Professional Documents

Culture Documents

Accounting White Paper PDF

Uploaded by

Indumathi KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting White Paper PDF

Uploaded by

Indumathi KumarCopyright:

Available Formats

Accounting in a Manufacturing Company

by Melanie Bock and Margaret Coleman

Consultants

Introduction

This paper explains accounting entries for a typical manufacturing company. We list most Manufacturing and

Financials accounting entries that Oracle Applications can produce, then provide detailed examples of the most

common transactions. We show entries using both standard and average inventory costing.

We cover the following modules:

Core Financials: General Ledger (GL), Accounts Payable (AP), and Accounts Receivable (AR)

Core Manufacturing: Order Entry, Purchasing (PO), Inventory (INV), Cost, and Work in Process (WIP)

The following modules and features are out of scope for this paper:

Manufacturing and Distribution modules that do not create accounting entries:

Engineering, Bill of Materials, and all planning modules

Other modules and features:

Assets, Projects, Human Resources, Sales and Marketing, Sales Compensation, Service, Supplier

Scheduling, Outside Processing, Intercompany Invoicing, Cash Basis Accounting, Encumbrance, and Funds

Control

We do not discuss detailed setup steps but see Exhibit 1 for a list of accounts and navigation paths for setup.

Standard and Average Costing

In Oracle Applications, you can select by inventory organization the method for inventory valuation, either standard

or average costing. With standard inventory costing, inventory valuation is based on a frozen standard cost that you

update periodically. With average costing, inventory valuation is based on a weighted average cost that is

automatically recalculated for each transaction using the following formula:

current inventory value + new transaction value

divided by

current on-hand quantity + new transaction quantity

There are currently some limitations if you use average costing. You specify one inventory value account for the

entire inventory organization, rather than setting up multiple valuation accounts by subinventory with standard

costing. All transactions are charged to the material cost element account, whereas you can charge transactions to

separate accounts by cost element with standard costing. You cannot share costs across organizations with average

costing. The ability to use average costing for WIP is not available in a production release until Release 11.

Types of Transactions

This section explains terminology we use for transactions in the remainder of the paper. Oracle documentation

sometimes uses different terminology.

Inventory Item: An item for which you track on-hand inventory balances and which is accounted for as an

inventory asset on your balance sheet. To specify this, set the Inventory Asset item attribute to Yes and Stockable to

Yes.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Inventoried Expense: An item for which you track on-hand inventory balances but you expense the cost at receipt

(set the Inventory Asset item attribute to No) or you receive it into an expense subinventory.

Expense: Goods or services on a PO that are expense (typically overhead) or fixed assets and are not tracked in the

Inventory module. These may or may not be setup as items on the item master.

Receipt and Payables Transactions

Oracle Purchasing and Inventory generate accounting entries for the following receipt transactions:

⇒ Inventory standard receipt

⇒ Inventory delivery

• Direct delivery receiving

• Return to vendor and correction

⇒ Inventoried expense standard receipt

⇒ Inventoried expense delivery

⇒ Expense period end receipt accrual

• Accrue expense items on receipt

Oracle Payables generates accounting entries for the following transactions:

⇒ Matched invoice for inventory

⇒ Matched invoice for expense

• Matched for inventoried expense

• Unmatched invoice

• Credit/debit memo

• Invoice adjustment and cancellation

• Expense report

⇒ Payment

• Void

• Prepayment

• Cash reconciliation accounting

In the following sections we describe the most common of the transactions above and provide examples of journal

entries with calculations. These are designated with the ⇒ symbol above.

Inventory Receipt Journals

There are two steps to an inventory receipt transaction, the receipt into receiving and inspection and then the actual

delivery to a subinventory. Receipts are either standard or direct. Standard receipts record goods into receiving and

inspection only. The actual delivery is another transaction. Direct receipts accomplish receiving and delivery in one

transaction. The Purchasing module accounts for receipts. Inventory accounts for delivery transactions. When an

invoice is matched to a PO, the Payables module generates additional accounting entries.

Transactions from the Inventory, Purchasing, and Payables modules are linked together using clearing accounts. The

Receiving account is a clearing account between Inventory and Purchasing. The Inventory AP Accrual account is a

clearing account between Purchasing and Payables. The graphic below shows the transactions with clearing

accounts for the three modules.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Delivery Match

,19 32 $3

'U#,QY#9DOXH Receipt 'U#,QY#$FFUXDO

'U2&U#339 'U#5FY#9DOXH 'U2&U#,39/(59

&U#5FY#9DOXH &U#,QY#$FFUXDO &U#/LDELOLW\

,19#-( 32#-( $3#-(

*HQHUDO#/HGJHU

Inventory Receipt - Standard Costing

For standard receipts into receiving for inventory PO distributions, the Purchasing accounting entry when using

standard costing is:

Account Calculation Dr Cr

Dr Receiving Value 1 part x $3 PO price 3

Cr Inventory AP Accrual 1 part x $3 PO price 3

The Inventory accounting entry for delivery to stock is:

Account Calculation Dr Cr

Dr Material Inventory Value 1 part x $4 material standard 4

Dr Material Overhead Inventory Value 1 part x $4 material standard x 50% burden 2

Dr/Cr Purchase Price Variance (PPV) 1 part x ($3 PO price - $4 material standard) 1

Cr Receiving Value 1 part x $3 PO price 3

Cr Material Overhead Absorption 1 part x $4 material standard x 50% burden 2

Direct delivery receiving accomplishes the receipt and delivery at the same time. The accounting is the same as with

the separate receipt and delivery transactions described above. Returns to vendor are exactly the opposite of receipt

and delivery transactions. Receipt corrections increase or decrease receipt amounts and account for transactions in

the same manner as original transactions.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Matched Invoice for Inventory

The basic Payables accounting entry when AP matches an inventory invoice to a PO is:

Account Calculation Dr Cr

Dr Inventory AP accrual 1 part x $3 PO price 3

Dr/Cr Invoice Price Variance (IPV) 1 part x ($5 invoice price - $3 PO price) 2

Cr AP Liability 1 part x $5 invoice price 5

Inventory Receipt - Average Costing

For standard receipts into receiving for inventory PO distributions, the Purchasing accounting entry when using

average costing is:

Account Calculation Dr Cr

Dr Receiving Value 1 part x $3 PO price 3

Cr Inventory AP Accrual 1 part x $3 PO price 3

The Inventory accounting entry for delivery to stock is:

Account Calculation Dr Cr

Dr Material Inventory Value 1 part x $3 PO price 3.00

Dr Material Overhead Inventory Value 1 part x $3 PO price x 50% burden 1.50

Cr Receiving Value 1 part x $3 PO price 3.00

Cr Material Overhead Absorption 1 part x $3 PO price x 50% burden 1.50

Inventory calculates no purchase price variance when using average costing. The Payables match transaction is the

same for standard and average costing so is not duplicated here.

