Professional Documents

Culture Documents

Credit Card Summary Box: Information Explanation

Credit Card Summary Box: Information Explanation

Uploaded by

M Faiq FaheemOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Card Summary Box: Information Explanation

Credit Card Summary Box: Information Explanation

Uploaded by

M Faiq FaheemCopyright:

Available Formats

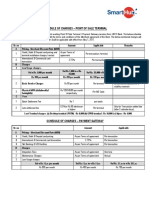

CREDIT CARD SUMMARY BOX

The information contained in this Box summarizes key features of UBL Credit Card and is not intended to replace any term &

condition of the product. It is very important that customer should carefully read the full terms & conditions before agreeing and

signing this information.

INFORMATION EXPLANATION

Joining Fee / Annual Joining Fee: None

Fee Annual Basic Fee:

Classic: Rs 3,500

Gold: Rs 7,000

Platinum: Rs 11,000

Supplementary Card Fee

Classic: Rs 1,500

Gold: Rs 2,150

Platinum: Rs 4,000

Corporate Cards

Normal: Rs 5,000

Gold: Rs 7,500

Annual Fee Waiver Criteria*:

Primary Card

Call UBL contact center to avail annual fee reversal on spend of 20% of assigned Credit Limit

within 90 days of statement generation date in which annual fee is levied, for all cards.

Supplementary Card

Call UBL contact center to avail annual fee reversal on spend of 10% of assigned Credit Limit

within 90 days of statement generation date in which annual fee is levied, for all cards.

➢ Annual fee is charged annually and at the time of card activation.

APR - Retail Transaction: 41.99%

Annualized

APR Calculation Formula:

Percentage Rate

(APR)

APR Cash Advance: 41.99%

APR Cash on Phone: 35%

APR BTF Open & Regular: up to 28%

APR LIP: 29%

*UBL offers fee waivers, discounts, promotional offers and other rewards that are discretionary, and the card members are

not entitled to claim the same as a matter of their right. UBL reserves the right, at any time without any liability to

cardmember in any manner whatsoever to terminate or withdraw or change the criteria and conditions for these fee waivers,

discounts, promotional offers and incentives.

Effective from July 01, 2019

APR - Retail Transaction: 41.99%

Interest Rates APR Cash Advance: 41.99%

APR Cash on Phone: 35%

APR BTF Open % Regular: up to 28%

APR LIP: 29%

Monthly Annual

Transaction Type Introductory Rate

Rate Rate

Retail Transactions Not Applicable 3.5% 41.99%

3% of the amount

Cash Advances withdrawn or Rs.1,000 3.5% 41.99%

whichever is higher

Rs.750/- per

transaction or 1.25% of

Cash on Phone 2.9% 35%

transaction amount

(whichever is higher)

Balance Transfer Rs. 500/- 2.3% 28%

3 months 5.25% of BT

Balance Transfer (Promotional) converted to 6 months 9.0% of BT Not Not

LIP for tenure of 3 months, 6 months, 9 months

9 months 12.75% of BT Applicable Applicable

& 12 months

12 months 16.5% of BT

Lite Installment Plan – Alliances Specific 0% APR for up to 6

2.4% 29%

(Tenure Available 3,6,12,18,24 & 36 Months) months tenure

Rs.600/- per

Lite Installment Plan - Retail Transaction transaction or 1.55% of

2.4% 29%

(Tenure Available 3,6,12,18,24 & 36 Months) transaction amount

(whichever is higher)

* Calculated on daily basis from date of the transaction

* Promotional BTF’s applicable tenure is subject to business discretion

Maximum of 50 credit free days are available for retail transactions. For other transactions than

Interest Free Period

retail like cash advance, BTF & LIP there is no interest-free time available.

Interest Charging No interest would be charged on new purchases if the payment is made in full within the due date

Information for each billing cycle and no balance is carried forward from the previous months. Otherwise, the

period over which interest is charged for different product features is mentioned below:

Transaction Type From Until

Retail Transactions Transaction Date Paid in full

Cash Advance Transaction Date Paid in full

Cash on Phone Transaction Date Paid in full

Balance Transfers Transaction Date Paid in full

Lite Installment Plan Transaction Date Paid in full

If the balance is not paid-off in full, payments received are applied as per the following payment

Payments Allocation hierarchy,

• Installment (EPP)

• Credit Shield Insurance

• Other Insurance Premiums

• FED on Fees

• Debit Interest

• Debit Fee

• Promotional BTF

• Balance Transfer

• Cash advance

• Cash on Phone (Cash Advance)

Effective from July 01, 2019

• Sales Draft (UBPS)

• Sales Draft

• Debit Adjustment and Other Debits

* Billed transactions are settled before unbilled transactions

5% or Rs. 500 (whichever is higher) of outstanding balance.

