Professional Documents

Culture Documents

Weather Derivatives and The Weather Derivatives Market

Uploaded by

mak112005gmailOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weather Derivatives and The Weather Derivatives Market

Uploaded by

mak112005gmailCopyright:

Available Formats

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

1

Weather derivatives and the weather

derivatives market

1.1 Introduction

This book is about the valuation of a certain class of financial contracts

known as weather derivatives. The purpose of weather derivatives is to allow

businesses and other organisations to insure themselves against fluctuations

in the weather. For example, they allow natural gas companies to avoid the

negative impact of a mild winter when no one turns on the heating, they

allow construction companies to avoid the losses due to a period of rain

when construction workers cannot work outside and they allow ski resorts

to make up for the money they lose when there is no snow.

The weather derivatives market, in which contracts that provide this kind

of insurance are traded, first appeared in the US energy industry in 1996

and 1997. Companies accustomed to trading contracts based on electricity

and gas prices in order to hedge their electricity and gas price risk realised

they could trade contracts based on the weather and hedge their weather

risk in the same way. The market grew rapidly and soon expanded to other

industries and to Europe and Japan. Volatility in the financial markets has

meant that not all of the original participants are still trading, but the

weather derivatives market has steadily grown and there are now a number

of energy companies, insurance companies, reinsurance companies, banks

and hedge funds that have groups dedicated purely to the business of buying

and selling weather derivatives. The Weather Risk Management Association

(WRMA), the industry body that represents the weather market, recently

reported a total notional value of over $10 billion for weather derivative

trades in the year 2002/2003.1

During the eight years since the first weather derivative trades took place

the ‘science’ of weather derivative pricing has gradually developed. It now

1 See http://wrma.org.

© Cambridge University Press www.cambridge.org

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

2 Weather derivatives and the market

seems possible, and – hopefully – useful, to bring this information together

into one place, both for the benefit of those already involved in the market as

a point of reference and for those outside the market who are interested to

learn what weather derivative pricing is all about. Other than this chap-

ter, which contains introductory material about weather derivatives and

the weather derivative market, the book focuses on the meteorological, sta-

tistical, mathematical and financial issues that determine the methods used

for the pricing, valuation and risk management of weather derivatives con-

tracts and portfolios. We attempt to describe all the methods and models

currently in use in the weather market and give examples of how they can be

applied in practice. We cannot cover everything, however. There are many

ways of approaching the question of how to price a weather derivative, there

are strong financial incentives to invent (and keep secret!) new and more

accurate methods for such pricing, and there is undoubtedly much progress

still to be made.

The overall level of this book is such that a technical graduate with a

reasonable understanding of mathematics should be able to follow almost all

of it, and no particular background in meteorology, statistics, mathematics

or finance is required. We hope that, if you read this book, you will learn

something of each of these subjects.

This chapter proceeds with a brief introduction to the weather derivatives

market, a description of the various weather indices used by the market, a

description of how these weather indices are related to the pay-offs of weather

derivative contracts, and an overview of the methods used for the valuation

of weather contracts.

1.1.1 The impact of weather on business and the

rationale for hedging

The types of impact of weather on businesses range from small reductions

in revenues, as might occur when a shop attracts fewer customers on a

rainy day, to total disaster, such as when a tornado destroys a factory. Tor-

nadoes are an example of what we will call catastrophic weather events.

Such weather events also include severe tropical cyclones, extra-tropical wind

storms, hail storms, ice storms and rain storms. They often cause extreme

damage to property and loss of life. Companies wishing to protect them-

selves against the financial impact of such disasters can buy insurance that

will pay them according to the losses they sustain. Weather derivatives,

however, are designed to help companies insure themselves against non-

catastrophic weather events. Non-catastrophic weather fluctuations include

© Cambridge University Press www.cambridge.org

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

Introduction 3

warm or cold periods, rainy or dry periods, windy or calm periods, and so

on. They are expected to occur reasonably frequently. Nevertheless, they can

cause significant discomfort for (or bring significant benefits to) businesses

with profits that depend in a sensitive way on the weather. Hedging with

weather derivatives is desirable for such businesses because it significantly

reduces the year-to-year volatility of their profits. This is beneficial for a

number of reasons, including:

r low volatility in profits can often reduce the interest rate at which companies

borrow money;

r in a publicly traded company low volatility in profits usually translates into low

volatility in the share price, and less volatile shares are valued more highly;

r low volatility in profits reduces the risk of bankruptcy.

