Professional Documents

Culture Documents

Por Medida: % Original:2016 A % Original:2017 A % Restated:2018 A % Original:2019 A % Original:2020 A

Uploaded by

angieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Por Medida: % Original:2016 A % Original:2017 A % Restated:2018 A % Original:2019 A % Original:2020 A

Uploaded by

angieCopyright:

Available Formats

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Por medida

% Original:2016 A % Original:2017 A % Restated:2018 A % Original:2019 A % Original:2020 A

Plazo termina 2016-1-29 2016-1-29 2017-2-3 2017-2-3 2018-2-2 2018-2-2 2019-2-1 2019-2-1 2020-1-31 2020-1-31

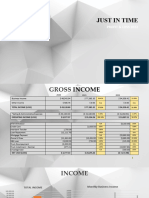

Ingreso 100.00 50,911.00 100.00 61,642.00 100.00 79,040.00 100.00 90,621.00 100.00 92,154.00

Client Solutions 77.85 39,634.00 58.54 36,754.00 48.82 39,218.00 47.30 43,196.00 49.55 45,838.00

Commercial 56.48 28,754.00 41.42 26,006.00 34.25 27,507.00 33.82 30,893.00 37.06 34,277.00

Consumer 21.37 10,880.00 17.12 10,748.00 14.58 11,711.00 13.47 12,303.00 12.50 11,561.00

Infrastructure solution 28.90 14,714.00 34.69 21,776.00 38.49 30,917.00 40.20 36,720.00 36.72 33,969.00

group

Servers and 24.29 12,368.00 20.44 12,834.00 19.34 15,533.00 21.85 19,953.00 18.52 17,127.00

Networking

Storage 4.61 2,346.00 14.24 8,942.00 19.15 15,384.00 18.36 16,767.00 18.21 16,842.00

VMware 0.00 5.14 3,225.00 10.56 8,485.00 10.67 9,741.00 11.79 10,905.00

Other Business 0.75 382.00 1.63 1,026.00 2.12 1,704.00 1.84 1,676.00 1.93 1,788.00

Reconciliation -1,139.00 -1,284.00 -712.00 -346.00

Reconciliation -7.50 -3,819.00

Ingreso - Desglose 100.00 50,911.00 100.00 61,642.00 100.00 79,040.00 100.00 90,621.00 100.00 92,154.00

suplementario

Product 83.95 42,742.00 79.01 48,706.00 77.05 60,898.00 78.02 70,707.00 75.87 69,918.00

Service 16.05 8,169.00 20.99 12,936.00 22.95 18,142.00 21.98 19,914.00 24.13 22,236.00

Coste de ingreso 100.00 48,683.00 100.00 58,503.00 100.00 65,568.00 100.00 63,221.00

Product 86.62 42,169.00 87.92 51,433.00 88.29 57,889.00 86.25 54,525.00

Service 13.38 6,514.00 12.08 7,070.00 11.71 7,679.00 13.75 8,696.00

Beneficio bruto 100.00 8,387.00 100.00 12,959.00 100.00 20,537.00 100.00 25,053.00 100.00 28,933.00

Product 61.75 5,179.00 50.44 6,537.00 46.09 9,465.00 51.16 12,818.00 53.20 15,393.00

Service 38.25 3,208.00 49.56 6,422.00 53.91 11,072.00 48.84 12,235.00 46.80 13,540.00

Margen bruto

Product -14.00 26.00 28.00 35.00 20.00

Service 13.00 100.00 79.00 11.00 11.00

Ingreso operativo -514.00 -3,252.00 -2,416.00 -191.00 100.00 2,622.00

Infrastructure solution -230.20 1,052.00 45.05 2,393.00 39.35 3,068.00 46.50 4,151.00 39.31 4,001.00

group

Client Solutions -308.53 1,410.00 34.73 1,845.00 26.22 2,044.00 21.96 1,960.00 30.83 3,138.00

VMware 0.00 20.95 1,113.00 34.26 2,671.00 32.78 2,926.00 30.27 3,081.00

Other Business 17.07 -78.00 -0.73 -39.00 0.17 13.00 -1.24 -111.00 -0.42 -43.00

Corporate -57.00 -902.00 -325.00 -419.00 -1,160.00

Reconciliation -7,662.00 -9,887.00 -8,698.00 -6,395.00

Reconciliation 621.66 -2,841.00

Margen operacional

VMware 31.50 30.00 28.30

Infrastructure solution 9.90 11.30 11.80

group

Client Solutions 5.20 4.50 6.80

Crecimiento de

ingresos operacionales

%

Client Solutions 17.00 -4.00 60.00

VMware 85.00 10.00 5.00

Infrastructure solution 5.00 35.00 -4.00

group

% crec de renta

VMware 126.00 15.00 12.00

Client Solutions 7.00 10.00 6.00

Commercial 7.00 12.00 11.00

Consumer 9.00 5.00 -6.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 1

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

% Original:2016 A % Original:2017 A % Restated:2018 A % Original:2019 A % Original:2020 A

Plazo termina 2016-1-29 2016-1-29 2017-2-3 2017-2-3 2018-2-2 2018-2-2 2019-2-1 2019-2-1 2020-1-31 2020-1-31

Infrastructure solution 40.00 19.00 -7.00

group

Storage 69.00 9.00 0.00

Servers and 20.00 28.00 -14.00

Networking

Ingreso ajustado 100.00 51,370.00 100.00 62,822.00 100.00 80,309.00 100.00 91,324.00 100.00 92,501.00

Product 83.15 42,715.00 78.01 49,006.00 76.04 61,068.00 77.49 70,768.00 75.61 69,937.00

Service 16.85 8,655.00 21.99 13,816.00 23.96 19,241.00 22.51 20,556.00 24.39 22,564.00

Beneficio bruto 100.00 9,307.00 100.00 16,819.00 100.00 25,668.00 100.00 29,022.00 100.00 31,563.00

ajustado

Product 60.29 5,611.00 55.57 9,346.00 52.24 13,408.00 55.20 16,021.00 55.52 17,523.00

Service 39.71 3,696.00 44.43 7,473.00 47.76 12,260.00 44.80 13,001.00 44.48 14,040.00

Margen bruto de

beneficio ajustado

Product -13.00 67.00 22.40 19.00 9.00

Service 0.00 102.00 63.00 6.00 8.00

Fondo de comercio 100.00 8,406.00 100.00 38,910.00 100.00 39,920.00 100.00 40,089.00 100.00 41,691.00

