Professional Documents

Culture Documents

Worksheet: Medicare Contributions Payable

Uploaded by

Shaira Mica Sanita0 ratings0% found this document useful (0 votes)

28 views2 pagesThis worksheet provides accounting information for a business including unadjusted trial balances, adjustments, adjusted trial balances, statements of income and financial position. It shows assets like cash, accounts receivable and inventory. It also shows liabilities such as accounts payable and notes payable. Revenue and expenses are listed including sales, purchases, wages and depreciation. The adjusted trial balance and statements of income and financial position are provided after incorporating adjustments.

Original Description:

credits to the owner, this work is not mine

Original Title

Wokrsheet

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis worksheet provides accounting information for a business including unadjusted trial balances, adjustments, adjusted trial balances, statements of income and financial position. It shows assets like cash, accounts receivable and inventory. It also shows liabilities such as accounts payable and notes payable. Revenue and expenses are listed including sales, purchases, wages and depreciation. The adjusted trial balance and statements of income and financial position are provided after incorporating adjustments.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views2 pagesWorksheet: Medicare Contributions Payable

Uploaded by

Shaira Mica SanitaThis worksheet provides accounting information for a business including unadjusted trial balances, adjustments, adjusted trial balances, statements of income and financial position. It shows assets like cash, accounts receivable and inventory. It also shows liabilities such as accounts payable and notes payable. Revenue and expenses are listed including sales, purchases, wages and depreciation. The adjusted trial balance and statements of income and financial position are provided after incorporating adjustments.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

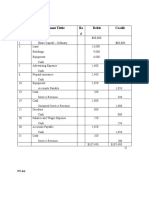

WORKSHEET

UNADJUSTED TRIAL ADJUSTED STATEMENT STATEMENT OF

ADJUSTMENTS

F BALANCE TRIAL BALANCE OF INCOME FINANCIAL POSITION

Cash on Hand 111 P 179 702 P 179 702 P 179 702

Cash in Bank 112 23 050 23 050 23 050

Accounts Receivable 113 24 000 24 000 24 000

Merchandise Inventory 114 18 000 18 000 18 000

Advance Rentals 115 8 000 P 4 000 4 000 4 000

Store Furniture 116 10 000 10 000 10 000

Store Equipment 117 11 880 11 880 11 880

Accounts Payable 118 P 24 000 P 24 000 P 24 000

Notes Payable 119 46 000 46 000 46 000

Withholding Taxes Payable 211 840 840 840

SSS Contributions Payable 212 1 600 1 600 1 600

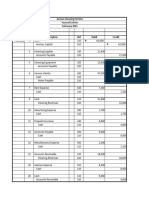

Medicare Contributions Payable 311 500 500 500

C. Dela Cruz, Capital 312 173 000 173 000 173 000

C. Dela Cruz, Drawing 411 800 800 800

Sales 511 167 950 167 950 P 167 950

Sales Returns & Allowances 512 1 200 1 200 P 1 200

Sales Discounts 513 140 140 140

Purchases 514 128 400 128 400 128 400

Purchases Returns Allowances 515 2 200 2 200 2 200

Purchases Discounts 516 342 342 342

Freight In 620 620 620

Wages Expense 10 000 10 000 10 000

Taxes and Licenses 580 580 580

Interest Income 30 30 30

Interest Expense 90 . 90 90

P 416 462 P 416 462

Acc. Depreciation- Furniture 416.67 416.67 416.67

Bad Debts Expense P 2 400 2 400 2 400

Allowance for Bad Debts 2 400 2 400 2 400

Depn. Expense- Equipment 330 330 330

Acc. Depreciation-Equipment 330 330 330

Rent Expense 4 000 4 000 4 000

Depn. Expense-Furniture 416.67 416.67 . 416.67 . . .

P419 608.67 P419 608.67 148 176.67 P 170 522 P 271 342 249 086.67

Net Income 22 345.33 22 345.33

P 170 522 P 271 342

You might also like

- Problem 1: University of San Jose-Recoletos Auditing ProblemsDocument9 pagesProblem 1: University of San Jose-Recoletos Auditing ProblemsPaul Doroin100% (1)

- Exercise 6 22 Acctba1Document11 pagesExercise 6 22 Acctba1Sophia Santos50% (2)

- Bohol Pension House 1Document7 pagesBohol Pension House 1Chloe Cataluna86% (7)

- Therese Zyra Lipang - Worksheet Activity - 10 Column WsDocument4 pagesTherese Zyra Lipang - Worksheet Activity - 10 Column WsJuvelyn Repaso100% (1)

- Answer To Sample Question 3Document3 pagesAnswer To Sample Question 3Farid Abbasov0% (1)

- Book 1Document1 pageBook 1iya RasonableNo ratings yet

- Comprehensive ProblemDocument14 pagesComprehensive ProblemMarian Augelio PolancoNo ratings yet

