Professional Documents

Culture Documents

Account Opening and KYC Form - International and Hybrid Accounts

Uploaded by

Manoj PatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Account Opening and KYC Form - International and Hybrid Accounts

Uploaded by

Manoj PatelCopyright:

Available Formats

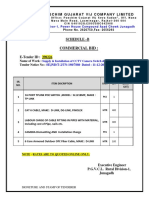

ACCOUNT OPENING FORM – International/Hybrid account

Name

Category □ Individual/Proprietary firm

□ Company

□ Trust / Foundation

□ Proprietary/Partnership firm/LLP

□ Institutions (including Embassy/ U.N. Bodies/ any

Government entities)

Principal business address/es from which business is

transacted

Telephone No

Mobile No

Website

Email ID for correspondence and billing

Name and title of authorized signatory/ies

For signing contractual documents. Please provide proof of

authority.

E-mail ID of authorized signatory

(for contractual documents)

IEC No (attach copy)

PAN No (attach copy)

TAN No (attach copy)

Registered under Goods & Service Tax

YES NO

GSTIN/UIN(attach copy) State:

Note: If there are more than one GSTIN/UIN please

provide details in Annexure 1 GSTIN/UIN:

GST Exemption YES NO

Reason for GST Exemption

FedEx Account No

to be completed by FedEx

I/We hereby declare that the particulars given herein above are true, correct and complete to the best of my/our

knowledge and belief. In case of any change in any of the aforementioned particulars, I/we undertake to notify you

in writing.

Place Signature

Date Name

Official Seal

Updated Jan 2019

KNOW YOUR CUSTOMER FORM

For international/hybrid shipping accounts

As mandated by Indian Customs vide CBEC Circulars 09/2010, 33/2010 and 07/2015 for identification/verification of

importers/exporters for customs clearance performed on their behalf by FedEx acting as an Authorized Courier/CHA

directly or through a CHA appointed by FedEx on behalf of Customer.

Please provide the following documents as per the checklist below:

a) Any one document (certified by individual/authorized signatory) to verify identity and address proof.

b) Any one document (certified by authorized signatory) to verify authority granted to signatory.

c) Certified copy of government-issued ID of authorized signatory

Note: the name and address on the KYC documents must match the address and name mentioned on the

Air Waybill / invoice.

Category Documents Required

1) Company, To verify identity

2) Trust or Foundation; □ GSTIN

3) Proprietorship Firm & □ PAN

4) Partnership Firm/LLP

(Registered under Goods & To verify address

Services Tax Act) □ Utility bill not more than 2 months old (landline/mobile phone/electricity/water/gas)

□ Bank Account statement not more than 2 months’ old

□ Shops and Establishment Act registration

□ GSTIN with address

□ Registered lease or leave and license agreement with 6 months’ validity

□ Additional address Proof Required for on-boarding Proprietary/Partnership Firms: The

Proprietor / Each Partner shall furnish their personal address proof for present and permanent

residence. In the event the Proprietor/ each Partner are staying at rented premises please procure

their permanent address proof. The requisite documents for present and permanent address proof

shall be: Bank Statement or Aadhar Card or Driving License or Passport

To verify authority of signatory

□ Power of Attorney/ Letter of Authority/ Resolution granted to its managers, officers or

employees to transact business on its behalf

1) Company, To verify identity

2) Trust or Foundation; □ PAN card

3) Proprietorship Firm & □ Unique Identification Number (UIN)

4) Partnership Firm/LLP

5) Institutions (including To verify address

Embassy/U.N.Bodies/ □ Utility bill not more than 2 months old (landline/mobile phone/electricity/water/gas)

Entities □ Utility bill not more than 2 months old (landline/mobile phone/electricity/water/gas)

□ Bank Account statement not more than 2 months’ old

□ Shops and Establishment Act registration

□ Registered lease or leave and license agreement with 6 months’ validity

□ Additional address Proof Required for on-boarding Proprietary/Partnership Firms: The

