Professional Documents

Culture Documents

Banks Dropping Foreclosures

Uploaded by

83jjmack0 ratings0% found this document useful (0 votes)

45 views2 pagesApril Charney, a Jacksonville-area legal aid attorney who's an expert on foreclosure issues, said for the most part banks have no way to prosecute their cases because the mortgages in mortgage-backed securities were never actually legally transferred to the trusts.

Original Title

BANKS DROPPING FORECLOSURES

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentApril Charney, a Jacksonville-area legal aid attorney who's an expert on foreclosure issues, said for the most part banks have no way to prosecute their cases because the mortgages in mortgage-backed securities were never actually legally transferred to the trusts.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views2 pagesBanks Dropping Foreclosures

Uploaded by

83jjmackApril Charney, a Jacksonville-area legal aid attorney who's an expert on foreclosure issues, said for the most part banks have no way to prosecute their cases because the mortgages in mortgage-backed securities were never actually legally transferred to the trusts.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

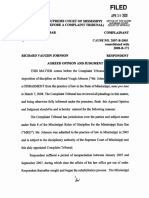

Banks drop foreclosures in

Southwest Florida

Hundreds of lawsuits dismissed

By DICK HOGAN • dhogan@news-press.com • January 19,

2011

1:10 A.M. — Banks in recent weeks have been dropping

hundreds of their Southwest Florida foreclosure lawsuits instead

of facing defendants at trial, according to local attorneys and

court records.

The banks are just taking a breather before refiling with stronger

evidence - or giving up for good on hopelessly flawed cases.

Some foreclosures at large law firms were never actually read by

the attorneys who filed them here and elsewhere, and some of the

mortgages that ended up in mortgage-backed securities sold to

investors were never legally transferred by the banks, defense

attorneys have alleged.

"We think they're going to come back and refile," Lee County

Clerk of Court Charlie Green said.

That's an expensive proposition, he said, noting foreclosure suits

carry a hefty filing fee: about $1,900 for a $250,000 house, for

example.

What happens is lawyers for the banks are asking judges to

dismiss their cases, which is "very much out of the ordinary,"

Green said. "You don't see cases dismissed without prejudice that

often."

Foreclosures were rare in Southwest Florida until the housing

market crashed at the end of 2005, bringing on waves of mortgage

defaults by investors and homeowners.

Green said he hasn't calculated exactly how many foreclosures are

being dismissed.

But eight voluntary dismissals were filed Tuesday alone by seven

different banks including Bank of America, one of the largest

filers of foreclosures in this area. Bank of America did not reply

to a request for comment Tuesday.

At one court hearing alone, attorney Kevin Jursinski said, one of

his associates watched as "50 in a row" were withdrawn.

"Can they re-litigate?" Fort Myers-based attorney Carmen

Dellutri asked. "I don't think so."

Most of the mortgages in dispute were sold to Wall Street and

sold in bundles to investors as mortgage-backed securities, he

said. But so many mistakes were made in the process it's unlikely

the banks can win those cases.

Some mortgages still held by the bank that made the loan might

be defensible but those are in the minority, Dellutri said.

He said he's seeing cases withdrawn in large numbers in Lee,

Collier and Charlotte counties, and he heard from an attorney in

Jacksonville the situation is the same there.

April Charney, a Jacksonville-area legal aid attorney who's an

expert on foreclosure issues, said for the most part banks have no

way to prosecute their cases because the mortgages in mortgage-

backed securities were never actually legally transferred to the

trusts.

She said much of the recent wave of voluntary dismissals may be

a result of a Massachusetts Supreme Court ruling Jan. 7

upholding a judge's decision two foreclosures were invalid

because the banks didn't prove they owned the mortgages, which

he said were improperly transferred into two mortgage-backed

trusts.

Now, she said, many mortgages simply aren't fixable. "You can't

go back and securitize. You run a red light, you can't go back and

unrun it."

