Professional Documents

Culture Documents

CreditAcc. Gram Analysis

Uploaded by

vvpvarunOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CreditAcc. Gram Analysis

Uploaded by

vvpvarunCopyright:

Available Formats

28-12-19

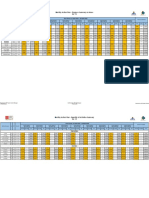

COMPANY NAME CREDITACCESS GRAMEEN LTD Mark Cap: 11,138.97 CMP: 774.30 FV: 10

QUARTER P&L Jun-17 Sep-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19 Jun-19 Sep-19 QUARTERLY P&L

Equity Shares in Cr Equity Shares

Equity

in Cr Shares

Equity

in Cr Shares in Cr12.84 12.84 12.84 12.84 14.36 14.36 14.36

Sales Growth EPS Growth 2 per. Mov. Avg. (Sales Growth) 2 per. Mov. Avg. (EPS Growth)

Sales 177.59 213.94 227.76 249.92 285.76 309.72 350.34 335.53 375.8 391.53

60.94%

52.94%

OPM 60% 85% 88% 77% 74% 72% 76% 66% 73% 68%

44.83%

Other Income 0.16 0.16 1.58 0.45 0.31 0.37 0.42 0.91 0.9 1.12

34.38%

31.68%

26.62%

22.86%

Net profit 14.14 61.03 64.36 71.71 72.22 73.46 99.74 76.31 95.83 100.88

18.71%

EPS #VALUE! #VALUE! #VALUE! 5.58 5.62 5.72 7.77 5.32 6.68 7.03

0.00%

0.00%

0.00%

Sales Growth 60.94% 44.83% 52.94% 34.38% 31.68% 26.62%

Net Profit Growth 410.75% 20.37% 54.97% 6.41% 32.69% 37.33%

-4.80%

JUN-17 SEP-17 DEC-17 MAR-18 JUN-18 SEP-18 DEC-18 MAR-19 JUN-19 SEP-19

EPS Growth #VALUE! #VALUE! #VALUE! -4.80% 18.71% 22.86%

ANNUAL P&L Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-14 Mar-16 Mar-17 Mar-18 Mar-19 TTM

Sales 0 0 0 0 0 146.02 464.46 708.18 870.58 1281.33 1453.2

OPM 0.00% 0.00% 0.00% 0.00% 0.00% 65.59% 72.80% 62.72% 78.89% 71.87%

ANNUAL P&L

Other Income 0 0 0 0 0 1.81 2.26 1.08 0.95 1.92 Sales Growth EPS Growth 2 per. Mov. Avg. (Sales Growth) 2 per. Mov. Avg. (EPS Growth)

263.38%

Depreciation 0 0 0 0 0 0.53 2.61 4.43 5.17 7.79

215.71%

Net profit 0 0 0 0 0 16.63 83.24 80.3 212.48 321.76 372.76

Cash from Operations 0 0 0 0 0 0 -931.09 -424.79 -1725.58 -1378.09

% CFO of Net Profit #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 0.00% -1118.56% -529.00% -812.11% -428.30%

Free Cash Flow 0 0 0 0 0 -3.39 -942.18 -433.17 -1732.68 -1395.76

76.52%

EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 3.14 11.41 9.37 16.54 22.41 25.97

51.97%

47.24%

35.49%

(FCF+Depr.)/Share 0 0 0 0 0 0 0 0 0 0

22.88%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

CF Operation/Share 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Sales Growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 215.71% 51.97% 22.88% 47.24%

-17.88%

Net Profit Growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 400.54% -3.53% 164.61% 51.43% MAR-11 MAR-12 MAR-13 MAR-14 MAR-14 MAR-16 MAR-17 MAR-18 MAR-19

EPS Growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 263.38% -17.88% 76.52% 35.49%

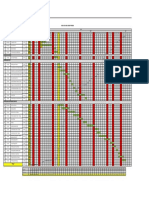

BALANCE SHEET Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-14 Mar-16 Mar-17 Mar-18 Mar-19 TTM

ROE 24.95% 13.96% 19.97% 16.92% 15.76% Balance Sheet

ROCE 19.17% 18.23% 14.57% 16.21% 14.89% 180%

Price to earning #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! 22.49

165.38%

Divident Yield #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! 0.00% 160%