Minimum Monthly If you make a minimum payment, interest will be charged on the remaining balance after due

Repayments date, so it will cost more and take longer to clear the balance. Interest free period is also lost if

any balance of the previous months bill is outstanding.

Card Limit:

Card Limits Classic Card Rs. 10,000 Rs.125,000

Gold Card Rs. 125, 001 Rs.399,999

Platinum Card Rs. 400,000 Rs.2,000,000

Cash Advance/Cash on Phone Limit: 30% of the total limit

Supplementary Card Limit: 100% of basic card unless specified by customer. Customer has an

option of capping the supplementary limit to a certain amount or % of credit limit.

Charges 3% of the amount withdrawn or Rs. 1,000 whichever is

Cash Advance Fee **

higher

Rs. 750/- per transaction or 1.25% of transaction

Cash on Phone Fee

amount (whichever is higher)

Balance Transfer Fee (Open) Rs. 500/-

3 months 5.25% of BT

Balance Transfer Fee 0% markup 6 months 9.0% of BT

(Promotional) 9 months 12.75% of BT

12 months 16.5% of BT

Foreign currency transaction charges 4.5% of the transaction amount

Utility bill payment charges Rs.60 per transaction

SMS alert charges Free

Cash payment fee Not applicable

Card replacement charges- Silver & Gold Rs 600

Card replacement charges- Platinum Rs 1,000

Copy of statement fee Not applicable

* Charges are subject to change at bank’s discretion and are communicated to customers timely

**All the charges passed on by the acquiring bank, additionally applicable withholding tax on the sum

of all the transactions in a day exceeding Rs.50,000/-

Default Charges Late Payment Charges: Rs.1,500/-

Cancellation

Charges – Lite 5% of the installment outstanding balance or Rs.1000/- (Whichever is higher)

Installment Plan

Expiry 5 years from the date of card issuance

All insurance policies on credit card are optional in nature – below is the list of insurance policies

Insurance Coverage available to customers:

Credit Guardian:

In the event of any temporary disability where UBL card member is unable to pay his/her monthly

dues, Credit Guardian allows payment of the outstanding monthly amount. Moreover, in the

unfortunate event of permanent disability or death, the entire outstanding amount is waived off.

Effective from July 01, 2019

Hospital Cash Plan:

UBL Cardholders can secure themselves and their families against financial emergencies during

hospitalization. Our card members can avail up to Rs.8,000/- cash coverage of each day in

hospital.

Family Security Plan:

UBL Family security plan helps UBL Cardholders to prepare for the uncertainties of life where an

injury or death of an earning family member can cause serious problems. This plan ensures a

regular source of income for the family and funds can either be paid in lump sum or by fixed monthly

payments. Coverage under Family Security Plan is up to Rs.75,000/- per month up to 3 years

Child Education Plan:

UBL Child Education Plan provides cover for children (aged between 1 to 21 years or full time

student below 25 years) for up to Rs.1,000,000 in case of your accidental death &/or permanent

disability

Free Travel Accident Insurance:

Each time customer uses his/her UBL Credit Card to purchase airline, train or bus tickets, they are

automatically covered against any sort of accident that might befall them while traveling:

The coverage amounts are: Classic Card: Up to Rs.3.5 Million Gold Card: Up to Rs.7 Million

P.S.UBL solicits / communicates insurance policies through different communication channels on

behalf of the insurance companies.

All the above plans are third party insurance products. UBL is acting as a distributor of EFU & ACE

Insurance Company and Premium amount will be charged with the consent of the customer.

Over Limit Fee If assigned credit limit is exceeded due to any retail purchase or system related charge/s, customer

will be charged Over Limit Fee of PKR 1,500/- per instance.

Card Renewal Card will be automatically renewed and replaced unless specified by customer.

Renewal Charges not applicable

Foreign Transaction 4.5 % of the transaction amount.

Charges Foreign transaction charges apply on purchases made in foreign currency AND/OR where the

Merchant is residing outside the country or the settlement currency is other than local currency and

processes the transaction in its local currency. Charges are applicable on all USD transactions and

all PKR transactions conducted outside of Pakistan.

