Professional Documents

Culture Documents

Latihan Soal Cash Flow

Uploaded by

Ruth AngeliaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Latihan Soal Cash Flow

Uploaded by

Ruth AngeliaCopyright:

Available Formats

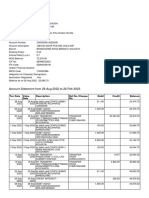

LATIHAN SOAL CASH FLOW

ANNA COMPANY

Comparative Statements of Financial Position

December 31

($ in thousands)

Assets 2019 2018

Land $ 157,500 $ 150,000

Buildings 450,000 450,000

Accumulated depreciation – building (45,000) (30,000)

Equipment 262,500 75,000

Accumulated depreciation – equipment (30,000) (18,000)

Prepaid expenses 12,000 15,000

Inventory 75,000 0

Accounts receivable 75,000 43,500

Cash 142,500 91,500

Totals 1,099,500 777,000

Equity and Liabilities

Share capital – ordinary ($1 par) $ 361,500 123,000

Bonds Payable 292,500 307,500

Accounts Payable 75,000 105,000

Accrued expense payable 22,500 0

Retained earnings 348,000 241,500

Totals 1.099.500 777,000

ANNA COMPANY

Income Statement

For the Year Ended December 31, 2019

($ in thousands)

Sales revenue $ 1,500,000

Cost of goods sold $ 825,000

Operating expenses 331,500

Interest expense 22,500

Loss on disposal of plant assets 1,500 (1,180,500)

Income before income taxes 319,500

Income tax expenses (147,500)

Net Income $172,500

Additional Information (all amounts in thousands of $)

1) Operating expenses include depreciation expense of $34,500.

2) Equipment with a cost of $63,000 and a book value of $67,500 was sold for $66,000

cash.

3) Land was sold at its book value for cash.

4) Interest expense of $22,500 was paid in cash.

5) Equipment with a cost of $250,500 was purchased for cash.

6) Bonds of $15,000 were redeemed at their face value for cash.

7) Ordinary shares ($2 par) of $75,750 were issued for cash.

8) Cash dividends of $66,000 were declared and paid in 2019.

9) Ordinary shares of $75,000 were issued in exchange for land.

Instruction :

Prepare a statement of cash flow using the indirect method!

You might also like

- Corporate FinanceDocument5 pagesCorporate FinancejahidkhanNo ratings yet

- Intermediate Debt and Leasing: Debagus SubagjaDocument12 pagesIntermediate Debt and Leasing: Debagus SubagjaDebagus SubagjaNo ratings yet

- Soal Latihan Cash Flow Fix Dan JawabanDocument6 pagesSoal Latihan Cash Flow Fix Dan JawabanInggil Subhan100% (1)

- AK1 Pertemuan 1Document41 pagesAK1 Pertemuan 1Stevani AngeliaaNo ratings yet

- Contoh Dan Soal Cash FlowDocument9 pagesContoh Dan Soal Cash FlowAltaf HauzanNo ratings yet

- Financial accounting journal entriesDocument3 pagesFinancial accounting journal entriesAlfiyanNo ratings yet

- 117 - 102 - 116 - 234-FINAL REPORT PT Panca Budi Idaman TBK Dan Entitas Anak 31 Desember 2017 PDFDocument138 pages117 - 102 - 116 - 234-FINAL REPORT PT Panca Budi Idaman TBK Dan Entitas Anak 31 Desember 2017 PDFYanNo ratings yet

- PT Sepatu Bata Financial Analysis and 2008 Financial CrisisDocument6 pagesPT Sepatu Bata Financial Analysis and 2008 Financial CrisisOlim BariziNo ratings yet

- Soal Siklus AkuntansiDocument10 pagesSoal Siklus AkuntansiAlfin Dwi SaptaNo ratings yet

- Soal Accounting (Teknikal EXCEL)Document9 pagesSoal Accounting (Teknikal EXCEL)M. Nico Wibowo0% (1)