Although a company hedging its weather risk using weather derivatives will

typically lose money, on average, on the hedge, it can still be very beneficial

to hedge for these reasons.

Governmental and non-profit use of weather derivatives

Weather derivatives can also be used by non-business entities, such as local

and national government organisations and charities. In these cases it would

typically be weather-induced fluctuations in costs that would be hedged.

Such hedging can reduce the variability of costs from season to season or

year to year, and hence reduce the risk of unexpected budget overruns.

1.1.2 Examples of weather hedging

Weather variability affects different entities in different ways. In many busi-

nesses weather is related to the volume of sales transacted. Examples of this

would include:

r a natural gas supply company, which would sell less gas in a warm winter;

r a ski resort, which would attract fewer skiers when there is little snow;

r a clothes retailing company, which would sell fewer clothes in a cold summer;

r an amusement park, which would attract fewer visitors when it rains.

But weather can also affect profits in ways other than through changes in

the volume of sales. Examples include:

r a construction company, which experiences delays when it is cold or raining be-

cause labourers cannot work outside;

r a hydroelectric power generation company, which generates less electricity when

rainfall is reduced;

© Cambridge University Press www.cambridge.org

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

4 Weather derivatives and the market

r a vehicle breakdown rescue company, which has increased costs on icy days, when

more traffic accidents occur;

r a fish farm, where fish grow less quickly when the sea temperature is lower.

All these risks could be hedged using weather derivatives.

1.1.3 The definition of a weather derivative

A standard weather derivative contract, as might be used to hedge the risks

described above, is defined by the following attributes:

r the contract period: a start date and an end date;

r a measurement station;

r a weather variable, measured at the measurement station, over the contract

period;

r an index, which aggregates the weather variable over the contract period in some

way;

r a pay-off function, which converts the index into the cashflow that settles the

derivative shortly after the end of the contract period;

r for some kinds of contract, a premium paid from the buyer to the seller at the

start of the contract.

These basic attributes are supplemented by:

r a measurement agency, responsible for measuring the weather variable;

r a settlement agent, responsible for producing the final values of the index on the

basis of the measured values; according to defined algorithms that (hopefully)

cope with all eventualities, such as a failure of the measuring equipment;

r a back-up station, to be used in case the main station fails;

r a time period over which the settlement takes place.

It is not the purpose of this book to describe the legal and administrative as-

pects of weather derivatives, although these are, clearly, of vital importance

for companies trading these contracts. Rather, we intend to investigate the

methods that can be used to set reasonable prices for and assess the value

of the various types of contracts available in the market today.

1.1.4 Insurance and derivatives

Weather derivatives have a pay-off that depends on a weather index that

has been carefully chosen to represent the weather conditions against which

protection is being sought. The economic effect of hedging using weather

derivatives can also be achieved using an insurance contract that has a

© Cambridge University Press www.cambridge.org

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

Introduction 5

pay-off based on a weather index. Nevertheless, we will use the phrase

weather derivatives throughout this book, although all the analysis pre-

sented applies equally well to both types of contract.

There are some differences between weather derivatives and index-based

weather insurance that may mean that one is preferable to the other in

certain circumstances. Some companies may not be happy with the idea of

trading derivatives but comfortable with buying insurance, for instance.

Other ways in which insurance and derivatives differ include the following:

r it may be necessary to perform a frequent (daily, weekly or monthly) revaluation

of derivative positions, known as mark to market or mark to model, but this is

usually not necessary for insurance;

r tax liabilities may be different (most commonly, insurance incurs a tax but deriva-

tives do not);

r the accounting treatment may be different;

r contractual details may be different.

All of these vary to a certain extent from country to country.

Indemnity-based weather insurance

There is also a kind of weather insurance in which the pay-off is related to

financial loss rather than to a weather index. Such contracts are less suitable

for the hedging of weather-related fluctuations in profits, because a lack of

profit cannot necessarily be classified as a weather-induced loss. The mod-

elling and pricing of these contracts are rather more complicated than those

of weather derivatives, since they involve understanding the relationships

between weather and loss, and the likelihood that the insured entity will

make a claim. Such pricing is more akin to the pricing of catastrophe-related

weather insurance (Woo, 1999) and is not covered in this book, although the

analysis we present does form a good first step towards the pricing of such

contracts in some cases.

