Professional Documents

Culture Documents

Annual Percentage Yield

Uploaded by

raluca chetaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Percentage Yield

Uploaded by

raluca chetaCopyright:

Available Formats

Annual Percentage Yield (APY)

By JAMES CHEN

Updated Aug 31, 2019

What Is the Annual Percentage Yield (APY)?

The annual percentage yield (APY) is the real rate of return earned on a savings

deposit or investment taking into account the effect of compounding interest.

Unlike simple interest, compounding interest is calculated periodically and the

amount is immediately added to the balance. With each period going forward, the

account balance gets a little bigger, so the interest paid on the balance gets bigger as

well.

KEY TAKEAWAYS

APY is the actual rate of return that will be earned in one year if the interest is compounded.

Compound interest is added periodically to the total invested, increasing the balance. That

means each interest payment will be larger, based on the higher balance.

The more often interest is compounded, the better the return will be.

Banks in the U.S. are required to include the APR when they advertise their interest-

bearing accounts. That tells potential customers exactly how much money a deposit

will earn if it is deposited for 12 months.

Formula and Calculation of APY

APY is calculated by:

In this APY formula, 1 is the amount deposited. So, if you deposited $100 for one

year at 5% interest and your deposit was compounded quarterly, at the end of the year

you would have $105.09. If you had been paid simple interest, you would have had

$105.

That's not too dramatic. But if you left that $100 in the bank to continue compounding

interest for four years, you would have $121.99. With simple interest, it would have

been $120.

What APY Can Tell You

Any investment is ultimately judged by its rate of return, whether it's a certificate of

deposit, a share of stock, or a government bond. The rate of return is simply the

percentage of growth in an investment over a specific period of time, usually one

year.

But rates of return can be difficult to compare across different investments if they

have different compounding periods. One may compound daily while another

compounds quarterly or biannually.

Standardizing the Rate of Return

Comparing rates of return by simply stating the percentage value of each over one

year gives an inaccurate result, as it ignores the effects of compounding interest. And,

it is critical to know how often that compounding occurs. The more often a deposit

compounds, the faster the investment grows, since every time it compounds the

interest earned over that period is added to the principal balance and future interest

payments are calculated on that larger principal amount.

APY standardizes the rate of return. It does this by stating the real percentage of

growth that will be earned in compound interest assuming that the money is deposited

for one year.

Therefore, in the example above, the $100 deposit is in an account that pays the

equivalent of 5.09% interest. It pays 5% a year interest compounded quarterly, and

that adds up to 5.09%.

Comparing the APY on Two Investments

Suppose you are considering whether to invest in a one-year zero-coupon bond that

pays 6% upon maturity or a high-yield money market account that pays 0.5% per

month with monthly compounding.

Comparing two investments by their interest rates doesn't work as it ignores the

effects of compounding interest and how often that compounding occurs.

At first glance, the yields appear equal because 12 months multiplied by 0.5% equals

6%. However, when the effects of compounding are included by calculating the APY,

the money market investment actually yields 6.17%, as (1 + .005)^12 - 1 = 0.0617.

APY versus APR

APY is similar to the annual percentage rate (APR) used for loans. The APR reflects

the effective percentage that the borrower will pay over a year in interest and fees for

the loan.

APY and APR are both standardized measures of interest rates expressed as an

annualized percentage rate.

However, the equation for APY does not incorporate account fees, only compounding

periods. That's an important consideration for an investor, who must consider any fees

that will be subtracted from an investment's overall return.

Related Terms

What the Annual Percentage Rate (APR) Tells You

An APR is defined as the annual rate charged for borrowing, expressed as

a single percentage number that represents the actual yearly cost over the

term of a loan.

more

Interest Rate: What the Lender Gets Paid for the Use of Assets

The interest rate is the amount charged, expressed as a percentage of the

principal, by a lender to a borrower for the use of assets.

more

Compound Interest

Compound interest is the number that is calculated on the initial principal

and the accumulated interest from previous periods on a deposit or loan.

more

Determining the Annual Equivalent Rate (AER)

The annual equivalent rate (AER) is the interest rate for a savings account

or investment product that has more than one compounding period.

more

What the Effective Annual Interest Rate Tells Us

The effective annual interest rate is the real return on an investment,

accounting for the effect of compounding over a given period of time.

more

What Does Nominal Mean and How Does it Compare to Real Rates

Nominal is a common financial term with several different contexts,

referring to something small, an unadjusted rate, or the face value of an

asset.

more

You might also like

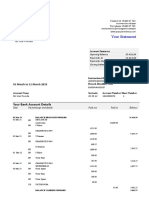

- Banco Popular StatementDocument2 pagesBanco Popular StatementLong Home ProductsNo ratings yet

- Investor S Perception Towards Mutual Funds Project ReportDocument80 pagesInvestor S Perception Towards Mutual Funds Project ReportRavi SharmaNo ratings yet

- Specific RatiosDocument26 pagesSpecific RatiosSunil KumarNo ratings yet

- Interest Time Value of Money 1 TaxesDocument35 pagesInterest Time Value of Money 1 TaxesEzgi KesifogluNo ratings yet

- Compound InterestaDocument2 pagesCompound Interestaankit chakrabortyNo ratings yet

- Interpreting key financial ratios: current, quick, receivables, inventory, debt, equity, times interest earned and moreDocument6 pagesInterpreting key financial ratios: current, quick, receivables, inventory, debt, equity, times interest earned and moreValven AnacioNo ratings yet

- PGDM - Fin. Planning - CAGR - Effective Rate of Interest - ZCBDocument7 pagesPGDM - Fin. Planning - CAGR - Effective Rate of Interest - ZCBNeha PrajapatiNo ratings yet

- What Is 'Compound Interest'Document2 pagesWhat Is 'Compound Interest'Riza Jane ManseguiaoNo ratings yet

- Dividend Payout RatioDocument5 pagesDividend Payout RatioInnocent IssackNo ratings yet

- What Is Bond Yield?Document5 pagesWhat Is Bond Yield?JNo ratings yet

- Accounts RatioDocument3 pagesAccounts RatioAnushkaa DattaNo ratings yet

- There Are So Many Fundamental Analysis ParametersDocument8 pagesThere Are So Many Fundamental Analysis Parametersanimesh dasNo ratings yet

- Compound InterestDocument2 pagesCompound InterestMary Grace BasilioNo ratings yet

- How Is It Important For Banks?: Investopedia SaysDocument5 pagesHow Is It Important For Banks?: Investopedia SaysSushant Dilip SalviNo ratings yet

- Evaluating PerformanceDocument16 pagesEvaluating PerformancemehdiNo ratings yet

- How Compounding Interest Can Grow Your MoneyDocument4 pagesHow Compounding Interest Can Grow Your Moneymaria gomezNo ratings yet

- Final Presentation On Bank Al-HabibDocument25 pagesFinal Presentation On Bank Al-Habibimran50No ratings yet

- Compound InterestDocument2 pagesCompound InterestMary Grace BasilioNo ratings yet

- Buffet BooksDocument3 pagesBuffet BooksyoloNo ratings yet

- Understanding Banking Industry: DR. Rajinder S. Aurora, Professor in Finance, IBS - MumbaiDocument37 pagesUnderstanding Banking Industry: DR. Rajinder S. Aurora, Professor in Finance, IBS - MumbaisushmaNo ratings yet

- 8 key ratios to analyze before buying sharesDocument10 pages8 key ratios to analyze before buying sharesSiva SubrahmanyamNo ratings yet

- CAGR, XIRR, Rolling ReturnDocument9 pagesCAGR, XIRR, Rolling ReturnKarthick AnnamalaiNo ratings yet

- Financial Ratios Are Mathematical Comparisons of Financial Statement Accounts or Categories. TheseDocument3 pagesFinancial Ratios Are Mathematical Comparisons of Financial Statement Accounts or Categories. TheseEllaine Pearl AlmillaNo ratings yet

- Financial Management Key ConceptsDocument8 pagesFinancial Management Key ConceptsLovely KhanNo ratings yet

- APR ExplainedDocument9 pagesAPR ExplainedRexyRayNo ratings yet

- Compound Interest Calculator (Daily, Monthly, Yearly Compounding)Document1 pageCompound Interest Calculator (Daily, Monthly, Yearly Compounding)Lucas OrellanaNo ratings yet

- Key Ratios For Picking Good Stocks: 1. Ploughback and ReservesDocument6 pagesKey Ratios For Picking Good Stocks: 1. Ploughback and ReservesAnonymous YkDJkSqNo ratings yet

- The Importance of Liquidity RatiosDocument12 pagesThe Importance of Liquidity Ratiosjma_msNo ratings yet

- Final ExamDocument5 pagesFinal Exammignot tamiratNo ratings yet

- Cheat SheetDocument6 pagesCheat Sheetm parivahanNo ratings yet

- Return On Investments.: Measuring Rate of ReturnDocument10 pagesReturn On Investments.: Measuring Rate of ReturnSaloniNo ratings yet

- RatioDocument5 pagesRatiomob1022No ratings yet

- Yield To CallDocument16 pagesYield To CallSushma MallapurNo ratings yet

- Investment and Portfolio Chapter 4Document48 pagesInvestment and Portfolio Chapter 4MarjonNo ratings yet

- Task 17Document7 pagesTask 17Medha SinghNo ratings yet

- Calculate share value using residual earnings model and analyze mispricingDocument3 pagesCalculate share value using residual earnings model and analyze mispricingVaibhav Gupta0% (1)

- What Is Nominal Yield?Document2 pagesWhat Is Nominal Yield?JNo ratings yet

- Ratios ExplainedDocument4 pagesRatios ExplainedSACHIDANAND KANDLOORNo ratings yet

- Engineering Economics Terms and Definition 2Document2 pagesEngineering Economics Terms and Definition 2Jackie DimayacyacNo ratings yet

- Math 1 Chapter 2 Consumer MathDocument24 pagesMath 1 Chapter 2 Consumer MathJohn Christian Elmo TabaneraNo ratings yet

- Fundamental Analysis: by Investorguide StaffDocument4 pagesFundamental Analysis: by Investorguide StaffsimmishwetaNo ratings yet

- Finance Material 3Document6 pagesFinance Material 3Akshay UdayNo ratings yet

- Chap Two Risk and ReturenDocument12 pagesChap Two Risk and ReturenAdugna KeneaNo ratings yet

- Working Capital Ratio: Key TakeawaysDocument3 pagesWorking Capital Ratio: Key TakeawaysAndrea Monique AlejagaNo ratings yet

- Discounting Cash FlowDocument9 pagesDiscounting Cash FlowBhavinRamaniNo ratings yet

- Weighted Average Cost of CapitalDocument26 pagesWeighted Average Cost of CapitalAysi WongNo ratings yet

- 3.1. Problem Statement: Supply DemandDocument29 pages3.1. Problem Statement: Supply DemandAysha LipiNo ratings yet

- M Lo Blanco Newsletter November 2019Document5 pagesM Lo Blanco Newsletter November 2019carminatNo ratings yet

- Long-Term Financial Planning and Growth AnswersDocument32 pagesLong-Term Financial Planning and Growth AnswersThảo NhiNo ratings yet

- Understand Time Value of Money and Financial ConceptsDocument6 pagesUnderstand Time Value of Money and Financial ConceptsNurun KamilaNo ratings yet

- Valuation of Stocks & Bonds: Bfinma2: Financial Management P-2Document47 pagesValuation of Stocks & Bonds: Bfinma2: Financial Management P-2Dufuxwerr WerrNo ratings yet

- Tata SteelDocument3 pagesTata SteelBinodini SenNo ratings yet

- Financial RatiosDocument6 pagesFinancial RatiosToan BuiNo ratings yet

- 04 Time Value of MoneyDocument39 pages04 Time Value of Moneyselcen sarıkayaNo ratings yet

- The Time Value Of Money ExplainedDocument40 pagesThe Time Value Of Money Explainedeshkhan100% (1)

- Pre Test Dan Quiz 1 2Document9 pagesPre Test Dan Quiz 1 2Devenda Kartika RoffandiNo ratings yet

- Time Value Offinanc MoneyDocument7 pagesTime Value Offinanc Moneyswayam anandNo ratings yet

- PepsiCo's Net Debt Ratio Target for Maintaining Single-A RatingDocument6 pagesPepsiCo's Net Debt Ratio Target for Maintaining Single-A RatingAbhishek GokhaleNo ratings yet

- Analyze stocks using key financial metricsDocument6 pagesAnalyze stocks using key financial metricsKSNo ratings yet

- Module 9 Bonds Mutual FundsDocument4 pagesModule 9 Bonds Mutual FundsKristine MartinezNo ratings yet

- Annual Percentage YieldDocument3 pagesAnnual Percentage Yieldraluca chetaNo ratings yet

- Annual Percentage YieldDocument3 pagesAnnual Percentage Yieldraluca chetaNo ratings yet

- Annual Percentage YieldDocument3 pagesAnnual Percentage Yieldraluca chetaNo ratings yet

- Star BurnDocument1 pageStar BurnJ SELVA ANTONY SANTOSHNo ratings yet

- Statement Chase PDFDocument4 pagesStatement Chase PDFN N100% (1)

- Unit 5 - Business StrategyDocument12 pagesUnit 5 - Business StrategyABRIL TANIA PATI TORREZNo ratings yet

- BUSINESS FINANCE - BDO BankDocument11 pagesBUSINESS FINANCE - BDO BankCarmela Isabelle DisilioNo ratings yet

- Hsslive-XII-english NotesDocument3 pagesHsslive-XII-english NotesAreej HassanNo ratings yet

- New Table of ContentsDocument4 pagesNew Table of ContentsSuvro AvroNo ratings yet

- Script in Cash FlowDocument7 pagesScript in Cash FlowMaxine Ayesha GabrielNo ratings yet

- R28 Uses of CapitalDocument16 pagesR28 Uses of CapitalSumair ChughtaiNo ratings yet

- Introduction to Accounting Notes PDFDocument5 pagesIntroduction to Accounting Notes PDFRishi ShibdatNo ratings yet

- Liquidity Ratio AnalysisDocument5 pagesLiquidity Ratio AnalysisbezeeNo ratings yet

- Analyzing hotel branding strategies and guest lifetime valueDocument24 pagesAnalyzing hotel branding strategies and guest lifetime valuet3ddyme123No ratings yet

- Public DebtDocument4 pagesPublic DebtMohit MandaniNo ratings yet

- MBTC and BPI RatiosDocument11 pagesMBTC and BPI RatiosarianedangananNo ratings yet

- BALAMURUGAN D - CibilDocument3 pagesBALAMURUGAN D - CibilVijay UNo ratings yet

- Immunization With FuturesDocument18 pagesImmunization With FuturesNiyati ShahNo ratings yet

- AU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryDocument4 pagesAU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryNick KNo ratings yet

- Etf N Index FundDocument72 pagesEtf N Index FundSanjana JangamNo ratings yet

- Extinguishing ObligationsDocument60 pagesExtinguishing ObligationsLarry Calata AlicumanNo ratings yet

- Quiz QuizDocument5 pagesQuiz QuizPMK PUNo ratings yet

- 141 14 513Document53 pages141 14 513Pik PokNo ratings yet

- Morrissette ProfileAngelInvestors 2007Document16 pagesMorrissette ProfileAngelInvestors 2007pattitil.ppNo ratings yet

- CHAPTER 6 (Payroll)Document9 pagesCHAPTER 6 (Payroll)lc100% (1)

- Performance Evaluation of Public and Private Sector Mutual FundsDocument73 pagesPerformance Evaluation of Public and Private Sector Mutual Fundssmart boyNo ratings yet

- Track Fixed Assets and Depreciation ScheduleDocument6 pagesTrack Fixed Assets and Depreciation ScheduleAHMED FAROUKNo ratings yet

- Finance Mohit Rajput PDFDocument60 pagesFinance Mohit Rajput PDFArjun ChouhanNo ratings yet

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 pagesCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- Module 5 Using Mathematical TechniquesDocument57 pagesModule 5 Using Mathematical Techniquessheryl_morales100% (5)

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- Commercial BanksDocument7 pagesCommercial BanksRashi BishtNo ratings yet