Customer may select his/her billing cycle during card activation or by calling UBL’s

Billing Cycle

24-hour Contact Center.

Effective from July 01, 2019

Other Information

Customer account details will be shared with a third party vendor for the purpose of preparing physical statement of Accounts.

The above mentioned detail has been mentioned for information purposes and is subject to change from time to time. Please

refer to the Schedule of Charges (SOC) placed on our website (http://www.ubldirect.com) or at our branches for latest

updates.

I hereby authorize the bank to obtain information / data regarding my financial and personal details from any credit bureau, agent, banks,

financial institutions, companies for purposes of processing my application and monitoring my facilities / account. Further I authorize the

bank to disclose and share information / data about my account / facilities to / with any other credit bureau, agent, banks, financial

institutions or companies as the bank considers appropriate from time to time.

I hereby confirm that I have understood and agreed to the information in this Summary Box.

_____________________________ ______________________________________

Customer’s Signatures & Date Authorized Banker’s Signature, Stamp and Date

Effective from July 01, 2019

You might also like

- #BWNLLSV #000000Q3S7YYT6A8#000JMA90F MR John Doe 2 Post Alley, SEATTLE, WA 98101Document9 pages#BWNLLSV #000000Q3S7YYT6A8#000JMA90F MR John Doe 2 Post Alley, SEATTLE, WA 98101HERBNEISHA Rainey100% (5)

- Chapter 6 Practice TestDocument4 pagesChapter 6 Practice TestQizhen Su100% (1)

- Blank Ncnda ImfpaDocument19 pagesBlank Ncnda ImfpaDickie Tsang100% (4)

- Anz Access Advantage Statement: Welcome To Your Anz Account at A GlanceDocument5 pagesAnz Access Advantage Statement: Welcome To Your Anz Account at A GlanceNadiia Avetisian100% (1)

- Data Migration Projects TDDDocument30 pagesData Migration Projects TDDMadhuNo ratings yet

- Asset - Migration - in - SAP - S - 4HANA - 1631694693 2021-09-15 08 - 32 - 29Document10 pagesAsset - Migration - in - SAP - S - 4HANA - 1631694693 2021-09-15 08 - 32 - 29Konstantin VutovNo ratings yet

- Assignment of ET NEWS ECO3Document72 pagesAssignment of ET NEWS ECO3SakshiNo ratings yet

- Mojo Platinum Credit Card: INR 1000 INR 1000Document4 pagesMojo Platinum Credit Card: INR 1000 INR 1000Saksham Goel100% (2)

- Unlimited Cash Back Bank Account, by Green Dot Deposit Account AgreementDocument49 pagesUnlimited Cash Back Bank Account, by Green Dot Deposit Account AgreementalanNo ratings yet

- Unit Three Money - Forms and FunctionsDocument6 pagesUnit Three Money - Forms and FunctionsMihai TudorNo ratings yet

- Credit Card Summary Box: Information ExplanationDocument4 pagesCredit Card Summary Box: Information ExplanationPanhji GaadiNo ratings yet

- Key Fact Statement of SBM Credilio Credit Card Description FeesDocument5 pagesKey Fact Statement of SBM Credilio Credit Card Description Feesgargmayank489.mgNo ratings yet

- HBL - Updated Charges Wef From 1-Jan-2018Document3 pagesHBL - Updated Charges Wef From 1-Jan-2018Mubin AshrafNo ratings yet

- HBL Credit Card - Basic Charges Sheet (Version 2 W.E.F July 01 2019)Document2 pagesHBL Credit Card - Basic Charges Sheet (Version 2 W.E.F July 01 2019)shani908No ratings yet

- Important TNCDocument20 pagesImportant TNCsanthoshsk3072002No ratings yet

- 17-CC-141 Credit Card New APR Sheet (VAT) - ENDocument2 pages17-CC-141 Credit Card New APR Sheet (VAT) - ENFaysal MadiNo ratings yet

- Key Fact Sheet - Credit Cards - 1st January 2020 To 30th June 2020 PDFDocument2 pagesKey Fact Sheet - Credit Cards - 1st January 2020 To 30th June 2020 PDFAbdul Rehman IlahiNo ratings yet

- CC Products Disclosure SheetDocument13 pagesCC Products Disclosure SheetLoVe YiYiNo ratings yet

- BT Credit Card Summary BoxDocument2 pagesBT Credit Card Summary BoxDawoodd10No ratings yet

