Professional Documents

Culture Documents

Excel Modeling of Portfolio Variance

Excel Modeling of Portfolio Variance

Uploaded by

tahaalkibsiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel Modeling of Portfolio Variance

Excel Modeling of Portfolio Variance

Uploaded by

tahaalkibsiCopyright:

Available Formats

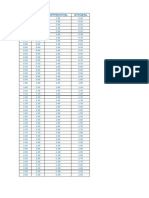

All numbers are hypothetical. Change data only in cells colored yellow.

Correlation matrix Weight (wn) Gold T-bonds Equities Crude Wheat EUR Total 20% 10% 40% 5% 15% 10% 100% 26.45%

Transpose this to get this matrix

Expected Annual volatility (n) returns 10% 5% 60% 30% 25% 40% 39% 29% 30% 25% 12% 7%

wnn 0.02 0.005 0.24 0.015 0.0375 0.04 Gold T-bonds Equities Crude Wheat EUR

Gold 1 0.5 0.5 0.5 0.5 0.5

Expected returns =

Annual volatility

Annual variance = Therefore volatility = Assume risk free rate = Sharpe Ratio =

0.09453125 30.75% 10% 0.535030083

Correlation matrix T-bonds 0.5 1 0.5 0.5 0.5 0.5 Equities 0.5 0.5 1 0.5 0.5 0.5 Crude 0.5 0.5 0.5 1 0.5 0.5 Wheat 0.5 0.5 0.5 0.5 1 0.5 EUR 0.5 0.5 0.5 0.5 0.5 1 Note that this matrix is symmetrical, ie the correlation of Gold and Wheat is the same as the correlation of Wheat and Gold. The blue cells therefore need no data entry. Also, the correlation of an asset with itself is always 1.

rical, ie the s the same as old. The blue ry. Also, the f is always 1.

You might also like

- 7 Stages of Business Life Cycle Thierry Janssen PDFDocument10 pages7 Stages of Business Life Cycle Thierry Janssen PDFtahaalkibsiNo ratings yet

- Excel Modeling of Portfolio VarianceDocument3 pagesExcel Modeling of Portfolio VarianceBigbi KumarNo ratings yet

- Excel Modeling of Portfolio VarianceDocument2 pagesExcel Modeling of Portfolio VarianceJain ChiragNo ratings yet

- Yield Distribution CalculatorDocument4 pagesYield Distribution Calculatorhpegoraro262No ratings yet

- Probability Examples of Discrete Probability DistributionDocument25 pagesProbability Examples of Discrete Probability DistributionSehzadNo ratings yet

- Probability and SamplingDistributionsDocument59 pagesProbability and SamplingDistributionsRmro Chefo LuigiNo ratings yet

- Z T and Chi-Square TablesDocument6 pagesZ T and Chi-Square TablesFrancisco HernandezNo ratings yet

- Quantitative Risk Management: CourseworkDocument14 pagesQuantitative Risk Management: CourseworkMichaelWongNo ratings yet

- Gráfico de HarmônicasDocument18 pagesGráfico de HarmônicasFelipe PradoNo ratings yet

- Programming ComputerDocument6 pagesProgramming ComputeribnikhairaniNo ratings yet

- Rumus Penentu SL TPDocument3 pagesRumus Penentu SL TPDeni SaddamNo ratings yet

- Solutions To Statistics1 QuestionsDocument5 pagesSolutions To Statistics1 QuestionsEq BrownNo ratings yet

- PV 25 Years, FIT 12 Years Ep 6%, D 4%, I 1%Document24 pagesPV 25 Years, FIT 12 Years Ep 6%, D 4%, I 1%dragance106No ratings yet

- Differensial and IntegralDocument11 pagesDifferensial and IntegralanainginNo ratings yet

- Gridding Report - : Data SourceDocument7 pagesGridding Report - : Data SourceLuqman HakimNo ratings yet

- CH 10Document37 pagesCH 10Md. Arif Hosen RajaNo ratings yet

- Luxor Prices VendeursDocument1 pageLuxor Prices VendeursDocteur BitNo ratings yet

- GridDataReport Ambatukam Fams 30 FEBRUARI 2222Document7 pagesGridDataReport Ambatukam Fams 30 FEBRUARI 2222Daniel HidayatNo ratings yet

- GridDataReport-Yacimientos Minerales SBDocument7 pagesGridDataReport-Yacimientos Minerales SBManuel otayaNo ratings yet

