Professional Documents

Culture Documents

Working MA

Working MA

Uploaded by

Jahidul Ahasan0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

Working MA.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesWorking MA

Working MA

Uploaded by

Jahidul AhasanCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

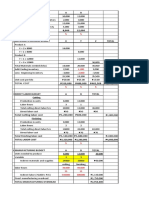

a) Absorption costing method

Paritculars Amount (£)

Direct material 100,000

Direct labour 150,000

Fixed overhead 250,000

Total cost 500,000

Number of units produced 10,000

(units)

Cost per unit under 50

absorption costing

b) Marginal costing

Paritculars Amount (£)

Direct material 100,000

Direct labour 150,000

Total cost 250,000

Number of units produced 10,000

(units)

Cost per unit under 25

absorption costing

Particulars January February

Sales revenue 700,000 560,000

January: 10,000 units @ £70

February: 8,000 pairs @ £70

Less: Cost of sales

Direct material 100,000 100,000

Direct labour 150,000 150,000

Fixed overhead 250,000 250,000

Cost of goods produced 500,000 500,000

Less: Ending inventory - (100,000)

Cost of goods sold (500,000) (400,000)

Profit 200,000 160,000

Particulars January February

Sales revenue 700,000 560,000

January: 10,000 units @ £70

February: 8,000 pairs @ £70

Less: Marginal cost of sales

Direct material 100,000 100,000

Direct labour 150,000 150,000

Cost of goods produced 250,000 250,000

Less: Ending inventory - (50,000)

Cost of goods sold (250,000) (200,000)

Contribution 450,000 360,000

Fixed overhead (250,000) (250,000)

Profit 200,000 110,000

Particulars Amount (£) Amount (£)

Profit according to marginal co 200,000 110,000

Add: Under allocation of 50,000

fixed cost in ending inventory

[(50-25) x 2,000]

Profit according to absorption 200,000 160,000

You might also like

- Special Report - Planet X WBDocument40 pagesSpecial Report - Planet X WBMf_Doom777100% (1)

- Paul Dukes (Auth.) - October and The World - Perspectives On The Russian Revolution-Macmillan Education UK (1979)Document233 pagesPaul Dukes (Auth.) - October and The World - Perspectives On The Russian Revolution-Macmillan Education UK (1979)Lazar39No ratings yet

- Living Comparative Liturgy Robert F Taft PDFDocument27 pagesLiving Comparative Liturgy Robert F Taft PDFUsca Ana-MariaNo ratings yet

- Test1 HL Seq Series Bin THM v1Document2 pagesTest1 HL Seq Series Bin THM v1priyaNo ratings yet

- Problem 9-1: Net IncomeDocument16 pagesProblem 9-1: Net IncomeHerlyn Juvelle SevillaNo ratings yet

- FK SummaryDocument4 pagesFK SummaryZane De witNo ratings yet

- Uniform Civil Code - One Nation, One Law (Research Paper)Document33 pagesUniform Civil Code - One Nation, One Law (Research Paper)Aditya Malhotra100% (1)

- Jose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyDocument6 pagesJose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyBernadette CaduyacNo ratings yet

- Building Quality CultureDocument20 pagesBuilding Quality CultureAnkurNo ratings yet

- Dispensers of California, Inc.Document7 pagesDispensers of California, Inc.Prashuk SethiNo ratings yet

- Flexible BudgetDocument3 pagesFlexible BudgetJasdeep Singh Deepu0% (2)

- n360 Process RecordingDocument7 pagesn360 Process Recordingapi-272566401100% (1)

- Model of Curriculum DevelopmentDocument15 pagesModel of Curriculum DevelopmentSupriya chhetryNo ratings yet

- BUS239 2018 Main Marking SchemeDocument13 pagesBUS239 2018 Main Marking SchemerahimNo ratings yet

- Mô HìnhDocument7 pagesMô HìnhThanh Tâm Lê ThịNo ratings yet

- Problem 2-29Document6 pagesProblem 2-29Love IslamNo ratings yet

- Quiz Absorption and Variable CostingDocument2 pagesQuiz Absorption and Variable CostingPISONANTA KRISETIANo ratings yet

- ASSIGNMENT N01 mgt402Document1 pageASSIGNMENT N01 mgt402armaghank1218No ratings yet

- Chap10 ProblemsDocument18 pagesChap10 ProblemsNikki GarciaNo ratings yet

- Case 1-Mano Sa: Additional InformationDocument17 pagesCase 1-Mano Sa: Additional InformationDavid MajánNo ratings yet