- Kumpulan Quiz UAS AkmenDocument23 pagesKumpulan Quiz UAS AkmenPutri NabilahNo ratings yet

- STTP - Annual Report 2019Document192 pagesSTTP - Annual Report 2019reroll exosNo ratings yet

- Tugas Sesi 7Document5 pagesTugas Sesi 7mutmainnahNo ratings yet

- MYOB Accounting Module PracticumDocument121 pagesMYOB Accounting Module PracticumVISTANo ratings yet

- RudiSetiadi 16AKJ ManagementAuditDocument2 pagesRudiSetiadi 16AKJ ManagementAuditRudi SetiadiNo ratings yet

- Tugas ObligasiDocument15 pagesTugas Obligasiwahdah ulin nafisahNo ratings yet

- Review Questions: Solutions Manual To Accompany Dunn, Enterprise Information Systems: A Pattern Based Approach, 3eDocument17 pagesReview Questions: Solutions Manual To Accompany Dunn, Enterprise Information Systems: A Pattern Based Approach, 3eOpirisky ApriliantyNo ratings yet

- AR2013 UltrajayaDocument166 pagesAR2013 UltrajayaTeri GregNo ratings yet

- Big Deal Vs SmallDocument2 pagesBig Deal Vs Smallspectrum_48No ratings yet

- Contoh Soal Pajak Dan PembahasannyaDocument24 pagesContoh Soal Pajak Dan PembahasannyaMerita Chen0% (1)

- Latihan Soal Analysis of Financial StatementDocument7 pagesLatihan Soal Analysis of Financial StatementCaroline H24No ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document5 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )johanes ongoNo ratings yet

- ch11 SolDocument20 pagesch11 SolJohn Nigz PayeeNo ratings yet

- IFA-I Assignment PDFDocument3 pagesIFA-I Assignment PDFNatnael AsfawNo ratings yet

- Case StudyDocument22 pagesCase StudyM Zain Ul AbedeenNo ratings yet

- Sesi 11 & 12 SharedDocument28 pagesSesi 11 & 12 SharedDian Permata SariNo ratings yet

- Accy225 Tri 2 2019 Tutorial 3 Revenue and Expenditure Controls SolutionDocument7 pagesAccy225 Tri 2 2019 Tutorial 3 Revenue and Expenditure Controls Solutionlana del reyNo ratings yet

- On January 1 2014 Paxton Company Purchased A 70 InterestDocument1 pageOn January 1 2014 Paxton Company Purchased A 70 InterestMuhammad ShahidNo ratings yet

- Materi APK Bapak Steven Tanggara RPL ACPA 7.7.20 IAPIDocument67 pagesMateri APK Bapak Steven Tanggara RPL ACPA 7.7.20 IAPIMuhammad TaufiqNo ratings yet

- Gracella Irwana - G - Pert 05-06 - Sia - 1Document51 pagesGracella Irwana - G - Pert 05-06 - Sia - 1Gracella IrwanaNo ratings yet

- International Investment AppraisalDocument6 pagesInternational Investment AppraisalZeeshan Jafri100% (1)

- Advanced Accounting Solutions Chapter-6Document2 pagesAdvanced Accounting Solutions Chapter-6john carlos doringo100% (1)

- Excel RevenueDocument44 pagesExcel RevenueromaricheNo ratings yet

- Jawaban UTS Manajemen KeuanganDocument16 pagesJawaban UTS Manajemen KeuanganMikhail BarenovNo ratings yet

- Siklus Pendapatan PDFDocument1 pageSiklus Pendapatan PDFwicak100% (1)

- Ebook PDF Financial Accounting Theory 8th EditionDocument41 pagesEbook PDF Financial Accounting Theory 8th Editionbrad.harper906No ratings yet

- MINI CASE - CH 14Document2 pagesMINI CASE - CH 14Dedi JayadiNo ratings yet

- Weisberg Corporation Has 10 000 Shares of 100 Par Value 6 PDFDocument1 pageWeisberg Corporation Has 10 000 Shares of 100 Par Value 6 PDFAnbu jaromiaNo ratings yet