- Key Fact Sheet (HBL CreditCard) - July2018Document5 pagesKey Fact Sheet (HBL CreditCard) - July2018pakistan jobsNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document44 pagesSUPERCARD Most Important Terms and Conditions (MITC)Chouhan Akshay SinghNo ratings yet

- Everyday Credit Card Keyfacts DocumentDocument10 pagesEveryday Credit Card Keyfacts Documentnoddieedwards260373No ratings yet

- Soc Idfc 2Document1 pageSoc Idfc 2rk4322016No ratings yet

- Key Fact Statement CorporateDocument7 pagesKey Fact Statement CorporateRAM MAURYANo ratings yet

- Key Fact Sheet - Credit Cards - 1st July 2019 To 31st Dec 2019Document2 pagesKey Fact Sheet - Credit Cards - 1st July 2019 To 31st Dec 2019Zaviar AliNo ratings yet

- Riplay en 2024Document4 pagesRiplay en 2024Rumah JaheNo ratings yet

- RBL BankDocument17 pagesRBL BankorekishNo ratings yet

- BFL MITC 02june21 - Final PDFDocument24 pagesBFL MITC 02june21 - Final PDFLokesh SriramNo ratings yet

- Balance Transfer Special Rate - HomeDocument2 pagesBalance Transfer Special Rate - Hometech.filnipponNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document17 pagesSUPERCARD Most Important Terms and Conditions (MITC)jinesh vgNo ratings yet

- ShopriteDocument1 pageShopriteAlrexie pgNo ratings yet

- Heritage MITCDocument12 pagesHeritage MITCSankalp PatelNo ratings yet

- Most Important Terms and ConditionsDocument44 pagesMost Important Terms and Conditionssarang chawareNo ratings yet

- Supercard Most Important Terms and ConditionsDocument26 pagesSupercard Most Important Terms and Conditionstauseef21scribdNo ratings yet

- Mitc For Amazon Pay Credit CardDocument7 pagesMitc For Amazon Pay Credit CardBlain Santhosh FernandesNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document44 pagesSUPERCARD Most Important Terms and Conditions (MITC)Aazad JiiNo ratings yet

- Corporate Finance: Credit CardsDocument24 pagesCorporate Finance: Credit Cardsusmanahmadqadri100% (2)

- 2018 FRM CandidateGuideDocument14 pages2018 FRM CandidateGuideSagar SuriNo ratings yet

- Crest Mitc LowDocument12 pagesCrest Mitc LowswastikNo ratings yet

- Niyo Global SBM CC - SOCDocument1 pageNiyo Global SBM CC - SOCMohit OberoiNo ratings yet

- Mobile Money Infosheet:: McashDocument2 pagesMobile Money Infosheet:: Mcashmoin06No ratings yet

- Zaggle Fee StructureDocument1 pageZaggle Fee StructureVishal TiwariNo ratings yet

- Fees and Charges For RHB Credit Card-I 2Document3 pagesFees and Charges For RHB Credit Card-I 2emnouseoffNo ratings yet

- Credit Process Manual For Lending Against GoldDocument28 pagesCredit Process Manual For Lending Against GoldAmit SinghNo ratings yet

- SCHEDULE - OF - CHARGES - Combined - PoS - PGMarch - 14 PDFDocument2 pagesSCHEDULE - OF - CHARGES - Combined - PoS - PGMarch - 14 PDFnits_chawlaNo ratings yet

- Kfs 3000Document1 pageKfs 3000PAVAN GHOLAPNo ratings yet

- SOC FlyerDocument2 pagesSOC Flyersammer1985No ratings yet

- PRODUCT NOTE - Mahindra Fixed DepositDocument5 pagesPRODUCT NOTE - Mahindra Fixed Depositmani8312No ratings yet

- MITC - Scapia Credit Card - 15-June-2023Document5 pagesMITC - Scapia Credit Card - 15-June-2023BhushanNo ratings yet

- CitiBusiness CurrentAccount SOCDocument1 pageCitiBusiness CurrentAccount SOCbdhariwala48No ratings yet

- Kotak Advance Fee-OnlineDocument1 pageKotak Advance Fee-Onlinejay.kumNo ratings yet

- SuperCard MITC PDFDocument47 pagesSuperCard MITC PDFPrudhvi RajNo ratings yet

- Transaction Conversion FormDocument1 pageTransaction Conversion FormROQUE JAY BROCENo ratings yet

- 2022 Purchase Convert Special Rate - HomeDocument3 pages2022 Purchase Convert Special Rate - HomeOT PRACTICE TIMENo ratings yet

