Professional Documents

Culture Documents

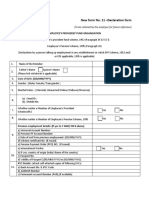

Composite Declaration Form-11 Employees' Provident Fund Organisation

Uploaded by

Harshit SuriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Composite Declaration Form-11 Employees' Provident Fund Organisation

Uploaded by

Harshit SuriCopyright:

Available Formats

www.epfindia.gov.

in

Composite Declaration Form-11

(To be retained by the employer for future reference)

EMPLOYEES’ PROVIDENT FUND ORGANISATION

Employees’ Provident Funds Scheme, 1952 (Paragraph 34 & 57) &

Employees’ Pension Scheme, 1995 (Paragraph 24)

(Declaration by a person taking up employment in any establishment on which EPF Scheme, 1952 and / or EPS, 1995 is applicable)

1 Name

Father's Name

2

Spouse's Name

3 Date of Birth :(DD/MM/YYYY)

4 Gender :(Male/Female/Transgender)

Marital Status

5

:(Married/Unmarried/Widow/Divorcee)

(a) Qualification :

6 (b) Email ID :

(c) Mobile No :

Present employment details:

7 Date of joining in the current

establishment(DD/MM/YYYY)

KYC Details: (attach self-attested copies of following KYC's)

a) Bank Account No. :

IFSC Code of the branch :

8 Employee Name as per Bank :

b) AADHAR Number

Employee Name as per Aadhar :

c) Permanent Account Number (PAN), if available

Employee Name as per PAN :

Whether earlier a member of Employee’s Provident Yes/No

9

Fund Scheme, 1952

Whether earlier a member of employee’s Pension Yes/No

10

Scheme, 1995

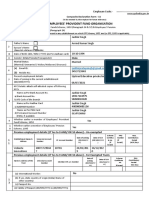

Previous employment details: [if Yes to 9 AND/OR 10 above] -- Un-exempted

Establishment Universal EPF Account Date of Date of Whether Scheme PPO Non

Name & Account Number Joining : Exit Withdrawn Certificate Number Contributory

Address Number (DD/MM/ :(DD/MM/ EPF & EPS No. (if issued) (if issued) Period (NCP)

YYYY) YYYY) Amount Days

Yes/No

Yes/No

11

Yes/No

Yes/No

Previous employment details: [if Yes to 9 AND/OR 10 above] – For Exempted Trusts

Name & Address Member EPS A/c Date of Date of Exit Whether Scheme Non

of the Trust UAN Number Joining (DD/MM/Y Withdrawn PF Certificate Contributory

(DD/MM/Y YYY) Amount No. (if issued) Period (NCP)

YYY) Days

12 Yes/No

Yes/No

Yes/No

13 a) International Worker Yes / No

b) If Yes, state country of origin (India / Name of the Country

c) Passport No.

d) Validity of Passport [(DD/MM/YYYY) to (DD/MM/YYYY)]

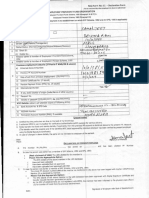

UNDERTAKING

1.Certified that the particulars are true to the best of my knowledge.

2.I authorize EPFO to use my Adhar for verification/authentication/e-KYC purpose for service delivery.

3.Kindly transfer the funds and service details, if applicable, from the previous PF account as declared above to the

present P.F. Account as I am Aadhar verified employee in my previous PF Account.

4.In case of changes in above details, the same will be intimated to employer at the earliest.

Date : Signature of Member

Place :

DECLARATION BY PRESENT EMPLOYER

A. The member Mr/Ms/Mrs ………………………………………………………. has joined on …………………………………. and has been

allotted PF No. ……………………………………………………………..and UAN…………………………………………………………………………..

B. In case the person was earlier not a member of EPF Scheme, 1952 and EPS, 1995:

• Please Tick the Appropriate Option:

The KYC details of the above member in the UAN database

Have not been uploaded

Have been uploaded but not approved

Have been uploaded and approved with DSC/e-Sign

C. In case the person was earlier not a member of EPF Scheme, 1952 and EPS, 1995:

• Please Tick the Appropriate Option:

The KYC details of the above member in the UAN database have been approved with E-

Sign/Digital Signature Certificate and tranfer request has been genereated on portal.

The previous Account of the member is not Aadhar Verified and hence physical trasnfer form

shall be intiatied.

Date : Signature of Employer with Seal of the

Establishment

*Auto transfer of previous PF account would be possible in respect of Aadhar verified employees only. Other employees

are requested to file physical claim (Form-13) for transfer of account from the previous establishment.

