Professional Documents

Culture Documents

070 - 075 Statistic SANITARI

Uploaded by

Ayan NoorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

070 - 075 Statistic SANITARI

Uploaded by

Ayan NoorCopyright:

Available Formats

Statistics

by MECS, Acimac Research Department - studi@acimac.it - www.mec-studies.com

World sanitaryware

production and exports

World ceramic sanitaryware the ceramic tile sector saw a ports, it closed the year with a Mexico, while non-EU Europe-

imports/exports grew by 78% similar slowdown in world im- 0.7% contraction against 2014 an countries likewise per-

from 1.6 to 2.9 million tons over port/export growth in 2015 (1.67 million tons), after the formed strongly (+4.2% to

the period 2005-2015, corre- with just a 1.5% increase over previous year’s 22% growth. 186,000 tons) in spite of the

sponding to an annual com- the previous year. This negative result did not in- slowdown of Turkey. By con-

pound growth rate of 6%. The clude the three large Asian ex- trast, South America re-

trend has remained almost The 2.9 million tons of sanitary- porters (China, India and Thai- mained in negative territory

constantly positive over the ware exports represent a sig- land), all of which reported (-12%, 72,000 tons) following

years, the only real downturn nificant share of the estimated growth in 2015. By contrast, the four years of contraction and

occurring in 2008 (-7.3%). world production of around European Union, the world’s Africa saw its first downturn in

This however was followed by 350 million pieces/year. In second largest exporter re- 6 years (-5%, 84,000 tons).

a rapid recovery in 2009 that practice, around 40% of global gion, further improved on its Looking at the ten-year period

brought levels back to above output was sold outside the 2014 growth rate to reach as a whole gives a very clear

previous years’ figures. A sec- country of production in 2015 569,000 tons (+7.4%). This re- picture of how exports have

ond slowdown in 2012 was (compared to 29% in 2004). sult was attributable to the evolved in each region. Par-

likewise followed by two years strong performance of the five ticularly evident is the excep-

of strong expansion in exports, The analysis of 2015 exports largest exporter countries in tional growth of Asia, whose

again however interrupted in by geographical area of pro- the EU, an area that boasts five exports have risen from

2015 due to the sluggishness duction reveals a heterogene- of the top ten world exporter 388,000 tons in 2005 to 1.6 mil-

of the world economy. ous trend. While Asia re- countries. Exports from North lion tons in 2015, an overall in-

Sanitaryware exports conse- mained the world’s largest America (NAFTA region) also crease of 329% (CAGR

quently rose by just 1.1% with sanitaryware manufacturer rose by 3.3% to reach 340,000 +15.7%). Asia saw its percent-

respect to 2014. Interestingly, with a 57% share of world ex- tons thanks to the growth of age share of global exports

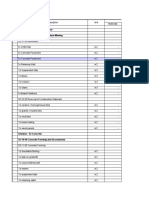

TAB. 1 - EXPORTS OF SANITARYWARE BY AREA (TONS)

% on

2005 2008 2009 2010 2011 2012 2013 2014 2015 % 15/14 CAGR 2015

15/05 world

exports

Asia 388,497 511,432 984,529 1,099,915 1,243,615 1,216,562 1,369,859 1,677,617 1,666,455 -0.7% 15.7% 57.1%

European Union

577,669 614,475 508,031 522,109 532,637 523,104 519,884 530,116 569,433 7.4% -0.1% 19.5%

(28)

Other Europe

155,024 148,553 125,198 132,132 145,787 169,188 171,264 178,482 185,960 4.2% 1.8% 6.4%

(Turkey included)

NAFTA 270,208 271,946 262,666 268,401 303,537 290,715 320,345 329,677 340,565 3.3% 2.3% 11.7%

South America 202,737 125,625 86,711 100,043 108,848 102,328 88,800 82,515 72,548 -12.1% -9.8% 2.5%

Africa 39,903 47,152 35,660 35,860 37,232 68,672 73,777 88,519 84,034 -5.1% 7.7% 2.9%

Oceania 4,035 1,971 2,061 1,960 1,063 875 608 847 902 6.5% -13.9% 0.0%

TOTAL WORLD 1,638,073 1,721,154 2,004,856 2,160,420 2,372,719 2,371,444 2,544,537 2,887,773 2,919,897 1.1% 6.0% 100.0%

% var y-o-y -7.3 16.5 7.8 9.8 -0.1 7.3 13.5 1.1

Source: Acimac Research Dept. on BSRIA and ITC data

Tile International 1/2017 70

Statistics

rise from 24% in 2005 to the 110% growth in sanitaryware firmly at the top of the rankings 2014 levels marked up the

current 57%, winning shares exports between 2005 and with an increase in exports highest CAGR 2015/2005 after

from all the other regions. The 2015 (CAGR +7.7%), raising its from 149,000 tons in 2005 to that of China, +9.1%. As men-

EU, which suffered an overall share of world trade from 2.4% 1.33 million tons in 2015 tioned above, there are now

1.4% decline with respect to to 2.9% and enabling it to over- (+795%!), corresponding to a five EU countries amongst the

the volumes exported in 2005, take even South America. compound annual growth rate top 10 world exporters, namely

saw its share of world trade of 24.5%. The year-on-year in- Portugal, Poland and Germa-

contract from 35.3% to 19.5%. The rankings of the top 10 ex- crease in 2015 was 4.3%. China ny (the only three of the top

The NAFTA region’s share fell porter countries remained un- alone accounted for 80% of ten to record double-figure

from 16.5% to 11.7% despite changed in 2015 with respect Asian exports and 45.7% of growth rates in 2015), followed

overall 26% growth in exports to the previous year apart from world exports. Mexico, the by Italy and Bulgaria. Italy has

over the decade. South Ameri- the entry of Italy in ninth posi- second largest exporter coun- entered the rankings following

ca, which in 2005 accounted tion. The fact that nine out of try with a 10% share of global its 7% growth in exports (57,601

for 12.4% of world exports, has the ten countries saw an in- exports, reached 295,000 tons tons), although this figure still

dropped to 2.5% following a crease in sanitaryware exports (up 6.7% on 2014), maintain- falls far short of the 80,000 tons

64% slump in volumes in 10 with respect to the previous ing the upward trend of the of 2005. As a result, Italy was

years (CAGR -9.8%). year is a positive sign. This per- last two years. The only country the only country in the top ten

The other European countries formance further boosted the in negative territory was third- to report a negative CAGR

have grown by 20% overall dur- overall share of world exports placed Turkey, which saw a 2015/2005 (-3.2%), compared

ing the period in question and held by the top 10 exporter 3.7% fall to 120,000 tons. India for example to Germany with a

now control a 6.4% share com- countries, up from 76% in 2014 reported the same export vol- CAGR of +3.7% over the same

pared to 9.5% in 2005. Africa is to 78% in 2015 (compared to umes (120,000 tons), and while period (the best performance

an exception to the trend with 57% in 2005). China remained remaining stable in 2015 at in Europe).

TAB. 2 - THE TOP EXPORTING COUNTRIES (TON)

CAGR % on 2015

2005 2008 2009 2010 2011 2012 2013 2014 2015 % 15/14 15/05 world

exports

China 149,220 244,769 768,129 901,962 958,533 918,750 1,015,513 1,280,270 1,335,212 4.3% 24.5% 45.7%

Mexico 233,672 227,734 223,709 226,569 245,964 237,954 268,502 276,984 295,439 6.7% 2.4% 10.1%

Turkey 117,915 101,195 84,933 94,354 101,350 113,445 119,602 125,256 120,613 -3.7% 0.2% 4.1%

India 50,322 82,511 70,354 15,076 90,611 118,226 134,255 119,626 119,752 0.1% 9.1% 4.1%

Portugal 88,392 85,538 78,297 75,049 65,552 67,251 68,525 78,360 87,434 11.6% -0.1% 3.0%

Thailand 75,911 71,949 52,857 57,189 58,712 56,976 68,107 75,794 79,242 4.5% 0.4% 2.7%

Poland 56,007 85,167 59,327 67,572 70,342 66,723 70,890 69,913 77,048 10.2% 3.2% 2.6%

Germany 45,759 66,058 58,722 63,742 68,291 66,712 56,560 58,343 65,734 12.7% 3.7% 2.3%

Italy 80,151 79,016 57,174 52,921 54,616 52,815 54,895 53,871 57,601 6.9% -3.2% 2.0%

Bulgaria 44,112 45,042 35,833 40,566 47,969 51,911 53,094 55,728 56,183 0.8% 2.4% 1.9%

TOTAL 941,461 1,088,979 1,489,335 1,595,000 1,761,940 1,750,763 1,909,943 2,194,145 2,294,258

% on total world

57.5 63.3 74.3 73.8 74.3 73.8 75.1 76.0 78.6

exports

Source: Acimac Research Dept. on BSRIA and ITC data

71 Tile International 1/2017

Statistics

TAB. 3: IMPORTS OF SANITARYWARE BY AREA (TONS)

CAGR % on 2015

2005 2008 2009 2010 2011 2012 2013 2014 2015 % 15/14 15/05 world

imports

Asia 237,308 286,742 429,387 478,300 618,296 582,609 659,174 847,355 792,223 -6.5% 12.8% 27.1%

European Union

647,944 663,567 663,492 692,242 712,756 667,798 665,631 729,744 788,686 8.1% 2.0% 27.0%

(28)

Other Europe (Turkey

95,287 122,982 91,631 96,487 107,822 115,890 124,113 124,274 89,730 -27.8% -0.6% 3.1%

included)

NAFTA 520,594 454,223 576,612 620,863 606,975 626,568 703,772 748,784 807,998 7.9% 4.5% 27.7%

South America 60,483 80,759 91,217 119,957 139,156 147,494 134,075 136,408 146,436 7.4% 9.2% 5.0%