- Finance in A Nutshell Javier Estrada FT Prentice Hall, 2005: Answer Key To Challenge SectionsDocument63 pagesFinance in A Nutshell Javier Estrada FT Prentice Hall, 2005: Answer Key To Challenge Sectionssanucwa6932No ratings yet

- Oward Imons B R: OnnectionsDocument4 pagesOward Imons B R: Onnectionsapi-245850635No ratings yet

- Why The Rule of 10Document9 pagesWhy The Rule of 10Nguyễn TrangNo ratings yet

- L2 Frequency Distributions and GraphsDocument67 pagesL2 Frequency Distributions and GraphsKent ChinNo ratings yet

- Tasks of Programming ComputerDocument7 pagesTasks of Programming ComputeryuliefridaNo ratings yet

- 20% 0.25 To 1 0.25 To 1 20% 50% 1 To 1 1 To 1 50% 75% 3 To 1 3 To 1 75% 90% 9 To 1 9 To 1 90%Document6 pages20% 0.25 To 1 0.25 To 1 20% 50% 1 To 1 1 To 1 50% 75% 3 To 1 3 To 1 75% 90% 9 To 1 9 To 1 90%krish lopezNo ratings yet

- Contoh BrosurDocument6 pagesContoh Brosur19Della Amanda M D4 GIZI1ANo ratings yet

- Er Variance U ADocument6 pagesEr Variance U AJappan AhluwaliaNo ratings yet

- Levels of Risk of Bond Funds: Below AverageDocument43 pagesLevels of Risk of Bond Funds: Below AverageTammy NguyenNo ratings yet

- Marcospelaez PracproblemsDocument23 pagesMarcospelaez Pracproblemsapi-270738615No ratings yet

- Ni-Zn Toroid Cores / TF Type: FeaturesDocument2 pagesNi-Zn Toroid Cores / TF Type: FeaturesAnonymous KhhapQJVYtNo ratings yet

- Newsvendor Problem - 30 Days: Q (Papers)Document4 pagesNewsvendor Problem - 30 Days: Q (Papers)Franklin Quihue CabezasNo ratings yet

- Gridding Report - : Data SourceDocument7 pagesGridding Report - : Data SourceSandra ArteagaNo ratings yet

- Risk and Return - Section 11.2Document99 pagesRisk and Return - Section 11.2Dane JonesNo ratings yet

- Chapter Eight End of Chapter Useful Questions and SolutionsDocument18 pagesChapter Eight End of Chapter Useful Questions and SolutionsAbhinav AgarwalNo ratings yet

- Expected Value CalculationsDocument6 pagesExpected Value CalculationsNprantoNo ratings yet

- Risk and Return Note 1Document12 pagesRisk and Return Note 1Bikram MaharjanNo ratings yet

- Method 1: Median 95% CI Simple Method PerDocument13 pagesMethod 1: Median 95% CI Simple Method PersoasabNo ratings yet

- Gridding Report - : Data SourceDocument7 pagesGridding Report - : Data SourceLuqman HakimNo ratings yet

- Staco Load Table SP Type IDocument1 pageStaco Load Table SP Type IAndrei ANo ratings yet

- Chapter 3 Part 3Document30 pagesChapter 3 Part 3Aditya GhoshNo ratings yet

- Continuous Probability DistributionsDocument48 pagesContinuous Probability DistributionsDaniel Tri RamadhaniNo ratings yet

- Efficient Frontier: Expected ReturnsDocument2 pagesEfficient Frontier: Expected ReturnsSunil KumarNo ratings yet

- Epi Info: Freq Didik Stratavar AsiDocument5 pagesEpi Info: Freq Didik Stratavar AsiDamayanti MayaNo ratings yet

- Standard NormalDocument2 pagesStandard NormalMissy van BelleNo ratings yet

- RiskReturn and CAPM ProblemsDocument9 pagesRiskReturn and CAPM ProblemsBabylyn NavarroNo ratings yet

- Standard DeviationDocument22 pagesStandard DeviationPriya VermaNo ratings yet

- Leyes Cu de Bloques: Existen 30 Secciones Iguales A Esta o Sea La Mina Es 30 Veces Más Grande Que Este PerfilDocument4 pagesLeyes Cu de Bloques: Existen 30 Secciones Iguales A Esta o Sea La Mina Es 30 Veces Más Grande Que Este PerfilGabriel Inostroza MedinaNo ratings yet

