Professional Documents

Culture Documents

Assessment Brief Main CW Asset Valuation (Draft) - 1208538227

Assessment Brief Main CW Asset Valuation (Draft) - 1208538227

Uploaded by

Rama KediaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assessment Brief Main CW Asset Valuation (Draft) - 1208538227

Assessment Brief Main CW Asset Valuation (Draft) - 1208538227

Uploaded by

Rama KediaCopyright:

Available Formats

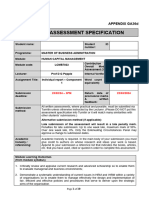

Assessment Brief

Module Title: Asset valuation Module Code: 7BSP1121

Assignment Format & INDIVIDUAL Report, maximum Assignment

50%

Maximum Word count 2,400 words Weighting:

Time:23:59 Coursework return Before 15/5/19

Coursework Submission: Date:17/4/19 Date returned to

Method: Canvas students:

Georgios

Module leader Georgios Katechos First marker

Katechos

Approved ☐

Internal Moderator Module Board name PG AFE

Date:

Approved ☐

External Examiner Module Board date

Date:

Assessment Criteria

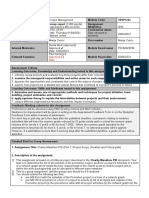

Learning Outcomes: Knowledge and Understanding tested in this assignment:

● 2. Examine the use of debt and derivative securities in formulating practical investment strategies;

● 3. Analyse, evaluate and critique the theoretical models when applied to debt instruments,

Learning Outcomes: Skills and Attributes tested in this assignment:

● 5. evaluate and critique how derivative instruments may be used in investment strategies;

Feedback /Marking criteria for this Assignment

Performance will be assessed using HBS Grading Criteria and Mark scheme.

Guidance for improvement will be given in writing on the Assessment Feedback Form or on the StudyNet

Feedback Form within 4 weeks of submission.

Assignments submitted up to one week late will receive a maximum numeric grade of:

Levels 4, 5 and 6 (UG) – 40 Level 7 (PG) – 50

Plagiarism offences will receive standard penalties.

Detailed Brief for Individual/Group Assessment

See next page

Assignment Title: Main Coursework

Karen Robins - Updated November 2016

Assessment Brief

Description of the assignment:

Task 1. (50%) (approx. 1000 - 1200 words)

You are a policy advisor. You have heard heated debates regarding the role of derivatives and

structured finance instruments (e.g. futures, options, swaps, CDOs, CMOs, CDOs etc) in the 2008

financial crisis.

Critically evaluate the following comments:

Comment A.

“Derivatives are used by major corporations to hedge risks”

Comment B.

“Derivatives and other complex financial instruments have significantly increased systemic risk”

Mark scheme:

In your essay you should demonstrate:

- A good understanding of derivatives and structured financial instruments (20%)

- A good understanding of how derivatives can be utilized to hedge risks (20%)

- A good understanding of implications of these instruments to systemic risk (20%)

- Evidence of further reading (20%)

- Appropriate referencing (10%)

- Appropriate presentation (10%)

Task 2. (50%) (approx. 1000-1200 words)

You are a financial analyst. At various times you have heard comments on the term structure of interest

rates from one of your clients. With reference to appropriate theory evaluate the following comment

“the pure expectation theory of the term structure of interest rates is not a useful concept for valuing

debt instruments as the theory is not supported by real world evidence”

Your essay should demonstrate:

- An understanding of the role of term structure in valuing debt instruments, good understanding

pure expectation theory as well as main other theories (e.g. liquidity preference theory) (20%)

- A good discussion of literature and empirical studies examining the real-world validity of

expectation theory. (40%)

- Ability to critically evaluate literature and empirical studies reviewed (20).

- Appropriate referencing (10%)

- Appropriate presentation (10%)

Student Support and Guidance

● For further help, contact your module leader in their drop-in hours or by email.

● Use the Grading Criteria and Mark Scheme to help improve your work.

Karen Robins - Updated November 2016

Assessment Brief

● Go to CASE workshops, use the CASE website and drop-in hours

www.studynet.herts.ac.uk/go/CASE/

● Academic English for Business support is available through daily drop-ins from the CASE office. See

the CASE workshop timetable on the CASE main website page for details.

● Make full use of Library search to identify relevant academic material and the ‘Subject Toolkit for

Business’ which contains links to other Information Databases and the Information Management

contact details.

