Professional Documents

Culture Documents

JR Mec Iii Term 06-12-18

Uploaded by

M JEEVARATHNAM NAIDUOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JR Mec Iii Term 06-12-18

Uploaded by

M JEEVARATHNAM NAIDUCopyright:

Available Formats

1

VIJAYAM JUNIOR COLLEGE

III TERMINAL COMMERCE JUNIOR MEC

Time: 3 Hours] DATE:06-12-18 [Max. Marks: 100

======================================================================

I Answer any TWO of the following questions not exceeding 40 lines each. 2 X 10 = 20

1. What do you mean by sole trading business? Discuss its merits and demerits.

2. What are the contents of Partnership Deed.

3. Explain the advantages and disadvantages of partnership firm.

II. Answer any FOUR of the following questions, not exceeding 20 lines each. 4 X 5 = 20

4. Explain the characteristics of sole trade.

5. State the rights of a partner.

6. Define MSMEs and Explain their significance.

7. Define MNCs. Explain their features.

8. Explain the advantages of MNCs.

9. What are the benefits of E-Business to the customers and organization..

III Answer any FIVE of the following questions, not exceeding 5 lines each. 5 X 2 = 10

10. Active partner 11. Dissolution of the partnership 12. Two duties of partners.

13. E- Banking 14. E-Auctioning 15. LPG 16. FDI 17. Globalisation

IV. Answer any TWO of the following questions. 2 X 5 = 10

18. What is the concept of accounting? Describe the major concepts in the accounting.

19. Explain the Double Entry System and its advantages

20. Prepare Ramesh a/c from the following Transactions.

2014 Rs.

Jan 1 Balance due to Ramesh 4,500

5 Purchased goods from Ramesh for cash 1,000

10 Bought goods from Ramesh 2,000

15 Goods returned to Ramesh 200

20 Cash paid to Ramesh 2,000

25 Cash purchases from Ramesh 2,000

28 Credit purchases from Ramesh 1,000

31 Settled Ramesh Account with a cheque.

21. From the following particulars prepare Subsidiary books.

2016 Rs.

Feb 1 Sold goods to Aparna 10,000

2 Anupama purchased goods 20,000

3 Sold goods to Aradhya 30,000

15 Purchased goods from Anitha 60,000

20 Sold goods to Apurva 40,000

28 Purchased goods from Avani 50,000

2

V. Answer any ONE of the following 1 X 10 = 10

22. Prepare Triple Column Cash Book of Kalyan from the following.

2016 Particulars Rs.

April 1 Cash Balance 28,000

Bank balance 30,000

5 Cash sales 5,000

6 Paid into Bank 25,000

8 Received cash from Mohan 2,000

Cheque 2,900

Full settlement of 5,000

10 Cash withdrawn from bank for office use 2,000

18 Bought Machinery paid by cheque 10,000

21 Received commission 800

25 Cash purchases paid through cheque 4,000

30 Paid to Vardhen by cheque 7,900

(in full settlement of Rs.8, 000)

23. From the following particulars of Ramoji Rao Prepare Bank Reconciliation Statement as it

would appear on 31-3-2017

1. Debit balance as per pass book Rs.15,600.

2. Cheques deposited into the bank for collection were Rs.3, 560 but they were not credited

by the bank by 31-3-17.

3. Out of the cheques issued in the month of March for Rs.4,800, cheques amounting to

Rs.1, 200 have been presented for payment before 31-3-17.

4. Bank commission Rs.75 which has been debited in the pass book has not been recorded

in the cash book.

5. The relevant entries for the amount collected by the bank as interest on debentures

Rs.215, can not be seen in cash book.

6. Rs.305 cheque was sent to bank for collection. This cheque was dishonoured. Information

was not supplied by the bank before 31-3-17.

I. Answer any FIVE of the following questions. 5 X 2 = 10

24. What is ‘Capital’? 25. Single Entry System?

26. Write Journal Entries in the books of Basi Reddy.

2016 Aug 1 Commenced business with Rs.50,000

2016 Aug 2 Paid into bank Rs.15,000

2016 Aug 3 Withdraw cash from bank for personal use Rs. 1,200

2016 Aug 5 Paid for postage Rs. 125

2016 Aug 7 Incurred sundry expenses Rs. 40

2016 Aug 9 Withdrew cash from bank Rs. 1,500

27. What is ledger? 28. What is contra entry?

29. From the following information. Write down the opening entries in the books of

Narayana as on January 1st 2018.