- F Unadjusted Trial Balance Adjustments Adjusted Trial Balance Statement of IncomeDocument1 pageF Unadjusted Trial Balance Adjustments Adjusted Trial Balance Statement of IncomeShaira Mica SanitaNo ratings yet

- Quijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodDocument4 pagesQuijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodzairahNo ratings yet

- Teresita Buenaflor ShoesDocument1 pageTeresita Buenaflor ShoesmonomagicshopNo ratings yet

- Accounting 1Document1 pageAccounting 1LinNo ratings yet

- 1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Document14 pages1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Shien Angel Delos ReyesNo ratings yet

- F Unadjusted Trial Balance Adjustments Adjusted Trial Balance Statement of IncomeDocument1 pageF Unadjusted Trial Balance Adjustments Adjusted Trial Balance Statement of IncomeShaira Mica SanitaNo ratings yet

- Company Code Account Group Description Number Range From Number Range ToDocument59 pagesCompany Code Account Group Description Number Range From Number Range ToFadelah HanafiNo ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- SEATWORK6Document6 pagesSEATWORK6dumpanonymouslyNo ratings yet

- 10-Column Worksheet FormDocument1 page10-Column Worksheet Formobrie diazNo ratings yet

- Fabm1 L7Document4 pagesFabm1 L7LinNo ratings yet

- CHAPTER 4: DO IT! 1 Worksheet: Blessie, Capital Jan. 1, 2019 961,900Document3 pagesCHAPTER 4: DO IT! 1 Worksheet: Blessie, Capital Jan. 1, 2019 961,900CacjungoyNo ratings yet

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75No ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Jupiter Store - Soln - Completing The Accounting CycleDocument10 pagesJupiter Store - Soln - Completing The Accounting CycleMariella Olympia PanuncialesNo ratings yet

- Homework Chapter 2: ExerciseDocument6 pagesHomework Chapter 2: ExerciseDiệu QuỳnhNo ratings yet

- Complete AccountingDocument4 pagesComplete AccountingLinNo ratings yet

- 3RD Activity - ComprehensiveDocument19 pages3RD Activity - ComprehensiveJJ Longno100% (2)

- WorksheetshubanesDocument2 pagesWorksheetshubanesKath Leynes100% (1)

- Tugas 5-Praktek Mandiri Ms Excel - Delilah RosmayantiDocument7 pagesTugas 5-Praktek Mandiri Ms Excel - Delilah RosmayantiDelilah RosmayantiNo ratings yet

- Seatwork No. 2 (Sanguine) AnswerDocument1 pageSeatwork No. 2 (Sanguine) AnswerJohn Paul Cristobal0% (1)

- Accounting 18Document7 pagesAccounting 18Kenshin HayashiNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Accounting ActivityDocument3 pagesAccounting ActivityKae Abegail GarciaNo ratings yet

- 1Document2 pages1Jimbo ManalastasNo ratings yet

- Explained: AccountingDocument3 pagesExplained: AccountingAJNo ratings yet

- ACP314 Competency PracticeDocument1 pageACP314 Competency PracticeJastine Rose CañeteNo ratings yet

- Module - WorksheetDocument2 pagesModule - WorksheetKae Abegail GarciaNo ratings yet

- Account TitleDocument3 pagesAccount TitleDonna Lyn BoncodinNo ratings yet

- Cae 1Document4 pagesCae 1stonefiona6No ratings yet

- Accounting AssignmentDocument2 pagesAccounting AssignmentAdisu MasreshaNo ratings yet

- Beginning Balances Debit CreditDocument23 pagesBeginning Balances Debit CreditRaff LesiaaNo ratings yet

- Date Account Title and Explanation Debit Credit: Ref. NoDocument7 pagesDate Account Title and Explanation Debit Credit: Ref. NoBlesh MacusiNo ratings yet

- PracticeDocument1 pagePracticeNana CatNo ratings yet

- 2.3 SAMPLE - WorkbookDocument11 pages2.3 SAMPLE - WorkbookJonalyn BedesNo ratings yet

- Book 1Document1 pageBook 1Ma AndiasonNo ratings yet

- Closing BalanceDocument1 pageClosing BalanceAnashivaNo ratings yet

- Rosalie Balhag CleanersDocument1 pageRosalie Balhag CleanersDominique Abrajano100% (1)

- Book 1Document4 pagesBook 1monteNo ratings yet

- Particular Unadjusted Trial BalanceDocument4 pagesParticular Unadjusted Trial BalanceRaymon Villapando BardinasNo ratings yet

- Allan & WallyDocument10 pagesAllan & WallyLaura OliviaNo ratings yet

- Untitled Spreadsheet - Sheet1Document1 pageUntitled Spreadsheet - Sheet1gnssgtld7No ratings yet

- Accounting Group FinishedDocument3 pagesAccounting Group Finishedapi-397864078No ratings yet

