Professional Documents

Culture Documents

New Form

Uploaded by

Pondara Naveen BadatyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Form

Uploaded by

Pondara Naveen BadatyaCopyright:

Available Formats

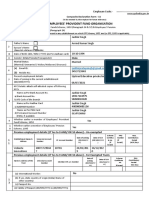

Composite Declaration Form - 11

(To be retained by the employer for future reference)

EMPLOYEES' PROVIDENT FUND ORGANISATION

Employees' Provident Funds Scheme, 1952 (Paragraph 34 & 57) &

Employees' Pension Scheme, 1995 (Paragraph 24)

(Declaration by a person taking up employment in any establishment on which EPF Scheme, 1952 and/or EPS, 1995 is applicable)

1 Name of the member Pondara Naveen Badatya

2 Father's Name Pondara Dilip Badatya

Husband's Name

3 Date of Birth: (DD/MM/YYYY) 15/02/2001

4 Gender: (Male/Female/Transgender) Male

5 Marital Status (Married/Unmarried/Widow/Widower/Divorcee) Unmarried

6 (a) Email ID: badatyanaveen15@gmail.com

(b) Mobile No.: 9182700400

7 Present employment details:

Date of Joining in the current establishment (DD/MM/YYYY) 01/04/2024

8 KYC Details (attach self attested copies of following KYCs)

a) Bank Account No. : 50100711898090

b) IFS Code of the branch: HDFC0000042

c) Aadhaar Number 847896936199

d) Permanent Account Number (PAN), if available FACPB6702B

9 Whether earlier a member of Employees' Provident Fund

Scheme, 1952 (Yes/No) No

Whether earlier a member of Employees' Pension Scheme,

10 No

1995 (Yes/No)

11 Previous employment details: (If Yes to 9 AND/OR 10 above] Un-exempted

Establishment Name

Establishment Address

Universal Account Number (UAN)

PF Account Number

Date of Joining (DD/MM/YYYY)

Date of Exit (DD/MM/YYYY)

Scheme Certificate No. (if issued)

PPO Number (if issued)

Non-Contributory Period (NCP) Days

12 Previous employment details: [if Yes to 9 AND/OR 10 above] - For Exempted Trusts

Name of the Trust

Address of the Trust

Universal Account Number (UAN)

Member EPS A/c Number

Date of Joining (DD/MM/YYYY)

Date of Exit (DD/MM/YYYY)

Scheme Certificate No. (if Issued)

Non-Contributory Period (NCP) Days

13 a) International Worker (Yes/No.) No

b) If yes, State Country or Origin (India/Name of other Country)

c) Passport No.

d) Validity of Passport From (DD/MM/YYYY)

To (DD/MM/YYYY)

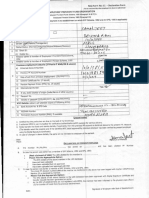

UNDERTAKING

1) Certified that the particulars are true to the best of my knowledge.

2) I authorise EPFO to use my Aadhaar for verification/authentication/eKYC purpose for service delivery

Kindly transfer the funds and service details, if applicable, from the previous PF account as declared above to the present P.F. Account

3)

as I am an Aadhaar verified employee in my previous PF Account.*

4) In case of changes in above details, the same will be intimated to employer at the earliest.

Date: 02/04/2024

Place: Hyderabad Signature of Member

DECLARATION BY PRESENT EMPLOYER

A The member Mr./Ms./Mrs. has joined on and has been

allotted PF No. and UAN

B. In case the person was earlier not a member of EPF Scheme, 1952 and EPS, 1995

* Please tick the Appropriate Option

The KYC details of the above member in the UAN database

[ ] Have not been uploaded

[ ] Have been uploaded but no approved

[ ] Have been uploaded and approved with DSC/e-sign

C. In case the person was earlier a member of EPF Scheme, 1952 and EPS, 1995

* Please Tick the Appropriate Option

The KYC details of the above member in the UAN database have been approved with E-sign/Digital Signature Certificate and

[ ]

transfer request has been generated on Portal.

[ ] he previous Account of the member is not Aadhaar verified and hence physical transfer form shall be initiated

Date: Signature of Employer with Seal of

Establishment

* Auto transfer of previous PF account would be possible in respect of Aadhaar verified employees only. Other

employees are requested to file physical claim (Form - 13) for transfer of account from the previous establishment.