Cash in Hand - Rs.4, 000 Cash at Bank – Rs.13, 000 Loan from Ramesh . – Rs.6, 000

3

Furniture & Fixtures – Rs.6, 000 Sundry Debtors – Rs.20, 000 Creditors – Rs.11, 000

Stock – Rs.27, 000

30. Pass Opening entry from the following balances.

Rs.

Machinery 20,000

Creditors 10,000

Debtors 12,000

Bills receivable 4,000

Outstanding salaries 1,000

Bills payable 3,000

Cash in hand 1,200

Cash at Bank 6,800

31. Prepare the Trial Balance from the following balances.

Rs.

Bills receivable 1,000

Sales 1,200

Purchase returns 300

Bills payable 800

Purchases 3,000

Capital 1,900

Sales returns 200

VII. Show the Trading, Profit & Loss Account and Balance Sheet of Mr. Nagur Bhasha as

on 31st March 2017 from the following Trial Balance. 1X 20 = 20

Particulars Debit Rs. Credit Rs.

Stock on 1-4-2016 4,500

Sales - 42,000

Returns outwards - 1,000

Returns inwards 2,000 -

Advertisement Expenses 4,600 -

Gas, water charges 1,800 -

Telephone charges 2,000 -

Bills receivable 7,000 -

Creditors - 8,000

Capital - 32,000

Drawings 1,400 -

General Expenses 900 -

Debtors 16,000 -

Bills payable - 2,500

Machinery 12,000 -

Furniture 6,000 -

Purchases 20,700 -

Cash in hand 1,200 -

Factory insurance 800 -

Loose tools 4,600 -

85,500 85,500

Adjustments:

1. Prepaid advertisements Rs.600/-. 2. Provide Rs.500 Bad Debts

3. Depreciate Machinery by 10%, Furniture by 5%

4. Outstanding Gas, Water charges Rs.200

5. Stock on 31-03-2017 Rs.22,000

4

You might also like

- Freight Trucking Business Plan ExampleDocument35 pagesFreight Trucking Business Plan Exampleanang WahjudiNo ratings yet

- FinMa ExamDocument7 pagesFinMa ExamRose Anne CastilloNo ratings yet

- Project Chariot IpDocument7 pagesProject Chariot Ipapi-544118373No ratings yet

- Company Law NotesDocument313 pagesCompany Law NotesHosea KanyangaNo ratings yet

- PWC Kyc Anti Money Laundering Guide 2013 PDFDocument292 pagesPWC Kyc Anti Money Laundering Guide 2013 PDFAgungNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Monzo Bank Statement 2020 11 01-2020 11 30 1836Document25 pagesMonzo Bank Statement 2020 11 01-2020 11 30 1836Vitor BinghamNo ratings yet

- Corporate Governance Practice in SBI and WIPRODocument44 pagesCorporate Governance Practice in SBI and WIPROashish_dubey_16100% (1)

- CLASS - B Activity - FABM2Document43 pagesCLASS - B Activity - FABM2FRANCES67% (3)

- Management Advisory Services (Mas) : The Cpa Licensure Examination SyllabusDocument4 pagesManagement Advisory Services (Mas) : The Cpa Licensure Examination SyllabusLala AlalNo ratings yet

- Revenue Recognition for Construction ContractsDocument12 pagesRevenue Recognition for Construction ContractsShane TorrieNo ratings yet

- Vijayam Junior College Commerce Exam QuestionsDocument2 pagesVijayam Junior College Commerce Exam QuestionsM JEEVARATHNAM NAIDUNo ratings yet

- Bba 1 Sem Business Accounting 21102401 Oct 2021Document4 pagesBba 1 Sem Business Accounting 21102401 Oct 2021lizabnamazliaNo ratings yet

- June, 2004 Q.P JRDocument4 pagesJune, 2004 Q.P JRM JEEVARATHNAM NAIDUNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- Question 1Document3 pagesQuestion 1Mohammad Tariq AnsariNo ratings yet

- Commerce First YearDocument7 pagesCommerce First Yearravulapallysona93No ratings yet

- Karnataka Ist PUC Accountcancy Sample Question Paper 4 PDFDocument4 pagesKarnataka Ist PUC Accountcancy Sample Question Paper 4 PDFNeha BaligaNo ratings yet