1.1.5 Liquidity and basis risk

Because the pay-off of a weather derivative depends on a weather index, not

on the actual amount of money lost due to weather, it is unlikely that the

pay-off will compensate exactly for the money lost. The potential for such a

difference is known as basis risk. In general, basis risk is smallest when the

financial loss is highly correlated with the weather, and when contracts of

the optimum size and structure, based on the optimum location, are used

for hedging.

© Cambridge University Press www.cambridge.org

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

6 Weather derivatives and the market

For a company deciding how to hedge its risk there is often a trade-off

between basis risk and the price of the weather hedge. Weather contracts on

standard indices on London, Chicago and New York temperatures are traded

frequently, and consequently it is usually easy to trade such contracts at a

good price. However, except in lucky cases, it is unlikely that such contracts

will minimise basis risk for the hedging company. Hedgers then have a choice

between, on the one hand, getting the best price but trading a contract

that may not hedge their business particularly well and, on the other hand,

hedging their business as well as possible but not necessarily getting such a

good price.

1.1.6 Hedgers and speculators, primary and secondary markets

Every weather derivative is a transaction between two parties. We will clas-

sify all such parties as being either hedgers, who have weather risk they want

to reduce or eliminate, or speculators, who are making a business by writing

weather contracts. This separation of all traders of weather derivatives into

hedgers and speculators is useful, but is also a simplification of reality. For

instance, many hedgers also trade speculatively, partly in order to ensure

that they understand the market before they buy a hedge, partly to disguise

their hedging intentions to other traders and partly just to try and make

money. Similarly, speculators may become hedgers if they decide that their

speculative trading has led them to a position where they hold too much

risk.

Transactions between hedgers and speculators are referred to as the pri-

mary market, while transactions between speculators and other speculators

are known as the secondary market. The speculators trade contracts with

each other either because they want to reduce the weather risk they have

that arises from holding previously traded weather derivatives (in which

case, they are also becoming hedgers), or simply because they think they

can make money by doing so.

Very occasionally contracts are exchanged directly between two hedgers,

who, by doing so, can hedge each other’s risks simultaneously. However, this

is extremely uncommon, since it is rare for two companies to have exactly

equal and opposite weather risks.

From the point of view of the speculator, who may be a bank, insur-

ance company, reinsurance company, energy company or hedge fund, trading

weather derivatives forms an attractive proposition for two reasons. First,

weather derivative pay-offs are generally uncorrelated with other forms of

insurance or investment. As a result of this an insurance company can issue

© Cambridge University Press www.cambridge.org

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

Introduction 7

weather derivatives cheaply relative to other forms of insurance because the

overall company risk will increase less. Similarly, a hedge fund can invest

in weather derivatives knowing that their return is uncorrelated with the

return on the other financial assets it may hold, such as equities and bonds.

Second, a portfolio of weather derivatives can, in itself, be very low risk

because of the potentially offsetting nature of weather contracts. An ideal

weather market would be driven by businesses that are, in aggregate, seek-

ing to hedge against equal and opposite amounts of each weather risk. In

principle this could lead to a situation in which the speculators hold very

little risk because they would simply be middlemen passing weather risk

from one hedger to another. The risk would be exchanged almost at cost

price, with little or no risk premium.

1.1.7 Over-the-counter and exchange trading

There are a number of ways in which a weather derivative trade can take

place. Primary market trades are usually ‘over the counter’ (OTC), mean-

ing that they are traded privately between the two counterparties. Much

of the secondary market is traded through voice-brokers, who act as in-

termediaries and cajole participants in the market to do deals, but do not

actually trade themselves. These trades are also described as OTC. Finally,

a growing part of the secondary market is traded on the Chicago Mercantile

Exchange (CME), which currently lists weather derivatives for fifteen US,

five European and two Japanese locations based on temperatures for each

month of the year. The CME plays the dual roles of bringing transparency

(the prices are freely available on the Internet) and eliminating credit risk

(since you trade with the CME rather than with the other counterparty, and

make margin payments on a daily basis).