- Staco Load Table SP Type MDocument1 pageStaco Load Table SP Type MAndrei ANo ratings yet

- Binomial and Poission Distribution 6Document34 pagesBinomial and Poission Distribution 6ss tNo ratings yet

- AnalisisUnivariadoyMultivariado Eje 3 Analisis de DatosDocument8 pagesAnalisisUnivariadoyMultivariado Eje 3 Analisis de DatosjoanaNo ratings yet

- FFM15, CH 08 (Risk), Chapter Model, 2-08-18Document17 pagesFFM15, CH 08 (Risk), Chapter Model, 2-08-18Mỹ XuânNo ratings yet

- Africa Economic, Banking and Systemic Crisis Data: IntroductionDocument14 pagesAfrica Economic, Banking and Systemic Crisis Data: IntroductionPooja SawarkarNo ratings yet

- The Programming Computer TaskDocument12 pagesThe Programming Computer TaskEsterlytaNo ratings yet

- Tugas PDF 1Document6 pagesTugas PDF 1RuiEn VanNo ratings yet

- Answers To The Questions/problems Recommended in The Learning ObjectivesDocument8 pagesAnswers To The Questions/problems Recommended in The Learning ObjectivesFami FamzNo ratings yet

- Efficient Trade-Off Line & Eff. Frontier Curve: Standard DeviationDocument5 pagesEfficient Trade-Off Line & Eff. Frontier Curve: Standard DeviationratikdayalNo ratings yet

- Exchange Rate Regime Analysis For The Chinese YuanDocument10 pagesExchange Rate Regime Analysis For The Chinese YuanCreditTraderNo ratings yet

- AES5ADocument4 pagesAES5AStephania MendozaNo ratings yet

- Instructor Information: Enabled: Statistics TrackingDocument3 pagesInstructor Information: Enabled: Statistics TrackingtahaalkibsiNo ratings yet

- BBA404 SLM Unit 04 PDFDocument19 pagesBBA404 SLM Unit 04 PDFtahaalkibsiNo ratings yet

- Life Cycle Analysis Checklist: Building ProjectDocument1 pageLife Cycle Analysis Checklist: Building ProjecttahaalkibsiNo ratings yet

- BUS 20 - EXAM II REVIEW CH 5-9Document6 pagesBUS 20 - EXAM II REVIEW CH 5-9tahaalkibsiNo ratings yet

- Cap Table GeneratorDocument4 pagesCap Table Generatortahaalkibsi100% (1)

- FiDocument9 pagesFitahaalkibsiNo ratings yet

- FMB Questionnaire Final PDFDocument5 pagesFMB Questionnaire Final PDFtahaalkibsiNo ratings yet

- CH 06Document14 pagesCH 06tahaalkibsiNo ratings yet

- CaseH BiolifeDocument2 pagesCaseH BiolifetahaalkibsiNo ratings yet

- Cummins Energy CalculatorDocument11 pagesCummins Energy CalculatortahaalkibsiNo ratings yet

- SBMT 2533 Time Management Common Course Outline: South Central CollegeDocument1 pageSBMT 2533 Time Management Common Course Outline: South Central CollegetahaalkibsiNo ratings yet

- BMET5103 - Assignment May Semester 2012 PDFDocument2 pagesBMET5103 - Assignment May Semester 2012 PDFtahaalkibsiNo ratings yet

- CH 06Document14 pagesCH 06tahaalkibsiNo ratings yet

- Entrepreneurial Pathways: An OverviewDocument7 pagesEntrepreneurial Pathways: An OverviewtahaalkibsiNo ratings yet

- CH 02Document17 pagesCH 02tahaalkibsiNo ratings yet

- Small Bus q-24Document2 pagesSmall Bus q-24tahaalkibsiNo ratings yet

- Data For The Year 2010: BanksDocument16 pagesData For The Year 2010: BankstahaalkibsiNo ratings yet

- bmcb5103 May10Document3 pagesbmcb5103 May10tahaalkibsiNo ratings yet

- CH 04Document16 pagesCH 04tahaalkibsi100% (1)

- bmcb5103 0110Document4 pagesbmcb5103 0110tahaalkibsiNo ratings yet

- A User's Guide For The Uniform Bank Performance: Federal Financial Institutions Examination CouncilDocument10 pagesA User's Guide For The Uniform Bank Performance: Federal Financial Institutions Examination CounciltahaalkibsiNo ratings yet