You might also like

- Why - Judges.are - Scowling.at - Banks NYtimes - Com 2013-09-28Document2 pagesWhy - Judges.are - Scowling.at - Banks NYtimes - Com 2013-09-28Star Gazon100% (1)

- Is This The Start of Armageddon For The Big Banks - Stocks Dropping-Investors SpookedDocument6 pagesIs This The Start of Armageddon For The Big Banks - Stocks Dropping-Investors Spooked83jjmackNo ratings yet

- Chase Foreclosure Rejected Due To Late Assignment Ot Trust - Banks Hit Hurdle To ForeclosuresDocument2 pagesChase Foreclosure Rejected Due To Late Assignment Ot Trust - Banks Hit Hurdle To ForeclosuresJesse SchachterNo ratings yet

- Nm2f - Joe Lents Has His Mortgage Situation Cleared!Document4 pagesNm2f - Joe Lents Has His Mortgage Situation Cleared!Eaton GoodeNo ratings yet

- Lender Robo-SigningDocument147 pagesLender Robo-SigningKevin Shirley100% (10)

- Robo-Signers: National AssociationDocument59 pagesRobo-Signers: National AssociationJohn Nehmatallah100% (4)

- 2010-09-22 Robo-Signatures - The Latest Computer Fraud in US Banking and CourtsDocument18 pages2010-09-22 Robo-Signatures - The Latest Computer Fraud in US Banking and CourtsHuman Rights Alert - NGO (RA)0% (1)

- Mass. Court Rules Against Banks in Pivotal Mortgage Case - Washington TimesDocument2 pagesMass. Court Rules Against Banks in Pivotal Mortgage Case - Washington TimesEli JonesNo ratings yet

- 10-10-08 A) AP - Bank of America Issues Nationwide Moratorium On Foreclosures, B) CNBC - Foreclosure PrimerDocument12 pages10-10-08 A) AP - Bank of America Issues Nationwide Moratorium On Foreclosures, B) CNBC - Foreclosure PrimerHuman Rights Alert - NGO (RA)No ratings yet

- Lawmaker Questions Power To ForecloseDocument44 pagesLawmaker Questions Power To ForecloseRicharnellia-RichieRichBattiest-Collins0% (1)

- Foreclosure Crisis - Florida Mediation Process and The Inability of The Bank To Show The Note.Document1 pageForeclosure Crisis - Florida Mediation Process and The Inability of The Bank To Show The Note.raguila00100% (1)

- Let The Lawsuits BeginDocument8 pagesLet The Lawsuits BegingoldkennyNo ratings yet

- Fed Up Judges Crack Down - Disorder in The Courts-Foreclosure Fiasco-Attorneys Take Heat From JudgesDocument3 pagesFed Up Judges Crack Down - Disorder in The Courts-Foreclosure Fiasco-Attorneys Take Heat From Judges83jjmackNo ratings yet

- Notice of Default Must Have Signature Of.....Document3 pagesNotice of Default Must Have Signature Of.....83jjmackNo ratings yet

- GOT NEW CENTURY? WIN FOR HOMEOWNER! READ JUDGE SEABRIGHT'S DECISION HERE!! AND COMPLAINT ETC. no evidence that plaintiff was validly assigned the Mortgage and Note. Deutsche had no standing. Fraudulent Assignment.Document106 pagesGOT NEW CENTURY? WIN FOR HOMEOWNER! READ JUDGE SEABRIGHT'S DECISION HERE!! AND COMPLAINT ETC. no evidence that plaintiff was validly assigned the Mortgage and Note. Deutsche had no standing. Fraudulent Assignment.83jjmackNo ratings yet

- Weekend Edition - April 8, To April 12, 2013 - ForeclosureGate GazetteDocument5 pagesWeekend Edition - April 8, To April 12, 2013 - ForeclosureGate GazetteForeclosureGate GazetteNo ratings yet

- Oregon Judge Voids Foreclosure Sale June 2011Document7 pagesOregon Judge Voids Foreclosure Sale June 201183jjmackNo ratings yet

- How To Bribe A Judge: Judges and Mortgage Loans by Janet Phelan 2009Document4 pagesHow To Bribe A Judge: Judges and Mortgage Loans by Janet Phelan 2009Paul Charles D.No ratings yet

- Reuters Investigation Finds That Many Banks Are Still Employing The Controversial Foreclosure PracticesDocument8 pagesReuters Investigation Finds That Many Banks Are Still Employing The Controversial Foreclosure PracticesdivinawNo ratings yet