Proprietor / Each Partner shall furnish their personal address proof for present and permanent

residence. In the event the Proprietor/ each Partner are staying at rented premises please procure

their permanent address proof. The requisite documents for present and permanent address proof

shall be: Bank Statement or Aadhar Card or Driving License or Passport

(Exempted/ Not-Registered

under Goods & To verify authority of signatory

Services Tax Act)

□ Power of Attorney/ Letter of Authority/ Resolution granted to its managers,

officers or employees to transact business on its behalf

I/We hereby declare that the particulars given herein above and the documents attached as per the checklist above are true,

correct and complete to the best of my/our knowledge and belief, and the documents submitted in support of this KYC Form are

genuine and obtained legally from the respective issuing authority. In case of any change in any of the aforementioned particulars,

I/we undertake to notify you in writing. I/We hereby authorize you to submit the above particulars to the customs and other

regulatory authorities on my/our behalf as may be required in order to transport and customs clear my/our shipments.

Place Signature

Date Name

Official Seal Updated Jan 2019

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Of Our Very Best: Recipe CardsDocument27 pagesOf Our Very Best: Recipe CardsManoj Patel83% (6)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Authorization To Use and Charge Credit Card 1 1Document1 pageAuthorization To Use and Charge Credit Card 1 1Franklin BasconNo ratings yet

- Specification Dried Oyster Mushrooms-2019Document2 pagesSpecification Dried Oyster Mushrooms-2019Manoj PatelNo ratings yet

- Execution Petition Under Order 21 Rule 10Document5 pagesExecution Petition Under Order 21 Rule 10muskan kalra100% (1)

- NPIR - Internal Audit Division Output StoryDocument4 pagesNPIR - Internal Audit Division Output StoryBritt John BallentesNo ratings yet

- Bailment Agreement: by and Between: (Name of Bailee)Document5 pagesBailment Agreement: by and Between: (Name of Bailee)Brandace Hopper100% (1)

- Ojas Aura Brochure-1Document17 pagesOjas Aura Brochure-1Manoj PatelNo ratings yet

- Fresh and Processed FV Products Inspections PDFDocument44 pagesFresh and Processed FV Products Inspections PDFManoj PatelNo ratings yet

- Bul-Spent Mushroom Substrate (SMS)Document56 pagesBul-Spent Mushroom Substrate (SMS)Manoj Patel100% (1)

- Recycling of Spent Mushroom Substrate To Use As Organic ManureDocument6 pagesRecycling of Spent Mushroom Substrate To Use As Organic ManureManoj PatelNo ratings yet

- Foreign Material Manual: July 2013Document69 pagesForeign Material Manual: July 2013Manoj PatelNo ratings yet

- Canned Mushrooms StandardDocument14 pagesCanned Mushrooms StandardManoj PatelNo ratings yet

- 9 Terms and ConditionsDocument5 pages9 Terms and ConditionsManoj PatelNo ratings yet

- Commercial Bid:: Paschim Gujarat Vij Company LimitedDocument1 pageCommercial Bid:: Paschim Gujarat Vij Company LimitedManoj PatelNo ratings yet

- IN - Band 11 - VIND3 - LWS 2020 - ExportDocument8 pagesIN - Band 11 - VIND3 - LWS 2020 - ExportManoj PatelNo ratings yet

- Electrical 1 PDFDocument16 pagesElectrical 1 PDFManoj PatelNo ratings yet

- Dealers Price List: W.E.F. 20-12-2016 Delton Cables LimitedDocument1 pageDealers Price List: W.E.F. 20-12-2016 Delton Cables LimitedManoj PatelNo ratings yet

- Grocery Products ListDocument2 pagesGrocery Products ListManoj PatelNo ratings yet

- Government of West Bengal Department of Health and Family Welfare, Wing-A, 4 Floor, Swasthya Bhavan GN 29, Sector - V, Salt Lake, Kolkata - 700091Document33 pagesGovernment of West Bengal Department of Health and Family Welfare, Wing-A, 4 Floor, Swasthya Bhavan GN 29, Sector - V, Salt Lake, Kolkata - 700091meenakshi.r.agrawalNo ratings yet