Inventoried Expense Receipt

For standard receipts into receiving for inventoried expense, the Purchasing accounting entry is the same as for an

inventory item:

Account Calculation Dr Cr

Dr Receiving Value 1 part x $3 PO price 3

Cr Inventory AP Accrual 1 part x $3 PO price 3

The Inventory delivery accounting entry is:

Account Calculation Dr Cr

Dr PO Charge Account 1 part x $3 PO price 3

Cr Receiving Value 1 part x $3 PO price 3

Inventory charges the expense account on the PO rather than an inventory valuation account and calculates no

purchase price variance for inventoried expense items.

Accounting for matched invoices for inventoried expense is the same as for inventory invoices.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Period End Receipt Accrual

The Period End Receipt Accrual process generates an accrual journal entry for expense receipts that exceed invoice

amounts. The accrual is a reversing journal entry. When AP matches an invoice to the expense PO, Payables

generates a journal entry to expense. The exhibit below shows transactions for expense purchase orders assuming

using the period end accrual, which is optional.

32 Match $3

Period End Accrual 'U#'LVWULEXWLRQ

'U#'LVWULEXWLRQ 'U2&U#'LVW#+,39/(59,

&U#([SHQVH#$FFUXDO &U#/LDELOLW\

GL Reversal of Last Accrual

32#-( 'U#$FFUXDO $3#-(

&U#'LVWULEXWLRQ

*HQHUDO#/HGJHU

The Purchasing accounting entry for the accrual is:

Account Calculation Dr Cr

Dr Distribution on PO 1 part x $100 PO price 100

Cr Expense AP Accrual 1 part x $100 PO price 100

The following month this is reversed in GL.

You can accrue expense items on receipt rather than period end, however this is less common and not recommended

so is not explained here.

Matched Invoice for Expense

The Payables accounting entry when AP matches an expense invoice with tax and freight to a PO is:

Account Calculation Dr Cr

Dr Distribution on PO 1 part x $100 PO price 100

Dr/Cr Distribution on PO 1 part x ($105 invoice price - $100 PO price) * 5

Dr Tax $10 tax on invoice 10

Dr Freight $20 freight on invoice 20

Cr AP Liability 1 part x $105 invoice price + tax + freight 135

* invoice price variance amount

Copyright © 1999 by Melanie J Bock and Margaret Coleman

There various ways to account for tax, including prorating to expense lines (most common in the US) or charging to

an expense account.

Accounting for unmatched invoices and expense reports is the same as for matched expense invoices, except there

are no distributions for the invoice price variance amount. Accounting for credit and debit memos is the exact

opposite as for invoices, whether inventory or expense. Invoice adjustments change accounting on invoices but work

the same way as the original transactions. Invoice cancellations reverse all distributions and the liability account on

the invoice and change the invoice amount to zero.

Accounts Payable Payment

The Payables accounting entry for a payment, assuming taking an early payment discount, is:

Account Calculation Dr Cr

Dr AP Liability $135 invoice 135

Cr Cash $135 invoice - $5 discount 130

Cr Discount $5 discount taken 5

The payment journal entry is the same for inventory and expense.

A void journal entry in AP is the exact opposite of a payment entry above and has no effect on invoice distributions

unless you also cancel the invoice at the same time. Prepayments are advances paid to suppliers or employees. They

are charged to a prepayment account when originally paid and the prepayment is reduced when it is applied to future

invoices or expense reports. The Cash Management module allows automatically generating accounting entries as

part of the AP close for bank reconciliation, such as a payment clearing for a different amount than the original

payment.

Inventory Transactions

Oracle Inventory generates accounting entries for the following transactions (besides receipts):

⇒ Account issue/receipt

⇒ Account alias issue/receipt

⇒ Miscellaneous issue/receipt

⇒ Subinventory transfer

• Inter-org transfer

− Direct transfer

− With/without intransit inventory

− With/without internal orders

⇒ Cost Update

In the following sections we describe the most common of the transactions above and provide examples of journal

entries with calculations. These are designated with the ⇒ symbol above.

Inventory Journals

You can perform various Inventory transactions within or across organizations. Each inventory transaction for an

inventory asset item creates costing entries in each inventory organization. You post to GL by inventory

organization.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

,19# ,19 ,19#

2UJ# 2UJ# 2UJ#

&4 &5 &6

Inventory

Transactions

2UJ# 2UJ# 2UJ#

,19#-( ,19#-( ,19#-(

*HQHUDO#/HGJHU

Miscellaneous Inventory Transactions

There are various types of miscellaneous issue and receipt transactions that differ primarily in the manner in which

the user enters them. These transactions are Account issue/receipt, Account Alias issue/receipt, and Miscellaneous

issue/receipt. They are used to increase or decrease inventory when required for an event other than a normal

receipt, issue, shipment, or transfer. Examples are inventory adjustments and unplanned usage. The accounting

treatment is equivalent for these transactions therefore only one, miscellaneous, is explained below.

Miscellaneous Transaction - Standard Costing

The Inventory accounting entry for a miscellaneous receipt transaction assuming standard costing is:

Account Calculation Dr Cr

Dr Inventory Value by Cost Element 1 part x $4 standard 4

Cr Transaction Charge Account 1 part x $4 standard 4

Accounting for a miscellaneous issue is the exact opposite of the receipt entry above.

Miscellaneous Transaction - Average Costing

The Inventory accounting entry for a miscellaneous receipt transaction assuming average costing is:

Account Calculation Dr Cr

Dr Material Inventory Value * 1 part x $3 PO price 3

Cr Transaction Charge Account 1 part x $3 PO price 3

* Dr/Cr Average cost variance if the quantity on hand is negative before the transaction or as a result of this

transaction

Accounting for a miscellaneous issue is the exact opposite of the receipt entry above.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Subinventory Transfer

The Inventory accounting entry for a transfer of material between subinventories is:

Account Calculation Dr Cr

Dr To Subinventory Value 1 part x $5 current cost 5

Cr From Subinventory Value 1 part x $5 current cost 5

Accounting for subinventory transfers is the same for standard and average costing except you can track valuation

accounts by cost element when using standard costing.

Inter-org Transfer

Inter-org transfer functionality allows you to transfer inventory between any two inventory organizations. You can

transfer the inventory directly from one subinventory/organization to another subinventory/organization or utilize

intransit inventory instead. Accounting entries are generated in the affected organizations.

