Professional Documents

Culture Documents

QTPL Form 11

Uploaded by

PreritOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QTPL Form 11

Uploaded by

PreritCopyright:

Available Formats

www.epfindia.gov.

in

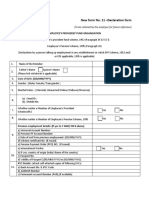

COMPOSITE DECLARATION FORM -11

(To be retained by the employer for future reference)

EMPLOYEES PROVIDENT FUND ORGANISATION

Employees’ Provident Funds Scheme, 1952 (paragraph 34&57) &

Employees’ pension Scheme, 1995 (Paragraph 24)

(Declaration by a person taking up employment in any establishment on which EPF scheme, 1952 and / or EPS, 1995 is

applicable

1 Name Of The Member PRERIT SINGHAL

2 Father Name:

DR. SATYENDRA SINGHAL

3 Date Of Birth 2ND MARCH 1995

4 Gender (Male/Female/Transgender) MALE

5 Marital Status (Unmarried/Married/Widow/Widower/Divorcee) UNMARRIED

(a) Email Id: Singhalprerit7@gmail.com

6

(b) Mobile Number: 7073352026

Present Employment Details:

7

Date Of Joining In The Current Establishment (DD/MM/YYYY) 28/04/2021

KYC Details: (attach self-attested copies of following KYC’s

a) Bank Account Number: 10403853163

8 b) IFS Code Of The Branch SBIN0002299

c) Aadhar Number: 388790192533

d) Permanent Account Number (PAN), if available FQBPS1490G

9 Whether earlier a member of Employees’ Provident Fund Scheme, 1952 NO

10 Whether earlier a member of Employees’ Pension Scheme, 1995 NO

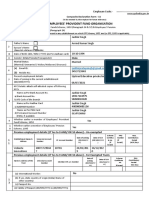

Previous Employment Details: (if Yes to 9 & 10 above) Un-Exempted

Establishment Name & Address

Universal Account Number

PF & EPS Account Number

11 Date of Joining (DD/MM/YYYY)

Date of Exit (DD/MM/YYYY)

Scheme Certificate No. (If Issued)

PPO Number (if Issued)

Non-Contribution Period (NCP) Days

Previous Employment Details: (if Yes to 9 & 10 above ) Exempted Trust

Name & Address of the Trust

Universal Account Number

Member EPS Account Number

12

Date of Joining (DD/MM/YYYY)

Date of Exit (DD/MM/YYYY)

Scheme Certificate No. (If Issued)

Non-Contribution Period (NCP) Days

13 International Worker: NO

a) If Yes, state country of origin (India/Name of the Country)

b) Passport Number

c) Validity of Passport (DD/MM/YYYY to DD/MM/YYYY)

UNDERTAKING

1) Certified that the particulars are true to the best of my knowledge.

2) I authorize EPFO to use my Aadhar for verification/authorisation/e-KYC purpose for service delivery.

3) Kindly transfer the funds and service details, if applicable, from the previous PF account as declared above to the present PF

account as I am an Aadhar verified employee in my previous PF account.

4) In case of changes in above details, the same will be intimated to employer at the earliest.

Date: 21/04/2021

Place: DELHI

Signature of Member:

DECLARATION BY PRESENT EMPLOYER

A) The Member Mr/Ms/Mrs.__________________________________________________ has joined on__________________

and has been allotted PF & EPS Account Number___________________________________ & Universal Account

Number___________________________.

B. In case the person was earlier not a member of EPF Scheme, 1952 and EPS, 1995:

Please Tick the Appropriate Option:

The KYC details of the above member in the UAN database

o Have not uploaded

o Have been uploaded but not approved

o Have been uploaded and approved with DSC/e-sign.

C. In case the person was earlier a member of EPF Scheme, 1952 and EPS, 1995:

* Please Tick the Appropriate Option:

o The KYC details of the member in the UAN database have been approved with E-sign/Digital Signature Certificate and transfer

request has been generated on portal.

o The previous Account of the member is not Aadhar verified and physical transfer from shall be initiated.

Date:

FOR QUALITY TUTORUIALS PRIVATE LIMITED

AUTHORISED SIGNATORY

*Auto transfer of previous PF account would be possible in respect of Aadhar verified employees only. Other Employees are

request to file physical claim (Form 13) for transfer of account from the previous establishment.

