functions of Indian financial system?

the right to get surplus profit

(oR)

14. Debt furancing is a cheaper source of finance because of b. Explain in detail the Indian financial system?

(A) Time value of money @) Cheap rate of interest

(C) Tax deductibility of interest (D) Dividends not payable to lenders 29. u What,are the various techniques of capital budgeting decisions?

15. Net working capital is a measure of the company's (oR)

(A) Profitability (B) Magnitude of sales b. Explain the phases in capital budgeting decision?

(C) Estimated liquidity @) Current assets

30. a- Explain the factors determining capital structure of a fimt?

i

16. Working capital gap is

(A) Equal to current assets plus current (B) Equal to current assets minus current

liabilities including bank borrowings liabilities including bank bonowings b. Elucidate the diflerent types of financialt8r?r-"ro issued by government?

(C) Equal to cwrent assets plus current (D) Equal to current assets minus current

liabilities excluding bank bonowings liabilities excluding bank bonowings 31. a" Compare the relative merits and demerits of equity share and debentures?

17. What type of budge is desiped to take into account forecast change in cos! prices etc? (oR)

(A) Masterbudget @) Rollingbudget b. Define: working capital? What are the consequences of excess and inadequate working

(C) Flexible budget @) Functionalbudget capital?

18. Cash budget does not include 32. a What is budgetary contol? Explain its objectives?

(A) Dividend payable @) Postal expenditure

(C) Issue of capital @) Total sales figure (oR)

b. What do you mean by zero base budgeting? Explain the pros and cons of ZBB?

19. _ is usually a long term budget

(A) Fixed budget (B) Sales budget

(C) Cash budget @) Capital expendihre budget ***{r*

20. Sales budget is a

(A) Functional budget @) Expenditure budget

(C) Master budget @) Flexible budget

Pagc 2 of3 3IMA5MB1208 Pagc 3 of3 31MA6MB12OE

You might also like

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Rajeev Institute of Technology Department of Management StudiesDocument5 pagesRajeev Institute of Technology Department of Management StudiesPriya PriyaNo ratings yet

- Bcm-17-06 Usama Mcqs FsaDocument4 pagesBcm-17-06 Usama Mcqs FsaUsama SaadNo ratings yet

- Economics For Engineers (HMTS 3201) : Time Allotted: 3 Hrs Full Marks: 70Document4 pagesEconomics For Engineers (HMTS 3201) : Time Allotted: 3 Hrs Full Marks: 70gaurav kumarNo ratings yet

- RKG Eco Mock 3Document6 pagesRKG Eco Mock 3Tushar AswaniNo ratings yet

- Adobe Scan 03 Feb 2023 PDFDocument7 pagesAdobe Scan 03 Feb 2023 PDFShraddhanjali NayakNo ratings yet

- CISI - 1. Financial Service IndustryDocument4 pagesCISI - 1. Financial Service Industrykhushi chaudhariNo ratings yet

- Chapter 2 Test BankDocument7 pagesChapter 2 Test Bankrajalaxmi rajendranNo ratings yet

- Sa 1 0107Document18 pagesSa 1 0107api-3749988100% (2)

- GAT MCQs Finance Management SciencesDocument5 pagesGAT MCQs Finance Management SciencesMuhammad NajeebNo ratings yet

- 2019 1 PDFDocument121 pages2019 1 PDFomiraskar1212No ratings yet

- Cape Mob 2011 U1 P1Document6 pagesCape Mob 2011 U1 P1Ronelle VincentNo ratings yet

- Economics For Engineers (HMTS 3101) - 2019Document2 pagesEconomics For Engineers (HMTS 3101) - 2019gaurav kumarNo ratings yet

- BA2087 AY2021 Practice Paper 2 (Blackboard)Document6 pagesBA2087 AY2021 Practice Paper 2 (Blackboard)jyNo ratings yet

- RKG Guess Paper 1Document7 pagesRKG Guess Paper 1krishnabagla373No ratings yet

- Paper 1-Fundamentals of Economics and Management: MTP - Foundation - Syllabus 2016 - December 2019 - Set 1Document7 pagesPaper 1-Fundamentals of Economics and Management: MTP - Foundation - Syllabus 2016 - December 2019 - Set 1Manirul NirobNo ratings yet

- PRE-BOARD TERM 1 ECONOMICS EXAM REVIEWDocument12 pagesPRE-BOARD TERM 1 ECONOMICS EXAM REVIEWAkshat GulatiNo ratings yet

- QCM Finance CompletDocument432 pagesQCM Finance CompletLinh PhamNo ratings yet

- CH 3Document12 pagesCH 3landmarkconstructionpakistanNo ratings yet

- Ref: GAT1002202 General Awareness Test Time: 15 Min.: (Economics)Document3 pagesRef: GAT1002202 General Awareness Test Time: 15 Min.: (Economics)vickyNo ratings yet

- SET B Class 11th Accountancy WPT -I 3Document5 pagesSET B Class 11th Accountancy WPT -I 3Shakshi ShudhNo ratings yet

- Sec-B2 2022Document3 pagesSec-B2 2022Sanchari DasNo ratings yet

- FM (ILO) Help BookDocument3 pagesFM (ILO) Help Booknikhitha jayaprakashNo ratings yet

- Finance Multiple Choice QuestionsDocument4 pagesFinance Multiple Choice QuestionsPikachuNo ratings yet

- This Study Resource Was: Fundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersDocument8 pagesThis Study Resource Was: Fundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersFunny idolNo ratings yet

- Accounting 2021 U1 P1 PDFDocument10 pagesAccounting 2021 U1 P1 PDFStephano OlliviereNo ratings yet

- Accounting An Introduction NZ 2nd Edition Atrill Test BankDocument18 pagesAccounting An Introduction NZ 2nd Edition Atrill Test BankAdrianHayescgide100% (13)

- Chapter 1 - Intro To CFDocument2 pagesChapter 1 - Intro To CFParth GargNo ratings yet

- RKG Guess paper 2Document6 pagesRKG Guess paper 2sanjaykr4991No ratings yet

- Advanced Financial Management Paper 2.9A Key FiguresDocument7 pagesAdvanced Financial Management Paper 2.9A Key FiguresNABAJYOTI KUMARNo ratings yet

- MB311 - July 06Document18 pagesMB311 - July 06lokeshgoyal2001No ratings yet

- SSB Commerce-2021Document16 pagesSSB Commerce-2021amit sinhaNo ratings yet

- IFS End Term 2015Document6 pagesIFS End Term 2015SharmaNo ratings yet

- P5 PDFDocument20 pagesP5 PDFTeddy BearNo ratings yet

- TIME: 2!110VJR: 4. E Uit ShareholdersDocument10 pagesTIME: 2!110VJR: 4. E Uit ShareholdersAditi VengurlekarNo ratings yet

- CSEC POB June 2019 P1 PDFDocument9 pagesCSEC POB June 2019 P1 PDFMiss KissoonNo ratings yet

- ACF End Term 2015Document8 pagesACF End Term 2015SharmaNo ratings yet

- Xi - BST Mid Term QP (2021-22)Document7 pagesXi - BST Mid Term QP (2021-22)mansi chandakNo ratings yet

- MCQ Financial Management B Com Sem 5 PDFDocument17 pagesMCQ Financial Management B Com Sem 5 PDFRadhika Bhargava100% (2)

- Outram Lines Finance Accounts QuestionsDocument6 pagesOutram Lines Finance Accounts QuestionsAkanksha GargNo ratings yet

- Common Course - Perspectives and Methodology of Business Studies Nov 2009Document3 pagesCommon Course - Perspectives and Methodology of Business Studies Nov 2009PRIYA CHARLESNo ratings yet

- Business Finance Nov Dec 2018Document13 pagesBusiness Finance Nov Dec 2018bimalNo ratings yet

- Tiong, Gilbert Charles - Financial Planning and ManagementDocument10 pagesTiong, Gilbert Charles - Financial Planning and ManagementGilbert TiongNo ratings yet

- Portfolio Management Question Paper Section ADocument18 pagesPortfolio Management Question Paper Section Athomas Ed HorasNo ratings yet

- Industrial Management Exam QuestionsDocument6 pagesIndustrial Management Exam QuestionsPalash BairagiNo ratings yet

- Commerce (1)Document16 pagesCommerce (1)sandeepbarik3062003No ratings yet

- Sample Paper 2 Economics Class 12thDocument13 pagesSample Paper 2 Economics Class 12thmathurusha39No ratings yet

- FSAI EXAM2 Solutions Fraser 10thDocument14 pagesFSAI EXAM2 Solutions Fraser 10thGlaiza Dalayoan Flores0% (1)

- Cbleecpu 12Document8 pagesCbleecpu 12Pubg GokrNo ratings yet

- Galaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii TrimesterDocument5 pagesGalaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii Trimesteralbinus1385No ratings yet

- F4 VP Pob Eot ExamDocument7 pagesF4 VP Pob Eot Examyuvita prasadNo ratings yet

- ICFAI University MBA Paper 2Document18 pagesICFAI University MBA Paper 2Rihaan ShakeelNo ratings yet

- 400_Paper-12CompanyAccounts&AuditDocument59 pages400_Paper-12CompanyAccounts&AuditDhana SekarNo ratings yet

- QuestionsDocument9 pagesQuestionsphiniejosepheenNo ratings yet

- Preboard 3 EcoDocument8 pagesPreboard 3 EcoSuganthi VNo ratings yet

- Cbleecpl 06Document6 pagesCbleecpl 06AdityaNo ratings yet

- 12 Economics Eng PP 2023 24 1Document8 pages12 Economics Eng PP 2023 24 1Shivansh JaiswalNo ratings yet

- Cbleecpu 07Document8 pagesCbleecpu 07Sanjay PanickerNo ratings yet

- Moodys All SetsDocument106 pagesMoodys All Setsiva100% (1)

- Sample Paper 1 Economics Class 12thDocument15 pagesSample Paper 1 Economics Class 12thdmsd3991No ratings yet

- Nirf AnalysisDocument2 pagesNirf AnalysisSiva Chandran SNo ratings yet

- Mani Wine 2Document116 pagesMani Wine 2Siva Chandran SNo ratings yet

- Me1019 5 SemDocument2 pagesMe1019 5 SemSiva Chandran SNo ratings yet

- Me1019 5 SemDocument2 pagesMe1019 5 SemSiva Chandran SNo ratings yet

- 125, II 100 650 (A) (C) : Ele. (B) (D)Document2 pages125, II 100 650 (A) (C) : Ele. (B) (D)Siva Chandran SNo ratings yet

- Probability, statistics exam questionsDocument2 pagesProbability, statistics exam questionsSiva Chandran SNo ratings yet

- Air ConditioningDocument25 pagesAir ConditioningSiva Chandran SNo ratings yet

- Multiple page document scanned by CamScannerDocument29 pagesMultiple page document scanned by CamScannerSiva Chandran SNo ratings yet

- Modern Advanced Accounting in Canada Canadian 8th Edition Hilton Solutions Manual PDFDocument106 pagesModern Advanced Accounting in Canada Canadian 8th Edition Hilton Solutions Manual PDFa748358425No ratings yet

- Final Examination Questions Cover Financial, Treasury and Forex ManagementDocument5 pagesFinal Examination Questions Cover Financial, Treasury and Forex ManagementKaran NewatiaNo ratings yet

- Oil and Gas Accounting OverviewDocument47 pagesOil and Gas Accounting Overviewtsar_philip2010100% (1)

- Outline 2014Document3 pagesOutline 2014alicesaysNo ratings yet

- Timeline of IAS 19 - Employee BenefitsDocument4 pagesTimeline of IAS 19 - Employee BenefitsRey OñateNo ratings yet

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- Corporation ProblemsDocument5 pagesCorporation ProblemsKathleenNo ratings yet

- Toaz - Info Acca f3 LRP Questions PRDocument64 pagesToaz - Info Acca f3 LRP Questions PRArt and Fashion galleryNo ratings yet

- CFA Level II Mock Exam 5 - Questions (AM)Document41 pagesCFA Level II Mock Exam 5 - Questions (AM)Sardonna FongNo ratings yet

- SY BCOM DIV C 23 24 PPFA Sem IV Internal Project TopicsDocument1 pageSY BCOM DIV C 23 24 PPFA Sem IV Internal Project TopicsDarshan BhutaNo ratings yet

- DST Computation Attempt ReviewDocument4 pagesDST Computation Attempt Reviewella angelicalNo ratings yet

- ITIL V3 Application SupportDocument49 pagesITIL V3 Application SupportAsh Ray75% (4)

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportZelalem RegasaNo ratings yet

- Week 5: Asset PricingDocument26 pagesWeek 5: Asset Pricingmike chanNo ratings yet

- ACCOUNTANCY DEPARTMENT ASSESSMENTDocument12 pagesACCOUNTANCY DEPARTMENT ASSESSMENTGRACELYN SOJORNo ratings yet

- 1 - Introduction To The CourseDocument17 pages1 - Introduction To The CourseGioacchinoNo ratings yet

- Latihan Soal Coc Dan WMCCDocument9 pagesLatihan Soal Coc Dan WMCCyolandaNo ratings yet

- Group 15 F 405 Working Capital ManagementDocument17 pagesGroup 15 F 405 Working Capital ManagementNowshad AyubNo ratings yet

- Capital Budgeting at MakeMyTripDocument82 pagesCapital Budgeting at MakeMyTripPratik Jalan100% (1)

- 2023 Guide To Startup FundingDocument47 pages2023 Guide To Startup FundingssdipaNo ratings yet

- Bank Mandiri Equity UpdateDocument5 pagesBank Mandiri Equity UpdateAhmad SantosoNo ratings yet

- Chapter - 1 Accounting in ActionDocument19 pagesChapter - 1 Accounting in ActionfuriousTaherNo ratings yet

- CengageNOWv2 - Online Teaching and Learning Resource From Cengage Learning Week 2Document8 pagesCengageNOWv2 - Online Teaching and Learning Resource From Cengage Learning Week 2Swapan Kumar SahaNo ratings yet

- Final Exam: Vietnam National University International SchoolDocument8 pagesFinal Exam: Vietnam National University International SchoolKhánh Linh MaiNo ratings yet

- Understanding Business and Entrepreneurship - 2024 v2 PDF-1Document37 pagesUnderstanding Business and Entrepreneurship - 2024 v2 PDF-1Nomvuma GubesaNo ratings yet

- Financial Statement PreparationDocument9 pagesFinancial Statement PreparationDELFIN, LORENA D.No ratings yet

- Business Finance AssignmentDocument16 pagesBusiness Finance AssignmentGannaNo ratings yet

- Lec 4 Log MGTDocument20 pagesLec 4 Log MGTShahriat Sakib DhruboNo ratings yet

- Avro SPTR FinalDocument48 pagesAvro SPTR FinalShadique ShamsNo ratings yet

- Fundamentals of Financial Management 15th Edition Brigham Test BankDocument18 pagesFundamentals of Financial Management 15th Edition Brigham Test BankGeraldTorresfdpam100% (11)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet