Professional Documents

Culture Documents

Advanced Financial Accounting Topics

Uploaded by

Andualem ZenebeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Financial Accounting Topics

Uploaded by

Andualem ZenebeCopyright:

Available Formats

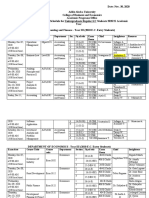

Course Information

Course code

Course Title Advanced Financial Accounting I

Degree Program BA Degree in Accounting and Finance

Lecturer

information

ETCTS Credits 6

Contact Hours 4

Course Description This course addresses the skills needed to apply some selected standards in

business environments. The topics covered in the course include employee

benefits, income taxes, share-based compensation, agriculture, insurance

contracts, and asset valuation.

Course Objectives In this course students examine several complex topics and their effect on

financial reporting and disclosure. The course is designed to cover a selected

group of advanced financial accounting topics under IFRS.

Upon successful completion of this course the student will have reliably

demonstrated the ability to:

Record, analyze and report financial information related to income taxes,

biological assets, insurance contracts, share-based compensations, and

employee benefits.

WEEKS Course Contents

1. Income Taxes

1.1. The tax base concept

1.2. Recognition of deferred tax liabilities and assets

1.2.1. Future taxable temporary differences

1.2.2. Future deductible temporary differences

1.3. Recognition of current and deferred tax

1.4. Accounting for net operating losses

1.5. Income tax presentation and disclosures

2. Share-based Compensation

2.1. Overview of Share-based Payments

2.2. Share-based Payments Settled with Equity

2.3. Share-based Payments Settled with Cash

2.4. Share-based Payments with Cash Alternatives

2.5. Counterparty Has Choice of Settlement

2.6. Issuer Has Choice of Settlement

2.7. Share-based Payment Disclosures

3. Accounting for Agriculture

3.1. Basic Terms and Scope

3.2. The Nature of Biological Assets

3.3. Recognition and Measurement of Biological Assets

3.4. Presentation and Disclosure Issues

4. Insurance Contracts

4.1. Insurance Contract Aggregation

4.2. Initial Recognition of Insurance Contracts

4.3. Initial Measurement of Insurance Contracts

4.4. Estimated Future Cash Flows

4.5. Discount Rates Used

4.6. Risk Adjustment for Non-Financial Risk

4.7. Contractual Service Margin

4.8. Subsequent Measurement of Insurance Contracts

4.9. Modification of Insurance Contracts

4.10. Derecognition of Insurance Contracts

4.11. Accounting Policy Changes

4.12. Presentation of Insurance Contract Information

4.13. Disclosures

5. Employee Benefits

5.1. Short-term employee benefits

5.1.1. Recognition and measurement

5.1.2. Disclosure

5.2. Termination benefits

5.2.1. Recognition and measurement

5.2.2. Disclosure

5.3. Post-employment benefits

Distinction between defined contribution plans and

defined benefit plans

11,12 6. Asset Valuation for Financial Reporting

6.1. Basics of valuation

6.2. Overview of International Valuation

Standards (IVS)

6.3. Valuation approaches

6.3.1. Market approach

6.3.2. Income approach

6.3.3. Cost approach

6.4. Valuation report

Teaching & Learning The teaching and learning methodology include lecturing, discussions, problem

Methods/strategy solving, and analysis. Take-home assignment will be given at the end of each

chapter for submission within a week. Solution to the assignments will be given

once assignments are collected. Cases with local relevance will also be given

for each chapter for group of students to present in a class room. The full and

active participation of students is highly encouraged.

Assessment/Evalua

tion The evaluation scheme will be as follows:

Test Test Test Case Analysis Assign Final Total

1 2 3 ment 1

10% 10% 10% 10% 10% 50% 100%

Ch. 1 Ch. Ch. 4 Ch. 5-7 Ch. 1-4 All Ch.

3

Work load in hours Total ECT

Hours Required

Hrs S

Asses Adv

sment Tutor Self- Assig isin

Lectures Lab s ials Studies nment g

64 - 22 12 64 - - 162 6

Roles of the He/she will come to the class regularly on time and deliver the lecture in a

Instructor well-organized manner. Besides, at the end of each class he/she gives reading

assignment for the next class. He/she will make sure that proper assessments is

given. He/she is also responsible to give feedback for each assessment.