You might also like

- Sample Filled EPF Composite Declaration Form 11Document2 pagesSample Filled EPF Composite Declaration Form 11Varalakshmi SharanNo ratings yet

- Composite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationDocument2 pagesComposite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationManasNo ratings yet

- EPFO Declaration Form SummaryDocument3 pagesEPFO Declaration Form SummaryManas67% (9)

- ESIC SPECIMEN - Form-1 Declaration FormDocument2 pagesESIC SPECIMEN - Form-1 Declaration FormnimishshrivastavNo ratings yet

- PF Nomination FormDocument3 pagesPF Nomination FormNarendra GaurNo ratings yet

- DTDC Authorization PDFDocument1 pageDTDC Authorization PDFAnoop KrishnanNo ratings yet

- Nomination Form 1Document2 pagesNomination Form 1KumarKd0% (1)

- FORM No 11 (NEW)Document2 pagesFORM No 11 (NEW)selvampanneer121No ratings yet

- EPF Declaration FormDocument2 pagesEPF Declaration Formvishalkavi18No ratings yet

- Composite Declaration Form for EPF MembershipDocument2 pagesComposite Declaration Form for EPF MembershipKeshav SarafNo ratings yet

- Form 11 (Download Here) - 54061825463895 - 54388549640084Document3 pagesForm 11 (Download Here) - 54061825463895 - 54388549640084Kishore NithyaNo ratings yet

- EPF Form 11Document3 pagesEPF Form 11warm bloodNo ratings yet

- Sample Composite Form 11Document2 pagesSample Composite Form 11Yuga NayakNo ratings yet

- PF Membership Details in Form 11Document2 pagesPF Membership Details in Form 11AbhilashNo ratings yet

- PF Declaration Form 11 New-Ayesha KhanDocument3 pagesPF Declaration Form 11 New-Ayesha KhanMalik PrintNo ratings yet

- PF - Form 11Document2 pagesPF - Form 11Log SquareNo ratings yet

- Joining Docket DocumentsDocument9 pagesJoining Docket Documentsgh75zs5m4dNo ratings yet

- Composite Form 11 - EditableDocument1 pageComposite Form 11 - EditableSoumya BanerjeeNo ratings yet

- India Statutory Form TemplateDocument11 pagesIndia Statutory Form TemplateMadhusudan MadhuNo ratings yet

- 01 PF Declaration Form 11Document1 page01 PF Declaration Form 11Vijayavelu AdiyapathamNo ratings yet

- EPF - New Form No. 11 - Declaration FormDocument2 pagesEPF - New Form No. 11 - Declaration FormNaveen SNo ratings yet

- 1 - EPF - Form No. 11 (Sample)Document1 page1 - EPF - Form No. 11 (Sample)Rajdeep GaharwarNo ratings yet

- (To Be Retained by The Employer For Future Reference) : Employees'Provident Fund OrganisationDocument3 pages(To Be Retained by The Employer For Future Reference) : Employees'Provident Fund Organisationshashi kiranNo ratings yet

- Composite Declaration FORM 11Document4 pagesComposite Declaration FORM 11Yaswanth ChallaNo ratings yet

- LTFS Statutory KitDocument12 pagesLTFS Statutory KitAyyanzeroNo ratings yet

- PF Form11 & Declaration FormDocument2 pagesPF Form11 & Declaration Formalapati NagalaxmiNo ratings yet

- Declare EPF detailsDocument2 pagesDeclare EPF detailsADITYA R P 1937302No ratings yet

- new-formDocument2 pagesnew-formPondara Naveen BadatyaNo ratings yet

- New Form 11 DeclarationDocument1 pageNew Form 11 Declarationsanjith_shelly290No ratings yet

- New EPF Form DeclarationDocument1 pageNew EPF Form Declarationhareesh bathalaNo ratings yet

- QTPL Form 11Document2 pagesQTPL Form 11PreritNo ratings yet

- Employees' Provident Fund Organisation: Composite Declaration Form - 11Document5 pagesEmployees' Provident Fund Organisation: Composite Declaration Form - 11Yashveer Pratap SinghNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- EPF - FormDocument1 pageEPF - FormBavithraNo ratings yet

- P.F. Form 11Document1 pageP.F. Form 11DattaNo ratings yet

- IN Form 11Document1 pageIN Form 11Chetan DhuriNo ratings yet

- New Form 11Document2 pagesNew Form 11నీలం మధు సూధన్ రెడ్డిNo ratings yet

- Employees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Document1 pageEmployees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Yash SellsNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormPAINNo ratings yet

- EPF Form-11Document1 pageEPF Form-11PulkKit SharMaNo ratings yet

- PFForm 11Document1 pagePFForm 11mohan vamsiNo ratings yet

- Employees' Provident Fund OrganisationDocument1 pageEmployees' Provident Fund Organisationvikas kunduNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormRajeshNo ratings yet

- Employees' Provident Fund OrganisationDocument2 pagesEmployees' Provident Fund OrganisationMuthiah ManiNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document3 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11Lance LeoNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11naresh2891No ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormDharshan ChandrasekaranNo ratings yet

- 7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Document1 page7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Vakati HemasaiNo ratings yet

- Print Form 11Document2 pagesPrint Form 11Andrew WinnerNo ratings yet

- Epf Form No 11Document1 pageEpf Form No 11Narayanprasad GhosalNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11Yash JainNo ratings yet

- PF Declaration Form No.-11Document2 pagesPF Declaration Form No.-11soumodip chakrabortyNo ratings yet

- Form11 - 111018740Document2 pagesForm11 - 111018740muskan davidNo ratings yet

- Lei C4 - 392-E.5-: - 4-6B Plat' I. S c.4Document4 pagesLei C4 - 392-E.5-: - 4-6B Plat' I. S c.4jasdeep singhNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormsarveshNo ratings yet

- PF Membership Details in Form 11 TemplateDocument2 pagesPF Membership Details in Form 11 TemplateNisumba SoodhaniNo ratings yet

- Efp Form No 11Document1 pageEfp Form No 11likhithkumar. 411No ratings yet

- Mahesh Band Venkah. Bandi: Kyc Details: (Attach Self Attested Copies of Following KVCS)Document2 pagesMahesh Band Venkah. Bandi: Kyc Details: (Attach Self Attested Copies of Following KVCS)NEW PREMIUMNo ratings yet

- New Form No.11- DeclarationDocument2 pagesNew Form No.11- DeclarationbhargavaNo ratings yet

- PFForm 11Document1 pagePFForm 11chvsrajNo ratings yet

- Onboarding Check ListDocument1 pageOnboarding Check ListHarshit SuriNo ratings yet

- Statutory-Form Q New PDFDocument1 pageStatutory-Form Q New PDFHarshit SuriNo ratings yet

- Harshit Suri ResumeDocument3 pagesHarshit Suri ResumeHarshit SuriNo ratings yet

- Gratuity Form FDocument2 pagesGratuity Form Fचेतांश सिंह कुशवाह100% (1)

- Employee Verification FormDocument4 pagesEmployee Verification FormHarshit Suri100% (9)

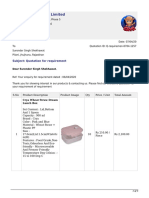

- SmartSchool Education Pvt Ltd tax invoice for Any Key for Administrative three year licenseDocument1 pageSmartSchool Education Pvt Ltd tax invoice for Any Key for Administrative three year licenseHarshit SuriNo ratings yet

- TNL 201712145194201801254Document2 pagesTNL 201712145194201801254Harshit Suri100% (1)

- Onboarding FormDocument1 pageOnboarding FormHarshit SuriNo ratings yet

- GST Reg Certificate UPDocument3 pagesGST Reg Certificate UPHarshit Suri100% (1)

- FORM 2 (Revised) : Nomination and Declaration FormDocument2 pagesFORM 2 (Revised) : Nomination and Declaration FormHarshit Suri100% (1)

- Contacts list for Tawk too messaging appDocument2 pagesContacts list for Tawk too messaging appHarshit SuriNo ratings yet

- Rotational and Vibrational Spectra ExplainedDocument7 pagesRotational and Vibrational Spectra ExplainedHarshit SuriNo ratings yet

- Company ProfileDocument22 pagesCompany ProfileAnonymous vkyBjm71% (7)

- Tax Invoice: Smartschool Education PVT LTDDocument1 pageTax Invoice: Smartschool Education PVT LTDHarshit SuriNo ratings yet

- Kitchen Super Star, FaridabadDocument8 pagesKitchen Super Star, FaridabadHarshit SuriNo ratings yet

- Omaxe Mall: Big Bazaar - Kitchen Superstar (24-6-2017)Document9 pagesOmaxe Mall: Big Bazaar - Kitchen Superstar (24-6-2017)Harshit SuriNo ratings yet

- Vasant Square Mall: Big Bazaar - Kitchen Superstar (24-6-2017)Document9 pagesVasant Square Mall: Big Bazaar - Kitchen Superstar (24-6-2017)Harshit SuriNo ratings yet

- K MapDocument32 pagesK MapHarshit SuriNo ratings yet

- Lunch Box QuotationDocument5 pagesLunch Box QuotationHarshit SuriNo ratings yet

- GIPDocument6 pagesGIPHarshit SuriNo ratings yet

- 1337345436physics Experiments Part VDocument9 pages1337345436physics Experiments Part VHarshit SuriNo ratings yet

- BookmarkDocument1 pageBookmarkHarshit SuriNo ratings yet

- HDFC Prudence FundDocument8 pagesHDFC Prudence FundDhuraivel GunasekaranNo ratings yet

- Payment Details Report: Orders Under This TransactionDocument1 pagePayment Details Report: Orders Under This TransactionSachin JainNo ratings yet

- Proj Fin Quest Paper 1Document2 pagesProj Fin Quest Paper 1Sunil PeerojiNo ratings yet

- Assignment No 1 FinalDocument13 pagesAssignment No 1 FinalMuhammad AwaisNo ratings yet

- Income From Capital GainsDocument13 pagesIncome From Capital Gainsbs_sharathNo ratings yet

- Cancellation of Mortgage SampleDocument1 pageCancellation of Mortgage SampleEsli Adam Rojas100% (6)

- Oblicon Art.1250 1253 FaithRadazaDocument2 pagesOblicon Art.1250 1253 FaithRadazaDah Rin CavanNo ratings yet

- Income Tax AustraliaDocument9 pagesIncome Tax AustraliaAbdul HadiNo ratings yet

- Fis Bba 115 2011Document292 pagesFis Bba 115 2011ppghoshinNo ratings yet

- Final AccountsDocument91 pagesFinal AccountsKartikey swami0% (1)

- Certificate for claiming house rent allowanceDocument1 pageCertificate for claiming house rent allowanceTally AnuNo ratings yet

- Chapter 07 - Financial Literacy RBI InitiativesDocument4 pagesChapter 07 - Financial Literacy RBI Initiativesshubhram2014No ratings yet

- Promissory Note: For Affordable Housing ProgramDocument2 pagesPromissory Note: For Affordable Housing ProgramAda Edaleen A. Diansuy33% (3)

- Financial Ratio Analysis - List of Financial RatiosDocument5 pagesFinancial Ratio Analysis - List of Financial RatiosHappy SunshineNo ratings yet

- PNB Ze Lo Mastercard - App Form OnePager - Jan2020 1Document9 pagesPNB Ze Lo Mastercard - App Form OnePager - Jan2020 1Crypto ManiacNo ratings yet

- AFFIDAVIT of Right To Lawful Currency of Exchange Template 1 1Document1 pageAFFIDAVIT of Right To Lawful Currency of Exchange Template 1 1Jason MannerNo ratings yet

- How to Turn Your Side Hustle into CashDocument13 pagesHow to Turn Your Side Hustle into CashNurizzah RoslanNo ratings yet

- Plant Asset Depreciation MethodsDocument25 pagesPlant Asset Depreciation Methodssamuel kebede100% (1)

- Financial Ratio Analysis - BestDocument50 pagesFinancial Ratio Analysis - BestAmit87% (45)

- HRCPC - LTC - LFC Reimbursement FormatDocument4 pagesHRCPC - LTC - LFC Reimbursement FormatAtul GuptaNo ratings yet

- AFAR - Construction, Franchise, Joint ArrangementDocument2 pagesAFAR - Construction, Franchise, Joint ArrangementJoanna Rose DeciarNo ratings yet

- Financial Performance Evaluation of Indian Rare Earths LimitedDocument27 pagesFinancial Performance Evaluation of Indian Rare Earths LimitedNitheesh VsNo ratings yet

- IndiaFilings Checkout PlansDocument3 pagesIndiaFilings Checkout PlansRitesh Kumar DubeyNo ratings yet

- Lesson 4 Income Statement Balance SheetDocument5 pagesLesson 4 Income Statement Balance SheetklipordNo ratings yet

- Responsibility AccountingDocument2 pagesResponsibility AccountingEugene Navarro100% (1)

- Simple Interest and Compound Interest Questions Moderate 1Document20 pagesSimple Interest and Compound Interest Questions Moderate 1Deepu dskNo ratings yet

- SBI Bank Statement Summary for Mr. SUGGU VINOD KUMARDocument8 pagesSBI Bank Statement Summary for Mr. SUGGU VINOD KUMARAravind ChunduriNo ratings yet

- Indian Financial SystemDocument6 pagesIndian Financial SystemManmeet Kaur100% (1)

- Regular Income Tax Chapter on Exclusions from Gross IncomeDocument15 pagesRegular Income Tax Chapter on Exclusions from Gross IncomeJolina AynganNo ratings yet

- Different Areas of Services Rendered by CAsDocument51 pagesDifferent Areas of Services Rendered by CAsAmit JainNo ratings yet