Cost Update Transactions

You can update your cost whether you use standard or average costing. In both cases, Inventory revalues inventory

on-hand balances and generates a journal entry to record the adjustment.

Cost Update - Standard Costing

The Inventory accounting entry for an increase in standard cost is:

Account Calculation Dr Cr

Dr Inventory Value by Cost Element 1 part on-hand x $1 increase in standard 1

Cr Standard Cost Adjustment 1 part on-hand x $1 increase in standard 1

Cost Update - Average Costing

The Inventory accounting entry for an increase in cost assuming using average costing is:

Account Calculation Dr Cr

Dr Material Inventory Value 1 part on-hand x $1 increase in cost 1

Cr Average Cost Adjustment 1 part on-hand x $1 increase in cost 1

The Inventory module also generates journal entries to adjust corresponding WIP valuation accounts.

Work In Process Transactions

Oracle Inventory generates accounting entries for the following WIP transactions:

⇒ Component issue/return

⇒ Charge resource/overhead

⇒ Assembly completion/return

⇒ Close discrete job

• Scrap assembly in WIP

• Non-standard job

• Repetitive manufacturing

Copyright © 1999 by Melanie J Bock and Margaret Coleman

In the following sections we describe the most common of the transactions above and provide examples of journal

entries with calculations. These are designated with the ⇒ symbol above.

WIP Journals

When you move material to or from the production floor, Oracle Inventory records the component issue or return

transaction. As you move assemblies through the shop floor routing, the WIP module accounts for earned resources

and overheads. As you close WIP jobs, any remaining WIP value is written off to variance accounts. All journal

entries are part of the Inventory to GL interface. The exhibit below shows which transactions are included in each

journal.

:RUN#LQ#3URFHVV

Comp issues/ Resource/ Assembly WIP close/

Returns Overhead Comp/Return Variances

'U#:,3 'U#:,3 'U#,QY 'U2&U 9DU

&U#,QY &U#$EVRUE &U#:,3 'U2&U#:,3#

,19#-( :,3#-( ,19#-( :,3#-(

*HQHUDO#/HGJHU

WIP Transactions - Standard Costing

The example below assumes the following standard costs for the assembly:

Material 1 component* x $2 standard cost $ 2

Resource 1 hour x $10 per hour standard rate 10

Overhead 10% x $10 resource value 1

Total $ 13

* In this example, assume the BOM calls out 1 part per assembly but you over-issue 1.

Inventory records the following accounting entry for issuing material to a job:

Account Calculation Dr Cr

Dr WIP Value by Cost Element 2 parts x $2 standard 4

Cr Inventory Value by Cost Element 2 parts x $2 standard 4

At this point the cumulative WIP value is $4. You can track valuation accounts by cost element for make items with

standard costing.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

As you perform shop floor moves, WIP records the following accounting entry for earned resources, assuming using

the WIP move autocharge method:

Account Calculation Dr Cr

Dr WIP Resource Value 1 unit x $10 standard 10

Cr Resource Absorption 1 unit x $10 standard 10

WIP records the following accounting entry for earned overhead:

Account Calculation Dr Cr

Dr WIP Overhead Value 1 unit x $10 resource standard x 10% 1

Cr Overhead Absorption 1 unit x $10 resource standard x 10% 1

At this point the cumulative WIP value is $15.

When you complete jobs, Inventory records the following entry to add the total standard cost of completed

assemblies to inventory:

Account Calculation Dr Cr

Dr Inventory Material Value $2 WIP Material Value 2

Dr Inventory Resource Value $10 WIP Resource Value 10

Dr Inventory Overhead Value $1 WIP Overhead Value 1

Cr WIP Material Value 1 part per BOM x $2 standard 2

Cr WIP Resource Value 1 unit x $10 standard 10

Cr WIP Overhead Value 1 unit x $10 resource standard x 10% 1

At this point the cumulative WIP value is $2.

When you close discrete jobs, WIP records an accounting entry to write off any remaining value to variance. In our

example, we over-issued one unit, thus causing a material variance:

Account Calculation Dr Cr

Dr/Cr WIP Material Variance 1 assembly x ($15 matl+earned -$13 assembly std) 2

Cr/Dr WIP Material Value 1 assembly x ($13 assembly std -$15 matl+earned) 2

The cumulative WIP value at completion is now zero.

WIP Transactions - Average Costing

The example below assumes the following costs for the assembly using average costing:

Material 1 component* x $2 current average cost $ 2

Resource 1 hour x $10 per hour actual rate 10

Overhead 10% x $10 resource value 1

Total $ 13

* In this example, assume the BOM calls out 1 part per assembly but you over-issue 1.

Assume the beginning on-hand quantity for this assembly is zero.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Inventory records the following accounting entry for issuing material to a job:

Account Calculation Dr Cr

Dr WIP Material Value 2 parts x $2 standard 4

Cr Inventory Material Value 2 parts x $2 standard 4

At this point the cumulative WIP value is $4.

As you manually charge resources to the job (such as labor), WIP records the following accounting entry:

Account Calculation Dr Cr

Dr WIP Resource Value 1 unit x $20 actual rate 20

Cr Resource Absorption 1 unit x $20 actual rate 20

WIP records the following accounting entry for earned overhead:

Account Calculation Dr Cr

Dr WIP Overhead Value 1 unit x $20 actual rate x 10% 2

Cr Overhead Absorption 1 unit x $20 actual rate x 10% 2

At this point the cumulative WIP value is $26.

When you complete jobs, Inventory records the following accounting entry to add the total cost of completed

assemblies to inventory:

Account Calculation Dr Cr

Dr Inventory Material Value $26 total WIP value for 1 completed assembly 26

Cr WIP Material Value 2 parts x $2 standard 4

Cr WIP Resource Value 1 unit x $20 actual rate 20

Cr WIP Overhead Value 1 unit x $20 actual rate x 10% 2

At this point the cumulative WIP value is zero.

When you close discrete jobs, WIP records any variances, such as from the issuing of material or charging of

resource after completion.

If an assembly is damaged beyond repair, you can scrap partially built assemblies at any operation on the shop floor

routing. The partial assembly value is calculated and charged to a user entered scrap account.

In addition to standard discrete jobs, you can use non-standard jobs for producing product that does not have a

predefined bill of material or routing. The accounting entries are the same as for standard jobs.

If a product is repetitively manufactured, you can use repetitive schedules to track production of the item.

Component issues/returns, resource/overhead charges, scrap, and assembly completion/returns accounting entries are

the same as discrete jobs. You can choose to write off WIP variances at the end of period instead at the close of the

schedule.

