Professional Documents

Culture Documents

Excel Modeling of Portfolio Variance

Uploaded by

Jain ChiragOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel Modeling of Portfolio Variance

Uploaded by

Jain ChiragCopyright:

Available Formats

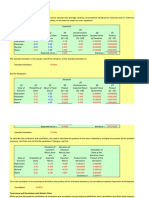

All numbers are hypothetical. Change data only in cells colored yellow.

Correlation matrix

Expected

Weight (wn) Annual volatility (σn) returns wnσn Gold

Gold 20% 10% 39% 0.02 Gold 1

T-bonds 10% 5% 29% 0.005 T-bonds 0.5

Equities 40% 60% 30% 0.24 Equities 0.5

Crude 5% 30% 25% 0.015 Crude 0.5

Wheat 15% 25% 12% 0.0375 Wheat 0.5

EUR 10% 40% 7% 0.04 EUR 0.5

Total 100%

Expected returns = 26.45%

Transpose

this to get

this matrix

Annual volatility

Annual variance = 0.09453125

Therefore volatility = 30.75%

Assume risk free rate = 10%

Sharpe Ratio = 0.535030083343586

Correlation matrix

T-bonds Equities Crude Wheat EUR

0.5 0.5 0.5 0.5 0.5 Note that this matrix is symmetrical, ie the

1 0.5 0.5 0.5 0.5 correlation of Gold and Wheat is the same

as the correlation of Wheat and Gold. The

0.5 1 0.5 0.5 0.5 blue cells therefore need no data entry.

0.5 0.5 1 0.5 0.5 Also, the correlation of an asset with itself

0.5 0.5 0.5 1 0.5 is always 1.

0.5 0.5 0.5 0.5 1

You might also like

- Ross CH 13Document23 pagesRoss CH 13miftahulamalahNo ratings yet

- AVE and Composite Reliability CalculatorDocument3 pagesAVE and Composite Reliability Calculatorshankar_mission100% (2)

- Excel Modeling of Portfolio VarianceDocument3 pagesExcel Modeling of Portfolio VarianceBigbi KumarNo ratings yet

- Excel Modeling of Portfolio VarianceDocument3 pagesExcel Modeling of Portfolio VariancetahaalkibsiNo ratings yet

- Yield Distribution CalculatorDocument4 pagesYield Distribution Calculatorhpegoraro262No ratings yet

- Er Variance U ADocument6 pagesEr Variance U AJappan AhluwaliaNo ratings yet

- ER σ ρ Asset A Asset BDocument8 pagesER σ ρ Asset A Asset BAbdul SattarNo ratings yet

- Estadistica CapingDocument6 pagesEstadistica CapingRicardo José Brito ValdesNo ratings yet

- Chapter 3 Part 3Document30 pagesChapter 3 Part 3Aditya GhoshNo ratings yet

- L2 Frequency Distributions and GraphsDocument67 pagesL2 Frequency Distributions and GraphsKent ChinNo ratings yet

- Uts Lab - Statiistik SafnaDocument7 pagesUts Lab - Statiistik SafnaSandra KaunangNo ratings yet

- Expected Value CalculationsDocument6 pagesExpected Value CalculationsNprantoNo ratings yet

- Initial Condition (At Day 0) NAM Parameters: NAM Modelling (Hand Calculations)Document16 pagesInitial Condition (At Day 0) NAM Parameters: NAM Modelling (Hand Calculations)Dendevil LivednedNo ratings yet

- Portfolio's KPIs Calculations TemplateDocument7 pagesPortfolio's KPIs Calculations TemplateGARVIT GoyalNo ratings yet

- WACC and Traditional AppoachDocument3 pagesWACC and Traditional AppoachAnuvratNo ratings yet

- Graficos Kaique Igor SamuelDocument2 pagesGraficos Kaique Igor SamuelDiogo AlmeidaNo ratings yet

- BCOM AssignmentDocument8 pagesBCOM AssignmentSneha KhaitanNo ratings yet

- Bot BTTS TESTE 20220825 003930Document18 pagesBot BTTS TESTE 20220825 003930ANTI-SPIRALNo ratings yet

- Why The Rule of 10Document9 pagesWhy The Rule of 10Nguyễn TrangNo ratings yet

- Cajas 2Document4 pagesCajas 2mster localNo ratings yet

- Benefits of DiversificationDocument4 pagesBenefits of DiversificationLAKHAN TRIVEDINo ratings yet

- Percentages and FractionsDocument57 pagesPercentages and FractionsViorica CiciocNo ratings yet

- Effect of Temperature On Enzyme RateDocument3 pagesEffect of Temperature On Enzyme RateJacob TremblayNo ratings yet

- Libro1 - FINANZAS CORPORATIVASDocument14 pagesLibro1 - FINANZAS CORPORATIVASLuis AscencioNo ratings yet

- Weekly 1000 0.1 LotDocument39 pagesWeekly 1000 0.1 LotLukas BastianNo ratings yet

- Pembuatan Model Arima Dengan Menggunakan Data Saham GGRMDocument7 pagesPembuatan Model Arima Dengan Menggunakan Data Saham GGRMDian MashitanNo ratings yet

- Risk and Return - Section 11.2Document99 pagesRisk and Return - Section 11.2Dane JonesNo ratings yet