Africa 55,955 89,755 122,529 111,881 146,841 190,945 212,389 247,590 234,367 -5.3% 15.4% 8.0%

Oceania 20,502 23,126 29,988 40,690 40,873 40,140 45,383 53,618 60,457 12.8% 11.4% 2.1%

TOTAL WORLD 1,638,073 1,721,154 2,004,856 2,160,420 2,372,719 2,371,444 2,544,537 2,887,773 2,919,897 1.1% 6.0% 100.0%

% var y-o-y -7.3 16.5 7.8 9.8 -0.1 7.3 13.5 1.1

Source: Acimac Research Dept. on BSRIA and ITC data

TAB. 4 - THE TOP IMPORTING COUNTRIES (TON)

CAGR % on 2015

2005 2008 2009 2010 2011 2012 2013 2014 2015 % 15/14 15/05 world

imports

USA 463,530 388,228 477,431 500,029 495,803 508,056 584,436 623,077 682,192 9.5% 3.9% 23.4%

UK 91,031 93,234 98,383 103,730 107,933 106,439 115,142 138,182 145,532 5.3% 4.8% 5.0%

Germany 80,932 94,541 100,140 107,509 114,714 111,368 111,505 128,532 142,383 10.8% 5.8% 4.9%

Korea Rep. 14,353 19,534 69,880 84,543 105,416 94,980 99,658 115,816 132,361 14.3% 24.9% 4.5%

Canada 52,245 58,207 84,545 104,680 92,441 105,658 104,119 109,558 104,119 -5.0% 7.1% 3.6%

France 94,573 102,426 111,245 115,108 118,930 118,078 107,792 104,078 101,812 -2.2% 0.7% 3.5%

Spain 129,129 104,902 82,378 83,634 84,827 70,252 70,741 82,755 88,245 6.6% -3.7% 3.0%

Saudi Arabia 30,674 33,921 45,770 33,592 48,346 63,797 71,593 71,623 83,934 17.2% 10.6% 2.9%

Singapore 3,797 6,479 18,907 23,467 29,444 29,855 21,620 52,294 64,323 23.0% 32.7% 2.2%

Nigeria 3,866 11,272 24,452 28,484 40,676 46,309 50,728 61,427 59,138 -3.7% 31.4% 2.0%

TOTAL 964,130 912,744 1,113,131 1,184,776 1,238,530 1,254,793 1,337,334 1,487,343 1,604,039

% on total world

58.9 53.0 55.5 54.8 52.2 52.9 52.6 51.5 54.9

imports

Source: Acimac Research Dept. on BSRIA and ITC data

Tile International 1/2017 72

Statistics

MORE INFO?

www.mec-studies.com! MECS

Machinery Economic Studies

The analysis of 2015 imports 2015, the imports of the top 10 2014). Saudi Arabia saw ers, China is also the top ex-

in the various continents and importers made up 55% of strong growth (+17% on 2014), porter to the European Union

regions also reveals a hetero- world sanitaryware imports, a as did Singapore (+23%), with a 20% share, followed by

geneous trend. share that has remained virtu- while Nigeria suffered a slight Portugal, Turkey, Poland and

With 8% growth over 2014 to ally unchanged since 2005. contraction (-3.7%). Singapore Germany with shares of be-

808,000 tons, North America and Nigeria, both of which en- tween 6% and 9%. Chinese ex-

(NAFTA) became the biggest The United States remained tered the rankings of top 10 im- ports are in second position

importing region with a 27.7% the world’s biggest sanitary- porters for the first time in 2015, only in non-EU European mar-

share of world imports. Asia ware importer in 2015 at did not open their markets to kets with a 13.6% share of total

dropped to second place 682,000 tons (up 9.5% on international trade until the imports, compared to the 16%

(27.1% of world imports) fol- 2014). The USA accounted for last decade (imports were vir- held by the leader Ukraine.

lowing a 6.5% fall in imports 23.4% of world imports, well tually non-existent in 2005),

with respect to 2014 to 792,000 ahead of all other importer since when they have main- Consequently, the analysis of

tons. The European Union countries, as well as almost all tained average annual com- main target markets of the

held a similar 27% share follow- (86%) of imports to the NAFTA pound growth rates of more largest exporter countries con-

ing 8% growth in imports to region. This is a longstanding than 30%. firms that only a small number

789,000 tons. Other regions record considering that in of them have significant ex-

that saw growth in imports 2005 the USA imported Last but not least, it is interest- port shares outside their own

were South America (+7.4%) 463,000 tons, 28% of world im- ing to analyse the origin of geographical regions. As men-

and Oceania (+12.8%), while ports. The UK and Germany, sanitaryware imports to each tioned, one of these is China

Africa (-5.3%) and non-EU Eu- in second and third positions, region or continent. whose exports are divided up

ropean countries (-27.8%) suf- imported respectively 145,000 This shows China’s position as 38% to Asia, 31.6% to North

fered declines. tons (up 5.3% on 2014) and the largest exporter to almost America, 12.7% to Europe, 9%

Observing the import trends in 142,000 tons (+10.8%) in 2015. all regions of the planet. China to Africa, 5.3% to South Ameri-

each region over the period Both have maintained a 5% is the country of origin of 64% ca and 3.2% to Oceania. Like-

2005-2015, we find that the share of global imports and of imports to Asia (India, Viet- wise, India sells just 48% of its

highest percentage variation have seen a similar growth nam and Thailand trail far be- exports in the Asian continent,

was in Africa with growth in trend over the last decade hind with shares of between while 39.6% is shipped to Afri-

volumes from 56,000 to (UK’s CAGR 2015/2005 +4.8%; 5% and 7%) and 71.5% of im- ca and 6.6% to North America.