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.From EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.No ratings yet

- Foreclosure Fraud 101Document7 pagesForeclosure Fraud 101Charlton Butler100% (1)

- You Can Beat The Big Bad Bank and Stop ForeclosureDocument3 pagesYou Can Beat The Big Bad Bank and Stop ForeclosureRicharnellia-RichieRichBattiest-CollinsNo ratings yet

- Bofa Disowns Its Own LawyerDocument3 pagesBofa Disowns Its Own Lawyer83jjmackNo ratings yet

- States AGs and Mortgage Lenders in Talks Over A Fund To Compensate Victims of Foreclosure Fiasco PaperworkDocument4 pagesStates AGs and Mortgage Lenders in Talks Over A Fund To Compensate Victims of Foreclosure Fiasco Paperwork83jjmackNo ratings yet

- Fla Bar foreclosure fraud complaints surge but no lawyer sanctionsDocument3 pagesFla Bar foreclosure fraud complaints surge but no lawyer sanctionsvar667No ratings yet

- 2011 Wall Street FraudDocument219 pages2011 Wall Street FraudeagleupNo ratings yet

- Wells Fargo, Carrington Must Pay $5M in Foreclosure Row VerdictDocument1 pageWells Fargo, Carrington Must Pay $5M in Foreclosure Row Verdictjp5170scNo ratings yet

- Elizabeth Warren "Government Hasn't Sufficiently Investigated Mortgage Abuses' See Video Link HereDocument5 pagesElizabeth Warren "Government Hasn't Sufficiently Investigated Mortgage Abuses' See Video Link Here83jjmackNo ratings yet

- PR - NJ Supreme Court - ForeclosuresDocument2 pagesPR - NJ Supreme Court - Foreclosuresadmin4031No ratings yet

- Ann Woolner - BloombergDocument5 pagesAnn Woolner - BloombergPeter MaverNo ratings yet

- Foreclosure Blocked - Six Predatory Lending ViolationsDocument5 pagesForeclosure Blocked - Six Predatory Lending Violations83jjmack100% (1)

- Robosigning Credit Cards - The Next Major Bank Scandal J Brown 17jan 12Document3 pagesRobosigning Credit Cards - The Next Major Bank Scandal J Brown 17jan 12dalerobertson8910No ratings yet

- The Most Reviled Law Firm in Florida and The "Unowned Mortgage Loans" Scheme By: LYNN SZYMONIAK, ESQ.Document7 pagesThe Most Reviled Law Firm in Florida and The "Unowned Mortgage Loans" Scheme By: LYNN SZYMONIAK, ESQ.DinSFLANo ratings yet

- Activist Official Mortgage Flaws Pervasive CrimeDocument3 pagesActivist Official Mortgage Flaws Pervasive CrimemodeboNo ratings yet

- Business & Financial News, Breaking US & International News - ReutersDocument1 pageBusiness & Financial News, Breaking US & International News - ReutersCarrieonicNo ratings yet

- BofA Disowns Own Attorneys in Mortgage CaseDocument4 pagesBofA Disowns Own Attorneys in Mortgage CaseBobNo ratings yet

- Bloomberg: Foreclosures May Be Undone by State Ruling On Mortgage Transfer 1-7-2011Document2 pagesBloomberg: Foreclosures May Be Undone by State Ruling On Mortgage Transfer 1-7-2011R. EthierNo ratings yet

- For The Families of Some Debtors, Death Offers No RespiteDocument5 pagesFor The Families of Some Debtors, Death Offers No RespiteSimply Debt SolutionsNo ratings yet

- Revenge of The Debtors - Who Can Legally Enforce A Mortgage After A "Landmark" CaseDocument6 pagesRevenge of The Debtors - Who Can Legally Enforce A Mortgage After A "Landmark" CaseForeclosure Fraud100% (6)

- Mers Huffing Ton Post 1-24-11 Randal Wray Editorial On MersDocument6 pagesMers Huffing Ton Post 1-24-11 Randal Wray Editorial On MersJulie Hatcher-Julie Munoz JacksonNo ratings yet

