Professional Documents

Culture Documents

SH-Apparel & Fabric Industry-H2-1-August 2018

Uploaded by

ApurvaDuaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SH-Apparel & Fabric Industry-H2-1-August 2018

Uploaded by

ApurvaDuaCopyright:

Available Formats

APPAREL AND FABRIC INDUSTRY

India’s apparel exports not out of the woods yet, though the worst appears to be over

UPDATE: AUGUST 2018 ICRA RESEARCH SERVICES

CORPORATE RATINGS

Deep Inder Singh

+91 124 4545 830

deep.singh@icraindia.com

Nidhi Marwaha

+91 124 4545 337

nidhim@icraindia.com

Jayanta Roy

+91 33 7150 1100

jayanta@icraindia.com

ICRA RESEARCH SERVICES

Contents: What’s Inside

❑ Industry ---------------------------------------------------------------------------------------------------------------------------------------------------------- ------------------------------------------------------8

Apparel

❑ Trend in global apparel trade

❑ Apparel imports of the US

❑ Apparel imports of the European Union

❑ Apparel exports of key exporting countries

❑ Share of key apparel exporting countries

❑ Share of key apparel importing countries

❑ India’s apparel exports

❑ India’s apparel exports to key importing regions

❑ Fiber-wise apparel exports of India

❑ Apparel export realizations of key exporting countries

❑ Financial performance of Indian apparel manufacturers

Fabric Industry --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------24

❑ India’s fabric production

❑ Fibre-wise fabric production

❑ Sector-wise fabric production

❑ India’s fabric exports and imports

❑ India’s fabric export destinations

❑ Fibre-wise fabric export mix

❑ Financial performance of Indian fabric manufacturers

Industry outlook---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 32

ICRA ratings on the apparel and fabric industry------------------------------------------------------------------------------------------------------------------------------------------------34

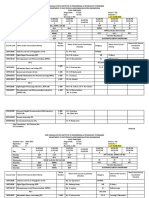

Operational and financial comparison----------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ------------36

Annexure I: Hike in import duty on textile imports -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------41

P A G E |2 ICRA RESEARCH SERVICES

Contents: What’s Inside

❑

Company Section---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------44

❑ Arvee Denims and Exports Limited

❑ Arvind Limited

❑ BSL Limited

❑ Gokaldas Exports Limited

❑ Jindal Worldwide Limited

❑ Kewal Kiran Clothing Limited

❑ Kitex Garments Limited

❑ KG Denim Limited

❑ Loyal Textile Mills Limited

❑ Mafatlal Industries Limited

❑ Morarjee Textiles Limited

❑ Nandan Denim Limited

❑ Orbit Exports Limited

❑ Page Industries Limited

❑ Pearl Global Industries Limited

❑ Rupa & Company Limited

❑ Siyaram Silk Mills Limited

❑ Suryalakshmi Cotton Mills Limited

❑ Zodiac Clothing Company Limited

P A G E |3 ICRA RESEARCH SERVICES

APPAREL AND FABRIC INDUSTRY

India’s apparel exports not out of the woods yet, though the worst appears to be over

ICRA RESEARCH SERVICES

Summary

Apparel Manufacturing Sector

Global Apparel Trade: The global apparel trade is back on the growth trajectory with an estimated growth of ~4-5% year-on-year (YoY) in H1 CY2018

(refers to Calendar Year) and 2% in CY2017 in US$ terms, following contractions reported in CY2015 and CY2016. The positive trend is being led by the

strong recovery in apparel imports by the European Union (EU), which accounts for two-fifth of the global apparel trade (including the trade within

Global apparel trade on a recovery EU). Unlike the EU, apparel imports by the United States of America (US) remain muted, despite the trend being increasing during the past two years.

trajectory after three consecutive

years of subdued trends; estimated China – the world’s largest apparel manufacturer and exporter, continues to be challenged by rising production costs. It has, however, been able to

to have touched an all-time high in arrest the pace of decline in its apparel exports. Compared to the 9% de-growth in CY2016 and 7% de-growth in CY2015, its apparel exports

H1 CY2018 declined by just 1% each in CY2017 and Q1 CY2018. Nevertheless, a continued decline in China’s apparel exports, amid rising global apparel trade,

implies a further shrinkage in China’s share in the global apparel trade, even though it continues to lead with a 35% market share in H1 CY2018.