(http://www.studynet1.herts.ac.uk/ptl/common/LIS.nsf/lis/4DAF5390094771C2802575ED004212BF)

● Some tutors allow students to test their work using Turnitin. Guidance on submission to Turnitin via

StudyNet can be found by using the following link.

http://www.studynet1.herts.ac.uk/ptl/common/asu.nsf/resource+library/TURNITIN+FOR+STUDENTS

+2016+USER+GUIDE.pdf/$FILE/TURNITIN+FOR+STUDENTS+2016+USER+GUIDE.pdf

Karen Robins - Updated November 2016

You might also like

- Business Strategy Mid Module Assignment (1700 Words) + Journal Entry (300 Words)Document4 pagesBusiness Strategy Mid Module Assignment (1700 Words) + Journal Entry (300 Words)Rama Kedia0% (1)

- FMI Submission Review Scoring - IFMA FMP PM Update 11.13.14 (For Public Comment) - 0Document5 pagesFMI Submission Review Scoring - IFMA FMP PM Update 11.13.14 (For Public Comment) - 0MHDNo ratings yet

- Faculty of Design, Media & Management Assignment BriefDocument3 pagesFaculty of Design, Media & Management Assignment BriefWaqar HussainNo ratings yet

- HRP of RakbankDocument36 pagesHRP of RakbankRama KediaNo ratings yet

- HRM - Chapter 1Document42 pagesHRM - Chapter 1Mogana GunasigrenNo ratings yet

- 7BSM2003 OBA - BA Assignment Brief-2Document2 pages7BSM2003 OBA - BA Assignment Brief-2Fadele Ayotunde AlabaNo ratings yet

- CW1 - Assignment 1 Brief - 6WBS0034!33!1Document6 pagesCW1 - Assignment 1 Brief - 6WBS0034!33!1San Thida SweNo ratings yet

- Draft Until Approved by The External Examiner. It May Be ModifiedDocument7 pagesDraft Until Approved by The External Examiner. It May Be ModifiedKim EvansNo ratings yet

- 5BUS2036 - Essay Assign GeopoliticsDocument3 pages5BUS2036 - Essay Assign GeopoliticsJowelle LowNo ratings yet

- ABRM Assessment Brief Reflective Portfolio 23-24Document6 pagesABRM Assessment Brief Reflective Portfolio 23-24khurain558No ratings yet

- CW1 - Assignment 1 Brief - 6WBS0034 - 33-1Document7 pagesCW1 - Assignment 1 Brief - 6WBS0034 - 33-1San Thida SweNo ratings yet

- PGBM133 Assessment 2021 22 Summer Term v1Document7 pagesPGBM133 Assessment 2021 22 Summer Term v1mehakjaanii55555No ratings yet

- GA36b Level 5 Assessment Specification Template Business 2023 24Document9 pagesGA36b Level 5 Assessment Specification Template Business 2023 24paulourena627No ratings yet

- Strategic Management Module HandbookDocument10 pagesStrategic Management Module HandbookAyesha IrumNo ratings yet

- LCMB7023 - HRM-Assignment Brief - Component 1 January 2024Document10 pagesLCMB7023 - HRM-Assignment Brief - Component 1 January 2024isha SolankiNo ratings yet

- GMEC Final Assessment Brief Sem A 2022-2-1-1 - 972681364Document5 pagesGMEC Final Assessment Brief Sem A 2022-2-1-1 - 972681364khizra saeedNo ratings yet

- 7BSP1244 Assessment Brief 2020-21 A1 DRAFTDocument2 pages7BSP1244 Assessment Brief 2020-21 A1 DRAFTUsman HussainNo ratings yet

- HRMN4005Document12 pagesHRMN4005mae ctNo ratings yet

- Lateral Thinking.L5Coursework (GA34b + GA 36b) CREATIVITY FBMB5002Document13 pagesLateral Thinking.L5Coursework (GA34b + GA 36b) CREATIVITY FBMB5002Steven IvanovNo ratings yet

- FINA 210 - Spring 2021 - Syllabus - HajjDocument8 pagesFINA 210 - Spring 2021 - Syllabus - Hajjbob1234No ratings yet

- Course Outline Iapm-Prof.p.saravananDocument6 pagesCourse Outline Iapm-Prof.p.saravananNicholas DavisNo ratings yet