- SCPI Annual Report 2015 - Bukti Gaada ADK (Gaditulis)Document124 pagesSCPI Annual Report 2015 - Bukti Gaada ADK (Gaditulis)Choco Glider100% (1)

- FinalDocument5 pagesFinalanika fierroNo ratings yet

- B1B121009 Linda Solusi Bab 8Document7 pagesB1B121009 Linda Solusi Bab 8Aslinda MutmainahNo ratings yet

- Solar Panel Stock Analysis and ValuationDocument10 pagesSolar Panel Stock Analysis and ValuationAkuw AjahNo ratings yet

- Tugas Chapter 15Document12 pagesTugas Chapter 15Ach Junaidi Irham FauziNo ratings yet

- Sesi 9 & 10 Praktikum - SharedDocument9 pagesSesi 9 & 10 Praktikum - SharedDian Permata SariNo ratings yet

- MPA703 Management Accounting Semester 2, 2019 AssignmentDocument21 pagesMPA703 Management Accounting Semester 2, 2019 AssignmentrhagitaanggyNo ratings yet

- SIA 1 ProblemDocument7 pagesSIA 1 Problemleny prianiNo ratings yet

- .Analisis Pengaruh DER, DPR, ROE Dan Size Terhadap PBV Perusahaan Manufaktur Yang Listing Di BEI Periode 2005-2007Document9 pages.Analisis Pengaruh DER, DPR, ROE Dan Size Terhadap PBV Perusahaan Manufaktur Yang Listing Di BEI Periode 2005-2007AtikaSandyNo ratings yet

- Acc TestDocument1 pageAcc TestWie Liana0% (2)

- Akuntansi Keuangan LanjutanDocument28 pagesAkuntansi Keuangan LanjutanYulitaNo ratings yet

- Soal Latihan MYOBDocument7 pagesSoal Latihan MYOBWinaya LarasatiNo ratings yet

- Neraca Saldo (Trial Balance)Document52 pagesNeraca Saldo (Trial Balance)Mochammad Firman IbrahimNo ratings yet

- Contoh Soal Laporan Arus KasDocument2 pagesContoh Soal Laporan Arus KasGabriel HarrisNo ratings yet

- Latihan Soal Advanced Accounting Chapter 3Document18 pagesLatihan Soal Advanced Accounting Chapter 3JulyaniNo ratings yet

- Risiko LikuiditasDocument19 pagesRisiko LikuiditasmiftaNo ratings yet

- SOAL AKUNTANSI KEUANGANDocument4 pagesSOAL AKUNTANSI KEUANGANekaeva03No ratings yet

- Kementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisDocument2 pagesKementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisAntique NariswariNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Latihan Soal KelompokDocument3 pagesLatihan Soal KelompokPutri RahmawatiNo ratings yet

- Case Study 1Document2 pagesCase Study 1ruruNo ratings yet

- Bank StatementDocument5 pagesBank StatementSANJIB GHOSHNo ratings yet

- EContent 1 2023 06 24 10 20 29 QTDM Studymaterialfeb23pdf 2023 03 15 11 44 02Document23 pagesEContent 1 2023 06 24 10 20 29 QTDM Studymaterialfeb23pdf 2023 03 15 11 44 02Tom CruiseNo ratings yet

- Mintons Car MartDocument5 pagesMintons Car MartDiệp AnhNo ratings yet

- Mayoral Candidate Profile - Laurie Sears DeppaDocument1 pageMayoral Candidate Profile - Laurie Sears DeppaZainaAdamuNo ratings yet

- Annual Income Statement Report Name: Laporan Laba Rugi / Nama / Ery Abd Nasir PelupessyDocument2 pagesAnnual Income Statement Report Name: Laporan Laba Rugi / Nama / Ery Abd Nasir PelupessyErry Abdul Nasir PelupessyNo ratings yet