234,000 tons (+319%, CAGR Germany’s +5.8%). ports to Oceania (second- Thailand sells 56.5% of its ex-

2015/2005 +15.4%). Asia The fourth largest importer in placed Malaysia makes up ports in Asia and Oceania

achieved similarly strong the world and the biggest in just 11%). and 37.2% in North America.

growth (+234% on 2005, CAGR Asia is North Korea, which im- Even outside its own regional The other large exporter coun-

+12.8%), as did South America ported 132,000 tons in 2015 market, China accounts for tries are much more closely

(from 60,000 to 146,000 tons, (+14% on 2014), confirming its 52% of total imports to Africa linked to their regional mar-

+142%, CAGR +9.2%) and Oce- position as one of the coun- (India is in second place with kets: 97.4% of Mexican exports

ania (from 20,000 to 60,000 tries with the highest annual just 20.2%) and to North Amer- are sold in North America; 99%

tons, +195%, CAGR +11.4%). growth rates in imports over ica despite the presence of of Polish exports remain in Eu-

the period 2005-2015 (+25%). Mexico, the local big player rope, as do 93% of Bulgarian

The first eight countries By contrast, import volumes fell with a share of 35.6%. China is exports and between 83% and

amongst the top 10 sanitary- in 2015 in Canada (104,000 likewise the top exporter to 86% of exports from Portugal,

ware importers in 2015 main- tons, -5% on 2014) and France South America with a 48% Germany and Italy. Turkey’s ge-

tained their positions with re- (102,000 tons, -2.2%), the latter share (compared to 37.7% in ographical position spanning

spect to the previous year. seeing a contraction since 2014), while Colombia, the Europe and Asia is reflected in

Seven of the ten countries saw 2012. Spain on the other hand second largest exporter coun- the fact that Europe is its larg-

an increase in exports with re- reported import growth for the try, has seen its share contract est market with 68.4% of its ex-

spect to 2014, in several cases second year running to reach from 23% to 16%. Despite the ports and Asia the second

with double-digit growth. In 88,000 tons in 2015 (+6.6% on presence of strong local play- largest with 20%. 5

73 Tile International 1/2017

Statistics

The big players in the sector

To round off the international ers (large multinationals, Where available we also pro- This allows for a more uniform

trade figures for the sanitary- groups or individual compa- vide the figures for turnover comparison between large

ware sector, we are presenting nies) updated to 31 Decem- generated purely from sales of groups which often operate in

the key figures for the big play- ber 2015. sanitaryware. multiple segments.

Installed capacity

Production

Exports %

(mill. Pcs.)

(mill. Pcs.)

Total group

Main Brands /

Group Country turnover Sanitaryware plants / Location

Companies

(mill. €)

75 (total group).

Sanitaryware plants in Spain (9), Roca, Laufen, Celite, Incepa,

1,717.0

Spain Portugal, Switzerland, Austria, Cro- Parryware, Jika, Ying, Santeri,

1 Roca n.a. 35.4 84 (sanitaryware, tiles,

atia, Poland, Czech Rep. Bulgaria, Santek

distribution)

Russia, Brazil, Argentina, Morocco,

Egypt, Malaysia, India, China

12 in USA, Mexico, Brazil, France, Kohler, Jacob Delafon, Sterling,

2 Kohler Group USA 22.0* 18.0* n.a. n.a.

Morocco, Thailand, India, China Ann Sacks

Sanitaryware plants in Finland, Swe- Kolo, Keramag, Ido, Ifo, Colom-

Sanitec Switzerland n.a. den, Poland, Germany, Switzerland, bo, Koralle, Selles, Allia, Pozzi

3 14.0* 12.0* n.a.