You might also like

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Aptitude Test - HR ExecutiveDocument9 pagesAptitude Test - HR ExecutiveHARCHARAN SINGH RANOTRA80% (5)

- "Improving Occupational Health and Workplace Safety in Saudi Arabia PDFDocument7 pages"Improving Occupational Health and Workplace Safety in Saudi Arabia PDFAnsarMahmoodNo ratings yet

- Safety Requirements Behavior Based Safety For Power Plants PDFDocument34 pagesSafety Requirements Behavior Based Safety For Power Plants PDFmaneesh_03100% (1)

- 01 Sample Director Resignation LetterDocument1 page01 Sample Director Resignation LetterMahaveer Dhelariya100% (1)

- New Form 11Document2 pagesNew Form 11నీలం మధు సూధన్ రెడ్డిNo ratings yet

- PF Membership Details in Form 11Document2 pagesPF Membership Details in Form 11AbhilashNo ratings yet

- QTPL Form 11Document2 pagesQTPL Form 11PreritNo ratings yet

- PF - Form 11Document2 pagesPF - Form 11Log SquareNo ratings yet

- P.F. Form 11Document1 pageP.F. Form 11DattaNo ratings yet

- PF Form11 & Declaration FormDocument2 pagesPF Form11 & Declaration Formalapati NagalaxmiNo ratings yet

- Form 11 (Download Here) - 54061825463895 - 54388549640084Document3 pagesForm 11 (Download Here) - 54061825463895 - 54388549640084Kishore NithyaNo ratings yet

- EPF - FormDocument1 pageEPF - FormBavithraNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormPAINNo ratings yet

- Form 11 - PF Declaration1Document2 pagesForm 11 - PF Declaration1ADITYA R P 1937302No ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- Composite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationDocument2 pagesComposite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationManasNo ratings yet

- PFForm 11Document1 pagePFForm 11sanjith_shelly290No ratings yet

- Epf Form No 11Document1 pageEpf Form No 11Narayanprasad GhosalNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormDharshan ChandrasekaranNo ratings yet

- PFForm 11Document1 pagePFForm 11mohan vamsiNo ratings yet

- New Form No.11-Declaration Form: Employees Provident Fund OrganizationDocument2 pagesNew Form No.11-Declaration Form: Employees Provident Fund OrganizationbhargavaNo ratings yet

- (To Be Retained by The Employer For Future Reference) : Employees'Provident Fund OrganisationDocument3 pages(To Be Retained by The Employer For Future Reference) : Employees'Provident Fund Organisationshashi kiranNo ratings yet

- 01 PF Declaration Form 11Document1 page01 PF Declaration Form 11Vijayavelu AdiyapathamNo ratings yet

- Employees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Document1 pageEmployees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Yash SellsNo ratings yet

- 1 - EPF - Form No. 11 (Sample)Document1 page1 - EPF - Form No. 11 (Sample)Rajdeep GaharwarNo ratings yet

- FORM No 11 (NEW)Document2 pagesFORM No 11 (NEW)selvampanneer121No ratings yet

- Efp Form No 11Document1 pageEfp Form No 11likhithkumar. 411No ratings yet

- PF Declaration Form No.-11Document2 pagesPF Declaration Form No.-11soumodip chakrabortyNo ratings yet

- Form11 - 111018740Document2 pagesForm11 - 111018740muskan davidNo ratings yet

- Composite Declaration Form: Employees'Document2 pagesComposite Declaration Form: Employees'Keshav SarafNo ratings yet

- EPF Declaration FormDocument2 pagesEPF Declaration Formvishalkavi18No ratings yet

- Print Form 11Document2 pagesPrint Form 11Andrew WinnerNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormsarveshNo ratings yet

- Employees' Provident Fund Organisation: New Form: 11 - Declaration FormDocument1 pageEmployees' Provident Fund Organisation: New Form: 11 - Declaration Formhareesh bathalaNo ratings yet

- PF Declaration Form 11 New-Ayesha KhanDocument3 pagesPF Declaration Form 11 New-Ayesha KhanMalik PrintNo ratings yet

- Eram Shaikh - Onboarding KIT Template 23 May 2022Document97 pagesEram Shaikh - Onboarding KIT Template 23 May 2022Tariq ShaikhNo ratings yet

- IN Form 11Document1 pageIN Form 11Chetan DhuriNo ratings yet

- EPF - New Form No. 11 - Declaration FormDocument2 pagesEPF - New Form No. 11 - Declaration FormNaveen SNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormRajeshNo ratings yet

- Please Tick The Appropriate OptionDocument2 pagesPlease Tick The Appropriate OptionJayant ChorariaNo ratings yet

- Composite Declaration FORM 11Document4 pagesComposite Declaration FORM 11Yaswanth ChallaNo ratings yet

- EPF Form-11Document1 pageEPF Form-11PulkKit SharMaNo ratings yet

- Employees' Provident Fund OrganisationDocument1 pageEmployees' Provident Fund Organisationvikas kunduNo ratings yet

- Employees' Provident Fund OrganisationDocument2 pagesEmployees' Provident Fund OrganisationMuthiah ManiNo ratings yet

- PF Form AgreementDocument2 pagesPF Form AgreementbindusNo ratings yet

- Joining Docket DocumentsDocument9 pagesJoining Docket Documentsgh75zs5m4dNo ratings yet

- Composite Declaration Form-11 Employees' Provident Fund OrganisationDocument2 pagesComposite Declaration Form-11 Employees' Provident Fund OrganisationHarshit SuriNo ratings yet

- PFForm 11Document1 pagePFForm 11chvsrajNo ratings yet

- Form 11Document2 pagesForm 11Arpit VermaNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11Yash JainNo ratings yet

- Employees' Provident Fund Organisation: Composite Declaration Form - 11Document5 pagesEmployees' Provident Fund Organisation: Composite Declaration Form - 11Yashveer Pratap SinghNo ratings yet

- 7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Document1 page7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Vakati HemasaiNo ratings yet

- PF Membership Details in Form 11 TemplateDocument2 pagesPF Membership Details in Form 11 TemplateNisumba SoodhaniNo ratings yet

- TALIC Form 11Document2 pagesTALIC Form 11Avdhesh Singh RajpootNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11naresh2891No ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document3 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11Lance LeoNo ratings yet

- Form13 Filled AllDocument3 pagesForm13 Filled AllShani KumarNo ratings yet

- Sample Composite Form 11Document2 pagesSample Composite Form 11Yuga NayakNo ratings yet

- Sample Filled EPF Composite Declaration Form 11Document2 pagesSample Filled EPF Composite Declaration Form 11Varalakshmi SharanNo ratings yet

- Lei C4 - 392-E.5-: - 4-6B Plat' I. S c.4Document4 pagesLei C4 - 392-E.5-: - 4-6B Plat' I. S c.4jasdeep singhNo ratings yet

- Khushboo Project ReportDocument71 pagesKhushboo Project ReportRahul Sharma100% (1)

- Industry Profile: Overview of The Footwear Industrial SectorDocument68 pagesIndustry Profile: Overview of The Footwear Industrial SectorBHARATNo ratings yet

- Socomec 2013Document660 pagesSocomec 2013thinewill_bedone8055No ratings yet

- 15283971Document41 pages15283971Abdul Kadir BagisNo ratings yet

- (Michele A. Paludi) The Psychology of Women at Wor (BookFi)Document615 pages(Michele A. Paludi) The Psychology of Women at Wor (BookFi)tansu KabylbekovaNo ratings yet

- Inccident Investigation Form v5.0Document4 pagesInccident Investigation Form v5.0ahmedNo ratings yet

- BBA 3RD YEAR Dimpy Yadav Summer-Internship-Project-ReportDocument74 pagesBBA 3RD YEAR Dimpy Yadav Summer-Internship-Project-ReportDugguNo ratings yet

- CS Form No. 7 Clearance FormDocument4 pagesCS Form No. 7 Clearance FormRoyal MarjNo ratings yet

- New Text DocumentDocument2 pagesNew Text Documentfirmansyahakbar150No ratings yet

- Case Study Imar Nursania 2018204426Document8 pagesCase Study Imar Nursania 2018204426Imar NursaniaNo ratings yet

- Digital HR Transformation at WorkplaceDocument3 pagesDigital HR Transformation at Workplaceharmain khalilNo ratings yet

- NATAN - Activity 2 (Human Resource Management)Document3 pagesNATAN - Activity 2 (Human Resource Management)Denmark David Gaspar NatanNo ratings yet

- Adminstration - Human Resources Clerk - Belle Cosmetic Limited - Hong Kong - JobsDBDocument2 pagesAdminstration - Human Resources Clerk - Belle Cosmetic Limited - Hong Kong - JobsDBBerberber YffNo ratings yet

- 14 - Cielo v. NLRC 193 SCRA 410 (1991)Document4 pages14 - Cielo v. NLRC 193 SCRA 410 (1991)Alelojo, NikkoNo ratings yet

- Resume Cover Letter For Receptionist PositionDocument7 pagesResume Cover Letter For Receptionist Positionafmrgjwjcowaov100% (1)

- RA 7877 Anti Sexual Harassment Act of 1995Document32 pagesRA 7877 Anti Sexual Harassment Act of 1995TUMAPANG RAMME ANTHONY NUEVONo ratings yet

- HR Strategy of Infosys LimitedDocument11 pagesHR Strategy of Infosys LimitedshamitasathishNo ratings yet

- Oksana Resume 2018Document1 pageOksana Resume 2018api-404432279No ratings yet

- Revision For Business GrammarDocument8 pagesRevision For Business GrammarDy DươngNo ratings yet

- Group 5Document8 pagesGroup 5Arfa FatimaNo ratings yet

- DBT Lab Exam FaqsDocument3 pagesDBT Lab Exam FaqsSumit Tembhare0% (1)

- The Law of Employees' Provident Funds - A Case Law PerspectiveDocument28 pagesThe Law of Employees' Provident Funds - A Case Law PerspectiveRamesh ChidambaramNo ratings yet

- Employment Application Form: Personal DetailsDocument9 pagesEmployment Application Form: Personal DetailsCaleb PriceNo ratings yet

- Right To Disconnect Bill, 2018 in EnglishDocument10 pagesRight To Disconnect Bill, 2018 in EnglishLatest Laws TeamNo ratings yet

- Case 7 - Death at MasseyDocument2 pagesCase 7 - Death at MasseyImandaMulia100% (1)

- Chapter - Iv: ConclusionDocument19 pagesChapter - Iv: ConclusionAlok NayakNo ratings yet