With China continuing to shed market share, Bangladesh and Vietnam remain the key gainers. Vietnam is maintaining a healthy growth in its

stronghold market of the US, with likelihood of its position strengthening further if the Comprehensive and Progressive Agreement for Trans-Pacific

Partnership (modified TPP) and EU-Vietnam Free Trade Agreement (FTA) are successfully consummated. Meanwhile, Bangladesh continues to gain

share in Europe, even as concerns on withdrawal of its duty-free access to the EU market have surfaced, given the improvement in its economic

China continues to lose market

share in the global apparel trade;

indicators. India, on the other hand, is witnessing challenges in light of internal as well as external developments as explained below.

though remains a distant leader India’s apparel exports: In contrast to the increasing trend witnessed in the global apparel trade, India’s apparel exports have remained weak

with a ~35% share during the past few quarters, primarily owing to an inexplicable decline in shipments to the United Arab Emirates (UAE, 17% share in India’s

apparel exports in FY2018). This is reflected in a YoY de-growth of 18% in Q1 FY2019 in US$ terms, following a decline of 20% and 12% YoY in Q3

FY2018 and Q4 FY2018 respectively. If the trade with UAE and Saudi Arabia is excluded, India’s apparel exports stood lower by only 1% in Q1

FY2019. While this provides some comfort, the situation remains unencouraging, when compared with a 4-5% growth in the global apparel trade.

Having said that, with the low-base effect setting in, the trend has moderated as reflected in a de-growth of only 1% in India’s total apparel exports

in July 2018. Nevertheless, FY2019 is expected to be the fourth consecutive weak year for India’s apparel exports following the 4% de-growth in

FY2018 and modest growth rates of 1% and 3% in FY2016 and FY2017 respectively.

Given the underperformance vis-à-

vis global trends, India has ICRA notes that the Government’s accommodative stance, of reversing the reduction in export incentives, has provided some interim relief to

dropped back to the sixth position apparel exporters. However, the industry now faces concerns on continuance of export subsidy schemes in India, after being challenged by the US at

amongst the largest apparel the World Trade Organisation (WTO). This seems to be constraining the growth momentum of India’s apparel export sector. Going forward, steps

exporting nations taken by the Government to address these concerns, besides impending developments in the international trade including the modified TPP and the

EU-Vietnam FTA, remain crucial for the sector participants. Moreover, movement in Indian currency vis-à-vis currencies of competing nations will

determine relatively competitiveness of the Indian players. This is particularly critical considering the cost advantages in terms of lower labor and

financing cost that some of these nations enjoy.

P A G E |4 ICRA RESEARCH SERVICES

Summary: Continued…

Financial performance of Indian apparel manufacturers (domestic-focused as well as exporters): Notwithstanding the pressures witnessed

owing to demonetisation and transition to GST, large apparel manufacturers have been able to tide over the challenges to a large extent. This is

reflected in a comfortable growth reported by them in recent quarters.

The aggregate revenues of 13 large, listed, garment-manufacturing companies in ICRA’s sample, grew by 10% (YoY) in Q1 FY2019 following the

similar average growth during the previous three quarters. During the past four quarters, aggregate operating margins of ICRA’s sample have also

Large apparel players continue to remained range-bound at a healthy level. Compared to aggregate operating margins of 7-10% during the five-quarter period ending June 2017,

grow at a reasonable pace while the operating margins have ranged between 10-11% since then. Supported by better margins, the aggregate interest cover for ICRA’s sample

maintaining profitability recovered on YoY basis and stood at 4.4 times in Q1 FY2019 compared to 2.9 times in Q1 FY2018.

Although the margins remain better vis-a-vis last year, there has been a marginal sequential dip during the past two quarters, because of an

increase in price of the key raw material i.e. yarn, besides the inherent seasonality in revenues and profitability of some of the players in ICRA’s

sample. Earlier, the profitability during the period Mar’16-Jun’17 was impacted by larger discounted sales undertaken amid demand-side

pressures, and destocking by retailers prior to the shift to GST regime, besides firm raw material prices following the spurt in cotton prices in

FY2017.

