0% found this document useful (0 votes)

710 views6 pagesSales Cycle Internal Control Overview

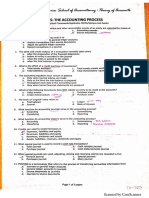

The document discusses internal controls related to the sales cycle for a company. It breaks the sales process down into key stages: order received, goods dispatched, invoice raised, payment received, and credit given. For each stage, it identifies potential risks and control procedures to address those risks. It emphasizes the difference between control objectives and control procedures/activities. It also provides examples of common sales frauds and discusses how internal control questionnaires can be used to document the controls in place and tests that can evaluate if controls are operating as intended.

Uploaded by

Glen JavellanaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

710 views6 pagesSales Cycle Internal Control Overview

The document discusses internal controls related to the sales cycle for a company. It breaks the sales process down into key stages: order received, goods dispatched, invoice raised, payment received, and credit given. For each stage, it identifies potential risks and control procedures to address those risks. It emphasizes the difference between control objectives and control procedures/activities. It also provides examples of common sales frauds and discusses how internal control questionnaires can be used to document the controls in place and tests that can evaluate if controls are operating as intended.

Uploaded by

Glen JavellanaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd