Professional Documents

Culture Documents

Amounts in Philippine Peso

Uploaded by

Jjiza MiclatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amounts in Philippine Peso

Uploaded by

Jjiza MiclatCopyright:

Available Formats

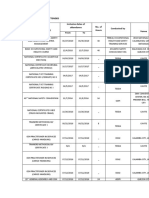

FIZER FORKLIFT AND EQUIPMENT SERVICES

STATEMENTS OF FINANCIAL POSITION

For the years ended December 31, 2019

(Amounts in Philippine Peso)

Notes 2019

ASSETS

Current Assets

Cash 3.1,5 55,586

Trade and receivables 6 516,257

Total current assets 571,843

Noncurrent Assets

Property and equipment 3.5,8 110,863

Total noncurrent assets 110,863

TOTAL ASSETS 682,706

LIABILITIES AND EQUITY

Current Liabilities

Accounts Payable 3.6, 9 -

Income Tax Payable 15.b 661,706

Other current liabilities 3.6,10 21,000

Total current liabilities 682,706

Noncurrent Liabilities

Advances from officer 3.10,11 -

Total noncurrent liabilities -

TOTAL LIABILITIES 682,706

EQUITY 3.11,3.12 -

TOTAL LIABILITIES AND EQUITY 682,706

See Accompanying Notes to Financial Statements.

FIZER FORKLIFT AND EQUIPMENT SERVICES

STATEMENTS OF INCOME

For the years ended December 31, 2019

(Amounts in Philippine Peso)

Notes 2019

SALES 3.14 2,514,000

DIRECT COST 3.14,12 103,349

GROSS INCOME 2,410,651

ADMINISTRATIVE EXPENSES 3.14,13 144,370

OTHER INCOME (EXPENSES) 3.14,14 -

OPERATING INCOME FROM OPERATION 2,266,281

PROVISION FOR INCOME TAX 3.15,16.b 665,006

NET INCOME 1,601,275

See Accompanying Notes to Financial Statements.

Note 5- CASH

This account consists of: 2019

Cash in bank 51,586

Cash on hand

Petty cash fund 4,000

Total 55,586

Cash in bank consist of savings and current account deposits in a reputable local bank which earn interest at the

prevailing bank deposit rates. Petty cash fund is established for petty expenses.

Note 6- TRADE AND OTHER RECEIVABLES

This account consists of: 2019

Trade -

Receivable- others 516,257

Total 516,257

During the year, the Company did not provide any allowance for doubtful accounts because management believes

that the accounts are subsequently collectible within the credit terms of the transactions.

Note 8- PROPERTY AND EQUIPMENT

As of December 31, 2019 there is no indication of any impairment loss on the carrying value of property, and

Revaluation/

This account consists of: 2019 Additions Reclassification 2019

Tools and Equipment 2,863 2,863

Transportation Equipment 120,000 120,000

Total 122,863 - - 122,863

Less: Accumulated depreciation

Tools and Equipment 12,000.00 12,000

Total 12,000.00 - - 12,000

Net book value 110,863.00 110,863

As of December 31, 2019 there is no indication of any impairment loss on the carrying value of property, and

equipment, since it is still in use and in good condition. Nothing of the above property and equipment were used as secutity

for the Company's liabilities.

Note 9- Accounts Payable

This account consists of: 2019

Trade -

Total -

Note 10- OTHER CURRENT LIABILITIES

This account consists of: 2019

SSS and philhealth premium payable 21,000

Total 21,000

Other current liabilities represent statutory liabilities and are measured initially at their transaction price and

subsequently being decreased by settlement payments. Obligations to the government are remitted on the following

month after being withheld from various income recipients.

Note 12- DIRECT COSTS

This account consists of: 2019

Materials and Supplies 44,422

Depreciation Expense Note 15 12,000

Salaries and Wages 12,050

Fuel and Oil 31,877

Repairs and Maintenance 3,000

Total 103,349

Note 13- ADMINISTRATIVE EXPENSES

This account consists of: 2019

Employees benefit 35,688

SSS, Philhealth, Pag-ibig Employer Contribution 14,700

Office supplies 452

Taxes and licenses Note 16.a.1 76,980

Rent Expense 2,150

Transportation 14,400

Miscellaneous

Total 144,370

Note 14- Depreciation Expense

2019

Direct Cost Administrative

Tools and Equipment 2,863

Transportation Equipment 120,000

122,863.00 -

Note 15- SUPPLEMENTARY TAX INFORMATION REQUIRED BY THE BUREAU OF INTERNAL

REVENUE

15.a. Supplemental Information Required under Revenue Regulation no. 15-2010

a. On December 28, 2010, Revenue Regulation (RR) No. 15-2010 became effective and amended certain provisions of

RR No 21-2001 prescribing the manner of compliance with any documentary and/or procedural requirements in

connection with the preparation and submission of financial statements and income tax returns. Section 2 of RR

No 21-2002 was further amended to include in the Notes to Financial Statements information on taxes, duties and

license fees paid or accrued duties for the year in addition to what is mandated by the PFRS on SMEs.

Below is the additional information required by RR No. 15-2010. This information is presented for purposes of filing

with the Bureau of Internal Revenue (BIR) and is not a required part of the basic financial statements.

Output Value Added Tax (VAT)

Output Vat declared for the year ended December 31, 2019 consists of:

Gross Amount Output

of Revenue VAT

Zero rated 2,514,000 -

Sales subject to 12% VAT - -

Total 2,514,000 -

Zero rated sales represents sales to customers registered as VAT zero-rated entities.

Input VAT

Details of input VAT for the year ended December 31, 2016 and their movements during the year follow:

Gross Amount Input

of Purchases VAT

Purchases of other than Capital Goods 118,301 14,196

Total Input VAT 14,196

Actual VAT Payments (14,196)

16.a.1 All Other Local and National taxes

All other local and national taxes paid and accrued for the year ended December 31,2016 consists of:

Business Permit 70,470

Community Tax Certificate 5,015

Bureau of Fire Certificate 995

BIR Registration fee 500

Total 76,980

15.a.2 W ithholding Taxes

Withholding taxes paid/ accrued and/or withheld for the year ended December 31,2016 consists of:

Paid Accrued Total

Withholding Tax on Compensation - - -

Expanded withholding taxes 42,580 3,700 46,280

Total 42,580 3,700 46,280

Tax Contingencies

The Company has no deficiency tax assessments or any cases, and/or prosecution in courts or bodies outside the BIR as of

December 31, 2019

15.b. Supplemental information Required under Revenue Regulation no. 19-2011

RR No. 19-2011 prescribes the new BIR forms that should be used for income tax filing covering and starting with the

calendar year 2012, and modifies Revenue Memorandum Circular No 57-2011. In the Guidelines and Instructions

Section of the new BIR FORM 1702 (version November 2011), a required attachment to the income tax returns is

an Account Information Form and/or Financial statements that include in the Notes to Financial Statements schedules

of sales/receipts/fees, cost of sales/services, non-operating and taxable other income, itemized deductions ( if the

taxpayer did not avail of OSD), taxes and licenses and other information prescribed to be disclosed in the Notes to

Financial Statements.

Below is the additional information required by RR No. 19-2011. This information is presented for purposes of filing

with the BIR and is not a required part of the basic financial statements.

Reconciliation of Net Income per Books to Taxable Income

Net income per books 2,266,281

Less: Net operating loss carry over from 2019 49,595

Total 2,216,686

Add: Interest income subject to final tax -

Taxable Income 2,216,686

Income Tax Due and Payable Computation

Income Tax Due at Regular Rate 30% 665,005.91

Less : Payments and Tax Credits

Previous year tax credit -

Creditable withholding tax previous quarters -

Creditable withholding tax in fourth quarter 3,300.00

Total Payments and Credits 3,300.00

Net Income Tax Due and Still Payable 661,705.91

You might also like

- Wings of Hope Equitherapy 7-31-2021 Audited Financial StatementsDocument16 pagesWings of Hope Equitherapy 7-31-2021 Audited Financial StatementsWings of Hope EquitherapyNo ratings yet

- 2316 Jan 2018 ENCS FinalDocument2 pages2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 2316 Jan 2018 ENCS FinalDocument2 pages2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- Answer:: Question 1. What Is Safety ?Document6 pagesAnswer:: Question 1. What Is Safety ?Jjiza MiclatNo ratings yet

- Answer:: Question 1. What Is Safety ?Document6 pagesAnswer:: Question 1. What Is Safety ?Jjiza MiclatNo ratings yet

- Annex CDocument2 pagesAnnex CCruz LheoNo ratings yet

- Mount Sinai Hospital Audited Financial StatementsDocument62 pagesMount Sinai Hospital Audited Financial StatementsJonathan LaMantia100% (1)

- Base Tables For Purchase Order in Oracle AppsDocument5 pagesBase Tables For Purchase Order in Oracle AppsKalyani DarbhalaNo ratings yet

- Reid v. Covert, 354 U.S. 1 (1957)Document65 pagesReid v. Covert, 354 U.S. 1 (1957)Scribd Government DocsNo ratings yet

- Food Link Audit Report 033119Document18 pagesFood Link Audit Report 033119Food LinkNo ratings yet

- Master Deed SampleDocument29 pagesMaster Deed Samplepot420_aivan0% (1)

- Example in ElectrostaticsDocument36 pagesExample in ElectrostaticsJoseMiguelDomingo75% (4)

- 6 Master Plans - ReviewerDocument2 pages6 Master Plans - ReviewerJue Lei0% (1)

- SSS Employer Data Change Request Form R-8Document2 pagesSSS Employer Data Change Request Form R-8Jolas E. Brutas50% (2)

- Family Supportive Housing, IncDocument22 pagesFamily Supportive Housing, IncAnthony RigogliosiNo ratings yet

- UCP Annual Report 2020Document25 pagesUCP Annual Report 2020ahmad princeNo ratings yet

- Practice Problems 2Document10 pagesPractice Problems 2Luigi NocitaNo ratings yet

- Inco 4Q2019Document62 pagesInco 4Q2019Stevany DarlingNo ratings yet

- PT - Mbi 2020Document65 pagesPT - Mbi 2020caesar putraNo ratings yet

- Audited FS 2019Document80 pagesAudited FS 2019mahesa putraNo ratings yet

- Itlog Ni JanDocument10 pagesItlog Ni JanAlejandro Javellana Paras IVNo ratings yet

- Informe Anual CECA Cuentas Consolidadas 2019 - EngDocument181 pagesInforme Anual CECA Cuentas Consolidadas 2019 - Engjosecente123321No ratings yet

- Tugas Accounting - Putra Ash S - 29121094Document5 pagesTugas Accounting - Putra Ash S - 29121094putraNo ratings yet

- Laporan Keuangan MatahariDocument100 pagesLaporan Keuangan MatahariIlham RamdaniNo ratings yet

- Junior Achievement USA FS 063019Document34 pagesJunior Achievement USA FS 063019Gaurav NaulakhaNo ratings yet

- IMCC 31.12.2023 FS - FinalDocument77 pagesIMCC 31.12.2023 FS - FinalBrian ManyauNo ratings yet

- 5bf19a1123 99c569a228Document115 pages5bf19a1123 99c569a228insta instaNo ratings yet

- FY - 2020 - MAIN - Malindo Feedmill TBKDocument68 pagesFY - 2020 - MAIN - Malindo Feedmill TBKIman Firmansyah IkaNo ratings yet

- Financial Statement Analysis - Financial RatiosDocument2 pagesFinancial Statement Analysis - Financial Ratioshoneyjoy salapantanNo ratings yet

- Activity-13 GreenDocument3 pagesActivity-13 GreenLaura KissNo ratings yet

- 2020 UltraDocument111 pages2020 UltraWidiasta AdhiNo ratings yet

- Tugas Accounting - Putra Ash S - 29121094Document5 pagesTugas Accounting - Putra Ash S - 29121094putraNo ratings yet

- 2019 Note Rupees: Property, Plant and EquipmentDocument15 pages2019 Note Rupees: Property, Plant and EquipmentWasim AsharNo ratings yet

- Astra Account December 2020Document140 pagesAstra Account December 2020Andreas PenaNo ratings yet

- Multiply PerformanceDocument7 pagesMultiply PerformanceAlanNo ratings yet

- ZVI AFS 2022 As of 03-21-2023Document18 pagesZVI AFS 2022 As of 03-21-2023Mike SyNo ratings yet

- One Acre Fund 2019 Audited Financial StatementsDocument28 pagesOne Acre Fund 2019 Audited Financial StatementsRichard UwizeyeNo ratings yet

- Laporan Keuangan Malindo Audited 19Document69 pagesLaporan Keuangan Malindo Audited 19Melinda HadiyantoNo ratings yet

- Measuring Financial Performance - HandoutDocument11 pagesMeasuring Financial Performance - HandoutAjayi Adebayo Ebenezer-SuccessNo ratings yet

- Module 10 BAEN 1 Principles of Accounting BSBADocument13 pagesModule 10 BAEN 1 Principles of Accounting BSBARyan Joseph GoNo ratings yet

- Mitchell Regional Habitat For Humanity-Mitchell Habitat Audit Report 06-30-2020Document17 pagesMitchell Regional Habitat For Humanity-Mitchell Habitat Audit Report 06-30-2020api-308302326No ratings yet

- Sample Construction Company Inc FinanciaDocument24 pagesSample Construction Company Inc FinanciaJamilene PandanNo ratings yet

- TNC Financial Statements FY19Document27 pagesTNC Financial Statements FY19Edgar VivancoNo ratings yet

- Financial Statement IPTV 2020Document73 pagesFinancial Statement IPTV 2020LOUIS LEONARDNo ratings yet

- 105 PrelimDocument10 pages105 PrelimEly DoNo ratings yet

- (Amounts in Philippine Pesos) : See Accompanying Notes To Financial StatementsDocument28 pages(Amounts in Philippine Pesos) : See Accompanying Notes To Financial StatementsNathaniel Niño TangNo ratings yet

- Colorpak Indonesia - Bilingual - 31 - Des - 19Document76 pagesColorpak Indonesia - Bilingual - 31 - Des - 19Jefri Formen PangaribuanNo ratings yet

- Extracted Pages From PVR Ltd. - 19Document4 pagesExtracted Pages From PVR Ltd. - 19jadgugNo ratings yet

- 2019 Friendly Hills BankDocument36 pages2019 Friendly Hills BankNate TobikNo ratings yet

- JSPT19Document152 pagesJSPT19SABDO PANGGIRINGNo ratings yet

- FS BEST 31 December 2020Document95 pagesFS BEST 31 December 2020alfatih1407497No ratings yet

- Astra Account December 2020Document163 pagesAstra Account December 2020Kalpin SaragihNo ratings yet

- HBL 2000Document2 pagesHBL 2000Shahid AwanNo ratings yet

- ZVI AFS 2022 As of 03-30-2023Document16 pagesZVI AFS 2022 As of 03-30-2023Mike SyNo ratings yet

- Acc 113day 23sasdocx PDF FreeDocument6 pagesAcc 113day 23sasdocx PDF FreeMariefel OrdanezNo ratings yet

- CAPS 2020 Audited Financial Statements ReportDocument16 pagesCAPS 2020 Audited Financial Statements ReportScooter SchaeferNo ratings yet

- 0033 POWR Laporan Keuangan FY19Document90 pages0033 POWR Laporan Keuangan FY19Ahmad KharisNo ratings yet