- Apauline IciciDocument41 pagesApauline Icicihalotog831No ratings yet

- Application Processing Fee Challan Application Processing Fee ChallanDocument1 pageApplication Processing Fee Challan Application Processing Fee ChallansayemlaeeqNo ratings yet

- Eco ProjectDocument16 pagesEco ProjectBedBrokenNo ratings yet

- Yayasan Dompet Dhuafa-Financial Statement 2020Document20 pagesYayasan Dompet Dhuafa-Financial Statement 2020Bagus Cayo MastrizaNo ratings yet

- Cs Form No. 212 Revised Personal Data Sheet - NewDocument10 pagesCs Form No. 212 Revised Personal Data Sheet - Newbaby blossomsNo ratings yet

- ZXWR RNC (V3.07.300) Radio Network Controller Signaling DescriptionDocument82 pagesZXWR RNC (V3.07.300) Radio Network Controller Signaling DescriptionNguyen ManhNo ratings yet

- SPA - Seller's Authorized Representative (Clean)Document2 pagesSPA - Seller's Authorized Representative (Clean)Ellaine D RamirezNo ratings yet

- Executive Order For UBASDocument2 pagesExecutive Order For UBASMa. Theresa LoraNo ratings yet

- Bharti IntimatationDocument2 pagesBharti IntimatationsarathlalNo ratings yet

- Canal Extension 2021 Package-IVDocument76 pagesCanal Extension 2021 Package-IVShakeeb KhanNo ratings yet

- 2307 New Template Ni PauDocument37 pages2307 New Template Ni Pau175pauNo ratings yet

- DTR FormDocument1 pageDTR FormkennethNo ratings yet

- Master Plan KolkattaDocument6 pagesMaster Plan KolkattaVidhi VyasNo ratings yet

- prc-2022-1553 PRESCRIPTIVE PERIODS FOR CPD TRANSACTIONSDocument7 pagesprc-2022-1553 PRESCRIPTIVE PERIODS FOR CPD TRANSACTIONSnonreyes100% (1)

- Ministry of Transportation: ImotkedtpDocument20 pagesMinistry of Transportation: Imotkedtpahmad kadafiNo ratings yet

- Skills Development Training Tender RFP EOI NSKFDC Skill Reporter 04042020 PDFDocument15 pagesSkills Development Training Tender RFP EOI NSKFDC Skill Reporter 04042020 PDFManishDwivediNo ratings yet

- ABAKADA VS ERMITA Case SyllabusDocument15 pagesABAKADA VS ERMITA Case SyllabusWræn ŸåpNo ratings yet

- Law On BlacklistingDocument2 pagesLaw On BlacklistingVARENIUMNo ratings yet

- Bima Bachat (Plan - 175)Document5 pagesBima Bachat (Plan - 175)Jothiranjini KarthikeyanNo ratings yet

- March 29 Grand Forks Board Appointment MaterialsDocument26 pagesMarch 29 Grand Forks Board Appointment MaterialsJoe BowenNo ratings yet

- Benchmarking: Definitions and OverviewDocument18 pagesBenchmarking: Definitions and OverviewZeeshan HaiderNo ratings yet

- StudentDocument1 pageStudentalaamabood6No ratings yet

- Laporan Jualan Tiket Ets KTM BULAN 2/20 Padang Besar - KL Sentral - GemasDocument5 pagesLaporan Jualan Tiket Ets KTM BULAN 2/20 Padang Besar - KL Sentral - Gemasazlina osmanNo ratings yet

- Shagun ConstiDocument16 pagesShagun ConstiShagun VishwanathNo ratings yet

- Certificate of Appearance: Prudencia Du-De Sagun Dentist Ii MHODocument1 pageCertificate of Appearance: Prudencia Du-De Sagun Dentist Ii MHOangel_sagun_1No ratings yet