Secondary trading and the Pareto optimum

Trading between speculators in the secondary market may, at first look,

appear to be a zero-sum game, and have little net economic benefit. This may

be the case with certain trades, but is not the case in general. A secondary

market trade can quite conceivably reduce the risk of both parties to the

trade, or at least reduce the total risk held by the two parties (i.e. the risk

decrease on one side is greater than the risk increase on the other). And

the lower the risk held by parties in the secondary market, the lower the

premiums that can be charged to hedgers. In this way, it is in both hedgers’

and speculators’ interest for secondary trading to occur until an optimum

situation has been achieved in which the total risk held by the players in

© Cambridge University Press www.cambridge.org

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

8 Weather derivatives and the market

the secondary market is the least. Reaching such a situation may take many

secondary market trades, even in a market with only a few players, and this

is reflected in the fact that there are typically many more secondary market

trades than primary market trades.

Mathematical models of this idea have been studied by economists. When

considered in terms of economic utility, secondary market trading is certainly

not a zero-sum game, and one can idealise secondary trading as moving

the entire market towards the situation where the total expected utility

of the participants is the greatest possible. This is known as the Pareto

optimum.

1.1.8 Hedging and forecasts

At this point the reader may be wondering about the relationship between

the hedging of weather risk and the use of weather forecasts. Meteorologi-

cal forecasts contain information about the weather a few days in advance

(in the case of weather forecasts) or a few months in advance (in the case

of seasonal forecasts). For certain business decisions, especially those on

timescales of a few days, such forecasts can be very useful. The appropriate

use of forecasts can both increase the expected profits and reduce the risk of

making a loss, while weather derivatives, in most cases, only reduce the risk

of making a loss. However, a company making plans for the month, quarter

or year ahead cannot make much use of forecasts. Weather derivatives, on

the other hand, are ideally suited to all periods in the future. Meteorological

forecasts and weather derivatives are thus perfect complements: what can

be predicted with accuracy should be, and action should be taken on the

basis of such predictions. Everything else can be hedged.

There are also two ways in which weather derivatives can be used to

enhance the usefulness of weather forecasts. One is that a forecast can be

used to determine the best course of action, and a weather derivative can

hedge against the possibility that the forecast is wrong. The derivative would

pay out according to the size, and possibly direction, of the forecast error.

For example, consider a supermarket that buys certain perishable fruits and

vegetables on short notice according to the weather forecast. If the forecast

is wrong and the supermarket sells less than predicted it will lose revenue

relative to the situation in which the forecast is correct. This revenue at

risk could be hedged using a weather derivative that pays according to the

forecast error.

The other way that weather derivatives can be used to enhance forecasts is

that a forecast can be used to determine the course of action, and a weather

© Cambridge University Press www.cambridge.org

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

Introduction 9

derivative can hedge against the occurrence of forecasts that lead to a high

cost being incurred. An example of this might be an oil platform in the Gulf

of Mexico that evacuates staff when there is a hurricane forecast. A weather

derivative could be structured to cover the cost of such an evacuation. In-

terestingly, in this case the actual weather does not influence the pay-out of

the contract, only the forecast.

A final aspect of the relationship between meteorological forecasts and

weather derivatives is that forecasts play a major role in the valuation of

weather derivatives in certain circumstances. This is addressed in detail in

chapter 10.

1.1.9 Hedging weather and price

The situation often arises that a company is exposed to both weather and

the price of some commodity in a connected way. Consider a company that

has to buy more natural gas when it is cold. If the gas is being bought at a

fixed price, then this purchase involves only weather risk. The total cost of

the gas bought is given by

cost = P0 V (1.1)

where P0 is the fixed price and V is the weather-dependent amount of gas.

But if the gas is being bought at a varying price then the company is

exposed not only to the weather but also to fluctuations in that price. The

total cost is now given by

cost = P V (1.2)

where P also varies. One can say that the level of weather risk depends on the

gas price, or that the level of gas price risk depends on the weather. In some

cases the variability of the weather and the gas price may be independent,

which simplifies the analysis of these situations. However, often the changes

in the gas price are partly affected by the weather as well (since cold weather

increases demand for gas, which in turn increases the price). Hedging com-

bined weather and price risk is more complex than hedging straightforward

weather risk or price risk alone, and ideally involves contracts that depend

on both the weather and the price. Only a few contracts of this type have

been traded to date. The pricing of such contracts is discussed briefly in

chapter 11.

© Cambridge University Press www.cambridge.org

Cambridge University Press

0521843715 - Weather Derivative Valuation: The Meteorological, Statistical, Financial and Mathematical

Foundations

Stephen Jewson and Anders Brix

Excerpt

More information

10 Weather derivatives and the market

1.2 Weather variables and indices

As we have seen, weather affects different entities in different ways. In or-

der to hedge these different types of risk, weather derivatives are based on

a variety of different weather variables and can also be structured to depend

on more than one weather variable. The most commonly used weather vari-

able is the temperature, as either hourly values, daily minima or maxima, or

daily averages. Of these, daily average is the most frequently seen. In most

countries daily average is defined by convention as the midpoint of the daily

minimum and maximum. However, in some countries daily average is defined

as a weighted average of more than two values of temperature per day. Defi-

nitions based on three, twelve, twenty-four or more values per day are all in

use. The exact time period over which the minimum and maximum temper-

ature are measured, and exactly how minimum and maximum are defined,

also vary from country to country. To participate in the weather market one

has to do thorough research into the weather measurement conventions in

use in each country in which one operates.

As an example of minimum and maximum temperature values, figure 1.1

shows daily minimum, maximum and average temperatures measured at

London’s Heathrow Airport for the year 2000.

In addition to temperature, wind and precipitation measurements are also

used as the weather variables underlying weather derivatives. Wind-based

hedges are, for instance, of interest to wind farms, which want protection

30

Temperature

20

10

0

15 Jan 15 Mar 15 May 15 Jul 15 Sep 15 Nov

Date

Figure 1.1. Daily minimum (dotted line), maximum (dashed line) and av-

erage (solid line) temperatures for London Heathrow, 2000.

© Cambridge University Press www.cambridge.org

You might also like

- Weather DerivativesDocument19 pagesWeather DerivativesSneha Lee100% (1)

- Assignment 2 - Weather DerivativeDocument8 pagesAssignment 2 - Weather DerivativeBrow SimonNo ratings yet

- DocxDocument7 pagesDocxRodrigo PerezNo ratings yet

- Microsoft Word DocumentDocument14 pagesMicrosoft Word Documentnileshgpatel88No ratings yet

- A Quick Guide To Weather DerivativesDocument3 pagesA Quick Guide To Weather DerivativesHummingbird11688No ratings yet

- XDDocument1 pageXDSahil LoombaNo ratings yet

- Risk Management Most of The Companies and Industries Are Directly or Indirectly Affected by The Risky Nature of Weather Which Can Be Further Classified As Catastrophic and Non-CatastrophicDocument1 pageRisk Management Most of The Companies and Industries Are Directly or Indirectly Affected by The Risky Nature of Weather Which Can Be Further Classified As Catastrophic and Non-CatastrophicSahil LoombaNo ratings yet

- FDDocument1 pageFDSahil LoombaNo ratings yet

- Risk management for weather-sensitive industries- Many businesses and industries face risk due to changes in weather conditions, such as energy companies, agriculture, manufacturing, construction, and tranDocument2 pagesRisk management for weather-sensitive industries- Many businesses and industries face risk due to changes in weather conditions, such as energy companies, agriculture, manufacturing, construction, and tranTOSHAK SHARMANo ratings yet

- Hedging DerivativesDocument32 pagesHedging DerivativesSaurav KumarNo ratings yet

- Weather DerivativesDocument6 pagesWeather DerivativesRuchit DoshiNo ratings yet

- Weather Derivatives for Managing Agricultural RiskDocument21 pagesWeather Derivatives for Managing Agricultural RiskGiang Nguyễn HươngNo ratings yet

- Schadenspiegel 302-07709 enDocument20 pagesSchadenspiegel 302-07709 enselvajanarNo ratings yet

- Energy Risk - Ilija Murisic - Weather DerivativesDocument6 pagesEnergy Risk - Ilija Murisic - Weather Derivativesakasaka99No ratings yet

- Thesis Weather DerivativesDocument5 pagesThesis Weather Derivativesjenniferontiveroskansascity100% (2)