Roles of the students The success of this course depends on the students’ individual and collective

contribution to the class discussions. Students are expected to participate

voluntarily, or will be called upon, to contribute to set exercises and problems.

Students are also expected to read the assigned readings and prepare the cases

before each class so that they could contribute effectively to class discussions.

Students must attempt assignments by their own. Proficiency in this course comes

from individual knowledge and understanding. Copying the works of others is

considered as serious offence and leads to disciplinary actions.

Text and reference Text Book:

books Kieso, Weygandt and Warfield, Intermediate Accounting, IFRS Edition (3rd

Ed. John Wiley & Sons, Inc. 2014).

Reference Books

Kieso, Weygandt and Warfield, Intermediate Accounting, (15th Ed. John Wiley

& Sons, Inc. 2013).

Intermediate Accounting (IFRS Edition). Authors: Spiceland J., Sepe J., Nelson

M., Tan P., Low B., and Low, K.Y. Publisher: McGraw-Hill.

Nikolai, Bazley and Jones, Intermediate Accounting, (10th Ed. McGraw- Hill co.

2007).

http://www.ifrs.org/IFRSs/IFRs.html

Department Accounting & Finance

Program BA Degree in Accounting & Finance

Course Number

Course Title Advanced Financial Accounting II

ETCTS Credits 6

Contact Hours 4

The course specifically deals with the accounting concepts and practices pertaining

to investments in joint arrangements, home office-branch operations, business

Course combinations, consolidated financial statements, foreign currency transactions and

Description translation of foreign currency financial statements, segment and interim reporting.

Course This course builds on the knowledge you obtained in your introductory and

Objectives intermediate financial accounting courses. The primary objective of the course is to

help students gain an in-depth understanding of the theory and current practice of

advanced and complex financial accounting issues for business firms. Upon

successful completion of this course, students will be able to:

Identify the alternative forms of a joint

venture and describe the accounting treatment for investments in joint

arrangements;

Apply proper accounting techniques to

account for branch operations and prepare combined financial statements for

home office and branch;

Explain the nature of business combinations

and its accounting treatment;

Explain the meaning and assessment of

control;

Prepare consolidated financial statements

for companies with parent-subsidiary relationship on date of acquisition and

subsequent to date of acquisition;

Explain and account for foreign currency

transactions and translate foreign currency financial statements; and

Prepare segment and interim financial

reports.