(Geberit Group) (2,394.0 Geberit Group) France, Portugal, Italy, Ukraine Ginori, Porsgrund, Sphinx

16 in Japan (4), China, Taiwan,

Japan 4,300.0

4 Toto 11.0 11.0 15 Indonesia, Vietnam, Thailand, India, TOTO

(bathroom, tiles, other)

USA, Mexico

474.0 Corona, Mansfield, Incesa

Colombia 7 in Colombia (2), USA, Nicaragua, Standard, American Standard,

5 Corona 13.9 10.9 19 (283.0 sanitaryware,

Costa Rica, Guatemala, Mexico Ecoline, Lamosa, Vortens

191.0 tiles)

Lixil 10- 10 in Japan, China, Vietnam, AS, Lixil, Inax, Grohe,

6 Japan 7-8* n.a. 6,969.0

Corporation 12* Indonesia, Thailand, South Africa Vaal Sanitaryware

1,061.0

7 Duratex Brazil 9.8 n.a. n.a. (338.5 sanitaryware, 722.5 5 in Brazil Deca

wood panels & metal fittings)

Poland 416.0 10 (total group), 4 sanitaryware Cersanit, Opoczno

8 Rovese 7.4* 6.0* n.a.

(tiles, sanitaryware, other) plants in Poland, Romania, Ukraine

Ideal 2 in Italy, 1 in Czech Rep., Ideal Standard, Jado, Armitage

9 Belgium 6.0* 6.0* n.a. 713.0

Standard 1 in Bulgaria, 1 in UK Shanks, Dolomite

159.7

10 Lecico Egypt 6.7 4.8 57 (83.7 sanitaryware, 3 (incl. tiles) in Egypt, 1 in Lebanon Lecico

76.0 tiles & other)

755.0

RAK UAE (490.0 tiles, 2 in UAE, 1 in Bangladesh, RAK, Elegance

11 5.0 4.8 70

Ceramics 109.0 sanitaryware, 1 in India

156.0 tableware and other)

Turkey 710.0 VitrA

12 Eczacibasi Vitra 5.5 4.5 65 1 in Turkey, 1 in Russia

(tiles, sanitaryware, other)

3 in Germany, 2 Egypt, 2 China,

13 Duravit Germany 4-5* 3.5 82 432.3 1 France, 1 Turkey, 1 Tunisia, Duravit

1 India

Tile International 1/2017 74

Statistics

MORE INFO?

www.mec-studies.com! MECS

Machinery Economic Studies

To provide a more com- over. or in some cases were

plete picture of group The figures were sup- based on estimates or

size, we also include to- plied directly by the obtained from public

tal or consolidated turn- companies themselves sources. 5

Installed capacity

Production

Exports %

(mill. Pcs.)

(mill. Pcs.)

Total group

Main Brands /

Group Country turnover Sanitaryware plants / Location

Companies

(mill. €)

106.0

14 CISA Group Ecuador 4.5 3.3 25 (85.0 sanitaryware, 2 in Chile, 1 in Ecuador Edesa, Briggs, Fanaloza

6.0 tiles, 15.0 other)

Saudi Saudi Arabia 416.4 Saudi Ceramics

15 n.a. 2.5 3 2 in Saudi Arabia

Ceramics (sanitaryware, tiles)

803.8

Villeroy & Germany 14 (total group) Villeroy & Boch

16 3.5* 2.4* n.a. (496.9 sanitaryware,

Boch in Germany, Mexico, Thailand

306.9 tableware)

17 Ferrum Argentina n.a. 2.4* n.a. 144.0 2 in Argentina Ferrum

18 Trebol Peru 3.0 2.3 9 n.a. 1 in Peru Trebol, Barcelona

907.0

Thailand (755.0 tiles, COTTO

19 SCG Group 2.8 2.2 33 2 in Thailand

93.0 sanitaryware,

59.0 fittings)

Ceramica Egypt n.a. Cleopatra, Eldorado

20 2.5* 2.0* n.a. 2 in Egypt

Cleopatra

148.0

Ceramic In- South Africa Betta, Bettabath

21 2.3 2.0 15 (117.0 tiles, 2 in South Africa

dustries

31.0 sanitaryware)

45.5

Kirovskaya Russia Kirovskaya

22 2.0 2.0 0 (31.8 sanitaryware, 1 in Russia

Keramika

13.7 tiles)

23 Golsar Fars Iran 1.3* 1.3* n.a. n.a. 12 in Iran Golsar

345.0

Turkey (278.5 tiles, Kale

24 Kale Group 1.6 1.1 32 1 in Turkey

22.0 sanitaryware,

44.5 bathroom products)

100.0

Turkey (50.0 sanitaryware, Creavit

25 Creavit 1.2 1.0 30 1 in Turkey

50.0 bathroom furniture &

fittings)

75 Tile International 1/2017

You might also like

- PSU2016 Chart Book - WebDocument36 pagesPSU2016 Chart Book - WebMiguel MendezNo ratings yet

- FranceDocument12 pagesFranceMusfequr Rahman (191051015)No ratings yet

- Economic Instability in PakistanDocument35 pagesEconomic Instability in PakistanJunaid NaseemNo ratings yet

- Data 01Document23 pagesData 01Đông NguyễnNo ratings yet

- Khadir Ib Assignment 1Document11 pagesKhadir Ib Assignment 1guna maariNo ratings yet

- Africa Food Trade 2017Document7 pagesAfrica Food Trade 2017nebiyuNo ratings yet

- Assignment 1 - GDP AnalysisDocument3 pagesAssignment 1 - GDP AnalysisLizzie NguyenNo ratings yet