- AsdasdDocument6 pagesAsdasdMaazNKNo ratings yet

- 7BUS2070 IMC - Formative Assessment - 2023 (2) - 946430072Document3 pages7BUS2070 IMC - Formative Assessment - 2023 (2) - 946430072Muhammad IrfanNo ratings yet

- IIBM7002 Entrep Ass 2Document9 pagesIIBM7002 Entrep Ass 2AnujanNo ratings yet

- Mba/Bba Course Outline To Be Used in Conjunction With The Subject SyllabusDocument4 pagesMba/Bba Course Outline To Be Used in Conjunction With The Subject SyllabusNithyananda PatelNo ratings yet

- IIBM7002 Entrep Ass 1Document9 pagesIIBM7002 Entrep Ass 1AnujanNo ratings yet

- BCC600 - International Financial Reporting and AnalysisDocument4 pagesBCC600 - International Financial Reporting and AnalysisHaritha SasankaNo ratings yet

- FINN353 - Investments Talha Farrukh Spring 2022Document5 pagesFINN353 - Investments Talha Farrukh Spring 2022Asad JamilNo ratings yet

- BSOM071 AS1 Assessment Brief - AUT 2324 - Oct 27Document4 pagesBSOM071 AS1 Assessment Brief - AUT 2324 - Oct 27Ahmed YusufNo ratings yet

- Course Outline ACCT 0104 Introduction To Financial Accounting CP-1Document12 pagesCourse Outline ACCT 0104 Introduction To Financial Accounting CP-1thejiannaneptuneNo ratings yet

- AF5365Document3 pagesAF5365Chin LNo ratings yet

- Forms L5Coursework (GA34b + GA 36b) CREATIVITY FBMB5002)Document13 pagesForms L5Coursework (GA34b + GA 36b) CREATIVITY FBMB5002)Borja Hernandéz Puig de los MoralesNo ratings yet

- FINA210 Business Finance Spring 2017 Mai DaherDocument5 pagesFINA210 Business Finance Spring 2017 Mai DaherPierre WehbeNo ratings yet

- T3 - Consumer Behaviour - Batch 2021-23 MDocument12 pagesT3 - Consumer Behaviour - Batch 2021-23 Mharshita bhatronjiNo ratings yet

- Assessment Brief L5 FDW 22-23Document7 pagesAssessment Brief L5 FDW 22-23faraaz360No ratings yet

- 2017 2018 - Man 2103Document4 pages2017 2018 - Man 2103parminderNo ratings yet

- Bus 405Document2 pagesBus 405Kashish LuthraNo ratings yet

- Level 7 Assessment Specification: Appendix Ga36DDocument9 pagesLevel 7 Assessment Specification: Appendix Ga36DKanchana PereraNo ratings yet

- 7BUS2055-0105 Assessment Brief, CW2CDocument3 pages7BUS2055-0105 Assessment Brief, CW2Crajchatterjee06No ratings yet

- B.SC - .CSIT 8th Sem SyllabusDocument34 pagesB.SC - .CSIT 8th Sem SyllabusPrabin DhunganaNo ratings yet

- PortfolioDocument9 pagesPortfolioRajas Niraj PatilNo ratings yet

- LCBB4005 - Global Business Environment Assessment 2Document9 pagesLCBB4005 - Global Business Environment Assessment 2Guzi OvidiuNo ratings yet

- Department of Mechanical, Automotive and Manufacturing Engineering (Proposed) Coursework BriefDocument3 pagesDepartment of Mechanical, Automotive and Manufacturing Engineering (Proposed) Coursework BriefAugustyn BrzuszekNo ratings yet

- Management Accounting PDFDocument6 pagesManagement Accounting PDFSukalp MittalNo ratings yet

- Proposal Title: Examining The Effects of Internationalization On Firms' PerformanceDocument33 pagesProposal Title: Examining The Effects of Internationalization On Firms' PerformanceYoussef ZohdiNo ratings yet

- Amb251 CBSDocument5 pagesAmb251 CBSfsjnc4dxtnNo ratings yet

- 2022 Project Management Module Guide MSC BSE and FM - AIBEDocument11 pages2022 Project Management Module Guide MSC BSE and FM - AIBEKenny MakNo ratings yet

- Project - E-Business - BBAD2006 - Dr. Vidya Dayinee SharanDocument12 pagesProject - E-Business - BBAD2006 - Dr. Vidya Dayinee SharanManan AswalNo ratings yet