Outlook:

Domestic-focused: A large population base, rising disposable incomes, and increasing share of organised retail present significant growth

opportunities for the domestic garmenting and retailing industry in the long term. However, the extent of growth for the domestic companies

will be partly determined by their competitiveness vis-a-vis the international suppliers and the level of imports in the country. Although on a low

base, apparel imports have increased by ~16% in the current year, highlighting a potential threat to the domestic industry. Having said that, large

garment manufactures would continue to benefit from the economies of scale in a fragmented industry, which would also enable them to cater

to the organised apparel sector, resulting in better realisations. Also, strong apparel brands would be in a better position to achieve growth in a

fragmented industry and command premium pricing.

Export-focused: While India has a large fibre base, the share of Indian garment exports has remained low at 3-4% in the global apparel trade.

Going forward, steps taken by the Government of India to address the concerns on continuance of export subsidy schemes, will remain crucial for

the Indian apparel exporters to capitalise on revived global apparel trade and loss of market share by China. Besides, the impending

developments in the international trade including the modified TPP and the EU-Vietnam FTA will remain key determinants of the opportunities

likely to be available to the Indian apparel exporters in the global market. Also, competitiveness of the Indian apparel exporters will remain

contingent upon the movement in foreign exchange rates. Nonetheless, fiscal incentives in the form of increased capital subsidy for capacity

additions under Amended Technology Upgradation Fund Scheme (A-TUFS) (from 15% to 25%) as well as several state textile policies, relaxed

labour norms, and sharing of the Employee Provident Fund (EPF) burden as introduced under the textile policy, augur well for the

competitiveness of Indian apparel exporters.

P A G E |5 ICRA RESEARCH SERVICES

Summary: Continued…

Fabric Sector

Trend in fabric production: Indian weaving sector has faced multiple headwinds during the past few years. Besides demand-side pressures arising

from subdued exports of apparels and fabrics, the sector experienced challenges owing to demonetisation as well as transition to GST regime. The

Fabric production recovers after headwinds because of demonetisation and transition to GST were particularly strong for the weaving segment as it is highly fragmented and

two years of subdued trend consisted primarily of the unorganised segment. Accordingly, India’s fabric production witnessed YoY decline in seven out of the twelve months

ending September 2017. However, the industry has subsequently reported a rebound in production levels as reflected in an 8% production growth

during H2 FY2018. In ICRA’s view, besides the low-base-effect, the sharp increase in production level can be partially attributed to suspected under-

reporting prevalent earlier and improved disclosures by the fabric manufacturers under the GST regime.

Given the sustained firmness in price of cotton vis-à-vis polyester staple fiber, the share of cotton fabrics declined marginally from 61% in FY2017 to

Share of cotton fabrics is no 60% in FY2018, for the first time in last many years. The production of blended and 100% non-cotton fabrics increased by 3% and 12% respectively

longer increasing as firm prices compared to 3% growth in cotton fabrics in FY2018. Nevertheless, the share of cotton fabrics is likely to remain high, if not increase further,

constrain cotton’s because of abundant cotton availability in the country. Also, a shift in domestic demand towards premium apparel products, which are typically

competitiveness made from cotton and blended fabric, is also likely to continue to support the growth in cotton fabric production over the longer term.

Fabric exports and imports: The Indian fabric industry continues to cater primarily to the domestic requirements with fabric exports (excluding the

supplies to apparel exporters) accounting for only ~6% of the domestic production as against a much higher proportion of exports in other

segments of the textile value chain like cotton yarn and apparels. Large domestic requirements, limited growth in production levels and low share of

Spurt in fabric imports likely to be

high-quality fabric, given the fragmented nature of the industry and old vintage of the machinery, explain the continued low share of fabric exports

arrested by recent hike in import

duty; trend in fabric exports from India. Accordingly, despite a 5% growth in India’s total fabric production during FY2018, fabric exports increased by just 1%. Nevertheless,

remains subdued despite the low share of fabric exports with respect to production, the share of the fabric segment in India’s total textile exports continues to be

higher at ~12%.

Similar to exports, India’s fabric imports also account for only 2% of the domestic production. Nevertheless, the industry has been challenged by a

spurt in fabric imports post the transition to the GST regime. The imports of cotton-based woven fabrics and man-made fiber based woven fabric

surged by 27% and 34% respectively during FY2018. This spurt was driven by shift in duty structure in favour of fabric imports. Thereafter, the

government has, however, taken a corrective measure, whereby import duty on key types of fabrics has been doubled to 20% in phases during the

current financial year. This measure is likely to curtail the fabric import levels.