- Bba Bcom Ll.b-I-Fincncial Accounting CC01Document2 pagesBba Bcom Ll.b-I-Fincncial Accounting CC01vijay.s12usNo ratings yet

- Accounting For Managers - Practical ProblemsDocument33 pagesAccounting For Managers - Practical ProblemsdeepeshmahajanNo ratings yet

- (C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10Document3 pages(C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10M JEEVARATHNAM NAIDUNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- Cash Book WorksheetDocument11 pagesCash Book WorksheetRaashiNo ratings yet

- Karnataka I PUC Accountancy 2019 Model Question Paper 1Document7 pagesKarnataka I PUC Accountancy 2019 Model Question Paper 1Lokesh Rao100% (1)

- I. Answer Any TWO of The Following Questions. 2 X 5 10Document3 pagesI. Answer Any TWO of The Following Questions. 2 X 5 10M JEEVARATHNAM NAIDUNo ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- JR Mec Monthly Test 15-07-19Document2 pagesJR Mec Monthly Test 15-07-19M JEEVARATHNAM NAIDUNo ratings yet

- ACCOUNTANCY CLASS NOTESDocument8 pagesACCOUNTANCY CLASS NOTESpraveenpv7No ratings yet

- Accounting from Incomplete Records: Trading and Profit Loss StatementDocument21 pagesAccounting from Incomplete Records: Trading and Profit Loss StatementbinuNo ratings yet

- SUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100Document3 pagesSUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100M JEEVARATHNAM NAIDUNo ratings yet

- Accountancy Model QP I Puc 2023-24 PDFDocument7 pagesAccountancy Model QP I Puc 2023-24 PDFsyedsaadss008No ratings yet

- Financial Accounting First Midterm Test Ii BcaDocument2 pagesFinancial Accounting First Midterm Test Ii BcasuryaNo ratings yet

- Business Accounting 2019-1Document4 pagesBusiness Accounting 2019-1justin joyNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFDocument46 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFQueen MNo ratings yet

- 4 PDFDocument15 pages4 PDFniks525No ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 5 JournalDocument46 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 5 JournalRUSHIL GUPTANo ratings yet

- Faculty of Commerce Department of Accountancy & Law SYLLABUS/QUESTION BANK (Session 2020-21)Document9 pagesFaculty of Commerce Department of Accountancy & Law SYLLABUS/QUESTION BANK (Session 2020-21)KARTIK SHARMANo ratings yet

- Accounting Practice For Cash BookDocument15 pagesAccounting Practice For Cash BookPrakriti Ram100% (1)

- ZR Ics Oray WFF 4 o YVGRi 7Document46 pagesZR Ics Oray WFF 4 o YVGRi 7RahulNo ratings yet

- Assignment 2023 For BPOI-102 (002) (DBPOFA Prog)Document2 pagesAssignment 2023 For BPOI-102 (002) (DBPOFA Prog)Pawar ComputerNo ratings yet

- Xicomm HHWDocument5 pagesXicomm HHWSSAV ALL IN ONE CHANNELNo ratings yet

- Double Entry Bookkeeping Cash BookDocument2 pagesDouble Entry Bookkeeping Cash BookAmritya TripathiNo ratings yet

- Revision Test FinalDocument4 pagesRevision Test FinalRitaNo ratings yet

- Financial Accounting - IA QPDocument2 pagesFinancial Accounting - IA QPShreeniwas BhawnaniNo ratings yet

- Worksheet Cash Book and Petty Cash BookDocument6 pagesWorksheet Cash Book and Petty Cash BookHarsh ShahNo ratings yet

- Fundamentals of Accounting 2020Document4 pagesFundamentals of Accounting 2020sreehari dineshNo ratings yet

- 1bba FOA Prep QPDocument2 pages1bba FOA Prep QPSuhail AhmedNo ratings yet

- Vijayam Junior College terminal exam questionsDocument2 pagesVijayam Junior College terminal exam questionsM JEEVARATHNAM NAIDUNo ratings yet

- Course Id 23324 CourseTitle Principals of Accounting and Costing-LABDocument4 pagesCourse Id 23324 CourseTitle Principals of Accounting and Costing-LABICIS CollegeNo ratings yet