Order Entry/Shipping and Accounts Receivable Transactions

Oracle Inventory generates accounting entries for the following transactions related to Order Entry/Shipping:

Copyright © 1999 by Melanie J Bock and Margaret Coleman

⇒ Confirm shipment

− Inventory interface

− Receivables interface - invoice

• Returned Material Authorization (RMA) receipts

− RMA interface

− RMA inventory receipt

− Receivables interface - credit memo

Oracle Receivables generates accounting entries for the following transactions:

⇒ Invoice

• Debit/credit memo

• Adjustment

• Commitment

• Revenue recognition

⇒ Cash receipt

• Receipt reversal

• Chargeback

• Miscellaneous cash

In the following sections we describe the most common of the transactions above and provide examples of journal

entries with calculations. These are designated with the ⇒ symbol above.

Shipment Journals

A shipment transaction in Order Entry generates transactions that are transferred to two other modules through

interfaces. The shipment is interfaced to Inventory for recording the decrease in inventory and for the accounting of

cost of goods sold. It is also interfaced to Accounts Receivable for generating the invoice and recording the revenue.

The graphic below shows the transactions for each module.

Ship 2UGHU# Ship $FFRXQWV

,QYHQWRU\

(QWU\ 5HFHLYDEOH

'U#&2*6 'U#5HFHLYDEOHV

&U#,19 &U#5HYHQXH

,19#-( $5#-(

*HQHUDO#/HGJHU

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Inventory Shipment

When you ship confirm and run the interface to Inventory, Inventory generates the following accounting entry:

Account Calculation Dr Cr

Dr Cost of Goods Sold 1 part x $26 current standard or average cost 26

Cr Inventory Value by Cost Element 1 part x $26 current standard or average cost 26

Running the Receivables Interface transfers the shipment to AR to allow importing the data with AutoInvoice and

generating the invoice.

Accounting for an RMA inventory receipt for returned goods is the opposite of the shipment above. Running the

RMA Interface provides RMA data to Inventory to allow a user to subsequently enter the RMA receipt transaction in

the Inventory module, which records the receipt of goods back into inventory. Running the Receivables Interface

transfers the RMA to AR to allow importing the data with AutoInvoice and generating the credit memo.

Accounts Receivable Invoice

Accounts Receivable generates the following accounting entry for the sales invoice:

Account Calculation Dr Cr

Dr Receivables 1 part x $50 invoice price + tax + freight 65

Cr Revenue 1 part x $50 invoice price 50

Cr Tax $5 tax on invoice 5

Cr Freight $10 freight on invoice 10

Accounting for debit memos is equivalent to invoices. Accounting for credit memos is the opposite as for invoices.

Adjustments typically write off invoices, such as immaterial short payments or write offs to bad debt. They typically

reduce the Receivables account and charge the amount to the specific account on the adjustment transaction.

In some businesses customers make commitments, either a prepayment/deposit which generates unearned revenue or

an agreement/guarantee to purchase a certain amount of goods which generates unearned revenue and unbilled

receivables. Subsequent invoices then reduce such commitments and reverse unearned and unbilled amounts. You

may use accounting or invoicing rules, such as recognizing deferred revenue over a period of a service; if so, the

original accounting entry is to unearned revenue and the Revenue Recognition process generates subsequent revenue

accounting entries.

Accounts Receivable Cash Receipt

Applying receipts to invoices produces the following Accounts Receivable accounting entry, assuming taking an

early payment discount:

Account Calculation Dr Cr

Dr Cash $65 invoice - $12 discount 53

Cr Unapplied Cash $65 invoice - $12 discount 53

Dr Unapplied Cash $65 invoice - $12 discount 53

Dr Discount $12 discount taken 12

Cr Receivables $65 invoice 65

A receipt reversal journal entry in AR is the exact opposite of the cash receipt entry above and has no effect on the

invoice or revenue. At cash application time, the user can generate a chargeback. Chargebacks reduce the

Receivables account on the original invoice and charge a chargeback receivables account, which could be different.

The AR module allows entry of miscellaneous non-customer cash receipts, which function like journal entries,

increasing cash and offsetting to the account(s) on the miscellaneous cash transaction.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Multi-Currency Accounting

If you use foreign currencies in Oracle Applications, you will have additional accounting entries from some modules.

Inventory, Cost, and WIP all convert foreign currency transactions to the functional currency based on the exchange

rate of the transaction and generate all transactions in the functional currency.

Purchasing, Accounts Payable, and Accounts Receivable generate journals in the currency of the original transaction,

whether that is foreign or functional. If the transaction is in a foreign currency, the foreign currency journal entry has

the functional equivalent amount, based on the exchange rate of the transaction, on each journal line.

Accounts Payable and Accounts Receivable account for any differences in exchange rates between major steps of a

transaction. If the exchange rate on the PO (and therefore the receipt) is different from the AP invoice, AP accounts

for the difference and charges it to the Exchange Rate Variance account. If the exchange rate on the AP or AR

invoice is different from the AP or AR payment, AP and AR account for the difference as Realized Gain/Loss.

Examples of these transactions are explained below.

Assume a PO has a price of 21 foreign currency units and an exchange rate of 5, which is converted to 105

functional currency units. Therefore the receipt was recorded in the Inventory AP Accrual account at receipt time as

21 foreign and 105 functional currency units using the PO exchange rate. The AP invoice has a price of 22 foreign

currency units and a rate of 6 for 132 in the functional currency. There are both Invoice Price Variance (IPV) and

Exchange Rate Variance (ERV) on this transaction.

Account Calculation Foreign Functional

Dr Inventory AP accrual 1 part x PO price 21 Dr 105 Dr

Dr/Cr Invoice Price Variance (IPV) 1 part x (invoice price - PO price) * 1 Dr 6 Dr

Dr/Cr Rate Variance Gain/Loss (ERV) ** 21 Dr

Cr AP Liability 1 part x invoice price 22 Cr 132 Cr

* 1 part x (22 invoice foreign currency price - 21 PO foreign currency price) x 6 invoice rate = 6 in functional currency

** 1 part x 21 PO foreign currency price x (6 invoice rate - 5 PO rate) = 21 in functional currency

Now assume the exchange rate at the time of AP payment is 7 and a discount of 1 foreign currency unit is taken

which is converted to 6 in the functional currency using the invoice rate. Actual cash received is 21 in the foreign

currency, which is 147 in the functional currency at the payment exchange rate. There is Realized Gain/Loss on this

transaction.