Dividend Payout 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

140%

Book Value 0 0 0 0 0 14.41 31.97 48.02 99.92 164.4

Book Value Growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 121.86% 50.20% 108.08% 64.53% 120% 121.86%

Net Block 0 0 0 0 0 2.63 11.34 12.26 16.16 24.74 108.08%

Investments 0 0 0 0 0 0.2 0.2 0.2 0.2 0.2 100%

Investment Growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 0.00% 0.00% 0.00% 0.00%

80%

Total Assets 0 0 0 0 0 1058.08 2807.97 3564.07 5113.57 7357.36

Balance sheet growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 165.38% 26.93% 43.48% 43.88% ` 60% 64.53%

Borrowings 0 0 0 0 0 805.23 2233.32 2668.24 3623.46 4866.57 50.20%

40% 43.48% 43.88%

Cash & Equalent 0 0 0 0 0 325.03 254.92 363.69 143.06 615.55

Capital Work in Prog. 0 0 0 0 0 1009.44 2681.65 3343.55 5043.52 7204.33 26.93%

20%

CapEx 0 0 0 0 0 3.39 11.09 8.38 7.1 17.67

Inventory 0 0 0 0 0 0 0 0 0 0 0% 0.00% 0.00% 0.00% 0.00% 0.00%

Debtors (Receivables) 0 0 0 0 0 0 0 0 0 0 Mar-11 Mar-12 Mar-13 Mar-14 Mar-14 Mar-16 Mar-17 Mar-18 Mar-19

Debtor Days 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Book Value Growth Balance sheet growth

Inventory Turnover 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

You might also like

- Fontana Product CardDocument2 pagesFontana Product CardBrian Mason50% (2)

- BeerCraftr Recipe Booklet 37Document41 pagesBeerCraftr Recipe Booklet 37Benoit Desgreniers0% (1)

- Lesson 3 Long Calls and PutsDocument19 pagesLesson 3 Long Calls and PutsvvpvarunNo ratings yet

- Lesson 4 Selling Covered CallsDocument12 pagesLesson 4 Selling Covered Callsvvpvarun100% (1)

- Option Buying Setup: by - Jitendra JainDocument17 pagesOption Buying Setup: by - Jitendra JainvvpvarunNo ratings yet

- tFYzwDhiQd PDFDocument64 pagestFYzwDhiQd PDFchinmay dalviNo ratings yet

- Agrawal Technical Analysis Gurukul: First Learn Than Earn .Document4 pagesAgrawal Technical Analysis Gurukul: First Learn Than Earn .vvpvarunNo ratings yet

- Lesson 5 Diagonal SpreadDocument11 pagesLesson 5 Diagonal Spreadvvpvarun100% (1)

- Bullish Iii Continuous PatternDocument7 pagesBullish Iii Continuous PatternvvpvarunNo ratings yet

- Agrawal Technical Analysis Gurukul: First Learn Than Earn .Document5 pagesAgrawal Technical Analysis Gurukul: First Learn Than Earn .vvpvarunNo ratings yet

- Agrawal Technical Analysis Gurukul: First Learn Than Earn .Document4 pagesAgrawal Technical Analysis Gurukul: First Learn Than Earn .vvpvarunNo ratings yet

- How To Be A Successful Scalper Using OI PulseDocument205 pagesHow To Be A Successful Scalper Using OI Pulsevvpvarun100% (7)

- Stock Selection For CPR BY KGSDocument1 pageStock Selection For CPR BY KGSvvpvarunNo ratings yet

- Construction of Internal Roads and Infrastructure For 354 Residential Plots in Shakhbout City, Abudhabi Cash Flow Histogram & S CurveDocument1 pageConstruction of Internal Roads and Infrastructure For 354 Residential Plots in Shakhbout City, Abudhabi Cash Flow Histogram & S CurveburereyNo ratings yet

- Physical Scurve Monthly (20jul2020)Document1 pagePhysical Scurve Monthly (20jul2020)burereyNo ratings yet

- Lesson 4 Earnings Probability SpreadDocument13 pagesLesson 4 Earnings Probability SpreadvvpvarunNo ratings yet

- UENR3832UENR3832-01 - SIS - PDF 966M - 972MDocument6 pagesUENR3832UENR3832-01 - SIS - PDF 966M - 972MJuan Rafael Vilchez SanchezNo ratings yet

- Progress S-CURVE: Plan Cumulative % Complete Actual Cumulative % Complete Revised Cumulative % CompleteDocument1 pageProgress S-CURVE: Plan Cumulative % Complete Actual Cumulative % Complete Revised Cumulative % CompleteburereyNo ratings yet

- 178 - 6 - Fun For Flyers On-Line Resources - 2017, 4th - 241pDocument241 pages178 - 6 - Fun For Flyers On-Line Resources - 2017, 4th - 241pNguyen HuyenNo ratings yet

- Bajaj Fin AnalysisDocument1 pageBajaj Fin AnalysisvvpvarunNo ratings yet

- Curva S - Servicio Integral de SoldaduraDocument1 pageCurva S - Servicio Integral de SoldaduraAlex TrujilloNo ratings yet

- BrandZ India TopMostValuable75IndianBrands - ReportDocument99 pagesBrandZ India TopMostValuable75IndianBrands - Reportartspace100% (1)

- Plant MIS Month of March '17Document7 pagesPlant MIS Month of March '17MEHAKNo ratings yet

- Weekly-26th Kurva SDocument1 pageWeekly-26th Kurva SJunior FernandoNo ratings yet

- Dar 10 Juli 2019Document1 pageDar 10 Juli 2019m_hidayatullahnurNo ratings yet

- 2023.09.18 - Curva S - ExcavaciónDocument1 page2023.09.18 - Curva S - ExcavaciónjhoanNo ratings yet

- 4.3 SPCDocument1 page4.3 SPCAndrea InfanteNo ratings yet

- Dokumen Progress Kurva-S M-18 (New)Document1 pageDokumen Progress Kurva-S M-18 (New)Sapruddin BatubaraNo ratings yet

- Catálogo Multi Inverter - Tabelas de Combinação - v4Document2 pagesCatálogo Multi Inverter - Tabelas de Combinação - v4Ney Robson SantanaNo ratings yet

- Propuesta MDI 2014 SQDCDocument1 pagePropuesta MDI 2014 SQDCarelyta8123No ratings yet

- Airline CEO PresentaionDocument10 pagesAirline CEO PresentaiontanmayNo ratings yet

- Upstream Petroleum Activities - April 2021: Inset NorthDocument1 pageUpstream Petroleum Activities - April 2021: Inset NorthumairahmedbaigNo ratings yet

- Boş Cevap AnahtarıDocument1 pageBoş Cevap AnahtarıTolga CaNo ratings yet

- Boş Cevap AnahtarıDocument1 pageBoş Cevap AnahtarıTolga CaNo ratings yet

- FPF-Monthly Action Plan-14010701-14010830Document33 pagesFPF-Monthly Action Plan-14010701-14010830Iraj OsouliNo ratings yet

- Kantar Indonesia COVID Anxiety Meter Update March 28Document12 pagesKantar Indonesia COVID Anxiety Meter Update March 28AryttNo ratings yet

- التكنولوجيا المالية كآلية لتعزيز الشمول المالي في الوطن العربي- دراسة حالة الشرق الأوسط وشمال أفريقياDocument17 pagesالتكنولوجيا المالية كآلية لتعزيز الشمول المالي في الوطن العربي- دراسة حالة الشرق الأوسط وشمال أفريقياcompta gfNo ratings yet

- Planilha - CopersucarDocument26 pagesPlanilha - CopersucarVENHAN PARA O MUNDO PES.No ratings yet

- Cabezal de Riego EstructurasDocument1 pageCabezal de Riego EstructurasRune HuamaniNo ratings yet

- Perf PDFDocument1 pagePerf PDFMGPHNo ratings yet

- A-04 Cortes HospitalDocument1 pageA-04 Cortes HospitalJessy HuertaNo ratings yet

- S-Curve 1Document1 pageS-Curve 1Silver James AustriaNo ratings yet

- Daily BDR, Dec-2015Document68 pagesDaily BDR, Dec-2015Yossy NugrahaNo ratings yet

- 01 Sewing DHU Report 07 March 2020Document1 page01 Sewing DHU Report 07 March 2020Abid HasanNo ratings yet

- School PLAN4Document1 pageSchool PLAN4Osama AbdellatefNo ratings yet

- Activity-Map Upstream ActivityDocument1 pageActivity-Map Upstream Activityjast5No ratings yet