- MM International School Class 11 Accountancy Worksheet Journal EntriesDocument1 pageMM International School Class 11 Accountancy Worksheet Journal Entriesshaurya patelNo ratings yet

- Financial Accounting Past Paper BCom Part 1 PU 2019Document3 pagesFinancial Accounting Past Paper BCom Part 1 PU 2019Rana Hanzila TahirNo ratings yet

- March 2006 Q.P. JURDocument4 pagesMarch 2006 Q.P. JURM JEEVARATHNAM NAIDUNo ratings yet

- Question Bank-Accountancy 11thDocument26 pagesQuestion Bank-Accountancy 11thshaurya goyalNo ratings yet

- Mid Term Accounts - SubjectiveDocument4 pagesMid Term Accounts - Subjectivekarishma prabagaranNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Paper A1Document3 pagesTime Allowed: 3 Hours Max Marks: 100: Paper A1KashifNo ratings yet

- Std XI COM Ujjwal Academy Time 2 hrs BK Q1-4 Journal EntriesDocument2 pagesStd XI COM Ujjwal Academy Time 2 hrs BK Q1-4 Journal EntriesObaid KhanNo ratings yet

- 2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Document4 pages2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Best ThingsNo ratings yet

- Basic Accounting Concepts and ModulesDocument11 pagesBasic Accounting Concepts and Modulespaul amo100% (1)

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- Accounts EnglishDocument12 pagesAccounts EnglishPradeepa SadhviNo ratings yet

- Valmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071Document3 pagesValmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071Rabindra Raj BistaNo ratings yet

- Accounts PaperDocument2 pagesAccounts PaperRohan Ghadge-46No ratings yet

- Question Paper 11 Accounts Time: 3Hrs Max Marks: 80Document5 pagesQuestion Paper 11 Accounts Time: 3Hrs Max Marks: 80manish jangidNo ratings yet

- B VocDocument9 pagesB VocHarshit SinghNo ratings yet

- 11th Accountancy Problems Practice Guide1Document13 pages11th Accountancy Problems Practice Guide1namita.nagar.1998No ratings yet

- Financial Accounts Questoin Paper UNOM 2018Document4 pagesFinancial Accounts Questoin Paper UNOM 2018lucy artemisNo ratings yet

- Public SectorDocument12 pagesPublic SectorM JEEVARATHNAM NAIDUNo ratings yet

- Private Sector Definition and RoleDocument4 pagesPrivate Sector Definition and RoleM JEEVARATHNAM NAIDUNo ratings yet

- May, 2007 AnswersDocument20 pagesMay, 2007 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- Multinational Corporations (MNC'S) : Meaning and DefinitionDocument5 pagesMultinational Corporations (MNC'S) : Meaning and DefinitionM JEEVARATHNAM NAIDUNo ratings yet

- May, 2006 AnswerDocument17 pagesMay, 2006 AnswerM JEEVARATHNAM NAIDUNo ratings yet

- March, 2007 AnswersDocument18 pagesMarch, 2007 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- CD Contents: S.No. Particulars PagesDocument2 pagesCD Contents: S.No. Particulars PagesM JEEVARATHNAM NAIDUNo ratings yet

- March, 2005 AnswersDocument25 pagesMarch, 2005 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- May, 2005 AnswersDocument21 pagesMay, 2005 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College::Chittoor I: Year Mec Ii Terminal ExaminatiuonDocument2 pagesVijayam Junior College::Chittoor I: Year Mec Ii Terminal ExaminatiuonM JEEVARATHNAM NAIDUNo ratings yet

- March, 2004 AnswersDocument22 pagesMarch, 2004 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- March, 2006 AnswerDocument23 pagesMarch, 2006 AnswerM JEEVARATHNAM NAIDUNo ratings yet

- I Yr Monthly 24-10-16Document1 pageI Yr Monthly 24-10-16M JEEVARATHNAM NAIDUNo ratings yet

- June, 2004 AnswersDocument18 pagesJune, 2004 AnswersM JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Pre Final 2Document1 pageJR Mec Pre Final 2M JEEVARATHNAM NAIDUNo ratings yet

- Liabilities Amount Rs. Assets Amount RsDocument2 pagesLiabilities Amount Rs. Assets Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Monthly Test 15-07-19Document2 pagesJR Mec Monthly Test 15-07-19M JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10Document1 pageVijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10M JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Pre Final 2Document1 pageJR Mec Pre Final 2M JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsDocument1 pageVijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsM JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Monthly 18-9-17Document1 pageJR Mec Monthly 18-9-17M JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College terminal exam questionsDocument2 pagesVijayam Junior College terminal exam questionsM JEEVARATHNAM NAIDUNo ratings yet