In contrast to industry production

trends, performance of large Financial performance: In contrast to the industry production trends, the aggregate performance of 12 large fabric manufacturers in ICRA’s sample

fabric manufacturers remains has remained weak during the past seven quarters. While the trouble started with the demonetization drive in Q3 FY2017, the performance came

depressed under further pressure during the transition to GST regime. Thereafter, while the overall fabric production in the country is reported to have grown at

a healthy pace, the aggregate revenues of ICRA’s sample remained flat in Q4 FY2018 before declining 4% YoY in Q1 FY2019. In fact, the aggregate

revenues in Q1 FY2019 were at same level as Q1 FY2016, despite the raw material prices being significantly (20%) higher. Hence, the implied sales

volumes of ICRA’s sample in Q1 FY2019 are estimated to have remained 10% lower than in Q1 FY2016.

P A G E |6 ICRA RESEARCH SERVICES

Summary: Continued…

The weakness in sales coupled with a surge in the cotton yarn prices over the past two quarters has brought the profitability of fabric

manufacturers under pressure. As a result, the aggregate operating margins of ICRA’s sample declined to 9.3% in Q4 FY2018 and further to 8.3%

in Q1 FY2019, compared to the level of 11-12% during the pre-demonetisation period.

Even though doubts on the production metrics reported by the sector remain, possibility of an inventory build-up cannot be ruled out given the

significant gap between industry-wide production trajectory and implied trend in sale volumes of ICRA’s sample. This could have in-turn

increased the dependence upon debt, in turn explaining the movement in interest cover which declined to 2.0 times in Q1 FY2019 from 2.6

times in Q4 FY2018 and 2.5 times in Q1 FY2018.

Outlook:

Fabric Sector: Notwithstanding the multiple challenges faced by the Indian weaving industry in the recent past, the growth in fabric demand

and hence production over the long term is expected to remain steady. This is expected to be driven by growth in the end -user industries of

apparels and home textiles, which in turn would stand to benefit from India’s large population base, rising disposable income s, increasing

share of organised retail and also the export opportunities. Within the highly fragmented weaving secto r, the players in the organised

segments are likely to outperform the overall growth in the sector. For the unorganised segment, the small scale and obsolesc ence of the

machinery remain the primary constraining factors which have impacted the productivity of the sector and quality of the fabric

manufactured. Modernisation and increase in the scale of operations would be critical to improve productivity, quality and co st

competitiveness of the domestic fabric, which, besides improving the direct fabric expor t opportunities, would also improve the availability

of quality fabric at competitive prices for the domestic consuming industries and help them increase their share in global exports.

P A G E |7 ICRA RESEARCH SERVICES

ICRA CONTACT DETAILS

CORPORATE OFFICE

CHENNAI HYDERABAD

Building No. 8, 2nd Floor,

Mr. Jayanta Chatterjee Mr. M.S.K. Aditya

Tower A, DLF Cyber City, Phase II,

Mobile: 9845022459 Mobile: 9963253777

Gurgaon 122002

5th Floor, Karumuttu Centre, 301, CONCOURSE, 3rd Floor,

Ph: +91-124-4545300, 4545800

498 Anna Salai, Nandanam, No. 7-1-58, Ameerpet,

Fax; +91-124-4545350

Chennai-600035. Hyderabad 500 016.

Tel: +91-44-45964300, Tel: +91-40-23735061, 23737251

REGISTERED OFFICE

24340043/9659/8080 Fax: +91-40- 2373 5152

1105, Kailash Building, 11th Floor,

Fax:91-44-24343663 E-mail: adityamsk@icraindia.com

26, Kasturba Gandhi Marg,

E-mail: jayantac@icraindia.com

New Delhi – 110 001

Tel: +91-11-23357940-50, Fax: +91-11-23357014

PUNE

MUMBAI KOLKATA

Mr. L. Shivakumar

Mr. L. Shivakumar Ms. Vinita Baid

Mobile: 9821086490

Mobile: 9821086490 Mobile: 9007884229

5A, 5th Floor, Symphony,

3rd Floor, Electric Mansion, A-10 & 11, 3rd Floor, FMC Fortuna,

S. No. 210, CTS 3202,

Appasaheb Marathe Marg, Prabhadevi, 234/ 3A, A.J.C. Bose Road,

Range Hills Road, Shivajinagar,

Mumbai - 400 025 Kolkata-700020.