VMware 0.00 38.73 15,070.00 44.75 17,863.00 46.45 18,621.00 49.25 20,532.00

Infrastructure solution 46.48 3,907.00 40.11 15,607.00 38.97 15,557.00 37.91 15,199.00 36.19 15,089.00

group

Client Solutions 52.68 4,428.00 10.89 4,237.00 10.61 4,237.00 10.57 4,237.00 10.16 4,237.00

Other Business 0.84 71.00 10.27 3,996.00 5.67 2,263.00 5.07 2,032.00 4.40 1,833.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 2

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Ajustado

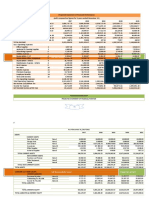

Original:2016 A Original:2017 A Restated:2018 A Original:2019 A Original:2020 A Actual/Ú12M

Plazo termina 2016-1-29 2017-2-3 2018-2-2 2019-2-1 2020-1-31 2020-7-31

Ingreso 50,911.00 61,642.00 79,040.00 90,621.00 92,501.00 91,687.00

+ Ingresos de servicios y ventas 50,911.00 61,642.00 79,040.00 90,621.00 92,501.00 91,687.00

- Coste de ingreso 41,996.00 46,476.00 57,066.00 64,573.00 62,782.00 62,558.00

+ Coste de bienes y servicios 41,996.00 46,476.00 57,066.00 64,573.00 62,782.00 62,558.00

Beneficio bruto 8,915.00 15,166.00 21,974.00 26,048.00 29,719.00 29,129.00

+ Otros ingresos operacionales 0.00 0.00 0.00 0.00 0.00 0.00

- Gastos operacionales 8,665.00 16,056.00 22,017.00 24,176.00 24,888.00 24,670.00

+ Ventas, generales y admin 7,850.00 13,575.00 18,569.00 20,640.00 21,319.00 20,317.00

+ Investigación y desarrollo 1,051.00 2,636.00 4,384.00 4,604.00 4,992.00 5,111.00

+ Otro gasto operativo -236.00 -155.00 -936.00 -1,068.00 -1,423.00 -758.00

Ingreso operacional (pérdida) 250.00 -890.00 -43.00 1,872.00 4,831.00 4,459.00

- Ingreso (pérdida) no operacional 770.00 1,771.00 2,425.00 2,512.00 2,820.00 2,659.00

+ Gastos de intereses 680.00 1,751.00 2,406.00 2,488.00 2,675.00

+ Otras pérdidas (ing) de inversión 39.00 102.00 207.00 313.00 160.00

+ (Plusvalía) pérdida del tipo de 107.00 77.00 113.00 206.00 162.00

cambio

+ Otro (ingreso) pérdida no op -56.00 -159.00 -301.00 -495.00 -177.00 472.00

Beneficios (pérdidas) antes de -520.00 -2,661.00 -2,468.00 -640.00 2,011.00 1,800.00

impuestos, ajustados

- Pérdida anormal 766.00 2,695.00 2,301.00 1,721.00 2,015.00 914.00

+ Gasto de fusión o adquisición 83.00 1,485.00 502.00 824.00 696.00 509.00

+ Rescate anticipado de deuda 337.00

+ Cancelación de activos 604.00 2,294.00 1,546.00 820.00 353.00

+ Beneficio/pérdida en la venta/ -2,319.00

adquisición de empresas

+ Venta de inversiones 2.00 -4.00

+ Inversiones no realizadas -72.00 -342.00 -194.00 -154.00

+ Otros elementos atípicos 77.00 902.00 325.00 419.00 1,160.00 559.00

Beneficios (pérdidas) antes de -1,286.00 -5,356.00 -4,769.00 -2,361.00 -4.00 886.00

impuestos, GAAP

- Gasto de impuesto a la renta -118.00 -1,619.00 -1,843.00 -180.00 -5,533.00 -1,363.00

(Beneficio)

Beneficios (pérdidas) de operaciones -1,168.00 -3,737.00 -2,926.00 -2,181.00 5,529.00 2,249.00

continuas

- Pérdidas (ganancias) -64.00 -2,019.00 0.00 0.00 0.00 0.00

extraordinarias netas

+ Operaciones discontinuas -64.00 -2,019.00 0.00 0.00 0.00 0.00

+ PE y cambios contables 0.00 0.00 0.00 0.00 0.00 0.00

Ingreso (pérdida) incl MI -1,104.00 -1,718.00 -2,926.00 -2,181.00 5,529.00 2,249.00

- Minoritarios 0.00 -46.00 -77.00 129.00 913.00 151.00

Beneficio neto, GAAP -1,104.00 -1,672.00 -2,849.00 -2,310.00 4,616.00 2,098.00

- Dividendos preferentes 0.00 0.00 0.00 0.00 0.00 0.00

- Otros ajustes 0.00 0.00 0.00 0.00 0.00 0.00

beneficio neto disponible a -1,104.00 -1,672.00 -2,849.00 -2,310.00 4,616.00 2,098.00

accionistas comunes, GAAP

Beneficio neto disponible a cap -545.83 -1,385.78 -1,192.85 -857.43 1,018.92 2,326.91

común, aj

Pérdidas atípicas netas (ganancias) 622.17 2,305.22 1,656.15 1,452.57 -3,597.08 228.91

Pérdidas (ganancias) -64.00 -2,019.00 0.00 0.00 0.00 0.00

extraordinarias netas

Acciones promedio básicas pond 405.00 470.00 567.00 582.00 724.00 741.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 3

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Original:2016 A Original:2017 A Restated:2018 A Original:2019 A Original:2020 A Actual/Ú12M

Plazo termina 2016-1-29 2017-2-3 2018-2-2 2019-2-1 2020-1-31 2020-7-31

BPA básicos, GAAP -2.73 -3.56 -5.02 -3.97 6.38 2.85

BPA básicos de ops cont -2.88 -7.85 -5.02 -3.97 6.38 2.85

BPA básicos de ops cont, ajustados -1.35 -2.95 -2.10 -1.47 1.41 3.16

Acciones diluidas promedio pond 405.00 470.00 567.00 582.00 751.00 761.00

BPA diluidos, GAAP -2.73 -3.56 -5.02 -3.97 6.03 2.76

BPA diluidos de ops cont -2.88 -7.85 -5.02 -3.97 6.03 2.76

BPA diluidos de ops cont, ajustados -1.35 -2.95 -2.10 -1.47 1.24 3.06

Referencia

Norma de contabilidad US GAAP US GAAP US GAAP US GAAP US GAAP

EBITDA 3,122.00 4,048.00 8,591.00 9,618.00 11,484.00 10,542.00

Margen EBITDA (U12M) 6.13 6.57 10.87 10.61 12.42 11.50

EBITA 2,250.00 2,810.00 6,957.00 7,972.00 9,749.00 8,690.00

EBIT 250.00 -890.00 -43.00 1,872.00 4,831.00 4,459.00

Margen bruto 17.51 24.60 27.80 28.74 32.13 31.77

Margen operacional 0.49 -1.44 -0.05 2.07 5.22 4.86

Margen de beneficio -1.07 -2.25 -1.51 -0.95 1.10 2.54

Ventas por empleado 368,920.29 446,681.16 545,103.45 577,203.82 560,612.12

Dividendos por acción 0.00 0.00 0.00 0.00 0.00

Dividendos ordinarios totales en 0.00 0.00 0.00 0.00 0.00

efectivo

Gasto de depreciación 872.00 1,238.00 1,634.00 1,646.00 1,735.00 1,852.00

Gasto de renta 91.00 279.00 571.00 457.00 671.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 4

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

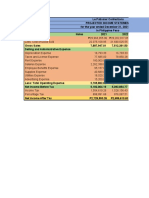

Estandarizado

Original:2016 A Original:2017 A Restated:2018 A Original:2019 A Original:2020 A Actual

Plazo termina 2016-1-29 2017-2-3 2018-2-2 2019-2-1 2020-1-31 2020-8-28

Activo total

+ Efectivo, equivalentes y STI 6,322.00 11,449.00 16,129.00 9,676.00 9,302.00 11,221.00

+ Efectivo y equivalentes 6,322.00 9,474.00 13,942.00 9,676.00 9,302.00 11,221.00

+ Inversiones a corto plazo 0.00 1,975.00 2,187.00 0.00 0.00 0.00

+ Cuentas y notas por cobrar 7,802.00 12,642.00 15,640.00 16,769.00 17,379.00 16,498.00

+ Cuentas por cobrar, neto 4,887.00 9,420.00 11,721.00 12,371.00 12,484.00 11,643.00

+ Notas por cobrar, netas 2,915.00 3,222.00 3,919.00 4,398.00 4,895.00 4,855.00

+ Inventarios 1,619.00 2,538.00 2,678.00 3,649.00 3,281.00 3,602.00

+ Mat primas 657.00 925.00 967.00 1,794.00 1,590.00 1,982.00

+ Trabajo en proceso 189.00 503.00 514.00 702.00 563.00 563.00

+ Bienes de consumo 773.00 1,110.00 1,197.00 1,153.00 1,128.00 1,071.00

+ Otro inventario 0.00 0.00 0.00 0.00 0.00 0.00

+ Otros activos a CP 7,830.00 4,144.00 5,881.00 6,044.00 6,906.00 9,769.00

+ Activos derivados y de cobertura 192.00 200.00 69.00 94.00 80.00 349.00

+ Activos mantenidos para la venta 4,333.00 0.00 2,058.00

+ Activos varios a CP 3,305.00 3,944.00 5,812.00 5,950.00 6,826.00 7,711.00

Activos totales actuales 23,573.00 30,773.00 40,328.00 36,138.00 36,868.00 41,090.00

+ Propiedad, planta y equipo; neto 1,649.00 5,653.00 5,390.00 5,259.00 7,835.00 6,380.00

+ Propiedad, planta y equipo 13,607.00 16,407.00

- Depreciación acumulada 8,348.00 8,572.00

+ Inversiones y cuentas por cobrar 2,291.00 6,453.00 7,887.00 5,229.00 5,712.00 6,451.00

a LP

+ Inversiones a largo plazo 114.00 3,802.00 4,163.00 1,005.00 864.00 1,073.00

+ Cuentas por cobrar LP 2,177.00 2,651.00 3,724.00 4,224.00 4,848.00 5,378.00

+ Otros activos a LP 17,609.00 75,327.00 70,588.00 65,194.00 68,446.00 67,355.00

+ Activos intangibles totales 16,983.00 73,963.00 68,185.00 62,359.00 59,798.00 56,708.00

+ Fondo de comercio 8,406.00 38,910.00 39,920.00 40,089.00 41,691.00 40,644.00

+ Otros activos intangibles 8,577.00 35,053.00 28,265.00 22,270.00 18,107.00 16,064.00

+ Activos de derivados y de 3.00 5.00 14.00 3.00 1.00 3.00

cobertura

+ Activos varios a LP 623.00 1,359.00 2,389.00 2,832.00 8,647.00 10,647.00

Activos totales no corrientes 21,549.00 87,433.00 83,865.00 75,682.00 81,993.00 80,186.00

Activos totales 45,122.00 118,206.00 124,193.00 111,820.00 118,861.00 121,276.00

Pasivo y capital social

+ Cuentas por pagar y devengos 17,093.00 21,480.00 26,177.00 27,659.00 29,376.00 28,258.00

+ Cuentas por pagar 12,881.00 14,422.00 18,334.00 19,213.00 20,065.00 19,500.00

+ Otras cuentas por pagar y en 4,212.00 7,058.00 7,843.00 8,446.00 9,311.00 8,758.00

devengo

+ Deuda CP 2,981.00 6,329.00 7,873.00 4,320.00 8,169.00 10,345.00

+ Préstamos CP 0.00 0.00 0.00 0.00 0.00 10,345.00

+ ST Lease Liabilities 0.00 0.00 0.00 0.00 432.00 403.00

+ Arrendamientos de finanzas a 0.00 0.00 0.00 0.00 0.00

CP

+ Arrendamientos de operación 432.00 403.00

a CP

+ Porción corriente de deuda a LP 2,981.00 6,329.00 7,873.00 4,320.00 7,737.00 8,375.00

+ Otros pasivos a corto plazo 5,236.00 10,326.00 11,789.00 12,993.00 14,911.00 15,685.00

+ Ingreso diferido 3,632.00 10,265.00 11,606.00 12,944.00 14,881.00 15,341.00

+ Derivados y cobertura 5.00 61.00 183.00 49.00 30.00 52.00

+ Pasivos varios a CP 1,599.00 0.00 0.00 0.00 0.00 344.00

Pasivos totales corrientes 25,310.00 38,135.00 45,839.00 44,972.00 52,456.00 54,288.00