- Article File 20220517085428Document8 pagesArticle File 20220517085428ZerakNo ratings yet

- Overview of Current Indian Fastener Market: India EconomyDocument4 pagesOverview of Current Indian Fastener Market: India EconomykunalNo ratings yet

- Economic Survey 2015-16 Brief SummaryDocument4 pagesEconomic Survey 2015-16 Brief Summaryrabia_rabiaNo ratings yet

- The World of International Economics: Mcgraw-Hill/IrwinDocument21 pagesThe World of International Economics: Mcgraw-Hill/IrwinLA SyamsulNo ratings yet

- IATA - Demand For Air Travel in 2015 Surges To Strongest Result in Five YearsDocument5 pagesIATA - Demand For Air Travel in 2015 Surges To Strongest Result in Five Yearsvigneshkumar rajanNo ratings yet

- The Philippine Export Development Plan 2015-2017: Executive SummaryDocument16 pagesThe Philippine Export Development Plan 2015-2017: Executive SummaryDenis SalvatierraNo ratings yet

- Seaborne TradeDocument18 pagesSeaborne Tradee.akcetin7135No ratings yet

- Afrika GlobalisierungDocument15 pagesAfrika GlobalisierungkevinNo ratings yet

- Ev - 170213 - South Centre Conference 2017 Dr. Akyuz Presentation - EN 1Document26 pagesEv - 170213 - South Centre Conference 2017 Dr. Akyuz Presentation - EN 1Diego AzziNo ratings yet

- Spectator Sportz: Analysis of The Football MarketDocument12 pagesSpectator Sportz: Analysis of The Football MarketMadiha AliNo ratings yet

- Illinois Exports 2016Document16 pagesIllinois Exports 2016atulnairNo ratings yet

- NQWO4VO99AJW8L66130Document6 pagesNQWO4VO99AJW8L66130yogeshwarattriNo ratings yet

- ChinaDocument4 pagesChinaRishi ReejhsinghaniNo ratings yet

- Ethiopia's trade performance and export outlookDocument18 pagesEthiopia's trade performance and export outlookAsniNo ratings yet

- IATA-Aviation Industry Fact 2010Document3 pagesIATA-Aviation Industry Fact 2010revealedNo ratings yet

- Egypt Gravity, 2014Document12 pagesEgypt Gravity, 2014Saleh ShahriarNo ratings yet

- 2012 World Footwear YearbookDocument98 pages2012 World Footwear YearbookCarlos Filipe SilvaNo ratings yet

- Indias International Trade and InvestmentDocument21 pagesIndias International Trade and InvestmentVamsi RajasekharNo ratings yet

- Assignment Develpment Economics Eco704Document11 pagesAssignment Develpment Economics Eco704Muhammad BilalNo ratings yet

- Vietnam - Economic Highlights - Stronger Economic Activities in May - 1/6/2010Document4 pagesVietnam - Economic Highlights - Stronger Economic Activities in May - 1/6/2010Rhb InvestNo ratings yet

- Economy of MauritaniaDocument7 pagesEconomy of Mauritaniaabdul sorathiyaNo ratings yet

- Aeo 2017 55 enDocument15 pagesAeo 2017 55 enWallaceAceyClarkNo ratings yet

- Machinery Industry in BangladeshDocument13 pagesMachinery Industry in BangladeshNusrat Sharmin MoutusiNo ratings yet

- Economy of ChadDocument6 pagesEconomy of ChadAman DecoraterNo ratings yet

- 6 16072019 Ap enDocument6 pages6 16072019 Ap enValter SilveiraNo ratings yet

- Trafic Mai2013 VA PDFDocument3 pagesTrafic Mai2013 VA PDFamitc5No ratings yet

- International Trade and Natural ResourcesDocument35 pagesInternational Trade and Natural ResourcesTimur LukinNo ratings yet

- Macroeconomic TrendsDocument5 pagesMacroeconomic Trendsberi tsegeabNo ratings yet

- Présentation MacroDocument10 pagesPrésentation MacroOussama MimoNo ratings yet

- State of The Economy As Reflected in The Central Bank Annual Report 2010Document44 pagesState of The Economy As Reflected in The Central Bank Annual Report 2010Anuruddha RukmalNo ratings yet

- 01 Growth and InvestmentDocument24 pages01 Growth and Investmentbugti1986No ratings yet

- GNL 2010Document32 pagesGNL 2010gasoline77100% (1)

- Malaysia External Trade: June Exports Unexpectedly Rises 3.4% YoyDocument4 pagesMalaysia External Trade: June Exports Unexpectedly Rises 3.4% YoyFaizal FazilNo ratings yet

- Growing Capabilities of Indian Auto Component Industry & Its SustainabilityDocument40 pagesGrowing Capabilities of Indian Auto Component Industry & Its SustainabilityRamesh RangachariNo ratings yet

- Bangladesh External Sector AnalysisDocument22 pagesBangladesh External Sector AnalysisS. M. Hasan ZidnyNo ratings yet