- JR Commerce Weekly Three Column Cash BookDocument3 pagesJR Commerce Weekly Three Column Cash BookM JEEVARATHNAM NAIDUNo ratings yet

- JR Mec Monthly 30.10.18Document2 pagesJR Mec Monthly 30.10.18M JEEVARATHNAM NAIDUNo ratings yet

- JR Commerce Weekly Three Column Cash BookDocument3 pagesJR Commerce Weekly Three Column Cash BookM JEEVARATHNAM NAIDUNo ratings yet

- SUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100Document3 pagesSUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100M JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsDocument1 pageVijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsM JEEVARATHNAM NAIDUNo ratings yet

- Vijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10Document1 pageVijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10M JEEVARATHNAM NAIDUNo ratings yet

- Silver River Manufacturing Company (SRM)Document45 pagesSilver River Manufacturing Company (SRM)Siddhartha Chhetri100% (2)

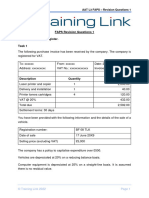

- AAT L3 FAPS Revision Questions 1Document7 pagesAAT L3 FAPS Revision Questions 1uzytkownik2207No ratings yet

- REsponsibilities of BODDocument4 pagesREsponsibilities of BODRizalyn Huraño MalalisNo ratings yet

- Problem Set # 8 Name - Ayushi Saxena Roll No. - PGP/24/442: Concept Questions (Ind - PS - BONDS - A2)Document2 pagesProblem Set # 8 Name - Ayushi Saxena Roll No. - PGP/24/442: Concept Questions (Ind - PS - BONDS - A2)Aditi BiswasNo ratings yet

- Wipro Accounting Policies ExplainedDocument3 pagesWipro Accounting Policies ExplainedNalin SNo ratings yet

- Egyptian Electrical Cables Increases 6.3% in Past YearDocument18 pagesEgyptian Electrical Cables Increases 6.3% in Past YearAhmed Ali HefnawyNo ratings yet

- 29 PDFDocument58 pages29 PDFAradhna BhasinNo ratings yet

- Adjusting EntriesDocument10 pagesAdjusting EntriesCharlene ViceralNo ratings yet

- Quiz 1.01 Financial Statements To Interim ReportingDocument22 pagesQuiz 1.01 Financial Statements To Interim ReportingJohn Lexter MacalberNo ratings yet

- Partnership Distribution of $60,000 in DissolutionDocument9 pagesPartnership Distribution of $60,000 in DissolutionAllynna JoyNo ratings yet

- Kitex 22nd Annual ReportDocument76 pagesKitex 22nd Annual ReportdduuuNo ratings yet

- Stock Account Opening: CDC "Cetral Depository Company: BadlaDocument2 pagesStock Account Opening: CDC "Cetral Depository Company: BadlaPasbanSaibanNo ratings yet

- FIN CCC Tanvir Ahmed Rony ID-18019042Document29 pagesFIN CCC Tanvir Ahmed Rony ID-18019042tanveer ahmedNo ratings yet

- Project Report For Trading in Welding EquipmentDocument15 pagesProject Report For Trading in Welding EquipmentSHRUTI AGRAWALNo ratings yet

- Finals Graded Exercises 002 Final Special Journals For Dist. FinalDocument4 pagesFinals Graded Exercises 002 Final Special Journals For Dist. FinalGarpt Kudasai100% (1)

- Sec vs. CaDocument2 pagesSec vs. CaRio TolentinoNo ratings yet

- Acc101 RevCh1 3 PDFDocument29 pagesAcc101 RevCh1 3 PDFWaqar AliNo ratings yet

- Company Final Accounts Theory and QuestionsDocument10 pagesCompany Final Accounts Theory and QuestionsPRABAL BHATNo ratings yet

- GFM Mock QuestionsDocument13 pagesGFM Mock QuestionsBhanu TejaNo ratings yet

- Nathan Steffl - Chapter 1 Assignment SheetDocument3 pagesNathan Steffl - Chapter 1 Assignment SheetNathan StefflNo ratings yet