- 3rd Long QuizDocument1 page3rd Long QuizRonah SabanalNo ratings yet

- Seatwork #6Document5 pagesSeatwork #6Jasmine Maningo100% (1)

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- PeriodicDocument19 pagesPeriodicAlyssa Mae MarceloNo ratings yet

- UD Sukses: Debit Kredit Debit Kredit Kode Dan Nama Akun Neraca Percobaan SaldoDocument2 pagesUD Sukses: Debit Kredit Debit Kredit Kode Dan Nama Akun Neraca Percobaan SaldoFarhan AuliaNo ratings yet

- Cash Disbursement JournalDocument3 pagesCash Disbursement JournalRhea Mikylla ConchasNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Final Output - Ais Elect 1Document18 pagesFinal Output - Ais Elect 1Joody CatacutanNo ratings yet

- MASECO ReportingDocument24 pagesMASECO ReportingShaira Mica SanitaNo ratings yet

- 11 Sunday: Ordinary TimeDocument188 pages11 Sunday: Ordinary TimeShaira Mica SanitaNo ratings yet

- Ais 2 Act 2Document1 pageAis 2 Act 2Shaira Mica SanitaNo ratings yet

- Chalice-Ariel Cruets - Jay-Allen Lavabo/Towel - Perlita-Ailyn Ciborium - Jaspher Water - LhynDocument1 pageChalice-Ariel Cruets - Jay-Allen Lavabo/Towel - Perlita-Ailyn Ciborium - Jaspher Water - LhynShaira Mica SanitaNo ratings yet

- Sanita, Shaira Micav V.Document1 pageSanita, Shaira Micav V.Shaira Mica SanitaNo ratings yet

- Marley CompanyDocument13 pagesMarley CompanyShaira Mica SanitaNo ratings yet

- Explanation Brunei ReportDocument3 pagesExplanation Brunei ReportShaira Mica SanitaNo ratings yet

- DaisyDocument1 pageDaisyShaira Mica SanitaNo ratings yet

- Activity 3Document1 pageActivity 3Shaira Mica SanitaNo ratings yet

- Sculpture and Photography: Reporter: Sanita, Shaira Mica, V.-BSA 2ADocument57 pagesSculpture and Photography: Reporter: Sanita, Shaira Mica, V.-BSA 2AShaira Mica SanitaNo ratings yet

- Activity 3Document1 pageActivity 3Shaira Mica SanitaNo ratings yet

- Introduction To ArtsDocument4 pagesIntroduction To ArtsShaira Mica SanitaNo ratings yet

- Ais 2 Act 2Document1 pageAis 2 Act 2Shaira Mica SanitaNo ratings yet

- Introduction To ArtsDocument4 pagesIntroduction To ArtsShaira Mica SanitaNo ratings yet

- Sanita, Shaira Mica, V.Document1 pageSanita, Shaira Mica, V.Shaira Mica SanitaNo ratings yet

- Stone Carving Is An Activity Where Pieces of Rough Natural Stone Are Shaped byDocument4 pagesStone Carving Is An Activity Where Pieces of Rough Natural Stone Are Shaped byShaira Mica SanitaNo ratings yet

- Process CostingDocument2 pagesProcess CostingShaira Mica SanitaNo ratings yet

- Materials Labor Overhead: Equivalent Units For MaterialsDocument25 pagesMaterials Labor Overhead: Equivalent Units For MaterialsShaira Mica SanitaNo ratings yet

- AccountingDocument1 pageAccountingRajashekar ReddyNo ratings yet

- Stone Carving Is An Activity Where Pieces of Rough Natural Stone Are Shaped byDocument4 pagesStone Carving Is An Activity Where Pieces of Rough Natural Stone Are Shaped byShaira Mica SanitaNo ratings yet

- Sanita, Shaira Mica, V.Document1 pageSanita, Shaira Mica, V.Shaira Mica SanitaNo ratings yet

- TOPIC: The Cost of Production Report: REPORTER: Sanita, Shaira Mica, VDocument33 pagesTOPIC: The Cost of Production Report: REPORTER: Sanita, Shaira Mica, VShaira Mica SanitaNo ratings yet

- TOPIC: The Cost of Production Report: REPORTER: Sanita, Shaira Mica, VDocument33 pagesTOPIC: The Cost of Production Report: REPORTER: Sanita, Shaira Mica, VShaira Mica SanitaNo ratings yet

- F Unadjusted Trial Balance Adjustments Adjusted Trial Balance Statement of IncomeDocument1 pageF Unadjusted Trial Balance Adjustments Adjusted Trial Balance Statement of IncomeShaira Mica SanitaNo ratings yet

- Acct TutorDocument22 pagesAcct TutorKthln Mntlla100% (1)

- Accounting Cycle ProblemDocument2 pagesAccounting Cycle ProblemShaira Mica SanitaNo ratings yet