- Growth and Investment Recovery in Pakistan's EconomyDocument31 pagesGrowth and Investment Recovery in Pakistan's Economymalikrahul_53No ratings yet

- Economic Outlook For EC2Document22 pagesEconomic Outlook For EC2Shishka7No ratings yet

- MM Report 30 - Year 2012 PDFDocument43 pagesMM Report 30 - Year 2012 PDFRaluca MaziluNo ratings yet

- Impact Assessment of The COVID-19 Outbreak On International TourismDocument16 pagesImpact Assessment of The COVID-19 Outbreak On International TourismPetrosRochaNo ratings yet

- Agriculture ExportDocument10 pagesAgriculture Exportrahmanhira516250% (2)

- China: The Hidden DragonDocument38 pagesChina: The Hidden DragonKanika PasariNo ratings yet

- MONTHLY FISCAL-MACRO UPDATE May 2011Document16 pagesMONTHLY FISCAL-MACRO UPDATE May 2011harunrosidNo ratings yet

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNo ratings yet

- Global Monitor Report 2018Document15 pagesGlobal Monitor Report 2018Darsh messiNo ratings yet

- Trends in India's Foreign TradeDocument7 pagesTrends in India's Foreign Tradekunal gargNo ratings yet

- Trade Deficit Jumps 29Document2 pagesTrade Deficit Jumps 29SHAHZAIB -No ratings yet

- Indian Textile IndustryDocument22 pagesIndian Textile IndustryKirti KachhapNo ratings yet

- Sectoral Analysis Foreign TradeDocument33 pagesSectoral Analysis Foreign TradeManish PashineNo ratings yet

- Middle East and North Africa Regional Economic Update, April 2014: Harnessing the Global Recovery - A Tough Road AheadFrom EverandMiddle East and North Africa Regional Economic Update, April 2014: Harnessing the Global Recovery - A Tough Road AheadNo ratings yet

- Resurgent Africa: Structural Transformation in Sustainable DevelopmentFrom EverandResurgent Africa: Structural Transformation in Sustainable DevelopmentNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- KPMG Brief On Finance Bill 2023Document37 pagesKPMG Brief On Finance Bill 2023Ayan NoorNo ratings yet

- FE ManualDocument189 pagesFE Manualapi-3704241100% (3)

- AFF's Tax Memorandum - Changes in Finance Bill, 2023 (Pakistan)Document14 pagesAFF's Tax Memorandum - Changes in Finance Bill, 2023 (Pakistan)salahuddin ahmedNo ratings yet

- Study For Ceramic Sanitary Ware Cluster, GujranwalaDocument63 pagesStudy For Ceramic Sanitary Ware Cluster, GujranwalatahirNo ratings yet

- LPG Marketing and Distribution Business Rs. 48.52 Million Dec-2020Document21 pagesLPG Marketing and Distribution Business Rs. 48.52 Million Dec-2020Ayan NoorNo ratings yet

- Ifrs 9 TransitionDocument12 pagesIfrs 9 TransitionAyan NoorNo ratings yet

- Sanitary Ware ManufacturingDocument24 pagesSanitary Ware ManufacturingAyan NoorNo ratings yet

- Annual Report and Financial Statements of Prosperity Weaving Mills LtdDocument89 pagesAnnual Report and Financial Statements of Prosperity Weaving Mills LtdAyan NoorNo ratings yet

- Business Valuations PDFDocument5 pagesBusiness Valuations PDFAyan NoorNo ratings yet

- Cluster Study Ceramics Sanitary Ware GujranwalaDocument49 pagesCluster Study Ceramics Sanitary Ware GujranwalaAyan Noor100% (1)

- Concept Paper of Rate of ReturnDocument12 pagesConcept Paper of Rate of ReturnAyan NoorNo ratings yet

- Accounting For Grants and Deferred IncomeDocument55 pagesAccounting For Grants and Deferred Incomecris lu salemNo ratings yet

- Equations From DamodaranDocument6 pagesEquations From DamodaranhimaggNo ratings yet

- Sanitaryware ProductionDocument1 pageSanitaryware ProductionAyan NoorNo ratings yet

- Ceramics Sanitary Ware Cluster ProfileDocument15 pagesCeramics Sanitary Ware Cluster ProfileRaghu NandanNo ratings yet

- Annual ReportDocument115 pagesAnnual ReportAyan NoorNo ratings yet

- Admission Deed SpecimenDocument6 pagesAdmission Deed SpecimenmbkapseNo ratings yet

- Enterprise Hospitality BeautyDocument23 pagesEnterprise Hospitality BeautyAyan NoorNo ratings yet

- Enterprise Hospitality BeautyDocument23 pagesEnterprise Hospitality BeautyAyan NoorNo ratings yet

- KPKDocument15 pagesKPKAyan NoorNo ratings yet

- Spring 2015 2Document15 pagesSpring 2015 2avelito bautistaNo ratings yet

- Updated newspaper circulation 2017Document2 pagesUpdated newspaper circulation 2017Shoaib AzamNo ratings yet