Pune-411 020

Ph : +91-22-30470000, Tel: +91-33-22876617/ 8839,

Tel : +91- 20- 25561194,

24331046/53/62/74/86/87 22800008, 22831411

25560195/196,

Fax : +91-22-2433 1390 Fax: +91-33-2287 0728

Fax : +91- 20- 2553 9231

E-mail: shivakumar@icraindia.com E-mail: Vinita.baid@icraindia.com

E-mail: shivakumar@icraindia.com

GURGAON AHMEDABAD BANGALORE

Mr. Soumitra Sarkar Mr. Animesh Bhabhalia Mr. Jayanta Chatterjee

Mobile: 9582335927 Mobile: 9824029432 Mobile: 9845022459

Building No. 8, 2nd Floor, 907 & 908 Sakar -II, Ellisbridge, 'The Millenia', Tower B,

Tower A, DLF Cyber City, Phase II, Ahmedabad- 380006 Unit No. 1004, 10th Floor,

Gurgaon 122002 Tel: +91-79-26585049/2008/5494, Level 2, 12-14, 1 & 2, Murphy Road,

Ph: +91-124-4545300, 4545800 Fax:+91-79- 2648 4924 Bangalore - 560 008

Fax; +91-124-4545350 E-mail: animesh@icraindia.com Tel: +91-80-43326400, Fax: +91-80-43326409

E-mail: soumitra.sarkar@icraindia.com E-mail: jayantac@icraindia.com

P A G E |8 ICRA RESEARCH SERVICES

CORPORATE OFFICE

Building No. 8, 2nd Floor, Tower A; DLF Cyber City, Phase II; Gurgaon 122 002

Tel: +91 124 4545300; Fax: +91 124 4545350

Email: info@icraindia.com, Website: www.icra.in

REGISTERED OFFICE

1105, Kailash Building, 11th Floor; 26 Kasturba Gandhi Marg; New Delhi 110001

Tel: +91 11 23357940-50; Fax: +91 11 23357014

Branches: Mumbai: Tel.: + (91 22) 24331046/53/62/74/86/87, Fax: + (91 22) 2433 1390 Chennai: Tel + (91 44) 2434 0043/9659/8080, 2433 0724/ 3293/3294, Fax + (91 44) 2434

3663 Kolkata: Tel + (91 33) 2287 8839 /2287 6617/ 2283 1411/ 2280 0008, Fax + (91 33) 2287 0728 Bangalore: Tel + (91 80) 2559 7401/4049 Fax + (91 80) 559 4065

Ahmedabad: Tel + (91 79) 2658 4924/5049/2008, Fax + (91 79) 2658 4924 Hyderabad: Tel +(91 40) 2373 5061/7251, Fax + (91 40) 2373 5152 Pune: Tel + (91 20) 2552

0194/95/96, Fax + (91 20) 553 9231

© Copyright, 2018 ICRA Limited. All Rights Reserved.

All information contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable. Although reasonable care has been taken to ensure that the

information herein is true, such information is provided 'as is' without any warranty of any kind, and ICRA in particular, makes no representation or warranty, express or implied,

as to the accuracy, timeliness or completeness of any such information. Also, ICRA or any of its group companies, while publishing or otherwise disseminating other reports may

have presented data, analyses and/or opinions that may be inconsistent with the data, analyses and/or opinions in this publication. All information contained herein must be

construed solely as statements of opinion, and ICRA shall not be liable for any losses incurred by users from any use of this publication or its contents.

P A G E |9 ICRA RESEARCH SERVICES

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- AkzoNobel Report 2019 InteractiveDocument554 pagesAkzoNobel Report 2019 InteractiveApurvaDuaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Deadly Bite: Covid-19 To Devour Half of Dine-In Revenues This FiscalDocument8 pagesDeadly Bite: Covid-19 To Devour Half of Dine-In Revenues This FiscalApurvaDuaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Transforming Indian Agriculture by Loving Some Agriculture Less and The Rest More PDFDocument16 pagesTransforming Indian Agriculture by Loving Some Agriculture Less and The Rest More PDFApurvaDuaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Wazir Advisors - Inside View - Annual Report On Textile and Apparel IndustryDocument40 pagesWazir Advisors - Inside View - Annual Report On Textile and Apparel IndustryApurvaDuaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Navigating TomorrowDocument141 pagesNavigating TomorrowApurvaDuaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- ICRA Report On Road Infra and Logistics CompDocument43 pagesICRA Report On Road Infra and Logistics CompApurvaDuaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Alicar: C-1, Block G A SandraDocument1 pageAlicar: C-1, Block G A SandraApurvaDuaNo ratings yet