- WEA Intro To Weather DerDocument10 pagesWEA Intro To Weather DerJugal DesaiNo ratings yet

- WeatherservicesplanningDocument45 pagesWeatherservicesplanningamuu08No ratings yet

- Thesis On Weather DerivativesDocument8 pagesThesis On Weather Derivativesamandawilliamscolumbia100% (1)

- Uv0618 PDF EngDocument12 pagesUv0618 PDF EngVinukartik PillaiNo ratings yet

- Jan Feb-WeatherRisk RevDocument4 pagesJan Feb-WeatherRisk RevYogesh PatilNo ratings yet

- How Companies Can Adapt To Climate Change PDFDocument5 pagesHow Companies Can Adapt To Climate Change PDFSurya SetipanolNo ratings yet

- White PaperDocument27 pagesWhite PaperDhasarathan RajendranNo ratings yet

- Miti Mills 2007Document34 pagesMiti Mills 2007AllishaneNo ratings yet

- Literature Review On Weather DerivativesDocument5 pagesLiterature Review On Weather Derivativesaflsvwoeu100% (1)

- Jewson, 2004Document9 pagesJewson, 2004Sara Maria Rincon BogotaNo ratings yet

- Introduction to Weather Derivatives: A Risk Management Tool for Businesses Impacted by WeatherDocument6 pagesIntroduction to Weather Derivatives: A Risk Management Tool for Businesses Impacted by WeatherAbhay KamathNo ratings yet

- Airmic Derisking The Climate TransitionDocument24 pagesAirmic Derisking The Climate TransitionYara AminNo ratings yet

- A Grim OutlookDocument3 pagesA Grim Outlookanon_118354306No ratings yet

- The Modelling of Extreme EventsDocument39 pagesThe Modelling of Extreme Eventsdimitrioschr100% (1)

- Chapter 8 Summary: SP8-08: External EnvironmentDocument2 pagesChapter 8 Summary: SP8-08: External EnvironmentPython ClassesNo ratings yet

- Group 6-PresentationDocument24 pagesGroup 6-PresentationPhan ChiNo ratings yet

- The Private Sector's Climate Change Risk and Adaptation Blind SpotsDocument8 pagesThe Private Sector's Climate Change Risk and Adaptation Blind SpotspeterNo ratings yet

- Climatewise Principles Report 2013: Principle 1 - Lead in Risk AnalysisDocument12 pagesClimatewise Principles Report 2013: Principle 1 - Lead in Risk AnalysissaxobobNo ratings yet

- Commercial Fire Insurance: Presented To The Staple Inn Actuarial Society On5 January 1988Document45 pagesCommercial Fire Insurance: Presented To The Staple Inn Actuarial Society On5 January 1988js1919No ratings yet

- Derivatives Add ValueDocument46 pagesDerivatives Add Valuemasyuki2002No ratings yet

- A Simulation of The Insurance Industry The ProblemDocument43 pagesA Simulation of The Insurance Industry The ProblemDavidon JaniNo ratings yet

- Climate Change Liability Risk ReportDocument94 pagesClimate Change Liability Risk ReportEarlnieNo ratings yet

- 2020 - Climate Risk - The Price of Drought - JCF - Dec2020Document26 pages2020 - Climate Risk - The Price of Drought - JCF - Dec2020L Prakash JenaNo ratings yet

- Final Report - Recommendations of The Task Force On Climate-Related Financial Disclosures - June 2017Document74 pagesFinal Report - Recommendations of The Task Force On Climate-Related Financial Disclosures - June 2017Seni NabouNo ratings yet

- Recommendations of The Task Force On Climate-Related Financial DisclosuresDocument74 pagesRecommendations of The Task Force On Climate-Related Financial DisclosuresGwenny DermawanNo ratings yet

- Climate-Determinants Financial-Services FinalDocument9 pagesClimate-Determinants Financial-Services FinalRichard J. MarksNo ratings yet

- BMA 2020 Climate Change Survey ReportDocument16 pagesBMA 2020 Climate Change Survey ReportBernewsAdminNo ratings yet

- Weather Derivatives - The ImpactDocument2 pagesWeather Derivatives - The ImpactWritum.comNo ratings yet