You might also like

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- new-formDocument2 pagesnew-formPondara Naveen BadatyaNo ratings yet

- PF - Form 11Document2 pagesPF - Form 11Log SquareNo ratings yet

- Form 11 (Download Here) - 54061825463895 - 54388549640084Document3 pagesForm 11 (Download Here) - 54061825463895 - 54388549640084Kishore NithyaNo ratings yet

- New Form 11 DeclarationDocument1 pageNew Form 11 Declarationsanjith_shelly290No ratings yet

- PFForm 11Document1 pagePFForm 11mohan vamsiNo ratings yet

- Epf Form No 11Document1 pageEpf Form No 11Narayanprasad GhosalNo ratings yet

- PF Form11 & Declaration FormDocument2 pagesPF Form11 & Declaration Formalapati NagalaxmiNo ratings yet

- New Form 11Document2 pagesNew Form 11నీలం మధు సూధన్ రెడ్డిNo ratings yet

- Efp Form No 11Document1 pageEfp Form No 11likhithkumar. 411No ratings yet

- (To Be Retained by The Employer For Future Reference) : Employees'Provident Fund OrganisationDocument3 pages(To Be Retained by The Employer For Future Reference) : Employees'Provident Fund Organisationshashi kiranNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormRajeshNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormDharshan ChandrasekaranNo ratings yet

- Form11 - 111018740Document2 pagesForm11 - 111018740muskan davidNo ratings yet

- Employees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Document1 pageEmployees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Yash SellsNo ratings yet

- PF Declaration Form 11 New-Ayesha KhanDocument3 pagesPF Declaration Form 11 New-Ayesha KhanMalik PrintNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- FORM No 11 (NEW)Document2 pagesFORM No 11 (NEW)selvampanneer121No ratings yet

- EPF - FormDocument1 pageEPF - FormBavithraNo ratings yet

- Joining Docket DocumentsDocument9 pagesJoining Docket Documentsgh75zs5m4dNo ratings yet

- PF Membership Details in Form 11Document2 pagesPF Membership Details in Form 11AbhilashNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormsarveshNo ratings yet

- New Form No.11- DeclarationDocument2 pagesNew Form No.11- DeclarationbhargavaNo ratings yet

- Employees' Provident Fund OrganisationDocument1 pageEmployees' Provident Fund Organisationvikas kunduNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormPAINNo ratings yet

- New EPF Form DeclarationDocument1 pageNew EPF Form Declarationhareesh bathalaNo ratings yet

- EPF Declaration FormDocument2 pagesEPF Declaration Formvishalkavi18No ratings yet

- Composite Declaration Form for EPF MembershipDocument2 pagesComposite Declaration Form for EPF MembershipKeshav SarafNo ratings yet

- Eram Shaikh - Onboarding KIT Template 23 May 2022Document97 pagesEram Shaikh - Onboarding KIT Template 23 May 2022Tariq ShaikhNo ratings yet

- Composite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationDocument2 pagesComposite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationManasNo ratings yet

- 1 - EPF - Form No. 11 (Sample)Document1 page1 - EPF - Form No. 11 (Sample)Rajdeep GaharwarNo ratings yet

- P.F. Form 11Document1 pageP.F. Form 11DattaNo ratings yet

- Please Tick The Appropriate OptionDocument2 pagesPlease Tick The Appropriate OptionJayant ChorariaNo ratings yet

- Form 11Document2 pagesForm 11Arpit VermaNo ratings yet

- Print Form 11Document2 pagesPrint Form 11Andrew WinnerNo ratings yet

- PFForm 11Document1 pagePFForm 11chvsrajNo ratings yet

- Declare EPF detailsDocument2 pagesDeclare EPF detailsADITYA R P 1937302No ratings yet

- Composite Declaration FORM 11Document4 pagesComposite Declaration FORM 11Yaswanth ChallaNo ratings yet

- 7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Document1 page7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Vakati HemasaiNo ratings yet

- PF Declaration Form No.-11Document2 pagesPF Declaration Form No.-11soumodip chakrabortyNo ratings yet

- EPF Form-11Document1 pageEPF Form-11PulkKit SharMaNo ratings yet

- 01 PF Declaration Form 11Document1 page01 PF Declaration Form 11Vijayavelu AdiyapathamNo ratings yet

- Composite Declaration Form-11 Employees' Provident Fund OrganisationDocument2 pagesComposite Declaration Form-11 Employees' Provident Fund OrganisationHarshit SuriNo ratings yet

- EPF - New Form No. 11 - Declaration FormDocument2 pagesEPF - New Form No. 11 - Declaration FormNaveen SNo ratings yet

- PF Form AgreementDocument2 pagesPF Form AgreementbindusNo ratings yet

- Employees' Provident Fund Organisation: Composite Declaration Form - 11Document5 pagesEmployees' Provident Fund Organisation: Composite Declaration Form - 11Yashveer Pratap SinghNo ratings yet

- IN Form 11Document1 pageIN Form 11Chetan DhuriNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11Yash JainNo ratings yet

- Sample Filled EPF Composite Declaration Form 11Document2 pagesSample Filled EPF Composite Declaration Form 11Varalakshmi SharanNo ratings yet

- Employee Provident fund Form11 (3) (3) (4) (6) (8) (1) (1)(9)Document1 pageEmployee Provident fund Form11 (3) (3) (4) (6) (8) (1) (1)(9)Shaik RasulNo ratings yet

- Form13 Filled AllDocument3 pagesForm13 Filled AllShani KumarNo ratings yet

- Employees' Provident Fund OrganisationDocument2 pagesEmployees' Provident Fund OrganisationMuthiah ManiNo ratings yet

- Employee Provided Fund OrganisationDocument1 pageEmployee Provided Fund Organisationsurya tejaNo ratings yet

- Form 2 and EPFODocument4 pagesForm 2 and EPFOSabarish T ENo ratings yet

- Sample Composite Form 11Document2 pagesSample Composite Form 11Yuga NayakNo ratings yet

- Transfer EPF Account FormDocument2 pagesTransfer EPF Account FormManas Kumar MohapatraNo ratings yet

- Setting up, operating and maintaining Self-Managed Superannuation FundsFrom EverandSetting up, operating and maintaining Self-Managed Superannuation FundsNo ratings yet

- Final Fantasy XIIIDocument23 pagesFinal Fantasy XIIIzzz_monsterNo ratings yet

- The 40 Year Old Virgin 2005 ScreenplayDocument110 pagesThe 40 Year Old Virgin 2005 ScreenplayStudio Binder Screenplay DatabaseNo ratings yet

- Academic art styleDocument6 pagesAcademic art styleHipsipilasNo ratings yet

- Basement Revised NewDocument12 pagesBasement Revised NewAnish ChandranNo ratings yet

- Inggris MDocument7 pagesInggris MSabrina CallistaNo ratings yet

- WATE1-5 Lost in The FogDocument30 pagesWATE1-5 Lost in The FogDonald Preuss100% (1)

- Different Types of FlourDocument21 pagesDifferent Types of FlourNiche Tanamor LazonaNo ratings yet

- Joysticks N Sliders Instructions v1.7Document7 pagesJoysticks N Sliders Instructions v1.7ash300% (1)

- Board Game Name 3 Things Easy Fun Activities Games 987Document1 pageBoard Game Name 3 Things Easy Fun Activities Games 987erjul71100% (1)

- PSD Bits PilaniDocument24 pagesPSD Bits PilaniSurya Tej BorraNo ratings yet

- CDR KingDocument2 pagesCDR KingLolotay PesiganNo ratings yet

- Technology Design Focus Scan Data Sheet2Document2 pagesTechnology Design Focus Scan Data Sheet2jcarbajal2013No ratings yet

- Chinese Art - History, Styles & Techniques - BritannicaDocument1 pageChinese Art - History, Styles & Techniques - BritannicaKatie is juanpitoNo ratings yet

- Sentimental Sing Along Lyrics Old Songs VOLUME 7Document5 pagesSentimental Sing Along Lyrics Old Songs VOLUME 7Chris AxlNo ratings yet

- Compact Passport ProDocument17 pagesCompact Passport ProGilbert GlobalNo ratings yet

- One-Arm Chinning GuideDocument21 pagesOne-Arm Chinning Guidesaurabhtyagi245No ratings yet

- Muscle&F USA - January 2016 - Rocky - 45Document158 pagesMuscle&F USA - January 2016 - Rocky - 45PatNo ratings yet

- 6 Month Certificate in Bakery & Patisserie ProgramDocument7 pages6 Month Certificate in Bakery & Patisserie ProgramkhooniNo ratings yet

- Malaysian Music - Nobat and CaklempongDocument3 pagesMalaysian Music - Nobat and CaklempongAidan TeohNo ratings yet

- Essential Phrasal VerbsDocument10 pagesEssential Phrasal VerbsAnna Delle DonneNo ratings yet

- D&D3.5 Multilclass Character Sheet - v6.512Document21 pagesD&D3.5 Multilclass Character Sheet - v6.512Chris MagillNo ratings yet

- Tuna Kimbap PDFDocument1 pageTuna Kimbap PDFHhaNo ratings yet

- Q2e LS2 U03 PianoDocument11 pagesQ2e LS2 U03 PianoNguyễn ThủyNo ratings yet

- Rhetorical Analysis ReviseDocument7 pagesRhetorical Analysis Reviseapi-261134489No ratings yet

- Caecilia v60n04 1934 04 PDFDocument48 pagesCaecilia v60n04 1934 04 PDFLeonardo D Amador100% (1)

- Buying House Association DirectoryDocument4 pagesBuying House Association DirectorySajid Israr Khan100% (3)

- Curriculum Joel CardosoDocument1 pageCurriculum Joel CardosoJoel CardosoNo ratings yet

- Screenshot 2023-02-25 at 22.26.16Document1 pageScreenshot 2023-02-25 at 22.26.16Real HydarkNo ratings yet

- 05 GXP B2 Progress Test 05Document6 pages05 GXP B2 Progress Test 05gabriela100% (1)