Weeks Course Contents

1. Joint Arrangements

1.1. Meaning and types of joint arrangements

1.2. Accounting for investments in joint ventures

1.3. Accounting for joint operations

1.4. Accounting for joint ventures

1.5. Disclosure requirements

2. Accounting for Public Enterprises in Ethiopia

2.1. Overview of Proc. No. 25/1992 and other related

Provisions

2.2. Accounting for Formation and Operation

2.3. Privatization of Public Enterprises

3. Accounting for Sales Agencies and Branch Operations

3.1. Characteristics and Principles

3.2. Distinction between Agencies and Branches

3.3. Accounting Systems and the Accounting Entity

3.4. Accounting for Sales Agencies

3.5. Accounting for Branch Operations

3.5.1. Reciprocal (Intracompany) Accounts

3.5.2. Merchandise Shipments to Branches

3.5.3. Allocation of Expenses incurred by Home Office to

Branches

3.5.4. Accounting for Branch Fixed Assets

3.5.5. Combined Financial Statements for Home Office

and Branch

3.5.6. Reconciliation of Home Office and Branch

Accounts

3.5.7. Transactions among Branches

3.5.8. Disposal of a Branch

4. Business Combinations

4.1. Definitions and Motives

4.2. Methods of arranging Business Combinations

4.3. The Acquisition Method

4.3.1. Identifying the acquirer

4.3.2. Determining the acquisition date

4.3.3. Recognition and measurement of the identifiable

net assets of the Acquiree

4.3.4. Recognition and measurement of goodwill or a

gain from a bargain purchase

4.4. Disclosure requirements

4.5. Overview of business combinations in Ethiopian context

5. Consolidation on Date of Acquisition

5.1. Definition of subsidiary and control

5.2. Assessing control

5.3. Accounting Requirements

5.4. Definition and presentation of non-controlling interests

5.5. Different reporting dates and accounting policies

5.6. Loss of Control

5.7. Consolidated Statement of Financial Position: Wholly

owned subsidiary

5.8. Consolidated Statement of Financial Position: Partially

owned subsidiary

5.9. Disclosure Requirements

6. Consolidation Subsequent to Acquisition

6.1. Accounting for investments in subsidiaries

6.2. Consolidated financial statements for wholly owned

subsidiary

6.3. Consolidated financial statements for partially owned

subsidiary

6.4. Consolidated financial statements: Intra-group trading

(Upstream and Downstream Transactions)

6.5. Disclosure requirements

7. The Effects of Changes in Foreign Exchange Rates

7.1. Definition of terms

7.2. Exchange Rates and Meaning of Translation

7.3. Types of currency-related exposures

7.4. Determination of functional currency

7.5. Accounting for foreign currency transactions

7.5.1. Recognition and reporting of exchange differences

7.6. Translation of foreign operations

7.6.1. Rationale/Objectives of translation

7.6.2. Translation methods & criteria for applications

7.7. Disclosure requirements

8. Segment and Interim Financial Reporting

8.1. Segment Reporting

8.1.1. Definition of an operating segment

8.1.2. Identifying externally reportable segments

8.1.3. Aggregation criteria

8.1.4. Quantitative thresholds

8.1.5. Disclosure

8.1.6. Measurement

8.1.7. Entity-wide disclosures

8.2. Interim Reporting

8.2.1. Definitions

8.2.2. Content of an Interim Financial Report

8.2.3. Disclosure in Annual Financial Statements

8.2.4. Recognition and Measurement

8.2.5. Restatement of Previously Reported Interim

Periods

Assessment/Eval The evaluation scheme will be as follows:

uation Component Weight coverage

Test 1 15% Chapters 1-3

Test 2 15% Chapters 4-6

Assignment 1 5% Chapters 1-4

Assignment 2 5% Chapters 5-8

Quiz 1 5%

Quiz 2 5%

Final Exam 50% All chapters

Work Load in

Hours

Total ECT

Hours Required

Hrs S

Asses Adv

sment Tutor Self- Assig isin

Lectures Lab s ials Studies nment g

Text and Text Book:

64 - 22 12 64 - - 162 6

Reference Books Herauf D. & Hilton M. (2016). Modern Advanced Accounting in Canada. Eighth ed.

McGraw-Hill Canada.

Baker, R. E., Lembke, V. C., King, T. E., Jeffrey, C. G., & Christensen, T.

(2016). Advanced Financial Accounting. Eleventh edition. McGraw-Hill/Irwin.

Reference Books:

Cotter, D. (2012). Advanced Financial Reporting: A complete guide to IFRS.

Financial Times/Prentice Hall.

Beechy, T. H., & Farrell, E. (2015). Advanced Financial Accounting. Seventh

edition. Prentice Hall.

Hoyle, J. B., Schaefer, T. F., & Doupnik, T. S. & Wang, X. (2016). 13th edition.

Advanced Accounting. McGraw-Hill Education.

Ernst & Young LLP, International GAAP, John Wiley & Sons Ltd. (Latest edition).

Richard E.Baker et al. Advanced Accounting. 7th Edition, FT Prentice Hall-

Financial Times, United Kingdom, 2004

Larsen, J. Modern Advanced Accounting. 11th edition. McGraw-Hill.

Commercial Code of Ethiopia

Public Enterprises Proclamation No. 25/1992

IFRS Blue Book (Latest edition)

IFRS Green Book (Latest edition)

IFRS Red Book (Latest edition)

You might also like

- Answers B Exercises 001Document7 pagesAnswers B Exercises 001Nashwa SaadNo ratings yet

- Zrzut Ekranu 2022-11-20 o 23.44.07Document74 pagesZrzut Ekranu 2022-11-20 o 23.44.07Bartek SalahNo ratings yet

- Financial Literacy 101 PDFDocument24 pagesFinancial Literacy 101 PDFDenver John Melecio TurtogaNo ratings yet

- Management Accounting Course ContentsDocument114 pagesManagement Accounting Course ContentsShivangi Patel100% (1)

- List of IT & BPO Services Providers in The PhilippinesDocument3 pagesList of IT & BPO Services Providers in The PhilippinesAaron Genota100% (1)

- Financial Literacy Objectives and ConceptsDocument26 pagesFinancial Literacy Objectives and ConceptslottyNo ratings yet

- Management Accounting - Chapter 1 Short QuizDocument2 pagesManagement Accounting - Chapter 1 Short QuizDhez Madrid100% (2)

- Financial Management SyllabusDocument21 pagesFinancial Management SyllabusRhea RomeroNo ratings yet

- Course Outline UGBS 205 2023Document6 pagesCourse Outline UGBS 205 2023Chocho berly100% (1)

- Lecture 1. Introduction To The Study of Consumer Behavior. IDocument30 pagesLecture 1. Introduction To The Study of Consumer Behavior. ILip Keong LowNo ratings yet

- Test Bank Ch6 ACCTDocument89 pagesTest Bank Ch6 ACCTMajed100% (1)

- Pricing:: Approaches and StrategiesDocument20 pagesPricing:: Approaches and StrategiesMonir HossainNo ratings yet

- Senior High School Department: Quarter 3 - Module 1: Introduction To AccountingDocument9 pagesSenior High School Department: Quarter 3 - Module 1: Introduction To AccountingJaye RuantoNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Customer Satisfaction Level at Wal-MartDocument17 pagesCustomer Satisfaction Level at Wal-MartShagun NagpalNo ratings yet

- Eng Shs Mod3 EAPP Techniques v1 ForprintingDocument14 pagesEng Shs Mod3 EAPP Techniques v1 ForprintingJoshua Vernon AtipNo ratings yet

- Finals Reviewer Compilation of QuizzesDocument24 pagesFinals Reviewer Compilation of QuizzessofiaNo ratings yet

- What Have I Learned From The ExperiencedDocument3 pagesWhat Have I Learned From The ExperiencedAngel Dela Cruz CoNo ratings yet

- Service Culture Module 2Document2 pagesService Culture Module 2Cedrick SedaNo ratings yet

- Chapter 4 Financial Management IV BbaDocument3 pagesChapter 4 Financial Management IV BbaSuchetana AnthonyNo ratings yet

- Hans Rosling Population Growth Video ActivityDocument2 pagesHans Rosling Population Growth Video Activityapi-655303552No ratings yet

- Intel College: Course Name: Business Finance and EconomicsDocument2 pagesIntel College: Course Name: Business Finance and EconomicsRocky Kaur100% (1)

- Investment Meaning, Nature and ScopeDocument8 pagesInvestment Meaning, Nature and Scopebhytgdfdfdfd83% (6)

- National Accounting Quiz Bee Showdown (NAQDOWN) 2012Document10 pagesNational Accounting Quiz Bee Showdown (NAQDOWN) 2012nfjpia30secgenNo ratings yet

- Ch01 fm202 Finance Small Business EnterpriseDocument9 pagesCh01 fm202 Finance Small Business Enterprisepratik_483No ratings yet

- Describe Procedures For Assessing and Measuring The Risk of A Single Asset 1Document12 pagesDescribe Procedures For Assessing and Measuring The Risk of A Single Asset 1Abdullah ghauriNo ratings yet

- VTU MBA Syllabus 2010Document149 pagesVTU MBA Syllabus 2010jysuraj100% (3)

- 57740006Document74 pages57740006Aticha KwaengsophaNo ratings yet

- Pricing Decision HandoutDocument4 pagesPricing Decision HandoutKeshet Rance Ellice RoblesNo ratings yet

- Ise 102 - Course OutlineDocument9 pagesIse 102 - Course OutlineRogen OjerioNo ratings yet

- Bookkeeping Lesson EditedDocument23 pagesBookkeeping Lesson EditedLu CioNo ratings yet

- Financial Statement Analysis RatiosDocument90 pagesFinancial Statement Analysis RatiosAlayou TeferaNo ratings yet

- Vision Statement of MacdonaldDocument2 pagesVision Statement of MacdonaldlalirisyaNo ratings yet

- Problems Problem 2-1 Multiple Choice (ACP)Document2 pagesProblems Problem 2-1 Multiple Choice (ACP)Jao FloresNo ratings yet

- Chap 7 ManagementDocument7 pagesChap 7 Managementshivani514No ratings yet

- Week Seven - Translation of Foreign Currency Financial StatementsDocument28 pagesWeek Seven - Translation of Foreign Currency Financial StatementsCoffee JellyNo ratings yet

- CMO - 03 - s2007 BSADocument222 pagesCMO - 03 - s2007 BSAcristinaNo ratings yet

- SJCC Final Exam Soc Sci 2Document1 pageSJCC Final Exam Soc Sci 2Jonalyn LodorNo ratings yet

- Preserving BambooDocument8 pagesPreserving BambooRaumir Gomez MancillaNo ratings yet

- Viney7e SM Ch01Document9 pagesViney7e SM Ch01Tofuu PowerNo ratings yet

- Understanding the Business Environment and Competitive StrategiesDocument10 pagesUnderstanding the Business Environment and Competitive StrategiesJedidahCuevasNo ratings yet

- Kotler POM 14 VideoguideDocument56 pagesKotler POM 14 VideoguideNatsuki Ka.No ratings yet

- CBM 112 ReviewerDocument1 pageCBM 112 Reviewerglrosaaa cNo ratings yet

- Interest RatesDocument38 pagesInterest RatesLealyn CuestaNo ratings yet

- Chapter 1 The Investment Environment: Fundamentals of InvestingDocument14 pagesChapter 1 The Investment Environment: Fundamentals of InvestingElen LimNo ratings yet

- Managerial EconomicsDocument7 pagesManagerial EconomicsRam SoniNo ratings yet

- Chapter - 4 Intermediate Term FinancingDocument9 pagesChapter - 4 Intermediate Term FinancingmuzgunniNo ratings yet

- Online Free Form Essay Questions and ExamplesDocument2 pagesOnline Free Form Essay Questions and ExamplesMd Delowar Hossain MithuNo ratings yet

- My Personal CredoDocument2 pagesMy Personal Credobella hNo ratings yet

- Channel Information Systems 14Document28 pagesChannel Information Systems 14anon_11218848No ratings yet

- Cap BudDocument29 pagesCap BudJorelyn Joy Balbaloza CandoyNo ratings yet

- Qualities of A TrainerDocument8 pagesQualities of A TrainerKommineni Ravie KumarNo ratings yet

- 4 Exam Part 2Document4 pages4 Exam Part 2RJ DAVE DURUHANo ratings yet

- Apply Business Math in Water Refilling StationDocument22 pagesApply Business Math in Water Refilling StationsdfdsfNo ratings yet

- Financial Dimensions of Pricing in International Business Strategies Docs.Document6 pagesFinancial Dimensions of Pricing in International Business Strategies Docs.Lizcel CastillaNo ratings yet

- MOAC Excel 2016 Core (058-100) PDFDocument43 pagesMOAC Excel 2016 Core (058-100) PDFDiana OstopoviciNo ratings yet

- Final Exam Audapp2 2020Document5 pagesFinal Exam Audapp2 2020HisokaNo ratings yet

- Organizational Diagnosis of Hotel IndustryDocument7 pagesOrganizational Diagnosis of Hotel IndustryAnushree BgNo ratings yet

- Chapter 2Document11 pagesChapter 2api-234284411100% (2)

- Cash Budget Definition GuideDocument4 pagesCash Budget Definition GuideSaloni JainNo ratings yet

- Financial Accounting 1 Course OutlineDocument3 pagesFinancial Accounting 1 Course OutlineAbdi Mucee TubeNo ratings yet

- ADMAS Financial Management I Course OutlineDocument5 pagesADMAS Financial Management I Course OutlineTesfaye TadeleNo ratings yet

- Chapter 2 - Capital Budgeting Under RiskDocument8 pagesChapter 2 - Capital Budgeting Under RiskAndualem ZenebeNo ratings yet

- Working Capital ManagementDocument79 pagesWorking Capital ManagementAndualem ZenebeNo ratings yet

- Chapter 2 - Capital Budgeting Under RiskDocument10 pagesChapter 2 - Capital Budgeting Under RiskAndualem ZenebeNo ratings yet

- Chapter 4 Capital Structure PolicyDocument17 pagesChapter 4 Capital Structure PolicyAndualem ZenebeNo ratings yet

- Chapter-1 Return and RiskDocument11 pagesChapter-1 Return and RiskAndualem ZenebeNo ratings yet

- FM II CH 1,2 and 3Document104 pagesFM II CH 1,2 and 3Andualem ZenebeNo ratings yet

- Chapter 5, Long Term Financing, RevisedDocument9 pagesChapter 5, Long Term Financing, RevisedAndualem ZenebeNo ratings yet

- Capital Budgeting Under UncertaintyDocument80 pagesCapital Budgeting Under UncertaintyAndualem ZenebeNo ratings yet

- AcFn - 2012-Worksheet - Ch01Document5 pagesAcFn - 2012-Worksheet - Ch01Andualem ZenebeNo ratings yet

- Chapter III Working Capital MangemntDocument15 pagesChapter III Working Capital MangemntAndualem ZenebeNo ratings yet

- How To Make Cash Flow Projections For Impairment Testing Under IAS 36Document13 pagesHow To Make Cash Flow Projections For Impairment Testing Under IAS 36Andualem ZenebeNo ratings yet

- Top Ethiopian Colleges HERQA ReportsDocument1 pageTop Ethiopian Colleges HERQA ReportsAndualem ZenebeNo ratings yet

- IFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Document55 pagesIFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Andualem ZenebeNo ratings yet

- Chapter 3, LeverageDocument7 pagesChapter 3, LeverageAndualem ZenebeNo ratings yet

- CHAPTER 2-Capital BudgetingDocument13 pagesCHAPTER 2-Capital BudgetingAndualem ZenebeNo ratings yet

- IFRS 9, 7 & 32 Financial Instruments OverviewDocument55 pagesIFRS 9, 7 & 32 Financial Instruments OverviewAndualem ZenebeNo ratings yet

- IFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Document55 pagesIFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Andualem ZenebeNo ratings yet

- Creating Inclusive Learning EnvironmentsDocument4 pagesCreating Inclusive Learning EnvironmentsAndualem Zenebe100% (1)

- Assessor Cecklist UG Social Science-Gage CollegeDocument15 pagesAssessor Cecklist UG Social Science-Gage CollegeAndualem ZenebeNo ratings yet

- Final Exam Schedule, Regular RevisedDocument5 pagesFinal Exam Schedule, Regular RevisedAndualem ZenebeNo ratings yet

- Supportive Courses S/N Course Title Course Code Cr. Hrs. RemarksDocument1 pageSupportive Courses S/N Course Title Course Code Cr. Hrs. RemarksAndualem ZenebeNo ratings yet

- Accounting and Finance Course Break Down (2019)Document12 pagesAccounting and Finance Course Break Down (2019)Andualem Zenebe100% (4)

- Comments On The CurriculumDocument8 pagesComments On The CurriculumAndualem ZenebeNo ratings yet

- Senior Research Project FrameworkDocument10 pagesSenior Research Project FrameworkAndualem ZenebeNo ratings yet

- 2018 Eligibility Procedures and Accreditation Standards For Accounting AccreditationDocument35 pages2018 Eligibility Procedures and Accreditation Standards For Accounting AccreditationAndualem ZenebeNo ratings yet

- Creating Inclusive Learning EnvironmentsDocument4 pagesCreating Inclusive Learning EnvironmentsAndualem Zenebe100% (1)

- ACFN CURRICULEM-Bikiltu-abebawDocument224 pagesACFN CURRICULEM-Bikiltu-abebawAndualem Zenebe100% (2)

- Accounting and Finance Course Break Down (2019)Document12 pagesAccounting and Finance Course Break Down (2019)Andualem Zenebe100% (4)

- The Role of The Global Accountancy Profession in Addressing 21st Century Public Sector ChallengesDocument3 pagesThe Role of The Global Accountancy Profession in Addressing 21st Century Public Sector ChallengesAndualem ZenebeNo ratings yet

- Strabag 2010Document174 pagesStrabag 2010MarkoNo ratings yet

- Mid Term Test Questions and SolutionsDocument4 pagesMid Term Test Questions and SolutionsNur hidayah putriNo ratings yet

- OTCEIDocument17 pagesOTCEIMani Sankar100% (1)

- British Petroleum LimitedDocument593 pagesBritish Petroleum Limitedjk kumarNo ratings yet

- IHRM Notes On Davis Group Case StudyDocument15 pagesIHRM Notes On Davis Group Case StudyPeeyush ThakurNo ratings yet

- Motilal Oswal Amc DetailsDocument75 pagesMotilal Oswal Amc Detailssudishsingh8No ratings yet

- Bjcorp19 1Document378 pagesBjcorp19 1Mina ZahariNo ratings yet

- MA Traditional Retailers Authd To Accept Food Stamps As of June 17 2008Document66 pagesMA Traditional Retailers Authd To Accept Food Stamps As of June 17 2008jromano1No ratings yet

- Guidance Note On Secretarial Audit-WordDocument229 pagesGuidance Note On Secretarial Audit-WordJitendar JoshiNo ratings yet

- 48-Hour Exam Corporate Governance and Finance: HandelsbankenDocument11 pages48-Hour Exam Corporate Governance and Finance: HandelsbankenHanne Bjørnslett NilsenNo ratings yet

- URC Annual Corporate Governance Report 2016 - FinalDocument74 pagesURC Annual Corporate Governance Report 2016 - FinalDennis DimaanoNo ratings yet

- 2018 - Audit - Reports Lotte ChilsungDocument103 pages2018 - Audit - Reports Lotte ChilsungroohanNo ratings yet

- Consolidated Financial Statements for P Corp and S Company (39Document1 pageConsolidated Financial Statements for P Corp and S Company (39Jean De GuzmanNo ratings yet

- Agriculture Mumbai DatabaseDocument7 pagesAgriculture Mumbai DatabaseAmitNo ratings yet

- Mini Project 2Document27 pagesMini Project 2SUMIT KUMAR PANDEY P100% (1)

- The Ad in The New York TimesDocument1 pageThe Ad in The New York TimesdallasnewsNo ratings yet

- Member Cooperative in EnglishDocument352 pagesMember Cooperative in Englishums tvishiNo ratings yet

- November 29, 2011, Federal Judge Ruling 2:06-cv-03731 Brown v. Brewer MySpace VS. News Corp $96billion Damage Antitrust - MySpace Founder Dealt Stunning LossDocument114 pagesNovember 29, 2011, Federal Judge Ruling 2:06-cv-03731 Brown v. Brewer MySpace VS. News Corp $96billion Damage Antitrust - MySpace Founder Dealt Stunning Losslen_starnNo ratings yet

- Plug (Parent) Spark (Subsidary) Lemon (Non Affiliate)Document25 pagesPlug (Parent) Spark (Subsidary) Lemon (Non Affiliate)Pasha HarahapNo ratings yet

- Ambience Mall: Submitted by Divya KalraDocument23 pagesAmbience Mall: Submitted by Divya KalrachickooooNo ratings yet

- Everything You Need to Know About Share Warrants /TITLEDocument11 pagesEverything You Need to Know About Share Warrants /TITLEZain aliNo ratings yet

- Dev Phil 1Document102 pagesDev Phil 1EyegateNo ratings yet

- Duties of Directors and Controlling StockholdersDocument58 pagesDuties of Directors and Controlling StockholderssalinaNo ratings yet

- Half Yearly Portfolio Disclosure For The Period Ended September 30, 2016 (Company Update)Document89 pagesHalf Yearly Portfolio Disclosure For The Period Ended September 30, 2016 (Company Update)Shyam SunderNo ratings yet

- Limited Companies and MultinationalsDocument3 pagesLimited Companies and MultinationalsKazi Rafsan NoorNo ratings yet

- Philippine Fire and Marine Insurance Corporation Company ProfileDocument21 pagesPhilippine Fire and Marine Insurance Corporation Company ProfilePhilfire Insurance100% (1)

- Creative Director or Creative Manager or Art Director or SeniorDocument3 pagesCreative Director or Creative Manager or Art Director or Seniorapi-121418511No ratings yet

- Class Action SuitDocument13 pagesClass Action SuitSannat SarangalNo ratings yet