- SSRN Id3317570Document43 pagesSSRN Id3317570Syed TabrezNo ratings yet

- Weather Forecasting and Energy Trading: Notes From The TrenchesDocument16 pagesWeather Forecasting and Energy Trading: Notes From The TrenchesviniNo ratings yet

- Climatewise Principles Report 2012: PublicDocument21 pagesClimatewise Principles Report 2012: PublicsaxobobNo ratings yet

- International Journal of Business and Management Invention (IJBMI)Document9 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Weather Derivatives - The ImpactDocument3 pagesWeather Derivatives - The ImpactWritum.comNo ratings yet

- Climate ChangeDocument16 pagesClimate ChangehaNo ratings yet

- Chapter 7Document5 pagesChapter 7Eko WaluyoNo ratings yet

- Catastrophic Risk and The Capital Markets: Berkshire Hathaway and Warren Buffett's Success Volatility Pumping Cat ReinsuranceDocument15 pagesCatastrophic Risk and The Capital Markets: Berkshire Hathaway and Warren Buffett's Success Volatility Pumping Cat ReinsuranceAlex VartanNo ratings yet

- Ey Climate Change and InvestmentDocument20 pagesEy Climate Change and InvestmentmaluNo ratings yet

- Financial Risks and Management: GlossaryDocument6 pagesFinancial Risks and Management: GlossaryhbNo ratings yet

- 1. CastroVicenzi_Resilience_ClimateDocument78 pages1. CastroVicenzi_Resilience_ClimategonzalolanisNo ratings yet

- Risk Managment - Individual AssignmentDocument17 pagesRisk Managment - Individual AssignmentBryanNo ratings yet

- The Impact of Climate Change On The Global EconomyDocument11 pagesThe Impact of Climate Change On The Global EconomyKaycee KarsorNo ratings yet

- 5Document4 pages5shitalzeleNo ratings yet

- How Insurers Have Shifted Weather Catastrophe Risk and Costs to Consumers and TaxpayersDocument19 pagesHow Insurers Have Shifted Weather Catastrophe Risk and Costs to Consumers and TaxpayersHoneyleth TinamisanNo ratings yet

- Evaluation of IndexbasedDocument10 pagesEvaluation of Indexbasedmak112005gmailNo ratings yet

- Agricultural Risk Management for Natural HazardsDocument201 pagesAgricultural Risk Management for Natural Hazardsmak112005gmailNo ratings yet

- Module 3 - All - Books - Mombassa - FinalDocument104 pagesModule 3 - All - Books - Mombassa - Finalmak112005gmailNo ratings yet

- Calculation of Velocity Potential Using Relaxation MethodDocument3 pagesCalculation of Velocity Potential Using Relaxation Methodmak112005gmailNo ratings yet

- Bayesian Inference in Weather InsuDocument1 pageBayesian Inference in Weather Insumak112005gmailNo ratings yet

- Linear Balance Equation Dynamic MeteorologyDocument1 pageLinear Balance Equation Dynamic Meteorologymak112005gmailNo ratings yet

- Calculating Arakawa JacobianDocument3 pagesCalculating Arakawa Jacobianmak112005gmailNo ratings yet

- Non Divergent Barotropic Vorticity EquationDocument1 pageNon Divergent Barotropic Vorticity Equationmak112005gmailNo ratings yet

- What Is Probabilistic Forecast - ScribdDocument11 pagesWhat Is Probabilistic Forecast - Scribdmak112005gmailNo ratings yet

- Calculating Arakawa JacobianDocument3 pagesCalculating Arakawa Jacobianmak112005gmailNo ratings yet

- Chapter 4 - Environmental Scanning & Industry AnalysisDocument25 pagesChapter 4 - Environmental Scanning & Industry AnalysisDaniel Hunks100% (3)

- Chapter Two The Economizing ProblemDocument13 pagesChapter Two The Economizing ProblemHannah CaparasNo ratings yet

- Capital Today FINAL PPMDocument77 pagesCapital Today FINAL PPMAshish AgrawalNo ratings yet

- Income StatementDocument13 pagesIncome StatementShakir IsmailNo ratings yet

- RULE XVII Section 5 of The Omnibus Rules Implementing E.O. 292Document2 pagesRULE XVII Section 5 of The Omnibus Rules Implementing E.O. 292Ros PalomoNo ratings yet