Account Calculation Foreign Functional

Dr AP Liability invoice amount 22 Dr 132 Dr

Dr/Cr Realized Gain/Loss * 21 Dr

Cr Discount Taken discount taken 1 Cr 6 Cr

Cr Cash invoice amount - discount taken 21 Cr 147 Cr

* 21 cash payment in foreign currency x (7 payment rate - 6 invoice rate) = 21 in functional currency

AR accounts for Realized Gain/Loss for differences in exchange rates between invoices and receipts in a similar

fashion.

Further multi-currency details are beyond the scope of this paper.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Period End Close

This section describes the overall typical close process for a manufacturing company. Your procedures may differ.

The AP, PO, Inventory, and AR modules generate accounting entries. Companies generally post from subledgers to

GL at least weekly. Users post to GL, post the journals in GL, run subledger reports, and reconcile to GL balances.

They close the period for their subledger and open the next period.

The order of the close is significant in some cases due to relationships between modules. For example, typically

users complete all PO receipts and deliveries and close the PO module before final posting from Inventory to GL.

The order of the typical basic close is shown and described below.

$3 ,QYRLFHV23D\PHQWV

32 5HFHLSWV

*HQHUDO

,19 0DWHULDO2:,3

/HGJHU

$5 ,QYRLFHV25HFHLSWV

AP users run the AP/GL transfer process by operating unit, which initiates Journal Import for purchase invoice and

payment journals. AP also typically runs the PO module Receipt Accrual Period End process to accrue uninvoiced

expense receipts and runs Journal Import to import journals into GL. Users then post all their journals in GL and

reverse the prior month accrual. AP users reconcile the AP module and balance to GL with reports including the AP

Trial Balance, Posted Invoice Register, Expense Distribution Detail, Posted Payment Register, Payment Register,

Void Register, and Uninvoiced Receipts Report.

Cost accountants are typically responsible for generating journals for both the Purchasing and Inventory modules.

They ensure no transactions remain in the interface tables before starting the period end process. In Purchasing,

recording an inventory receipt generates a journal entry line for GL. Users run Journal Import to import receipt

entries into GL and they then post journals in GL. Users transfer from Inventory to GL by inventory organization,

which generates both WIP and Inventory journals. They run Journal Import to import journals into GL and post

them in GL. Cost accountants reconcile the Purchasing and Inventory modules and balance to GL with reports

including the Accrual Reconciliation Report, Receiving Account Distribution Report, Receiving Valuation Reports,

Inventory Value Reports, Material Account Distribution Summary and Detail Reports, Period Close Summary,

Transaction Balance Historical Summary, WIP Value Reports, and WIP Account Distribution Summary Report.

AR users run the AR/GL transfer process by operating unit, which initiates Revenue Recognition and Journal Import

for sales invoice, credit memo, adjustment, receipt, and other journals. Users then post their journals in GL. AR

Copyright © 1999 by Melanie J Bock and Margaret Coleman

users reconcile the AR module and balance to GL with reports including the Aged Trial Balance, Transaction

Register, Sales Journal, Adjustment Register, Applied and Unapplied Receipts Registers, Deposited Cash, Receipt

Register, Reversed Receipts, and Journal Entries Report.

Order Entry has no period end close processes, however, users ensure that shipments for the period are complete and

interfaces run to Inventory and AR before closing those modules.

GL users complete the close with additional journals, allocations, reconciliations, and reports.

Overall Advice

There are many options you face when implementing Oracle Manufacturing and Financials and many ways to

operate the system from a procedural standpoint. This section explains some of the best practices related to

accounting and closing with Oracle Applications.

Determine your setup options, make initial setup decisions, then test all transactions and variations very carefully.

Verify all resulting journal entries, run balancing reports, and test your reconciliation procedures. You will likely

need to change some setup and procedures and re-test. Have your Accounting users signoff on the accounting

transactions; they will need to see and understand the journal entries to do so. Perform full integration and

conference room pilot tests to verify all accounting is working as planned.

Use separate natural account numbers for different types of accounts to facilitate reconciliation. For example, your

Inventory AP Accrual, Expense AP Accrual, and Receiving accounts need to be different accounts. You will likely

need to add new natural accounts to your chart of accounts when implementing Oracle Manufacturing.

Setup security rules on major accounts that you typically reconcile. For example, do not allow Manufacturing users

to enter transactions to AP and AR control accounts. Test rules carefully as some transactions will fail when trying

to generate accounts in the background if security rules disallow entry to those background accounts.

Design your close process early in the implementation. The project team can then test and enhance it throughout the

implementation. Include all close steps for each module in sequence, journal entries produced (note key account

numbers used), reports to run, and reconciliation steps.

Post to GL from subledgers and reconcile two to four times per month. This allows users to detect and resolve any

problems early in the month before monthend close. If you find errors with journal entries from Oracle subledgers,

enter separate correcting journals in GL to correct the entry for the month rather than changing the journal that the

subledger generated. This will provide an audit trail of the correction and not interfere with any current or future

drilldown features Oracle may offer. If your journals are incorrect, determine the source of the problem in the

subledger and resolve it for future transactions, which may involve a setup or procedural change. Do not delete any

subledger journals Oracle produces as you cannot re-generate them from the subledger. The one exception to this is

the Period End Receipt Accrual for expense uninvoiced receipts, which you can re-generate if you close and re-open

the PO period.

Allow subledger owners to complete the full accounting cycle for their transactions, including importing journals

into GL, posting their journals in GL, and reconciling appropriate accounts. This allows them to be responsible for

the process through to successful completion/posting and allows them to reconcile their own data as they are the

people who know their data and can resolve any problems.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

About the Authors

Melanie Bock is a consultant exclusively for Oracle Financials implementations. She began working with the

Financials in 1987 while a Consulting Manager with Oracle Corporation. Since 1990 she has been an independent

consultant and has provided consulting assistance to over 120 Financials clients. Melanie specializes in GL, AP, PO,

FA, and AR, primarily from the user perspective. She is a Certified Public Accountant and has spent most of her

career in systems. Melanie has also been an auditor and consultant with Arthur Andersen & Co. and an MIS

Manager.

Margaret Coleman is the owner of Margaret Coleman Consulting, and has been an independent consultant since

1985. Maggie has specialized in implementing manufacturing and distribution systems for over 20 years. She

participated in the original design and testing of the Oracle Manufacturing modules, and has been consulting on the

Oracle Applications since 1988. Prior to consulting, Maggie worked in various information systems positions from a

programmer analyst to a supervisor of systems analysts. She has received her Certification in Production and

Inventory Management (CPIM) from the American Production and Inventory Control Society.