- LL-Unit 6 MSBP Assignment Brief - Sep 2020 NNDocument7 pagesLL-Unit 6 MSBP Assignment Brief - Sep 2020 NNMahnoor RehmanNo ratings yet

- BSOM074 PS1 Group Poster - With Policy LinksDocument4 pagesBSOM074 PS1 Group Poster - With Policy LinksHafeez ShaikhNo ratings yet

- EXPLORE PORT 2 Assessment Brief 23-24Document9 pagesEXPLORE PORT 2 Assessment Brief 23-24herocreeperbrplaysNo ratings yet

- Business Research Methods CODocument8 pagesBusiness Research Methods COHarsh ThakurNo ratings yet

- MGT 612: Leading People and Projects: SyllabusDocument5 pagesMGT 612: Leading People and Projects: SyllabusMinh Ngan NguyenNo ratings yet

- 1 Course Outline - Accounting For Managers - AY - 2022 - 2023Document7 pages1 Course Outline - Accounting For Managers - AY - 2022 - 2023Mansi GoelNo ratings yet

- Lean Production and Lean Construction Brief 2019 20 FinalDocument9 pagesLean Production and Lean Construction Brief 2019 20 Finalsikandar abbasNo ratings yet

- Big DataDocument4 pagesBig DataMohamed MohieldinNo ratings yet

- Syllabus FINA210 Business Finance FALL 2013Document6 pagesSyllabus FINA210 Business Finance FALL 2013Mahmoud KambrisNo ratings yet

- Skills For MannagementDocument10 pagesSkills For MannagementAlam ShahNo ratings yet

- Course Specification - MSC Big Data TechnologiesDocument4 pagesCourse Specification - MSC Big Data TechnologiesMuchati AakashNo ratings yet

- Project Guidelines BBA IV Sem JNU 2017 20Document5 pagesProject Guidelines BBA IV Sem JNU 2017 20Mahesh PandianNo ratings yet

- Assignment Brief For Assignment/coursework 3: Research Proposal. 7BUS2002-0901-2022Document6 pagesAssignment Brief For Assignment/coursework 3: Research Proposal. 7BUS2002-0901-2022AliNo ratings yet

- Assessment Handout: RICS School of Built Environment, Amity UniversityDocument4 pagesAssessment Handout: RICS School of Built Environment, Amity UniversityAKSHAYNo ratings yet

- Istanbul Assignment 1Document9 pagesIstanbul Assignment 1Rama Kedia0% (1)

- Case StudyDocument9 pagesCase StudyRama KediaNo ratings yet

- Code Darshan StarbucksDocument15 pagesCode Darshan StarbucksRama KediaNo ratings yet

- Research Proposal: Financial Analysis of Hospitality Sector in UKDocument13 pagesResearch Proposal: Financial Analysis of Hospitality Sector in UKRama Kedia100% (1)

- MG5556 Coursework Brief (Main) 2018.19Document6 pagesMG5556 Coursework Brief (Main) 2018.19Rama KediaNo ratings yet

- Mark and Spencer Excel For Calc - 130319 FINAL DRAFTDocument12 pagesMark and Spencer Excel For Calc - 130319 FINAL DRAFTRama KediaNo ratings yet

- Airlines Financial Reporting Implications of Covid 19Document15 pagesAirlines Financial Reporting Implications of Covid 19Rama KediaNo ratings yet

- 1 TM C Transaction-AssignmentDocument21 pages1 TM C Transaction-AssignmentRama KediaNo ratings yet

- University NameDocument21 pagesUniversity NameRama KediaNo ratings yet

- Case Study in Supermarkets in AustraliaDocument9 pagesCase Study in Supermarkets in AustraliaRama KediaNo ratings yet

- The Unknown Sita Within YouDocument1 pageThe Unknown Sita Within YouRama KediaNo ratings yet

- Chapter Three: Impact of Recent International Trade Policy DevelopmentsDocument27 pagesChapter Three: Impact of Recent International Trade Policy DevelopmentsRama KediaNo ratings yet

- Strategic Development - Acquisition or Internal DevelopmentDocument3 pagesStrategic Development - Acquisition or Internal DevelopmentRama KediaNo ratings yet

- CSR in BiconDocument25 pagesCSR in BiconRama KediaNo ratings yet

- Profitability Analysis On The Tourism Industry in New ZealandDocument10 pagesProfitability Analysis On The Tourism Industry in New ZealandRama KediaNo ratings yet