- Financial Cost Sheet Unit 2Document6 pagesFinancial Cost Sheet Unit 2Julls ApouakoneNo ratings yet

- UTS AkutansiDocument24 pagesUTS AkutansiAbraham KristiyonoNo ratings yet

- PrelimQuiz1 AnswerKeyDocument3 pagesPrelimQuiz1 AnswerKeyAnnabelle RafolsNo ratings yet

- Case 10 CLAUS StatementDocument6 pagesCase 10 CLAUS StatementClaudia AgüeraNo ratings yet

- Master Budget SolutionDocument2 pagesMaster Budget SolutionAra FloresNo ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- Solution Cost AccountingDocument3 pagesSolution Cost AccountingHaris KhanNo ratings yet

- Lecture 4Document33 pagesLecture 4api-3767414No ratings yet

- Intermediate Accounting 1 - Meeting 2 (Answers Sheets)Document4 pagesIntermediate Accounting 1 - Meeting 2 (Answers Sheets)WILLIAM CHANDRANo ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- Inventory ValuationDocument6 pagesInventory ValuationJane Bagui LaluñoNo ratings yet

- Chapter 2-Test Material 2 1Document7 pagesChapter 2-Test Material 2 1Marcus MonocayNo ratings yet

- Intacc Quiz 1Document6 pagesIntacc Quiz 1Rhea YugaNo ratings yet

- Midterm Exam FALL SOLUTION Feb 27Document10 pagesMidterm Exam FALL SOLUTION Feb 27rawanelayusNo ratings yet

- Quest 3Document4 pagesQuest 3kaji cruzNo ratings yet

- Absorption & Marginal Costing-1Document6 pagesAbsorption & Marginal Costing-1田淼No ratings yet

- Flexible Budget: ProblemsDocument3 pagesFlexible Budget: ProblemsRenu PoddarNo ratings yet

- Hans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentDocument4 pagesHans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentHans Gabriel T. CabatinganNo ratings yet

- Budget Format Sales Budget: Cash Collection Total Budgeted SalesDocument6 pagesBudget Format Sales Budget: Cash Collection Total Budgeted Salessernhaow_658673991No ratings yet

- Finals Unit 4 Exercise - Variable and Absorption CostingDocument2 pagesFinals Unit 4 Exercise - Variable and Absorption CostingMelo RiegoNo ratings yet

- Cost AccountingDocument39 pagesCost AccountingNadir ParachaNo ratings yet

- Quiz No. 4 - Variable and Absorption CostingDocument2 pagesQuiz No. 4 - Variable and Absorption CostingRio Cyrel CelleroNo ratings yet

- Assignment On BudgetingDocument5 pagesAssignment On BudgetingRameshNo ratings yet

- MAF Assignment QuestionDocument13 pagesMAF Assignment QuestionKietHuynhNo ratings yet

- Chapter - 1 Cost Sheet - Problems - & - Solution - 3-9Document12 pagesChapter - 1 Cost Sheet - Problems - & - Solution - 3-9Legends CreationNo ratings yet

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- Hà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICEDocument7 pagesHà Hoàng Anh - IBUFP4 - PA03 - CHAP 5+6 PRACTICE31231020411No ratings yet

- Direct Costing 4Document3 pagesDirect Costing 4Hasan AhmmedNo ratings yet

- 704966Document6 pages704966Alison JcNo ratings yet

- Mock Exam QuestionDocument11 pagesMock Exam QuestionSubmission PortalNo ratings yet

- Statement of Cost of Goods SoldDocument3 pagesStatement of Cost of Goods SoldMARIA67% (3)

- Reggie's BudgetDocument5 pagesReggie's BudgetYazan AdamNo ratings yet

- Hasan Yaseen 9990Document3 pagesHasan Yaseen 9990Haris KhanNo ratings yet

- COSMAN2 Final ExamDocument18 pagesCOSMAN2 Final ExamRIZLE SOGRADIELNo ratings yet

- April May June Quarter Product: 1 Budgeted Sales (Units) Selling Price Per Unit Total RevenueDocument18 pagesApril May June Quarter Product: 1 Budgeted Sales (Units) Selling Price Per Unit Total Revenueyonna anggrelinaNo ratings yet

- Variable Costing Case Part A SolutionDocument3 pagesVariable Costing Case Part A SolutionG, BNo ratings yet

- Q 8.2 Solution With WorkingsDocument8 pagesQ 8.2 Solution With WorkingsGhulam NabiNo ratings yet