- Work: Waterproofing Works For The Proposed 'Residential & Commercial Complex at Mohili, Sakinaka Mumbai 400 072' ContractorDocument11 pagesWork: Waterproofing Works For The Proposed 'Residential & Commercial Complex at Mohili, Sakinaka Mumbai 400 072' ContractorShubham DubeyNo ratings yet

- Financial Statement Analysis ReportDocument47 pagesFinancial Statement Analysis Reportgaurang90% (80)

- Passreview: Passreview - It Certification Exams Pass ReviewDocument5 pagesPassreview: Passreview - It Certification Exams Pass Reviewdisney007No ratings yet

- Semi Formal ExamplesDocument3 pagesSemi Formal ExamplesDjshh oiNo ratings yet

- IncentiveDocument7 pagesIncentiveSwetaNo ratings yet

- AICPA Problem Set LiabilitiesDocument3 pagesAICPA Problem Set LiabilitiesElla Rence TablizoNo ratings yet

- Derivatives FundamentalsDocument1 pageDerivatives FundamentalsShailaja RaghavendraNo ratings yet

- P9 RevDocument540 pagesP9 Revayyanar7100% (1)

- Understanding Mergers and Acquisitions (M&A) Introduction: Mergers and Acquisitions (M&A) Are Complex Financial Transactions That InvolveDocument2 pagesUnderstanding Mergers and Acquisitions (M&A) Introduction: Mergers and Acquisitions (M&A) Are Complex Financial Transactions That InvolveSebastian StolkinerNo ratings yet

- Sales Order FormDocument1 pageSales Order FormDeepthireddyNo ratings yet

- Shrimp Farming in Pakistan Urdu GuideDocument17 pagesShrimp Farming in Pakistan Urdu GuidesohailauhNo ratings yet

- BuxlyDocument13 pagesBuxlyAimen KhatanaNo ratings yet

- Final Exam Theories ValuationDocument6 pagesFinal Exam Theories ValuationBLN-Hulo- Ronaldo M. Valdez SRNo ratings yet

- 4bs1 02 Que 20231122Document24 pages4bs1 02 Que 20231122supercoolhashir100% (1)

- Mba FT 2024-26Document27 pagesMba FT 2024-26Khushi BerryNo ratings yet

- Final Reaserch-3Document52 pagesFinal Reaserch-3Dereje BelayNo ratings yet

- Bsa - Finman - SyllabusDocument13 pagesBsa - Finman - SyllabusAbdulmajed Unda MimbantasNo ratings yet

- Organization: The Five Trademarks of Agile OrganizationsDocument20 pagesOrganization: The Five Trademarks of Agile OrganizationsAbdelmutalab Ibrahim AbdelrasulNo ratings yet

- MRA Project Milesone-1: BY-Shorya Goel PGP Dsba Oct - 20 BDocument35 pagesMRA Project Milesone-1: BY-Shorya Goel PGP Dsba Oct - 20 Bshorya90% (21)

- Pay Electric Bill by October 3rd to Avoid Late FeesDocument5 pagesPay Electric Bill by October 3rd to Avoid Late Feesnguyen tungNo ratings yet

- Trends in Ethics in Computing Assignment # 05 Sap Ids of Group MembersDocument2 pagesTrends in Ethics in Computing Assignment # 05 Sap Ids of Group Memberswardah mukhtarNo ratings yet

- Standardizing Innovation Management: An Opportunity For Smes in The Aerospace IndustryDocument43 pagesStandardizing Innovation Management: An Opportunity For Smes in The Aerospace IndustryDr. Ammar YakanNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- Solution Time Value of Money 5 Loan Amortization Schedule and PV of Perpetual Annuity and PV Growing Annuity 3PVyvICyHiDocument5 pagesSolution Time Value of Money 5 Loan Amortization Schedule and PV of Perpetual Annuity and PV Growing Annuity 3PVyvICyHiShareshth JainNo ratings yet

- BMOA DAYS GENERAL GUIDELINES FinalDocument26 pagesBMOA DAYS GENERAL GUIDELINES FinalCharlotte Balladares LarideNo ratings yet