Professional Documents

Culture Documents

Press Release: COVID-19 Pandemic

Uploaded by

numero2Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Press Release: COVID-19 Pandemic

Uploaded by

numero2Copyright:

Available Formats

Press release

FOR IMMEDIATE RELEASE

COVID-19 Pandemic

The government is moving ahead to July 1, 2020

the reduction of the school tax

Québec City, June 10, 2020 – To afford individuals and businesses greater financial flexibility

during the COVID-19 pandemic, the government is moving ahead to July 1, 2020 the reduction

of the single school tax rate.

The government had already announced in Budget 2020-2021 an additional reduction of nearly

$182 million in the tax burden of property owners that attained two-thirds of the anticipated

reduction. The addition of nearly $173 million is enabling the government to announce today

full standardization this year.

Accordingly, property owners will benefit from a $355-million reduction in their tax burden for

2020-2021.

The school tax rate applicable to Québec for the period from July 2020 to June 2021 will thus

be set at $0.1054 per $100 of standardized property assessment.

All told, the reductions announced last year and this year represent an annual saving of

$622 million for taxpayers.

“This acceleration in the reduction of the school tax rate is an effective way to afford Quebecers

financial flexibility when they need it the most. We are fulfilling our commitment to eliminate

injustice between the regions by standardizing the school tax rate to the lowest rate in Québec.

Lastly, it should be noted that the reduction of the school tax rate has no impact on funding for

the education network.”

Eric Girard, Minister of Finance

Related link:

For information on COVID-19 and the assistance programs offered, please visit

Québec.ca/coronavirus.

− 30 −

Source: Fanny Beaudry-Campeau

Press Relations Officer

Office of the Minister of Finance

Telephone: 418-576-2786

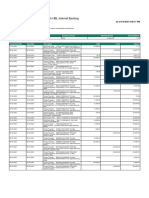

Appendix

– Impact of the school tax reduction by region –

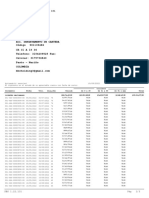

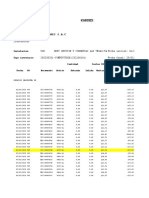

This appendix compares the situation of taxpayers in July 2020 with that prevailing in

2018 when the commitment was made.

Illustration of the reduction in the school tax for a residence with a value of

$275 000

($)

2018 Single rate – July 2020

(1) (2) (1), (2)

School School

(3)

Tax rate tax Tax rate tax Difference

Bas-Saint-Laurent 0.26107 653 0.10540 264 –389

Saguenay–Lac-Saint-

Jean 0.30932 773 0.10540 264 –509

Capitale-Nationale 0.13360 334 0.10540 264 –70

Mauricie 0.30932 773 0.10540 264 –509

Estrie 0.18434 461 0.10540 264 –197

Montréal 0.17832 446 0.10540 264 –182

Outaouais 0.13694 342 0.10540 264 –78

Abitibi-Témiscamingue 0.13694 342 0.10540 264 –78

Côte-Nord 0.23901 598 0.10540 264 –334

Nord-du-Québec 0.30551 764 0.10540 264 –500

Gaspésie 0.28500 713 0.10540 264 –449

Îles-de-la-Madeleine 0.28420 711 0.10540 264 –447

Chaudière-Appalaches 0.22586 565 0.10540 264 –301

Laval 0.23095 577 0.10540 264 –313

Lanaudière 0.27072 677 0.10540 264 –413

Laurentides(4) 0.10540 264 0.10540 264 —

Montérégie 0.17832 446 0.10540 264 –182

Centre-du-Québec 0.29640 741 0.10540 264 –477

Note: In 2019, the average value of a single-family home in Québec was $275 148 according to data

compiled by the Institut de la statistique du Québec and available from the Banque de données des

statistiques officielles sur le Québec.

(1) The rate is applicable per $100 of adjusted standardized property assessment.

(2) The school tax payable includes the basic exemption of the first $25 000 of adjusted standardized

property assessment.

(3) The single school tax rate corresponds to the lowest effective taxation rate in Québec in 2018-2019,

that is, the rate in the Laurentides region.

(4) Taxpayers in the Laurentides region already benefit from the lowest school taxation rate in Québec.

You might also like

- Taxes in Canada-Final 2010-4-07 Recovered)Document112 pagesTaxes in Canada-Final 2010-4-07 Recovered)DayarayanCanadaNo ratings yet

- Taxes in Canada-Final 2011Document145 pagesTaxes in Canada-Final 2011Dayarayan CanadaNo ratings yet

- Politics Canada Budget PackDocument40 pagesPolitics Canada Budget Packapi-26105918No ratings yet

- Attachment 2 Guidance For AssessmentDocument5 pagesAttachment 2 Guidance For Assessmentultimatecombat92No ratings yet

- LW Calculation Spreadsheet - Apr 2014 - VancouverDocument10 pagesLW Calculation Spreadsheet - Apr 2014 - Vancouvergharavii2063No ratings yet

- 2022 Asphodel-Norwood Township Capital and Operating BudgetsDocument22 pages2022 Asphodel-Norwood Township Capital and Operating BudgetsPeterborough ExaminerNo ratings yet

- Canada Tax Sumury 2012Document54 pagesCanada Tax Sumury 2012Dayarayan CanadaNo ratings yet

- Y T D Budget Report:3Document2 pagesY T D Budget Report:3api-25982822No ratings yet

- 2021 Budget in Brief Executive SummaryDocument2 pages2021 Budget in Brief Executive SummaryScott AtkinsonNo ratings yet

- 2014-15 Brookfield BudgetDocument13 pages2014-15 Brookfield BudgetABoyd8No ratings yet

- Church Financial Report-2Document8 pagesChurch Financial Report-2Grace ChandaNo ratings yet

- Profit & Loss Comparison StatementDocument2 pagesProfit & Loss Comparison StatementMichelle MorganNo ratings yet

- Profit & Loss Comparison StatementDocument2 pagesProfit & Loss Comparison StatementMichelle MorganNo ratings yet

- Y-T-D Budget Report:2: IncomeDocument2 pagesY-T-D Budget Report:2: Incomeapi-25982822No ratings yet

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Document1 pageMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoeNo ratings yet

- Kirk Summers Budget Defense BenchmarkDocument15 pagesKirk Summers Budget Defense BenchmarkKirk SummersNo ratings yet

- Muhammad Zidan Akbar - Morgan Company - 1EB09Document12 pagesMuhammad Zidan Akbar - Morgan Company - 1EB09rully.movizarNo ratings yet

- Financial Report 2022Document7 pagesFinancial Report 2022api-190988063No ratings yet

- M. Firman Ardiyansyah - Morgan Company - 1EB09Document6 pagesM. Firman Ardiyansyah - Morgan Company - 1EB09rully.movizarNo ratings yet

- Progress Report - 2252024Document2 pagesProgress Report - 2252024Cindy OmapasNo ratings yet

- Bend Bend Bend Bend Spring Hill Mac+ T1 iOS T1 Mac+ T2 iOS T2 Mac+ T1Document3 pagesBend Bend Bend Bend Spring Hill Mac+ T1 iOS T1 Mac+ T2 iOS T2 Mac+ T1Ahsan TirmiziNo ratings yet

- Str. Poieni Nr. 1 Wernersholmvegen 5 5232 Paradis NORWAY: Seatrans Crewing A/S Constanta Filip, Dumitru IulianDocument1 pageStr. Poieni Nr. 1 Wernersholmvegen 5 5232 Paradis NORWAY: Seatrans Crewing A/S Constanta Filip, Dumitru Iuliandumitru68No ratings yet

- Rios Choque. EnviadoDocument2 pagesRios Choque. EnviadoMARIA DEL PILAR RIOS CHOQUENo ratings yet

- Account Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Document6 pagesAccount Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Khaja Naseeruddin MuhammadNo ratings yet

- Facturas de San Luis Eirl 2020: Fecha Factura Cliente Total Fecha Monto Por PagarDocument1 pageFacturas de San Luis Eirl 2020: Fecha Factura Cliente Total Fecha Monto Por PagarMarleny CuaylaNo ratings yet

- 6.0 Financial PlanDocument2 pages6.0 Financial PlanraihanNo ratings yet

- Fee Receipt: Student ID: 6909 Class GR 9 DDocument2 pagesFee Receipt: Student ID: 6909 Class GR 9 DJitendra AhujaNo ratings yet

- Mayor Chokwe Antar Lumumba's FY19 Budget PresentationDocument25 pagesMayor Chokwe Antar Lumumba's FY19 Budget Presentationthe kingfishNo ratings yet

- État de Compte - Effets ScolairesDocument1 pageÉtat de Compte - Effets Scolairesmelanie mauriceNo ratings yet

- DEPARTMENT: Mayor's Office: City of Akron - 2021 Budget ListingDocument8 pagesDEPARTMENT: Mayor's Office: City of Akron - 2021 Budget ListingDougNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- Teja WorkDocument12 pagesTeja WorkSiddhant SrivastavaNo ratings yet

- Property No: Bill Year:: Interest at 18% Is Charged On Remaining AmountDocument1 pageProperty No: Bill Year:: Interest at 18% Is Charged On Remaining AmountGOPAL DHUMADIYANo ratings yet

- PDFDocument5 pagesPDFranvir ranaNo ratings yet

- Estado de Cuenta BBC HOLDING SeptiembreDocument3 pagesEstado de Cuenta BBC HOLDING SeptiembreCarolina RodríguezNo ratings yet

- March 15 TXN PDFDocument15 pagesMarch 15 TXN PDFAlen Matthew AndradeNo ratings yet

- 2024 2 255993097 SFS-C 2TNFGAW4PPP0J9 Square Savings StatementDocument3 pages2024 2 255993097 SFS-C 2TNFGAW4PPP0J9 Square Savings StatementjoshuaharaldNo ratings yet

- Kainantu Urban Local Level Governmen: Village Service Grant - AdministrationDocument1 pageKainantu Urban Local Level Governmen: Village Service Grant - AdministrationMichael MotanNo ratings yet

- 2024 Sylvan View BudgetDocument1 page2024 Sylvan View Budgetapi-250618742No ratings yet

- FY25 Virginia Governor Glenn Youngkin's Budget Informational PresentationDocument14 pagesFY25 Virginia Governor Glenn Youngkin's Budget Informational PresentationnewsNo ratings yet

- Erp University..Document2 pagesErp University..EDITH GABRIELA QUISPE GOMEZNo ratings yet

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- Notice of Assessment 2021 05 07 05 37 16 132636Document4 pagesNotice of Assessment 2021 05 07 05 37 16 132636bibicolibri1961No ratings yet

- Surigao Del Sur State University: - Financial AspectDocument8 pagesSurigao Del Sur State University: - Financial AspectGian CarloNo ratings yet

- Kardex: Conalvias Construcciones S.A.CDocument6 pagesKardex: Conalvias Construcciones S.A.CCindy G GrNo ratings yet

- Notice - of - Assessment - 2022 BachDocument4 pagesNotice - of - Assessment - 2022 Bachalmostaunicorn84No ratings yet

- Sip FinalDocument65 pagesSip Finalbabu raoNo ratings yet

- Pay Nama: District Accounts Office SialkotDocument1 pagePay Nama: District Accounts Office SialkotAEO Begowala100% (1)

- Noa 2022 3Document4 pagesNoa 2022 3haroldkenardNo ratings yet

- Federal Ministry of Youth and Sport Development PDFDocument10 pagesFederal Ministry of Youth and Sport Development PDFFortune Nwachukwu OnweNo ratings yet

- NS Klasik Sebelum End PeriodDocument3 pagesNS Klasik Sebelum End PeriodElis RosmanawatiNo ratings yet

- 2018 - Budget FormsDocument49 pages2018 - Budget FormsFreda Lyn Benito Namuro100% (1)

- Utah Housing Numbers (Jan 2023)Document1 pageUtah Housing Numbers (Jan 2023)KUTV 2NewsNo ratings yet

- Journal of Disbursement 2023 HalayhayinDocument157 pagesJournal of Disbursement 2023 HalayhayinNazzer Balmores NacuspagNo ratings yet

- Geothermal Power Generation in The World 2015-2020 Update ReportDocument17 pagesGeothermal Power Generation in The World 2015-2020 Update ReportergtewfgergNo ratings yet

- Presidency PDFDocument21 pagesPresidency PDFFortune Nwachukwu OnweNo ratings yet

- N. Whitehall 2024 Proposed BudgetDocument12 pagesN. Whitehall 2024 Proposed BudgetLVNewsdotcomNo ratings yet

- Mayor David Cassetti's Requested BudgetDocument44 pagesMayor David Cassetti's Requested BudgetThe Valley IndyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

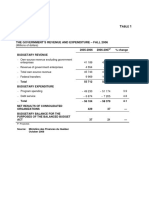

- The Government'S Revenue and Expenditure - Fall 2006: Source: Ministère Des Finances Du Québec October 2006Document1 pageThe Government'S Revenue and Expenditure - Fall 2006: Source: Ministère Des Finances Du Québec October 2006numero2No ratings yet

- Press Release: Another Agency Upgrades Québec's Credit RatingDocument1 pagePress Release: Another Agency Upgrades Québec's Credit Ratingnumero2No ratings yet

- Press Release: Minister Audet Announces The Appointment of New Members of The Board of Directors of SonaccDocument1 pagePress Release: Minister Audet Announces The Appointment of New Members of The Board of Directors of Sonaccnumero2No ratings yet

- Press Release: "A Historic Step For The Future of Québec"Document2 pagesPress Release: "A Historic Step For The Future of Québec"numero2No ratings yet

- Press Release: "A Lasting Solution in The Interests of All Partners of The Federation" Michel AudetDocument3 pagesPress Release: "A Lasting Solution in The Interests of All Partners of The Federation" Michel Audetnumero2No ratings yet

- Practical Steps For Greater Transparency: Improved Financial InformationDocument1 pagePractical Steps For Greater Transparency: Improved Financial Informationnumero2No ratings yet

- Harmonization To Certain Measures of The Federal Budget of May 2, 2006 and Other Fiscal MeasuresDocument19 pagesHarmonization To Certain Measures of The Federal Budget of May 2, 2006 and Other Fiscal Measuresnumero2No ratings yet

- Press Release: The Minister Announces Harmonization With Measures of The May 2, 2006 Federal BudgetDocument1 pagePress Release: The Minister Announces Harmonization With Measures of The May 2, 2006 Federal Budgetnumero2No ratings yet

- Comen 20061220Document1 pageComen 20061220numero2No ratings yet

- Press Release: Québec's Income Tax System Indexed at 2.03% For 2007Document2 pagesPress Release: Québec's Income Tax System Indexed at 2.03% For 2007numero2No ratings yet

- M ' S C T R C R I: Inister S Tatement Oncerning The AX Eduction For Ouples With Etirement NcomeDocument3 pagesM ' S C T R C R I: Inister S Tatement Oncerning The AX Eduction For Ouples With Etirement Ncomenumero2No ratings yet

- Press Release PDFDocument3 pagesPress Release PDFnumero2No ratings yet

- Press Release: $106 Million For 370 000 Retired CouplesDocument3 pagesPress Release: $106 Million For 370 000 Retired Couplesnumero2No ratings yet

- Modification of The Rules Relating To Tax Withholding at Source Regarding Amounts From An RRSP or A RRIFDocument2 pagesModification of The Rules Relating To Tax Withholding at Source Regarding Amounts From An RRSP or A RRIFnumero2No ratings yet

- Tax Parameters Subject To Automatic Indexation (Dollars) : AppendixDocument1 pageTax Parameters Subject To Automatic Indexation (Dollars) : Appendixnumero2No ratings yet

- Press ReleaseDocument1 pagePress Releasenumero2No ratings yet

- AcDocument1 pageAcnumero2No ratings yet

- Comen 20200715Document2 pagesComen 20200715numero2No ratings yet

- ADocument3 pagesAnumero2No ratings yet

- Comen 20200629Document2 pagesComen 20200629numero2No ratings yet

- 20041222a PDFDocument1 page20041222a PDFnumero2No ratings yet

- TabacDocument2 pagesTabacnumero2No ratings yet

- ADocument3 pagesAnumero2No ratings yet

- 2003 6 A BDocument2 pages2003 6 A Bnumero2No ratings yet

- Q and The Wongwei Affair: Knowledge Essential To The Management of The United States.Document14 pagesQ and The Wongwei Affair: Knowledge Essential To The Management of The United States.numero2No ratings yet

- Trump, Q and The Deep State Revealed (2020)Document9 pagesTrump, Q and The Deep State Revealed (2020)numero2No ratings yet

- 20031128a PDFDocument1 page20031128a PDFnumero2No ratings yet

- ADocument1 pageAnumero2No ratings yet

- Supporting Trump in An Age of Enlightment and FreedomDocument16 pagesSupporting Trump in An Age of Enlightment and Freedomnumero2No ratings yet

- Invoice 25 Januari - Kelab Pencinta Alam SMK SepulotDocument1 pageInvoice 25 Januari - Kelab Pencinta Alam SMK SepulotNOR AZIMA BINTI SHAARI MoeNo ratings yet

- Nowadays Plastic Money Replacements Such As Credit and Debit Cards Are Extremely Popular, Even More Than Banknotes and CoinsDocument3 pagesNowadays Plastic Money Replacements Such As Credit and Debit Cards Are Extremely Popular, Even More Than Banknotes and CoinsGurpal VehniwalNo ratings yet

- Aston Corporation Performs Year End Planning in November of Each YearDocument2 pagesAston Corporation Performs Year End Planning in November of Each YearAmit PandeyNo ratings yet

- And Dydacomp Multichannel Order Manager GuideDocument22 pagesAnd Dydacomp Multichannel Order Manager GuideDydacompNo ratings yet

- Ssa 7163Document3 pagesSsa 7163GabrielNo ratings yet

- Account Activity Generated Through HBL Internet BankingDocument1 pageAccount Activity Generated Through HBL Internet BankingJafar HussainNo ratings yet

- Mid-Central Forensic AuditDocument201 pagesMid-Central Forensic AuditDana FergusonNo ratings yet

- Non-Judicial Rs.50/-Attested: (On Stamp Paper Notary Public/ First Class Magistrate)Document2 pagesNon-Judicial Rs.50/-Attested: (On Stamp Paper Notary Public/ First Class Magistrate)Aadhira BhardwajNo ratings yet

- Gaur City Center Chambers & Wholesale Mart Price List W.E.F. 07.02.2019Document1 pageGaur City Center Chambers & Wholesale Mart Price List W.E.F. 07.02.2019Nitin AgnihotriNo ratings yet

- Soriano vs. Secretary of FinanceDocument3 pagesSoriano vs. Secretary of FinanceDenn Geocip SalimbangonNo ratings yet

- Nature and Scope of GST: by Amandeep DrallDocument8 pagesNature and Scope of GST: by Amandeep DrallAman SinghNo ratings yet

- EcoDocument21 pagesEcoMAYHAY, ADRIAN PAULNo ratings yet

- ATC HandbookDocument15 pagesATC HandbookPrintet08No ratings yet

- UNIT 2 Registration Under GSTDocument35 pagesUNIT 2 Registration Under GSTaKsHaT sHaRmANo ratings yet

- REG CPA - Entity Basis IssuesDocument2 pagesREG CPA - Entity Basis IssuesManny MarroquinNo ratings yet

- Efektivitas E-Samsat, Pajak Progresif Dan Kualitas Pelayanan Terhadap Kepatuhan Wajib Pajak Kendaraan BermotorDocument12 pagesEfektivitas E-Samsat, Pajak Progresif Dan Kualitas Pelayanan Terhadap Kepatuhan Wajib Pajak Kendaraan BermotorWira Eka WulandariNo ratings yet

- Adjusted Retained Earnings StatementDocument2 pagesAdjusted Retained Earnings StatementSerazul Arafin MrinmoyNo ratings yet

- Tech-Savvy Banks, and Included Global Trust Bank (The First of Such New Generation Banks ToDocument9 pagesTech-Savvy Banks, and Included Global Trust Bank (The First of Such New Generation Banks ToAbhik RoyNo ratings yet

- Retail Banking Assignm, EntDocument28 pagesRetail Banking Assignm, EntArafatAdilNo ratings yet

- Resentation ON Online Payment Gateway SystemDocument25 pagesResentation ON Online Payment Gateway SystemvincentNo ratings yet

- Press Release No 128/15: Court of Justice of The European UnionDocument2 pagesPress Release No 128/15: Court of Justice of The European UnionMirunaSavNo ratings yet

- Quiz #2: SEMI-FINAL: Answer KeyDocument3 pagesQuiz #2: SEMI-FINAL: Answer KeyAngel MaghuyopNo ratings yet

- OD116684569642334000Document1 pageOD116684569642334000Thirumal K SNo ratings yet

- Soal-Soal LatihanDocument5 pagesSoal-Soal LatihanAldoNo ratings yet

- Did Deutsch-Institut Worldwide: Invoice 55873Document1 pageDid Deutsch-Institut Worldwide: Invoice 55873Celal KuyuNo ratings yet

- TAX INVOICE Unique Glass 30janDocument1 pageTAX INVOICE Unique Glass 30janRupam SahaNo ratings yet

- Walmart Money Card 2020 - 2Document3 pagesWalmart Money Card 2020 - 2william wailterNo ratings yet

- 0b8a014c0000001306696 ESTATEMENT 012023 0b8a014c00000013 PDFDocument7 pages0b8a014c0000001306696 ESTATEMENT 012023 0b8a014c00000013 PDFV TravelNo ratings yet

- 2 D21 - Packages - 020617Document2 pages2 D21 - Packages - 020617CHIA SIA HOCKNo ratings yet

- Philippine Airlines Vs CIR DigestDocument2 pagesPhilippine Airlines Vs CIR DigestlumengggNo ratings yet