Professional Documents

Culture Documents

Artical On Failure of Kingfisher Airlines

Uploaded by

VishalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Artical On Failure of Kingfisher Airlines

Uploaded by

VishalCopyright:

Available Formats

Name: Janki Unadkat

Roll no: Im-15107

Airlines' crisis: Why is Kingfisher Airlines constantly

losing money

By

Vivek Kaul

Kingfisher has started it’s airline services in May 2005 with huge expectations, investors also had faith

on Vijay Mallya because he is running United beverages group(Kingfisher Beer) successfully, he has a

good relationship with top politicians in India, his personal wealth is more than 7000 crore at that

time.

It takes a brave man to buy an airline. And it takes a braver man to keep running it into the ground.

Ask liquor baron Vijay Mallya, who has been running Kingfisher Airlines for a while now. The airline

now has accumulated losses running into more than Rs 6000 crore, having never made money since

its launch in 2005.

But that is hardly surprising, given that most airlines make losses rather than profits. Warren Buffett

explained this in a letter he wrote to the shareholders of Berkshir . explained this in a letter he wrote to

the shareholders of Berkshire Hathaway in February 2008: "The worst sort of business is one that

grows rapidly, requires significant capital to engender the growth, and then earns little or no money.

Think airlines. Here, a durable competitive advantage has proven elusive ever since the days of the

Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done

his successors a huge favour by shooting Orville down." But such is the glamour of owning an airline

that people cannot keep away from it. This, despite the evidence of the sector making huge losses

because of the very high capital required to start it, tough competition and the rising price of oil over

the last few years.

Interestingly, the only airline to make profits consistently over the years is Southwest Airlines. The

low-cost airline has made profits year after year since it started operating in 1973, though in the

recent past its its profits have come more from successful bets on oil derivatives rather than

passenger revenue.

The reason airlines constantly lose money is because it is one business where companies really have

no way to control their costs. The primary expense in running an airline (a company doesn't always

have to buy the aircrafts, it can lease them) is oil. And oil prices in the recent past have been on their

way up and currently quote at around $120 a barrel. Airline companies have no control over this price.

The higher it goes, the higher is their expenditure in running the airline and given the competition that

prevails, they are not always in a position to pass on the increasing cost to the customer

Hence, airlines are specialised businesses which require full time attention. Mallya's business

interests are too diverse to allow him the time and attention required to manage Kingfisher, busy as

he is running his diverse businesses and doing other things. What clearly did not help was his

decision to take over Deccan Aviation (which he shut down a few months ago).

A premium brand like Kingfisher operating a low-cost airline, by buying Air Deccan and rebranding it

as Kingfisher Red, was a big mistake in the first place. Also his other primary business interests are in

the fields of alcohol and now real estate. There isn't really any link among these businesses.

Businesses over the years have become more complicated. And just because a company has been

good at one particular business doesn't mean it will be good at another totally unrelated business.

Several big businessmen have learnt this in the recent past, the hard way. Reliance's attempts at the

retail business haven't gone anywhere. Bharti recently exited the insurance business it had started

with much fanfare. NDTV's attempts in the general entertainment business by launching the Imagine

channel came a cropper.

Marketing guru Al Ries has said in the past "Focus is the essence of marketing and branding." To his

observation, we could add the word 'business' as well. And it's time Mallya learnt that lesson. The

good times last as long as you stick to what you know.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Stiffened Seat ConnectionDocument2 pagesStiffened Seat ConnectionVishalNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Design and Analysis of Pre-Engineered Buildings Using STAAD ProDocument6 pagesDesign and Analysis of Pre-Engineered Buildings Using STAAD ProHowo4DieNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- (Code) ACI 349.2R-97 Embedment Design Examples (ACI, 1997)Document26 pages(Code) ACI 349.2R-97 Embedment Design Examples (ACI, 1997)sungwgNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- An Introduction To Vedic Mathematics: Course ContentDocument0 pagesAn Introduction To Vedic Mathematics: Course ContentAmit ChaudhuriNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- DBR How To MakeDocument15 pagesDBR How To Maketanmay271100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- DBR How To MakeDocument15 pagesDBR How To Maketanmay271100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- DBR How To MakeDocument15 pagesDBR How To Maketanmay271100% (1)

- DBR How To MakeDocument15 pagesDBR How To Maketanmay271100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- DBR How To MakeDocument15 pagesDBR How To Maketanmay271100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Truss PDFDocument5 pagesTruss PDFVishalNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Pay Slip Details for Siddharth in September 2022Document1 pagePay Slip Details for Siddharth in September 2022SiddharthNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Rags2Riches by Reese FernandezDocument1 pageRags2Riches by Reese FernandezChristian Gerard P. BerouNo ratings yet

- Documento PDFDocument6 pagesDocumento PDFangye08vivasNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Strategic Marketing Plan of NagadDocument26 pagesStrategic Marketing Plan of Nagadhojega100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- 29 - Bechtel r2 Project Execution Plan - Ac Submission PDFDocument53 pages29 - Bechtel r2 Project Execution Plan - Ac Submission PDFtarek.abbas8598No ratings yet

- Adobe Scan May 04, 2021Document12 pagesAdobe Scan May 04, 2021Anil ShuklaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Week 5 - Production SmoothingDocument34 pagesWeek 5 - Production SmoothingQuynh Chau Tran100% (1)

- ODLIČNO Marsden - Et - Al-2000-Sociologia - Ruralis PDFDocument15 pagesODLIČNO Marsden - Et - Al-2000-Sociologia - Ruralis PDFIzabela MugosaNo ratings yet

- Poa - Edu Loan1Document3 pagesPoa - Edu Loan1Anand JoshiNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 04 - Slums and Informal Settlements: Study of Its Cause and EffectsDocument6 pages04 - Slums and Informal Settlements: Study of Its Cause and EffectsJC DoloritoNo ratings yet

- Saic P 3002Document1 pageSaic P 3002aneeshjokay0% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Contract of AgencyDocument2 pagesContract of Agencyjonel sembranaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Auto and Home Insurance QuotesDocument9 pagesAuto and Home Insurance QuotesBarja FeedsNo ratings yet

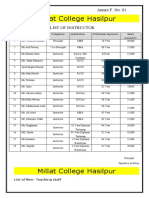

- Millat College Hasilpur: Annex F. No. 01Document3 pagesMillat College Hasilpur: Annex F. No. 01Hashim IjazNo ratings yet

- Sales AssDocument5 pagesSales AssPASCHALNo ratings yet

- There Are No Permanent Changes Because Change Itself Is Permanent. It Behooves The Industrialist To Research and The Investor To Be VigilantDocument10 pagesThere Are No Permanent Changes Because Change Itself Is Permanent. It Behooves The Industrialist To Research and The Investor To Be Vigilantagrvinit123No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Presentation - Pakistan Railways (Swot Analysis)Document24 pagesPresentation - Pakistan Railways (Swot Analysis)zubair_ahmed_importsNo ratings yet

- Department of Labor and Employment Vs Kentex Manufacturing Corporation (Case Digest)Document1 pageDepartment of Labor and Employment Vs Kentex Manufacturing Corporation (Case Digest)Ma. Fabiana GarciaNo ratings yet

- Answers - Test - Strategic Management Class 0322Document5 pagesAnswers - Test - Strategic Management Class 0322Kuzi TolleNo ratings yet

- Deed of Conditional Sale ReaperDocument2 pagesDeed of Conditional Sale ReaperRandolf Forster DeeNo ratings yet

- Fortinet Specialized Partner NFR KitDocument8 pagesFortinet Specialized Partner NFR KitQualit ConsultingNo ratings yet

- Internal Control and Control Risk HandoutsDocument38 pagesInternal Control and Control Risk Handoutsumar shahzadNo ratings yet

- Specialized Expertise: Established Knowledge, Guiding You ThroughDocument6 pagesSpecialized Expertise: Established Knowledge, Guiding You ThroughOmar GuillenNo ratings yet

- LESSONS LEARNED FROM CO2 SYSTEM SHUTDOWNDocument6 pagesLESSONS LEARNED FROM CO2 SYSTEM SHUTDOWNLuthius100% (2)

- The Isis Engineering Company Operates A Job Order Costing System WhichDocument2 pagesThe Isis Engineering Company Operates A Job Order Costing System WhichAmit PandeyNo ratings yet

- A brief history of how brands and place branding evolvedDocument7 pagesA brief history of how brands and place branding evolvedSalma wahbiNo ratings yet

- BC 103. Taxation IncomeDocument8 pagesBC 103. Taxation Incomezekekomatsu0No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LEGAL DOSSIER AND LEGAL DOCUMENT IN ENGLISHDocument58 pagesLEGAL DOSSIER AND LEGAL DOCUMENT IN ENGLISHCristian Silva TapiaNo ratings yet

- Basel IV and Proportionality Initiatives enDocument12 pagesBasel IV and Proportionality Initiatives enJune JuneNo ratings yet

- Iso-Dis-10009-2023 enDocument15 pagesIso-Dis-10009-2023 enSandro GarcíaNo ratings yet