+ Deuda LP 10,650.00 43,061.00 43,998.00 49,201.00 45,679.00 43,608.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 5

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Original:2016 A Original:2017 A Restated:2018 A Original:2019 A Original:2020 A Actual

Plazo termina 2016-1-29 2017-2-3 2018-2-2 2019-2-1 2020-1-31 2020-8-28

+ Préstamos a largo plazo 10,650.00 43,061.00 43,998.00 49,201.00 44,319.00 43,608.00

+ LT Lease Liabilities 0.00 0.00 0.00 0.00 1,360.00 1,350.00

+ Arrendamientos de finanzas a 0.00 0.00 0.00 0.00 0.00

LP

+ Arrendamientos de operación a 1,360.00 1,350.00

LP

+ Otros pasivos a LP 7,590.00 17,770.00 16,487.00 17,393.00 16,942.00 18,212.00

+ Pasivos acum 0.00 0.00 0.00 0.00 0.00

+ Pasivos de pensiones 0.00 0.00 0.00

+ Pensiones 0.00 0.00 0.00

+ Otros beneficios de jubilac 0.00 0.00 0.00

+ Ingreso diferido 4,089.00 8,431.00 9,210.00 11,066.00 12,919.00 13,450.00

+ Derivados y cobertura 7.00 3.00 1.00 11.00 38.00 62.00

+ Pasivos varios a LP 3,494.00 9,336.00 7,276.00 6,316.00 3,985.00 4,762.00

Pasivos totales no corrientes 18,240.00 60,831.00 60,485.00 66,594.00 62,621.00 61,820.00

Pasivos totales 43,550.00 98,966.00 106,324.00 111,566.00 115,077.00 116,108.00

+ Acciones preferentes y capital 0.00 0.00 0.00 0.00 0.00 0.00

híbrido

+ Capital en acciones y APIC 5,727.00 20,199.00 19,889.00 16,114.00 16,091.00 16,339.00

+ Capital común 5,727.00 20,199.00 19,889.00 7.21 7.45 7.42

+ Capital adicional pagado 16,106.79 16,083.55 16,331.58

- Acciones de Tesorería 0.00 752.00 1,440.00 63.00 65.00 305.00

+ Beneficios retenidos -3,937.00 -5,609.00 -6,860.00 -21,349.00 -16,891.00 -16,858.00

+ Otro capital -218.00 -364.00 514.00 729.00 -80.00 191.00

Capital antes de interés minoritario 1,572.00 13,474.00 12,103.00 -4,569.00 -945.00 191.00

+ Participación minoritaria/no 0.00 5,766.00 5,766.00 4,823.00 4,729.00 4,977.00

dominante

Patrimonio total 1,572.00 19,240.00 17,869.00 254.00 3,784.00 5,168.00

Pasivo y capital totales 45,122.00 118,206.00 124,193.00 111,820.00 118,861.00 121,276.00

Referencia

Norma de contabilidad US GAAP US GAAP US GAAP US GAAP US GAAP

Publication Date n/a n/a n/a n/a n/a 03/27/2020

Acciones en circulación: 405.00 792.00 794.00 719.00 743.00 740.00

Núm de acciones de Tesorería 0.00 24.00 2.00 2.00 2.00

Obligaciones de pensión 0.00 0.00 0.00 0.00 0.00

Arriendos futuros mínimos de 0.00 2,156.00 2,060.00 1,856.00 2,139.00 2,118.00

operaciones

Arrend capital - Total 0.00 0.00 0.00 0.00 0.00

Opciones dadas en el periodo 2.00 2.00 0.00 0.00 0.00

Opciones en circulación al fin del 54.00 48.00 42.00 42.00 18.00

periodo

Deuda neta 7,309.00 37,941.00 35,742.00 43,845.00 44,546.00 42,732.00

Deuda neta a capital 464.95 197.20 200.02 17,261.81 1,177.22 826.86

Ratio de capital ordinario tangible -54.77 -136.72 -100.13 -135.31 -102.84 -87.53

Ratio corriente 0.93 0.81 0.88 0.80 0.70 0.76

Ciclo de conversión de efectivo -24.74 -20.31 -20.05 -26.34 -27.82

Número de empleados 138,000.00 138,000.00 145,000.00 157,000.00 165,000.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 6

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Estandarizado

Original:2016 A Original:2017 A Restated:2018 A Original:2019 A Original:2020 A Actual/Ú12M

Plazo termina 2016-1-29 2017-2-3 2018-2-2 2019-2-1 2020-1-31 2020-7-31

Efectivo de actividades operacionales

+ Ingreso neto -1,104.00 -1,672.00 -2,849.00 -2,310.00 4,616.00 2,098.00

+ Depreciación + amortización 2,872.00 4,938.00 8,634.00 7,746.00 6,143.00 5,685.00

+ Partidas no monetarias 275.00 -3,646.00 -1,093.00 472.00 -3,226.00 1,431.00

+ Compensación en acciones 72.00 398.00 835.00 918.00 1,262.00

+ Impuestos al ingreso diferidos -205.00 -2,201.00 -2,605.00 -1,331.00 -6,339.00

+ Otros ajustes no en efectivo 408.00 -1,843.00 677.00 885.00 1,851.00 1,386.00

+ Var en fondo de maniobra no en 119.00 2,602.00 2,151.00 1,083.00 1,758.00

efectivo

+ (Inc) dec en cuentas por cobrar 187.00 -1,776.00 -1,590.00 -1,104.00 -286.00

+ (Aum) baja en inventarios -5.00 1,076.00 -325.00 -1,445.00 311.00

+ (Aum) baja en cuentas por pagar -374.00 751.00 3,779.00 952.00 894.00

+ Aum (baja) de otros 311.00 2,551.00 287.00 2,680.00 839.00

+ Efectivo neto de ops disc 0.00 0.00 0.00

Efectivo de actividades operacionales 2,162.00 2,222.00 6,843.00 6,991.00 9,291.00 7,865.00

Efectivo de actividades de inversión

+ Cambio en fijos e intangibles -394.00 -675.00 -1,212.00 -1,158.00 -2,584.00 -2,421.00

+ Desp en fijos e intangibles 88.00 24.00 0.00 0.00 0.00 0.00

+ Desp de activos fijos prod 0.00 0.00 0.00 0.00

+ Desp de activos intangibles 0.00 0.00 0.00 0.00

+ Adq de fijos e intangibles -482.00 -699.00 -1,212.00 -1,158.00 -2,584.00 -2,421.00

+ Adq de activos fijos prod -482.00 -699.00 -1,212.00 -1,158.00 -2,249.00 -2,270.00

+ Adq de activos intangibles 0.00 0.00 0.00 0.00 -335.00 -151.00

+ Cambio neto en inversiones LP 0.00 0.00 0.00 0.00 0.00 0.00

+ Dec en inversiones LP 0.00 0.00 0.00 0.00 0.00 0.00

+ Inc en inversiones LP 0.00 0.00 0.00 0.00 0.00 0.00

+ Efectivo neto de adq y div 8.00 -30,756.00 -658.00 -770.00 -2,455.00 -2,282.00

+ Efectivo por despojos 8.00 6,873.00 0.00 142.00 0.00 123.00

+ Efectivo para adq de subs 0.00 -37,629.00 -658.00 -912.00 -2,455.00 -2,405.00

+ Efectivo para JVs 0.00 0.00 0.00 0.00 0.00 0.00

+ Otras actividades de inversión 65.00 175.00 -1,005.00 5,317.00 353.00 -109.00

+ Efectivo neto de ops disc 0.00 0.00 0.00 0.00

Efectivo de actividades de inversión -321.00 -31,256.00 -2,875.00 3,389.00 -4,686.00 -4,812.00

Efectivo de actividades de

financiación

+ Dividendos pagados 0.00 0.00 0.00 -2,134.00 0.00 0.00

+ Efectivo de (pagos) deuda -490.00 29,933.00 2,157.00 1,594.00 -1,636.00 1,701.00

+ Efectivo (recompra) de acciones 2.00 3,264.00 -1,315.00 -13,251.00 -2,348.00 -1,699.00

+ Aumento en capital 2.00 4,586.00 132.00 805.00 658.00 746.00

+ Baja en capital 0.00 -1,322.00 -1,447.00 -14,056.00 -3,006.00 -2,445.00

+ Otras actividades de financiación -8.00 -1,289.00 -439.00 -538.00 -620.00 -857.00

+ Efectivo neto de ops disc 0.00 0.00 0.00 0.00

Efectivo de actividades de -496.00 31,908.00 403.00 -14,329.00 -4,604.00 -855.00

financiación

Efecto de los tipos de cambio -167.00 24.00 175.00 -189.00 -90.00 -80.00

Cambios netos en el efectivo 1,178.00 2,898.00 4,546.00 -4,138.00 -89.00 2,118.00

Efectivo pagado por impuestos 924.00 747.00 1,414.00

Efectivo pagado en intereses 2,192.00 2,347.00 2,500.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 7

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Original:2016 A Original:2017 A Restated:2018 A Original:2019 A Original:2020 A Actual/Ú12M

Plazo termina 2016-1-29 2017-2-3 2018-2-2 2019-2-1 2020-1-31 2020-7-31

Referencia

EBITDA 2,358.00 1,686.00 6,218.00 7,555.00 9,275.00 9,474.00

Margen EBITDA últimos 12M 4.63 2.74 7.87 8.34 10.06 10.35

Efectivo neto desembolsado por 0.00 37,629.00 658.00 912.00 2,455.00 2,405.00

adquisiciones

Flujo de caja libre 1,680.00 1,523.00 5,631.00 5,833.00 7,042.00 5,595.00

Flujo libre de caja a capital 31,480.00 7,788.00 7,427.00 5,406.00 7,296.00

Flujo libre de caja por acción 4.15 3.24 9.93 10.02 9.73 7.62

Precio a flujo de caja libre 4.95 5.01 8.68

Flujo de caja a beneficio neto 2.01 3.18

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 8

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Por geografía

% Original:2016 A % Original:2017 A % Restated:2018 A % Original:2019 A % Original:2020 A

Plazo termina 2016-1-29 2016-1-29 2017-2-3 2017-2-3 2018-2-2 2018-2-2 2019-2-1 2019-2-1 2020-1-31 2020-1-31

Ingreso 100.00 50,911.00 100.00 61,642.00 100.00 79,040.00 100.00 90,621.00 100.00 92,154.00

Foreign Countries 47.75 24,309.00 50.20 30,943.00 51.26 40,512.00 52.77 47,818.00 52.44 48,325.00

United States 52.25 26,602.00 49.80 30,699.00 48.74 38,528.00 47.23 42,803.00 47.56 43,829.00

Propiedad/Planta/ 100.00 1,649.00 100.00 5,653.00 100.00 5,390.00 100.00 5,259.00 100.00 6,055.00

Equipo

United States 28.93 477.00 23.58 1,333.00 75.94 4,093.00 77.16 4,058.00 71.38 4,322.00

Foreign Countries 71.07 1,172.00 76.42 4,320.00 24.06 1,297.00 22.84 1,201.00 28.62 1,733.00

Net PP&E Excluding 100.00 5,390.00 100.00 5,259.00 100.00 6,055.00

Right of Use Assets

United States 75.94 4,093.00 77.16 4,058.00 71.38 4,322.00

Foreign Countries 24.06 1,297.00 22.84 1,201.00 28.62 1,733.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 9

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Por segmento

Original:2016 A Original:2017 A Restated:2018 A Original:2019 A Original:2020 A

Plazo termina 2016-1-29 2017-2-3 2018-2-2 2019-2-1 2020-1-31

Client Solutions

Ingreso 39,634.00 36,754.00 39,218.00 43,196.00 45,838.00

Ingreso operativo 1,410.00 1,845.00 2,044.00 1,960.00 3,138.00

Fondo de comercio 4,428.00 4,237.00 4,237.00 4,237.00 4,237.00

Margen operacional 5.20 4.50 6.80

% crec de renta 7.00 10.00 6.00

Crecimiento de ingresos operacionales % 17.00 -4.00 60.00

VMware

Ingreso 0.00 3,225.00 8,485.00 9,741.00 10,905.00

Ingreso operativo 0.00 1,113.00 2,671.00 2,926.00 3,081.00

Fondo de comercio 0.00 15,070.00 17,863.00 18,621.00 20,532.00

Margen operacional 31.50 30.00 28.30

% crec de renta 126.00 15.00 12.00

Crecimiento de ingresos operacionales % 85.00 10.00 5.00

Infrastructure solution group

Ingreso 14,714.00 21,776.00 30,917.00 36,720.00 33,969.00

Ingreso operativo 1,052.00 2,393.00 3,068.00 4,151.00 4,001.00

Fondo de comercio 3,907.00 15,607.00 15,557.00 15,199.00 15,089.00

Margen operacional 9.90 11.30 11.80

% crec de renta 40.00 19.00 -7.00

Crecimiento de ingresos operacionales % 5.00 35.00 -4.00

Other Business

Ingreso 382.00 1,026.00 1,704.00 1,676.00 1,788.00

Ingreso operativo -78.00 -39.00 13.00 -111.00 -43.00

Fondo de comercio 71.00 3,996.00 2,263.00 2,032.00 1,833.00

Reconciliation

Ingreso -1,139.00 -1,284.00 -712.00 -346.00

Ingreso operativo -7,662.00 -9,887.00 -8,698.00 -6,395.00

Corporate

Ingreso operativo -57.00 -902.00 -325.00 -419.00 -1,160.00

Product

Beneficio bruto 5,179.00 6,537.00 9,465.00 12,818.00 15,393.00

Ingreso - Desglose suplementario 42,742.00 48,706.00 60,898.00 70,707.00 69,918.00

Margen bruto -14.00 26.00 28.00 35.00 20.00

Coste de ingreso 42,169.00 51,433.00 57,889.00 54,525.00

Beneficio bruto ajustado 5,611.00 9,346.00 13,408.00 16,021.00 17,523.00

Ingreso ajustado 42,715.00 49,006.00 61,068.00 70,768.00 69,937.00

Margen bruto de beneficio ajustado -13.00 67.00 22.40 19.00 9.00

Service

Beneficio bruto 3,208.00 6,422.00 11,072.00 12,235.00 13,540.00

Ingreso - Desglose suplementario 8,169.00 12,936.00 18,142.00 19,914.00 22,236.00

Margen bruto 13.00 100.00 79.00 11.00 11.00

Coste de ingreso 6,514.00 7,070.00 7,679.00 8,696.00

Beneficio bruto ajustado 3,696.00 7,473.00 12,260.00 13,001.00 14,040.00

Ingreso ajustado 8,655.00 13,816.00 19,241.00 20,556.00 22,564.00

Margen bruto de beneficio ajustado 0.00 102.00 63.00 6.00 8.00

Reconciliation

Ingreso -3,819.00

Ingreso operativo -2,841.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 10

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Múltiplos

Original:2019 A Original:2020 A Actual

Plazo termina 2019-2-1 2020-1-31 2020-8-28

PER 39.32 21.61

Media 39.32

Máx 39.32

Mín. 39.32

Media 2.98

Máx 3.21

Mín. 2.77

P/Ventas 0.32 0.38 0.53

Media 0.33 0.35

Máx 0.36 0.45

Mín. 0.30 0.28

P/Flujo de caja 4.13 3.80 6.18

Media 3.77 4.55

Máx 4.13 5.81

Mín. 3.49 3.77

P/Flujo libre caja 4.95 5.01 8.68

Media 4.58 5.46

Máx 4.95 6.96

Mín. 4.25 4.52

EV/Ventas 0.93 0.93 1.06

Media 0.94 0.97

Máx 0.97 1.09

Mín. 0.91 0.90

EV/EBITDA 11.17 9.22 10.21

Media 11.91 11.66

Máx 12.32 13.08

Mín. 11.16 9.15

EV/EBIT 31.79 27.97

Media 31.54

Máx 31.54

Mín. 31.54

Precio/Acc 49.65 48.77 66.16

Máx 49.75 70.55 67.62

Mín. 42.02 44.35 64.80

Valor de empresa 84,366.35 85,511.11 96,721.05

Media 74,656.46 88,127.42

Máx 84,338.28 98,821.34

Mín. 72,127.68 81,218.31

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 11

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Valor de empresa

Original:2016 A Original:2017 A Restated:2018 A Original:2019 A Original:2020 A Actual

Plazo termina 2016-1-29 2017-2-3 2018-2-2 2019-2-1 2020-1-31 2020-8-28

Capitalización de mercado 35,698.35 36,236.11 49,012.05

- Efectivo y equivalentes 6,322.00 11,449.00 16,129.00 9,676.00 9,302.00 11,221.00

+ Acciones preferentes 0.00 0.00 0.00 0.00 0.00 0.00

+ Interés minoritario 0.00 5,766.00 5,766.00 4,823.00 4,729.00 4,977.00

+ Deuda total 13,631.00 49,390.00 51,871.00 53,521.00 53,848.00 53,953.00

Valor de empresa 84,366.35 85,511.11 96,721.05

Capital 15,203.00 68,630.00 69,740.00 53,775.00 57,632.00 59,121.00

Deuda total/Capital total 89.66 71.97 74.38 99.53 93.43 91.26

Deuda/Vlr emp 0.63 0.63 0.56

EV/Ventas 0.93 0.93 1.06

EV/EBITDA 11.17 9.22 10.21

EV/EBIT 31.79 27.97

Cap de mercado diluido 28,896.30 36,626.27 50,347.38

Valor diluido de empresa 77,564.30 85,901.27 98,056.38

VE por participación 117.34 115.09 109.06

Referencia

Valores últimos 12 meses para

Ratios

IFRS 16/ASC 842 Adoption No No No No Sí Sí

Ventas 50,911.00 61,642.00 79,040.00 90,621.00 92,154.00 91,506.00

EBITDA 2,358.00 1,686.00 6,218.00 7,555.00 9,275.00 9,474.00

EBIT -514.00 -3,252.00 -2,416.00 -191.00 2,622.00 3,391.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 12

Análisis de informe financiero

Ticker: DELL US Equity Periodo: Anuales Divisa: USD Nota: Años mostrados en el informe son fiscales. Empresa: Dell Technologies Inc

Registro: Más reciente

Destacados aj

Original:2016 A Original:2017 A Restated:2018 A Original:2019 A Original:2020 A Actual/Ú12M

Plazo termina 2016-1-29 2017-2-3 2018-2-2 2019-2-1 2020-1-31 2020-7-31

Capitalización de mercado 35,698.35 36,236.11 49,012.05

- Efectivo y equivalentes 6,322.00 11,449.00 16,129.00 9,676.00 9,302.00 11,221.00

+ Preferente y otros 0.00 5,766.00 5,766.00 4,823.00 4,729.00 4,977.00

+ Deuda total 13,631.00 49,390.00 51,871.00 53,521.00 53,848.00 53,953.00

Valor de empresa 84,366.35 85,511.11 96,721.05

Ingresos, aj 50,911.00 61,642.00 79,040.00 90,621.00 92,501.00 91,687.00

% Crec, YoY 21.08 28.22 14.65 2.07 -0.19

Beneficio bruto, aj 8,915.00 15,166.00 21,974.00 26,048.00 29,719.00 29,129.00

% Margen 17.51 24.60 27.80 28.74 32.13 31.77

EBITDA, aj 3,122.00 4,048.00 8,591.00 9,618.00 11,484.00 10,542.00

% Margen 6.13 6.57 10.87 10.61 12.42 11.50

Beneficio neto, aj -545.83 -1,385.78 -1,192.85 -857.43 1,018.92 2,326.91

% Margen -1.07 -2.25 -1.51 -0.95 1.10 2.54

BPA, aj -1.35 -2.95 -2.10 -1.47 1.24 3.06

% Crec, YoY -118.77 28.65 29.97 1,635.74

Efectivo de operaciones 2,162.00 2,222.00 6,843.00 6,991.00 9,291.00 7,865.00

Gastos de capital -482.00 -699.00 -1,212.00 -1,158.00 -2,249.00 -2,270.00

Flujo de caja libre 1,680.00 1,523.00 5,631.00 5,833.00 7,042.00 5,595.00

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the (“BFLP

Countries”). BFLP is a wholly-owned subsidiary of Bloomberg LP (“BLP”). BLP provides BFLP with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their affiliates

do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® 08/28/2020 14:04:14 13

You might also like

- By Measure: % Restated:2018 A % Original:2019 A % Original:2020 A % Original:2021 A % Original:2022 ADocument6 pagesBy Measure: % Restated:2018 A % Original:2019 A % Original:2020 A % Original:2021 A % Original:2022 AMaria Pia Rivas LozadaNo ratings yet

- Nov PayoutDocument1 pageNov Payouthamzguiapal01No ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- Yolanda Resort FSDocument17 pagesYolanda Resort FSnyx100% (1)

- 9S-2B Corporation Forecasted FinancialsDocument5 pages9S-2B Corporation Forecasted FinancialsFlora Fil GutierrezNo ratings yet

- Normina FinancialDocument8 pagesNormina FinancialAMER MAYATONo ratings yet

- Worksheet - Service - Cotton CompanyDocument7 pagesWorksheet - Service - Cotton CompanyJasmine ActaNo ratings yet

- Dudirty Laundry FS 09272018Document157 pagesDudirty Laundry FS 09272018kempNo ratings yet

- Just in Time 2020-2022Document6 pagesJust in Time 2020-2022Jan Ray Oviedo EscotoNo ratings yet

- Name of Company Worksheet for the period endedDocument11 pagesName of Company Worksheet for the period endedRaymond RocoNo ratings yet

- Monthly Profit & Loss Statement 2021 Vs 2022 Vs EXPDocument8 pagesMonthly Profit & Loss Statement 2021 Vs 2022 Vs EXPGarden View HotelNo ratings yet

- Spicy Malunggay CookiesDocument19 pagesSpicy Malunggay CookiesChristine Margoux SiriosNo ratings yet

- Financial Statement - Is and NotesDocument31 pagesFinancial Statement - Is and NotesAlvin James OlayaNo ratings yet

- Profit and LossDocument2 pagesProfit and LossjuandavidnivelNo ratings yet

- Form 60 - May, 2021Document19 pagesForm 60 - May, 2021Hannah ManieboNo ratings yet

- Grand MLB Basic Commodities Corporation 2023'Document8 pagesGrand MLB Basic Commodities Corporation 2023'Bambie Porras Jaca100% (1)

- Aqua Spruce Corporation: Statement of Comprehensive IncomeDocument4 pagesAqua Spruce Corporation: Statement of Comprehensive Incomenicolaus copernicusNo ratings yet

- Quickbook Company Accounts.Document1 pageQuickbook Company Accounts.Talal KhanNo ratings yet

- BBG Adj HighlightsDocument1 pageBBG Adj HighlightsMaria Pia Rivas LozadaNo ratings yet

- Financial AspectDocument56 pagesFinancial AspectAngela LaurillaNo ratings yet

- Katherine Ducusin Budgeting System 2022Document3 pagesKatherine Ducusin Budgeting System 2022kenjy2022No ratings yet

- Plan de Financement 2023 2024Document4 pagesPlan de Financement 2023 2024Rahim DoudouNo ratings yet

- Fit Deli TODAY Version 1.xlsb 1Document17 pagesFit Deli TODAY Version 1.xlsb 1Micah Valerie SaradNo ratings yet

- HandyMeal Sept.2018 Financial45Document50 pagesHandyMeal Sept.2018 Financial45L.a.ZumárragaNo ratings yet

- Project Report Final 1Document11 pagesProject Report Final 1ManiyarSant & Co., Chartered AccountantsNo ratings yet

- Annual financial report and resort menu for Cora Vergel ResortDocument16 pagesAnnual financial report and resort menu for Cora Vergel ResortAnn Jalene Soterno AguilarNo ratings yet

- Consolidado de Nominas 2023Document59 pagesConsolidado de Nominas 2023carlos andres caicedo quimbayoNo ratings yet

- PR N Budget ForecastDocument4 pagesPR N Budget Forecastvithash shanNo ratings yet

- 10 Column Heavy BombersDocument3 pages10 Column Heavy BombersVince Ferdinand Pajanustan100% (1)

- Cost Analysis and Sales Projections for Cosmetics Product LineDocument25 pagesCost Analysis and Sales Projections for Cosmetics Product LineGina AquinoNo ratings yet

- Profit & Loss Account of Reliance Industries - in Rs. Cr.Document9 pagesProfit & Loss Account of Reliance Industries - in Rs. Cr.Mansi DeokarNo ratings yet

- Capital Investment 12-1 To 6 PanisalesDocument8 pagesCapital Investment 12-1 To 6 PanisalesVincent PanisalesNo ratings yet

- Estimating With Microsoft Excel 2Document1 pageEstimating With Microsoft Excel 2rabzihNo ratings yet

- Operating Performance: Air Philippines Employees' CooperativeDocument4 pagesOperating Performance: Air Philippines Employees' CooperativeChristian LlanteroNo ratings yet

- Projected Income: Annual Sales Twister Smoothies/power Booster SmoothiesDocument56 pagesProjected Income: Annual Sales Twister Smoothies/power Booster SmoothiesDominic AlimNo ratings yet

- ControldegokuDocument1 pageControldegokupedroNo ratings yet

- Hind Adhesives BBG AdjustedDocument2 pagesHind Adhesives BBG Adjustedgraheeth26No ratings yet

- BB Airport Citimall: Semi-Monthly SummaryDocument1 pageBB Airport Citimall: Semi-Monthly SummaryIaAn Krstoper SaronNo ratings yet

- Gentle Hands Spa & Welness Center Trial Balance December 31, 2016Document54 pagesGentle Hands Spa & Welness Center Trial Balance December 31, 2016Trixie LadesmaNo ratings yet

- CLBS Financial Statement 1Document6 pagesCLBS Financial Statement 1Peter Cranzo MeisterNo ratings yet

- Form Analisa Kebutuhan PegawaiDocument21 pagesForm Analisa Kebutuhan Pegawaiyuni malitafirda17No ratings yet

- 2014 Taun Harga Indeks 2027 Tahun Harga Index 2014 Tahun Harga 2027 Tahun HargaDocument34 pages2014 Taun Harga Indeks 2027 Tahun Harga Index 2014 Tahun Harga 2027 Tahun HargaRizka AuliaNo ratings yet

- Comparative Statements of Financial PositionDocument83 pagesComparative Statements of Financial PositionHarold Beltran DramayoNo ratings yet

- Screenshot 2020-08-05 at 3.15.16 PM PDFDocument2 pagesScreenshot 2020-08-05 at 3.15.16 PM PDFShiv ChauhanNo ratings yet

- Balance Comprob (Youtube)Document5 pagesBalance Comprob (Youtube)luisNo ratings yet

- Income Statement Format (KTV 1)Document30 pagesIncome Statement Format (KTV 1)Darlene Jade Butic VillanuevaNo ratings yet

- Valorizacion Principal 65% Valorizacion Principal 35%Document3 pagesValorizacion Principal 65% Valorizacion Principal 35%andrea martinez paredesNo ratings yet

- BLACKLIST - Financial-StatementDocument9 pagesBLACKLIST - Financial-StatementJam SurdivillaNo ratings yet

- Statement of Financial Position 2018 2019 AssetsDocument19 pagesStatement of Financial Position 2018 2019 AssetsChristine Margoux SiriosNo ratings yet

- Tema: Balanse de Comprobacion: Universidad Católica Los Ángeles de ChimboteDocument5 pagesTema: Balanse de Comprobacion: Universidad Católica Los Ángeles de ChimboteYudid ChuraNo ratings yet

- Parcial2 - Actividades de La Semana 4Document23 pagesParcial2 - Actividades de La Semana 4Luis Eduardo Meunier MendezNo ratings yet

- PL InventoryDocument18 pagesPL InventoryAndika OktavianiNo ratings yet

- Projected Financial StatementsDocument46 pagesProjected Financial Statementsvictorious xtremeNo ratings yet

- Empresa COBOCE S.A.Document2 pagesEmpresa COBOCE S.A.Sarah Janco RoqueNo ratings yet

- Restaurant Profit and Loss Statement 2018Document1 pageRestaurant Profit and Loss Statement 2018Fresh OunceNo ratings yet

- Financial Analysis Test Project 2Document5 pagesFinancial Analysis Test Project 2Pattee QuiambaoNo ratings yet

- Financial Slide For ReportDocument6 pagesFinancial Slide For ReportTuan Noridham Tuan LahNo ratings yet

- BC XCDocument6 pagesBC XCKaren Sofía Villa RealNo ratings yet

- (Loss) - 197,037.76 - 142,192.76: ProfitDocument7 pages(Loss) - 197,037.76 - 142,192.76: ProfitJulious Capricho GerodiasNo ratings yet

- Quiz #2Document4 pagesQuiz #2angieNo ratings yet

- Latin Music in The USDocument2 pagesLatin Music in The USangieNo ratings yet

- Communicative Task II - Course 05 - WaystageDocument1 pageCommunicative Task II - Course 05 - WaystageangieNo ratings yet

- Topic and The Main IdeasDocument7 pagesTopic and The Main IdeasangieNo ratings yet

- Ibm Ingresos DeclaradosDocument8 pagesIbm Ingresos DeclaradosangieNo ratings yet

- Por Medida: % Original:2010 A % Original:2011 A % Original:2012 A % Restated:2013 A % Restated:2014 ADocument39 pagesPor Medida: % Original:2010 A % Original:2011 A % Original:2012 A % Restated:2013 A % Restated:2014 AangieNo ratings yet

- Means of TranspotationDocument3 pagesMeans of TranspotationangieNo ratings yet

- Amazon Ingresos DeclaradosDocument4 pagesAmazon Ingresos DeclaradosangieNo ratings yet

- Por Medida: % Original:2012 A % Restated:2013 A % Original:2014 A % Restated:2015 ADocument22 pagesPor Medida: % Original:2012 A % Restated:2013 A % Original:2014 A % Restated:2015 AangieNo ratings yet

- Means of TranspotationDocument3 pagesMeans of TranspotationangieNo ratings yet

- Municative Task 1 04-Basic Waystage-SatDocument1 pageMunicative Task 1 04-Basic Waystage-SatangieNo ratings yet

- NEIGHBORHOODDocument8 pagesNEIGHBORHOODangieNo ratings yet

- IDL Application Form-1Document2 pagesIDL Application Form-1Fkrl RzyNo ratings yet

- Seagate Part1 PDFDocument113 pagesSeagate Part1 PDFwaranhaNo ratings yet

- Group Company Company NameDocument7 pagesGroup Company Company Nametahsin shaikhNo ratings yet

- Seagate Family F3 Part21 Drive SpecsDocument52 pagesSeagate Family F3 Part21 Drive SpecsOmegalexNo ratings yet

- DP Touchpad Alps 15015 DriversDocument107 pagesDP Touchpad Alps 15015 DriversMohammed Tahver Farooqi QuadriNo ratings yet

- N-Series NetApp Net Apps Drive Part NumbersDocument3 pagesN-Series NetApp Net Apps Drive Part NumbersrejnanNo ratings yet