- CMSIMPLE Content Management System: I NSTALLI N G CM Simple An OverviewDocument28 pagesCMSIMPLE Content Management System: I NSTALLI N G CM Simple An OverviewGuillermoST14No ratings yet

- Dassey V Dittmann - State's Response To Motion To Lift StayDocument13 pagesDassey V Dittmann - State's Response To Motion To Lift StayLaw&CrimeNo ratings yet

- WHMIS and Safety AssignmentDocument3 pagesWHMIS and Safety AssignmentClaireNo ratings yet

- DELOITTE - US Retail Industry Outlook - 2023Document5 pagesDELOITTE - US Retail Industry Outlook - 2023Fábio CasottiNo ratings yet

- Automotive Tire Information System Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast - Facts and TrendsDocument3 pagesAutomotive Tire Information System Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast - Facts and Trendssurendra choudharyNo ratings yet

- Acade My: Design Procedure For Channel/i - Section Purlins (!)Document7 pagesAcade My: Design Procedure For Channel/i - Section Purlins (!)18TK-5-129No ratings yet

- REX521 Tech ENdDocument72 pagesREX521 Tech ENdm khNo ratings yet

- Catalogue Modular KitchenDocument88 pagesCatalogue Modular Kitchenswizar pradhanNo ratings yet

- Personality ProfileDocument13 pagesPersonality Profilehumayrar22No ratings yet

- HFF Carquest Friction 2010Document29 pagesHFF Carquest Friction 2010gearhead1No ratings yet

- KOmatsu DemingDocument2 pagesKOmatsu Demingsamriddha pyakurelNo ratings yet

- App GtreDocument8 pagesApp GtreprankysayuNo ratings yet

- Journal of Equity in Science and Sustainable Development: J. Equity Sci. & Sust. DevDocument10 pagesJournal of Equity in Science and Sustainable Development: J. Equity Sci. & Sust. DevKindhun TegegnNo ratings yet

- How To Make Value-Based Care Work in CardiologyDocument29 pagesHow To Make Value-Based Care Work in CardiologyPat WilsonNo ratings yet

- FTM - TPM PresentationDocument13 pagesFTM - TPM Presentationnikhilrocks1No ratings yet

- SDLC ModelsDocument44 pagesSDLC ModelsVishal KumarNo ratings yet

- AMIHAN BUS LINES, INC., vs. ROMARS INTERNATIONAL GASES CORPORATION, Et AlDocument2 pagesAMIHAN BUS LINES, INC., vs. ROMARS INTERNATIONAL GASES CORPORATION, Et AlMarvin ChoyansNo ratings yet

- Harmonised Survey SystemDocument4 pagesHarmonised Survey SystemSumeet SawantNo ratings yet

- Recently Announced A Slew of Reforms: Other ImpactsDocument27 pagesRecently Announced A Slew of Reforms: Other ImpactsPriya VermaNo ratings yet

- Quick Sizer Guide For SAPDocument76 pagesQuick Sizer Guide For SAPpkv001No ratings yet

- AOS200 Laser SourceDocument2 pagesAOS200 Laser SourceMOHAMMAD YASSIRNo ratings yet

- Role of Computer and Its Application in Scientific ResearchDocument11 pagesRole of Computer and Its Application in Scientific ResearchShinto Babu100% (1)

- Deed of DonationDocument2 pagesDeed of DonationDax MonteclarNo ratings yet

- HES Price Book 2012Document52 pagesHES Price Book 2012Security Lock DistributorsNo ratings yet

- Russia Guidance December 2023Document24 pagesRussia Guidance December 2023stephencweeksNo ratings yet

- Rolling Cargo Discharging FlowDocument15 pagesRolling Cargo Discharging FlowAlphie CampoNo ratings yet

- 19180525RCDocument12 pages19180525RCPedja MetlicNo ratings yet

- Ijrar Issue 20542862 PDFDocument7 pagesIjrar Issue 20542862 PDFkavin prasathNo ratings yet

- UNSW Institute of Languages UNSW Foundation Studies Student Guide 2018 UNSW Institute of Languages UNSW Foundation Studies Student Guide 2018Document62 pagesUNSW Institute of Languages UNSW Foundation Studies Student Guide 2018 UNSW Institute of Languages UNSW Foundation Studies Student Guide 2018Mohamed ElsalehNo ratings yet