- Test 1untitledDocument2 pagesTest 1untitledValar MathiNo ratings yet

- AP Biology Chi - Square Practice ProblemsDocument1 pageAP Biology Chi - Square Practice ProblemsPaulus VillanuevaNo ratings yet

- 3 Ds Max Arc Diagram 514581Document1 page3 Ds Max Arc Diagram 514581Ene CostinNo ratings yet

- Schedule S-Curve Fasilitas Dan Canopi PremixDocument1 pageSchedule S-Curve Fasilitas Dan Canopi PremixredharereNo ratings yet

- Alem - Do - Rio - Azul Adapt-ViolonceloDocument1 pageAlem - Do - Rio - Azul Adapt-ViolonceloErika OliveiraNo ratings yet

- Planta 3: LeyendaDocument1 pagePlanta 3: LeyendaAnderson johan Espinoza malcaNo ratings yet

- Acumulare Competente Din Tinta Medie Lunara: Fisa de Evaluare A Stagiului - v1.1Document2 pagesAcumulare Competente Din Tinta Medie Lunara: Fisa de Evaluare A Stagiului - v1.1Razvan Pomana100% (1)

- 2 S-CurveDocument1 page2 S-CurveAshri MuhammadNo ratings yet

- Ridership PDFDocument1 pageRidership PDFRosieGroverNo ratings yet

- Proposed Group Housing Project at Dhakoli, Zirakpur, HaryanaDocument1 pageProposed Group Housing Project at Dhakoli, Zirakpur, HaryanakaliaNo ratings yet

- التحليل العددي ماتلابDocument230 pagesالتحليل العددي ماتلابlazhorlazhorNo ratings yet

- Aims To Provide A Mix of Large, Mid and Small Cap Companies Identified Through A Robust Research ProcessDocument4 pagesAims To Provide A Mix of Large, Mid and Small Cap Companies Identified Through A Robust Research ProcessBharatNo ratings yet

- HHP Jan2023 KeyResultsDocument53 pagesHHP Jan2023 KeyResultsZerohedge JanitorNo ratings yet

- Kamado - Tanjiro - No - Uta KalimbaDocument2 pagesKamado - Tanjiro - No - Uta KalimbaPatricia ReichelNo ratings yet

- Generales (4) - ModelDocument1 pageGenerales (4) - ModelCarlos InostrozaNo ratings yet

- GRCM BLDG 4 BASEPLAN4-ModelDocument1 pageGRCM BLDG 4 BASEPLAN4-ModelJeniel PascualNo ratings yet

- 4090 IPru BAF Detailed Presentation November 2017Document28 pages4090 IPru BAF Detailed Presentation November 2017Keerthy VeeranNo ratings yet

- Cantan Santos Angeles Niños-Flauta - 1Document1 pageCantan Santos Angeles Niños-Flauta - 1MonicaNo ratings yet

- Activity MapAo Feb2018Document1 pageActivity MapAo Feb2018perry wangNo ratings yet

- Limit Reviewed Against 83 Accounts For Tk. 13 MNDocument9 pagesLimit Reviewed Against 83 Accounts For Tk. 13 MNAnik MuidNo ratings yet

- Ingreso Ganaderos 02: A B C F G H D EDocument1 pageIngreso Ganaderos 02: A B C F G H D EFredy Rene M. CatariNo ratings yet

- Ratod Ji Kasrawad 2-ModelDocument1 pageRatod Ji Kasrawad 2-ModelParas PatidarNo ratings yet

- Projecto de Sinalética e Decoração - Sinalética Decorativa: Corte - ADocument1 pageProjecto de Sinalética e Decoração - Sinalética Decorativa: Corte - AOffice NewacoNo ratings yet

- Norma 55597-05Document10 pagesNorma 55597-05Monalisa RodriguesNo ratings yet

- Activity MapAo Feb2019Document1 pageActivity MapAo Feb2019Muhammad BilalNo ratings yet

- 05 Printables - Com Competitor - Analysis - April - 2023Document3 pages05 Printables - Com Competitor - Analysis - April - 2023Justin TanNo ratings yet

- Activity MapAo Sept PDFDocument1 pageActivity MapAo Sept PDFRahul ChoudharyNo ratings yet

- Human Resource Management in Indonesia: Important Issues to Know before Establishing a Subsidiary in IndonesiaFrom EverandHuman Resource Management in Indonesia: Important Issues to Know before Establishing a Subsidiary in IndonesiaNo ratings yet