- CbgapiDocument32 pagesCbgapiBurke Coco NoorNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Law Syllabus LL.M Final 1st Year 2ndDocument14 pagesLaw Syllabus LL.M Final 1st Year 2ndAnkitaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Dunning Objects ListsDocument1 pageDunning Objects ListsSachin SinghNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- GTX 3XX Part 23: AML STC Installation ManualDocument367 pagesGTX 3XX Part 23: AML STC Installation ManuallocoboeingNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- PapelDocument8 pagesPapelignacio galindoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Bba IiiDocument81 pagesBba IiiSajai SureshNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- ICDL Module 1 FinalDocument131 pagesICDL Module 1 Finalyousef100% (1)

- Bpi V TrinidadDocument1 pageBpi V TrinidadangelusirideNo ratings yet

- Datacard150i ManualDocument2 pagesDatacard150i Manualb00sey0% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Vaccine CIER Form For SeniorDocument1 pageVaccine CIER Form For Seniorrandy hernandezNo ratings yet

- Full-Wave Controlled Rectifier RL Load (Continuous Mode)Document6 pagesFull-Wave Controlled Rectifier RL Load (Continuous Mode)hamza abdo mohamoud100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Exploring The Sysmaster Database: by Lester KnutsenDocument23 pagesExploring The Sysmaster Database: by Lester Knutsenabille01No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Mangayar Malar Recipes - 01-09-2013 - Tamil MagazinesDocument4 pagesMangayar Malar Recipes - 01-09-2013 - Tamil MagazinesiyappangokulNo ratings yet

- App 1238 PDFDocument3 pagesApp 1238 PDFIBRNo ratings yet

- PMC Standards Indexes and Tickmarks Page 1 of 2Document2 pagesPMC Standards Indexes and Tickmarks Page 1 of 2Grecio CaguisaNo ratings yet

- Magento2 - How To Load Product by SKU in Magento 2Document2 pagesMagento2 - How To Load Product by SKU in Magento 2m1k13No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Release Notes For Altium Designer Version 14.3 - 2014-05-29Document7 pagesRelease Notes For Altium Designer Version 14.3 - 2014-05-29Luiz Ricardo PradoNo ratings yet

- Field Density TestDocument12 pagesField Density TestRoyNo ratings yet

- TS 4015942Document3 pagesTS 4015942phonglinh0101No ratings yet

- Roff Master Fix Adhesive Mfa Tds DownloadDocument5 pagesRoff Master Fix Adhesive Mfa Tds DownloadsanjayNo ratings yet

- ERP Implementation: Assignment No 1 By: Syed Hasan Ali Shah 02-111162-213 Bba 8Document5 pagesERP Implementation: Assignment No 1 By: Syed Hasan Ali Shah 02-111162-213 Bba 8Abdur-Rehman QureshiNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- 10 Healthy Eating Rules From A NutritionistDocument2 pages10 Healthy Eating Rules From A NutritionistarjanNo ratings yet

- Ket Exam 3 ListeningDocument6 pagesKet Exam 3 ListeningFranciscaBalasSuarezNo ratings yet

- Hunger Affect Children in AfricaDocument7 pagesHunger Affect Children in AfricaNguyen Hoang Tran VanNo ratings yet

- Proof of AnsweresDocument40 pagesProof of AnsweresDream SquareNo ratings yet

- Bill Presentment Architecture in Oracle ReceivablesDocument42 pagesBill Presentment Architecture in Oracle Receivablessrees_15No ratings yet

- III B.Tech TT 2021-22Document5 pagesIII B.Tech TT 2021-22ravikumar rayalaNo ratings yet

- A6V10063560 - Data Sheet For Product - Universal Controllers RMU7..B - enDocument21 pagesA6V10063560 - Data Sheet For Product - Universal Controllers RMU7..B - enBülent KabadayiNo ratings yet

- 08 VLAN Principles and ConfigurationDocument46 pages08 VLAN Principles and Configurationdembi86No ratings yet

- Types of Residential PropertyDocument32 pagesTypes of Residential PropertyAlex CruzNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)