- Bajaj Tiger CC MITC NewDocument12 pagesBajaj Tiger CC MITC NewMinatiNo ratings yet

- RBL MITC FinalDocument43 pagesRBL MITC Finalharshitgupta000000No ratings yet

- Summary Box For The Natwest Credit Card: Our Pricing PolicyDocument2 pagesSummary Box For The Natwest Credit Card: Our Pricing PolicylftmadNo ratings yet

- HDFC Bank Marketing StrategiesDocument28 pagesHDFC Bank Marketing Strategiespriya choudharyNo ratings yet

- Niyo Global SBM CC - SOCDocument1 pageNiyo Global SBM CC - SOCAvijit DebnathNo ratings yet

- Kfs LTFDocument1 pageKfs LTFsamarth guptaNo ratings yet

- Sustaining PromoDocument11 pagesSustaining PromoCarla Dela CruzNo ratings yet

- Sosc Ver 210313Document3 pagesSosc Ver 210313Shashank AgarwalNo ratings yet

- Mitc For Amazon Pay Credit CardDocument7 pagesMitc For Amazon Pay Credit Cardsomeonestupid19690% (1)

- Platinum Aura Edge Govt Card MITC 4 10 2022Document12 pagesPlatinum Aura Edge Govt Card MITC 4 10 2022Aaryan S.No ratings yet

- India'S First Supercard: A Credit Card With The Power of Four Cards in OneDocument11 pagesIndia'S First Supercard: A Credit Card With The Power of Four Cards in OnevipulNo ratings yet

- Platinum Plus Supercard Faqs 3 07 02 18 PDFDocument11 pagesPlatinum Plus Supercard Faqs 3 07 02 18 PDFMidimalapu Venu ReddyNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Home Take Exam Investment ManagementDocument29 pagesHome Take Exam Investment ManagementyebegashetNo ratings yet

- Compilation of BFM FormsDocument118 pagesCompilation of BFM FormsMaricris BiscarraNo ratings yet

- Kotak Multi Currency World Travel Application FormDocument2 pagesKotak Multi Currency World Travel Application FormVivek ShuklaNo ratings yet

- Atlas ClubDocument29 pagesAtlas ClubConsumatore InformatoNo ratings yet

- MCB Project ReportDocument18 pagesMCB Project ReportAyaan Muhammad0% (1)

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- Number of Employees and Their Duties:: Branch Manager Mr. Nadeem YousafDocument6 pagesNumber of Employees and Their Duties:: Branch Manager Mr. Nadeem Yousafإحسان شهزادNo ratings yet

- NRB News Vol.36 20770404 PDFDocument6 pagesNRB News Vol.36 20770404 PDFNarenBistaNo ratings yet

- Chapter 2Document28 pagesChapter 2Kul Bunna100% (1)

- 26Document302 pages26m_a_1993No ratings yet

- Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesGrace Period Granted - 1 Month As Per RBI Guidelines To Restore MABprasanNo ratings yet

- Ncnda Imfpa Liberty Shanay 100kg-AuDocument12 pagesNcnda Imfpa Liberty Shanay 100kg-AuJuan BriceñoNo ratings yet

- Banking Products and Operations - Unit 4Document57 pagesBanking Products and Operations - Unit 4Vaidyanathan RavichandranNo ratings yet

- Mnemonics of AuditsDocument17 pagesMnemonics of AuditsKhundrakpam SatyabartaNo ratings yet

- Lockbox Process in SAP S4 HANADocument16 pagesLockbox Process in SAP S4 HANAashokgsingh4893No ratings yet

- IFRS vs. IFRS For SMEsDocument33 pagesIFRS vs. IFRS For SMEsLohraine DyNo ratings yet

- At P Finals CasesDocument62 pagesAt P Finals CasesGladys Bustria OrlinoNo ratings yet

- Malinao, Chatty Bsa 3 - 1A: Name: Date: ScoreDocument3 pagesMalinao, Chatty Bsa 3 - 1A: Name: Date: ScoreChatty MalinaoNo ratings yet

- Remedies NIRCDocument25 pagesRemedies NIRCTj CabacunganNo ratings yet

- Onapal v. CA FPIB v. CADocument5 pagesOnapal v. CA FPIB v. CAAnonymous XvwKtnSrMR0% (1)

- Teresita Buenaflor Shoes 5 PDF FreeDocument19 pagesTeresita Buenaflor Shoes 5 PDF FreeAlexandrea San Buenaventura Baay100% (1)