- FY2009 Financial StatementsDocument21 pagesFY2009 Financial StatementsmontalvoartsNo ratings yet

- Humpuss Trading - Eng - 31 - Des - 2018 - ReleasedDocument42 pagesHumpuss Trading - Eng - 31 - Des - 2018 - ReleasedDaffa DarwisNo ratings yet

- PT Wintermar Offshore Marine TBK Dan Entitas AnakDocument87 pagesPT Wintermar Offshore Marine TBK Dan Entitas AnakTonga ProjectNo ratings yet

- Bird FS 4Q19Document111 pagesBird FS 4Q19KarmilaNo ratings yet

- CFIN AuditedDocument103 pagesCFIN AuditedDika DaniswaraNo ratings yet

- 0019 POWR Laporan Keuangan FY20Document110 pages0019 POWR Laporan Keuangan FY20frankie rizkyNo ratings yet

- Reading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsDocument5 pagesReading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsSaransh ReuNo ratings yet

- 08-PangamihanToledoCity2019 Part1-Notes To FSDocument5 pages08-PangamihanToledoCity2019 Part1-Notes To FSJerwin Cases TiamsonNo ratings yet

- Pmi-2020-Financial-Statements 09 - 24 - 2021Document34 pagesPmi-2020-Financial-Statements 09 - 24 - 2021Govil GawadeNo ratings yet

- Evocative Projected FsDocument17 pagesEvocative Projected FsExequiel AmbasingNo ratings yet

- FINMAN1 Module2Document15 pagesFINMAN1 Module2Jayron NonguiNo ratings yet

- Poll 3 - SolutionDocument19 pagesPoll 3 - Solutionakshita bansalNo ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Contract of Lease (400sq.m.)Document4 pagesContract of Lease (400sq.m.)Jjiza MiclatNo ratings yet

- Contract of Lease (400sq.m.)Document4 pagesContract of Lease (400sq.m.)Jjiza MiclatNo ratings yet

- Trainings / Seminars Attended Inclusive Dates of Attendance No. of Hours Conducted by Venue From ToDocument9 pagesTrainings / Seminars Attended Inclusive Dates of Attendance No. of Hours Conducted by Venue From ToJjiza MiclatNo ratings yet

- Duties and ResponsibilitiesDocument5 pagesDuties and ResponsibilitiesJjiza MiclatNo ratings yet

- I Would Like To Apply For Accreditation As:: Osh Practitioner/ Consultant AF-PCN-A1 Application Form (New Applicant)Document12 pagesI Would Like To Apply For Accreditation As:: Osh Practitioner/ Consultant AF-PCN-A1 Application Form (New Applicant)Jjiza MiclatNo ratings yet

- Certified By: Approved By: Checked By: Requested byDocument2 pagesCertified By: Approved By: Checked By: Requested byJjiza MiclatNo ratings yet

- If You Think Safety Is Expensive, Try AccidentDocument47 pagesIf You Think Safety Is Expensive, Try AccidentJjiza MiclatNo ratings yet

- Bosh - Registration FormDocument2 pagesBosh - Registration FormJjiza Miclat100% (1)

- Injury Incident ReportDocument1 pageInjury Incident ReportJjiza MiclatNo ratings yet

- QUITCLAIM - AmistosoDocument1 pageQUITCLAIM - AmistosoJjiza MiclatNo ratings yet

- House Cleaning ChecklistDocument2 pagesHouse Cleaning ChecklistJjiza MiclatNo ratings yet

- Canvass Sheet: Battery Supplier (Cavite)Document1 pageCanvass Sheet: Battery Supplier (Cavite)Jjiza MiclatNo ratings yet

- Amounts in Philippine PesoDocument2 pagesAmounts in Philippine PesoJjiza MiclatNo ratings yet

- Guidelines DO16Document77 pagesGuidelines DO16Marlo ChicaNo ratings yet

- JLF Comp ProDocument77 pagesJLF Comp ProJjiza MiclatNo ratings yet

- SSSForms Contribution Collection ListDocument2 pagesSSSForms Contribution Collection ListJjiza MiclatNo ratings yet

- SSSForms Contribution Collection ListDocument2 pagesSSSForms Contribution Collection ListJjiza MiclatNo ratings yet

- High-Frequency Trading - Reaching The LimitsDocument5 pagesHigh-Frequency Trading - Reaching The LimitsBartoszSowulNo ratings yet

- Foreign Investment Is Boon or Bane For IndiaDocument19 pagesForeign Investment Is Boon or Bane For IndiaAbhimanyu SinghNo ratings yet

- Investing in The Philippine Stock MarketDocument13 pagesInvesting in The Philippine Stock MarketJohn Carlo AquinoNo ratings yet

- Domestic ViolenceDocument27 pagesDomestic Violenceparvinshaikh9819No ratings yet

- Franca Aix Marseille UniversityDocument4 pagesFranca Aix Marseille UniversityArthur MograbiNo ratings yet

- People V SabalonesDocument49 pagesPeople V SabalonesKarlo KapunanNo ratings yet

- Summary Notes Pecentage Tax On Vat Exempt Sales and Transactions Section 116, NIRCDocument2 pagesSummary Notes Pecentage Tax On Vat Exempt Sales and Transactions Section 116, NIRCalmira garciaNo ratings yet

- Equatorial Realty Development, Inc. v. Mayfair Theater, IncDocument3 pagesEquatorial Realty Development, Inc. v. Mayfair Theater, IncJm SantosNo ratings yet

- Types of IP AddressesDocument3 pagesTypes of IP Addressesbekalu amenuNo ratings yet

- Project Cerberus Processor Cryptography SpecificationDocument16 pagesProject Cerberus Processor Cryptography SpecificationabcdefghNo ratings yet

- DV MCDocument288 pagesDV MCSham David PTNo ratings yet

- Civil Procedure CaseDocument3 pagesCivil Procedure CaseEarl Ian DebalucosNo ratings yet

- Original Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full ChapterDocument41 pagesOriginal Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full Chapterbetty.neverson777100% (26)

- Ethnic Networks, Extralegal Certainty, and Globalisation - PeeringDocument23 pagesEthnic Networks, Extralegal Certainty, and Globalisation - PeeringRGinanjar Nur RahmatNo ratings yet

- Kevin Murphy V Onondaga County (Doc 157) Criminal Acts Implicate Dominick AlbaneseDocument11 pagesKevin Murphy V Onondaga County (Doc 157) Criminal Acts Implicate Dominick AlbaneseDesiree YaganNo ratings yet

- Benefits BookletDocument59 pagesBenefits BookletThe QuadfatherNo ratings yet

- School AllotDocument1 pageSchool Allotamishameena294No ratings yet

- Contract of BailmentDocument20 pagesContract of BailmentRounak BhagwatNo ratings yet

- President EngDocument88 pagesPresident Engapi-3734665No ratings yet

- Date Sheet For Pms in Service 02 2021Document1 pageDate Sheet For Pms in Service 02 2021Oceans AdvocateNo ratings yet

- FY22 IPEC Annual Report - FinalDocument163 pagesFY22 IPEC Annual Report - Finallars cupecNo ratings yet

- 5 Engineering - Machinery Corp. v. Court of Appeals, G.R. No. 52267, January 24, 1996.Document16 pages5 Engineering - Machinery Corp. v. Court of Appeals, G.R. No. 52267, January 24, 1996.June DoriftoNo ratings yet

- Inputs Comments and Recommendation On CMC Rationalized Duty Scheme of PNP PersonnelDocument3 pagesInputs Comments and Recommendation On CMC Rationalized Duty Scheme of PNP PersonnelMyleen Dofredo Escobar - Cubar100% (1)

- Ethics of Ethical HackingDocument3 pagesEthics of Ethical HackingnellutlaramyaNo ratings yet