- Ascending & Descending BroadingDocument9 pagesAscending & Descending BroadingvvpvarunNo ratings yet

- ID LPO Item Code Item Size Item Description Grade Heat No Qty Rec'dDocument1 pageID LPO Item Code Item Size Item Description Grade Heat No Qty Rec'dvvpvarunNo ratings yet

- Position Size With StopsDocument1 pagePosition Size With StopsvvpvarunNo ratings yet

- Sbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanDocument9 pagesSbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanvvpvarunNo ratings yet

- Time Symbol Trade Ype Qy PriceDocument6 pagesTime Symbol Trade Ype Qy PricevvpvarunNo ratings yet

- Indiabulls HousDocument10 pagesIndiabulls HousvvpvarunNo ratings yet

- Fingerprint Guide ApplicantDocument2 pagesFingerprint Guide ApplicantRahmatullah MardanviNo ratings yet

- Marketing DocumentDocument4 pagesMarketing DocumentEliezha Mae AsuncionNo ratings yet

- 64-Kenya Citizenship Regulations 2012Document81 pages64-Kenya Citizenship Regulations 2012aleemtharaniNo ratings yet

- Balance Score Card (MCS Course) : Concept and Application at Tata SteelDocument40 pagesBalance Score Card (MCS Course) : Concept and Application at Tata SteelRohit Kumar YadavNo ratings yet

- Adjectives and Adverbs - English Speaking Course LucknowDocument13 pagesAdjectives and Adverbs - English Speaking Course LucknowSelfhelNo ratings yet

- Iim Bodh Gaya SynopsisDocument7 pagesIim Bodh Gaya SynopsiskhanNo ratings yet

- Ds Web Gateway Reverse ProxyDocument3 pagesDs Web Gateway Reverse ProxyKuncen Server (Yurielle's M-Chan)No ratings yet

- Word OrderDocument6 pagesWord OrderEditura Sf MinaNo ratings yet

- EmiratesTicket Japan MancDocument3 pagesEmiratesTicket Japan MancTheodore69No ratings yet

- Army Corps NegDocument53 pagesArmy Corps NegiRox132No ratings yet

- The Little Match Girl Short StoryDocument2 pagesThe Little Match Girl Short StoryTin AcidreNo ratings yet

- Bruynzeel KeukensDocument14 pagesBruynzeel KeukensAneela JabeenNo ratings yet

- Case Study of Orion FailureDocument4 pagesCase Study of Orion FailurePhương DiNo ratings yet

- ERIN LEWIS - MARS-Member Annual Retirement Statement - 2023Document2 pagesERIN LEWIS - MARS-Member Annual Retirement Statement - 2023Erin LewisNo ratings yet

- GentlenessDocument3 pagesGentlenessHai NeNo ratings yet

- ANTHRO 179 Notes DGDocument11 pagesANTHRO 179 Notes DGJerico RiveraNo ratings yet

- Si3586DV: Vishay SiliconixDocument13 pagesSi3586DV: Vishay SiliconixLeslie StewartNo ratings yet

- Moulana Innamul Hasan SabDocument6 pagesMoulana Innamul Hasan SabsyedNo ratings yet

- CH - 01 Introduction To Accounting (Edited)Document38 pagesCH - 01 Introduction To Accounting (Edited)arifhasan953No ratings yet

- 7 S MckinseyDocument3 pages7 S MckinseyBriand DaydayNo ratings yet

- MCQs 2Document7 pagesMCQs 2Walchand Electrical16No ratings yet

- PMOB AllDocument300 pagesPMOB AllshashankNo ratings yet

- Adaptation Studies at CrossroadsDocument80 pagesAdaptation Studies at Crossroadssheela sinhaNo ratings yet

- Accounting For Overheads by DR Kamlesh KhoslaDocument16 pagesAccounting For Overheads by DR Kamlesh KhoslaKrati SinghalNo ratings yet

- The Victorian EraDocument15 pagesThe Victorian Eraiqra khalidNo ratings yet

- Jadwal Atls Online 12 Juni 21, JKTDocument3 pagesJadwal Atls Online 12 Juni 21, JKTTedja PrakosoNo ratings yet

- Narrative Report in School: Department of EducationDocument2 pagesNarrative Report in School: Department of EducationKairuz Demson Aquilam100% (1)