- Business ValuationsDocument5 pagesBusiness ValuationsAyan NoorNo ratings yet

- Real Estate Investment Analysis PDFDocument10 pagesReal Estate Investment Analysis PDFAyan NoorNo ratings yet

- HT Media IPO detailsDocument286 pagesHT Media IPO detailsAyan NoorNo ratings yet

- Procedure Voluntary de ListingDocument4 pagesProcedure Voluntary de ListingAyan NoorNo ratings yet

- Banquet Hall 500 Hosts Rs. 51.85 Million Apr 2016Document23 pagesBanquet Hall 500 Hosts Rs. 51.85 Million Apr 2016Ayan NoorNo ratings yet

- BrochureDocument26 pagesBrochureAyan NoorNo ratings yet

- Rating Methodology For Entities in The Print Media IndustryDocument9 pagesRating Methodology For Entities in The Print Media IndustryAyan NoorNo ratings yet

- Little ThingsDocument3 pagesLittle ThingszwartwerkerijNo ratings yet

- Plant Chicago 2Document4 pagesPlant Chicago 2api-321978505No ratings yet

- Construction Materials and Testing: "WOOD"Document31 pagesConstruction Materials and Testing: "WOOD"Aira Joy AnyayahanNo ratings yet

- Mondstadt City of Freedom Travel GuideDocument10 pagesMondstadt City of Freedom Travel GuideShypackofcheetos100% (3)

- HEC-HMS Tutorials and Guides-V3-20210529 - 140315Document756 pagesHEC-HMS Tutorials and Guides-V3-20210529 - 140315Ervin PumaNo ratings yet

- Joe Ann MarcellanaDocument17 pagesJoe Ann MarcellanarudyNo ratings yet

- JKSTREGIESDocument59 pagesJKSTREGIESmss_singh_sikarwarNo ratings yet

- Altered Ventilatory Function Assessment at Pamantasan ng CabuyaoDocument27 pagesAltered Ventilatory Function Assessment at Pamantasan ng Cabuyaomirai desuNo ratings yet

- Year 12 Holiday Homework Term 3Document4 pagesYear 12 Holiday Homework Term 3Lucas GauciNo ratings yet

- Unit Rates and Cost Per ItemDocument213 pagesUnit Rates and Cost Per ItemDesiree Vera GrauelNo ratings yet

- Inner Unit EstimateDocument35 pagesInner Unit EstimateMir MoNo ratings yet

- Annual Report 18Document363 pagesAnnual Report 18Safeer UllahNo ratings yet

- Theory and Practice of Crown and Bridge Prosthodontics 4nbsped CompressDocument1,076 pagesTheory and Practice of Crown and Bridge Prosthodontics 4nbsped CompressYuganya SriNo ratings yet

- Twingo 3 & Clio 4Document10 pagesTwingo 3 & Clio 4Alexandre Le GrandNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementSanna KazmiNo ratings yet

- Technology Class ResumeDocument4 pagesTechnology Class Resumeapi-259588430No ratings yet

- Forecast Time Series-NotesDocument138 pagesForecast Time Series-NotesflorinNo ratings yet

- Grab E-Receipt for 15,000 RP Ride on March 30Document1 pageGrab E-Receipt for 15,000 RP Ride on March 30WellyNo ratings yet

- Assessmentof Safety Cultureand Maturityin Mining Environments Caseof Njuli QuarryDocument12 pagesAssessmentof Safety Cultureand Maturityin Mining Environments Caseof Njuli QuarryAbdurrohman AabNo ratings yet

- JMPRTraininga I5545e PDFDocument500 pagesJMPRTraininga I5545e PDFmvptoxNo ratings yet

- Lodha GroupDocument2 pagesLodha Groupmanish_ggiNo ratings yet

- Cubic Spline Tutorial v3Document6 pagesCubic Spline Tutorial v3Praveen SrivastavaNo ratings yet

- VIP 32 Hybrid VentDocument8 pagesVIP 32 Hybrid VentsagarNo ratings yet

- Unit 7 Noun ClauseDocument101 pagesUnit 7 Noun ClauseMs. Yvonne Campbell0% (1)

- COR2-03 Admist The Mists and Coldest Frost PDFDocument16 pagesCOR2-03 Admist The Mists and Coldest Frost PDFLouis BachNo ratings yet

- High Speed Board Design: Signal Integrity AnalysisDocument35 pagesHigh Speed Board Design: Signal Integrity Analysissrikanth chundiNo ratings yet

- Lecture01 PushkarDocument27 pagesLecture01 PushkarabcdNo ratings yet

- Chapter 25 (10) Capital Investment Analysis: ObjectivesDocument40 pagesChapter 25 (10) Capital Investment Analysis: ObjectivesJames BarzoNo ratings yet

- Radio Drama (Rubric)Document1 pageRadio Drama (Rubric)Queenie BalitaanNo ratings yet

- Daftar Pustaka DaniDocument3 pagesDaftar Pustaka Danidokter linggauNo ratings yet