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Exhibit 1

Major Account Setup

This chart shows major account setups mentioned in our paper, by the lowest organizational level in the Applications

architecture at which you set them up. It shows by 10SC/NCA navigation path the major accounts in Oracle AP, AR,

PO, Inventory, Cost Management, and WIP and the costing method(s) with which you use the account. The far right

column shows features that allow users to further customize the account generation and thereby override default

accounts. Release 10.7 FlexBuilder has been renamed Account Generator in Release 11.

* Organization Level: Op Unit = Operating Unit, Inv Org = Inventory Organization, Subinv = Subinventory

Org Costing Ability to

Level * 10SC/NCA Navigation Path Account Method Customize

Op Unit AP : Suppliers : Entry (Sites, Accounting) AP liability Both --

defaults from AP : Setup : Options : Financials

Op Unit AP : Setup : Tax : Names AP tax Both --

Op Unit AP : Setup : Payment : Banks AP cash Both --

(Bank Accounts, GL Accounts)

Op Unit AP : Setup : Options : Financials AP discount taken Both Prorate

Op Unit AR : Setup : Transactions : Transaction Types AR receivable Both AutoAcctg

or AR : Setup : Salespersons AR freight Both AutoAcctg

or INV : Items: Master Items AR revenue Both AutoAcctg

or AR : Setup : Tax : Codes AR tax Both AutoAcctg

(See AutoAccounting options for each account)

Op Unit AR : Setup : Receipts : Receipt Class AR cash Both --

(Remittance Banks, GL Accounts) AR unapplied receipts Both --

AR unearned discounts Both --

AR earned discounts Both --

Op Unit PO : Setup : Organizations : Purchasing Options Expense AP accrual Both FlexBuilder

(Accrual)

Inv Org PO : Setup : Organizations : Receiving Options Receiving Both --

Inv Org INV : Setup : Organizations : Parameters Material Both --

(Costing Information) Outside processing Standard --

Material overhead Standard --

Overhead Standard --

Resource Standard --

Expense Both FlexBuilder

Inv Org INV : Setup : Organizations : Parameters Purchase price variance Standard --

(Other Accounts) Invoice price variance Both FlexBuilder

Inventory AP accrual Both FlexBuilder

Sales (revenue) Both AutoAcctg

Cost of goods sold Both FlexBuilder

Average cost variance Average --

Inv Org INV: Items: Master Items default from Expense Both FlexBuilder

INV : Setup : Organizations : Parameters Sales (revenue) Both AutoAcctg

(Costing Information or Other Accounts) Cost of goods sold Both FlexBuilder

Inv Org INV : Setup : Organizations : Shipping Network Inter-Org accounts:

(Special menu, Primary Accounts, Secondary Transfer credit Both --

Accounts) default from Purchase price variance Both --

INV : Setup : Organizations : Parameters Receivable Both --

(Inter-Org Information) Payable Both --

Intransit inventory Both --

Inv Org CST : Setup : Sub-elements : Overheads Overhead absorption Both --

Copyright © 1999 by Melanie J Bock and Margaret Coleman

Org Costing Ability to

Level * 10SC/NCA Navigation Path Account Method Customize

Inv Org CST : Setup : Sub-elements : Resources Resource absorption Both --

Resource variance Both --

Inv Org WIP : Setup : WIP Accounting Classes WIP accounts:

Material Both --

Material variance Both --

Material overhead Both --

Resource Both --

Resource variance Both --

Outside processing (OSP) Both --

OSP variance Both --

Overhead Both --

Overhead variance Both --

Standard cost update Standard --

Subinv INV : Setup : Organizations : Subinventories Material Standard --

Outside processing Standard --

Material overhead Standard --

Overhead Standard --

Resource Standard --

Expense Both --

Copyright © 1999 by Melanie J Bock and Margaret Coleman

You might also like

- Mexico - Electronic Invoicing and Accounting - Feb 2017Document19 pagesMexico - Electronic Invoicing and Accounting - Feb 2017JAN2909No ratings yet

- Back To The Basics - : Account Amount Profit CentreDocument14 pagesBack To The Basics - : Account Amount Profit CentreReddy BDNo ratings yet

- AFA For MBA-1Document25 pagesAFA For MBA-1Purushottam RathiNo ratings yet

- Lock Box Doc 1Document16 pagesLock Box Doc 1krishan0432No ratings yet

- GSI Fusion GL - Budget Entry and Reporting - R11Document10 pagesGSI Fusion GL - Budget Entry and Reporting - R11rasiga6735No ratings yet

- 06 - Sap Fi Clearing Item 06Document22 pages06 - Sap Fi Clearing Item 06NASEER ULLAHNo ratings yet

- Master General Ledger Account CodesDocument34 pagesMaster General Ledger Account CodesSoru SaxenaNo ratings yet

- SAP - FI - Basics ConceptsDocument55 pagesSAP - FI - Basics Conceptsganesanmani19850% (1)

- Sappress - Segment - Reporting (Sample) PDFDocument13 pagesSappress - Segment - Reporting (Sample) PDFomiconNo ratings yet

- Sequencing by Legal Entity or LedgerDocument61 pagesSequencing by Legal Entity or LedgerMatthew PitkinNo ratings yet

- FM-GM Troubleshooting TipsDocument37 pagesFM-GM Troubleshooting TipsBAble996No ratings yet

- Accruals & PrepaidDocument20 pagesAccruals & Prepaidmeliana sariNo ratings yet

- Trial Balance BasicsDocument11 pagesTrial Balance Basicsabdirahman YonisNo ratings yet

- SAP-TO BE Bank Accounting ProcessDocument17 pagesSAP-TO BE Bank Accounting ProcesssivasivasapNo ratings yet

- Chapter 3 FARDocument4 pagesChapter 3 FARZee DrakeNo ratings yet

- Financial Accounting & Controlling: Run ServerDocument106 pagesFinancial Accounting & Controlling: Run ServergundasatishNo ratings yet

- Sap Fi/Co: Transaction CodesDocument51 pagesSap Fi/Co: Transaction CodesReddaveni NagarajuNo ratings yet

- Accounting Entries For Sales From Sales Order Stock in SAPDocument6 pagesAccounting Entries For Sales From Sales Order Stock in SAPPankaj KhatoniarNo ratings yet

- Assessment and distribution in Profit Center AccountingDocument2 pagesAssessment and distribution in Profit Center Accountingashish19s680No ratings yet

- QA VAT GuideDocument23 pagesQA VAT GuideViSpNo ratings yet

- EC029 - A - Fixed Assets Setup & Common Data - v11.00Document14 pagesEC029 - A - Fixed Assets Setup & Common Data - v11.00Ariel SpallettiNo ratings yet