- 11-02-18 US Drops Criminal Probe of Former Country Wide Chief Angelo Mozilo - LATimesDocument4 pages11-02-18 US Drops Criminal Probe of Former Country Wide Chief Angelo Mozilo - LATimesHuman Rights Alert - NGO (RA)No ratings yet

- California Homeowner Bill of Rights Blocks BofA ForeclosureDocument3 pagesCalifornia Homeowner Bill of Rights Blocks BofA ForeclosureHelpin HandNo ratings yet

- Wisconsin Lawyer: Beyond Robo-Signing: Mortgage Foreclosure Defense Basics:.pdfDocument10 pagesWisconsin Lawyer: Beyond Robo-Signing: Mortgage Foreclosure Defense Basics:.pdfNye LavalleNo ratings yet

- BAUM Assignment of Mortgage But Not The Note BankruptcyDecisionsOverviewDocument9 pagesBAUM Assignment of Mortgage But Not The Note BankruptcyDecisionsOverviewwingandaprayerNo ratings yet

- Judge Rules Wells Fargo Engages in "Reprehensible," Systemic Accounting Abuses On Mortgages, Hits With $3.1 Million Punitive Damages For One LoanDocument1 pageJudge Rules Wells Fargo Engages in "Reprehensible," Systemic Accounting Abuses On Mortgages, Hits With $3.1 Million Punitive Damages For One LoanMumtazAhmadNo ratings yet

- LYNN E. SZYMONIAK, ESQ. Open Letter To Honorable Judges in Foreclosure and Bankruptcy ProceedingsDocument5 pagesLYNN E. SZYMONIAK, ESQ. Open Letter To Honorable Judges in Foreclosure and Bankruptcy ProceedingsDinSFLA100% (3)

- TO: FROM: Jason Gold, Senior Fellow For Housing and Financial Services Policy REDocument10 pagesTO: FROM: Jason Gold, Senior Fellow For Housing and Financial Services Policy REForeclosure FraudNo ratings yet

- Banks Warn of Punishment - HSBC WARNS THEIR INVESTORS - ARE OTHER BANKS GOING TO BE PUNISHED?Document2 pagesBanks Warn of Punishment - HSBC WARNS THEIR INVESTORS - ARE OTHER BANKS GOING TO BE PUNISHED?83jjmackNo ratings yet

- In Proposed Mortgage Fraud Settlement, A Gift To Big Banks - EisingerDocument3 pagesIn Proposed Mortgage Fraud Settlement, A Gift To Big Banks - EisingerjosephsomersNo ratings yet

- Prosecuting Mortgage Document FraudDocument2 pagesProsecuting Mortgage Document FraudForeclosure Fraud100% (3)

- Country Wide Litigation Database 01072007Document15 pagesCountry Wide Litigation Database 01072007Carrieonic100% (1)

- Major Mortgage Firms Accused of Fraud May 2011 - From CONFIDENTIAL FEDERAL AUDITSDocument4 pagesMajor Mortgage Firms Accused of Fraud May 2011 - From CONFIDENTIAL FEDERAL AUDITS83jjmack100% (1)

- Judge Rejects Sec, Bofa Settlement Over Merrill Takeover: Mark Hamblett 09-15-2009Document3 pagesJudge Rejects Sec, Bofa Settlement Over Merrill Takeover: Mark Hamblett 09-15-2009Human Rights Alert - NGO (RA)No ratings yet

- MERS: Is Your Home Foreclosure Proof?"Document6 pagesMERS: Is Your Home Foreclosure Proof?"seekerno14308100% (1)

- Momentum Builds For Nationwide Freeze On ForeclosuresDocument4 pagesMomentum Builds For Nationwide Freeze On ForeclosuresTmr Gitu LoohNo ratings yet

- Foreclosure ChicagoDocument1 pageForeclosure Chicagoaburnham1392No ratings yet

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsFrom EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsRating: 5 out of 5 stars5/5 (12)

- Successfully Defending Your Credit Card Lawsuit: What to Do If You Are Sued for a Credit Card DebtFrom EverandSuccessfully Defending Your Credit Card Lawsuit: What to Do If You Are Sued for a Credit Card DebtRating: 3.5 out of 5 stars3.5/5 (2)

- Loan Modifications, Foreclosures and Saving Your Home: With an Affordable Loan Modification AgreementFrom EverandLoan Modifications, Foreclosures and Saving Your Home: With an Affordable Loan Modification AgreementNo ratings yet

- Free & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageFrom EverandFree & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageRating: 2 out of 5 stars2/5 (3)

- Appellant Brief - Alan Jacobs As Trustee For The New Century Liquidating TrustDocument94 pagesAppellant Brief - Alan Jacobs As Trustee For The New Century Liquidating Trust83jjmack100% (3)

- Landmark Decision For Homeowners Feb. 2016 From The California Supreme Court in Yvanova v. New Century Appeal in WORD FormatDocument32 pagesLandmark Decision For Homeowners Feb. 2016 From The California Supreme Court in Yvanova v. New Century Appeal in WORD Format83jjmack100% (2)

- Huge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New CenturyDocument33 pagesHuge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New Century83jjmack0% (1)

- 2ND QTR 2014 Financials For The New Century Mortgage Bankruptcy (NCLT)Document4 pages2ND QTR 2014 Financials For The New Century Mortgage Bankruptcy (NCLT)83jjmackNo ratings yet

- FEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may15Document361 pagesFEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may1583jjmack100% (1)

- In-Re-MERS V Robinson 12 June 2014Document31 pagesIn-Re-MERS V Robinson 12 June 2014Mortgage Compliance InvestigatorsNo ratings yet

- SLORP v. Bank of America Shellie Hill MERS Et Al - Appeal Opinion - Homeowner May Challenge A Putative Assignment's Validity On The ...Document28 pagesSLORP v. Bank of America Shellie Hill MERS Et Al - Appeal Opinion - Homeowner May Challenge A Putative Assignment's Validity On The ...83jjmack100% (1)

- Amicus Brief by The National Association of Consumer Bankruptcy Attorneys in The New Century TRS Holdings, Inc. Appeal at The Third CircuitDocument29 pagesAmicus Brief by The National Association of Consumer Bankruptcy Attorneys in The New Century TRS Holdings, Inc. Appeal at The Third Circuit83jjmack100% (1)

- United States Filed Suit Against Several Mortgage Servicers-See US v. BofA & WFBDocument8 pagesUnited States Filed Suit Against Several Mortgage Servicers-See US v. BofA & WFB83jjmackNo ratings yet

- Lawyer Antognini Files Reply Brief in The Yvanova v. New Century Mortgage, OCWEN, Deutsche California Appeal Case at The California Supreme Court - Filed March 2015Document35 pagesLawyer Antognini Files Reply Brief in The Yvanova v. New Century Mortgage, OCWEN, Deutsche California Appeal Case at The California Supreme Court - Filed March 201583jjmack100% (2)

- New Century Mortgage Bankruptcy Judge's Order Is Vacated by Usdc in Delaware On Appeal - Huge Win For HomeownerDocument34 pagesNew Century Mortgage Bankruptcy Judge's Order Is Vacated by Usdc in Delaware On Appeal - Huge Win For Homeowner83jjmack100% (2)

- Violations of California Civil Code 1095 - Power of Attorney Law Violated-Gives Homeowner Good NewsDocument2 pagesViolations of California Civil Code 1095 - Power of Attorney Law Violated-Gives Homeowner Good News83jjmackNo ratings yet

- US SUPREME COURT RULES ON THE EBIA CASE JUNE 9, 2014 - Executive Benefits Insurance Agency v. Arkison, 12-1200 - THE CASE HAD ECHOES OF ANNE NICOLE SMITH'S BANKRUTPCY (STERN V. MARSHALL)Document16 pagesUS SUPREME COURT RULES ON THE EBIA CASE JUNE 9, 2014 - Executive Benefits Insurance Agency v. Arkison, 12-1200 - THE CASE HAD ECHOES OF ANNE NICOLE SMITH'S BANKRUTPCY (STERN V. MARSHALL)83jjmack100% (1)

- The Didak Law Office Files Amicus Curiae in Support of Yvanova's Appeal To The California Supreme Court Case S218973 - Amicus Filed April 2015Document36 pagesThe Didak Law Office Files Amicus Curiae in Support of Yvanova's Appeal To The California Supreme Court Case S218973 - Amicus Filed April 201583jjmack100% (2)

- Examining The Consequences of Mortgage Irregularities For Financial Stability and Foreclosure MitigationDocument178 pagesExamining The Consequences of Mortgage Irregularities For Financial Stability and Foreclosure Mitigation83jjmackNo ratings yet

- AIG Offer To Buy Maiden Lane II SecuritiesDocument43 pagesAIG Offer To Buy Maiden Lane II Securities83jjmackNo ratings yet

- In Alameda County Are Foreclosure Cases Rigged?? in Alameda County 15 Judges Have Disclosed Ownership or Stocks in Financial Firms. What About Your County?Document6 pagesIn Alameda County Are Foreclosure Cases Rigged?? in Alameda County 15 Judges Have Disclosed Ownership or Stocks in Financial Firms. What About Your County?83jjmack100% (1)

- Bank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 2014Document2 pagesBank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 201483jjmackNo ratings yet

- New Century Liquidating Trust Still Has Over $23 Million in Cash in Their Bankruptcy - 1ST Quarter 2014 Financial Report From Alan M Jacobs The Apptd. Bankruptcy Trustee For Nclt.Document4 pagesNew Century Liquidating Trust Still Has Over $23 Million in Cash in Their Bankruptcy - 1ST Quarter 2014 Financial Report From Alan M Jacobs The Apptd. Bankruptcy Trustee For Nclt.83jjmack100% (1)

- Helen Galope's LIBOR Appeal Case - Order For Rehearing Denied To The BanksDocument1 pageHelen Galope's LIBOR Appeal Case - Order For Rehearing Denied To The Banks83jjmackNo ratings yet

- In The Helen Galope Matter - Plaintiffs Revised Statement of Genuine IssuesDocument28 pagesIn The Helen Galope Matter - Plaintiffs Revised Statement of Genuine Issues83jjmack100% (1)

- Attorney Albert Demands Retraction From Lexis Nexis About The Helen Galope Deicison Which Was Favorable For The Homeowner!!!Document7 pagesAttorney Albert Demands Retraction From Lexis Nexis About The Helen Galope Deicison Which Was Favorable For The Homeowner!!!83jjmack100% (2)

- LPS COURT EXHIBIT #7 Service Providers Even Lexis NexisDocument6 pagesLPS COURT EXHIBIT #7 Service Providers Even Lexis Nexis83jjmackNo ratings yet

- FINAL Q4 2013 Hardest Hit Fund Program Performance Summary-3.18.14Document22 pagesFINAL Q4 2013 Hardest Hit Fund Program Performance Summary-3.18.1483jjmackNo ratings yet

- Appellees Petition For Rehearing in The Helen Galope Matter-Ninth CircuitDocument52 pagesAppellees Petition For Rehearing in The Helen Galope Matter-Ninth Circuit83jjmack100% (2)

- Homeowner Helen Galope Overjoyed at Decision by Ninth Circuit Court of Appeal - March 27 2014 - This Is The Deutsche Bank Appellee Answering BriefDocument57 pagesHomeowner Helen Galope Overjoyed at Decision by Ninth Circuit Court of Appeal - March 27 2014 - This Is The Deutsche Bank Appellee Answering Brief83jjmackNo ratings yet

- Helen Galope 3RD Amended Complaint in California Federal Court Prior To The Decision and Appeal To The Ninth Circuit Court of Appeals.Document45 pagesHelen Galope 3RD Amended Complaint in California Federal Court Prior To The Decision and Appeal To The Ninth Circuit Court of Appeals.83jjmackNo ratings yet

- Homeowner Helen Galope's Opening Appellant Brief in 9th Circuit Regarding The LIBOR Class Action Case.Document82 pagesHomeowner Helen Galope's Opening Appellant Brief in 9th Circuit Regarding The LIBOR Class Action Case.83jjmackNo ratings yet

- Answering Brief of Appellees Barclays Bank PLC and Barclays Capital Real Estate Inc. D/B/A Homeq ServicingDocument31 pagesAnswering Brief of Appellees Barclays Bank PLC and Barclays Capital Real Estate Inc. D/B/A Homeq Servicing83jjmackNo ratings yet

- Analysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.Document8 pagesAnalysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.83jjmackNo ratings yet

- Nevada Supreme Court Establishes Access to Justice CommissionDocument4 pagesNevada Supreme Court Establishes Access to Justice Commissionacie600No ratings yet

- Durban Apartments Co VS Pioneer Insurance and Surety CorpDocument7 pagesDurban Apartments Co VS Pioneer Insurance and Surety CorpTon Ton CananeaNo ratings yet

- Wednesday, January 15, 2014 EditionDocument14 pagesWednesday, January 15, 2014 EditionFrontPageAfricaNo ratings yet

- Jeff Rubenstein Ceo and President DepositionDocument140 pagesJeff Rubenstein Ceo and President DepositionZ KMNo ratings yet

- FLORAN Vs EDIZADocument2 pagesFLORAN Vs EDIZAFred Michael L. GoNo ratings yet

- Basic Legal Ethics - Course OutlineDocument9 pagesBasic Legal Ethics - Course OutlineDenise GordonNo ratings yet

- Caci 2016 Complete EditionDocument3,098 pagesCaci 2016 Complete EditionKelly Lynn CampbellNo ratings yet

- Part 7 CasesDocument94 pagesPart 7 CasesNicole Aldrianne OmegaNo ratings yet

- Legal Counseling and Social Res Term PaperDocument4 pagesLegal Counseling and Social Res Term PaperZah PGNo ratings yet

- Trade Law ProjectDocument21 pagesTrade Law ProjectsankalppatelNo ratings yet

- Bar Questions 2009 Political LawDocument6 pagesBar Questions 2009 Political LawAries MatibagNo ratings yet

- Agreement For Legal ServicesDocument3 pagesAgreement For Legal ServicesSarj Luzon100% (1)

- PALE Canon 7-9 Case DigestsDocument12 pagesPALE Canon 7-9 Case DigestsFlorence Rosete100% (2)

- T2 - Application For Free Legal AssistanceDocument2 pagesT2 - Application For Free Legal AssistanceCj CarabbacanNo ratings yet

- PALE Case DigestDocument4 pagesPALE Case DigestRochelle Lacsina-CanasaNo ratings yet

- A.C. No. 11981Document9 pagesA.C. No. 11981JP JimenezNo ratings yet

- Pangcatan Vs MaghuyopDocument2 pagesPangcatan Vs MaghuyopAngelDelaCruz75% (4)

- ABA Child Law Practice December 2014Document16 pagesABA Child Law Practice December 2014UDC LawNo ratings yet

- Legal System in SingaporeDocument28 pagesLegal System in SingaporeLatest Laws TeamNo ratings yet

- Buenaseda vs. Flavier - Case DigestDocument4 pagesBuenaseda vs. Flavier - Case Digestratud5952100% (1)

- No 132022Document50 pagesNo 132022Denise StephensNo ratings yet

- Samaniego VS FerrerDocument5 pagesSamaniego VS FerrerAweRiceNo ratings yet

- Compiled Legprof DigestsDocument203 pagesCompiled Legprof DigestsBenitez Gherold100% (8)

- Bar Exam Leakage CaseDocument12 pagesBar Exam Leakage CaseckqashNo ratings yet

- 2008 DigestsDocument11 pages2008 Digestsdodong123No ratings yet

- Hilado Versus David Case DigestDocument2 pagesHilado Versus David Case DigestPaul Sarangaya80% (5)

- Legal EthicsDocument7 pagesLegal EthicsZacky Dela TorreNo ratings yet

- 328 Bachrach V PPADocument8 pages328 Bachrach V PPAMlaNo ratings yet

- Bar Sanctions Jun 2020Document34 pagesBar Sanctions Jun 2020the kingfishNo ratings yet

- JGLS End-term Examination – Spring 2022Document11 pagesJGLS End-term Examination – Spring 2022ManishaNo ratings yet