Professional Documents

Culture Documents

Shriram Hybrid Equity Fund Direct Dividend Reinvestment

Shriram Hybrid Equity Fund Direct Dividend Reinvestment

Uploaded by

Yogi173Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shriram Hybrid Equity Fund Direct Dividend Reinvestment

Shriram Hybrid Equity Fund Direct Dividend Reinvestment

Uploaded by

Yogi173Copyright:

Available Formats

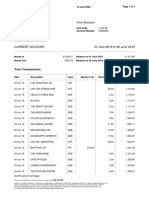

Report as of 22 Aug 2020

Shriram Hybrid Equity Fund Direct Dividend Reinvestment

Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™

Category_INCA000043 CRISIL Hybrid 35+65 - Aggressive TR INR 30% CRISIL Composite Bond Fund TR INR, QQQ

Used throughout report 70% IISL Nifty 50 TR INR

Investment Objective Performance

To generate long-term capital appreciation and current

17,000

income with reduced volatility by investing in a

15,250

judicious mix of a diversified portfolio of equity and

13,500

equity related investments, debt and money market 11,750

instruments. 10,000

8,250

2015 2016 2017 2018 2019 2020-07

0.39 1.52 24.17 1.79 9.90 -3.41 Fund

3.10 8.24 23.64 2.83 10.66 -0.32 Benchmark

3.11 6.71 26.48 -3.25 7.81 -4.72 Category

Risk Measures Trailing Returns % Fund Bmark Cat Quarterly Returns % Q1 Q2 Q3 Q4

3Y Alpha -1.92 3Y Sharpe Ratio 0.08 3 Months 17.26 10.11 18.00 2020 -18.40 12.85 - -

3Y Beta 0.99 3Y Std Dev 13.98 6 Months -1.64 -0.11 -3.69 2019 4.02 0.92 0.44 4.24

3Y R-Squared 97.16 3Y Risk Low 1 Year 8.67 6.97 7.22 2018 -2.45 2.88 0.41 1.02

3Y Info Ratio -0.86 5Y Risk Low 3 Years Annualised 5.57 5.88 3.23 2017 10.92 3.43 2.79 5.30

3Y Tracking Error 2.36 10Y Risk - 5 Years Annualised 6.10 8.20 6.15 2016 -2.96 5.14 6.98 -6.98

Calculations use CRISIL Hybrid 35+65 - Aggressive TR INR (where applicable)

Portfolio 31/07/2020

Asset Allocation % Net Morningstar Style Box™ America Europe Asia

Stocks 68.57 Equity Style Fixed Income Style

Bonds 16.78

Large Mid

Size

High Med Low

Cash 14.65 Credit Quality

Other 0.00

Small

Value Blend Growth Ltd Mod Ext

Style Interest Rate Sensitivity

<25 25-50 50-75 >75

Top Holdings Stock Sector Weightings % Fund World Regions % Fund

Holding Name Sector %

h Cyclical 44.61 Americas 0.00

Reliance Industries Ltd o 7.64 United States 0.00

j Sensitive 26.55

LIC Housing Finance Limited - 6.10 Canada 0.00

ICICI Bank Ltd y 4.92 k Defensive 28.84 Latin America 0.00

Rural Electrification... - 4.00

Fixed Income Sector Weightings % Fund Greater Europe 0.00

HDFC Bank Ltd y 3.97

United Kingdom 0.00

⁄ Government 10.65

Sanofi India Ltd d 3.88 Eurozone 0.00

› Corporate 42.75

HDFC Asset Management... y 3.77 Europe - ex Euro 0.00

u Securitized 0.00

Bharti Airtel Ltd i 3.45 Europe - Emerging 0.00

‹ Municipal 0.00

Hindustan Unilever Ltd s 2.34 Africa 0.00

y Cash & Equivalents 46.60

7.26% Govt Stock 2029 - 1.96 Middle East 0.00

± Derivative 0.00

Assets in Top 10 Holdings % 42.06 Greater Asia 100.00

Total Number of Equity Holdings 57 Japan 0.00

Total Number of Bond Holdings 9 Australasia 0.00

Asia - Developed 0.00

Asia - Emerging 100.00

Operations

Fund Company Shriram Asset Share Class Size (mil) - Minimum Initial Purchase 5,000 INR

Management Co Ltd Domicile India Minimum Additional Purchase 1,000 INR

Phone +91 33 23373012 Currency INR Exit Load 1.00% - 0-365 days

Website www.shriramamc.com UCITS - 0.00% - >365 days

Inception Date 29/11/2013 Inc/Acc Inc Expense Ratio 0.65%

Manager Name Gargi Banerjee ISIN INF680P01067

Manager Start Date 21/11/2016

NAV (21/08/2020) INR 14.59

Total Net Assets (mil) 551.64 INR

(31/07/2020)

© 2020 Morningstar. All Rights Reserved. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and Morningstar’s third party licensors; (2) may ®

not be copied or redistributed except as specifically authorised;(3) do not constitute investment advice;(4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may

be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it

ß

and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well

as up.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (347)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Pago Banco Transferiencia PDFDocument2 pagesPago Banco Transferiencia PDFluis luis100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bond SolutionDocument13 pagesBond Solution신동호100% (1)

- Attachments 71b8d55c 2019 June Statement PDFDocument5 pagesAttachments 71b8d55c 2019 June Statement PDFMarianaNo ratings yet

- Shipham Special Alloy ValvesDocument62 pagesShipham Special Alloy ValvesYogi173No ratings yet

- ErisLifesciences Q1FY22ResultReview30Jul21 ResearchDocument6 pagesErisLifesciences Q1FY22ResultReview30Jul21 ResearchYogi173No ratings yet

- V-Guard Industries - R - 10052019Document8 pagesV-Guard Industries - R - 10052019Yogi173No ratings yet

- Climate Change and Extreme Weather Events - Implications For FoodDocument16 pagesClimate Change and Extreme Weather Events - Implications For FoodYogi173No ratings yet

- Press Release Aries Agro Limited: Ratings Facilities Amount (Rs. Crore) Rating Rating Action - Total Facilities 175.05Document4 pagesPress Release Aries Agro Limited: Ratings Facilities Amount (Rs. Crore) Rating Rating Action - Total Facilities 175.05Yogi173No ratings yet

- Alkali Metals Limited - R - 26112020Document7 pagesAlkali Metals Limited - R - 26112020Yogi173No ratings yet

- Axis Special Situations Fund Direct GrowthDocument1 pageAxis Special Situations Fund Direct GrowthYogi173No ratings yet

- Covid-19 Related Item - : - Inj. Itolizumab (100mg)Document50 pagesCovid-19 Related Item - : - Inj. Itolizumab (100mg)Yogi173No ratings yet

- Press Release Dhampur Sugar Mills Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Dhampur Sugar Mills Limited: Details of Instruments/facilities in Annexure-1Yogi173No ratings yet

- 1 PDFDocument9 pages1 PDFYogi173No ratings yet

- Motilal Oswal Nifty Smallcap 250 Index Fund PDFDocument1 pageMotilal Oswal Nifty Smallcap 250 Index Fund PDFYogi173No ratings yet

- BHARAT Bond FOF April 2023Document1 pageBHARAT Bond FOF April 2023Yogi173No ratings yet

- Kotak Bond Growth Direct: Interest Rate SensitivityDocument1 pageKotak Bond Growth Direct: Interest Rate SensitivityYogi173No ratings yet

- Edelweiss Overnight FundDocument1 pageEdelweiss Overnight FundYogi173No ratings yet

- Defence Sector Product Import - Embargo ListDocument11 pagesDefence Sector Product Import - Embargo ListYogi173No ratings yet

- Shriram Long Term Equity Fund Direct GrowthDocument1 pageShriram Long Term Equity Fund Direct GrowthYogi173No ratings yet

- Shriram Multicap Regular Dividend PayoutDocument1 pageShriram Multicap Regular Dividend PayoutYogi173No ratings yet

- Shriram Balanced Advantage FundDocument1 pageShriram Balanced Advantage FundYogi173No ratings yet

- Introducing The Economic Way of ThinkingDocument36 pagesIntroducing The Economic Way of ThinkingDiego Fernando Ariza GonzálezNo ratings yet

- CENG-6105 Construction Materials Assignment 1 - (Agg Production Site Visit Report)Document12 pagesCENG-6105 Construction Materials Assignment 1 - (Agg Production Site Visit Report)Andu TadesseNo ratings yet

- Sirena Baliza Klaxon PSB-0004 220vacDocument5 pagesSirena Baliza Klaxon PSB-0004 220vacElsonAlfredoEscobarArosNo ratings yet

- Economic ExamDocument8 pagesEconomic Exam黄修文No ratings yet

- Apo Cement Plant Cebu Descaling of 12units Bearing Water JacketDocument11 pagesApo Cement Plant Cebu Descaling of 12units Bearing Water JacketDextran AlidonNo ratings yet

- International Economics 9Th Edition Appleyard Field 125929062X 9781259290626 Test Bank Full Chapter PDFDocument33 pagesInternational Economics 9Th Edition Appleyard Field 125929062X 9781259290626 Test Bank Full Chapter PDFjohn.vansickle782100% (13)

- Chapter 6 - Foreign Exchange MarketDocument36 pagesChapter 6 - Foreign Exchange MarketAntoine DangNo ratings yet

- 8 Better and Better LTD SolutionDocument23 pages8 Better and Better LTD SolutionAbhijeet JatoliaNo ratings yet

- Schedule Plan Project, ASP, Repair (Juli)Document2 pagesSchedule Plan Project, ASP, Repair (Juli)Jayz Sii ReshegNo ratings yet

- Đề Thi Thử TN THPT Tiếng Anh 2024 - Sở Giáo Dục Và Đào Tạo Thanh Hóa - File Word Có Lời Giải.docx-2Document35 pagesĐề Thi Thử TN THPT Tiếng Anh 2024 - Sở Giáo Dục Và Đào Tạo Thanh Hóa - File Word Có Lời Giải.docx-2TuộcNo ratings yet

- Answers Assignment 2 SolutionsDocument3 pagesAnswers Assignment 2 SolutionsPrathibha VikramNo ratings yet

- Economic Systems: Name: DateDocument5 pagesEconomic Systems: Name: DateTarek SouheilNo ratings yet

- US-Japan Global Cooperation in An Age of DisruptionDocument52 pagesUS-Japan Global Cooperation in An Age of DisruptionHoover InstitutionNo ratings yet

- (High Res Singles - Issuu) Market Technician Issue 88 (March 2020) PDFDocument60 pages(High Res Singles - Issuu) Market Technician Issue 88 (March 2020) PDFjoeNo ratings yet

- Departemen Teknik Sistem Perkapalan Daftar Pembagian Kapal Design I: Rencana Garis SEMESTER GANJIL 2019/2020Document3 pagesDepartemen Teknik Sistem Perkapalan Daftar Pembagian Kapal Design I: Rencana Garis SEMESTER GANJIL 2019/2020Nur Aufaq Rizky IrfanNo ratings yet

- Decent Work and Economic GrowthDocument10 pagesDecent Work and Economic GrowthAbe LorNo ratings yet

- Master Dissertation Topics EconomicsDocument4 pagesMaster Dissertation Topics EconomicsCustomWritingPaperServiceCanada100% (1)

- KIMSEN - Company ProfileDocument21 pagesKIMSEN - Company ProfileQUYEN TRANNo ratings yet

- Economics: Money Growth and InflationDocument24 pagesEconomics: Money Growth and InflationHanNo ratings yet

- SUGARDocument15 pagesSUGARtakshi80% (5)

- Maf651 Seminar 2 ReportDocument13 pagesMaf651 Seminar 2 Report2022908185No ratings yet

- HDFC Securities Results ReviewDocument5 pagesHDFC Securities Results ReviewmisfitmedicoNo ratings yet

- Summative Test in UcspDocument2 pagesSummative Test in UcspKharroscel Alocillo PotestasNo ratings yet

- Hhse - JSJ Ozark Bank GarnishmentDocument38 pagesHhse - JSJ Ozark Bank GarnishmentYTOLeaderNo ratings yet

- Corporate Finance Group AssignmentDocument19 pagesCorporate Finance Group AssignmentTrần LinhNo ratings yet

- COMESA Annual Report 2020 EnglishDocument152 pagesCOMESA Annual Report 2020 EnglishKaleb TibebeNo ratings yet

- Tax and Other Forms of Exactions RevisedDocument2 pagesTax and Other Forms of Exactions RevisedKawhi James100% (1)