- CDS CurveDocument1 pageCDS Curvesaurabh mahajanNo ratings yet

- Mico Lab2 BiostatsDocument5 pagesMico Lab2 BiostatsMichael Angelo ZafeNo ratings yet

- Michael Angelo Zafe - MM - 226918 - Lab Exercise 2Document5 pagesMichael Angelo Zafe - MM - 226918 - Lab Exercise 2Michael Angelo ZafeNo ratings yet

- Bot TESTE MEU 20220914 063346Document16 pagesBot TESTE MEU 20220914 063346ANTI-SPIRALNo ratings yet

- 20% 0.25 To 1 0.25 To 1 20% 50% 1 To 1 1 To 1 50% 75% 3 To 1 3 To 1 75% 90% 9 To 1 9 To 1 90%Document6 pages20% 0.25 To 1 0.25 To 1 20% 50% 1 To 1 1 To 1 50% 75% 3 To 1 3 To 1 75% 90% 9 To 1 9 To 1 90%krish lopezNo ratings yet

- FCY LCY Rack Rates July 2023Document2 pagesFCY LCY Rack Rates July 2023Madad GaarNo ratings yet

- Imp Stable Worse EP Conservative 30 5 - 10 6 Speculative 40 10 - 30 9 Countercyclic - 10 0 15 0.5Document2 pagesImp Stable Worse EP Conservative 30 5 - 10 6 Speculative 40 10 - 30 9 Countercyclic - 10 0 15 0.5Gurpreet Singh DhindsaNo ratings yet

- EarlyRetirementNow SWR Toolbox v2.0 - Save Your Own Copy Before Editing!Document634 pagesEarlyRetirementNow SWR Toolbox v2.0 - Save Your Own Copy Before Editing!yiboNo ratings yet

- Week 7 Maths (Lead) - PercentagesDocument33 pagesWeek 7 Maths (Lead) - Percentageseshaal junaidNo ratings yet

- Probijanje 45 CM Q335Document1 pageProbijanje 45 CM Q335maxing021nsNo ratings yet

- Frequencies VariablesDocument3 pagesFrequencies VariablesAgustina SisterNo ratings yet

- Capsun (Radial Thru-Hole) SW5 SeriesDocument2 pagesCapsun (Radial Thru-Hole) SW5 Serieshes545No ratings yet

- Descriptive Statistic1Document3 pagesDescriptive Statistic1daniel mekonkNo ratings yet

- Name: Number Correct: Time Taken: Previous ScoreDocument2 pagesName: Number Correct: Time Taken: Previous ScoreSharma SunilNo ratings yet

- Harvard FileDocument14 pagesHarvard FileAmanya KapoorNo ratings yet

- FT Mba Section 4b Probability SvaDocument26 pagesFT Mba Section 4b Probability Svacons theNo ratings yet

- Descriptive and VisualDocument26 pagesDescriptive and Visualsai revanthNo ratings yet

- t2 M 17501 Ultimate Equivalent Fractions Decimals and Percentages Challenge Activity Sheet - Ver - 8Document2 pagest2 M 17501 Ultimate Equivalent Fractions Decimals and Percentages Challenge Activity Sheet - Ver - 8Dũng Nguyễn TríNo ratings yet

- Anak BubleDocument9 pagesAnak Bubletarlim08No ratings yet

- Data and CalculationDocument7 pagesData and CalculationRaphael NgNo ratings yet

- Math 16B: Homework 7 Solutions: 1. Let Z Be The Standard Normal Random Variable. Find: (A) P (Z (B) P (0.45Document13 pagesMath 16B: Homework 7 Solutions: 1. Let Z Be The Standard Normal Random Variable. Find: (A) P (Z (B) P (0.45anon_665109185No ratings yet

- Anand RathiDocument1 pageAnand RathijashmathewwNo ratings yet

- Practice ExcerciseDocument17 pagesPractice ExcerciseStella ShineNo ratings yet

- Example 1Document2 pagesExample 1MY LIFE MY WORDSNo ratings yet

- NicolasDocument6 pagesNicolasestefanyNo ratings yet

- Fractions and Decimals Questions and AwnsersDocument20 pagesFractions and Decimals Questions and AwnsersMohanChand PandeyNo ratings yet

- Waktu Jumlah Kematian Larva Aedes Aegypti Aquades 0% Abate 0,01% Daun Rambutan 0,15% Daun Rambutan 0,3% Daun Rambutan 0,6% T T T T T T T TDocument2 pagesWaktu Jumlah Kematian Larva Aedes Aegypti Aquades 0% Abate 0,01% Daun Rambutan 0,15% Daun Rambutan 0,3% Daun Rambutan 0,6% T T T T T T T TTriratna FauziahNo ratings yet

- Tabel Matriks Kesalahan Dan Perhitungan AkurasiDocument1 pageTabel Matriks Kesalahan Dan Perhitungan AkurasiRendy EmzetNo ratings yet

- Assignment 1 SolutionDocument8 pagesAssignment 1 SolutionDanial HemaniNo ratings yet

- DiagDocument4 pagesDiagmtorvaroNo ratings yet

- 2020 İddaa Man Ozel ExcelDocument2 pages2020 İddaa Man Ozel ExcelSapunaru AdrianNo ratings yet

- Poisson DistributionDocument2 pagesPoisson Distributionrengarajan nNo ratings yet