- LC PC ConfigurationDocument2 pagesLC PC ConfigurationmoorthykemNo ratings yet

- MIRO Credit MemoDocument5 pagesMIRO Credit Memochapx032No ratings yet

- Define Tax Codes For Sales and Purchases in SapDocument6 pagesDefine Tax Codes For Sales and Purchases in SapNaveen kumar reddy VNo ratings yet

- Lockbox Configuration - SCN PDFDocument10 pagesLockbox Configuration - SCN PDFManish Bhasin100% (1)

- Questionnaire Split Valuation en No ScenariosDocument15 pagesQuestionnaire Split Valuation en No ScenariosPrasanna Kumar SethiNo ratings yet

- Lock Box File2Document5 pagesLock Box File2SATYANARAYANA MOTAMARRINo ratings yet

- EDI 820 Guide en PDFDocument14 pagesEDI 820 Guide en PDFVivek KovivallaNo ratings yet

- Define FI Validations in SAPDocument4 pagesDefine FI Validations in SAPanad12No ratings yet

- Challenges in collection and lockbox solutionDocument4 pagesChallenges in collection and lockbox solutionNaveen KumarNo ratings yet

- Introduction To Migration To New General LedgerDocument18 pagesIntroduction To Migration To New General LedgerGurpreet Singh100% (1)

- S - ALR - 87003642 - Open and Close Posting Periods - SAPDocument2 pagesS - ALR - 87003642 - Open and Close Posting Periods - SAPheshamali99No ratings yet

- Accounts Payable: Global Process Management SystemDocument89 pagesAccounts Payable: Global Process Management SystemcybervistaNo ratings yet

- 18C - CDocument9 pages18C - CELOUSOUANI0% (1)

- Sap Fico Go Live DetailedCutover ActivitiesDocument4 pagesSap Fico Go Live DetailedCutover Activitiesanand chawanNo ratings yet

- Dunning, Dunning Procedure in SAPDocument3 pagesDunning, Dunning Procedure in SAPmr_relyNo ratings yet

- Resolve "not modifiableDocument15 pagesResolve "not modifiablePriyabrata RayNo ratings yet

- WBS MPM KT Doc-1Document22 pagesWBS MPM KT Doc-1Himanshu KapoorNo ratings yet

- 7717 - Manual Cash Management PDFDocument70 pages7717 - Manual Cash Management PDFkoos_engelbrechtNo ratings yet

- TRN FI101 Account Payable v1.4Document93 pagesTRN FI101 Account Payable v1.4Shyam JaganathNo ratings yet

- Application Account Payables Title: Retainage Invoice: OracleDocument24 pagesApplication Account Payables Title: Retainage Invoice: OraclesureshNo ratings yet

- Multiple Partial Payments From An Invoice Through Automatic Payment ProgramDocument26 pagesMultiple Partial Payments From An Invoice Through Automatic Payment ProgramnasuuNo ratings yet

- T CodeDocument5 pagesT CodeUsman Ali100% (2)

- Financial Advisory Services Training ManualDocument11 pagesFinancial Advisory Services Training ManualAnonymous 7CVuZbInUNo ratings yet

- Sap Financial StatementsDocument9 pagesSap Financial StatementsJose Luis GonzalezNo ratings yet

- Account Assignment and Revenue RecognitionDocument8 pagesAccount Assignment and Revenue RecognitionPraveen KumarNo ratings yet

- Automate bank reconciliation and accounting with search strings in electronic bank statementsDocument7 pagesAutomate bank reconciliation and accounting with search strings in electronic bank statementspandu MNo ratings yet

- Revenue Recognition PDFDocument6 pagesRevenue Recognition PDFObilesu RekatlaNo ratings yet

- Accounts Payable AssessmentDocument2 pagesAccounts Payable AssessmentbeatriceNo ratings yet

- SAP FI - Automatic Payment Run - TutorialspointDocument7 pagesSAP FI - Automatic Payment Run - TutorialspointsridharNo ratings yet

- Tcs DocDocument8 pagesTcs DocSelvaRajNo ratings yet

- AS01 Create An AssetDocument14 pagesAS01 Create An AssetAgostino Fusar BassiniNo ratings yet

- Indirect Activity Allocation May 2013Document16 pagesIndirect Activity Allocation May 2013Naveen KumarNo ratings yet

- Accounting Transactions in PODocument3 pagesAccounting Transactions in POsherif ramadanNo ratings yet

- Accounting Entries in Oracle Purchasing and PayablesDocument15 pagesAccounting Entries in Oracle Purchasing and PayablesmuradNo ratings yet

- Accounting Entries in Oracle Purchasing and PayablesDocument15 pagesAccounting Entries in Oracle Purchasing and PayablesEhsan AliNo ratings yet

- Harrison Chapter 5 Student 6 CeDocument46 pagesHarrison Chapter 5 Student 6 CeAliyan AmjadNo ratings yet

- Oracle purchasing accounts guideDocument15 pagesOracle purchasing accounts guideali iqbalNo ratings yet

- Oracle Question AnswerDocument44 pagesOracle Question AnswerVijay PatelNo ratings yet

- Integration PointsDocument3 pagesIntegration PointsIndumathi KumarNo ratings yet

- COGS Accounting Solutions v6 PDFDocument98 pagesCOGS Accounting Solutions v6 PDFIndumathi KumarNo ratings yet

- Demand SupplyDocument1 pageDemand SupplyIndumathi KumarNo ratings yet

- Oracle Erp Cloud Period Close WhitepaperDocument92 pagesOracle Erp Cloud Period Close WhitepaperskshivaNo ratings yet

- Oracle HRMS CRP - Oracle Payroll: Abu Dhabi Motorsports Management AdmmDocument98 pagesOracle HRMS CRP - Oracle Payroll: Abu Dhabi Motorsports Management AdmmIndumathi KumarNo ratings yet

- Demand SupplyDocument1 pageDemand SupplyIndumathi KumarNo ratings yet

- Article Effective Knowledge Transfer 11Document7 pagesArticle Effective Knowledge Transfer 11Indumathi KumarNo ratings yet

- Oracle ReqDocument2 pagesOracle ReqIndumathi KumarNo ratings yet

- Oracle® Iprocurement: Implementation and Administration Guide Release 12.2Document290 pagesOracle® Iprocurement: Implementation and Administration Guide Release 12.2Indumathi KumarNo ratings yet

- Uae HRMSDocument206 pagesUae HRMSIndumathi KumarNo ratings yet

- HRMS Questionnaire PDFDocument16 pagesHRMS Questionnaire PDFIndumathi KumarNo ratings yet

- Oracle® Iprocurement: User Guide Release 12.2Document152 pagesOracle® Iprocurement: User Guide Release 12.2Indumathi KumarNo ratings yet

- Article Effective Knowledge Transfer 11Document7 pagesArticle Effective Knowledge Transfer 11Indumathi KumarNo ratings yet

- RD.020 Process Questionnaire TemplateDocument13 pagesRD.020 Process Questionnaire TemplateIndumathi KumarNo ratings yet

- 120wipug PDFDocument836 pages120wipug PDFvkathorNo ratings yet

- Rd020 Process QuestionnaireDocument151 pagesRd020 Process QuestionnaireIndumathi KumarNo ratings yet

- RD.020 Process Questionnaire TemplateDocument13 pagesRD.020 Process Questionnaire TemplateIndumathi KumarNo ratings yet

- Questions To Client Replies / Comments UK Replies / Comments USDocument35 pagesQuestions To Client Replies / Comments UK Replies / Comments USIndumathi KumarNo ratings yet

- OBM Level I OBM Level II Obm Level Iii Application Category Process Analysis QuestionsDocument4 pagesOBM Level I OBM Level II Obm Level Iii Application Category Process Analysis QuestionsIndumathi KumarNo ratings yet

- Transistion PlanDocument3 pagesTransistion PlanpradeepNo ratings yet

- Requi ProcessDocument2 pagesRequi ProcessIndumathi KumarNo ratings yet

- Article Effective Knowledge Transfer 11Document7 pagesArticle Effective Knowledge Transfer 11Indumathi KumarNo ratings yet

- Project Transition PlanDocument11 pagesProject Transition PlanIndumathi KumarNo ratings yet

- Rd020 Process QuestionnaireDocument151 pagesRd020 Process QuestionnaireIndumathi KumarNo ratings yet

- Questions To Client Replies / Comments UK Replies / Comments USDocument35 pagesQuestions To Client Replies / Comments UK Replies / Comments USIndumathi KumarNo ratings yet

- Problem29 40Document1 pageProblem29 40IENCSNo ratings yet

- CaracterizacióndeSalpicadurasSMAW Molleda 2007Document5 pagesCaracterizacióndeSalpicadurasSMAW Molleda 2007Tamara Maria Ortiz MendezNo ratings yet

- Outline of The Gospel of John: Book of Signs: Jesus Reveals His Glory To The World (Israel) (1:19-12:50)Document4 pagesOutline of The Gospel of John: Book of Signs: Jesus Reveals His Glory To The World (Israel) (1:19-12:50)Aamer JavedNo ratings yet

- Capstone Presentation 2020Document12 pagesCapstone Presentation 2020api-539629427No ratings yet

- Novec1230 RoomIntegrityDocument2 pagesNovec1230 RoomIntegritynastyn-1No ratings yet

- The Management of Productivity and Technology in Manufacturing PDFDocument333 pagesThe Management of Productivity and Technology in Manufacturing PDFmythee100% (2)

- Class Xii Appendix-Iii: Colligative PropertiesDocument3 pagesClass Xii Appendix-Iii: Colligative PropertiesSrijan JaiswalNo ratings yet

- Introduction to Pidilite IndustriesDocument8 pagesIntroduction to Pidilite IndustriesAbhijit DharNo ratings yet

- 2narrative Essay - My Favorite TeacherDocument9 pages2narrative Essay - My Favorite TeacherHerbertKoh100% (1)

- Organization-and-Management Q1 LAS Wk1Document5 pagesOrganization-and-Management Q1 LAS Wk1Joyce CelineNo ratings yet

- Intro To Rizal LawDocument61 pagesIntro To Rizal Lawnicachavez030No ratings yet

- World After CovidDocument18 pagesWorld After CovidVidhisha AgrawalNo ratings yet

- HW3 - Chapter 9-2Document3 pagesHW3 - Chapter 9-2Zachary MedeirosNo ratings yet

- Social Engineering For Pentester PenTest - 02 - 2013Document81 pagesSocial Engineering For Pentester PenTest - 02 - 2013Black RainNo ratings yet

- A Review of Agricultural Drought Assessment With Remote Sensing Data: Methods, Issues, Challenges and OpportunitiesDocument14 pagesA Review of Agricultural Drought Assessment With Remote Sensing Data: Methods, Issues, Challenges and Opportunitiesاسامة نعمة جبارNo ratings yet

- TECHNICALPAPER2Document8 pagesTECHNICALPAPER2spiderwebNo ratings yet

- GCMS-QP2010 User'sGuide (Ver2.5) PDFDocument402 pagesGCMS-QP2010 User'sGuide (Ver2.5) PDFnguyenvietanhbtNo ratings yet

- Course 1 ProjectDocument6 pagesCourse 1 ProjectDhruvNo ratings yet

- State-of-Charge Estimation On Lithium Ion Batteries - Mori W YatsuiDocument5 pagesState-of-Charge Estimation On Lithium Ion Batteries - Mori W Yatsuit3hgoneNo ratings yet

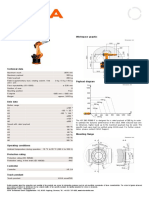

- KR 280 R3080 F technical specificationsDocument1 pageKR 280 R3080 F technical specificationsDorobantu CatalinNo ratings yet

- Khwaja Moinuddin Chishti Language UniversityDocument30 pagesKhwaja Moinuddin Chishti Language UniversityShivam ShuklaNo ratings yet

- Introduction To Engineering Economy: Title of The LessonDocument16 pagesIntroduction To Engineering Economy: Title of The LessonsdanharoldNo ratings yet

- Daniel J. Wood - Realm of The Vampire - History and The Undead-Galde Press (2013)Document156 pagesDaniel J. Wood - Realm of The Vampire - History and The Undead-Galde Press (2013)Jerry KanneNo ratings yet

- Acid-Base Titration Using PH Meter and Finding The Equivalence Point Naoh ConcentrationDocument8 pagesAcid-Base Titration Using PH Meter and Finding The Equivalence Point Naoh ConcentrationYocobSamandrewsNo ratings yet

- 255 Introduction Vocational Service enDocument12 pages255 Introduction Vocational Service enDmitri PopaNo ratings yet

- 7Document19 pages7Maria G. BernardinoNo ratings yet

- Leading Causes of MortalityDocument12 pagesLeading Causes of MortalityJayricDepalobosNo ratings yet

- Inspire Physics 9 AdvanceDocument285 pagesInspire Physics 9 AdvanceJenan Zriak100% (2)

- New Technique for Producing 3D Fabrics Using Conventional LoomDocument1 pageNew Technique for Producing 3D Fabrics Using Conventional LoomSujit GulhaneNo ratings yet