- ExamDocument1 pageExamHarshNo ratings yet

- AnsweredASS17 AccountingDocument2 pagesAnsweredASS17 Accountingvomawew647No ratings yet

- Solution 10.18 & 10.22Document2 pagesSolution 10.18 & 10.22scheepersbrNo ratings yet

- ProblemsDocument11 pagesProblemsMohamed RefaayNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- WK 4 Solutions To Thread Practice ProblemsDocument3 pagesWK 4 Solutions To Thread Practice Problemsmasta4ulskilzNo ratings yet

- Jawaban Soal InventoryDocument4 pagesJawaban Soal InventorywlseptiaraNo ratings yet

- Manufacturing Account Worked Example Question 12Document6 pagesManufacturing Account Worked Example Question 12Roshan RamkhalawonNo ratings yet

- Job Order Costing (2-1 To 2-11)Document8 pagesJob Order Costing (2-1 To 2-11)Mhekylha's AñepoNo ratings yet

- Biasong SCMDocument10 pagesBiasong SCMgeraldine biasongNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Module 1-6 Luna ShielaMarie BSED Science 3ADocument20 pagesModule 1-6 Luna ShielaMarie BSED Science 3AJohn Bernard RiliNo ratings yet

- Running WildDocument34 pagesRunning WildCzink TiberiuNo ratings yet

- How Is Gender Constructed Through Social Interactions in The Shops of Hindley Street, and How Much Control Do We Really Have Over Already Established Gender Notions in The Hospitality IndustryDocument3 pagesHow Is Gender Constructed Through Social Interactions in The Shops of Hindley Street, and How Much Control Do We Really Have Over Already Established Gender Notions in The Hospitality Industrysheryl nangsNo ratings yet

- Process: Tutored By: Prof. Sunil D' AntoDocument23 pagesProcess: Tutored By: Prof. Sunil D' AntoArunNo ratings yet

- By Nandini S Patil From Alliance School of Law, Alliance University, Bengaluru "Give Me The Liberty To Know, To Utter, and To Argue Freely According To Conscience, Above All Liberties."Document13 pagesBy Nandini S Patil From Alliance School of Law, Alliance University, Bengaluru "Give Me The Liberty To Know, To Utter, and To Argue Freely According To Conscience, Above All Liberties."KASHISH AGARWALNo ratings yet

- Knowledge Representation and Reasoning: University "Politehnica" of Bucharest Department of Computer ScienceDocument25 pagesKnowledge Representation and Reasoning: University "Politehnica" of Bucharest Department of Computer Scienceusman kebatoNo ratings yet

- DocumentDocument38 pagesDocumentStalloneStalloneNo ratings yet

- Cover: Next PageDocument55 pagesCover: Next PagepoepoeNo ratings yet

- Major Science ThreoriesDocument98 pagesMajor Science ThreoriesShiarica Mae NeriNo ratings yet

- Health Behavior - MESP: Biochemistry / Dietetics / Behavior Analysis / Nutrition EducationDocument22 pagesHealth Behavior - MESP: Biochemistry / Dietetics / Behavior Analysis / Nutrition EducationDonna GudrunNo ratings yet

- Cave of LascauxDocument5 pagesCave of LascauxAira ManaboNo ratings yet

- New Century Mathematics 8 SyllabusDocument12 pagesNew Century Mathematics 8 SyllabusDee Jay Monteza Cabungan100% (1)

- SUBJECT VERB AGREEMENT LET ReviewerDocument2 pagesSUBJECT VERB AGREEMENT LET ReviewerMacky ReyesNo ratings yet

- Statistics and Probability Chapter 1 2 3Document89 pagesStatistics and Probability Chapter 1 2 3Ren PonceNo ratings yet

- DR Shwe Zin Maw (21-30)Document10 pagesDR Shwe Zin Maw (21-30)易嘉No ratings yet

- General Technologies Group LTD.: CASE 2.5Document9 pagesGeneral Technologies Group LTD.: CASE 2.5Hana Amalia VirantiNo ratings yet

- Cost Accounting NotesDocument5 pagesCost Accounting NotesapkavishuNo ratings yet

- Oralcom-2: Pre TestDocument21 pagesOralcom-2: Pre Testsellos Ko50% (4)

- Lair of The Lizard Lord (1e, OSRIC)Document1 pageLair of The Lizard Lord (1e, OSRIC)hotel DumortNo ratings yet

- 10.07.xMaterialistischeDialektik END BandDocument14 pages10.07.xMaterialistischeDialektik END BandMarianaMonteiroNo ratings yet