- What Jobs Can You Do With An Electrical Engineering DegreeDocument3 pagesWhat Jobs Can You Do With An Electrical Engineering DegreeImam d'SmartanNo ratings yet

- Account Entries in p2p CycleDocument2 pagesAccount Entries in p2p CycleNikhil SharmaNo ratings yet

- Chapter 19 - Earnings and Discrimination: Key Factors That Impact WagesDocument4 pagesChapter 19 - Earnings and Discrimination: Key Factors That Impact WagesFidan MehdizadəNo ratings yet

- Myanmar Overseas Employment Agencies Federation Certificate of MembershipDocument1 pageMyanmar Overseas Employment Agencies Federation Certificate of MembershipHtet Wai Yan kyawNo ratings yet

- Evaluation of Effectiveness of TrainingDocument42 pagesEvaluation of Effectiveness of TrainingSarah AzizNo ratings yet

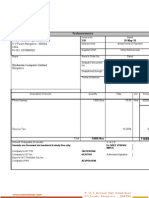

- VAT Invoice - 2024-01-31 - 00000007031318-2401-18359960Document2 pagesVAT Invoice - 2024-01-31 - 00000007031318-2401-18359960mhzp4ckj47No ratings yet

- How Can We ExportDocument94 pagesHow Can We ExportUdit PradeepNo ratings yet

- Acct Statement - XX9642 - 10082022Document87 pagesAcct Statement - XX9642 - 10082022sunkenapelli adityaNo ratings yet

- Spatial Organization: Circulation Area Service Area Display AreaDocument55 pagesSpatial Organization: Circulation Area Service Area Display AreakartikharishNo ratings yet

- Defining The Necessary Components of Creative, Effective AdsDocument20 pagesDefining The Necessary Components of Creative, Effective AdsMildaNo ratings yet

- Trial Balance and Accounting Errors: ModuleDocument17 pagesTrial Balance and Accounting Errors: ModuleCharming MakaveliNo ratings yet

- Team 8 Buyers and Sellers Negotiation AnalysisDocument9 pagesTeam 8 Buyers and Sellers Negotiation AnalysisSWAGATO MUKHERJEENo ratings yet

- FH3 - Learner Guide - Module 1Document249 pagesFH3 - Learner Guide - Module 1ZwelizweleereevereNo ratings yet

- SODA 2020 Q1 IR PresentationDocument42 pagesSODA 2020 Q1 IR PresentationprasenjitNo ratings yet

- SITARAM JINDAL FOUNDATION DONATION APPLICATIONDocument2 pagesSITARAM JINDAL FOUNDATION DONATION APPLICATIONRs WsNo ratings yet

- MidtermsDocument8 pagesMidtermsRhea BadanaNo ratings yet

- Econ Gr10 - Lessons 1 and 2Document20 pagesEcon Gr10 - Lessons 1 and 2Carl Tan0% (1)

- Usha Letter Head CurvedDocument1 pageUsha Letter Head Curvedsales7705No ratings yet

- 10 Famous Successful Filipino Entrepreneurs: 1. Socorro C. Ramos National Book Store, IncDocument4 pages10 Famous Successful Filipino Entrepreneurs: 1. Socorro C. Ramos National Book Store, IncMarkmarilynNo ratings yet

- IntroductiontoAccounting STDocument328 pagesIntroductiontoAccounting STAbsara Khan100% (1)

- Erkende Referenten / Recognised Sponsors: Arbeid Regulier en Kennismigranten / Regular Labour and Highly Skilled MigrantsDocument162 pagesErkende Referenten / Recognised Sponsors: Arbeid Regulier en Kennismigranten / Regular Labour and Highly Skilled MigrantsSirius KitapNo ratings yet

- 1.7M BTC JPMORGAN T089 MT103 (International) or Wire USA OctDocument14 pages1.7M BTC JPMORGAN T089 MT103 (International) or Wire USA OctJose Lahoz100% (1)

- Bankruptcy Removal Procedure KitDocument7 pagesBankruptcy Removal Procedure Kitduvard purdue100% (1)

- 1570-1635319411751-Unit 02 Marketing Processes and PlanningDocument17 pages1570-1635319411751-Unit 02 Marketing Processes and Planningsathsaraniranathunga6No ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet